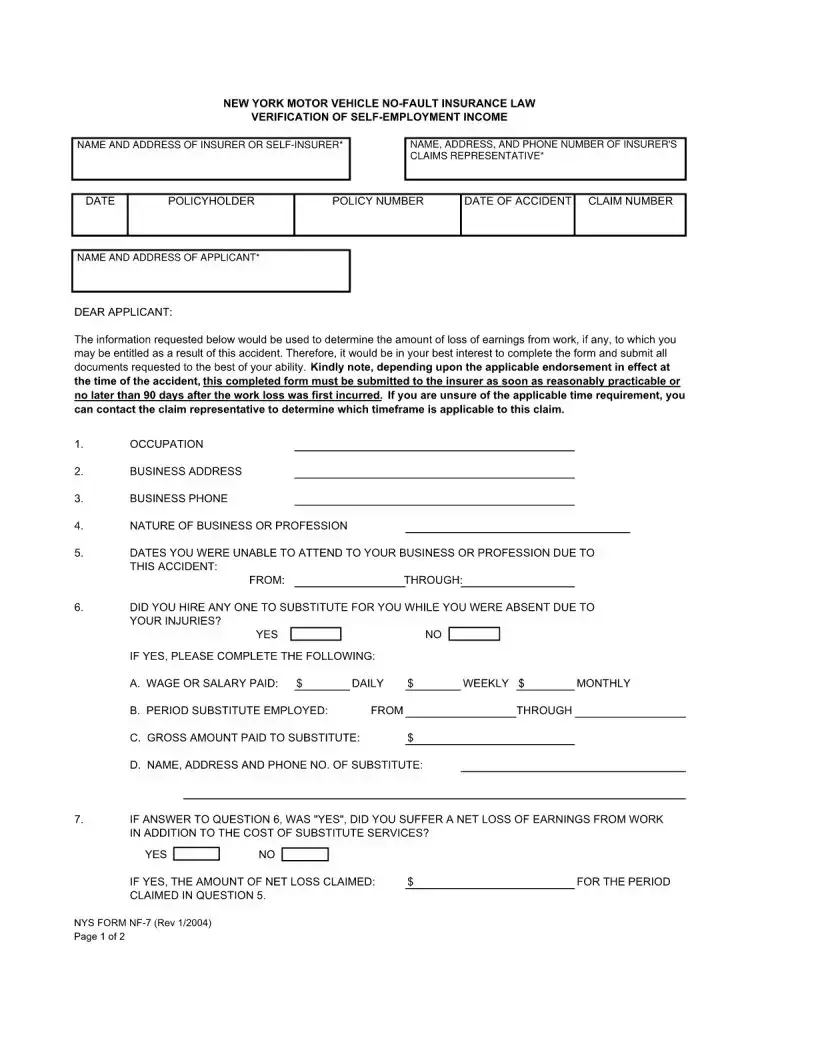

Free Nys Nf 7 Form in PDF

In navigating the complexities of insurance claims within New York State, individuals and professionals often encounter various forms, each designed to facilitate specific aspects of the claims process. Among these, the NYS NF 7 form stands out as a critical document for those seeking reimbursement or addressing issues related to no-fault insurance claims. This form, integral to the procedural landscape of managing no-fault claims, serves as a direct channel for claimants to present their case to insurance providers. It encapsulates the claimant's request for essential services and the reimbursement of expenses tied to accidents under no-fault insurance coverage. Its design and required information aim to streamline the evaluation process, making it easier for insurers to assess and respond to claims. By addressing key details such as personal information, details of the accident, and specific expenses incurred, the NYS NF 7 simplifies the complex interactions between claimants and insurance companies, thereby playing a pivotal role in the efficient processing of no-fault insurance claims.

Nys Nf 7 Sample

File Overview

| Fact Number | Details |

|---|---|

| 1 | The NYS NF-7 Form is also known as the "No-Fault Wage Verification Report". |

| 2 | It is used in the state of New York. |

| 3 | The purpose of the form is to verify the lost wages of individuals who have been injured in a motor vehicle accident and are making a no-fault insurance claim. |

| 4 | Employers fill out this form to provide verification of the employee's earnings and employment status before and after the accident. |

| 5 | Submission of the NYS NF-7 Form is a requirement for individuals seeking compensation for lost wages under a no-fault insurance policy. |

| 6 | The form requires detailed employment information including dates of absence, salary, and hours worked. | >

| 7 | Governed by New York State's Comprehensive Motor Vehicle Insurance Reparations Act, commonly known as the No-Fault Law. |

| 8 | Failure to accurately complete and submit the form can result in denial of the wage compensation claim. |

| 9 | The NY NF-7 Form must be submitted to the claimant’s insurance provider, not directly to any state office. |

Nys Nf 7: Usage Guidelines

Upon encountering the Nys Nf 7 form, the person needs to be thorough and attentive. The information conveyed in this document is crucial for further processes that will follow. Each step, which has been streamlined for clarity, must be followed meticulously. This ensures that the individuals involved can advance without unnecessary setbacks. Following these steps not just demonstrates an individual's ability to comply with guidelines but also sets the stage for the subsequent stages that hinge on the accuracy of this form's completion.

- Start by entering the date at the top right corner of the form. Ensure the date format follows the local standard for New York State.

- In the section labeled "Insurer's Name," write the name of the insurance company that is issuing or managing the policy.

- Fill in the "Claim Number" field with the unique identifier provided by the insurer for this specific claim.

- Under the "Patient's Name" section, provide the full legal name of the individual receiving the medical treatment or services.

- Next, input the patient's date of birth and social security number in the spaces marked accordingly. Double-check for accuracy to prevent identity errors.

- Specify the date of the accident/incident leading to the medical claim. This is crucial for establishing the timeline of events.

- In the "Employer's Name" section, write the name of the patient's employer at the time of the accident/incident, if applicable.

- Detail the nature of the accident/incident in the space provided, including how, when, and where it occurred. Be concise but thorough in the description.

- The section labeled "Details of Treatment" should be filled with information regarding the medical services received by the patient. Include dates, types of treatment, and the names of any treating physicians or facilities.

- For any expenses incurred, list them in the "Expenses" section. Itemize each cost and attach supporting documentation, such as receipts or invoices, as required.

- Sign and date the form in the designated area at the bottom. If you are filling this out on behalf of someone else, include your relationship to the patient.

- Finally, review the entire form for completeness and accuracy. Any mistakes could delay the process. Once everything is verified, submit the form to the insurer or designated representative as directed.

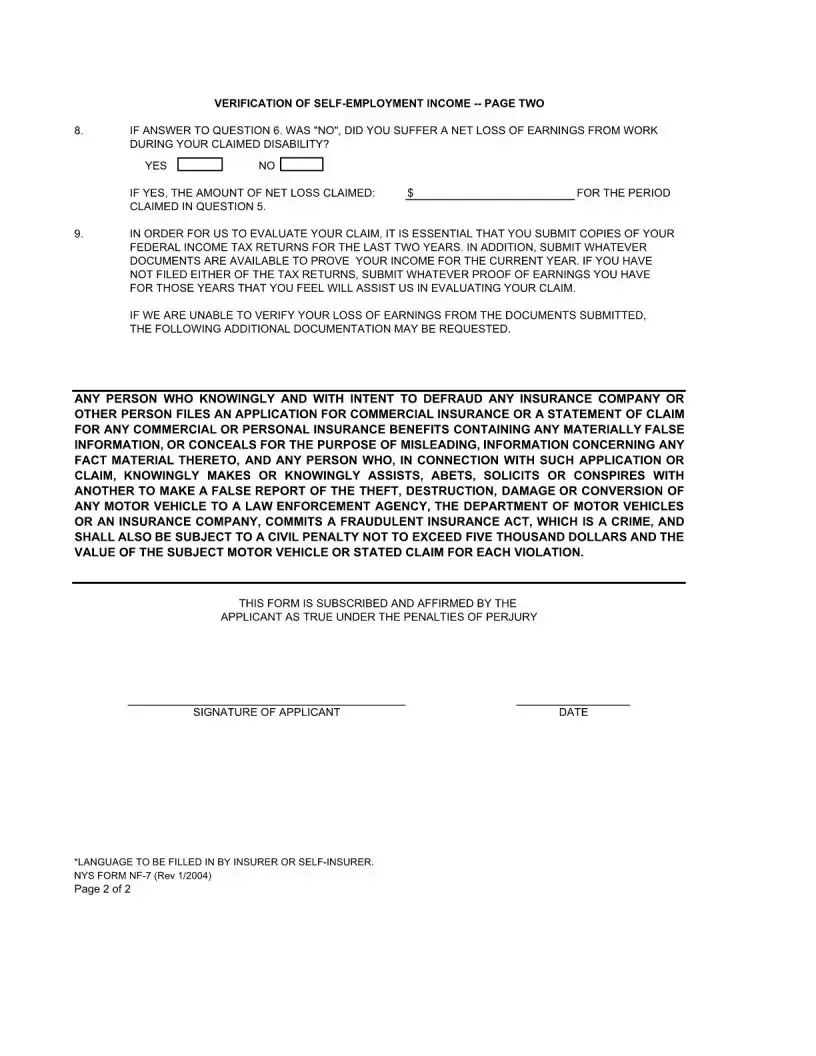

With the form filled out carefully and accurately, it is ready for submission. The details provided will undergo scrutiny during the evaluation process, making it imperative that all information is correct and up to date. Submitting this form is a pivotal step in ensuring that the individuals involved can move forward, whether it concerns resolution, compensation, or further necessary action. Precision in this stage lays a solid foundation for the stages that follow.

FAQ

-

What is the NYS NF 7 form?

The NYS NF 7 form, also known as the New York State No-Fault Wage Verification Report, is a document used by employers to verify the wages of an employee who has filed a no-fault insurance claim. This form is crucial for insurance providers to determine the amount of lost earnings benefits the injured employee is entitled to receive due to an automobile accident.

-

Who needs to fill out the NYS NF 7 form?

This form must be completed by the employer of the individual who is making a no-fault insurance claim. It is the employer’s responsibility to fill out this form with accurate information about the employee's wages, work schedule, and any changes in their employment status resulting from the accident.

-

What type of information is required on the NYS NF 7 form?

The NYS NF 7 form requires detailed information regarding the employee's employment status and earnings. This includes the employee's personal information, employment details (such as position, rate of pay, normal work hours, and wages), and any changes in employment or earnings due to the accident. Accurate and thorough completion of this form is important to ensure the correct calculation of benefits.

-

Where should the completed NYS NF 7 form be sent?

Once completed, the NYS NF 7 form should be sent directly to the insurance company handling the no-fault claim. It is important to check with the specific insurance provider for their preferred method of submission, whether it be through mail, fax, or email, to ensure the form is received and processed in a timely manner.

Common mistakes

When filling out the NYS NF-7 form, which is crucial for No-Fault insurance claims in New York State, many people inadvertently make mistakes. These errors can delay or even jeopardize their ability to receive benefits. Understanding these common pitfalls can help ensure the process goes more smoothly.

One of the most frequent mistakes is not providing complete information. The NYS NF-7 form requires detailed personal, accident, and insurance information. Sometimes, individuals leave sections blank or provide incomplete answers. It's essential to review the form carefully and fill out each section fully to avoid processing delays.

Another common error is submitting the form late. There's a specific timeframe within which the form must be submitted to your insurance provider. Waiting too long or neglecting the deadlines can lead to a denial of the claim. Ensuring the form is submitted promptly is key to securing your benefits.

Some people make the mistake of failing to include accurate accident details. The circumstances of the accident, including the date, time, and location, need to be clearly described. Vague or inaccurate descriptions can confuse the situation, potentially leading to questions regarding the validity of the claim.

Frequently, individuals also err by not providing sufficient evidence. Supporting documents, such as medical reports, police reports, and witness statements, bolster your claim. Failing to attach these necessary documents can weaken your position and lead to unnecessary complications.

Incorrect insurance information is another common error. This includes mistakes in policy numbers, the insurance company's name, or contact details. Such inaccuracies can redirect your claim to the wrong department or even the wrong company, significantly delaying the process.

Lastly, many overlook the importance of verifying the claim with their healthcare provider. It is crucial that the healthcare provider is informed about the claim being processed under No-Fault insurance to ensure they submit the necessary medical information in support of your claim. Miscommunication in this area can lead to disputes over coverage and eligibility.

To avoid these mistakes on the NYS NF-7 form, it's vital to approach the task with attention to detail and an understanding of the requirements. Taking the time to carefully review and complete each section, submitting the form within the designated deadlines, and including all necessary documentation can greatly increase the likelihood of a favorable outcome.

Documents used along the form

When dealing with motor vehicle accidents in New York State, the NYS NF-7 form, often known as the "No-Fault Wage Verification Report," is crucial for processing claims. This document is particularly important for individuals seeking to receive compensation for lost wages due to injuries sustained in a motor vehicle accident. However, the NF-7 form is just one piece of the puzzle. To paint the full picture of an individual's claim and circumstances following an accident, several other documents are typically required. These documents vary in purpose, from reporting the accident to detailing medical treatment received. Understanding each document's role can streamline the claims process, making it more efficient and less stressful.

- NYS MV-104 form - This is an "Accident Report" form. It's essential for drivers involved in accidents that result in either injury or property damage over a specific amount to complete this form. It provides the baseline of facts surrounding the accident.

- Police Report - A report filed by the officer who responds to the scene of the accident. It includes a third-party perspective on the accident, including any determinations of fault. This document can be pivotal in the claims process.

- NF-2 form - Known as the "Application for No-Fault Benefits," this form is where the claim process starts. It's used by claimants to officially request compensation for medical expenses and lost wages.

- Medical Reports - Detailed reports from treating physicians and healthcare providers that outline the nature of the injuries, the expected course of treatment, and the prognosis. These are critical for substantiating claims for medical benefits.

- Proof of Employment and Earnings - Documents that verify one's employment status and earnings at the time of the accident. Pay stubs, employment letters, and other official documents can serve this purpose.

- Receipts for Additional Expenses - Receipts for any additional expenses incurred as a result of the accident, such as for medication, equipment, or services like physical therapy, which are crucial for reimbursement claims.

- NF-10 form - The "Denial of Motor Vehicle No-Fault Benefits" form. If a claim for no-fault benefits is denied, this form outlines the reasons for the denial and the next steps for the claimant. It's an important document for understanding and possibly contesting a denial.

Together, these forms and documents play essential roles in the no-fault claims process. By providing detailed information about the accident, the injuries sustained, and the financial impact of those injuries, they help ensure that claimants receive fair and timely compensation. It's important for individuals involved in motor vehicle accidents in New York State to be aware of these documents and to gather and submit them as required to support their claims. Remember, proper documentation can make all the difference in the resolution of a claim.

Similar forms

The New York State No-Fault (NYS NF) 7 form shares similarities with the Workers' Compensation First Report of Injury (FROI) form. Both documents are pivotal in initiating claims following an injury – the NYS NF 7 form in the context of motor vehicle accidents and the FROI in workplace injuries. Each form collects preliminary information about the incident, including details about the injured party, the date, time, and location of the event, and a description of the injury. This initial data is crucial for the respective insurance processes to begin, ensuring timely and appropriate response to the injury claims.

Another document akin to the NYS NF 7 form is the Personal Injury Protection (PIP) application form, common in states with no-fault insurance systems. Similar to the NYS NF 7, the PIP application requires detailed information about the automobile accident and the resulting injuries to initiate a claim under the no-fault insurance coverage. Both forms are instrumental in accessing benefits designed to cover medical expenses, lost earnings, and other related costs without the need to prove who was at fault in the accident.

The Property Damage Report Form also shares characteristics with the NYS NF 7 form. Though focused on damage to property rather than personal injury, it similarly requires the claimant to provide comprehensive details about the incident—such as the date, time, and location, along with a description of the damage. This documentation is essential for insurance companies to assess the claim and determine the extent of coverage for the damaged property, mirroring the process for injury claims in automobile accidents.').

Similarly, the General Liability Notice of Occurrence / Claim form, often used in various insurance claims, matches the NYS NF 7 form in structure and purpose. It serves as a notification to an insurer about an event that may lead to a claim, whether it be personal injury or property damage. Critical information about the incident, including specifics of the parties involved and the nature of the injury or damage, is required on the form. This parallel in gathering initial information makes it a crucial step in the claims process.

The Health Insurance Claim Form, such as the standard CMS-1500 used by healthcare providers to bill Medicare and all health insurance companies, also parallels the NYS NF 7 form. It captures detailed information about the patient, their injury or illness, and the medical services provided, which is integral for processing healthcare claims. The purpose of both forms is to ensure the injured or ill party receives coverage for their medical needs, highlighting the emphasis on timely and accurate documentation for claim processing.

Last but not least, the Disability Benefits Claim form, which is used to apply for benefits under a disability insurance policy, shares similarities with the NYS NF 7 form. Both collect detailed information about the claimant, the nature of their injury or disability, and the impact it has on their ability to work. These forms are essential for initiating the claim process and establishing the claimant's eligibility for benefits, providing a foundation for financial support during recovery.

Dos and Don'ts

When it comes to handling legal documents, precision is key. The New York State NF-7 form, which is a crucial piece of documentation in various legal and medical claims, is no exception. Understanding the right and wrong ways to fill out this form can significantly impact the processing time and outcome of your claim. Below, you'll find a curated list of dos and don’ts to guide you through the process of completing the NYS NF-7 form accurately.

Things You Should Do

- Read the instructions carefully before you start filling out the form. This can help prevent common mistakes that may delay your claim.

- Fill out the form completely. Missing information can lead to processing delays or even the outright rejection of your claim.

- Use black or blue ink for filling out the form. This ensures the information is legible and photocopies clearly.

- Review your information for accuracy before submitting the form. Double-check personal information, dates, and details related to your claim.

- Keep a copy for your records. Always make a copy of the completed form for your personal files before submitting it. This documentation can be crucial in case of disputes or for future reference.

Things You Shouldn't Do

- Don’t rush through the form. Take the time needed to ensure all information is correct and complete.

- Don’t use pencil or non-standard ink colors. This can make your form hard to read or photocopy, which can lead to processing issues.

- Don’t overlook any sections. Each section of the form is important and requires your attention.

- Don’t guess on dates or figures. Accurate information is crucial. If you’re unsure, it’s better to verify first before submitting incorrect data.

- Don’t forget to sign and date the form. An unsigned form is often considered incomplete and can significantly delay the processing of your claim.

Filling out the NYS NF-7 form, or any legal document for that matter, demands your full attention and care. By following these guidelines, you can ensure the swift and accurate processing of your form, thus avoiding unnecessary delays or complications with your claim. Remember, when in doubt, seeking assistance from a legal professional can provide clarity and help safeguard your rights throughout the process.

Misconceptions

Many people think the NYS NF-7 form is only for reporting vehicle accidents, but it's actually much broader. This form covers various types of incidents related to motor vehicles, not just accidents. It's crucial for ensuring all necessary details are properly documented.

There's a common misconception that you need to be at fault to fill out an NYS NF-7 form. This is not the case. Regardless of who is at fault, if you're involved in an incident, it's wise to fill out the form. It provides a clear record of what happened, which can be invaluable later.

Some people believe that you can only submit the NYS NF-7 form in the immediate aftermath of an incident. However, there's actually a timeframe in which you can submit. It's essential to review the specific guidelines, as this window allows for proper documentation even if you're initially unable to complete the form.

It's a misconception that the NYS NF-7 form is complicated and requires legal assistance to complete. While it's important to fill out the form accurately, many find it straightforward. Guidelines are provided, and seeking clarification from a professional is always an option if needed. The form is designed to be accessible to individuals, not just lawyers.

Lastly, many assume that once the NYS NF-7 form is submitted, it no longer needs attention. However, it's essential to keep a copy for your records and follow up as necessary. The form is a part of the process, not the conclusion. Staying proactive and involved is key to ensuring that matters are resolved satisfactorily.

Key takeaways

The New York State NF-7 form, also known as the "New York Motor Vehicle No-Fault Insurance Law Verification of Treatment" form, is an essential document for individuals seeking coverage for medical treatment due to injuries sustained in a motor vehicle accident under the state’s no-fault insurance policy. Here are key takeaways to consider when filling out and using this form:

Accuracy is crucial: Ensure all information provided on the form is accurate and complete. Inaccuracies can delay processing and may affect eligibility for benefits.

Understand the deadlines: The NF-7 form must be submitted to the insurance provider within a certain timeframe following the accident, typically within 45 days. Missing this deadline can result in a denial of benefits.

Detail medical services: Provide a comprehensive list of all medical services received due to the accident, including dates of service and the names of providers. This detail is vital for the insurance company to evaluate and cover treatment costs.

Signature is mandatory: The form requires the signature of the treating healthcare provider. Unsigned forms will not be processed, leading to potential delays in receiving benefits.

Include supporting documentation: Submitting the NF-7 form with all necessary supporting documents, such as medical records and bills, expedites the verification process and facilitates quicker reimbursement.

Stay informed about the status of your claim: After submitting the NF-7 form, keep in communication with the insurance company to stay updated on the status of your claim and to address any requests for additional information.

Understand your coverage: Familiarize yourself with your insurance policy’s coverage limits for medical treatment under no-fault insurance. This knowledge will help you comprehend the extent of the benefits you can receive.

Seek assistance if needed: If you encounter difficulties in filling out the form or if you have questions about the claims process, do not hesitate to seek assistance from a healthcare provider, lawyer, or insurance representative who can provide guidance and support.

Common PDF Documents

Block Party - With spaces to detail every aspect of your event, this form serves as a blueprint for a memorable community gathering.

Ct 400 - Insights on how group filings for combined returns should handle their estimated tax declarations and payments.