Free Nys 45 Form in PDF

Navigating the complexities of payroll and taxation is a significant responsibility for employers, particularly in New York State, where the NYS-45 form comes into play. This form, serving as a quarterly combined withholding, wage reporting, and unemployment insurance return, is essential for businesses operating within the state. By marking the applicable quarter and year, employers detail their withholding identification number, report on whether dependent health insurance benefits are available to employees, and declare the number of employees. The form intricately combines the need for unemployment insurance information with withholding tax insights, offering a comprehensive snapshot of total remuneration paid, taxes withheld, and contributions due within the quarter. New York City and Yonkers' specifics are also addressed, alongside the reemployment service fund and adjustments for over or underpaid UI contributions. An interesting feature of this form is its insistence on precision, particularly in reporting employee wage and withholding information, with a dedicated section for amendments through Parts D and E if necessary. Additionally, the form positions itself as a bridge between employers and the state, facilitating a smoother transaction of employment-related taxes and contributions, all while maintaining a structured format for information pertaining to employee benefits and wages. This underscores the form's critical role in ensuring employers adhere to state tax laws, thereby maintaining compliance and supporting New York's workforce development initiatives.

Nys 45 Sample

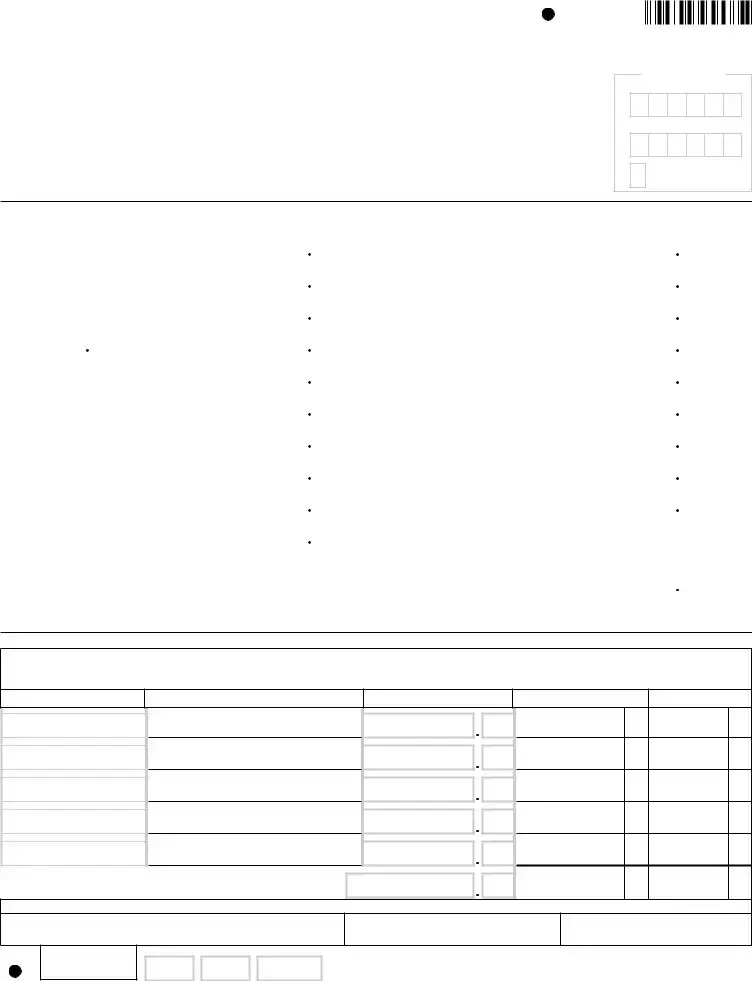

Quarterly Combined Withholding, Wage Reporting, |

|

|

|

|

|

|

|

|||||||||||||||||||||

Reference these numbers in all correspondence: |

|

|

|

|

And Unemployment Insurance Return |

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

Mark an X in only one box to indicate the quarter (a separate |

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

UI Employer |

|

|

|

|

|

|

|

|

|

|

|

return must be completed for each quarter) and enter the year. |

||||||||||||||||

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

1 |

2 |

3 |

4 |

|

|

|

Y Y |

||||||||||||||||

registration number |

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

Jan 1 - |

|

Apr 1 - |

|

July 1 - |

|

Oct 1 - |

|

Year |

|

|

|

|

||||

Withholding |

|

|

|

|

|

|

|

|

|

|

|

Mar 31 |

|

Jun 30 |

|

Sep 30 |

|

Dec 31 |

|

|

|

|

||||||

identification number |

|

|

|

|

|

|

|

|

|

|

|

Are dependent health insurance benefits |

|

|

|

|

|

|

|

|||||||||

Employer legal name: |

|

|

|

|

|

|

|

|

|

|

available to any employee? ...................... Yes |

|

|

No |

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

If seasonal employer, mark an X in the box |

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

Number of employees |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

a. First month |

|

b. Second month |

|

c. Third month |

|

|||||||||||||||||

Enter the number of |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

employees who worked during or received pay for |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

the week that includes the 12th day of each month. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

UI SK

41919415

For office use only

Postmark

Received date

AI |

|

SI |

|

WT |

|

|

|

SK |

|

||

|

|

|

|

|

Part A - Unemployment insurance (UI) information |

Part B - Withholding tax (WT) information |

||||||||||||||||||||

1. |

|

|

|

|

|

|

|

|

|

|

|

12. |

New York State |

|

|

|

|

|

|

|

|

Total remuneration paid this |

|

|

|

|

|

0 0 |

|

|

|

|

|

|

|

||||||||

2. |

quarter |

|

|

|

|

..........................tax withheld |

|

|

|

|

|

|

|||||||||

Remuneration paid this quarter |

|

|

|

|

|

|

13. |

New York City |

|

|

|

|

|

|

|

||||||

|

in excess of the UI wage base |

|

|

|

|

|

0 0 |

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

tax withheld |

|

|

|

|

|

|

|

|||||||

|

since January 1 (see instr.) |

|

|

|

|

|

|

|

|

|

|

||||||||||

3. |

|

|

|

|

|

|

|

|

|

|

|

14. |

Yonkers tax |

|

|

|

|

|

|

||

Wages subject to contribution |

|

|

|

|

|

0 0 |

|

|

|

|

|

|

|

||||||||

4. |

(subtract line 2 from line 1) |

|

|

|

|

...............................withheld |

|

|

|

|

|

|

|||||||||

UI contributions due |

|

|

|

|

|

|

15. |

Total tax withheld |

|

|

|

|

|

|

|

||||||

|

Enter your |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

UI rate |

|

|

|

|

% |

|

|

|

|

|

|

(add lines 12, 13, and 14) |

|

|

|

|

|

|

|

|

5. |

|

|

|

|

|

|

16. |

WT credit from previous |

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

(multiply line 3 × .00075) |

|

|

|

|

|

|

.......quarter’s return (see instr.) |

|

|

|

|

|

|

|||||||

6. |

UI previously underpaid with |

|

|

|

|

|

|

17. |

Form |

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

interest |

|

|

|

|

|

|

............................for quarter |

|

|

|

|

|

|

|||||||

7. |

|

|

|

|

|

|

|

|

|

|

|

18. |

Total payments |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Total of lines 4, 5, and 6 |

|

|

|

|

|

|

.................(add lines 16 and 17) |

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

19. |

Total WT amount due (if line 15 |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

8. |

Enter UI previously overpaid |

|

|

|

|

|

20. |

...is greater than line 18, enter difference) |

|

|

|

|

|

|

|||||||

9. |

Total UI amounts due (if line 7 is |

|

|

|

|

|

Total WT overpaid (if line 18 |

|

|

|

|

|

|

|

|||||||

|

|

|

|

is greater than line 15, enter difference |

|

|

|

|

|

|

|

||||||||||

|

greater than line 8, enter difference) |

|

|

|

|

|

|

|

* |

|

|

|

|

|

|

|

|

||||

10. |

|

|

|

|

|

|

here and mark an X in 20a or 20b) ... |

|

|

|

|

|

|

|

|||||||

Total UI overpaid (if line 8 is |

|

|

|

|

|

|

20a. Apply to outstanding |

|

|

|

or |

20b. Credit to next quarter |

|

||||||||

|

greater than line 7, enter difference |

|

|

|

|

|

|

|

|

|

|

||||||||||

11. |

and mark box 11 below) * |

|

|

|

|

|

|

liabilities and/or refund |

|

|

|

|

.......withholding tax |

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

Apply to outstanding liabilities |

|

|

|

21. Total payment due (add lines 9 and 19; make one |

|

|

|

|

|

||||||||||||

|

and/or refund |

|

|

remittance payable to NYS Employment Contributions |

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

and Taxes) |

|

|

|

|

|

|

|

|

|

|

||

*An overpayment of either UI contributions or withholding tax cannot be used to offset an amount due for the other.

Complete Parts D and E on back of form, if required.

Part C – Employee wage and withholding information

Quarterly employee/payee wage reporting and withholding information

(If more than five employees or if reporting other wages, do not make entries in this section; complete Form

Do not use negative numbers; see instructions.)

aSocial Security number

bLast name, first name, middle initial

c

Total UI remuneration

paid this quarter

d Gross federal wages or distribution (see instructions)

e Total NYS, NYC, and Yonkers tax withheld

Totals (column c must equal remuneration on line 1; see instructions for exceptions)

Sign your return: I certify that the information on this return and any attachments is to the best of my knowledge and belief true, correct, and complete.

Signature (see instructions)

Signer’s name (please print)

Title

Date

Telephone number

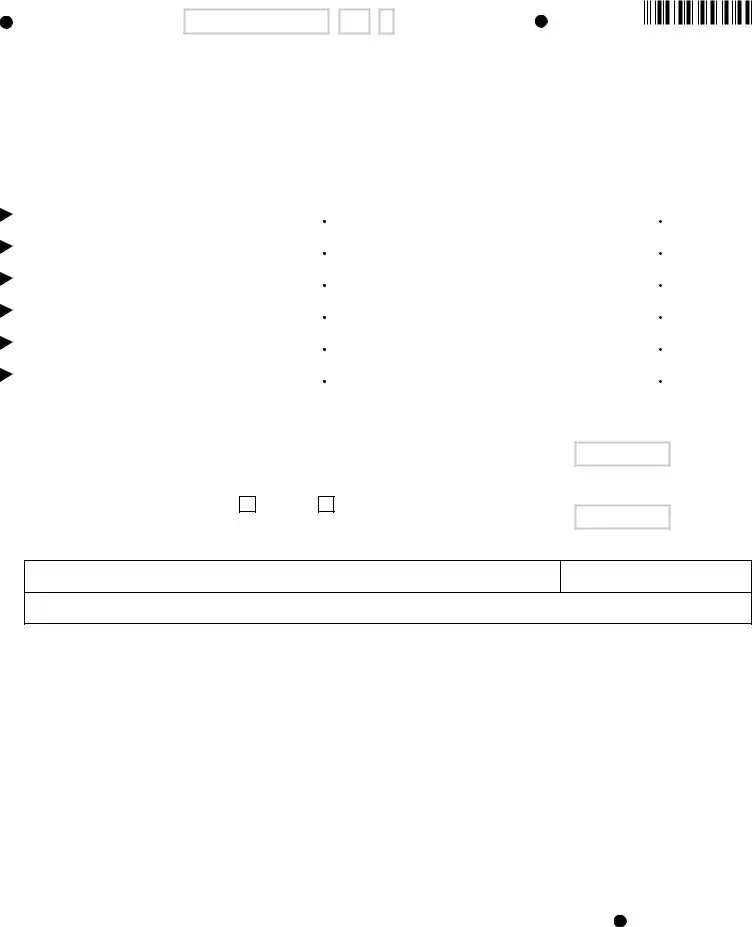

Withholding identification number

41919422

Part D - Form

Use Part D only for corrections/additions for the quarter being reported in Part B of this return. To correct original withholding information reported on Form(s)

|

a |

|

b |

|

|

c |

|

d |

|

|

|

||||

|

Original |

|

Original |

|

|

Correct |

|

Correct |

|

|

|

||||

last payroll date reported |

|

total withheld |

|

last payroll date |

|

total withheld |

|

|

|

||||||

on Form |

|

reported on Form |

|

|

(mmdd) |

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Part E - Change of business information

22. This line is not in use for this quarter.

23. If you permanently ceased paying wages, enter the date (mmddyy) of the final payroll (see Note below).........

24. If you sold or transferred all or part of your business:

• Mark an X to indicate whether in whole or in part

• Enter the date of transfer (mmddyy).................................................................................................................

• Complete the information below about the acquiring entity

Legal name

EIN

Address

Note: For questions about other changes to your withholding tax account, call the Tax Department at

Paid |

Preparer’s signature |

|

Date |

Preparer’s NYTPRIN |

|

|

Preparer’s SSN or PTIN |

|

NYTPRIN |

||||

|

|

|

|

|

|

|

|

|

excl. code |

||||

preparer’s |

|

|

|

|

|

|

|

|

|

|

|

|

|

use |

|

|

|

|

|

|

|

|

|

|

|

|

|

Preparer’s firm name (or yours, if |

Address |

|

Firm’s EIN |

Telephone number |

|||||||||

|

|

|

|

|

|

|

|

|

( ) |

||||

Payroll service’s name |

|

|

|

|

Payroll |

|

|

|

|

|

|

||

|

|

|

|

|

|

service’s |

|

|

|

|

|

|

|

|

|

|

|

|

|

EIN |

|

|

|

|

|

|

|

Checklist for mailing: |

|

|

Mail to: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

•File original return and keep a copy for your records.

•Complete lines 9 and 19 to ensure proper credit of payment.

•Enter your withholding ID number on your remittance.

•Make remittance payable to NYS Employment Contributions and Taxes.

•Enter your telephone number in boxes below your signature.

•See Need help? on Form

NYS EMPLOYMENT CONTRIBUTIONS AND TAXES PO BOX 4119 BINGHAMTON NY

File Overview

| Fact Number | Fact Name | Description |

|---|---|---|

| 1 | Purpose of Form NYS-45 | Used by employers to report quarterly combined withholding, wage reporting, and unemployment insurance returns in New York State. |

| 2 | Frequency of Submission | Required to be completed and submitted every quarter. |

| 3 | Quarterly Reporting Dates | Jan 1 - Mar 31, Apr 1 - Jun 30, Jul 1 - Sep 30, Oct 1 - Dec 31. |

| 4 | Concerned Entities | Applicable to employers operating within the jurisdiction of New York State. |

| 5 | Governing Law | New York State Unemployment Insurance Law and Tax Law. |

| 6 | Seasonal Employer Indicator | Allows seasonal employers to mark their status on the form. |

| 7 | Health Insurance Benefits Reporting | Employers must indicate if dependent health insurance benefits are available to any employee. |

| 8 | Employee Count Reporting | Employers must report the number of full-time and part-time covered employees for each month. |

| 9 | Tax Credit and Overpayment | Provision to report withholdings and UI contributions, including any credits from previous quarters and instructions for handling overpayments. |

| 10 | Multiple Parts for Comprehensive Reporting | Form includes sections for UI information, withholding tax information, employee wage, and withholding information, along with correction/addition pages for accurate reporting. |

Nys 45: Usage Guidelines

Filling out the NYS-45 form is a critical task for employers in New York State, as it combines quarterly reporting requirements for withholding tax, wage reporting, and unemployment insurance contributions. The accuracy of this information is paramount for compliance with state regulations. Here are step-by-step instructions to navigate this form with ease:

- At the top of the form, mark an "X" in the box that corresponds to the quarter for which you are filing. Enter the year next to the quarter.

- Provide your UI (Unemployment Insurance) Employer Registration Number and the Withholding Identification Number in the designated fields.

- Answer the question regarding dependent health insurance benefits for employees by marking "Yes" or "No."

- If you are a seasonal employer, mark an "X" in the appropriate box.

- Enter the number of employees for each month of the quarter in the boxes labeled a. First month, b. Second month, and c. Third month.

- Under "Part A - Unemployment insurance (UI) information," input the total remuneration paid for the quarter in line 1.

- In line 2, detail the remuneration paid this quarter that exceeds the UI wage base, following guidelines from the instructions section.

- Subtract line 2 from line 1 and enter the wages subject to UI contribution on line 4.

- Calculate UI contributions due and enter this figure in line 5, applying your UI rate percentage.

- If applicable, include re-employment service fund details on line 6.

- For any UI overpayments or underpayments, provide details in lines 8 and 7, respectively.

- Under "Part B - Withholding tax (WT) information," record tax withholdings for the state, New York City, and Yonkers in lines 12 through 14.

- Add up the total tax withheld and fill in line 15.

- If you have a WT credit from a previous quarter, mention it on line 16.

- Sum up the total payments including any credits on line 18 and calculate the total WT amount due in line 19.

- Choose how to address any overpaid WT amounts by marking an "X" in box 20a or 20b, and complete lines 20 through 21 accordingly.

- For "Part C – Employee wage and withholding information," only complete this section if reporting for five or fewer employees. Otherwise, use Form NYS-45-ATT.

- If corrections or additional withholdings need to be reported, use "Part D - Form NYS-1 corrections/additions" to provide the corrected or additional information.

- In "Part E - Change of business information," mark the relevant sections if you permanently ceased paying wages, sold, or transferred your business.

- Ensure the signer's name, title, date, and telephone number are filled in the signature section at the bottom of the form.

- If a paid preparer or payroll service was used, complete the section at the bottom with their information.

- Review the checklist for mailing to ensure all components of the form are accurately completed before mailing it to the provided address.

By following these instructions carefully, you can complete the NYS-45 form with confidence. Remember, maintaining accurate records and promptly addressing any errors are essential practices for managing these requirements smoothly.

FAQ

-

What is the NYS-45 form used for?

The NYS-45 form is a quarterly combined filing for New York State (NYS) withholding tax, wage reporting, and unemployment insurance (UI). Employers use this form to report wages paid to employees, withholdings made from those wages, and the amount of unemployment insurance contributions due. It serves to consolidate several reporting requirements into a single form, making it easier for employers to comply with state tax and employment laws.

-

When must the NYS-45 form be filed?

Employers must file the NYS-45 form quarterly. The deadlines are April 30 for the first quarter (January 1 - March 31), July 31 for the second quarter (April 1 - June 30), October 31 for the third quarter (July 1 - September 30), and January 31 for the fourth quarter (October 1 - December 31). Timely filing is crucial to avoid penalties and interest for late submissions.

-

How do I indicate the quarter for which I am filing?

On the NYS-45 form, you will mark an "X" in the box corresponding to the quarter for which you are filing: 1 for the first quarter, 2 for the second, 3 for the third, and 4 for the fourth. You must also enter the year of the quarter you are reporting. Separate forms must be completed for each quarter.

-

Can I report negative numbers on the NYS-45 form?

No, negative numbers should not be reported on the NYS-45 form. If adjustments are needed to correct previously reported figures or to report negative amounts, you should follow the specific instructions provided for making those adjustments. The guidelines for reporting and correcting information are outlined in the instructions accompanying the form.

-

What should I do if I've overpaid or underpaid amounts due when filing the NYS-45?

If you've identified an overpayment or underpayment on the NYS-45 form, specific lines allow you to report these amounts. Overpayments can be indicated for redirection towards outstanding liabilities or as credits for next quarters. Underpayments should be addressed by including the additional amount due with your filing. Instructions on the form offer guidance on how to calculate these amounts and where to report them. It's important to correct discrepancies to ensure your accounts are accurate.

-

Are there penalties for filing the NYS-45 form late?

Yes, there are penalties for filing the NYS-45 form late. These penalties vary and may include a percentage of the unpaid tax due, additional interest on the amount owed, and fixed late filing fees. The New York State Department of Taxation and Finance assesses these penalties based on the duration of the delay and the amount of tax that is due. To avoid penalties, it is advisable to file and make payments before the deadline, even if an estimated payment is necessary.

-

How do I report employee wage and withholding information on the NYS-45 form?

Employee wage and withholding information should be reported in Part C of the NYS-45 form. For each employee, you will need to provide their social security number, last name, first name, middle initial, total unemployment insurance remuneration paid for the quarter, and their gross federal wages or distribution. Additionally, the total New York State, New York City, and Yonkers tax withheld must be included. If you have more than five employees or are reporting other wages, you should complete Form NYS-45-ATT instead of making entries directly on the NYS-45 form.

-

What happens if I made a mistake on a previously filed NYS-45 form?

If a mistake was made on a previously filed NYS-45 form, corrections can be made by using Part D of the form to correct original withholding information or to report additional withholding information not previously submitted. Ensure that the corrected totals on lines 12 through 15 reflect these adjustments. For mistakes related to other parts of the form, instructions provide guidance on the specific steps to take to amend the information.

-

Can I apply an overpayment from my NYS-45 filing to future liabilities?

Yes, if you have an overpayment on your NYS-45 form, you have the option to apply it to outstanding liabilities or credit it to future quarters. This option is available in Part E of the form, where you can mark the appropriate option for handling overpayments. Choose to either apply the overpayment to outstanding taxes or as a credit for upcoming filing periods, according to your preference and financial planning strategy.

-

Who should I contact if I have questions about completing the NYS-45 form or if I encounter specific issues?

For questions regarding the completion of the NYS-45 form or specific issues related to your filing, the New York State Department of Taxation and Finance provides resources for assistance. For questions about your withholding tax account, you can call the Tax Department at 518-485-6654. If your questions are related to your unemployment insurance account, the UI Employer Hotline at 1-888-899-8810 is available. Additionally, the form instructions and the department's website offer comprehensive resources and guides to assist taxpayers.

Common mistakes

Filling out the NYS-45 form, also known as the Quarterly Combined Withholding, Wage Reporting, and Unemployment Insurance Return, can be a complex task fraught with potential errors. Businesses need to be particularly vigilant to avoid common mistakes that could lead to inaccuracies in their reporting, which in turn can result in penalties or delays. Here are some of the missteps to watch out for:

- Incorrect Quarter Marking: One of the initial sections of the form requires indicating the current quarter by marking one of the boxes (1 for January-March, 2 for April-June, 3 for July-September, 4 for October-December). A surprisingly common mistake is marking the incorrect quarter or forgetting to mark a quarter altogether. This error can cause confusion and potentially lead to the form being processed for the wrong period.

- Failing to Provide Accurate Employer Information: The form requires details such as the employer's legal name and withholding identification number. Errors or omissions in this section can cause significant delays, as this information is critical for identifying and associating the return with the correct employer account.

- Omitting Dependent Health Insurance Benefits Status: Employers must indicate whether dependent health insurance benefits are available to any employee. Overlooking or incorrectly answering this question impacts not only the accuracy of the return but also potential benefits implications for employees.

- Incorrect Number of Employees: The form requires reporting the number of full-time and part-time employees for each month in the quarter. Incorrectly reporting these numbers, either by overestimating or underestimating, can affect unemployment insurance contributions and obligations.

- Miscalculating Total Remuneration or Taxes Withheld: Precisely calculating and reporting the total remuneration paid and taxes withheld during the quarter is crucial. Mistakes in this area can lead to underpayment or overpayment of taxes, both of which have implications for the business.

- Not Using the Revised Form for Corrections: If there is a need to correct withholding information reported previously through Form NYS-1, Part D of the NYS-45 form must be used. Failing to use this section for corrections or additions can lead to inaccurate tax records and potential conflicts with previously submitted data.

- Not Properly Addressing Overpayments or Amounts Due: The final sections of the form address overpayments and amounts due for both unemployment insurance contributions and withholding taxes. Incorrectly applying these amounts, or failing to accurately calculate the total payment due, can result in financial discrepancies and might attract penalties.

Accuracy and attentiveness are key when completing the NYS-45 form. By steering clear of these common mistakes, employers can ensure their submissions are correct and minimize the risk of complications with their quarterly reporting. It’s always advisable to double-check each entry and consult with a professional if any uncertainties arise during the process..

Documents used along the form

When dealing with the NYS-45 form, which is a Quarterly Combined Withholding, Wage Reporting, and Unemployment Insurance Return, it is often necessary to gather and prepare additional forms and documents. These materials are crucial for providing accurate and comprehensive information required for proper filing and compliance with state regulations.

- Form NYS-45-ATT: This attachment is used for detailed quarterly employee wage reporting and withholding information. It's necessary when reporting for more than five employees or when additional wage data needs to be documented beyond the space provided in the main NYS-45 form.

- Form NYS-1: Employers use this form to report and pay the total amount of state and local income taxes withheld from employees' wages. It is particularly relevant for adjustments or additional withholdings not previously reported.

- Form IT-2: This summarizes W-2 information for New York State residents. Employers provide it to employees so they can report wage and withholding information on their personal state income tax returns.

- Form W-2: The Wage and Tax Statement reports an employee's annual wages and the amount of taxes withheld from their paycheck. Employers must send out this form to employees and file a copy with the state, which can accompany the NYS-45 filing.

- Form W-3: The Transmittal of Wage and Tax Statements summarizes all W-2 forms for an employer. Although primarily submitted to the Social Security Administration, it supports the aggregate reporting of wages and taxes withheld as part of state filings.

- Unemployment Insurance (UI) Employer Registration Form: Employers new to New York or those who haven't previously filed need to submit this form for obtaining a UI identification number, which is required for the NYS-45.

- Quarterly Contribution Return and Continuation Sheet (NYS-45x): This is used to amend previously filed NYS-45 forms. Employers might need to file this if they discover errors or omissions in their original submissions.

Accurate completion and timely submission of the NYS-45 form and its related documents ensure compliance with New York State's taxation and unemployment insurance requirements. It's crucial for employers to understand each document’s purpose and how it fits into the broader context of their payroll and tax responsibilities. By keeping records organized and staying informed about filing requirements, employers can maintain good standing with state agencies and provide their employees with the necessary documentation for their own tax filings.

Similar forms

The Form 941, Employer's Quarterly Federal Tax Return, bears a resemblance to the NYS-45 form. Both documents are utilized for reporting wages paid, taxes withheld from employees, and the employer's portion of social security and Medicare taxes. Just like the NYS-45, Form 941 is filed quarterly and requires detailed employee wage information, making it crucial for both compliance and accurate tax reporting. The primary difference lies in the jurisdiction, with Form 941 focusing on federal taxation while NYS-45 is specific to New York State.

Form W-3, Transmittal of Wage and Tax Statements, shares similarities with the NYS-45 form in that it summarizes employee wage information and tax withholdings for a given period. This form accompanies Form W-2, Wage and Tax Statement, when submitted to the Social Security Administration. Like the NYS-45 form, Form W-3 aggregates data pertinent to employee compensation and tax withholding but serves as a year-end summary rather than a quarterly submission, highlighting a key difference in their usage and timing.

State Unemployment Tax Act (SUTA) forms, which vary by state, are comparable to the NYS-45 form in that both are concerned with unemployment insurance. Employers use these forms to report wages and pay unemployment taxes at the state level. While the specifics and the form numbers might differ from state to state, the underlying purpose aligns with the unemployment insurance section of the NYS-45, emphasizing the commitment to support workers who may find themselves unemployed.

The Federal Unemployment Tax Act (FUTA) Tax Return, often associated with IRS Form 940, shares objectives with the UI component of the NYS-45 form. It details the employer's federal unemployment tax liabilities, focusing on contributions to the unemployment pool at a national level. Both forms play vital roles in financing unemployment benefits, albeit the NYS-45 also incorporates state-level data and additional tax withholdings beyond the scope of FUTA.

Form W-2, Wage and Tax Statement, is fundamentally linked to the NYS-45 form through the quarterly wage reporting and withholding information requirements. Employers annually provide Form W-2 to their employees and the Social Security Administration, detailing wages paid and taxes withheld. The NYS-45 form collects similar information but does so on a quarterly basis and includes specific New York State, New York City, and Yonkers taxes, making it a more frequent and locally focused counterpart.

The Quarterly Federal Excise Tax Return, known as Form 720, bears resemblance to the NYS-45 form in its periodicity and in serving as a mechanism for tax reporting. This form is used by businesses to report and pay federal excise taxes on specific goods, services, and activities. Similar to the NYS-45, Form 720 is filed quarterly, underlining the ongoing responsibility of businesses to manage and report their tax obligations throughout the year.

Form NYS-1, Return of Tax Withheld, complements the NYS-45 form by allowing businesses to report and pay withheld income taxes more frequently if required. While Form NYS-45 consolidates withholding tax and unemployment insurance information on a quarterly basis, Form NYS-1 may need to be filed more regularly by employers with large tax withholdings. This highlights how both forms contribute to the broader framework of employment tax compliance within New York State, ensuring accurate and timely tax collection and reporting.

Dos and Don'ts

When you're getting ready to fill out the NYS-45 form, it's like preparing for a small journey. You'll want to make sure you've got everything you need before you set off. This form, which you submit quarterly, is your way of reporting wages and calculating both your unemployment insurance contributions and withholding taxes for New York State. To help you navigate this process smoothly, let's go through seven dos and don'ts.

- Do double-check the quarter and year at the top of the form to ensure you're filing for the correct period.

- Do accurately report the number of employees and their wages to avoid discrepancies with the unemployment insurance part of the form.

- Do carefully review which taxes you need to withhold (state, city, and Yonkers) and make sure you're applying the correct rates.

- Do use the totals from your payroll records to fill in the wage and withholding information accurately for each employee.

- Do sign and date the form - an unsigned form is like sending a letter without a stamp, it just won't go anywhere.

- Don't forget to enter your Employer Registration Number and Withholding Identification Number where required. These are key identifiers for your business.

- Don't ignore the correction/addition sections (Part D and Part E) if applicable. Whether your business underwent changes or you found mistakes in past filings, this is your chance to set the record straight.

Remember, the goal is to provide complete and accurate information to avoid penalties, interest, or audits down the line. Taking your time to fill out the NYS-45 form correctly pays off in the end, keeping your business in good standing and ensuring that your contributions and taxes are well accounted for.

Misconceptions

Understanding the NYS-45 form, officially known as the Quarterly Combined Withholding, Wage Reporting, and Unemployment Insurance Return, can sometimes be confusing due to various misconceptions that circulate about its requirements and purposes. Below are seven common misunderstandings explained to offer clarity:

- Only businesses with employees need to file: Some believe that if they don't have employees, they don't need to file the NYS-45. However, businesses that are registered as employers in New York State are required to file the NYS-45 form quarterly, regardless of whether they have paid any employees during that quarter.

- Filing is annual: A common misconception is that the NYS-45 form is to be filed annually. In fact, it must be filed quarterly, with specific deadlines for each quarter to avoid penalties.

- The form is only for unemployment insurance: While Part A of the form does relate to unemployment insurance (UI) information, the NYS-45 is also used for reporting withholding tax and wage data. It is a comprehensive form that covers multiple areas of employer reporting.

- Online filing is optional: With advancing technology and efforts to streamline tax reporting processes, New York State mandates electronic filing for most employers. Thus, filing the NYS-45 form online is not merely an option for convenience; it is a requirement for many.

- Health insurance benefits information is irrelevant: On the contrary, one section of the NYS-45 form asks specifically about the availability of dependent health insurance benefits to employees. This question must be answered, as it is relevant for certain tax credits and benefits.

- Corrections cannot be made after submission: If errors are discovered after the NYS-45 form has been filed, corrections are indeed allowed. Part D focuses on corrections and additions for withholding information, allowing for adjustments to be made and ensuring accurate reporting.

- Overpayments cannot be addressed through the form: If a business overpays on either UI contributions or withholding tax, these overpayments can be marked on the form for credit to the next quarter or request a refund, demonstrating the form's flexibility in handling various payment situations.

Correctly understanding and managing the NYS-45 form is crucial for all employers in New York State. By dispelling these common misconceptions, employers can ensure that they remain compliant with state reporting requirements, avoid unnecessary penalties, and manage their payroll taxes more effectively.

Key takeaways

The NYS-45 form is a comprehensive document designed for employers in New York State to report quarterly combined withholding, wage reporting, and unemployment insurance return. This summary provides key takeaways that help ensure its proper completion and use.

- Employers must select the correct quarter for which they are filing by marking one of the boxes at the top of the form and entering the year to ensure accurate processing.

- The form requires detailed employer information, including the legal name and the number of employees. For each month within the quarter, the number of full-time and part-time employees who worked or received pay during the week including the 12th day of each month must be reported.

- Part A focuses on unemployment insurance information, asking for totals of remuneration paid and wages subject to unemployment contribution. These figures help in calculating the unemployment insurance contributions due.

- Part B is dedicated to withholding tax information. It encompasses New York State, New York City, and Yonkers taxes withheld, and totals need to reflect any corrections or additions from Form NYS-1.

- The form provides space for reporting employee wage and withholding information directly. However, employers with more than five employees or those reporting other wages should use Form NYS-45-ATT instead.

- Adjustments for overpaid or underpaid unemployment insurance contributions and withholding taxes are accounted for in the summary sections of Parts A and B, respectively. Any overpayment can be applied to outstanding liabilities or credited to the next quarter.

- Changes related to business information, such as the cessation of business operations or sale/transfer of the business, are addressed in Part E. Accurate and prompt reporting of these changes is crucial.

- Employers using a paid preparer or payroll service need to ensure that the preparer’s information is filled out at the bottom of the form. This includes the preparer’s signature, details, and date.

Overall, accurate completion and timely submission of the NYS-45 form are essential for compliance with New York State employment and tax regulations. Keeping a copy of the submitted form is also recommended for record-keeping purposes.

Common PDF Documents

New York 1481 - This form bridges the gap for New York firefighting personnel, guiding them towards certification in code compliance and enforcement practices.

Unemployment Claim Pending Status Ny - Describes the process of benefit charging against employers' accounts based on employees’ base period earnings and UI claims.

Nyc Doing Business Data Form - Before any affordable housing transaction, the City agency must complete the form to ensure compliance and transparency.