Free Nys 45 Mn Form in PDF

The NYS-45-MN form serves a critical role for employers in New York State, encompassing the comprehensive reporting of unemployment insurance, wage data, and withholding tax information on a quarterly basis. This document requires employers to detail their legal name, specify the reporting quarter and tax year, and mark whether they operate seasonally. A clear breakdown of full-time and part-time employees who were active or paid in the specified months is demanded, ensuring accurate employment figures are reported. Critical financial data, such as total remuneration, wages subject to contributions, and respective tax withholdings—including state and notable city-specific taxes—are meticulously laid out, necessitating precise calculations and adherence to current tax thresholds and rates. Moreover, the form accommodates adjustments for overpayments or underpayments in unemployment insurance and withholding tax, offering a path toward rectifying discrepancies. Further emphasizing transparency and accuracy, sections dedicated to detailed employee wage reports and potential business changes underline the state's commitment to maintaining up-to-date employer records. This requirement extends to those ceasing business operations or undergoing ownership transitions, ensuring a continuous and clear line of communication with the tax authorities. Through this multifaceted reporting tool, the state aims to streamline tax and wage reporting processes, promoting compliance and fiscal responsibility among its business community.

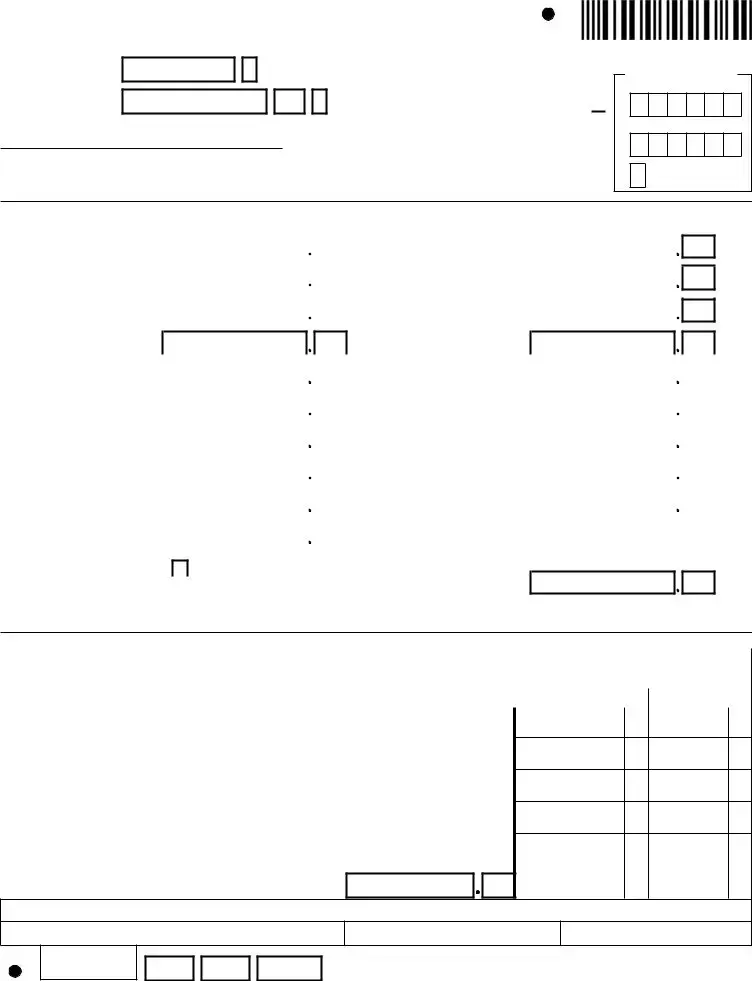

Nys 45 Mn Sample

Reference these numbers in all correspondence:

UI Employer registration number

Withholding identification number

Employer legal name:

Quarterly Combined Withholding, Wage Reporting,

And Unemployment Insurance Return

Mark an X in only one box to indicate the quarter (a separate return must be completed for each quarter) and enter the tax year.

Jan 1 - |

|

Apr 1 - |

|

July 1 - |

|

Oct 1 - |

|

Tax |

|

|

|

|

|

|

|||||

Mar 31 |

|

Jun 30 |

|

Sep 30 |

|

Dec 31 |

|

year |

|

1 |

2 |

3 |

4 |

|

Y Y |

||||

If seasonal employer, mark an X in the box ......

40519418

For office use only

Postmark

Received date

Number of employees |

a. First month |

|

b. Second month |

|

c. Third month |

Enter the number of |

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

employees who worked during or received pay for the |

|

|

|

|

|

week that includes the 12th day of each month. |

|

|

|

|

|

|

|

|

|

|

UI SK

AI |

|

SI |

|

WT |

|

|

|

SK |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

Part A - Unemployment insurance (UI) information |

|

|

|

Part B - Withholding tax (WT) information |

|||||

1. |

Total remuneration paid this |

|

|

|

|

|

12. |

New York State |

|

|

|

0 |

0 |

|

|||||

|

quarter |

|

|

|

|

tax withheld |

|

||

2. |

Remuneration paid this quarter |

|

|

|

|

|

13. |

City of New York |

|

|

|

|

|

|

|

||||

|

to each employee in excess of |

|

|

0 |

0 |

|

|||

|

$8,500 since January 1 |

|

|

|

|

tax withheld |

|

||

|

|

|

|

|

|

|

|

|

|

3. |

Wages subject to contribution |

|

|

0 |

0 |

14. |

City of Yonkers |

|

|

|

(subtract line 2 from line 1) |

|

|

|

tax withheld |

|

|||

4.UI contributions due

|

Enter your |

|

|

|

|

15. |

Total tax withheld |

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

Tax rate |

|

|

|

% |

|

|

|

|

|

|

........(add lines 12, 13, and 14) |

|

|

|

|

|

|

||||

5. |

|

|

|

|

|

|

|

WT credit from previous |

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

16. |

|

|

|

|

|

|

|

|

||||||||||

|

(multiply line 3 × .00075) |

|

|

|

|

|

|

...quarter’s return (see instr.) |

|

|

|

|

|

|

|

|||||||

6. |

UI previously underpaid with |

|

|

|

|

|

|

|

Form |

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

17. |

|

|

|

|

|

|

|

|

|

||||||||

|

interest |

|

|

|

|

|

|

|

.........................for quarter |

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

18. |

Total payments |

|

|

|

|

|

|

|

|

||||

7. |

Total of lines 4, 5, and 6 |

|

|

|

|

|

|

(add lines 16 and 17) |

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

19. |

Total WT amount due (if line 15 |

|

|

|

|

|

|

|

|

||||

8. |

Enter UI previously overpaid |

... |

|

|

|

|

|

|

is greater than line 18, enter difference) .. |

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

9. |

Total UI amounts due (if line 7 |

|

|

|

|

|

|

20. |

Total WT overpaid (if line 18 |

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

is greater than line 8, enter difference) ... |

|

|

|

|

|

|

is greater than line 15, enter difference |

|

|

|

|

|

|

|

|

||||||

10. |

Total UI overpaid (if line 8 |

|

|

|

|

|

|

|

here and mark an X in 20a or 20b)* |

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

20b. Credit to next quarter |

|

|

||||||||||

|

is greater than line 7, enter difference |

|

|

|

|

|

20a. |

Apply to outstanding |

|

|

|

|

or |

|

|

|||||||

|

|

|

|

|

|

|||||||||||||||||

|

and mark box 11 below)* |

|

|

|

|

|

|

|

liabilities and/or refund ... |

|

|

|

|

.........withholding tax |

|

|

||||||

11.Apply to outstanding liabilities

and/or refund |

|

21. Total payment due (add lines 9 and 19; make one |

|

||

|

|

remittance payable to NYS Employment Taxes) |

*An overpayment of either tax cannot be used to offset the amount due on the other tax.

Complete Parts D and E on back of form, if required. This is a scannable form; please file the original.

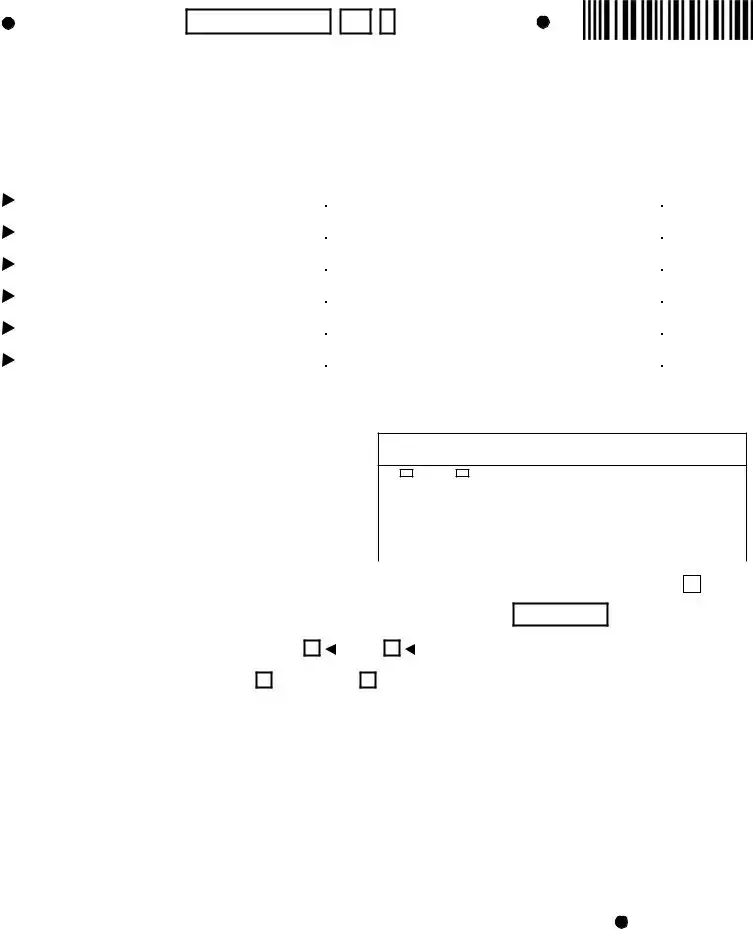

Part C – Employee wage and withholding information

Quarterly employee/payee wage reporting information (if more than five employees or if |

|

Annual wage and withholding totals |

||||

|

If this return is for the 4th quarter or the last return you will be |

|||||

reporting other wages, do not make entries in this section; complete Form |

|

|||||

|

filing for the calendar year, complete columns d and e. |

|||||

|

|

|

|

|

|

|

a Social security number |

b Last name, first name, middle initial |

c UI total remuneration/gross |

|

d Gross wages or distribution |

e Total tax withheld |

|

|

|

wages paid this quarter |

|

(see instructions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Totals (column c must equal remuneration on line 1; see instructions for exceptions) .........

Sign your return: I certify that the information on this return and any attachments is to the best of my knowledge and belief true, correct, and complete.

Taxpayer’s signature

Signer’s name (please print)

Title

Date

Telephone number

Withholding identification number

Part D - Form |

40519425 |

|

Use Part D only for corrections/additions for the quarter being reported in Part B of this return. To correct original withholding information reported on Form(s)

|

a |

|

b |

|

|

c |

|

d |

|

|

|

||||

|

Original |

|

Original |

|

|

Correct |

|

Correct |

|

|

|

||||

last payroll date reported on |

|

total withheld |

|

last payroll date |

|

total withheld |

|

|

|

||||||

Form |

|

reported on Form |

|

|

(MMDD) |

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Part E - Change of business information

22.Enter below the address at which you want to receive this form if different from the preprinted address.

Taxpayer’s trade name

c/o: |

attn: |

(if applicable, mark either box and enter name) |

||

|

|

|

||

Number and street or PO box |

|

|||

|

|

|

|

|

City |

|

|

State |

ZIP code |

|

|

|

|

|

If the above address is for your paid preparer, mark this box and the c/o

box, and enter preparer’s name on the second line above .......................

23. If you permanently ceased paying wages, enter the date (MMDDYY) of the final payroll

(see Note below) ............................................................................................................................

24.Did you sell or transfer all or part of your business?

Yes

No

If Yes, indicate if sale or transfer was in

Whole or

Part

Note: Complete Form

If you are using a paid preparer or a payroll service, the section below must be completed.

Paid |

Preparer’s signature |

Telephone number |

Date |

|

Mark an X if |

|

|

Preparer’s SSN or PTIN |

|||

|

|

|

|||||||||

|

( |

) |

|

|

|

|

|

|

|||

preparer’s |

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

use |

Preparer’s firm name (or yours, if |

|

Address |

|

|

|

Preparer’s EIN |

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Payroll service name |

|

|

|

Payroll service’s EIN |

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Checklist for mailing:

•File original return and keep a copy for your records

•Complete lines 9 and 19 to ensure proper credit of payment

•Enter your withholding ID number on your remittance

•Make remittance payable to NYS Employment Taxes

•Enter your telephone number in boxes below your signature Need help or forms? Call 1 800

Mail to:

NYS EMPLOYMENT TAXES PO BOX 4119 BINGHAMTON NY

File Overview

| Fact | Description |

|---|---|

| Form Title | NYS-45-MN: Quarterly Combined Withholding, Wage Reporting, And Unemployment Insurance Return |

| Version Date | January 2005 (1/05) |

| Purpose | Used by employers to report quarterly withholding, wage details, and unemployment insurance information in New York State. |

| Governing Law | New York State Tax Law and the Unemployment Insurance Law. |

| Sections | Includes specific sections for unemployment insurance information (Part A), withholding tax information (Part B), employee wage and withholding information (Part C), Form NYS-1 corrections/additions (Part D), and change of business information (Part E). |

| Quarter Reporting | Employers must indicate the specific quarter being reported by marking one of the provided boxes and entering the tax year. |

| Signatory Requirements | The form requires a signature to certify the provided information's accuracy, along with the signer’s name, title, and date. |

| Employer Identification Numbers Required | Employers must include both their UI (Unemployment Insurance) Employer registration number and their Withholding identification number. |

Nys 45 Mn: Usage Guidelines

Filling out tax forms can sometimes feel like navigating through a maze. Yet, understanding the steps to complete the NYS-45-MN form can make the process less daunting. This form is essential for reporting quarterly combined withholding, wage reporting, and unemployment insurance returns in New York State. It's important to fill it out accurately and timely to maintain compliance with state tax obligations. Follow these steps to ensure your form is completed correctly:

- Start by entering your UI Employer registration number and Withholding identification number at the top of the form.

- Next, fill in the Employer legal name.

- Mark an X in the box that corresponds to the quarter you are reporting for and enter the tax year.

- If you're a seasonal employer, mark an X in the relevant box.

- Under the section marked "Number of employees," enter the number of full-time and part-time covered employees for each month of the quarter.

- In Part A, provide your unemployment insurance (UI) information by:

- Entering the total remuneration paid this quarter.

- Listing the remuneration paid to each employee in excess of $8,500 since January 1.

- Calculating the wages subject to contribution by subtracting line 2 from line 1.

- Entering UI contributions due, considering the tax rate percentage.

- Calculating the Re-employment service fund contribution.

- Adjusting for any UI previously underpaid or overpaid.

- Summarizing the total UI amounts due or overpaid.

- In Part B, clarify withholding tax (WT) information:

- Detail the New York State, City of New York, and City of Yonkers taxes withheld.

- Add these amounts to calculate the total tax withheld.

- Note any withholding tax (WT) credit from the previous quarter.

- Finalize the total payments, amount due, or overpaid, and how any overpayment should be applied.

- For Part C, if applicable, enter employee wage and withholding information, especially if this return is for the 4th quarter.

- Under Part D, correct or add withholding information as necessary.

- In Part E, update any change of business information.

- Review, sign, and date the form. Ensure your telephone number is included.

- Finally, if using a paid preparer or payroll service, complete the designated section at the bottom.

With all sections accurately filled, you’re ready to file the form. Remember to keep a copy for your records. Filing this form correctly and within the specified deadlines is crucial for compliance with New York State's tax regulations. It ensures your business remains in good standing, avoiding potential penalties or interest for late or incorrect filings.

FAQ

What is the NYS-45-MN form used for?

The NYS-45-MN form is utilized for quarterly combined withholding, wage reporting, and unemployment insurance returns in New York State. Employers fill out this form to report wages paid, withholdings made, and unemployment insurance dues on a quarterly basis.

When should the NYS-45-MN form be submitted?

Employers must complete and submit this form each quarter. The deadlines are as follows: April 30 for Quarter 1 (January 1 - March 31), July 31 for Quarter 2 (April 1 - June 30), October 31 for Quarter 3 (July 1 - September 30), and January 31 for Quarter 4 (October 1 - December 31).

Where can I get the NYS-45-MN form?

This form can be obtained by visiting the New York State Department of Taxation and Finance website or by calling their hotline at 1 800 972-1233 to request a copy be mailed to you.

Can I file the NYS-45-MN form electronically?

Yes, employers are encouraged to file this form electronically for faster processing and convenience. The New York State Department of Taxation and Finance provides online services where you can submit the form directly.

What information is needed to complete the NYS-45-MN form?

You will need your UI Employer registration number, Withholding identification number, total remuneration paid, the tax withheld, and other necessary payroll information. It's important to accurately report the number of employees and their earnings for the quarter.

How can I correct a mistake on a previously filed NYS-45-MN form?

If you need to make corrections or additions to a previously filed NYS-45-MN, you should complete Part D of the form, specifying the original and corrected amounts. Ensure the front of the return reflects these adjustments.

What should I do if I overpay or underpay?

If you identify an overpayment or underpayment, calculate the difference and report it accordingly on the form. For overpayments, you can mark a box to credit it to the next quarter or apply it to outstanding liabilities. If there's an underpayment, ensure you complete the payment due to avoid penalties.

Is there a penalty for filing the NYS-45-MN late?

Yes, failing to file the form on time may result in penalties and interest charges. It's important to adhere to the submission deadlines to avoid these penalties.

How can I get help filling out the NYS-45-MN form?

For assistance, call the New York State Department of Taxation and Finance at 1 800 972-1233. There are representatives available to guide you through filling out the form or to answer any questions you may have.

Common mistakes

Filling out government forms can be tricky, and the NYS-45-MN is no exception. It's designed to report wages, withholding taxes, and unemployment insurance. Not paying attention to detail can lead to several common mistakes. Here's a list of pitfalls to avoid:

- Not marking the correct quarter. The form requires you to indicate which quarter you're reporting for by marking an X in one of the boxes provided. Overlooking this step can result in processing delays.

- Incorrect employer information. The employer's legal name, UI Employer registration number, and Withholding identification number should be double-checked for accuracy. Errors here can lead to misfiled documents and subsequent headaches.

- Miscalculating total remuneration paid. All remuneration paid within the quarter needs to be accurately reported. Common errors include not accounting for all types of remuneration or simple miscalculations.

- Failing to accurately report the number of employees. You need to enter the number of full-time and part‑time covered employees who worked during or received pay for the week that includes the 12th day of each month. Inaccuracies can impact your contribution amounts.

- Incorrect withholding information. Part B requires detailed tax withholding information. It's easy to transpose numbers or misreport amounts, leading to either overpaying or underpaying taxes.

- Skipping over the sections that may not initially seem applicable, such as Parts D and E for corrections, additions, and change of business information. These sections are crucial for maintaining accurate records and ensuring the state has the most current information.

Avoiding these mistakes requires a keen eye for detail and a clear understanding of your payroll for the quarter. The most effective strategy is to review each section carefully before submission and use the checklist provided to ensure all parts of the form are complete and accurate. This diligence not only helps in avoiding processing delays but can also save your business from potential penalties or audits down the timeline.

Remember, accurate and timely filing reflects well on your business and helps in maintaining a good standing with state authorities. When in doubt, consulting a professional for assistance can be a wise decision to ensure the form is filled out correctly.

Documents used along the form

When handling the NYS-45-MN form, a range of additional forms and documents often complement the filing process, ensuring compliance and accuracy in reporting. These forms each serve specific facets of employer responsibilities in New York State, from detailing employee wage data to adjusting previously reported information. Understanding the role and purpose of each document can significantly streamline the reporting process for employers.

- Form NYS-1, Return of Tax Withheld: Employers use this form to report and remit taxes withheld from employees' wages promptly after each payroll period. It's crucial for maintaining up-to-date tax payments and avoiding potential penalties for late submissions.

- Form NYS-45-ATT, Quarterly Combined Withholding, Wage Reporting, and Unemployment Insurance Return Attachment: This attachment is used when an employer has more than five employees or is reporting wages not included in the initial NYS-45-MN form, providing a more detailed breakdown of wages and withholdings.

- Form DTF-95, Business Tax Account Update: If there are any changes to business information, such as address, federal identification number, or ownership, this form is used to update the New York State Tax Department to ensure records are current and correspondence is accurately directed.

- Form IT-2, Summary of W-2 Statements: This form summarizes information from employees' W-2 statements when employees are filing their personal income tax returns, aiding in the state tax return process.

- Form W-2, Wage and Tax Statement: Employers must provide this crucial document to employees annually. It reports employee annual wages and the amount of taxes withheld from their paychecks, necessary for both Federal and State tax return filings.

- Form IT-209, Claim for Noncustodial Parent New York State Earned Income Credit: This form is not directly used by employers but is essential for eligible employees claiming the noncustodial EIC on their New York State personal income tax returns. Awareness of such forms can assist employers in providing necessary wage information and support to their employees.

Together, these documents facilitate a smoother operation of reporting and compliance for New York State employers. By thoroughly understanding and utilizing each form in its appropriate context, employers can better navigate the complexities of payroll and tax obligations, ensuring both accuracy in their filings and the well-being of their employees. Managing these documents efficiently can lead not only to compliance but also to more informed and effective payroll administration.

Similar forms

The IRS Form 941, Employer's Quarterly Federal Tax Return, is similar to the NYS-45-MN form as both are quarterly reports. Form 941 is used by employers to report income taxes, social security tax, or Medicare tax withheld from employees' paychecks. Additionally, it reports the employer's portion of social security or Medicare tax, paralleling the NYS-45-MN's function of reporting state-level tax obligations and contributions to unemployment insurance.

The IRS Form W-2, Wage and Tax Statement, shares similarities with the NYS-45-MN form, particularly in the aspect of wage reporting. While the Form W-2 is an annual report sent to employees and the Social Security Administration, detailing the employee's annual wages and the amount of taxes withheld, the NYS-45-MN includes quarterly wage reporting and withholding information for state-level tax purposes.

Form W-3, Transmittal of Wage and Tax Statements, serves a related purpose to part of the NYS-45-MN by summarizing the information reported on individual W-2 forms for all employees of a company. This form, submitted to the Social Security Administration along with copies of Form W-2, complements the NYS-45-MN's role in aggregating and reporting quarterly wage and tax information to state authorities.

The state counterpart for many employers, the Quarterly Federal Unemployment Tax Act (FUTA) Tax Return, or IRS Form 940, aligns closely with the unemployment insurance aspects of the NYS-45-MN form. While Form 940 is used to report and pay the federal portion of unemployment taxes, the NYS-45-MN covers state-specific unemployment insurance contributions, ensuring compliance on both federal and state levels.

IRS Form 944, Employer’s Annual Federal Tax Return, designed for smaller employers to report their tax responsibilities annually, has its periodicity as a contrast to the NYS-45-MN’s quarterly reporting structure. Nonetheless, it fulfills a similar role in tax and wage reporting at the federal level, emphasizing the importance of accurate payroll tax reporting regardless of the reporting frequency.

The Schedule B (Form 941), Report of Tax Liability for Semiweekly Schedule Depositors, although a supplemental form, shares its basis with the NYS-45-MN form through its focus on the timing and amounts of tax liabilities. Employers who have a larger tax liability use Schedule B to enumerate tax obligations more precisely throughout the quarter, akin to how the NYS-45-MN form gathers detailed tax and wage data within New York State.

Lastly, Form 1099-MISC, Miscellaneous Income, and its newer counterpart, Form 1099-NEC, for reporting non-employee compensation, bear resemblance in their role of reporting specific payments. These forms are used for various types of payments to individuals not classified as employees. The connection to the NYS-45-MN comes into play with the comprehensive scope of wage reporting and withholding requirements for different categories of income earners and the necessity of reporting certain types of state-level compensation.

Dos and Don'ts

When completing the NYS-45-MN form, attention to detail is paramount for accurately reporting quarterly combined withholding, wage reporting, and unemployment insurance returns. The following tips outline best practices and common pitfalls to avoid:

Do:- Use the correct form version. Always verify that you are using the most current version of the NYS-45-MN form to ensure compliance with the latest legal requirements.

- Double-check numbers. Carefully review the employer registration number, withholding identification number, and all financial figures. Errors can lead to processing delays or incorrect tax liabilities.

- Indicate the correct quarter and tax year. Mark only one box to indicate the quarter for which you are filing and accurately enter the tax year to avoid misfiling.

- Report accurate employee counts and wages. For each month, enter the number of full-time and part-time covered employees and ensure that remuneration figures align with your payroll records.

- Clearly mark any overpayments. If applicable, clearly indicate overpayments and specify your preference by marking the appropriate box for credit or refund applications.

- Sign and date the form. The form must be signed and dated, confirming that the information provided is, to the best of your knowledge, true, correct, and complete.

- Overlook the seasonal employer box. If you are a seasonal employer, ensure to mark the box as this can affect your tax liabilities and reporting schedule.

- Miscalculate tax due. Avoid common mistakes in calculating total remuneration, taxes withheld, or contributions due. Use the form instructions to accurately compute amounts.

- Omit parts D or E if necessary. If you need to correct withholding information or report changes in business information, complete parts D and E on the back of the form.

- Forget to include payment. If payment is due, make sure it is included with the form submission and payable to NYS Employment Taxes, with your withholding ID number noted.

- Mail to the wrong address. Double-check the mailing address, especially if using an older form version, to ensure your documentation reaches the correct processing center.

- Ignore instructions for special situations. If the return is for the 4th quarter or you are reporting other wages, follow the specific instructions provided to avoid incomplete filings.

Misconceptions

When it comes to the NYS-45-MN form, numerous misconceptions often lead to confusion and errors in its completion and submission. Here, we aim to clarify these misunderstandings to ensure that employers are better informed.

- Misconception 1: The form is only for businesses with a large number of employees. In reality, any employer that pays wages to employees in New York State must file the NYS-45-MN form, regardless of the size of their workforce.

- Misconception 2: Seasonal businesses do not need to file if they did not operate that quarter. Every employer, including seasonal ones, must file the NYS-45-MN for each quarter, even if no wages were paid during that period. The form includes a specific box to indicate seasonal employment status.

- Misconception 3: The form is complicated and time-consuming. With proper knowledge and preparation, completing the NYS-45-MN can be straightforward. Employers should gather all relevant wage and tax withheld information ahead of time to ease the process.

- Misconception 4: All parts of the form must be completed for every filing. Certain sections of the NYS-45-MN form are only required under specific circumstances, such as Parts D and E, which are meant for corrections, additions, and business information changes.

- Misconception 5: Overpayments cannot be applied to future liabilities. The form actually allows for overpayments to be credited to the next quarter or applied to outstanding liabilities, offering flexibility in managing overpayments.

- Misconception 6: Electronic filing is not allowed. Electronic submission of the NYS-45-MN is not only allowed but encouraged, as it can streamline the process and ensure timely receipt and processing of the form.

- Misconception 7: Late filing penalties are negligible. Failing to submit the NYS-45-MN on time can result in significant penalties and interest charges, emphasizing the importance of timely filing.

- Misconception 8: Employers do not need to file if they have not withheld any taxes. Employers are required to file the NYS-45-MN form even if no taxes were withheld during the quarter, as it also reports wage information.

- Misconception 9: Personal information of the preparer is not necessary. If the form is prepared by someone other than the employer, details regarding the preparer, including their name and SSN or PTIN, must be included to ensure accountability.

- Misconception 10: The form only reports New York State taxes. While it primarily focuses on New York State taxes, the NYS-45-MN also encompasses reporting for unemployment insurance and city-level taxes for New York City and Yonkers.

Clarifying these misconceptions is crucial for ensuring that the NYS-45-MN form is completed accurately and in compliance with New York State requirements. Employers should always verify current guidelines and seek professional advice if necessary to avoid penalties and ensure proper reporting.

Key takeaways

Understanding the NYS-45-MN form is crucial for businesses operating in New York State. It combines quarterly reporting for withholding tax, wage reporting, and unemployment insurance. Here are four key takeaways that can help ensure compliance and accuracy when managing this form:

- Accurate Quarter and Year Reporting: Mark the correct box to indicate the quarter for which you are filing the return and enter the correct tax year. This form requires separate submissions for each quarter, making accurate date marking essential to avoid processing delays or penalties.

- Comprehensive Employee Information: It’s important to accurately enter the number of full-time and part-time covered employees who worked during or received pay for the week that includes the 12th day of each month. Additionally, the form requires detailed wage and withholding information for each employee, ensuring the state receives a clear picture of payroll expenses.

- Detailed Financial Breakdowns: The form breaks down financial obligations into specific categories, including unemployment insurance contributions, withholding tax amounts, and any overpayments or underpayments. Careful calculation and reporting in these sections are vital for accurate financial documentation and to prevent discrepancies with state records.

- Correct Application of Overpayments: If you discover that your business has overpaid on taxes, the form allows you to indicate how these overpayments should be applied, whether towards future liabilities or requested as a refund. This flexibility can aid in managing your business’s cash flow more effectively.

Completing the NYS-45-MN form with thoroughness and precision is key to maintaining compliance with New York State’s tax and unemployment insurance requirements. Keep records well-organized, check calculations for accuracy, and consult with a professional if you encounter any uncertainties during the process. This proactivity will not only uphold your business's reputation but also ensure that your financial responsibilities to the state are met accurately and timely.

Common PDF Documents

It 214 - It serves to inform the buyer about any potential issues, such as lead paint, which is especially important for homes built before 1978.

Nysid 41C W - Acts as evidence of compliance with insurance laws by brokers.