Free Nys State Aid Voucher Form in PDF

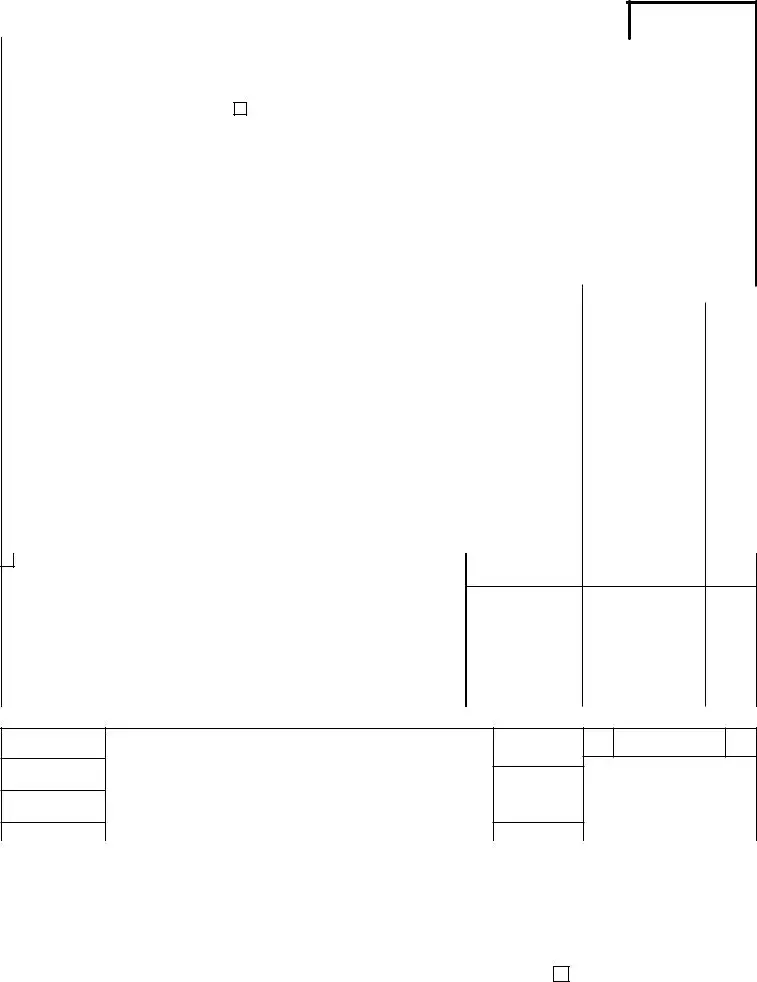

In navigating the complexities of state aid, the State of New York utilizes a structured approach through the New York State Aid Voucher form, identified as AC 1171 (Rev 10/96), to streamline the processing and distribution of funds. Designed to ensure a thorough and organized submission of claims, this form encompasses various vital components that facilitate a clear presentation of financial transactions eligible for state assistance. The form requests detailed information starting from the basic identifiers like the voucher number, originating agency, and the eligibility for interest, to more specified details including the payee's identification, the payment amount, and the relevant dates affiliated with the transaction such as the payment and liability dates. Additionally, it meticulously gathers data on the type of expenditure, breaking down the cost into the IRS amount, the payee's certification regarding compliance with statute provisions, and the net amount after deductions. Moreover, this form also incorporates sections for pre-audit and approval by the State Comptroller, ensuring that each claim undergoes rigorous verification for accuracy and legitimacy. Through delineating sections for the name and address of the payee, the specific details of the charges, and the applicable state aid program or statute, it constructs a comprehensive framework for the transparent and accountable allocation of state funds, reflecting New York's commitment to prudent fiscal management.

Nys State Aid Voucher Sample

AC 1171 (Rev 10/96)

STATE

OF STATE AID VOUCHER

NEW YORK

Voucher No.

1 |

Originating Agency |

|

|

|

|

|

|

Orig. Agency Code |

Interest Eligible (Y/N) |

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Payment Date |

(MM) |

(DD) (YY) |

OSC Use Only |

|

|

|

|

Liability Date |

|

(MM) (DD) |

|

(YY) |

|

|||||||

|

|

/ |

/ |

|

|

|

|

|

|

|

|

/ |

/ |

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2 |

Payee ID |

|

|

Additional |

3 Zip Code |

|

Route |

Payee Amount |

|

|

|

|

|

MIR Date (MM) (DD) (YY) |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/ |

/ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4 |

Payee Name (Limit to 30 spaces) |

|

|

|

|

|

IRS Code |

IRS Amount |

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Payee Name (Limit to 30 spaces) |

|

|

|

|

|

Stat. Type |

Statistic |

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Address (Limit to 30 spaces) |

|

|

|

|

|

|

|

|

5 |

Ref/Inv. No. (Limit to 20 spaces) |

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address (Limit to 30 spaces) |

|

|

|

|

|

|

|

|

Ref/Inv. Date |

(MM) |

(DD) (YY) |

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

/ |

/ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City (Limit to 20 spaces) |

(Limit to 2 spaces) à |

State |

Zip Code |

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6 |

Date |

Check or |

|

|

|

|

|

|

Description of Charges |

|

|

|

|

|

|

Amount |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

Paid |

Voucher No. |

|

(If Personal Service, show name, title, period covered) |

|

|

|

Dollars |

Cents |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7State Aid Program or Applicable Statute:

TOTAL

8 |

Payee Certiication: |

|

|

|

|

I certify that the above expenditures have been made in accordance with the provisions of the Applicable Statute; that the |

|

Less Receipts |

|

|

claim is just and correct; that no part thereof has been paid except as stated; that the balance is actually due and owing, |

|

|

|

|

and that taxes from which the State is exempt are excluded. |

|

|

|

è_________________________________________________________ |

_______________________________ |

|

NET |

|

|

Signature in Ink |

Date |

|

|

|

Title____________________________________________________________________________________________ |

|

State Aid |

|

|

|

|

|

|

|

Name of Municipality ______________________________________________________________________________ |

|

_____% Claimed |

|

|

|

|

||

|

|

|

|

|

|

FOR STATE AGENCY USE ONLY |

|

STATE COMPTROLLER’S |

|

Merchandise Received

Date

Page No.

By

I certify that this claim is correct and just, and payment is approved.

__________________________________________________________________________________

By

__________________________________________________________________________________

Date

Veriied

Audited

State

Aid

Certiied For Payment

of

State AId Amount

By ______________________________

|

|

|

|

|

Expenditure |

|

|

Liquidation |

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost Center Code |

|

|

Object |

Accum |

Amount |

Orig. Agency |

|

PO/Contract |

Line |

F/P |

|

Dept. |

Cost Center Unit |

Var. |

Yr. |

Dept. |

Statewide |

|

||||||

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Distribution: Original to OSC with Copy to Agency and Municipality

Check if Continuation form is attached

File Overview

| Fact | Detail |

|---|---|

| Form Number and Revision Date | AC 1171 (Rev 10/96) |

| Title and Purpose | State Aid Voucher for the State of New York, used to request payment under state aid programs. |

| Governing Law | Specific statutes governing state aid programs in New York (varies by program). |

| Key Components | Includes fields for originating agency information, payee details, payment and liability dates, description of charges, and certification of expenditures as per applicable statutes. |

| Submission Requirements | Voucher must be signed in ink by the payee certifying expenditures in accordance with the applicable statute, and it must be pre-audited and approved by the State Comptroller’s Office prior to payment. |

Nys State Aid Voucher: Usage Guidelines

Filling out a State Aid Voucher for the State of New York involves multiple steps but is crucial for requesting aid. Precision and attention to detail ensure accurate processing. Here's how to complete the form:

- Enter the Voucher No. It's unique to your request and may be provided by your agency.

- Specify the Originating Agency and its Code. This information identifies the agency from which the aid request originates.

- Indicate whether the aid is Interest Eligible with a simple "Y" for yes or "N" for no.

- Fill in the Payment Date and Liability Date using the MM/DD/YY format. These dates track when the aid is paid and the liability is incurred.

- Input the Payee ID, Additional Zip Code Route (if applicable), and the Payee Amount MIR Date to ensure the payment is directed correctly.

- For the Payee information section:

- Write the Payee Name (limited to 30 spaces).

- Insert the Address, City, State, and Zip Code accurately to avoid any mailing issues.

- Record the Ref/Inv. No. and its corresponding date to provide a reference or invoice number for the transaction.

- Detail the Description of Charges, displaying a clear explanation of what the aid covers, including the Date Check, Voucher No. if applicable, and the total Amount Paid.

- Specify the State Aid Program or Applicable Statute under which the aid is requested to ensure compliance with state laws.

- In the Payee Certification section, the payee must:",

- Sign their name in ink.

- Print their title.

- State the name of the municipality if applicable.

- Declare the percentage of aid claimed.

- For State Agency Use Only, this section is filled out by state officials to certify, approve, and process the aid payment.

Once completed, ensure to attach any required documentation and submit the form according to your agency's process. Remember, this form enables municipalities or state agencies to request financial aid, and accurate completion is paramount for the State Comptroller's approval.

FAQ

- What is the NYS State Aid Voucher?

The NYS State Aid Voucher is a document used by the State of New York to process payments for various state aid programs. It outlines the details of the payment, including the payee's information, the amount, and the program under which the payment is being made. It serves as an official request for payment from the originating agency to the Office of the State Comptroller (OSC).

- Who fills out the State Aid Voucher form?

Typically, an authorized representative from the state agency or municipality that is requesting the state aid fills out the form. This person must have knowledge of the expenditures and the authority to certify that the expenses comply with the applicable statutes and regulations.

- What does "Interest Eligible" mean on the form?

"Interest Eligible" indicates whether the payment being requested is eligible for interest if there are delays in processing. An answer of "Y" for yes means that, under certain conditions, the payee might receive interest if the payment is not made in a timely manner. "N" for no indicates the opposite.

- How is the "Payee ID" used?

The "Payee ID" is a unique identifier for the individual or entity receiving the state aid. It's crucial for ensuring that the payment is issued to the correct party and helps streamline the processing and tracking of payments within the state's financial systems.

- What information is required in the "Description of Charges" section?

In the "Description of Charges" section, the agency must detail the expenditures for which state aid is being requested. This includes personal services, where the name, title, and period covered should be specified, along with any other relevant expenses related to the aid program.

- Can you explain the "Payee Certification" section?

The "Payee Certification" is a declaration by the payee confirming that the claimed expenditures comply with the legal and regulatory provisions of the applicable state aid program. It also asserts that the claim is just and correct, no part of it has been paid except as stated, the balance is due, and taxes from which the state is exempt are excluded.

- What is meant by "FOR STATE AGENCY USE ONLY"?

This section is reserved for the State Comptroller's Office and other authorized state personnel to process, audit, and approve the voucher for payment. It includes fields for verification, audit, and payment approval that are not to be filled out by the originating agency or municipality.

- What happens if there are errors in the form?

If errors are found in the form, it may be returned to the originating agency for correction, which can delay the payment process. It's important to review the form for accuracy and completeness before submission to avoid such delays.

- Where should the State Aid Voucher be submitted?

The completed State Aid Voucher form, along with any necessary documentation, should be submitted to the New York State Comptroller's Office. A copy should also be sent to the originating agency and the municipality involved, if applicable. Submission procedures and addresses can usually be found on the OSC's website or by contacting the office directly.

Common mistakes

When it comes to navigating the complexities of the New York State Aid Voucher form (AC 1171 Rev 10/96), individuals often encounter several common pitfalls that can lead to errors in their submissions. These mistakes can potentially delay the processing of aid or result in the rejection of the voucher. Recognizing and avoiding these errors is crucial for a smooth transaction.

Here are eight common mistakes people make when filling out the NYS State Aid Voucher form:

- Incorrect Payee Information: One of the most common mistakes is incorrectly entering the payee's name or identification number. It is essential to double-check that these details match exactly with official documents to ensure the payment is processed correctly.

- Failing to Specify the Payment Date: The payment date fields (Payment Date and Liability Date) are often left blank or filled out incorrectly. It's important to note the correct format (MM/DD/YY) and to make sure that the dates are accurate to avoid any confusion.

- Overlooking the Interest Eligibility: Marking the “Interest Eligible” field incorrectly can lead to unintended financial implications. It’s crucial to understand the criteria for interest eligibility before marking ‘Y’ (Yes) or ‘N’ (No).

- Leaving Required Fields Blank: Fields such as City, State, and Zip Code are sometimes left incomplete. These details are critical for ensuring that any correspondence or payments reach the correct destination.

- Misunderstanding the Description of Charges: In section 6, it’s necessary to provide a clear and precise description of the charges. Vague descriptions or misunderstanding the requirement to detail personal services can lead to processing delays.

- Underestimating the Importance of the Ref/Inv. No: The Reference/Invoice Number (Ref/Inv. No.) is a critical piece of information that should not be overlooked. This number ties your voucher to specific expenses or transactions.

- Incorrectly Calculating Totals: An error in the calculation of the total amount requested, including the failure to subtract any applicable receipts, can lead to discrepancies that may require additional clarification or correction.

- Neglecting the Payee Certification: The form requires the payee's certification to attest to the accuracy and legitimacy of the claim. Neglecting to sign or improperly filling out this section can invalidate the entire voucher.

To avoid these common pitfalls:

- Always review the entire form before submission to ensure that all required fields are completed accurately.

- Refer to the instructional guide or seek clarification on any unclear sections to ensure compliance with the form’s requirements.

- Double-check calculations and the accuracy of financial information to prevent errors.

- Ensure that all personal and agency information is up-to-date and correctly entered.

By paying close attention to these details, individuals can improve the accuracy of their State Aid Voucher submissions, facilitating a smoother and more efficient processing experience. Remember, when in doubt, it's better to seek assistance than to submit a form with errors.

Documents used along the form

When submitting the New York State Aid Voucher form, several other forms and documents often accompany it to ensure a seamless and compliant financial process. These documents help to paint a complete picture of the transaction and ensure that all the details and requisite approvals are in place for a successful aid distribution. Below is a list of additional forms and documents that are frequently used alongside the NYS State Aid Voucher form.

- IRS W-9 Form: Used to provide a Taxpayer Identification Number (TIN) and certification, helping to ensure that the payee is correctly identified for tax purposes.

- Budget Allocation Notice: Outlines the specific amounts allocated for different expenses or programs, providing a reference point for the voucher's expenditures.

- Invoice: Details the goods or services provided, including amounts due, which substantiate the claims made in the voucher.

- Receipts: Evidence of payment, crucial for verifying that the expenses claimed on the voucher have actually been incurred and paid.

- Contract or Agreement Documents: Provide the terms and conditions under which services or goods are delivered, justifying the expenditures claimed.

- Approval Memos: Written approvals from authorized personnel, required for expenditures exceeding certain thresholds or for specific types of expenses.

- Program Performance Reports: Detail the outcomes or outputs of the funded program, necessary for demonstrating compliance with grant or aid conditions.

- Expenditure Schedule: Breaks down the expenses for which reimbursement is requested, aligning them with the approved budget categories.

- Audit Reports: May be required for certain types of funding, providing an independent verification of expenditures and program performance.

The compilation of these documents with the NYS State Aid Voucher form contributes to a system of checks and balances, ensuring that state funds are used efficiently, effectively, and in accordance with legal and regulatory requirements. Each document plays a crucial role in building a clear, auditable record of financial transactions, facilitating accountability and transparency in the management of public funds.

Similar forms

The NYS State Aid Voucher form shares similarities with the IRS Form 1040, which is the standard U.S. individual income tax return form. Both forms require personal identification information, such as name, address, and specific identification numbers (Social Security Number for the IRS 1040 and Payee ID for the State Aid Voucher). They also demand detailed financial information, including amounts received or paid, and they necessitate a certification or signature that attests to the accuracy of the information provided. This process helps ensure accountability and compliance with regulatory requirements.

Another document comparable to the NYS State Aid Voucher is the Purchase Order (PO) form used in business procurement. Similar to the section in the State Aid Voucher where details of the payment for services or goods are listed, a PO specifies the types of goods or services being purchased, their costs, and payment terms. Both documents serve as a formal offer to buy products or services and require detailed information about the transaction, including a unique identification number, the names of the parties involved, and the total amount payable.

The Expense Report forms found in many organizations also mirror aspects of the NYS State Aid Voucher. These forms are used by employees to claim reimbursement for expenditures incurred on behalf of the organization. Like the State Aid Voucher, Expense Reports require detailed descriptions of each charge, proof that the expenses align with policy (similar to how expenses on the State Aid Voucher must be in accordance with the Applicable Statute), and a certification that the claim is accurate and just. Both forms are crucial for financial transparency and accountability within entities.

Finally, Grant Application Forms share similarities with the NYS State Aid Voucher form, particularly in how they both outline specific financial requests and require detailed descriptions of the use of funds. Grant applications typically require applicants to provide a budget, similar to how the State Aid Voucher requires a breakdown of expenses. Both forms also require the applicant or payee to certify the accuracy of the information provided and that the requested funds will be used as stated, ensuring funds are allocated and used responsibly.

Dos and Don'ts

When it comes to filling out the New York State Aid Voucher form, attention to detail and accuracy are crucial. Below are essential do's and don'ts to guide you through the process:

Do's:

- Verify all information before filling out the form to ensure accuracy. This includes checking the originating agency code, payee ID, and all dates (liability date, payment date, etc.).

- Clearly print or type the payee name, limiting it to 30 spaces as instructed. This helps in avoiding any confusion and ensures the voucher is processed smoothly.

- Include the precise amount to be paid, breaking it down into dollars and cents. This clarity is essential for the State's accounting processes.

- Fill in the State Aid Program or Applicable Statute section carefully. This information is crucial for the voucher's processing and approval.

- Sign the payee certification section in ink. A signature verifies that the information provided is accurate and truthful.

- Make sure all sections relevant to your claim are completed. If additional space is needed, check the box indicating that a continuation form is attached.

Don'ts:

- Don't leave any mandatory fields blank. Incomplete forms can delay processing and may result in the voucher being returned for corrections.

- Don't guess on dates or amounts. Verify all information against your records before entering it on the voucher.

- Avoid making corrections or using white-out on the form. If an error is made, it's advisable to start with a fresh form to maintain legibility.

- Don't exceed the space limits for text fields, such as the payee name or address. Adhering to the space limitations ensures all information is displayed correctly in the system.

- Don't handwrite in a manner that's difficult to read. Poor handwriting can lead to errors in processing the voucher.

- Don't forget to attach additional documentation that supports your voucher claim, if necessary. This may include invoices, contracts, or other relevant materials.

Adhering to these guidelines when filling out the New York State Aid Voucher form will help ensure a smoother process for all parties involved. Proper completion of the form is essential for timely and accurate processing of state aid funds.

Misconceptions

When dealing with the New York State Aid Voucher form, it's important to clarify common misconceptions that can confuse first-time or even experienced users. Here are six such misconceptions:

- Every section must be completed by the applicant. In reality, certain sections are designated for State Agency Use Only, such as the "STATE COMPTROLLER’S PRE-AUDIT" section. Applicants are responsible only for the parts of the form relevant to their claims.

- The voucher is for individual claims only. This is not accurate. The form is designed to facilitate payments to multiple types of payees, including individuals and entities, which is why sections like "Payee ID" and "Payee Name" are provided.

- Interest is always eligible. Whether interest is eligible or not is specified in the form. If "Interest Eligible" is marked "N" (No), then no interest claims can be made for that particular voucher.

- Financial details are limited to the "Amount Paid" section. Financial information is critical throughout the voucher, including sections like "IRS Amount" and "NET" which indicate specific financial transactions beyond just the amount paid.

- The form is only for internal use within New York State agencies. Although the form is used by state agencies, it must also be shared with and completed by individuals or entities claiming state aid, making it a document handled by both internal and external parties.

- Submission of the form guarantees payment. Completion and submission of the voucher form is merely a step in the state aid payment process. It must undergo verification, pre-audit approvals, and satisfy all statutory requirements before any payment is disbursed.

Understanding these points helps in accurately completing the form and managing expectations regarding the processing of state aid claims. It is crucial for applicants to carefully read the instructions and complete only the sections that apply to their situation, ensuring all required documentation is submitted to support their claims.

Key takeaways

Filling out and using the New York State Aid Voucher form is crucial for the correct processing and receiving of state aid payments. Here are key takeaways to ensure accurate and efficient handling:

- Every section of the form must be completed accurately to avoid delays. This includes personal and agency information, payment details, and relevant dates.

- It is important to indicate the Originating Agency Code precisely; this ensures the payment is processed by the correct department within the state system.

- The Payee ID and additional identification information are critical for ensuring the funds are allocated to the right recipient.

- Determining whether the payment is Interest Eligible (marked as Y/N) impacts the calculation of any applicable interest due to the payee.

- Specific dates, such as the Payment Date, Liability Date, and the MIR Date, are essential for tracking the voucher's processing status and for auditing purposes.

- The Description of Charges should clearly detail the purpose of the payment or service provided, including any personal service information, if applicable.

- Under the Payee Certification section, the signatory confirms that the expenses meet the statutory requirements, ensuring compliance with state regulations.

- For agencies, proper authorizations, including the signature and title of the certifying official, are required to validate the claimed expenses.

- The State Comptroller’s pre-audit section is reserved for internal use by the state to certify the accuracy and eligibility of the voucher before payment is approved.

Adhering to these guidelines when filling out the New York State Aid Voucher form helps in facilitating a smoother, more efficient state aid payment process. This ensures that funds are disbursed correctly and timely, supporting the essential services and programs critical to New York State's operations and its residents.

Common PDF Documents

How to Transfer Car Title in Ny - This form is an essential tool for preserving historical vehicle data, especially for non-titled vehicles that lack modern tracking.

Nyc Retirement System - A document that demands thoughtful consideration, as it solidifies retirement payment options and sets the stage for beneficiary provisions.