Free Nys 100 Form in PDF

The New York State Employer Registration Form for Unemployment Insurance, Withholding, and Wage Reporting, commonly referred to as the NYS-100 form, serves as a critical gateway for employers to commence their statutory responsibilities when operating in New York. Issued by the Department of Taxation and Finance along with the Department of Labor's Unemployment Insurance Division, this comprehensive document is designed to facilitate the proper registration of businesses across a variety of classifications including corporations, limited liability companies (LLCs), partnerships, and sole proprietorships. It provides a structured process for employers to report necessary information such as business identification, employer information, and detailed data regarding employment practices. Including sections tailored for different employer types, such as household employers of domestic services, the form mandates disclosure of intricate details including the date of first operations, payroll schedules, employee counts, and the nature of the business's legal entity. Notably, this form differentiates between those registering for withholding tax remittance and those liable for unemployment insurance contributions, adding layers of specificity to the registration process. Employers are directed to either submit this form by mail, fax, or complete their registration online, with extensive instructions and various parts of the form ensuring accurate completion. This careful delineation of various business operations and employer obligations underscores the state's commitment to efficient taxation and labor standards enforcement, providing a foundational step for employer compliance within New York State.

Nys 100 Sample

Department of Taxation and Finance and

Department of

Albany, N.Y.

New York State Employer Registration for Unemployment Insurance, Withholding, and Wage Reporting

You may apply online at www.labor.ny.gov.

For office use only:

U.I. Employer Registration No.

Return completed form (type or print in ink) to the address above, or fax to (518)

Need Help? Call

Do Not use this form to register a Nonprofit IRC 501 (c) (3), Agricultural, Governmental Employer, or Indian Tribe.

Call

Part A – Employer Information

1. |

Type (check one): |

|

Business (complete parts A, B, D, and E) |

|

|

|||||||

|

|

|

|

|

Household Employer of Domestic Services (complete A, C, D, and |

|||||||

|

|

|

|

|

||||||||

2. |

Legal entity (check one – do not complete if household employer): |

|

|

|||||||||

|

|

|

Corporation (includes |

|

Limited Liability Company (LLC) |

|

Limited Liability Partnership (LLP) |

|||||

|

|

|

|

|

||||||||

|

|

|

Sole Proprietorship |

|

Partnership |

|

|

Other (please describe):_______________________________________ |

||||

|

|

|

|

|

|

|||||||

3. FEIN (Federal Employer Identification Number):

-

4. Phone no.: ( |

|

|

|

|

|

) |

|

|

|

|

|

- |

|

|

|

|

|

|

|

5. Fax no.: ( |

|

|

|

|

|

) |

|

|

|

|

|

- |

6.Legal name of business: ____________________________________________________________________________

7.Trade name (doing business as), if any: ________________________________________________________________

8.Business

Part B – Business Employer

1. |

Enter date of first operations in New York |

State: |

|

|

|

/ |

|

|

|

/ |

|

|

|

|

|

|

|

(mm/dd/yyyy) |

|||||||||||||||

2. |

Enter the date of the first payroll from which you withheld or will withhold NYS Income Tax from your employees’ |

||||||||||||||||||||||||||||||||

|

pay: |

|

|

|

/ |

|

|

|

/ |

|

|

|

|

|

|

|

(mm/dd/yyyy) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

3.a. Indicate the first calendar quarter and enter the year you paid (or expect to pay) total remuneration of $300 or more. (Remuneration is every form of compensation, including payments to employees or to corporate and

|

|

|

Jan 1 – Mar 31 (1st) |

|

Apr 1 – Jun 30 (2nd) |

|

Jul 1 – Sep 30 (3rd) |

|

Oct 1 – Dec 31 (4th) |

Year |

||||||||

|

b. Are you registering to remit withholding tax only? |

|

|

Yes |

|

|

No |

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

||||||||||

4. |

Total number of employees:_____________________ |

|

|

|

|

|

|

|

|

|||||||||

5. |

Do persons work for you, whom you do not consider employees? |

|

|

Yes* |

|

|

No |

|

||||||||||

|

|

|

|

|

||||||||||||||

*If Yes, explain the services performed and the reason you do not consider these persons employees.

__________________________________________________________________________________________________

__________________________________________________________________________________________________

__________________________________________________________________________________________________

* REFER TO NYS – 100 I FOR INSTRUCTIONS.

NYS 100 page 2 |

|

|

|

|

|

Legal Name: __________________________________ER Number: _________________________ |

|||||||||||||||||||||||||||||||||||||||||||||||

6. |

Have you acquired the business of another employer liable for NYS Unemployment Insurance? |

|

|

|

|

|

Yes* |

|

No |

||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||

|

* If Yes, did you acquire |

|

All or |

|

|

Part? |

Date of acquisition: |

|

|

|

|

|

/ |

|

|

|

/ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(mm/dd/yyyy) |

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

|

Prior Owner’s: Registration number: |

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

FEIN: |

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

Legal name of business: ______________________________________________________________ |

||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Address:___________________________________________________________________________ |

||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

7. |

Have you changed legal entity? |

|

|

Yes* |

|

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

* If Yes, date of legal entity change:

Previous employer’s: Registration number:

Previous employer’s: Registration number:

/

/

-

(mm/dd/yyyy)

FEIN:

-

Part C – Household Employer of Domestic Services

1. Indicate the first calendar quarter and enter the year you paid (or expect to pay) total cash wages of $500 or more:

|

|

|

Jan 1 – Mar 31 (1st) |

|

Apr 1 – Jun 30 (2nd) |

|

Jul 1 – Sep 30 (3rd) |

|

|

Oct 1 – Dec 31 (4th) |

Year |

|||

2. |

Enter the total number of persons employed in your home: ________________________ |

|

||||||||||||

|

|

|

|

|

|

|

|

|||||||

3. |

Will you withhold New York State income tax from these employees? |

|

|

Yes |

|

No |

|

|||||||

Part D – Required Addresses

1.Mailing Address: This is your business mailing address where your Withholding Tax (WT) and Unemployment Insurance (UI) mail will be delivered. However, if you elect to have your UI mail directed to an address other than your place of business, complete number 4 below.

Street or PO Box: _______________________________________________________________________________

City:_______________________________________________________ State: _________ZIP Code:____________

2.Physical Address: This is the physical location of your business, if different from the Mailing Address in number 1.

Street: ________________________________________________________________________________________

City:_______________________________________________________ State: _________ZIP Code:____________

3.Location of Books/Records: This is the physical location where your Books and Records are maintained.

Street: ________________________________________________________________________________________

City:_______________________________________________________ State: _________ZIP Code:____________

Optional Addresses

4.Agent Address (C/O): Complete this if your UI mail should be sent to an address other than your business address.

C/O: __________________________________________________________________________________________

Street or PO Box: _______________________________________________________________________________

City:_______________________________________________________ State: _________ZIP Code:____________

Telephone: (

)

-

ext:________________

5.LO 400 Form - Notice of Entitlement and Potential Charges Address: If completed, this is where the LO 400 will be directed. (It is mailed each time a former employee files a claim for Unemployment Insurance benefits.)

C/O: __________________________________________________________________________________________

Street or PO Box: _______________________________________________________________________________

City:_______________________________________________________ State: _________ZIP Code:____________

Telephone: (

)

-

ext:________________

* REFER TO NYS – 100 I FOR INSTRUCTIONS.

NYS 100 page 3 |

Legal Name: __________________________________ER Number: _________________________ |

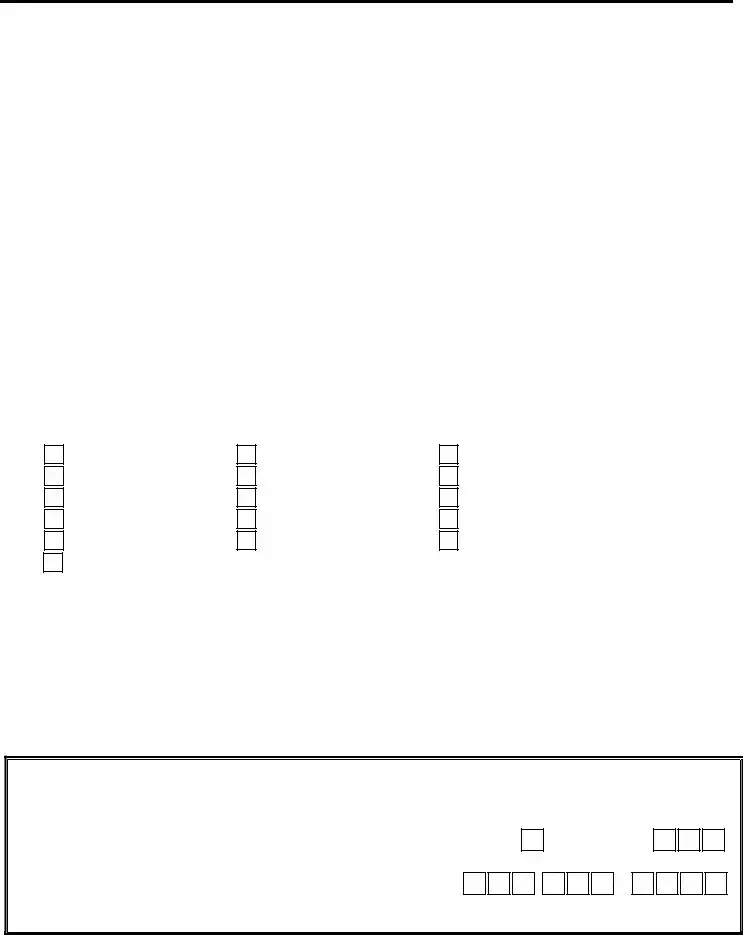

Part E – Business Information

1.Complete the following for sole proprietor (owner), household employer of domestic services, all partners, including partners of LP, LLP or RLLP, all members of LLC or PLLC, and corporate officers (President, Vice President, etc.), whether or not remuneration is received or services are performed in New York State.

Name |

|

Social Security |

|

Title |

|

Residence Address |

|

|

Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2.Please enter the number of physical locations at which your company operates: _____. You MUST list the physical address and answer questions A through E below, for each location. Use a separate sheet of paper for each.

a. Location: _______________________ |

____________________ |

_____________________ |

___________ |

Number and Street |

City or Town |

County |

Zip Code |

b. Approximately how many persons do you employ there? _______________

c. Check the principal activity at the above location:

Manufacturing

Wholesale trade

Retail trade

Construction

Warehousing

Transportation

Computer services

Educational services

Health & social assistance

Real estate

Scientific/professional & technical services

Finance & insurance

Arts, entertainment & recreation

Food service, drinking & accommodations

Corporate, subsidiary managing office

Other (Please specify):_____________________________________________________________________

d. If you are primarily engaged in manufacturing, complete the following:

Principal Products Produced |

Percent of Total Sales Value |

Principal Raw Materials Used |

____________________________ |

__________________________ |

_________________________ |

e. If your principal activity is not manufacturing, indicate products sold or services rendered:

Type of Establishment |

Principal Product Sold or |

Percent of Total Revenue |

|

Service Rendered |

|

_____________________________ |

__________________________ |

________________________ |

I affirm that I have read the above questions and that the answers provided are true to the best of

my knowledge and belief.

X________________________________________________________________

Signature of Officer, Partner, Proprietor, Member or Individual

_______________________________________________ Phone no.: (

Official Position

)

|

/ |

|

|

|

/ |

|

(mm/dd/yyyy)

-

* REFER TO NYS – 100 I FOR INSTRUCTIONS.

File Overview

| Fact Number | Description |

|---|---|

| 1 | The NYS-100 Form is used for New York State Employer Registration for Unemployment Insurance, Withholding, and Wage Reporting. |

| 2 | The form is managed by the Department of Taxation and Finance and the Department of Labor-Unemployment Insurance Division, located at the W A Harriman State Campus, Bldg. 12, Albany, NY. |

| 3 | Employers can apply for registration through the NYS-100 Form online at www.labor.ny.gov. |

| 4 | The form specifies not to use it for registering a Nonprofit IRC 501 (c) (3), Agricultural, Governmental Employer, or Indian Tribe, but instead to call 1-888-899-8810 or visit www.labor.ny.gov. |

| 5 | Employers are required to provide detailed information, including type of business, legal entity, Federal Employer Identification Number (FEIN), and contact details. |

| 6 | Governing laws for this form include state laws related to unemployment insurance, withholding tax, and wage reporting requirements in New York State. |

Nys 100: Usage Guidelines

Getting started with the NYS-100 form, an essential step for new employers in New York State, involves gathering the right information to register your business for Unemployment Insurance, withholding tax, and wage reporting. This form is a requirement for business and household employers alike. Filing the NYS-100 correctly ensures your business adheres to state laws and regulations. Let's break down the process into manageable steps.

- Decide whether you're registering as a Business or as a Household Employer of Domestic Services. This decision will affect which parts of the form you need to complete.

- If registering as a Business, select the type of legal entity your business is (e.g., Corporation, Limited Liability Company, etc.). Household employers can skip this step.

- Provide your Federal Employer Identification Number (FEIN) in the space provided.

- Fill in your contact information, including phone and fax numbers.

- Enter the legal name and, if applicable, the trade name of your business. Provide your business's email and website if available.

- For Business Employers: Specify your date of first operation in New York State and the date of your first payroll. Household employers can skip this.

- Indicate when you first paid or expect to pay $300 or more in remuneration, selecting the appropriate calendar quarter and year. Answer whether you're registering to remit withholding tax only and the total number of employees.

- Detail any business acquisition or legal entity changes if applicable.

- For Household Employers: Indicate when you paid or expect to pay total cash wages of $500 or more, selecting the appropriate calendar quarter and year. Fill in the total number of persons employed in your home and whether you will withhold New York State income tax.

- Provide Required Addresses for mailing, the physical address of the business, and where books and records are maintained. Optionally, you can specify an Agent Address and an address for LO 400 Forms.

- In Part E, list the personal information for the sole proprietor, partners, members, or corporate officers, including their name, Social Security Number, title, and residence address. Also, note the number of physical locations your company operates, providing detailed information for each location as instructed.

- Finally, sign and date the form at the bottom, affixing your title and providing a contact phone number.

Once completed, the NYS-100 form should be sent to the Department of Taxation and Finance and Department of Labor in Albany, or you can opt to complete registration online for a more streamlined process. Filling out the form accurately and thoroughly is critical to ensure compliance with New York State's requirements for employers. If you encounter any confusion or need assistance during the process, the contact information provided at the top of the form or the online help resources can offer the necessary guidance.

FAQ

Frequently Asked Questions about the NYS-100 Form

- What is the NYS-100 form used for?

- Can I submit the NYS-100 form online?

- Who should not use the NYS-100 form for registration?

- What information do I need to complete the NYS-100 form?

- The type of legal entity.

- Federal Employer Identification Number (FEIN).

- Legal name and trade name of the business.

- Primary business activities.

- Date of first operations in New York State and date of first payroll.

- Total number of employees.

- What if my business acquires another business that is already registered for Unemployment Insurance in New York State?

- Are household employers required to file the NYS-100 form?

- How do I report a change in legal entity or business information?

The NYS-100 form is employed to register a business for Unemployment Insurance, Withholding, and Wage Reporting with the New York State Department of Taxation and Finance and the Department of Labor. This registration is mandatory for businesses that have employees in New York State, including those who withhold state income tax from their employees' wages.

Yes, the NYS-100 form can be submitted online. Businesses are encouraged to register through the New York State Department of Labor's website at www.labor.ny.gov. This method is more efficient and can speed up the registration process.

The NYS-100 form should not be used by Nonprofit IRC 501(c)(3) organizations, agricultural employers, governmental employers, or Indian Tribes. Such entities are required to request a different form by calling 1-888-899-8810 or by visiting www.labor.ny.gov for the appropriate registration documents.

To properly complete the NYS-100 form, businesses need to provide several pieces of information, including, but not limited to:

If your business acquires another business that is registered for Unemployment Insurance in New York State, you must indicate this on the NYS-100 form by answering "Yes" to the question regarding business acquisition and providing the date of acquisition, as well as the previous owner's registration number and FEIN.

Yes, household employers who pay cash wages of $500 or more in a calendar quarter to domestic workers are required to register using the NYS-100 form. However, they only need to complete specific sections designated for household employers of domestic services.

If there is a change in the legal entity or if any other business information previously reported on the NYS-100 form changes, businesses must provide updated information to the New York State Department of Labor. This can involve completing a new NYS-100 form or contacting the Department for guidance on how to report the change.

Common mistakes

Filling out the NYS-100 form, which is essential for New York State employer registration for unemployment insurance, withholding, and wage reporting, can be a complex task. Several common mistakes are often made during this process. Recognizing and avoiding these errors can ensure smoother interactions with state agencies.

Not choosing the correct type of employer: The form requires you to indicate whether you're a business or a household employer of domestic services. Mixing these up can lead to incorrect processing and delays.

Providing an incorrect or incomplete legal entity type can create confusion and delay. It's crucial to check the appropriate box that accurately describes your business structure, whether it's a corporation, LLC, LLP, sole proprietorship, partnership, or other.

Errors in the Federal Employer Identification Number (FEIN) are common but can seriously affect the registration process. Double-check this number for accuracy.

Overlooking the requirement to enter the date of first operations in New York State or the date of the first payroll from which NYS income tax was withheld can stall the application. These dates are essential for determining your obligations to the state.

Incorrectly estimating the number of employees or misclassifying workers: It is important not to underestimate or overestimate the number of employees. Also, ensuring that workers are correctly classified as employees or non-employees is critical for compliance with state laws.

Failure to report the acquisition of a business or change in legal entity properly can lead to penalties and complications with your registration. If you've acquired another business or changed your business structure, this information must be reported accurately.

Omitting information on whether you will withhold New York State income tax from employees (for household employers). This decision has implications for your tax obligations and must be indicated clearly on the form.

Not providing complete and accurate addresses for mailing, the physical location of the business, and the location of books/records can slow down communication and processing. Being precise with these details ensures that you receive necessary correspondence and comply with regulatory requirements.

Avoiding these mistakes when completing the NYS-100 form is essential for a smooth registration process. By paying close attention to details and ensuring all information is accurate and complete, employers can avoid unnecessary delays or issues with New York State's Department of Taxation and Finance and the Department of Labor. It's always a good idea to review the form several times before submission or seek professional assistance if you have any doubts.

Documents used along the form

When businesses in New York State embark on the journey of establishing themselves and complying with state regulations, the NYS-100 form serves as a crucial first step, especially for new employers registering for Unemployment Insurance, Withholding, and Wage Reporting. However, to ensure a full compliance spectrum, businesses often find themselves navigating through additional forms and documents. Highlighted below are several key documents that are frequently used alongside the NYS-100 form, each serving its unique purpose in the intricate landscape of business and regulatory compliance.

- IT-2104 (Employee's Withholding Allowance Certificate): This form is filled out by employees to determine the amount of state income tax to withhold from their paychecks.

- IA 12.3 (Certificate of Compliance): Companies may need to file this form with the Department of Labor to certify compliance with state labor laws.

- W-4 (Employee's Withholding Certificate): Similar to IT-2104 but for federal tax withholdings, helping employers withhold the correct federal income tax from employees' pay.

- DB-450 (Claim for Disability Benefits Form): Used by employees to claim disability benefits under the NYS Disability Benefits Law.

- DB-120.1 (Certificate of Insurance Coverage under the NYS Disability and Paid Family Leave Benefits Law): Employers obtain this form from their disability benefits insurance carrier as proof of coverage.

- DOL-800 (Report to Determine Liability): Employers may need to file this with the Department of Labor to determine if they are liable for unemployment insurance contributions.

- ST-100 (New York State Sales Tax Return): Required for businesses collecting sales tax, to report and remit taxes collected from customers.

- OSHA-300 (Log of Work-Related Injuries and Illnesses): Federally required form for tracking injuries and illnesses that occur in the workplace.

- SS-4 (Application for Employer Identification Number): Used by businesses to apply for an Employer Identification Number (EIN) from the IRS, often a prerequisite for the NYS-100.

- Form I-9 (Employment Eligibility Verification): Mandatory for all U.S. employers to verify the identity and employment authorization of new employees.

Each of these documents serves a specific role in ensuring that businesses comply with various employment, tax, and labor regulations. Staying informed and up-to-date with these requirements is essential for the smooth operation of any business in New York State. By understanding and properly managing these forms, employers can avoid potential legal pitfalls and contribute to a fair and thriving workplace environment.

Similar forms

The Federal Employer Identification Number (FEIN) application, also known as Form SS-4, shares similarities with the NYS 100 form's requirement for an FEIN. This element is crucial for both forms as it helps in identifying the employer's tax accounts across federal and state levels. The FEIN serves as a unique identifier for businesses and is required for various tax purposes, mirroring the NYS 100 form's role in establishing an employer's identity for state tax and unemployment insurance obligations.

Form W-4, or the Employee's Withholding Certificate, parallels the NYS 100 in its relation to withholding taxes. While the NYS 100 form registers an employer to withhold New York State income taxes from employees' wages, the Form W-4 collects employee information to determine federal income tax withholdings. Both documents are integral to ensuring that employers accurately withhold taxes from employees' paychecks, albeit at different government levels.

The Quarterly Federal Tax Return, known as Form 941, bears resemblance to the NYS 100 form by necessitating employers to report wages paid, tips earned by employees, and taxes withheld. Similar to the section of the NYS 100 that deals with withholding tax and unemployment insurance, Form 941 addresses federal withholdings plus Social Security and Medicare taxes. Both forms are essential in fulfilling employers' reporting responsibilities to government agencies.

Form I-9, Employment Eligibility Verification, and the NYS 100 form share a common purpose in the employment process, although they have different focuses. The NYS 100 form registers a business with New York State for tax and employment purposes, while Form I-9 ensures that employees are legally authorized to work in the United States. Each document must be completed by employers to comply with respective state and federal regulations regarding hiring practices.

The Application for Employer Identification Number (EIN) online, while not a form in the traditional sense, aligns with the NYS 100's requirement for obtaining an EIN or FEIN. This digital application process facilitates the acquisition of an EIN from the IRS, necessary for tax administration purposes, similarly to how the NYS 100 facilitates state tax and unemployment insurance registrations.

Unemployment Insurance (UI) Tax Registration forms, specific to each state, share the goal of the NYS 100 form in registering employers for unemployment insurance contributions. These forms, though tailored to individual state requirements, collectively ensure that employers contribute to the state-run UI programs. This contributions help to provide temporary financial assistance to workers who have lost their jobs.

The New Hire Reporting Form, mandated by federal law, complements the NYS 100 form's function in the realm of employment. This form requires employers to report new hires to a state directory, aiding in child support enforcement and detecting unemployment insurance and welfare benefit fraud. Similarly, the NYS 100 form plays a role in the broader framework of employment-related reporting and regulations.

Lastly, the Business License Application forms, which vary by state, city, and business type, resonate with the purpose of the NYS 100 form concerning business registration. While the NYS 100 primarily focuses on tax and employer obligations, business license applications are broader in scope, covering permissions and compliance for operational purposes. Both are crucial steps in establishing and maintaining a legitimate business entity within regulatory frameworks.

Dos and Don'ts

When completing the NYS-100 form, which is essential for registering a new business for Unemployment Insurance, Withholding, and Wage Reporting in New York State, attention to detail and thoroughness are key. Below are six do's and don'ts that can guide you through the process.

Do:- Read the instructions carefully before starting the form to ensure you understand each section's requirements.

- Confirm your legal entity type (e.g., Corporation, LLC, Sole Proprietorship) as this affects how you complete the form.

- Provide accurate employer information, including the Federal Employer Identification Number (FEIN) and contact details.

- Detail your first date of operations in New York State and the date of the first payroll from which New York State Income Tax was withheld.

- Answer all questions truthfully regarding the acquisition of a business or change in legal entity, which could affect your Unemployment Insurance obligations.

- Sign and date the form, affirming the accuracy and truthfulness of the information provided.

- Leave sections incomplete. If a section does not apply to your business, ensure you mark it as N/A or provide an explanation as required.

- Guess information. If you are unsure about certain details, such as the exact date of the first payroll, verify this information before completing the form.

- Use this form if it's not applicable to your situation (e.g., if you need to register a Nonprofit IRC 501(c)(3), Agricultural, Governmental Employer, or Indian Tribe), seek the correct form.

- Forget to list the physical locations of operation if your company operates in multiple places within New York State.

- Misclassify employees as independent contractors or vice versa. This misclassification can lead to issues with unemployment insurance and withholding taxes.

- Submit without reviewing for mistakes or omissions that could delay your registration process.

Accurately completing the NYS-100 form is crucial for ensuring your business complies with New York State laws regarding unemployment insurance, tax withholding, and wage reporting. By following these guidelines, you can avoid common pitfalls and streamline your registration process.

Misconceptions

Many misconceptions surround the NYS 100 form, leading to misunderstandings about its purpose, who needs to complete it, and the specific requirements involved. Clarification of these misconceptions is essential for businesses and individuals navigating New York State's employment and taxation regulations.

- Misconception 1: The NYS 100 form is only for large businesses. The form is required for all employers operating in New York State, including small businesses and those hiring domestic services. Whether you are a sole proprietorship or a multinational corporation, if you meet the criteria for employing individuals in New York State, this form applies to you.

- Misconception 2: Nonprofit organizations do not need to file the NYS 100. While nonprofit organizations with 501(c)(3) status are exempt from certain tax obligations, they are not exempt from registering as employers if they have employees. These organizations must use a specific form designed for their sector, and should not use the NYS 100 form, but they still have to register with the state.

- Misconception 3: Only businesses with a physical presence in New York need to complete the NYS 100. This is not accurate. Even if a business is based outside of New York but has employees working in the state, it must register using the NYS 100 form. This requirement ensures that all employees within New York are covered by unemployment insurance and have taxes appropriately withheld.

- Misconception 4: The NYS 100 form is purely for unemployment insurance purposes. While a significant portion of the form relates to unemployment insurance, it also covers the registration for withholding tax and wage reporting. This comprehensive form is designed to streamline the process of meeting New York State's employment and taxation regulations.

In conclusion, understanding the purpose and requirements of the NYS 100 form is crucial for businesses and employers in New York State. Misconceptions can lead to compliance issues, so accurate information and adherence to state guidelines are imperative.

Key takeaways

Filling out and using the New York State (NYS) 100 form, an essential document for registering a business for Unemployment Insurance, Withholding, and Wage Reporting, demands meticulous attention to detail to ensure full compliance with state requirements. Below are seven key takeaways that businesses should be aware of when handling this form:

- The NYS 100 form is a multifaceted form that serves as a registration tool for Unemployment Insurance, Withholding, and Wage Reporting in New York State.

- Businesses can choose to submit the form online at www.labor.ny.gov, which offers a streamlined and potentially faster processing time compared to mailing or faxing the form.

- It is critical to identify the correct type of employer from the choices provided, such as Business or Household Employer of Domestic Services, to ensure that the form is accurately completed according to the specific registration requirements.

- Applicants must provide detailed employer information, including the Federal Employer Identification Number (FE

Common PDF Documents

Cpd-b - Details around employability, such as work authorization in the U.S., are critical for all applicants to provide, utilizing the I-9 form for verification.

Dob Forms - Real estate developers and business operators rely on the PA1 form to navigate the regulatory landscape of New York City's vibrant event scene.

Primary Beneficiary Designation - If a member needs to nominate more beneficiaries than the form allows, they are instructed to use the supplemental Form #136.