Free Nysid 41C W Form in PDF

Navigating the complexities of insurance underwriting and compliance in New York State requires familiarity with specific forms and regulatory requirements, one of these being the NYSID 41C W form. This form serves a critical function in the process, particularly for producing brokers who are tasked with affirming various aspects of an insurance placement. Notably, the form encompasses sections that require the producing broker to provide detailed information about themselves and the risk in question, ensuring that the insured's name is uniformly represented across all documents. A significant portion of the form is dedicated to disclosure information, primarily focusing on whether the producing broker has complied with New York Insurance Law by providing a written Notice of Excess Line Placement to the insured. Furthermore, the form delves into declination information, which is pivotal in cases where coverage cannot be procured through authorized New York insurers. Brokers must indicate whether declinations are not required for the type of risk being insured, or whether the insured qualifies as an "Exempt Commercial Purchaser." Should a risk be submitted to, and declined by, authorized companies, such instances must be thoroughly documented, including the reasons for declination and the basis on which the broker believed the insurer would consider the risk. This form is a testament to the structured and detailed approach required in the insurance industry to ensure compliance and proper risk management, culminating in an affirmation section where the producing broker attests to the veracity of the provided information under the penalties of perjury.

Nysid 41C W Sample

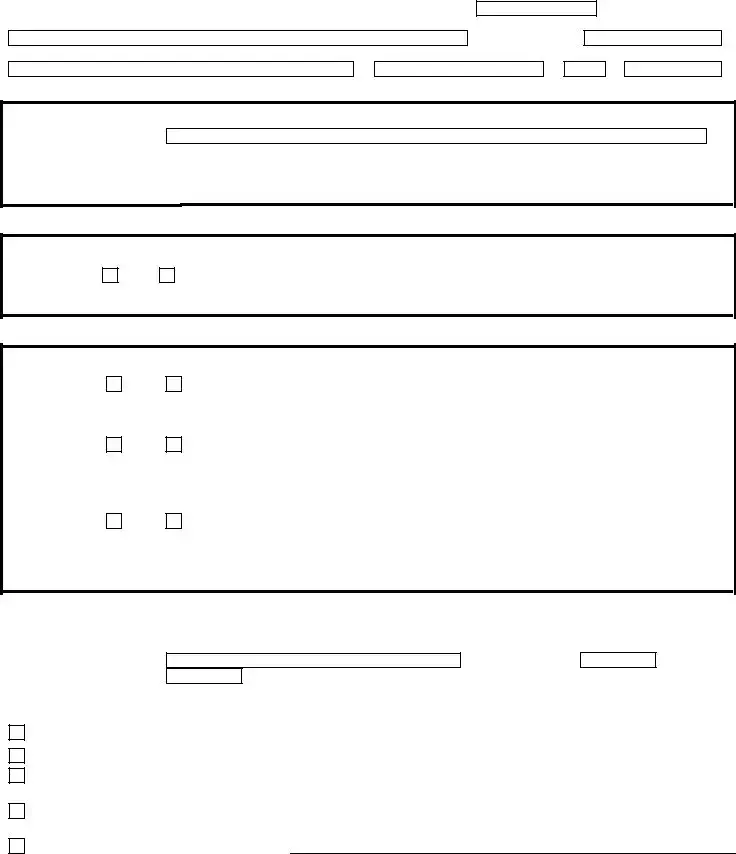

PART C – AFFIDAVIT BY PRODUCING BROKER

1. PRODUCING BROKER INFORMATION |

AFFIDAVIT NO. |

Name

Address

License No. BR-

CityState

Zip Code

2.RISK INFORMATION: Name of the Insured

(The name of the insured must be precisely the same in this affidavit and the declarations page, binder, cover note or confirmation of coverage.

3. DISCLOSURE INFORMATION

Yes

No

Did you personally provide a written Notice of Excess Line Placement (Form: NELP/2011) to the insured as required by Section 2118 of the New York Insurance Law and Regulation 41?

4. DECLINATION INFORMATION

(a)Yes

No

Has the Superintendent determined that declinations are not required for this type ofrisk? IF ANSWER TO QUESTION (a) IS “YES”, SKIP QUESTIONS (b) AND (c) GO ON TOTHE AFFIRMATION SECTION.

(b)Yes

No

Does the insured qualify as an “Exempt Commercial Purchaser” that made a written request consistent with the requirements of New York Insurance Law Section 2118(b)(3)(F)? IF ANSWER TO QUESTION (b) IS “YES”, SKIP QUESTION (c) GO ON TO THE AFFIRMATION SECTION.

(c)Yes

No

Was the risk described above submitted by the producing broker to companies: (1) each authorized in New York to write coverages of the kind requested; (2) which the licensee has reason to believe might consider writing the type of coverage or class of insurance involved; and (3) was such risk declined by each such company? If the answer to QUESTION (c) above is “YES”, COMPLETE THE FOLLOWING SCHEDULE:

AUTHORIZED COMPANIES DECLINING THE RISK

1.Name of company

NAIC Code

I believed this insurer would consider underwriting this risk because:

Date of Declin.:

Recent acceptance by the insurer of a risk, requiring that type of coverage or class of Insurance. Advertising by the insurer or its agent indicating it entertains that type of risk/coverage.

Media communications (Newspapers, Trade Magazines, Radio) which indicate the insurer will underwrite that type of coverage.

Communications with other professionals, such as brokers, agents, risk managers, insurance department or ELANY Personnel indicating the insurer entertains such risks.

Any other valid basis you can document.

NYSID Form 41C - W (Ed. January 2023) |

Page 1 of 2 |

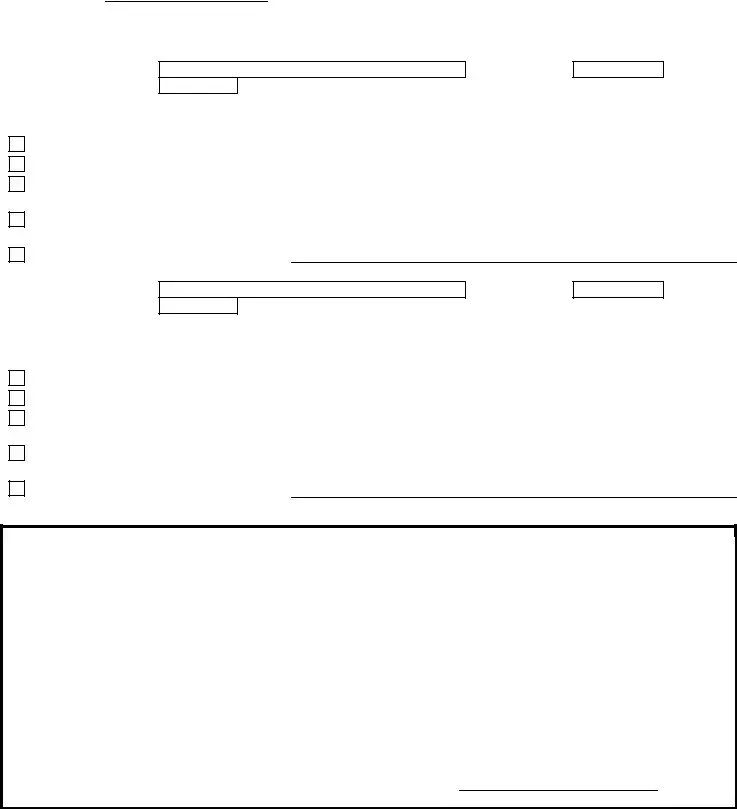

PART C – AFFIDAVIT BY PRODUCING BROKER

AFFIDAVIT NO.

AUTHORIZED COMPANIES DECLINING THE RISK

2.Name of Company NAIC Code

I believed this insurer would consider underwriting this risk because:

Date of Declin.:

Recent acceptance by the insurer of a risk, requiring that type of coverage or class of Insurance. Advertising by the insurer or its agent indicating it entertains that type of risk/coverage.

Media communications (Newspapers, Trade Magazines, Radio) which indicate the insurer will underwrite that type of coverage.

Communications with other professionals, such as brokers, agents, risk managers, insurance department or ELANY Personnel indicating the insurer entertains such risks.

Any other valid basis you can document.

3.Name of Company NAIC Code

Date of Declin.:

I believed this insurer would consider underwriting this risk because:

Recent acceptance by the insurer of a risk, requiring that type of coverage or class of Insurance. Advertising by the insurer or its agent indicating it entertains that type of risk/coverage.

Media communications (Newspapers, Trade Magazines, Radio) which indicate the insurer will underwrite that type of coverage.

Communications with other professionals, such as brokers, agents, risk managers, insurance department or ELANY Personnel indicating the insurer entertains such risks.

Any other valid basis you can document.

AFFIRMATION

I, |

|

, am the licensee or sublicensee of the named broker |

in Section 1 of this affirmation and I hereby affirm under penalties of perjury that all of the information contained herein is true to the best of my knowledge and belief.

Signature of Affiant |

|

Date |

NYSID Form 41C - W (Ed. January 2023) |

Page 2 of 2 |

File Overview

| Fact | Detail |

|---|---|

| Purpose | Form 41C-W is used for the Affidavit by Producing Broker, affirming compliance with specific requirements of the New York Insurance Law. |

| Producing Broker Information | The form captures the license number, name, and address of the producing broker. |

| Risk Information | It details the name of the insured, which must match across related documents. |

| Disclosure Information | Confirms whether a written Notice of Excess Line Placement was provided, as required by Section 2118 of the New York Insurance Law and Regulation 41. |

| Declination Information | It inquires about specific conditions under which declinations for providing coverage are not required or were obtained from authorized companies. |

| Governing Law | Guided by Section 2118 of the New York Insurance Law and related regulations. |

| Affirmation | The form concludes with an affirmation by the licensee or sublicensee of the named broker, asserting the truthfulness of the provided information under penalties of perjury. |

Nysid 41C W: Usage Guidelines

When it's time to navigate the waters of the insurance industry in New York, certain documents become crucial, and the NYSID 41C W form is a key piece of that puzzle for insurance brokers. This form serves as an affidavit for producing brokers, ensuring all the necessary legal and regulatory steps have been taken when dealing with excess line placements. Completing this form accurately is essential, not just for compliance with New York Insurance Law but also for facilitating a smooth insurance transaction process. Here's a straightforward guide to help you fill out the form correctly.

- Start with PART C – AFFIDIT BY PRODUCING BROKER. Fill in the affidavit number, your license number (BR-), name, address, city, state, and zip code under the PRODUCING BROKER INFORMATION section.

- Under RISK INFORMATION, accurately enter the name of the insured. Ensure it matches exactly with what is provided on the declarations page, binder, cover note, or confirmation of coverage.

- In the DISCLOSURE INFORMATION section, indicate with a "Yes" or "No" whether you personally provided a written Notice of Excess Line Placement (Form: NELP/2011) to the insured as required.

- For DECLINATION INFORMATION, respond to question (a) about the Superintendent's determination regarding declinations for this type of risk. If you answer "Yes," you can skip to the affirmation section. If "No," proceed to question (b).

- If the insured qualifies as an "Exempt Commercial Purchaser" and has made a written request, answer "Yes" to question (b). Otherwise, indicate "No" and move on to question (c).

- Question (c) asks if the risk was submitted to companies authorized in New York and was declined by each. If "Yes," provide details in the following schedule, including the name of the company, NAIC Code, reasons for declination, date of declination, the affiliation of the representative, and why you believed the insurer would consider underwriting the risk. Repeat this step for up to three companies.

- In the AFFIRMATION section at the end of the document, print your name as the licensee or sublicensee of the named broker in Section 1, then sign and date the form, affirming under penalties of perjury that all contained information is true.

After completing the NYSID 41C W form, it's vital to review it to ensure all information is accurate and consistent with the relevant documentation. Any inconsistency can lead to unnecessary delays or rejections. Once satisfied, the form should be submitted according to the instructions provided by the New York State Insurance Department or the relevant regulatory body overseeing your insurance transaction. Timely and accurate submission reinforces compliance and fosters a trustworthy relationship with the authorities and your clients.

FAQ

What is the NYSID 41C W form?

The NYSID 41C W form, used in the state of New York, is an affidavit completed by a producing broker for surplus line insurance placements. It gathers essential information about the broker, the insured, and details concerning the insurance coverage sought. Moreover, it includes disclosures about the notification provided to the insured, declination information for risk coverage from authorized New York insurers, and an affirmation section to be signed under penalty of perjury.

Who is required to fill out the NYSID 41C W form?

Producing brokers, who are responsible for placing insurance with surplus line insurers on behalf of insured entities, must fill out and submit the NYSID 41C W form. This requirement ensures that all surplus line placements comply with New York's Insurance Law and Regulation 41.

What is the significance of the "Producing Broker Information" section?

This section collects basic but essential information about the broker who is placing the insurance, including their license number and contact details. This data helps in identifying the broker responsible for the insurance placement and facilitates communication if needed.

Why is the "Risk Information" section important?

The "Risk Information" section mandates the precise identification of the insured entity, ensuring that the coverage is correctly aligned with the entity seeking insurance. Accurate information prevents discrepancies that could affect the validity of the insurance coverage.

What is the purpose of the "Disclosure Information" section?

This part of the form requires the broker to confirm whether they have provided the insured with a written Notice of Excess Line Placement (Form: NELP/2011) as mandated by Section 2118 of the New York Insurance Law. It ensures the insured is aware that their coverage is being placed with a surplus line insurer.

What does the "Declination Information" section entail?

This section records if the insurance coverage sought has been declined by authorized New York insurers, whether declinations are not required for certain risks, or if the insured qualifies as an "Exempt Commercial Purchaser". The details provided help in validating the necessity to pursue insurance from a surplus line insurer.

Who qualifies as an "Exempt Commercial Purchaser"?

An "Exempt Commercial Purchaser" is defined by specific criteria in the New York Insurance Law, relating to the size and expertise of the purchaser, including but not limited to the purchaser's annual insurance expenditures. This classification allows for a streamlined process in obtaining insurance from surplus line insurers without needing to meet the usual declination requirements.

Why is the schedule of "AUTHORIZED COMPANIES DECLINING THE RISK" necessary?

This schedule documents the attempts made by the broker to place the insurance coverage with authorized insurers in New York and their reasons for declination. It serves as proof that the broker sought coverage from the standard market before resorting to a surplus line insurer.

Can you skip certain questions in the form?

Yes, certain sections of the form allow brokers to skip questions based on previous answers. For example, if it is determined that declinations are not required for the type of risk or if the insured is an "Exempt Commercial Purchaser," the broker can move directly to the affirmation section without completing the full declination schedule.

What is the importance of the affirmation section at the end of the form?

The affirmation section is where the broker affirms under penalties of perjury that all the information provided in the form is true to the best of their knowledge and belief. This commitment underscores the legal responsibility of the broker in ensuring the accuracy of the information disclosed on the NYSID 41C W form.

Common mistakes

When filling out the NYSID 41C W form, which is an essential document for insurance brokers managing excess line placements in New York, there are several common mistakes that can lead to significant delays, misunderstandings, or even legal issues. To ensure accuracy and compliance, it's critical to avoid these pitfalls.

Incorrectly Identifying the Insured: A common, yet critical mistake made is inaccurately recording the name of the insured in Part C under the Risk Information section. It's imperative that the name of the insured matches exactly across the affidavit, the declarations page, binder, cover note, or confirmation of coverage. Misalignment in this detail can cause confusion, lead to the insurance coverage not being properly recognized, and possibly result in a lack of coverage during a claim.

Failure to Provide Required Notices: Another error occurs in the Disclosure Information section, where brokers must indicate whether they have provided the insured with the written Notice of Excess Line Placement (NELP/2011), as mandated by Section 2118 of the New York Insurance Law and Regulation 41. Neglecting to provide this notice, or incorrectly indicating that it has been provided, exposes the broker to compliance issues and potential legal challenges.

- Lacking Documentation for Declinations: In the Declination Information section, brokers are asked if the risk was presented to and declined by authorized New York companies. A frequent mistake here is asserting that risks were declined without retaining proper documentation from these companies. This oversight can be problematic during audits or reviews, where evidence of such declinations is required.

- Omitting Valid Basis for Insurer Consideration: Within the same Declination Information section, brokers must document why they believed an insurer would consider underwriting the risk. Often, brokers provide incomplete explanations or overlook this requirement altogether, which could question the thoroughness and due diligence performed during the risk placement process.

For those navigating the intricacies of the NYSID 41C W form, being meticulous in these areas can significantly influence the success and legality of excess line insurance placements. Ensuring accurate information and thorough documentation are key to avoiding the common pitfalls that can arise during the filing process.

Documents used along the form

When navigating through insurance processes, particularly in New York, there's a core set of documents that accompany the NYSID 41C W form. Understanding these documents makes the journey smoother for everyone involved, from the producing broker to the insured party.

- Notice of Excess Line Placement (NELP/2011): This document is a mandatory notice to the insured about the placement of insurance with an excess line insurer. It ensures the insured is informed that their insurance coverage is being placed with an insurer not licensed in New York but legally allowed to provide coverage.

- Declaration Page: Typically the first page of an insurance policy, this document outlines the key elements of the insurance coverage, including the insured's name, the policy term, coverage limits, and the premium amount.

- Insurance Binder: A temporary insurance contract that provides proof of coverage before the issuance of a formal policy. It outlines the basic terms, coverages, and conditions of the agreement between the insured and the insurer.

- Cover Note: Similar to an insurance binder, a cover note serves as temporary proof of insurance coverage until the actual policy is issued. It is particularly common in certain lines of insurance, such as marine and cargo.

- Confirmation of Coverage: This document serves as verification that an insurance policy has been issued and outlines the scope of coverage. It's essential for the insured to ensure that the coverage meets their needs.

- Exempt Commercial Purchaser Declaration: For those insureds who qualify as "Exempt Commercial Purchasers," this declaration confirms their status and the nature of their request for insurance coverage, bypassing some of the standard market searching requirements.

- Risk Declination Schedule: This document records instances when insurance carriers, authorized in New York to write the type of coverage requested, have declined to underwrite a risk. It supports the use of the excess line market to find coverage for the insured.

Together, these documents form a comprehensive toolkit that ensures the clarity, legality, and adequacy of insurance arrangements. For professionals handling these forms, a deep understanding not only fulfills legal obligations but also affirms their commitment to serving their clients' best interests.

Similar forms

The ACORD 125 Commercial Insurance Application is similar to the NYSID 41C W form in that both are used in the insurance application process, but for different purposes. The ACORD 125 gathers broad information about the applicant's business operations and risk exposures, providing insurers with the necessary details to underwrite commercial insurance policies. Like the NYSID form, it’s an essential step in obtaining coverage, but focuses more on collecting general business information rather than the specifics of insurance placement practices and declination records.

The Surplus Lines Affidavit shares similarities with the NYSID 41C W form as it is used in the context of surplus lines insurance, which is insurance placed with non-admitted insurers when coverage cannot be found within the admitted market. Both documents involve affirmations related to the search for coverage and compliance with specific regulatory requirements, but the Surplus Lines Affidavit specifically focuses on the acknowledgment and acceptance of obtaining insurance from a surplus lines insurer.

Excess Line Association of New York (ELANY) Financial Statement Filings are required for excess line brokers in New York, similar to the NYSID 41C W form which is also a regulatory document for brokers dealing with excess line insurance. While the NYSID form documents efforts to place a risk and affirmations of compliance with regulatory requirements, the ELANY Financial Statement Filings focus on the financial aspects of the broker's operations, ensuring financial stability and compliance with surplus lines tax obligations.

Notice of Excess Line Placement (NELP/2011) is mentioned within the NYSID 41C W form and serves a complementary purpose. The NELP is a document that brokers are required to provide to insureds, notifying them that their coverage is being placed with an excess or surplus lines insurer. This document is directly linked to the practices documented in the NYSID form, underscoring the broker’s duty to inform the insured about the nature of their coverage placement.

The Certificate of Insurance is similar to the NYSID 41C W form in its function to provide evidence of insurance coverage but is distinct in its application and audience. While the NYSID form is an internal document used between brokers and regulators to affirm certain brokerage activities, a Certificate of Insurance is issued to the insured or interested third parties as proof of insurance coverage in place, detailing the terms and limits of the policy.

Insurance Binder similarly serves as temporary evidence of insurance coverage before the issuance of a formal policy, much like the NYSID 41C W form which involves documenting efforts to secure coverage. However, the binder is a contract that provides immediate insurance protection for a specified period, offering temporary coverage while the insurance underwriting process is completed.

The Declaration Page is part of an insurance policy that summarizes key information regarding the coverage, similar to how the NYSID 41C W form summarizes efforts to place coverage. Although serving different stages in the insurance process, both documents detail specific information about the insurance arrangement, such as the parties involved, types of coverage, and limits.

Policy Endorsements, which modify the terms of an insurance policy after it has been issued, can be related to the NYSID 41C W form in the sense both involve documentation that alters or affirms insurance coverage details. The NYSID form, however, is more about regulatory compliance in the placement process, whereas endorsements adjust the policy terms themselves.

The Risk Management Plan is a comprehensive document that identifies potential risks to a business and outlines strategies to mitigate these risks, sharing a preventative nature with the NYSID 41C W form. While the Risk Management Plan is broad and focused on overall business strategies, the NYSID form specifically deals with the brokerage aspect, ensuring that insurance placement activities adhere to regulatory standards.

Last, the Loss Run Report, which provides a history of claims on an insurance policy, has an indirect relation to the NYSID 41C W form through its use in the insurance underwriting process. Both documents provide insurers with crucial information needed to evaluate risk and make informed decisions — the NYSID form from a regulatory compliance standpoint, and the Loss Run Report from a claims history perspective.

Dos and Don'ts

When completing the NYSID 41C W form, there are several important steps to take and mistakes to avoid. Following these guidelines will ensure a smoother process:

- Do review the entire form before starting to familiarize yourself with the required information.

- Do ensure the name of the insured on the affidavit matches exactly with the name on the declarations page, binder, cover note, or confirmation of coverage.

- Do supply accurate and comprehensive information for the producing broker, including the license number and contact details.

- Do provide detailed declination information from authorized companies, including specific reasons for the risk declination.

- Do confirm that a written Notice of Excess Line Placement was provided to the insured, as required by law.

- Don’t skip any sections that require your attention and response, unless specifically directed by the form instructions.

- Don’t provide false or misleading information, as this affidavit is signed under the penalties of perjury.

- Don’t forget to sign and date the affirmation section, acknowledging the accuracy and truthfulness of the provided information.

- Don’t ignore the requirement to document any valid basis for believing an insurer would consider underwriting the risk.

- Don’t submit the form without revisiting all entered information for completeness and accuracy.

Adhering to these do’s and don’ts will help ensure a comprehensive and compliant submission of the NYSID 41C W form, avoiding potential issues or delays in processing.

Misconceptions

When navigating the complexities of the New York State insurance industry, the NYSID Form 41C - W stands out as a document of paramount importance. However, it's surrounded by misconceptions that can hinder both brokers and clients from leveraging its full benefits. Let's delve into four common misunderstandings and clear the air:

- The necessity of a written Notice of Excess Line Placement is often underestimated.

There's a common misconception that the step of providing a written Notice of Excess Line Placement (Form: NELP/2011) to the insured is merely formalistic and can be bypassed or substituted with verbal communication. This couldn't be further from the truth. The NYSID 41C - W Form reinforces the statutory requirement, stipulated under Section 2118 of the New York Insurance Law, emphasizing the necessity of this written notice to ensure clarity and compliance. This document serves as a tangible record that the insured has been informed about their coverage being placed in the excess line market.

- Many assume that declinations are required for every type of risk.

A significant area of confusion lies in the assumption that all risks must be declined by authorized companies before proceeding with excess line placement. However, the NYSID 41C - W Form introduces a nuanced perspective by inquiring if the Superintendent has determined that declinations are not necessary for the specific type of risk in question. This exception underscores the adaptability of regulatory requirements, reflecting an understanding that not all risks are created equal, and therefore, not all need to undergo the traditional declination process.

- Exempt Commercial Purchaser (ECP) status is often misunderstood.

The intricacies of how Exempt Commercial Purchaser (ECP) status affects the insurance process are frequently misconstrued. Many brokers and clients believe that ECP status automatically exempts them from many steps in securing insurance. The NYSID 41C - W Form clarifies that while ECPs do have a streamlined path, namely bypassing the need for declinations (as outlined in question (b)), this special status still requires strict adherence to certain criteria outlined in New York Insurance Law. This includes the necessity of a written request from the ECP, consistent with Section 2118(b)(3)(F), to qualify for the streamlined process.

- The process of documenting declined risks is frequently over-simplified in discussions.

Finally, there's a misconception about the simplicity of documenting declined risks. The NYSID 41C - W Form demands a rigorous and detailed account of why each insurer declined to underwrite the risk, including the specific reasons for declination and the basis on which the broker believed the insurer would consider the risk. This goes beyond merely listing companies that have declined to underwrite; it requires a comprehensive understanding of the market and the reasons behind insurers' decisions not to engage with particular risks. This detailed documentation ensures transparency and accountability within the excess line placement process.

Correcting these misunderstandings is essential for brokers to navigate the procedures associated with excess line insurance placements efficiently and compliantly. The NYSID 41C - W Form serves as a critical tool in this process, ensuring that all parties are adequately informed and that all regulatory requirements are met.

Key takeaways

Filling out and using the NYSID 41C W form is a crucial step for insurance brokers in New York when dealing with excess line placements. Understanding the key aspects of this form can help ensure compliance with state regulations and smooth operation for both brokers and clients. Here are six key takeaways:

- Ensure consistency in naming: The name of the insured provided on the NYSID 41C W form must match exactly with the name given on the declarations page, binder, cover note, or confirmation of coverage. This consistency is vital for legal and identification purposes.

- Disclosure requirements: The form includes a section for the producing broker to disclose whether a written Notice of Excess Line Placement has been provided to the insured as mandated by Section 2118 of the New York Insurance Law and Regulation 41.

- Understanding declination information: Brokers are required to indicate if declinations are necessary for the risk in question. If the Superintendent has determined declinations are not needed, or if the insured qualifies as an "Exempt Commercial Purchaser," specific sections of the form may be skipped.

- Detailed documentation of declinations: In cases where risk has been declined by authorized companies, the form requires comprehensive documentation. This includes the name of the company, the reason for declination, and the date it occurred, alongside the affiliation and name of the representative who declined the risk.

- Rationale behind company selection: Brokers must document the basis for believing an insurer would consider underwriting the risk. This could include factors such as recent acceptances of similar risks, advertising, media communications, or interactions with other industry professionals.

- Affirmation of accuracy: The final section of the NYSID 41C W form includes an affirmation by the licensee or sublicensee of the named broker. By signing, they affirm under penalties of perjury that all information contained within the form is true to the best of their knowledge and belief.

By paying close attention to these elements, brokers can navigate the complexities of excess line placements with greater confidence and ensure their paperwork is in complete compliance with New York's insurance regulations.

Common PDF Documents

Dob Forms - By mandating the provision of zoning and floor plan details, the PA1 form plays a crucial role in urban management and safety regulation.

Nyc School Tax Credit - It serves as a formal request for dividend option changes, requiring careful completion and timely submission.