Free Nys Nf 10 Form in PDF

In the bustling state of New York, individuals involved in motor vehicle accidents may encounter the complexities of insurance claims, especially when facing denials under the No-Fault Insurance Law. Central to navigating these intricacies is the NYS NF-10 form, a critical document for anyone whose claim has been denied by their insurance carrier. This form serves as a formal notification from the insurer, detailing the reasons behind the denial of a No-Fault claim. It encapsulates various facets, including policy issues, denied benefits ranging from loss of earnings to health service benefits, and guidance on how to contest these denials, whether through the New York State Department of Financial Services, arbitration, or litigation. Importantly, it instructs insurers to provide, upon request, all pertinent forms and documentation submitted by or on behalf of the injured party. The form not only outlines the grounds for denial but also delineates the steps for resolution—be it submitting a dispute for arbitration with the American Arbitration Association or pursuing legal action. Furthermore, it emphasizes the legal obligation of the applicant to provide accurate information under penalty of perjury, highlighting the seriousness with which the state regards the insurance claims process. For those navigating the aftermath of a motor vehicle incident, understanding and utilizing the NYS NF-10 form is a vital step in advocating for their rightful claims.

Nys Nf 10 Sample

NEW YORK MOTOR VEHICLE

DENIAL OF CLAIM FORM

TO INSURER: Complete this form, including item 33. Send two copies to applicant. Upon the request of the injured person, the insurer should send to the injured person a copy of all prescribed claim forms and documents submitted by or on behalf of the injured person.

NAME, ADDRESS AND NAIC NUMBER OF INSURER OR NAME AND

ADDRESS OF

For American Arbitration Association use

A. POLICYHOLDER |

B. POLICY NUMBER |

C. DATE OF ACCIDENT |

D. INJURED PERSON |

||||||

|

|

|

|

|

|||||

E. CLAIM NUMBER |

F. APPLICANT FOR BENEFITS (Name and address) |

G. AS ASSIGNEE |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

YES |

|

|

|

|

|

|

|

|

|

NO |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TO APPLICANT: SEE REVERSE SIDE IF YOU WISH TO CONTEST THIS DENIAL |

|

|||||

YOU ARE ADVISED THAT FOR REASONS NOTED BELOW: |

|

|

|

|

|

|

|||

|

1. Your entire claim is denied as follows: |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|||

|

2. A portion of your claim is denied as follows: |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|||

|

|

A. Loss of Earnings |

$ |

|

|

D. Interest |

$ |

||

|

|

|

|

||||||

|

|

B. Health Service Benefits |

$ |

|

|

E. Attorney's Fee |

$ |

||

|

|

|

|

||||||

|

|

C. Other Necessary Expenses |

$ |

|

|

F. Death Benefit |

$ |

||

|

|

|

|

||||||

|

|

|

REASON(S) FOR DENIAL OF CLAIM (Check reasons and explain below in item 33) |

|

|||||

|

|

|

|

POLICY ISSUES |

|

|

|

||

3.Policy not in force on date of accident

4.Injured person excluded under policy conditions or exclusion

5.Policy conditions violated:

a.No reasonable justification given for late notice of claim

b.Reasonable justification not

6.Injured person not an "Eligible Injured Person"

7.Injuries did not arise out of use or operation of a motor vehicle

8.Claim not within the scope of your election under Optional Basic Economic Loss coverage

LOSS OF EARNINGS BENEFITS DENIED

9.Period of disability contested: period in dispute From_______________Through_____________

10.Claimed loss not proven

11.Exaggerated earnings claim

of $______________per month denied

12.Statutory offset taken

13.Other, explained below

OTHER REASONABLE AND NECESSARY EXPENSES DENIED

14.Amount of claim exceeds daily limit of coverage

15.Unreasonable or unnecessary expenses

16.Incurred after one year from date of accident

17.Other, explained below

|

HEALTH SERVICE BENEFITS DENIED |

|||

18. |

Fees not in accordance with fee schedules |

|

20. |

Treatment not related to accident |

|

||||

19. |

Excessive treatment, service or hospitalization |

|

Unnecessary treatment, service or hospitalization |

|

|

21. |

|||

|

From_______________Through_____________ |

|

|

From_______________Through_____________ |

|

|

|

Other, explained below |

|

|

|

|

22. |

|

COMPLETE ITEMS 23 THROUGH 32 IF CLAIM FOR HEALTH SERVICE BENEFITS IS DENIED

23. Provider of Health Service (Name, Address and Zip Code) |

25. |

Period of bill - treatment dates |

29. Date final verification received |

|

|

|

|

|

|

|

26. |

Date of bill |

30. |

Amount of bill |

|

|

|

$ |

|

24. Type of service rendered |

27. |

Date bill received by insurer |

31. |

Amount paid by insurer |

|

|

|

$ |

|

|

28. |

Date final verification requested |

32. |

Amount in dispute |

|

|

|

$ |

|

33. State reason for denial, fully and explicitly (attach extra sheets if needed):

DATE |

|

Name and Title of Representative of Insurer |

|

Telephone No. & Ext. |

|

|

|||

Name and address of Insurer claim processor (Third Party Administrator), if applicable |

Telephone No. & Ext. |

|||

NYS FORM

Page 1 of 3

DENIAL OF CLAIM FORM

IF YOU WISH TO CONTEST THIS DENIAL, YOU HAVE THE FOLLOWING OPTIONS:

1.Should you wish to take this matter up with the New York State Department of Financial Services, you may file with the Department either on its website at http://www.dfs.ny.gov/consumer/fileacomplaint.htm or you may write to or visit the Consumer Assistance Unit, Financial Frauds and Consumer Protection Division, New York State Department of Financial Services, at: One State Street, New York, NY 10004; One Commerce Plaza, Albany, NY 12257; 163B Mineola Boulevard, Mineola, NY 11501, or Walter J. Mahoney Office Building, 65 Court Street, Buffalo, NY 14202.

Although the Department of Financial Services will attempt to resolve disputed claims, it cannot order or require an insurer to pay a disputed claim. If you wish to file a written complaint, send one copy of this Denial of Claim Form with copies of other pertinent documents with a letter fully explaining your complaint to the Department of Financial Services at one of the above addresses.

If you choose this option, you may at a later date still submit this dispute to arbitration or bring a lawsuit; or

2.You may submit this dispute to arbitration. If you wish to submit this claim to arbitration, then mail or

together with a $40 filing fee, payable by check, money order, or credit card to the American Arbitration Association (AAA) to:

AMERICAN ARBITRATION ASSOCIATION (AAA)

NEW YORK INSURANCE CASE MANAGEMENT CENTER 120 BROADWAY

NEW YORK, NEW YORK 10271

nyicmc.filingsubmissions@adr.org

Please contact the American Arbitration Association's customer service department at (917)

A complete copy of this filing, listing all bills and proofs as well as a table of contents listing your submissions must be provided to the AAA and the insurer at the time of filing for arbitration. The filing must be complete with all necessary documentation, as any late submission may not be admissible at arbitration. The filing fee will be returned to you if the arbitrator awards you any portion of your claim. However, you may be assessed the costs of the arbitration proceeding if the arbitrator finds your claim to be frivolous, without factual or legal merit or was filed for the purpose of harassing the respondent. The decision of an arbitrator is binding, except for limited grounds for review set forth in the Law and regulations promulgated thereunder.

If you are contesting the denial of claim and wish to submit the dispute to arbitration, state on accompanying sheets the reason(s) you believe the denied or overdue benefits should be paid. Attach proof of disability and verification of loss of earnings in dispute, sign below, and send the completed form to the American Arbitration Association at the address given in item 2 above.

Loss of earnings: |

Date claim made:_____________________ |

Gross earnings per month $______________________ |

Period of dispute: |

From ___________ Through _____________ |

Amount claimed: $_____________________________ |

Health Services: (Attach bills in dispute and list each one separately)

Name of Provider(s) |

Date of Service |

Amount of Bill |

|

|

|

Amount in Dispute

Date Claim Mailed

Other Necessary Expenses: (Attach bills in dispute and list each one separately)

Type of Expenses Claimed |

Amount Claimed |

Date Incurred |

|

|

|

Date Claim Mailed

Amount in Dispute

Other: (attach additional sheet if necessary)

·Upon your request, if you file for arbitration within 90 days of the date of this denial or the claim becoming overdue, your case will be scheduled for arbitration on a priority basis.

·You qualify for special expedited arbitration if the insurer has determined that your written justification for submitting late notice of claim failed to meet a “reasonableness standard”. Your specific request for special expedited arbitration must be filed within 30 days of the date of denial. Your filing must be complete and contain all information that you are submitting at the time of filing.

NYS FORM

Page 2 of 3

DENIAL OF CLAIM FORM

3.You may bring a lawsuit to recover the amount of benefits you claim to be entitled to.

THE UNDERSIGNED AFFIRMS AND CERTIFIES AS TRUE UNDER THE PENALTY OF PERJURY THAT THIS FILING IS BEING MADE IN GOOD FAITH AND THAT UPON INFORMATION, BELIEF AND REASONABLE INQUIRY THE DOCUMENTS BEING SUBMITTED HEREWITH ARE NOT FRAUDULENT AND THAT EXACT COPIES OF ALL DOCUMENTS PROVIDED HEREWITH HAVE BEEN MAILED TO THE INSURER AGAINST WHOM THE ARBITRATION IS BEING REQUESTED. UNLESS DISCLOSED WITH THIS SUBMISSION, THE DISPUTED AMOUNTS REMAIN UNPAID TO THE APPLICANT BY ANY PAYOR AND THERE HAS BEEN NO OTHER FILING OF AN ARBITRATION REQUEST OR LAWSUIT TO RESOLVE THE DISPUTED MATTERS CONTAINED IN THIS SUBMISSION.

ANY PERSON WHO KNOWINGLY AND WITH INTENT TO DEFRAUD ANY INSURANCE COMPANY OR OTHER PERSON FILES AN APPLICATION FOR COMMERCIAL INSURANCE OR A STATEMENT OF CLAIM FOR ANY COMMERCIAL OR PERSONAL INSURANCE BENEFITS CONTAINING ANY MATERIALLY FALSE INFORMATION, OR CONCEALS FOR THE PURPOSE OF MISLEADING, INFORMATION CONCERNING ANY FACT MATERIAL THERETO, AND ANY PERSON WHO, IN CONNECTION WITH SUCH APPLICATION OR CLAIM, KNOWINGLY MAKES OR KNOWINGLY ASSISTS, ABETS, SOLICITS OR CONSPIRES WITH ANOTHER TO MAKE A FALSE REPORT OF THE THEFT, DESTRUCTION, DAMAGE OR CONVERSION OF ANY MOTOR VEHICLE TO A LAW ENFORCEMENT AGENCY, THE DEPARTMENT OF MOTOR VEHICLES OR AN INSURANCE COMPANY, COMMITS A FRAUDULENT INSURANCE ACT, WHICH IS A CRIME, AND SHALL ALSO BE SUBJECT TO A CIVIL PENALTY NOT TO EXCEED FIVE THOUSAND DOLLARS AND THE VALUE OF THE SUBJECT MOTOR VEHICLE OR STATED CLAIM FOR EACH VIOLATION.

ARBITRATION REQUESTED BY:

LAST NAME |

FIRST NAME |

NAME OF LAW FIRM, IF ANY |

|

|

TELEPHONE NUMBER: |

|

|

|

|

|

|

|

|

|

FAX NUMBER: |

|

|

|

|

|

|

|

|

|

EMAIL ADDRESS: |

|

|

|

|

|

|

ADDRESS |

|

|

|

|

ARE YOU AN ATTORNEY? |

|

DATE |

|

|

YES |

|

|

|

|

NO |

|

|

SIGNATURE |

|

|

|

|

IMPORTANT NOTICE TO APPLICANT

If box number 3 ("Policy not in force on date of accident") on the front of this form is checked as a reason for this denial, you may be entitled to

your best interest to contact the M.V.A.I.C. immediately and file such an affidavit, even if you intend to contest this denial.

NYS FORM

File Overview

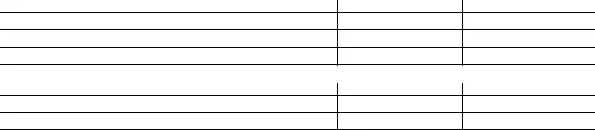

| Fact | Detail |

|---|---|

| Purpose of the Form | This form is used to notify an applicant that their claim for benefits under the New York Motor Vehicle No-Fault Insurance Law has been denied. |

| Form Contents Requirement | Insurers must complete the form, including item 33, and send two copies to the applicant. |

| Availability of Additional Documentation | Upon the request of the injured person, insurers should provide a copy of all prescribed claim forms and documents submitted by or on behalf of the injured person. |

| Options Following Denial | The form outlines specific steps the applicant can take if they wish to contest the denial, including contacting the New York State Department of Financial Services or submitting the dispute to arbitration. |

| Governing Law | The procedures and rights described in the form are governed by the New York Motor Vehicle No-Fault Insurance Law. |

| Fraud Warning | The form includes a fraud warning, indicating that knowingly providing false information or submitting fraudulent documents is a crime and subject to civil penalties. |

Nys Nf 10: Usage Guidelines

Filling out the New York State NF-10 form is a critical step in contesting a denial of a claim under the New York Motor Vehicle No-Fault Insurance Law. This form is your pathway to notify the insurer of your disagreement with their decision and to potentially escalate the matter for a more favorable outcome. Whether you are dealing with a complete or partial denial of your claim, it's essential to provide accurate and comprehensive information to support your case. Here's a straightforward guide to help you accurately complete the form:

- Begin by clearly writing the name, address, and NAIC number of the insurer, or if you are self-insured, your name and address, in the designated section at the top of the form.

- Fill in the policyholder’s name (A. POLICYHOLDER).

- Enter the policy number (B. POLICY NUMBER) associated with the claim.

- Indicate the date of the accident (C. DATE OF ACCIDENT) related to the claim.

- Provide the name of the injured person (D. INJURED PERSON) if it is different from the applicant for benefits.

- List the claim number (E. CLAIM NUMBER) assigned by the insurer.

- Enter the name and address of the applicant for benefits (F. APPLICANT FOR BENEFITS).

- Mark whether the applicant is an assignee (G. AS ASSIGNEE) with a YES or NO.

- Under the section titled "REASON(S) FOR DENIAL OF CLAIM," check the appropriate boxes that correspond to the reasons provided by the insurer for denying the claim.

- Detailed explanations for the denial must be entered in item 33. If necessary, attach extra sheets to fully explain the reasoning.

- At the bottom of the form, ensure you fill out the date and provide the name and title of the representative of the insurer, along with their telephone number and extension. Also, if a third-party administrator processed the claim, include their name, address, and telephone number.

- If you're contesting the denial and wish to submit the dispute to arbitration, specify the reasons on the accompanying sheets, attach proof of disability, verification of loss of earnings, the amounts claimed, and details regarding health services, other necessary expenses, and any additional documentation as required.

- Complete the arbitration request section on the third page, including your last name, first name, (if applicable) name of law firm, contact information, and whether you are an attorney, followed by your signature and date.

After completing and reviewing the form to ensure accuracy and completeness, send two copies to the applicant along with any required documentation. If contesting the decision, follow the instructions on page two for submitting your dispute to the New York State Department of Financial Services or for arbitration. Remember, thorough and accurate completion of this form is essential for a successful contestation of the claim denial.

FAQ

Frequently Asked Questions about the NYS NF-10 Form

- What is the NYS NF-10 Form?

The NYS NF-10 Form, under New York's Motor Vehicle No-Fault Insurance Law, is a denial of claim form that insurers use to notify an applicant that their claim for benefits following a motor vehicle accident has been fully or partially denied. It outlines the reasons for the denial and provides instructions for contesting the decision.

- When do I receive an NYS NF-10 Form?

You will receive an NYS NF-10 Form if an insurance company decides to deny your claim for no-fault benefits after a motor vehicle accident. This form should be sent to you with detailed explanations of why the claim was denied and any specific portions of the claim affected.

- What should I do if I receive an NYS NF-10 Form?

Upon receiving an NYS NF-10 Form, review it carefully to understand the reasons for the denial. If you wish to contest the decision, you can either file a complaint with the New York State Department of Financial Services, submit the dispute to arbitration through the American Arbitration Association, or initiate a lawsuit to recover the claimed benefits.

- How can I contest the denial of my claim?

If you decide to contest the denial, you have several options:

- File a complaint with the New York State Department of Financial Services.

- Submit the dispute to arbitration.

- Bring a lawsuit against the insurer.

Choosing the most appropriate option will depend on the specific details of your case and the reasons for the denial.

- What is "special expedited arbitration" mentioned in the form?

Special expedited arbitration is a process available for those who submitted a late notice of claim that the insurer decided did not meet a "reasonableness standard." You must file for this type of arbitration within 30 days of receiving the denial, and it is designed to resolve certain disputes more quickly.

- What happens if the arbitrator rules in my favor?

If the arbitrator rules in your favor, the insurance company will be required to pay the portion of the claim that was awarded to you. Additionally, the filing fee you paid for the arbitration will be returned to you.

- Can the decision of an arbitrator be challenged?

Yes, the decision of an arbitrator can be challenged, but only on limited grounds as set forth in the law and the regulations promulgated under it. Grounds for review typically involve procedural errors or issues related to the interpretation of the law.

- What if my claim involves a policy that was not in force at the time of the accident?

If your claim was denied because the policy was not in force at the time of the accident, you may be entitled to benefits from the Motor Vehicle Accident Indemnification Corporation (M.V.A.I.C.). You should contact M.V.A.I.C. immediately to file an affidavit of intention to make a claim, even if you intend to contest the denial.

- What should I include if I file for arbitration?

When filing for arbitration, you should include a copy of the NYS NF-10 Form, a complete submission of all pertinent documents and a table of contents listing your submissions, and the required filing fee. Make sure to provide proof of disability, verification of loss of earnings in dispute, and any other necessary documents to support your claim.

- What constitutes a "fraudulent insurance act" as mentioned in the form?

A "fraudulent insurance act" includes, but is not limited to, submitting an application for insurance or a statement of claim containing materially false information, or concealing information for the purpose of misleading concerning any fact material thereto. Such acts are considered crimes and may also be subject to civil penalties.

Common mistakes

Filling out the New York State NF-10 form, a critical step in the insurance claim process under the No-Fault Insurance Law, requires accuracy and attentiveness. Individuals often encounter setbacks that delay their claim or, worse, result in denial due to common errors made when completing this form. Recognizing and avoiding these mistakes is essential for ensuring your submission is processed smoothly and efficiently.

Overlooking the Deadline for Claim Submission constitutes a significant error made by many. The insurance law stipulates specific timeframes within which claims must be reported and filed following an accident. Failure to adhere to these deadlines can lead to the outright denial of the claim. Thus, it’s imperative to be aware of and respect all relevant time constraints.

Incomplete or Incorrect Information in certain fields can also hinder the claim's progression. The form demands comprehensive details regarding the policyholder, the injured person, and the specifics of the accident and resulting injuries or damages. Neglecting to furnish complete information or inadvertently entering incorrect data can cause delays or denials, necessitating further correspondence and resubmission, which prolongs the entire process.

- Ensure that all required sections are thoroughly and accurately completed before submission.

- Carefully review the form for any errors or omissions that might affect the claim's validity.

Failure to Attach Necessary Documentation is another prevalent mistake. The NF-10 form requires accompanying documents that substantiate the claim, such as medical reports, proof of earnings loss, and any other relevant records. Overlooking or assuming the submission is complete without these critical attachments often results in a denial, as the insurer lacks the necessary evidence to proceed with the claim.

- Double-check that all supporting documents are attached before sending the form.

- Maintain copies of the entire submission for personal records, ensuring you have evidence of what was provided.

Ignoring the Denial Appeal Process is the final, yet common, mistake to avoid. In cases where a claim is denied, individuals frequently miss the opportunity to contest the decision. The NF-10 form explicitly outlines the steps to take if one wishes to challenge the denial, including filing a complaint with the Department of Financial Services or initiating arbitration. Awareness and understanding of these options can be crucial in overturning a denial decision.

In summary, success in navigating the No-Fault Insurance claim process is significantly influenced by the meticulous attention to the details of the NF-10 form. Avoiding these common mistakes not only accelerates the claims process but also increases the likelihood of receiving the entitled benefits. Therefore, it is of utmost importance to approach this task diligently, ensuring all information is accurate, complete, and punctually submitted alongside the requisite documents.

Documents used along the form

When dealing with the aftermath of a motor vehicle accident in New York under the No-Fault Insurance Law, various forms and documents often accompany the NYS NF-10 form. These help in the process of filing and contesting claims, making sure you or the injured party receive the benefits entitled under the law. Here's an overview of these important forms and documents.

- Police Accident Report (MV-104): Required for providing official information about the accident. This document gives details about the involved parties, the location of the incident, and the circumstances surrounding the accident.

- Application for No-Fault Benefits (NF-2 Form): This form initiates a no-fault insurance claim, providing the insurer with information about the injured party and the nature of their injuries.

- Wage Verification Report (NF-6 Form): Used by the employer to verify the injured person's earnings. This helps in calculating any loss of earnings benefits.

- Medical Treatment Authorization Form: Gives healthcare providers authorization to treat the injured person and bill the insurance company directly.

- Attending Physician's Report (NF-3 Form): Completed by the treating healthcare provider, this form details the nature of the injuries, the treatment provided, and the prognosis.

- Hospital Facility Form (NF-5 Form): For use by hospitals to submit claims for services provided to the injured party. It includes information on the treatment and charges.

- Assignment of Benefits Form: Allows the injured party to assign their right to receive no-fault benefits directly to the healthcare provider.

- Proof of Claim Form: Used by the policyholder or claimant to provide proof to the insurance company of the expenses incurred as a result of the accident.

Understanding and properly filing these forms and documents can significantly influence the outcome of the claims process. It's crucial to pay attention to deadlines and provide comprehensive and accurate information to ensure a smooth claims experience. If you feel overwhelmed or unsure about any part of the process, seeking professional guidance can be invaluable in navigating the complexities of no-fault insurance claims in New York.

Similar forms

The New York State Form NF-2, or Application for Motor Vehicle No-Fault Benefits, shares similarities with the NF-10 form as it initiates the claim process under the No-Fault Insurance Law. While the NF-10 form is used by insurers to formally deny a claim or a part of it, the NF-2 form is the starting point, where the claimant provides detailed information about the accident, their injuries, and any initial expenses. Both forms are integral to the New York No-Fault Insurance process, guiding the interaction between claimants and insurers.

The New York State Proof of Claim Form (NF-5) is another document closely related to the NF-10 form. This form is used by the claimant to provide a detailed account of their expenses and request reimbursement under the No-Fault Insurance. Like the NF-10 form, which outlines the reasons for claim denial, the NF-5 form plays a pivotal role in the documentation and substantiation of claims, presenting insurers with the necessary details to assess and respond to a claim.

The New York State Denial of Motor Vehicle Registration (MV-103) form, although used in a different context, is similar to the NF-10 form in that it involves a formal denial by a New York State authority. While the MV-103 is used by the Department of Motor Vehicles (DMV) to deny vehicle registration for reasons such as unpaid taxes or fines, the NF-10 form serves a similar function in the insurance domain, detailing the denial of No-Fault Insurance claims. Both documents provide a structured way for authorities to communicate denials to applicants.

Form AR-1, the New York No-Fault Arbitration Request Form, has a significant connection to the NF-10 form. When a claim or part of it is denied through the NF-10, claimants have the option to dispute the decision through arbitration. The AR-1 form is specifically designed for this purpose, allowing claimants to formally request arbitration. It directly follows the denial process indicated in the NF-10 form, facilitating the next steps for claimants seeking to contest the insurer’s decision.

Lastly, the Motor Vehicle Accident Indemnification Corporation (MVAIC) Claim Form bears a resemblance to the NF-10 in its role in the insurance claims process. Specifically designed for individuals hit by uninsured motorists, this form is used when no traditional No-Fault benefits can be claimed through an insurer, a situation sometimes referenced in the NF-10 denial form. Both forms play crucial roles in ensuring that parties involved in motor vehicle accidents have a means to seek compensation or benefits, albeit through different mechanisms depending on the specific circumstances of the coverage and accident.

Dos and Don'ts

When filling out the New York State Form NF-10, a Denial of Claim Form under the Motor Vehicle No-Fault Insurance Law, there are several important things you should do and avoid doing to ensure the process goes smoothly and your rights are protected. These guidelines will help you navigate the complexities of contesting a denial effectively.

- Do review the entire form carefully before you start filling it out, including any instructions or additional information on the reverse side or subsequent pages.

- Do provide all required information accurately, including policy numbers, dates of the accident, claim numbers, and any other specifics that identify your claim.

- Do state clearly the reasons you believe the denial of your claim was incorrect. Attach additional sheets if necessary, ensuring they are well-organized and referenced in the main form.

- Do include all pertinent documents and evidence to support your case when contesting the denial. This might include medical bills, proof of loss of earnings, and any correspondence related to the claim.

- Do send the form and all accompanying documentation to the appropriate address, whether it's for arbitration with the American Arbitration Association or a complaint with the New York State Department of Financial Services, as outlined on the form.

- Don't leave out any sections of the form that apply to your claim. Incomplete forms may result in further delays or the continuation of the denial of your claim.

- Don't forget to sign and date the form. An unsigned form may be considered invalid, which could hinder the process of overturning the denial of your claim.

- Don't submit the form without first making a copy for your records. It's important to have a copy of all submitted documents in case there are questions or issues down the line.

Correctly filling out and submitting the NYS Form NF-10 is crucial in the process of appealing a denial of no-fault insurance benefits. By following these dos and don'ts, you'll be better positioned to ensure that your contestation is clear, complete, and likely to result in a favorable reevaluation of your claim.

Misconceptions

The New York Motor Vehicle No-Fault Insurance Law Denial of Claim Form, known as the NYS Form NF-10, is surrounded by misconceptions that can complicate the process both for those filing claims and for those processing them. Here, we aim to clarify some of the most common misunderstandings.

It's only used for denied claims: While it's true that the NF-10 form is primarily associated with the denial of a claim, it’s crucial for claimants to understand that the form is part of a larger process that includes rights to contest the denial, seek arbitration, or escalate the issue to the New York State Department of Financial Services. Therefore, receiving this form does not represent the end of the road.

Submission means the end of the claim: Receiving a denial through an NF-10 Form is not necessarily the final say. Applicants have several options to contest the denial, including arbitration and filing a complaint with the Department of Financial Services.

Claimants cannot understand the denial reasons: The form is designed to specify the exact reasons for denial in item 33. Whether it's due to policy issues, excluded conditions, or lack of proof, the aim is for the reasons to be clear and actionable.

Arbitration is the only next step: While arbitration is one path forward, the form also explains that applicants can bring a lawsuit or file a complaint directly with the New York State Department of Financial Services. It's important to consider all options.

Claimants need an attorney to respond: Although legal representation can be beneficial, especially in cases of arbitration or lawsuits, claimants can pursue many initial steps on their own, such as filing a complaint with the Department of Financial Services.

All denied claims are reported as fraud: The stern warnings about fraudulent claims on the form can be intimidating, but not all denials imply fraud. Most rejections are due to eligibility, coverage, or submission issues, not intentional deceit.

No assistance is available for claimants: The form and its instructions point towards multiple resources available to claimants, including the Department of Financial Services and even specific guidance for expedited arbitration processes.

Filing with the Department of Financial Services guarantees payment: While the Department can assist in resolving disputes, it cannot mandate an insurer to pay a claim. Its role is more about mediation and oversight.

An attorney must file the arbitration request: Claimants can initiate arbitration themselves, including submitting the necessary documents and the filing fee. Assistance from an attorney is optional but can be helpful.

Only the claimant can file for arbitration: In reality, either party in a dispute can initiate arbitration. This means the insurance company or the claimant has the right to take this step if a resolution cannot be reached independently.

Understanding the details and implications of the NYS Form NF-10 is crucial for navigating the often complex terrain of insurance claims following motor vehicle accidents in New York. With clarity on these common misconceptions, both claimants and insurers can engage with the process more effectively, ensuring fair consideration and resolution of each case.

Key takeaways

Understanding the New York State (NYS) NF-10 form is crucial for anyone involved in a motor vehicle accident within New York, especially when dealing with no-fault insurance claims. The NYS NF-10 form is a denial of claim form that insurance companies use. It outlines the reasons why an insurer has decided not to pay a claim, partially or fully. Here are four key takeaways regarding filling out and using the NYS NF-10 form:

- Details required on the form: The NYS NF-10 form requires comprehensive information about the insurer and the claimant, including policy numbers, dates of the accident, claim numbers, and specific benefit amounts denied. It is vital to complete all fields accurately to avoid any misunderstanding or delay in processing.

- Reasons for denial: The form lists various reasons for claim denial, such as policy not in force, the injured person not covered under the policy, violation of policy conditions, and exaggerated claims. Claims can be denied in whole or in part for these specified reasons, and the form provides space for insurers to state their reasons clearly.

- Contesting a denial: If a claimant wishes to dispute a denial, the form outlines the steps to take, including contacting the New York State Department of Financial Services or entering into arbitration. It’s crucial for claimants to understand their rights and the procedures to follow if they disagree with an insurance company's decision.

- Legal and fraud warnings: The form includes stern warnings about the legal repercussions of submitting fraudulent claims. It emphasizes that any attempt to deceive or defraud insurance companies or other parties is a crime with severe penalties, including civil penalties.

Filling out and submitting the NYS NF-10 form marks a critical step in the no-fault insurance claim process in New York State. Both insurers and claimants must handle the form with care, ensuring all information is accurate and all appropriate steps are followed in the case of a dispute. Understanding these key aspects can help navigate through potentially complicated no-fault insurance claim denials.

Common PDF Documents

Medical Proxy - Witnesses add a layer of formal verification, affirming that you are of sound mind and making the health care proxy under your own free will.

When Are Payroll Taxes Due - Must be filled out with black ink to ensure clarity and legibility for processing.