Free Rp 5217Nyc Form in PDF

When engaged in the sale and purchase of real estate in New York City, individuals and entities face a myriad of paperwork, among which the RP-5217NYC form stands out due to its importance and specificity. This document, a crucial part of the real estate transaction process, serves as a real property transfer report utilized specifically within the confines of the five boroughs of New York City. It is designed to collect detailed information on the transfer of title, including but not limited to the identities of the buyer and seller, the sale price, and the specifics of the property sold. Accuracy in completing this form is not only necessary for the legal transfer of property but also impacts the determination of real estate taxes and fees. The RP-5217NYC form thus plays a significant role in ensuring transparency in real estate transactions, aiding in the assessment for tax purposes, and providing a reliable record for both the city's records and the parties involved. Understanding its nuances is essential for anyone involved in the real estate market within New York City, from lawyers and real estate professionals to buyers and sellers aiming for a smooth transition of property ownership.

Rp 5217Nyc Sample

File Overview

| Name of Fact | Description |

| Form Purpose | The RP-5217-NYC is a real property transfer report used exclusively for documenting the sale of property within New York City. |

| Required for Transactions | This form must be filed with any deed transfer of residential, commercial, or industrial real estate within New York City's boroughs. |

| Filing Office | It is submitted to the New York City Department of Finance for processing and recording. |

| Governing Law | Its requirements and use are dictated by New York State law, as well as local New York City regulations. |

| Electronic Filing | As of the latest update, New York City accepts and may require electronic filing of the RP-5217-NYC form for certain transactions. |

| Information Required | The form requires detailed information about the property, selling price, seller and buyer information, and the type of transfer. | Impact on Property Taxes | Filing the RP-5217-NYC can impact property tax assessments, as it is utilized in the tax assessment process to update property values. |

| Fees | A fee is associated with filing the RP-5217-NYC form, and it varies depending on the type of property and its sale price. |

Rp 5217Nyc: Usage Guidelines

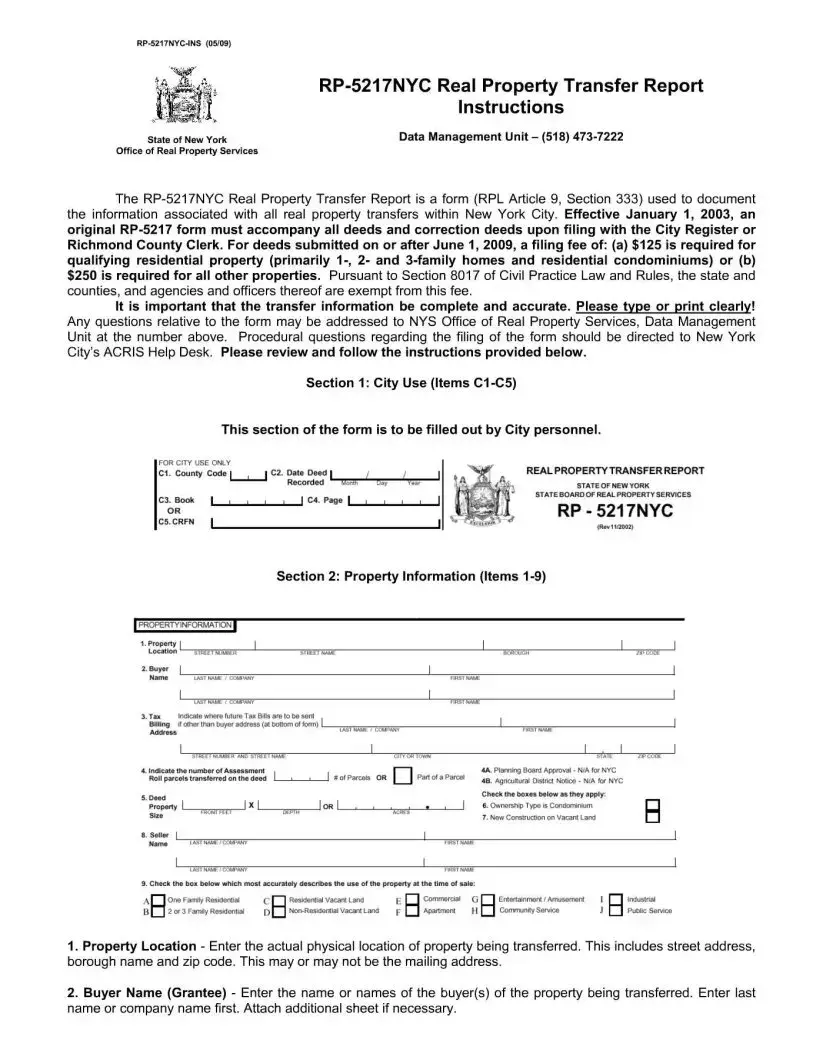

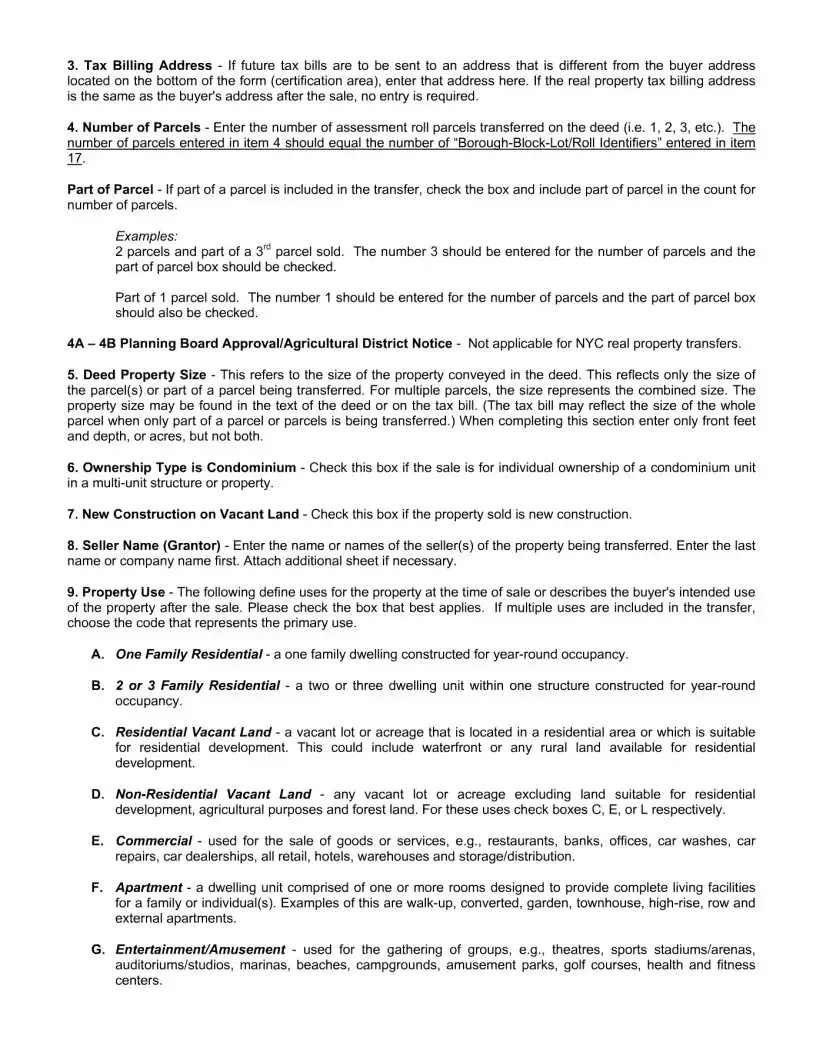

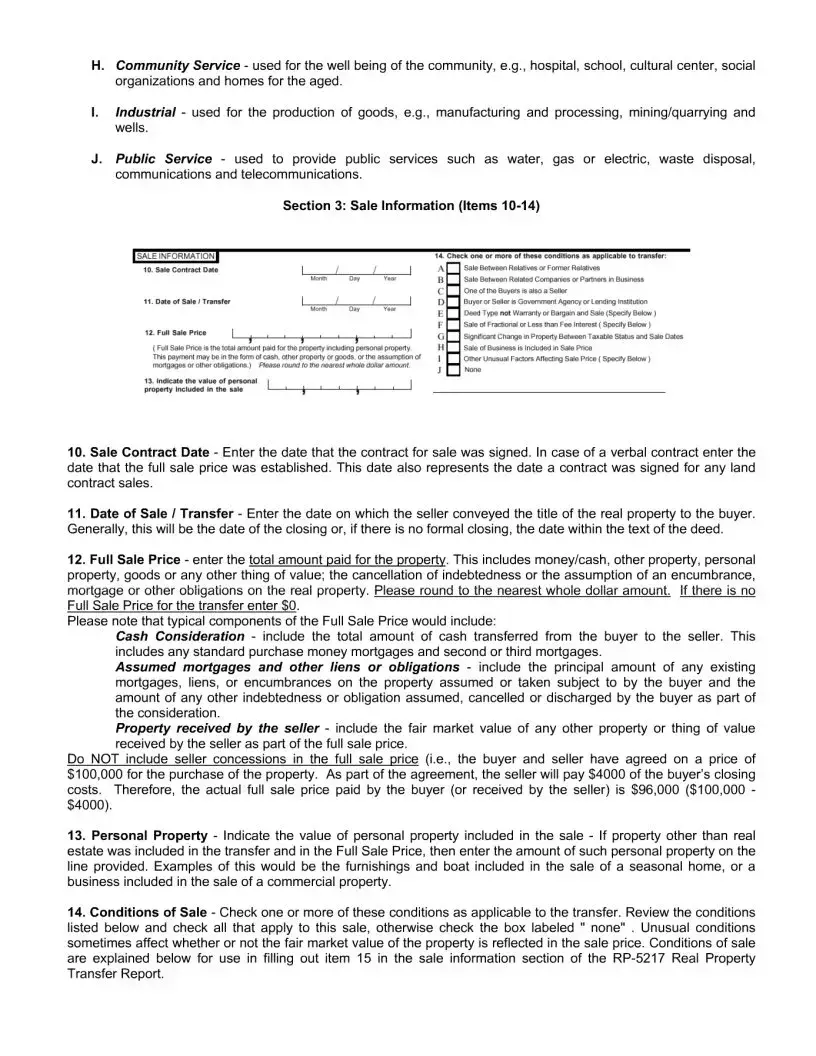

Filling out the RP-5217NYC form is a required step in the process of completing a real estate transaction in New York City. This document is vital for reporting the sale or transfer of real property. Properly completing this form ensures that property records are updated accurately, which is essential for both buyers and sellers. The following steps will guide you through filling out the RP-5217NYC form accurately and efficiently.

- Start by entering the date of the transfer at the top of the form.

- Fill in the names and addresses of both the grantor (seller) and grantee (buyer) in their respective sections.

- Provide the location of the property, including the borough, block number, lot number, and address.

- Enter the actual consideration amount, which is the total payment made for the property.

- Indicate the type of deed executed (e.g., warranty, executor's, quitclaim) in the designated section.

- Select the property class code that best describes the use of the property (e.g., residential, commercial).

- Describe any personal property included in the sale, if applicable, and its value.

- If the property is subject to any exemptions (e.g., senior citizen, veteran), list them in the provided space.

- Complete the seller's and buyer's identifying information, including Social Security numbers or Employer Identification numbers, if applicable.

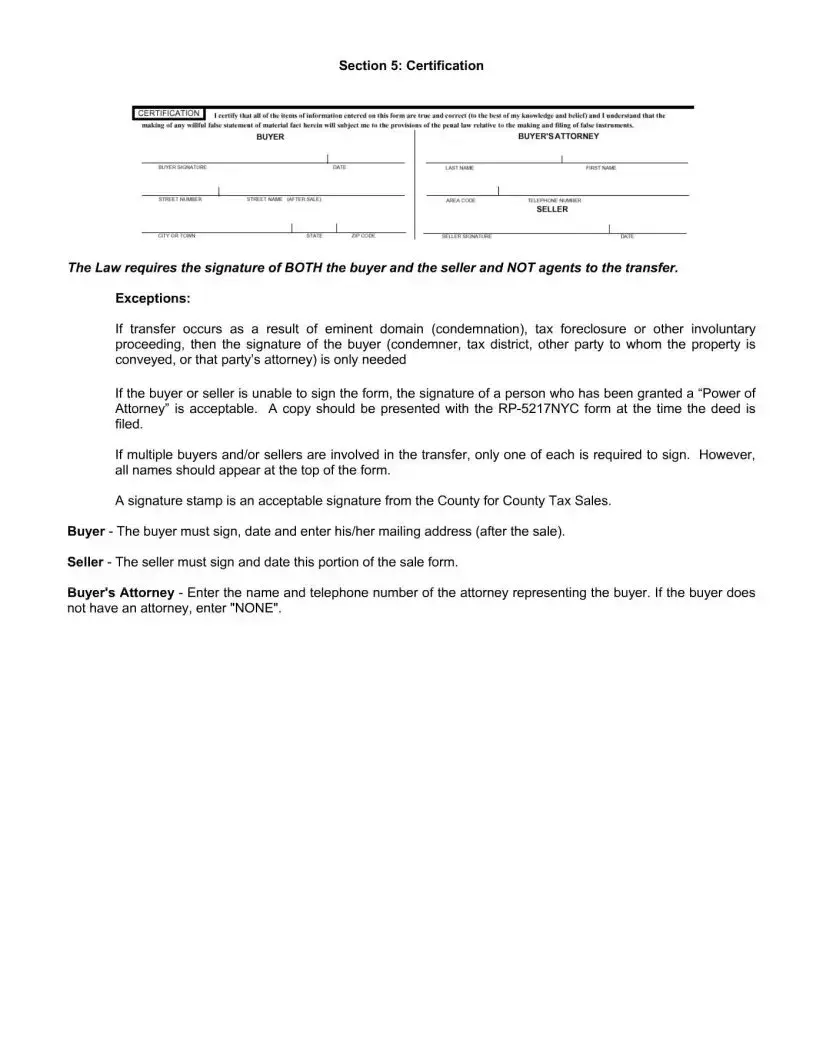

- Sign and date the form at the bottom, ensuring both the grantor and grantee signatures are included.

After filling out the RP-5217NYC form, double-check all information for accuracy to prevent delays in the property transfer process. Once completed, submit the form along with any required fees to the appropriate county clerk's office. This step is crucial as it legally finalizes the transfer of property. Timely submission and accurate completion of the RP-5217NYC form play a vital role in ensuring a smooth transition of property ownership.

FAQ

What is the RP-5217NYC form?

The RP-5217NYC form is a document required for the sale or transfer of certain real estate properties in New York City. It's used to report relevant information about the transaction to various city departments. This form plays a crucial role in updating official records to reflect the current ownership and to ensure accurate property tax assessments.

Who needs to fill out the RP-5217NYC form?

Typically, the seller or the seller’s legal representative completes the RP-5217NYC form as part of the closing process for a real estate transaction. It's important for anyone involved in the sale or transfer of real estate within New York City to ensure this form is accurately filled out and submitted to avoid potential delays or complications in the transaction process.

Where do I file the RP-5217NYC form?

The completed RP-5217NYC form should be submitted to the New York City Department of Finance. It can be submitted electronically, which is the preferred method for faster processing, or it can be mailed to their office if necessary. Always check the latest guidelines on the Department of Finance's website to ensure you are following the most current submission procedures.

Is there a fee to file the RP-5217NYC form?

Yes, there is a filing fee associated with the RP-5217NYC form. The fee amount can vary depending on the type of property being sold or transferred and other factors related to the transaction. For the most accurate and up-to-date fee information, it's advisable to consult the New York City Department of Finance's website or contact them directly.

What information do I need to provide in the RP-5217NYC form?

The RP-5217NYC form requires detailed information about the property transaction, including but not limited to the names and addresses of the buyer and seller, the sale price, the date of transfer, and specifics about the property itself (e.g., block and lot numbers, property type). Accurate and complete information is crucial for the form's acceptance and the successful recording of the transaction.

What happens if I make a mistake on the RP-5217NYC form?

If a mistake is made on the RP-5217NYC form, it's important to address it as soon as possible. The New York City Department of Finance may allow for corrections to be submitted, but the process may vary depending on the nature of the mistake. It’s best to contact the Department directly to understand how to correct any errors and ensure your real estate transaction is accurately documented.

Common mistakes

Filling out the RP-5217NYC form, a document needed for the transfer of real estate in New York City, often comes with pitfalls that can lead to unnecessary delays or complications. While completing this form might seem straightforward, it’s crucial to pay attention to detail and understand the common mistakes that people make. This can ensure smoother transactions, saving time and potentially costs associated with corrections. Below are five common mistakes made when filling out the form.

Incorrect or Incomplete Property Information: One of the most crucial aspects of the RP-5217NYC form is the detailed information about the property being transferred. This includes block and lot numbers, address, borough, and other specific details. Errors or omissions in this section can lead to processing delays or even transaction rejections. Double-checking this information against official property records can prevent such mishaps.

Failure to Indicate Transfer Type Correctly: The RP-5217NYC form requires the seller to indicate the nature of the property transfer. Whether it's a sale, a gift, an exchange, or a consolidation of lots, accurately indicating the transfer type is critical. Misclassifying the transfer type can affect not only the processing of the form but also potentially impact tax liabilities and assessments associated with the property transfer.

Incorrect Seller or Buyer Information: Just as critical as the property information, the details regarding the seller and buyer must be accurate. This includes full legal names, addresses, and contact information. Mistakes in this area can lead to significant complications in establishing the legal chain of title, potentially hindering future transactions involving the property.

Failing to Properly Indicate Assessed Value: The form requires reporting the property's assessed value, which can often lead to confusion. Some parties mistakenly enter the sale price or the market value instead of the assessed value. Since the assessed value can influence property taxes, incorrectly reporting this figure can lead to unexpected financial implications.

Omitting Signature and Date: Perhaps one of the simplest yet frequently overlooked mistakes is failing to sign and date the form. The RP-5217NYC is not considered valid without the signatures of both the seller and the buyer and the date of the signing. Neglecting this final step can invalidate the entire document, necessitating the corrections and resubmission of the form.

Avoiding these mistakes requires attention to detail and a comprehensive review of the form before submission. It's advisable for individuals to consult with legal or real estate professionals to ensure all information is accurate and complete. Taking the time to carefully complete the RP-5217NYC can help facilitate a smoother property transfer process, ultimately benefiting all parties involved.

Documents used along the form

When completing a real estate transaction in New York City, the RP-5217NYC form plays a crucial role as part of the documentation required. However, it's just one piece of the complex puzzle of paperwork needed to successfully navigate the property transfer process. The entire procedure often involves several additional forms and documents, each serving its unique purpose and adding layers of detail to ensure the transaction is clear, legal, and binding. Here's an overview of six other key documents typically used alongside the RP-5217NYC to facilitate a smooth property transfer.

- Title Deed: This document is vital as it officially transfers ownership of the property from the seller to the buyer. It outlines the property's legal description, its location, and details of the new owner.

- Mortgage Agreement: If the buyer is financing the purchase with a mortgage, this contract between the buyer and the lender details the loan's terms, including the interest rate, repayment schedule, and the consequences of non-payment.

- Property Tax Bill: A recent property tax bill is often required to confirm the property's tax status, ensure that all taxes are up-to-date, and determine any adjustments needed at closing.

- Closing Statement: A comprehensive breakdown of all the financial transactions and costs associated with the sale, including the sale price, taxes, lender fees, and agent commissions. This document ensures transparency for both parties.

- Building and Zoning Compliance Documentation: These documents verify that the property meets all local building codes and zoning laws, an important consideration for ensuring the property's use is legal and any future developments comply with city regulations.

- Home Inspection Reports: These reports provide detailed information on the condition of the property, including any major repairs or maintenance issues that might influence the sale's terms or need addressing before the transfer of ownership.

Together with the RP-5217NYC form, these documents form a comprehensive package that addresses the legal, financial, and physical aspects of a property transaction. By thoroughly preparing and reviewing these documents, all parties can ensure a transparent and efficient transaction process, minimizing potential disputes and laying the groundwork for a successful property transfer.

Similar forms

The RP-5217NYC form is a real estate transfer document used primarily in New York City. It details the sale or transfer of property within the city limits. Similar to the RP-5217NYC, the Warranty Deed is a common document in real estate transactions across the United States. The Warranty Deed guarantees that the seller holds clear title to a piece of real estate and has the right to sell it, offering more protection to the buyer than the RP-5217NYC might by specifying the legal status of the property's title.

Another document resembling the RP-5217NYC is the Grant Deed. Like the RP-5217NYC, a Grant Dee

Dos and Don'ts

Filling out the RP-5217-NYC form, a real property transfer report specifically for transactions within New York City, is a crucial step in the conveyancing process. This document, required by law, provides essential information for tax and property record purposes. To ensure this process is as smooth and error-free as possible, there are a series of dos and don'ts one should adhere to.

What You Should Do:

- Double-check all entries for accuracy. Make sure all the information entered on the form is correct, including addresses, block and lot numbers, sale price, and dates. Inaccuracies can lead to unnecessary delays or errors in public records.

- Consult with a professional if you're unsure. Whether it's a legal advisor or a real estate expert, getting professional advice can prevent mistakes and provide clarity on complex questions.

- Use black ink and print clearly. This enhances the legibility of the form, ensuring that all details are easy to read and correctly processed.

- Review the requirement for notarization. Depending on the situation, the form may need to be notarized before submission. Confirm this requirement to ensure the document is properly validated.

What You Shouldn't Do:

- Don't leave sections blank. If a section does not apply to your transaction, it's better to write "N/A" than to leave it empty. Empty fields can lead to questions about whether parts were overlooked.

- Don't guess on details. Estimations or guesses can lead to incorrect information being recorded. If you're not sure about a detail, it's crucial to verify it before proceeding.

- Don't use correction fluid or tape. Corrections should be made by neatly crossing out the incorrect entry and writing the new information above or next to it. Using correction fluid or tape can make the document appear tampered with.

- Don't disregard the form's instructions. The RP-5217-NYC form comes with detailed instructions that should be read carefully. Ignoring these can lead to a variety of errors, affecting the validity of the submission.

Approaching the RP-5217-NYC form with diligence and attention to detail will ensure that your property transfer records are accurately and efficiently processed. Avoiding common mistakes not only helps streamline the transaction but also protects the interests of all parties involved. Remember, this document is a critical step in the real estate process in New York City, and its accuracy is paramount.

Misconceptions

The RP-5217NYC form, often associated with property transactions in New York City, is surrounded by a cloud of misunderstandings. Clearing up these misconceptions can help ensure smoother real estate transactions and prevent unnecessary stress or confusion. Here are eight common misconceptions:

The RP-5217NYC form is only for commercial properties. This is not the case. The form is used for both residential and commercial property sales. It's a crucial document in the transfer process, detailing the sale and allowing for accurate property tax records.

It's the buyer's responsibility to file the form. Actually, it's typically the seller's responsibility to complete and file the form as part of the closing process. However, both parties should ensure its accurate completion and submission to avoid potential issues.

You can submit the RP-5217NYC form online anytime. While the form can be submitted online, there are specific deadlines and procedures that must be followed. Timeliness and accuracy are key in avoiding delays or penalties.

The form is complicated and requires a lawyer to fill out. While having a lawyer or a professional familiar with real estate transactions can be helpful, particularly for complex deals, the form itself is designed to be filled out by the seller with straightforward information about the property and sale.

Filling out the RP-5217NYC form is the final step in the property transaction. Submitting this form is indeed a vital step, but it's not always the last one. Other post-closing activities may include settling any closing conditions, recording the deed, and addressing any post-closing adjustments.

There is a penalty for late submission, but no real urgency. Beyond just a potential penalty, late submission can delay the entire closing process, affecting tax records and possibly the buyer’s ability to take possession or secure financing. It's crucial to prioritize its timely submission.

The information on the form doesn’t need to be verified by a third party. It's essential for the accuracy of the form to be verified, ideally by professionals involved in the transaction. Errors can lead to disputes or complications in property records and taxation.

Once submitted, the RP-5217NYC form can't be amended. If inaccuracies are discovered after submission, it's important to address them promptly. Amendments can be made, but the process requires contacting the appropriate city department and possibly submitting additional documentation.

Understanding these aspects of the RP-5217NYC form not only helps in demystifying part of the real estate transaction process but also underscores the importance of careful attention to details and deadlines throughout these transactions.

Key takeaways

The RP-5217NYC form is a crucial document for real estate transactions in New York City, specifically used for reporting property transfers. It's important to understand not just how to complete this form accurately, but also its implications and requirements. Here are seven key takeaways to help guide individuals and professionals through the process.

- Required for All Boroughs: The RP-5217NYC form is mandatory for all property transfers in the five boroughs of New York City. Whether you're dealing with residential or commercial property, this form plays a vital role in the transaction.

- Accuracy Is Critical: Every detail on the form must be accurately reported. Mistakes or inaccuracies can delay the transaction process, potentially leading to legal or financial complications.

- Electronic Filing: In most cases, the RP-5217NYC form must be filled out electronically. This requirement facilitates more efficient processing and ensures better legibility of the information provided.

- Correct Fee Payment: There is a fee associated with filing the RP-5217NYC form. The exact amount can vary, so it’s essential to verify the current rate to ensure correct payment and avoid processing delays.

- Consult Professionals When Necessary: If you're unsure about any aspect of filling out the form or its requirements, consulting with a real estate professional or legal advisor is highly recommended. Their expertise can help navigate the complexities of property transactions.

- Complements Other Documents: The RP-5217NYC is part of a suite of documents required for property transactions in New York City. It should be filled out in conjunction with other necessary paperwork, such as the deed, to ensure a comprehensive and compliant transaction process.

- Keep a Copy for Your Records: After submitting the RP-52517NYC form, keeping a copy for your personal records is advisable. This ensures you have a record of the information submitted and can be helpful for future reference or if any disputes arise.

Understanding and correctly completing the RP-5217NYC form is fundamental for anyone involved in real estate transactions within New York City. By paying close attention to these key takeaways, parties can navigate the process more smoothly, ensuring a legally compliant and efficient transfer of property.

Common PDF Documents

How Long Does a Judgement Stay on Your Record - The document highlights the importance of following procedural norms in arbitration services.

Nyc Crt - Explains how to compute the tax for premises rented for less than the full three-month period or with special circumstances.