Free Nys 45 Att Mn Form in PDF

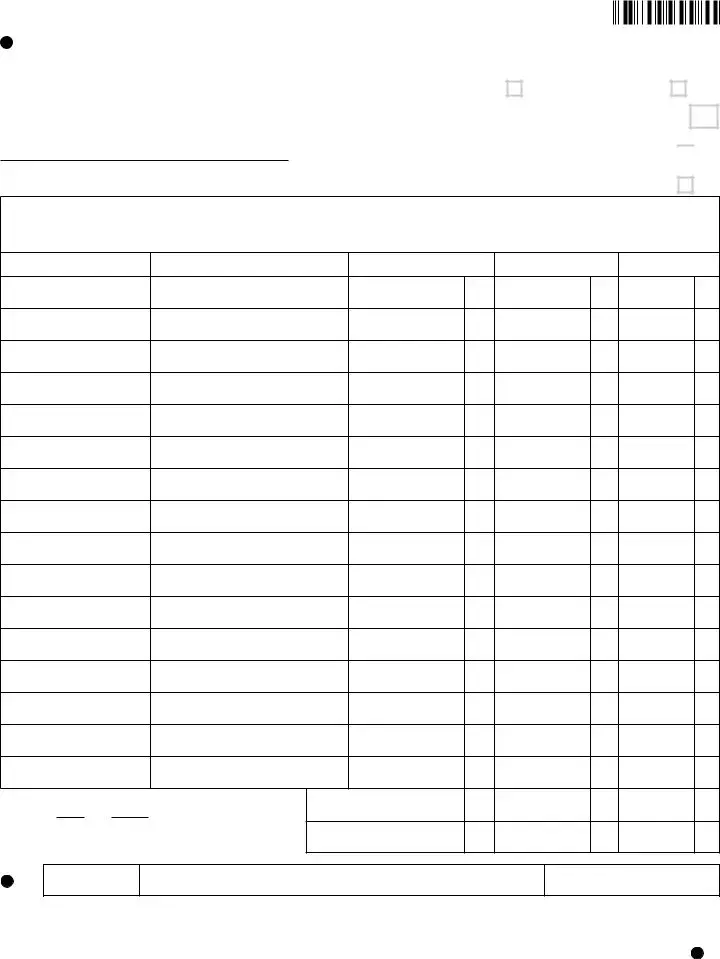

Filing taxes and managing payroll obligations are essential tasks for employers, including those in New York State. Among the various forms and documents required, the NYS-45-ATT stands out as a key piece for quarterly reporting. This form, officially named the Quarterly Combined Withholding, Wage Reporting, and Unemployment Insurance Return Attachment, is designed to streamline the process of reconciling and reporting employees' wages, withholding amounts, and unemployment insurance contributions. The form itself is used by employers to provide detailed information about wages paid to employees, taxes withheld from those wages, and any unemployment insurance dues paid during a specific quarter of the fiscal year. With specific boxes to check off for whether the return is original or amended, and sections dedicated to reporting other wages or declaring seasonal employment, the NYS-45-ATT brings clarity and precision to the complex process of quarterly payroll reporting. Additionally, the importance of accurate social security numbers, comprehensive employee information, and precise figures for wages and taxes withheld cannot be overstated, as these elements are crucial for compliance with state regulations and the smooth operation of the tax system. Contact details are also requested to ensure that any questions or concerns can be promptly addressed, highlighting the form's role in facilitating communication between employers and the New York State Employment Contributions and Taxes office.

Nys 45 Att Mn Sample

(1/19)

Quarterly Combined Withholding, Wage Reporting, And Unemployment Insurance

61939417

Withholding identification number: |

|

|

Mark an X in the applicable box(es): |

|

||||||||||

|

|

A. Original |

|

or Amended return |

|

|||||||||

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Jan 1 - |

|

Apr 1 - |

|

July 1 - |

|

Oct 1 - |

|

|

|

Employer legal name: |

|

|

|

|

|

|

|

|

||||||

|

|

Mar 31 |

|

Jun 30 |

|

Sep 30 |

|

Dec 31 |

|

|

Year |

|||

1 |

2 |

3 |

4 |

|||||||||||

Y Y

B. Other wages only reported on this page .....

C. Seasonal employer ....................................

Quarterly employee/payee wage reporting and withholding information

(Do not enter negative numbers in columns c, d, and e; see instructions)

aSocial Security number

bLast name, first name, middle initial

cTotal UI remuneration

paid this quarter

dGross federal wages or distribution (see instr.)

eTotal NYS, NYC, and

Yonkers tax withheld

Page No. of Total this page only ......

If first page, enter grand totals

of all pages .................................

Contact information Name

(see instructions)

Daytime telephone number

( )

For office use only |

|

Received date |

Mail to: NYS EMPLOYMENT CONTRIBUTIONS AND TAXES |

|

Postmark |

|

|||

|

|

|

|

PO BOX 4119 |

|

|

|

|

|

|

|

|

|

BINGHAMTON NY |

|

|

|

|

|

File Overview

| Fact Name | Detail |

|---|---|

| Form Purpose | The NYS-45-ATT form serves as an attachment for reporting quarterly wages, withholding taxes, and unemployment insurance contributions for employers in New York State. |

| Applicable Periods | This form is required to be filed quarterly with specific periods marked as Jan 1-Mar 31, Apr 1-Jun 30, July 1-Sep 30, and Oct 1-Dec 31 of a given year. |

| Governing Law(s) | The form is governed by New York State law, specifically under the jurisdiction of the New York State Department of Taxation and Finance and the Department of Labor. |

| Reporting Requirements | Employers must report employee Social Security numbers, names, total unemployment insurance (UI) remuneration paid, gross federal wages, and total New York State, New York City, and Yonkers tax withheld for the quarter. |

Nys 45 Att Mn: Usage Guidelines

Filling out the NYS-45-ATT form is a necessary step for employers in New York State when they're managing their quarterly tax and wage reports. This form is an attachment that is used in conjunction with the main NYS-45 form for specific reporting requirements. It can seem daunting at first, but with clear instructions, the process becomes straightforward. Whether you're filing for the first time or amending previous information, the following steps will guide you through completing this form accurately.

- Start by filling in your Withholding identification number at the top of the form; this unique identifier is crucial for your filing.

- Next, mark an X in the box that corresponds to your filing status. If this is your first time filing for the quarter, select "Original." If you are making corrections to a previously filed report, select "Amended return."

- Indicate the quarter for which you are filing by marking an X in the appropriate box under the dates given (Jan 1 - Mar 31, Apr 1 - Jun 30, July 1 - Sep 30, Oct 1 - Dec 31).

- Fill in the Year of the quarter you are reporting for next to the quarter selection.

- In the section titled "Employer legal name," enter the legal name of the employer as registered with the New York State Department of Labor.

- If you are only reporting other wages not included on the main NYS-45 form, mark an X in the box labeled "B. Other wages only reported on this page."

- If you're a seasonal employer, indicate this by marking an X in the corresponding box labeled "C. Seasonal employer."

- For each employee, enter their Social Security number, last name, first name, and middle initial in the designated areas (a through b).

- In column c, enter the total UI (Unemployment Insurance) remuneration paid to the employee during the quarter.

- In column d, specify the employee's gross federal wages or distribution for the quarter.

- Column e is where you'll note the total NYS, NYC, and Yonkers tax withheld from the employee during the quarter.

- Ensure you fill in the Page No. at the bottom of the form and, if it's the first page, enter the grand totals of all pages in the space provided.

- Complete the contact information section with the employer's name and daytime telephone number.

- Review the form to make sure all the information entered is accurate and complete.

- Lastly, send your completed NYS-45-ATT form to the address provided on the form: NYS EMPLOYMENT CONTRIBUTIONS AND TAXES, PO BOX 4119, BINGHAMTON, NY 13902-4119.

By following these steps, you should have a fully completed NYS-45-ATT form, ready for submission. This process plays a vital part in ensuring that your business stays compliant with New York State's tax and employment laws. Remember, it's always better to double-check each piece of information for accuracy before mailing the form to avoid any potential issues that might arise from incorrect or incomplete filings.

FAQ

- What is the NYS-45-ATT form used for?

The NYS-45-ATT form is a crucial document for employers in New York State. It serves as an attachment to the Quarterly Combined Withholding, Wage Reporting, and Unemployment Insurance Return. This form is specifically designed for detailing the wages paid to employees and the taxes withheld from those wages during a quarter. It's used to report and distinguish different types of wages and to adjust reports if necessary, including the reporting of seasonal employees' wages.

- When should an employer file the NYS-45-ATT form?

Employers must file the NYS-45-ATT form quarterly along with the main NYS-45 form. The form breaks down the quarterly periods as follows: January 1 to March 31, April 1 to June 30, July 1 to September 30, and October 1 to December 31. The exact filing deadlines for these periods are typically the last day of the month following the end of the quarter.

- Can the NYS-45-ATT form be used for amended returns?

Yes, if an employer needs to amend previously submitted wage and withholding information, they can mark the "Amended return" box on the form. It's essential to provide accurate and updated information to correct any errors or omissions in the initially submitted return.

- Is it necessary to report all wages on the NYS-45-ATT form?

It's important to report all wages paid to employees during the quarterly period, including those for seasonal workers if applicable. However, the form has a specific box to mark if it's being used to report "Other wages only," which refers to wages not reported elsewhere on the form.

- What happens if I report negative numbers on the NYS-45-ATT form?

Negative numbers should not be entered on the NYS-45-ATT form. The form's instructions explicitly state that negative figures in the totals for UI (Unemployment Insurance) remuneration, gross federal wages, or taxes withheld are not acceptable. Adjustments requiring negative numbers should be handled as instructed by New York State's guidelines for amendments.

- How do I calculate the total UI remuneration and taxes withheld?

Total UI remuneration paid to each employee during the quarter should be reported, alongside the gross federal wages or distributions and the total New York State, New York City, and Yonkers tax withheld from those wages. Calculations should follow the guidelines provided by New York State, ensuring accuracy to avoid discrepancies.

- What should I do if this is my first time filing the NYS-45-ATT form?

If it's your first time filing, it's essential to ensure that all employee wage information is accurately reported. You should cross-reference the totals on the NYS-45-ATT with your payroll records. If the document is the first page, remember to include grand totals of all pages submitted. Ensure to also provide the required contact information for any follow-up.

- Where do I mail the completed NYS-45-ATT form?

The completed form, along with any attachments, should be mailed to: NYS EMPLOYMENT CONTRIBUTIONS AND TAXES, PO BOX 4119, BINGHAMTON, NY 13902-4119. Verify the current address and any mailing instructions on the New York State Department of Taxation and Finance website before sending.

- What if I make a mistake on the form after it's been sent?

If you realize a mistake after sending the form, you'll need to file an amended return. Correct the erroneous information and mark the form as an "Amended return." It's crucial to address and correct mistakes promptly to maintain accurate employment records and comply with New York State tax laws.

- Is it possible to file the NYS-45-ATT electronically?

Yes, New York State encourages employers to file electronically for convenience and to ensure accurate and timely processing of wage and tax information. Employers can use the New York State Department of Taxation and Finance's online services to file. This method is faster and reduces the risk of errors.

Common mistakes

Filling out the NYS-45-ATT form, a Quarterly Combined Withholding, Wage Reporting, and Unemployment Insurance Return, often poses challenges for individuals due to its detailed requirements. A clear understanding of common pitfalls can help avoid mistakes that could lead to processing delays or errors in record-keeping.

One frequent mistake is the improper identification of the form as an original or amended return. Many individuals inadvertently fail to mark the appropriate box indicating whether the submission is an Original or Amended return. This error can lead to significant confusion and delays in processing, as it is crucial for the New York State Department of Tax and Finance to know the nature of the submission in order to accurately process and record the employer's payroll tax obligations.

Another common error involves inaccuracies in reporting employee/payee wage information. Specifically, sections c, d, and e-requiring details on total UI remuneration paid for the quarter, gross federal wages or distribution, and total NYS, NYC, and Yonkers tax withheld, respectively-are often filled out incorrectly. Entering negative numbers or inaccurately calculating these amounts can adversely affect the accuracy of the reported data. It's crucial to follow the form's instructions carefully to ensure that all financial information is reported correctly.

Additionally, individuals often overlook the need to report Other wages only applicable on this page or mistakenly mark themselves as a Seasonal employer when it does not apply. This misstep can lead to incorrect tax liability calculations and unexpected tax outcomes at the end of the fiscal year. Understanding the specific criteria that define seasonal employment and other wages as per New York State's guidelines can help mitigate this issue.

Failure to include contact information, such as a daytime telephone number, is another oversight that can complicate communication between the employer and the Department of Tax and Finance. Given that questions or issues may arise during the processing of the form, providing accurate contact details is essential for resolving any matters efficiently.

In summation, when completing the NYS-45-ATT form, employers should meticulously ensure the accuracy of their submission by:

- Correctly identifying the nature of the return as Original or Amended.

- Accurately calculating and reporting employee wages and withheld taxes without entering negative numbers.

- Correctly identifying employment status and wages specific to additional compensation not reported elsewhere.

- Providing complete and accurate contact information.

Adhering to these guidelines will help prevent processing delays, ensure accurate tax reporting, and maintain compliance with New York State tax laws.

Documents used along the form

Understanding the documents related to employment and tax matters in New York State can indeed be challenging. Apart from the NYS-45-ATT, which serves as a quarterly combined withholding, wage reporting, and unemployment insurance return attachment, there are several other forms and documents that employers frequently need to manage. Each of these plays a critical role in ensuring compliance with state regulations and helps in the systematic reporting and payment of taxes and contributions.

- NYS-45: This is the primary form that accompanies the NYS-45-ATT. Essentially, it provides a comprehensive overview of an employer’s quarterly payroll expenses, tax withholdings, and unemployment insurance contributions. It is crucial for reporting the total payroll and calculating the amount due for state unemployment contributions.

- IT-2104: The Employee's Withholding Allowance Certificate allows employees to indicate their withholding status for state taxes. This ensures that employers withhold the correct amount of New York State income tax from each paycheck.

- W-2: The Wage and Tax Statement is an essential yearly form detailing the total wages paid to an employee and the taxes withheld from those wages. Employers must send this form to both the employees and the Social Security Administration.

- W-4: While primarily for federal tax withholdings, the Employee's Withholding Certificate is a critical document for employers to collect so they can withhold the correct federal income tax from employees' paychecks.

- IT-2: This form summarizes W-2 information for New York State tax returns. It's a necessary document that employees must attach to their state tax returns if their W-2 forms are not electronically filed by their employer.

- UIA-1028: The Employer's Quarterly Tax Report is specific to unemployment insurance. While not a New York-specific form (as it varies by state), it serves a similar purpose to the NYS-45 but focuses on unemployment insurance at the federal level. It's important for employers to ensure that contributions to both state and federal unemployment insurance funds are reported accurately.

Together, these forms create a framework that supports the accurate reporting and payment of wages, taxes, and insurance. It ensures transparency between the employer and the state, minimizing errors and compliance issues. Understanding how they interact with each other can provide clearer insights into the responsibilities of employers and help streamline the process of managing employee contributions and taxes.

Similar forms

The Form 941, "Employer's Quarterly Federal Tax Return," closely parallels the NYS-45-ATT in function. Both are mandated quarterly submissions that require employers to report wages paid, taxes withheld from employees' pay, and the employer's portion of social security and Medicare taxes. While the Form NYS-45-ATT is specific to New York State, incorporating details for state unemployment insurance and withholding taxes, the Form 941 addresses federal tax obligations. Each serves as a critical tool for governmental bodies to collect employment taxes and maintain accurate records of earnings and withholdings.

Another document sharing similarities with the NYS-45-ATT is the W-2 Form, "Wage and Tax Statement." Despite the W-2 being an annual report and NYS-45-ATT being quarterly, both forms compile essential wage and tax withholding information for employees. The NYS-45-ATT aggregates this data on a quarterly basis, aiding in the precise collection and reporting of state and local taxes, while the W-2 summarizes an employee's annual wages and the taxes withheld by the employer for the entire year, serving as a key document for employees' personal tax filings.

The Form W-3, "Transmittal of Wage and Tax Statements," functions comparably to the NYS-45-ATT when considered alongside the W-2 forms. The W-3 is sent to the Social Security Administration (SSA) alongside the W-2 forms and provides a summary of an employer's total earnings, Social Security wages, Medicare wages, and withholding for all employees annually. Though it serves a different level of government and is annual rather than quarterly, like the NYS-45-ATT, it compiles comprehensive wage and withholding information for an entity's workforce.Form UC-2, "Employer's Quarterly Unemployment Insurance Wage Report," shares aspects with the NYS-45-ATT, specifically concerning unemployment insurance. Both documents are crucial for reporting total wages paid to employees, which are used to determine unemployment insurance obligations. However, whereas the NYS-45-ATT requires detailed individual employee wage reporting and includes additional state and local tax withholdings, the UC-2 focuses solely on unemployment contributions and is tailored to the requirements of each state's unemployment insurance program.

The Schedule H (Form 1040), "Household Employment Taxes," is another document with functions similar to those found in the NYS-45-ATT. Schedule H is used by employers to report taxes for household employees, such as nannies or home health aides, if certain conditions are met. Like the NYS-45-ATT, it includes calculations for social security, Medicare taxes, and, if applicable, federal unemployment (FUTA) tax, and income tax withholdings. Although aimed at a specific employment sector and part of the federal tax system, Schedule H aligns with the NYS-45-ATT in facilitating accurate tax reporting and payment for workers.

Dos and Don'ts

When preparing the NYS-45-ATT form, a comprehensive approach ensures accuracy and compliance. Here is a list of dos and don'ts to assist in the process:

- Do carefully read all instructions provided with the form to prevent common mistakes.

- Do ensure accurate entry of the Withholding identification number to avoid processing delays.

- Do mark the correct box for the type of return you are filing — distinguishing between Original, Amended, and Other wages is crucial.

- Do report all employee/payee wage information clearly and accurately, including Social Security numbers and total remuneration.

- Don't enter negative numbers in columns designated for total UI remuneration paid, gross federal wages, and total NYS, NYC, and Yonkers tax withheld. Positive figures are required.

- Don't overlook the requirement to mark whether you are a Seasonal employer if it applies, as this can impact your filing.

- Don't neglect to include your contact information, including a daytime telephone number, which is essential for any needed clarifications.

- Don't use pencil or any erasable ink to fill out the form. Documents should be completed in blue or black ink to ensure permanence and readability.

Adherence to these points can help ensure the process is smooth and the information provided is useful for both compliance and record-keeping purposes. Properly completed, the NYS-45-ATT form supports accurate reporting to the New York State Employment Contributions and Taxes department, facilitating a clear account of wages and withholdings that benefit both employers and employees.

Misconceptions

Understanding the NYS-45-ATT form can be complex. Many misconceptions exist about its purpose, requirements, and how it should be filled out. Here are ten common misunderstandals clarified to help ensure compliance and accuracy.

- Misconception 1: The form is required for all New York State businesses.

Only businesses with employees in New York State need to complete it, specifically for reporting quarterly wages and withholdings.

- Misconception 2: Negative numbers can be reported for corrections.

Negative numbers should not be entered in the quarterly total columns; corrections must follow the guidelines outlined in the form's instructions.

- Misconception 3: It’s the same as the federal unemployment tax forms.

This form is specifically designed for New York State and relates to state unemployment insurance, wage reporting, and withholding taxes, not federal taxes.

- Misconception 4: The form covers annual reporting requirements.

It is a quarterly form, not an annual one, and each quarter must be reported separately.

- Misconception 5: Amendments can't be made once the form is submitted.

Amendments are possible; businesses must mark the "Amended return" box and ensure accurate information for the specific quarter is reported.

- Misconception 6: The form is only for employers who operate year-round.

Seasonal employers also need to use this form, indicating their status by marking the "Seasonal employer" box as applicable.

- Misconception 7: All wages need to be reported on the main form.

The NYS-45-ATT is specifically for reporting other wages not included on the main NYS-45 form, making it an attachment for additional reporting.

- Misconception 8: Employer legal name and contact information are optional.

This information is mandatory for identification purposes and for any potential follow-up by the New York State Department of Taxation and Finance.

- Misconception 9: The form can be filed at any time during the year.

Form filing is tied to specific quarters of the fiscal year and must be submitted by the respective deadlines for each quarter.

- Misconception 10: Once the business information is submitted, no updates are required.

Updates to the business's contact information or legal name must be reported to ensure the New York State Department of Taxation and Finance has the most current information.

It’s important for businesses to be aware of these misconceptions to accurately fulfill their reporting requirements and avoid potential penalties. Always refer to the latest instructions and guidelines provided by New York State when completing the NYS-45-ATT form.

Key takeaways

Filling out and using the NYS-45-ATT form, a crucial document for employers in New York State for reporting quarterly wages, withholding, and unemployment insurance, requires attention to detail and adherence to specific instructions. Here are six key takeaways to ensure accuracy and compliance:

- Identify the Type of Return: It's imperative to mark the correct box at the beginning of the form to indicate whether you're submitting an original or an amended return. This distinction guides the processing of your paperwork.

- Report Accurate Periods: The form is divided into quarters, with specific dates for each period. Ensure that you report wages and withholdings in the correct quarter to avoid discrepancies and potential penalties.

- Employer Information: Clearly provide the employer's legal name and withholding identification number. This information is vital for associating the submitted data with the correct employer account within the state system.

- Wage and Withholding Details: For each employee, you must list their social security number, full name, total unemployment insurance remuneration paid within the quarter, gross federal wages, and total New York State, New York City, and Yonkers tax withheld. Accuracy here is critical for both compliance and the employees’ tax records.

- Do Not Enter Negative Numbers: If adjustments need to be made, ensure that you follow the specific instructions for doing so. Negative numbers are not permitted in the columns for unemployment insurance remuneration, gross federal wages, or tax withheld.

- Contact Information and Submission: Providing accurate contact information is crucial for any follow-up or clarification needed. The form also includes specific mailing instructions, including the address to send the completed forms to, ensuring they are directed to the correct office for processing.

Remember, the NYS-45-ATT form is a legal document, and accurate, timely submission helps maintain your compliance with state tax and employment law. Keeping detailed employment records will streamline the process of filling out this form each quarter.

Common PDF Documents

Nys State Aid Voucher - Essential for financial clarity, the State Aid Voucher delineates all specifics, from payee identity to payment qualifications, ensuring transparent transactions.

Nycers F291 - Form F291 facilitates members' requests for a name change with NYCERS, requiring documentation for processing.

Corprate Tax Rate - This form accommodates both calendar year filers and those operating on a different fiscal year schedule, with spaces to indicate the beginning and end of their fiscal year.