Free Nys It 255 Form in PDF

The New York State Department of Taxation and Finance offers a valuable opportunity for residents aiming to make their homes more environmentally friendly through the use of solar energy. The IT-255 form, known as the Claim for Solar Energy System Equipment Credit, plays a pivotal role in this initiative. This form is designed for individuals who have installed solar energy systems in their homes, including those used for heating, cooling, hot water, or electricity. To be eligible, the system must utilize solar radiation to produce energy for residential purposes. Completing the IT-255 allows eligible taxpayers to claim a credit for a portion of their qualified solar energy system equipment expenditures. The form requires details such as the date the equipment was placed in service and the purchase amount, which are then used to calculate the credit. Additionally, the form includes sections for calculating the current year's credit, any carryover credit from the previous year, and the application of this credit against the tax due. It is important to note that there are expenditure limits and specific instructions for lease agreements and power purchase agreements, emphasizing the state’s encouragement for renewable energy adoption while also setting boundaries to ensure the program’s effectiveness and fairness.

Nys It 255 Sample

New York State Department of Taxation and Finance

Claim for Solar Energy System Equipment Credit

Submit this form with Form

Name(s) as shown on return

Your social security number

ADoes the solar energy system use solar radiation to produce energy for heating, cooling,

hot water, or electricity for residential use? |

Yes |

If NO, stop; you do not qualify for the solar energy system equipment credit. |

|

If YES, see instructions and continue with Schedule A below. |

|

No

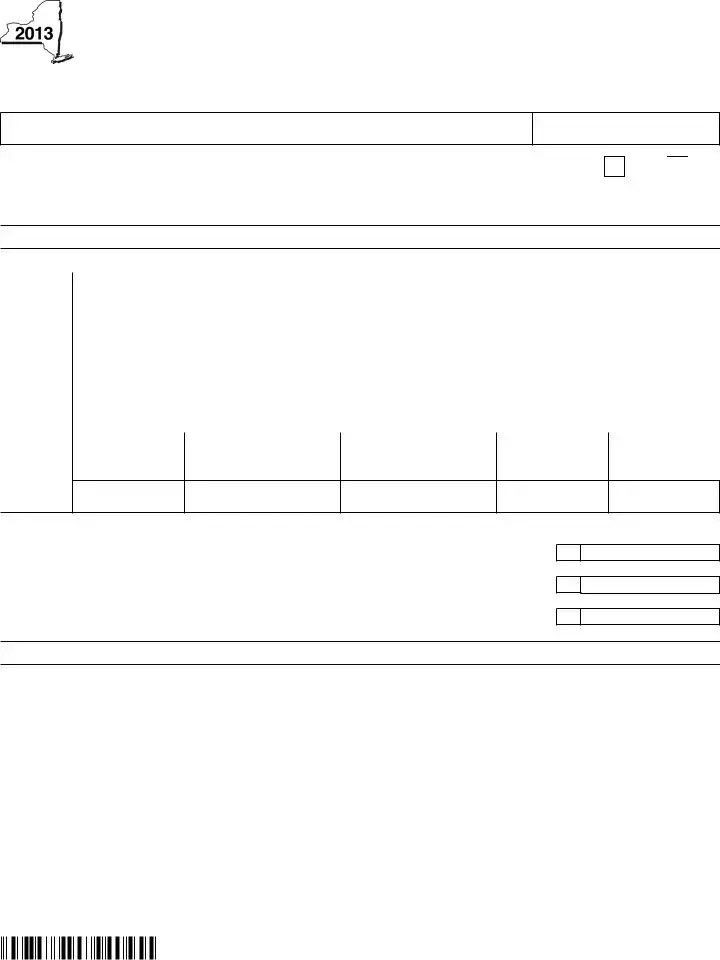

Schedule A – Computation of solar energy system equipment credit

Complete the information in the applicable chart with respect to your solar energy system equipment.

|

A |

|

|

|

B |

|

|

|

|

C |

|

Date equipment |

|

|

Qualiied solar energy system |

|

Column B x 25% (.25) |

||||

Purchase |

placed in service |

|

equipment expenditures (see instr.) |

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

.00 |

|

|

.00 |

|

A |

|

|

B |

|

C |

|

|

|

D |

Power |

Date equipment |

Qualiied solar energy system |

Column B x 25% (.25) |

|

Limitation |

|||||

purchase |

placed in service |

equipment expenditures (see instr.) |

|

|

|

(see instructions) |

||||

agreement |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

.00 |

|

.00 |

|

.00 |

||

|

|

|

|

|

|

|

||||

|

A |

|

B |

|

C |

|

D |

E |

||

|

Date equipment placed Qualiied solar energy system |

Column B x 25% (.25) not to |

Amount from column B |

Limitation |

||||||

Lease |

in service |

exceed $5000 |

|

paid in 2013 |

(see instructions) |

|||||

|

|

|

|

|

|

|

|

|

|

|

.00

.00 |

.00 |

.00 |

1 Current year credit (see instructions.) .....................................................................................................

2 Enter the carryover credit from last year’s Form

3 Solar energy system equipment credit (add lines 1 and 2) .....................................................................

1

2

3

.00

.00

.00

Schedule B – Application of credit and computation of carryover

4 |

Tax due before credits (see instructions) |

4 |

.00 |

|

|

|

|

5 |

Other credits that you applied before this credit (see instructions) |

5 |

.00 |

|

|

|

|

6 |

Subtract line 5 from line 4 |

6 |

.00 |

|

|

|

|

7 |

Enter the lesser of line 3 (or your portion of line 3) or line 6 (see instructions) |

7 |

.00 |

|

|

|

|

8 |

Subtract line 7 from line 3 (or your portion of line 3; see instructions) |

8 |

.00 |

|

|

|

|

9 |

Amount, if any, included on line 8 that expired this tax year (see instructions) |

9 |

.00 |

|

|

|

|

10 |

Amount of credit available for carryover to next year (subtract line 9 from line 8) |

10 |

.00 |

255001130094

File Overview

| Fact | Detail |

|---|---|

| 1. Form Objective | The NYS IT-255 form is used to claim the Solar Energy System Equipment Credit. |

| 2. Eligibility Requirement | Only systems that use solar radiation for heating, cooling, hot water, or electricity for residential use qualify. |

| 3. Accompanying Forms | This form must be submitted with Form IT-201 or Form IT-203. |

| 4. Credit Calculation | The credit is calculated as 25% of qualified solar energy system equipment expenditures. |

| 5. Credit Limitations | The credit cannot exceed $5,000. |

| 6. Carryover Provision | Unused credits can be carried over to the following years. |

| 7. Documentation Requirement | Detailed documentation of the solar energy system's purchase and installation must be maintained. |

| 8. Expiration of Credit | Part of the credit that can expire is identified and calculated in the form. |

| 9. Governing Law | This credit is governed by New York State tax law. |

| 10. Importance of Accurate Information | Accuracy in filling out the form is essential to qualifying for and correctly calculating the credit. |

Nys It 255: Usage Guidelines

Filing the NYS IT-255 form is an important process for those seeking to claim the solar energy system equipment credit in New York State. This credit can significantly reduce the amount of tax owed by recognizing the investment in solar energy. The form itself is straightforward but ensuring correctness is crucial for its acceptance. Below are the steps to complete the NYS IT-255 form properly, ensuring you provide all the necessary details for your claim.

- Start by entering your name(s) as shown on your tax return and your social security number at the top of the form.

- Determine if your solar energy system qualifies by answering the question in section A about the system's use of solar radiation for heating, cooling, hot water, or electricity for residential use. If the answer is "No," you are not eligible for the credit.

- Proceed to Schedule A - Computation of solar energy system equipment credit. Here, you will need detailed information about your solar energy system equipment.

- In the applicable chart, input the date the equipment was placed in service. This should match the mm-dd-yyyy format.

- For each piece of qualified solar energy system equipment, list the expenditure in Column B. Refer to the instructions to determine what qualifies as an expenditure.

- Calculate 25% (.25) of the amount in Column B and enter this in Column C. This is your equipment credit amount.

- If applicable, fill in the Limitation section based on any power purchase agreement (Section D) or lease limitations (Section E), adhering to the $5000 cap for leased systems paid in the year claimed.

- Sum up the current year's credit in line 1, and enter any carryover credit from last year's Form IT-255 on line 2.

- Add lines 1 and 2 to get the total solar energy system equipment credit and enter this on line 3.

- Move to Schedule B for the Application of credit and computation of carryover. Enter the tax due before credits on line 4.

- List other credits applied before this credit on line 5.

- Subtract line 5 from line 4 and enter this amount on line 6 to find out how much of the solar energy credit can be applied.

- The lesser value between line 3 (or your portion of it) or line 6 goes on line 7.

- To calculate the amount that can be carried over to next year, subtract line 7 from line 3 (or your portion of line 3) and enter this on line 8.

- Identify any amount on line 8 that expired this tax year and list it on line 9.

- Finally, subtract line 9 from line 8 to find the total amount of credit available for carryover to the next year and enter this on line 10.

Ensure all information is accurately provided, as mistakes could delay processing or impact the credit received. Once completed, attach this form to Form IT-201 or Form IT-203 when you submit your tax return. This step is crucial in claiming your solar energy system equipment credit and ensuring that your investment in sustainable energy is recognized and rewarded by New York State.

FAQ

-

What is Form IT-255?

Form IT-255, issued by the New York State Department of Taxation and Finance, is used to claim the Solar Energy System Equipment Credit. This form applies to taxpayers who install solar energy systems that use solar radiation for heating, cooling, hot water, or electricity for residential use.

-

Who is eligible to file Form IT-255?

Eligibility is for individuals who have installed qualified solar energy system equipment in their residential property located in New York State. The system must be used for heating, cooling, hot water production, or electricity generation.

-

How can one qualify for the Solar Energy System Equipment Credit?

To qualify, the solar energy system must use solar radiation for residential purposes such as heating, cooling, hot water, or electricity production. Additionally, the installed equipment must meet the specific qualifications outlined by the Department of Taxation and Finance.

-

How is the credit calculated on Form IT-255?

The credit is calculated as 25% of the qualifying solar energy system equipment expenditures. However, there are limitations. For example, for purchases, the credit is limited to $5,000. For leased systems, certain other limits apply, and credit amounts depend on the payment made in the respective tax year.

-

What forms should accompany Form IT-255?

When filing Form IT-255, it must be submitted alongside Form IT-201 or Form IT-203, depending on the taxpayer’s specific situation.

-

Can credit from Form IT-255 be carried over to future tax years?

Yes, if the solar energy system equipment credit exceeds the taxpayer’s tax liability, the surplus can be carried over to the following tax years as specified in the form's instructions.

-

What happens if the solar energy system is leased?

For leased solar energy systems, the credit is also available but is calculated based on the payments made during the tax year. The total credit is subject to a $5,000 limitation.

-

Is there an expiration date for this credit?

Credits not utilized in the current tax year may be carried forward, but specific credits may expire. Taxpayers should refer to the latest version of Form IT-255 instructions for details on expiration or time limits for using the carried-over credits.

-

Where can one find more information or assistance on Form IT-255?

For additional assistance or more detailed information, taxpayers should visit the New York State Department of Taxation and Finance’s official website or contact a tax professional familiar with New York State tax laws.

Common mistakes

When filling out the New York State Department of Taxation and Finance Claim for Solar Energy System Equipment Credit, IT-255, individuals often encounter several common mistakes. These errors can delay the processing of the form or may result in the rejection of the credit claim altogether. It's crucial to complete the form accurately and thoroughly to ensure you receive the solar energy credit you're entitled to.

One of the first mistakes made is overlooking the eligibility criteria detailed at the beginning of the form. The IT-255 form is exclusively for those who have installed a solar energy system that uses solar radiation for heating, cooling, hot water, or electricity for residential use. Failing to meet this criterion automatically disqualifies the applicant, yet, some attempt to submit the form without verifying their eligibility.

Incorrect or incomplete information in Schedule A of the form is another common error. This section requires precise details about the solar energy system equipment, including the date the equipment was placed in service and the qualified solar energy system equipment expenditures. Often, individuals either leave sections blank or enter inaccurate data, which can lead to incorrect computation of the credit.

- Not checking the eligibility requirements.

- Leaving sections of Schedule A incomplete.

- Entering incorrect installation dates.

- Miscalculating the qualified solar energy system equipment expenditures.

- Incorrectly computing the credit amount.

- Failing to include the form with either Form IT-201 or Form IT-203.

- Omitting the social security number or entering it incorrectly.

- Not entering the carryover credit from the previous year's Form IT-255, if applicable.

- Misunderstanding the instructions regarding the application of credit and computation of carryover in Schedule B.

- Overlooking the need to sign and date the form, thereby invalidating it.

The IT-255 form also includes complex computations, such as determining the credit limit and carrying over unused credits. These areas frequently lead to confusion. Incorrectly filling out the Schedule B, which deals with the application of credit and computation of carryover, is a frequent issue. The process involves subtracting other credits applied before this credit from the tax due before credits to figure out the solar energy credit's impact. Mistakes here can either result in an overestimation or underestimation of the credit.

To avoid these pitfalls, it is advised that individuals read the instructions carefully and verify all the information entered against their official documents. Attention to detail can significantly influence the outcome and effectiveness of the IT-255 form submission. For those unsure about certain sections, consulting with a tax professional can provide clarity and ensure the form is completed correctly.

Documents used along the form

When working to maximize solar energy incentives through the New York State Department of Taxation and Finance, the IT-255 form becomes crucial for individuals seeking the Solar Energy System Equipment Credit. However, to ensure a thorough and corroborated filing, several other forms and documents often accompany the IT-255 form. This comprehensive approach not only supports the claims made but also streamlines the process, leading to a smoother experience with the tax authorities. Below is an outline of other vital forms and documents commonly used alongside IT-255, each serving its unique function in substantiating one's eligibility and the credit amount for solar energy system installations.

- Form IT-201: The Resident Income Tax Return. It's where individuals report their annual income to New York State. Since the IT-255 form has to be submitted with either Form IT-201 or Form IT-203, having this form prepared is the first step in claiming the solar energy equipment credit.

- Form IT-203: The Nonresident and Part-Year Resident Income Tax Return. For those who do not reside in New York State year-round but have installed qualifying solar energy systems on properties within the state, this form acts as a vehicle for the IT-255 when filing taxes.

- Form IT-2: The Summary of W-2 Statements. Although it might seem unrelated, providing a clear picture of one's income through Form IT-2 can be crucial. It underlines the filer's financial habitat, adding credibility and context to the tax credits claimed on the IT-255.

- Receipts and Invoices for Solar Equipment and Installation: Keeping detailed records, including dates of service, amounts paid, and descriptions of the installed equipment, directly supports the figures entered in Schedule A of the IT-255. These documents are indispensable in justifying the investment and the subsequent claim.

- Manufacturer’s Certification Statement: A document certifying that the solar energy system is eligible for tax credits. This certification often comes from the equipment manufacturer and is crucial in proving that the installed system meets the necessary criteria for the credit.

- Power Purchase Agreement (PPA) or Lease Documents: For those who did not purchase their systems outright but instead entered into a lease or a PPA, these documents specify the terms and conditions, including financial obligations and system specifications, which can influence the credit computation.

- Schedule B forms: Depending on the taxpayer's situation, additional schedules may be needed to calculate limitations on credits or carryovers from previous years. While specific Schedule B forms vary, having a detailed record that matches the IT-255 claims is essential.

Filing for the Solar Energy System Equipment Credit with form IT-255 is not just about submitting one document. It is a comprehensive process that involves a variety of forms and supporting documents. Each plays a pivotal role in affirming eligibility, enhancing the credibility of the claim, and ensuring that taxpayers receive the full credit to which they are entitled. With this understanding, individuals can navigate the complexity of tax filings more confidently and efficiently.

Similar forms

The Form IT-201, "Resident Income Tax Return," is similar to the NYS IT-255 form in that both are used by New York State residents when filing their income taxes. The IT-201 form is the primary document for individuals to report their annual income and calculate taxes owed or refunds due, while the IT-255 form is specifically for claiming a tax credit for solar energy system equipment. Both forms require personal information and financial details relevant to the taxpayer's income and tax situation.

Form IT-203, "Nonresident and Part-Year Resident Income Tax Return," shares similarities with the IT-255 form, as individuals use it to file their taxes in New York State when they do not reside there the entire year. Like the IT-255, which is submitted alongside the IT-201 or IT-203, the latter form collects detailed information on the taxpayer's income earned in New York State, deductions, and credits, including those related to energy efficiency or investment, such as the solar energy system equipment credit.

The Form IT-270, "Application for Automatic Six-Month Extension of Time to File for Individuals," while primarily used for requesting an extension on filing income tax returns, is similar to the IT-255 in its supplementary role in the tax filing process. Both forms assist taxpayers in managing their tax responsibilities—IT-255 by providing a way to claim a credit, and IT-270 by offering extra time to file returns, including those that might claim such credits.

IRS Form 5695, "Residential Energy Credits," serves a similar purpose to the IT-255 but on a federal level. This form allows taxpayers to claim credits for qualified solar electric property costs among other energy-saving improvements to their homes. Just like the IT-255, Form 5695 requires detailed information about the costs involved and the dates of service installation to calculate the credit amount.

Form DTF-624, "Claim for Clean Heating Fuel Credit," is akin to the IT-255 form as both support New York State’s initiative to encourage environmentally sustainable practices. The DTF-624 form specifically provides a credit for the purchase of bioheat for heating purposes, requiring documentation of the purchase similar to how the IT-255 form necessitates details of the solar energy system.

Form IT-212, "Investment Tax Credit," relates to the IT-255 as it is another form used to claim a tax credit in New York State, albeit for different types of investments, including property, equipment, or other capital expenditures. Both IT-212 and IT-255 require taxpayers to provide specifics about their investments, including costs and service dates, to calculate the allowable credit.

The IT-2 form, "Summary of W-2 Statements," while not a claim form for credits, shares the feature of being a supplementary form necessary for processing certain individual income tax returns in New York State, similar to the IT-255. Taxpayers use the IT-2 to summarize W-2 information when filing their state tax returns, which might include claims made on forms like the IT-255.

Form IT-112-R, "New York State Resident Credit," offers similarities with the IT-255 in that it targets New York State residents looking to claim a credit, this time for taxes paid to other states. Both forms require detailed financial information and have the broader goal of providing tax relief based on specific qualifying conditions.

Form IT-216, "Claim for Child and Dependent Care Credit," parallels the IT-255 form in its purpose of providing tax relief to eligible New Yorkers. While IT-216 focuses on expenses related to child and dependent care, IT-255 is concerned with solar energy system equipment. Both forms involve calculating a credit based on expenditures and adding that credit to the taxpayer's return.

Last but not least, Form IT-249, "Claim for Long-Term Care Insurance Credit," shares common ground with the IT-255 as both target individuals seeking to reduce their tax liability through specific personal investments, in this case, premiums paid for long-term care insurance. Similar to the solar equipment credit, the long-term care insurance credit requires documentation of the expenses to qualify.

Dos and Don'ts

When you're preparing to fill out the New York State Department of Taxation and Finance Claim for Solar Energy System Equipment Credit (IT-255), there are several important dos and don'ts you should keep in mind. This guidance is designed to help ensure that your claim is processed smoothly and efficiently, allowing you to take advantage of the solar energy system equipment credit for which you may be eligible.

Things You Should Do:

- Verify your eligibility for the credit by ensuring that your solar energy system uses solar radiation for heating, cooling, hot water, or electricity for residential use.

- Complete Schedule A with detailed and accurate information about your solar energy system equipment, including the date the equipment was placed in service and qualified expenditures.

- Calculate the credit amount correctly, applying 25% to the qualified solar energy system equipment expenditures, mindful of any applicable limitations.

- Maintain records of all purchases and installations related to your solar energy system to support your claim, including invoices and receipts.

- Include your social security number and ensure it is correct to avoid delays or issues with your claim.

Things You Shouldn't Do:

- Don’t overlook the requirement to submit Form IT-255 along with Form IT-201 or Form IT-203, as failing to include the necessary forms can result in your claim being delayed or denied.

- Don’t guess or estimate expenses; provide actual figures to ensure the accuracy of your claim and avoid possible audits or penalties.

- Don’t ignore the carryover credit section if you had a credit from last year. If applicable, it could increase your total credit amount.

- Don’t miss the deadline for submitting your claim. Be aware of the New York State tax filing deadlines to ensure your claim is considered for the correct tax year.

By following these guidelines, you can help ensure that your claim for the solar energy system equipment credit is accurate and complies with New York State regulations. Careful attention to detail and compliance with the submission requirements will facilitate the processing of your claim.

Misconceptions

There are several misconceptions regarding the New York State Department of Taxation and Finance Claim for Solar Energy System Equipment Credit, specifically the IT-255 form. Understanding these misconceptions is crucial for accurately applying for the solar energy system equipment credit.

Misconception 1: Any type of solar energy system qualifies for the credit. In reality, the form clarifies that only systems using solar radiation to produce energy for heating, cooling, hot water, or electricity for residential use qualify. This distinction ensures the focus is on residential energy efficiency and sustainability.

Misconception 2: The credit is calculated based on the total cost of the solar system. This is not entirely accurate, as the form states, the credit is calculated as 25% of the qualified solar energy system equipment expenditures, with a limitation not to exceed $5,000. This specifies how much of the expenditure can be credited, not the total installation cost.

Misconception 3: You can claim the credit every year. According to the form, the credit is based on the date the equipment was placed in service and calculates a current year credit along with any carryover from the previous year. This implies that the initial claim is tied to the installation year, with the possibility of carrying over unclaimed credit to subsequent years, not claiming the entire credit annually.

Misconception 4: The form can be submitted on its own. As stated, the IT-255 form must be submitted along with Form IT-201 or Form IT-203. This requirement emphasizes that the solar energy system equipment credit claim is part of the broader state tax return process, not a standalone application.

Misconception 5: The credit is available regardless of other credits applied. The form instructs to subtract other credits applied before this credit from the tax due before credits to determine the amount eligible for the solar energy credit. This ensures that the solar energy system equipment credit is applied in the context of the total tax situation, possibly affecting the credit's value.

Clarifying these misconceptions is important for taxpayers who are considering installing solar energy systems and wish to accurately claim the available credit. It helps ensure that the benefits of solar energy systems are maximized within the guidelines provided by the New York State Department of Taxation and Finance.

Key takeaways

Filling out and using the New York State IT-255 form, which is designed for claiming the Solar Energy System Equipment Credit, is a vital step for homeowners who have installed solar energy systems. This form allows them to claim a credit for a percentage of their qualified solar energy system equipment expenses. Here are several key takeaways to guide you through the process:

- Eligibility Criteria: To be eligible for the solar energy system equipment credit, your system must utilize solar radiation to produce energy for heating, cooling, hot water, or electricity exclusively for residential use. If your system does not meet these criteria, you cannot claim the credit.

- Submission with Tax Return: When you are ready to claim this credit, you must submit the IT-255 form alongside your New York State tax return, specifically forms IT-201 or IT-203. This ensures your claim is processed alongside your tax obligations.

- Calculating the Credit: The form requires detailed information about your solar energy system, including the date the equipment was placed in service and the qualified solar energy system equipment expenditures. The credit amount is calculated as 25% of these expenditures, subject to a maximum limit.

- Limitations and Carryovers: There is a maximum credit limit that cannot exceed $5,000. However, if your credit exceeds your tax due, you can carry over the unused portion to the next tax year, ensuring you benefit fully from your investment in solar energy.

- Documentation and Accuracy: Accurate and complete documentation of your solar energy system's purchase and installation is crucial. This documentation supports the expenditures and dates entered on the IT-255 form. Keeping precise records can streamline the process and safeguard against potential disputes regarding your claim.

Approaching the IT-255 form with a clear understanding of these key takeaways ensures a smoother process in claiming your Solar Energy System Equipment Credit. It's an opportunity to support sustainable energy initiatives while benefiting from tax incentives designed to reduce the overall cost of such systems for New York State residents.

Common PDF Documents

Acp-5 Inspection - Applicants seeking an asbestos variance in NYC must complete the ACP9 form, detailing the reasons for deviation from regular protocols and the alternative methods employed.

Nyc Doing Business Data Form - The Doing Business Data Form is essential for entities engaging in affordable housing transactions with the City of New York.