Free Nys 1 Form in PDF

In today's fast-paced business environment, staying compliant with tax regulations is a top priority for employers, and the New York State (NYS) Form 1, also known as NYS-1-MN, plays a crucial role in this process. Designed by the New York State Department of Taxation and Finance, this form is essential for reporting and returning tax withheld from employees' wages. Its structured layout ensures that employers can accurately detail New York State, New York City, and Yonkers taxes withheld, along with the total tax due and any credits claimed. Employers are encouraged to fill out the form with black ink, a requirement that underscores the importance of clarity and legibility in tax documentation. Notably, the form is versatile, allowing for both two-sided printing and the option to be printed on separate sheets, thereby accommodating various filing preferences. Before submitting, the form necessitates a thorough review and a certification by the taxpayer that the information provided is correct to the best of their knowledge. Additionally, for those utilizing paid preparers or payroll services, a section is allocated for these entities to furnish their details, ensuring a complete record of all parties involved in the tax withholding and reporting process. The NYS-1 form is an indelible piece of the tax compliance puzzle, assisting employers in navigating the complexities of payroll tax withholding and contributing to the efficient functioning of tax systems within New York State.

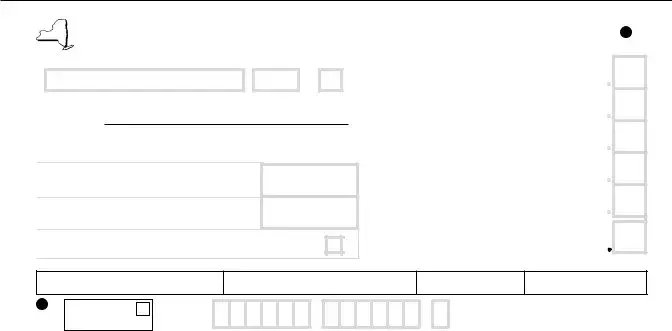

Nys 1 Sample

Scroll down to complete Form

Tab between entry areas and click on the check boxes to

mark and unmark them.

This form is set up for either printing on two separate sheets

of paper, or

Scroll down to complete the back of Form

Cut on the dotted lines before filing this form.

New York State Department of Taxation and Finance |

Please file the original form |

|

|

(not a copy) and print or |

|

type in black ink, not pencil. |

Withholding identification number

Employer’s legal name:

ALast payroll date – Enter date of last payroll covered by this return (MMDDYY)

BIf you permanently ceased paying wages, enter date of inal payroll (MMDDYY)

CMark an X in the box for additional payment

1 |

New York State |

|

|

|

tax withheld |

|

|

|

|

|

|

2 |

New York City |

|

|

|

tax withheld |

|

|

|

|

|

|

3 |

Yonkers |

|

|

|

tax withheld |

|

|

|

|

|

|

4 |

Total withheld |

|

|

|

( add lines 1, 2, & 3 ) |

|

|

|

|

|

|

5 |

Credit |

|

|

|

claimed |

|

|

|

|

|

|

6 |

Total tax due |

$ |

|

|

|||

|

(line 4 minus line 5) |

|

|

I certify that this information is to the best of my knowledge and belief true, correct, and complete.

Taxpayer’s signature

Taxpayer’s name ( print or type )

Date

Telephone number

()

Mark X if new employer or address change ( see back )

For office use only

11019411

POSTMARK |

RECEIVED DATE |

SI |

Scroll down to complete the back of Form

Cut on dotted lines before filing this form.

Paid preparer: If you are using a paid preparer or payroll service, have the preparer or payroll service complete the appropriate section(s) below.

Preparer’s signature |

Telephone number |

Date |

|

Mark an |

|

|

Preparer’s SSN or PTIN |

|

|

|

|

||||||

|

( |

) |

|

|

X if |

|

|

|

|

|

|

|

|

||||

|

|

|

|

|||||

Preparer’s irm name (or preparer’s name, if |

Address |

|

|

|

|

|

Preparer’s EIN |

|

|

|

|

|

|

|

|

|

|

Payroll service’s name |

|

|

|

Payroll service’s EIN |

|

|||

|

|

|

|

|

|

|

|

|

Make check payable to NYS Income Tax and mail to: |

|

|

|

|

|

Taxpayer’s business name |

|

|

|||

NYS TAX DEPARTMENT, PROCESSING UNIT |

|

|

|

||

|

|

|

|

|

|

PO BOX 4111, BINGHAMTON NY |

|

|

|

|

|

|

c/o |

attn |

( if applicable, mark either box and enter name ) |

||

If you are a PrompTax participant and you are filing a paper return, |

|

|

|

|

|

Number and street or PO box |

|

||||

mail your return and payment to: |

|

|

|||

|

|

|

|

|

|

PROMPTAX, NYS TAX DEPARTMENT, |

|

|

|

|

|

|

City |

|

State |

ZIP code |

|

PO BOX 4131, BINGHAMTON NY |

|

|

|||

|

|

|

|

|

|

New employer or address change: Enter at right the |

|

|

|

|

|

|

|

|

|

|

|

address at which you will receive withholding tax forms |

If the address above is for your paid preparer, mark an X in the c/o box, |

||||

and notices. For other changes, see instructions. |

enter the preparer’s name on the second line, and mark an X in this box.. |

||||

|

|

|

|

|

|

File Overview

| Fact | Description | Governing Law(s) |

|---|---|---|

| Form Purpose | Form NYS-1-MN is used for the Return of Tax Withheld in New York State. | New York State Tax Law |

| Printing Instructions | The form is designed for two-sided printing or on two separate sheets but must be printed in black ink. | N/A |

| Filing Requirement | Original NYS-1-MN forms, not copies, must be submitted to the Department of Taxation and Finance. | New York State Tax Law |

| Content Details | Information required includes employer's legal name, payroll date, taxes withheld, and total tax due. | New York State Tax Law |

| Certification | The taxpayer certifies the form's accuracy by signing, dating, and providing contact information. | New York State Tax Law |

| Paid Preparer Section | If a paid preparer or payroll service is used, they must complete designated sections of the form. | New York State Tax Law |

Nys 1: Usage Guidelines

Faced with the task of reconciling taxes withheld from wages with the New York State Department of Taxation and Finance, employers are required to carefully complete Form NYS-1-MN. This document plays a crucial role in ensuring that taxes withheld from employees' wages are accurately reported to the state. Mastering the form's filling ensures compliance with state tax obligations, preventing potential penalties. The key to doing it correctly lies in thoughtful preparation, attention to detail, and following the specified instructions to the letter. After completion, knowing what steps come next is essential for proper filing and compliance with state tax laws.

- Before beginning, ensure you have the employer's withholding identification number and the legal name ready for input.

- Look for the section labeled "Last payroll date" and enter the date of the last payroll covered by this return in the format MMDDYY.

- If wages have been permanently ceased, specify the date of the final payroll in the designated section.

- Locate the check box for additional payments. If making an additional payment, mark an "X" in this box.

- Accurately calculate and enter the New York State tax withheld, New York City tax withheld, and Yonkers tax withheld in their respective fields.

- Add the values from lines 1, 2, and 3 to determine the total amount withheld. Enter this total in the space provided.

- Should there be any credit claimed, note the amount on line 5.

- Subtract the credit claimed (line 5) from the total withheld (step 6) to calculate the total tax due. Record this amount accordingly.

- The taxpayer's section necessitates careful completion - sign to certify the accuracy and completeness of the information, print your name, date the form, and provide a telephone number.

- If there are any changes such as a new employer or address update, mark the relevant box and ensure the new details are correctly entered.

- On the back of the form, if using a paid preparer or payroll service, complete the designated sections with the preparer's information, including signature, telephone number, date, Social Security Number or Preparer Tax Identification Number (SSN or PTIN), firm name, address, and, if applicable, Employer Identification Number (EIN).

- Before submission, ensure you have checked all the information for accuracy, cut along the dotted lines as instructed for filing, and clarified the form's correct mailing address depending on whether you are a PrompTax participant.

- Make your check payable to "NYS Income Tax" and mail the form along with the payment to the address provided on the form, taking care to note any c/o attention if applicable.

After the Form NYS-1-MN is completely filled out and double-checked for any errors, employers must mail it to the correct address provided on the form. Depending on the individual's or entity's situation, this could be the standard Tax Department Processing Unit or the PrompTax location. Timely submission is essential to avoid any potential late fees or penalties. Subsequently, employers should keep a record of their submission, including a copy of the filled-out form and proof of mailing, to ensure they can verify compliance with state requirements if ever needed. Staying organized and maintaining good records can make all the difference in managing tax obligations efficiently.

FAQ

What is Form NYS-1?

Form NYS-1, also known as the Return of Tax Withheld, is a document required by the New York State Department of Taxation and Finance. Employers use this form to report the state, New York City, and Yonkers taxes they have withheld from employees' wages. This form should be completed with black ink and filed after each payroll period if the amount withheld reaches certain thresholds. It's critical for timely tax reporting and compliance.

How do I complete Form NYS-1?

To fill out Form NYS-1, start by entering your withholding identification number and the legal name of the employer. You'll then need to input the last payroll date covered by the return and if applicable, the date of the final payroll if you've permanently ceased paying wages. The form requires you to detail New York State, New York City, and Yonkers tax amounts withheld, before calculating the total tax withheld and any credits claimed. The total tax due should then be calculated and noted. Finally, ensure the form is signed and dated, with contact information clearly provided.

When should I file Form NYS-1?

Filing requirements for Form NYS-1 depend on the amount of New York State, New York City, and Yonkers taxes you've withheld. Generally, if you withhold more than $700 during a payroll period, you must file this form within 3-5 days after the payroll period ends. Employers who withhold less might qualify for monthly or quarterly filing. It's important to consult the latest guidelines from the New York State Department of Taxation and Finance to adhere to the correct filing schedule.

Can I file Form NYS-1 electronically?

Yes, employers are encouraged to file Form NYS-1 electronically for efficiency and speed. Electronic filing is available through the New York State Department of Taxation and Finance's website. Filing electronically ensures faster processing and can help in reducing errors typically associated with manual entries. If you're unable to file electronically, the form allows for mailing, but make sure to comply with the mailing instructions to avoid delays.

What should I do if I make a mistake on Form NYS-1?

If a mistake is made on Form NYS-1, it's essential to correct it promptly to avoid potential penalties. The New York State Department of Taxation and Finance provides guidelines for amending previously filed returns. In general, you will need to file a corrected form detailing the accurate information. If the error pertains to the amount of tax withheld or reported, adjustments may need to be made to the subsequent filing or through another designated amendment process. For specific instructions on correcting errors, it's advisable to contact the department directly or visit their website.

Common mistakes

When it comes to completing the New York State Form NYS-1, known as the Return of Tax Withheld, individuals often find themselves making mistakes that can lead to headaches and delays in processing. This form, crucial for reporting taxes withheld from employees' wages, requires meticulous attention to detail. Here are four common mistakes to avoid:

- Failing to use black ink or print the form properly. The instructions clearly state that the form should be filled out in black ink. This requirement is not merely a suggestion; using other colors or pencil can cause readability issues, leading to processing delays. Additionally, the form is designed for two-sided printing. Not adhering to this can result in submitting incomplete information since some individuals might overlook the second side of the form.

- Incorrect Withholding Identification Number. A vital piece of information on the form is the Withholding Identification Number. Mistakes here can lead to significant processing delays and potential mismatches in records. It's crucial that this number is entered accurately, reflecting the employer’s official records with the New York State Department of Taxation and Finance.

- Omitting necessary check marks or signatures. Certain sections of the form require a check mark to indicate specific conditions, such as being a new employer or noting an address change. Similarly, the form must be signed to certify the accuracy of the information provided. Overlooking these areas can invalidate the submission, requiring you to resubmit the form, thereby delaying the processing time.

- Not cutting along the dotted line when filing a paper return. While it might seem like a minor detail, the instruction to cut along the dotted lines is intended to facilitate the processing of the form. If the form is submitted without following this instruction, it can lead to issues with machine scanning and ultimately slow down the entire processing procedure.

Avoiding these mistakes can streamline the filing process, ensuring that the form is processed efficiently and accurately. It is essential for individuals responsible for payroll and tax withholding to review the form thoroughly before submission. Taking the time to double-check entries, adhere to printing instructions, and ensure that all required sections are completed and signed can save a significant amount of time and effort in the long run.

In conclusion, attention to detail is paramount when filling out Form NYS-1. By avoiding common pitfalls such as incorrect ink usage, missing information, and submission errors, you can ensure a smoother process for both the employer and the New York State Department of Taxation and Finance.

Documents used along the form

When dealing with New York State taxes, particularly in the realm of employment and withholding taxes, the NYS-1 form serves as a crucial component in ensuring tax compliance. However, navigating through the process requires more than just this single document. An understanding of other forms and documents that are often used in tandem with the NYS-1 can simplify compliance, streamline processes, and preempt potential issues.

- Form IT-2104, Employee's Withholding Allowance Certificate: This form is completed by employees to determine the correct amount of state income tax to withhold from their paychecks.

- Form W-2, Wage and Tax Statement: Employers use this form to report an employee's annual wages and the amount of taxes withheld from their paycheck to the IRS. A copy is also provided to the employee.

- Form W-4, Employee's Withholding Certificate: Similar to the IT-2104 but for federal taxes, it determines the amount of federal income tax to withhold from the employee’s wages.

- Form IT-941, Employer’s Quarterly Return: Employers file this form to report the total wages paid and the taxes withheld during the quarter to New York State.

- Form NYS-45, Quarterly Combined Withholding, Wage Reporting, and Unemployment Insurance Return: This is a comprehensive form that reports employees' wages, withheld taxes, and unemployment insurance contributions.

- Form 1099-MISC, Miscellaneous Income: Businesses use this form to report payments made to independent contractors or other non-employees.

- Form IT-2, Summary of W-2 Statements: This form summarizes the information from an individual's W-2 forms and is used by employees when filing their personal income tax returns.

- Form IT-201, Resident Income Tax Return: This is the annual income tax return form for New York State residents, where they report their income, deductions, and credits to determine their tax liability or refund.

- Form IT-203, Nonresident and Part-Year Resident Income Tax Return: Nonresidents or part-year residents of New York State use this form to report income earned within the state.

- Form IT-204-IP, Partnership, Limited Liability Company, and Limited Liability Partnership Filing Fee Payment Form: This form is used by partnerships and LLCs to pay the filing fee required by New York State.

Navigating through these documents, each with its unique purpose, contributes significantly to managing and upholding tax responsibilities effectively. Establishing a comprehensive understanding not only aids in maintaining compliance but also lays down a foundation for a smoother operational flow concerning tax-related duties. It’s beneficial for employers, employees, and financial professionals to familiarize themselves with these documents to ensure an accurate and thorough approach to tax compliance within New York State.

Similar forms

The IRS Form 941, Employer's Quarterly Federal Tax Return, closely mirrors the NYS-1 form in structure and purpose. Both documents are essential for employers to report tax withholdings from their employees' wages. They include details about the total amount of taxes withheld and must be filed at specific times throughout the year. The key difference lies in the jurisdiction they serve; while the NYS-1 is for New York State, Form 941 covers federal tax obligations.

W-2 forms are annual reports that showcase the amount of money employees earn and the taxes withheld from their salaries. Similar to the NYS-1 form, W-2 forms are crucial for both employees and the government to ensure the correct taxes are paid. The main likeness is in their focus on reporting income and withholdings to tax authorities, but while the NYS-1 form is used by employers on a more frequent basis, W-2 forms provide an annual summary.

The W-3 form, Transmittal of Wage and Tax Statements, works in tandem with the W-2 form but is designed for the Social Security Administration. It summarizes the total earnings, Social Security, and Medicare wages for all employees of a company. Like the NYS-1 form, it plays a vital role in reporting tax and wage information to governmental entities, ensuring compliance with tax laws and aiding in the accurate recording of employees' earnings and contributions.

State-specific quarterly unemployment tax forms, such as the NYS-45 form in New York, have similarities to the NYS-1 form in that they both require detailed employment tax information from employers within the state. These forms are critical for reporting wages paid and taxes withheld, contributing to the state's ability to provide unemployment benefits. They differ primarily in their specific focus on unemployment insurance contributions versus general tax withholdings.

The 1099 forms, particularly the 1099-MISC and 1099-NEC, are important for reporting income outside of traditional employment, including freelance and independent contractor earnings. Similar to the NYS-1 form, they are crucial for tax reporting and ensuring individuals and entities pay the correct amounts. The overlap lies in their shared goal of maintaining tax compliance, though they cater to different categories of income earners.

The IRS Form 945, Annual Return of Withheld Federal Income Tax, is akin to the NYS-1 form but on an annual basis, covering withheld federal income tax from non-payroll sources. Both forms are pivotal in tracking withheld taxes and ensuring these are properly reported to appropriate tax authorities. They differ primarily in their coverage, with Form 945 focusing on specific non-payroll income, while NYS-1 handles payroll tax withholdings within New York State.

The IRS Form 940, Employer's Annual Federal Unemployment (FUTA) Tax Return, although different in its specific focus on unemployment tax, shares the core purpose of reporting and paying taxes pertinent to employment. Like the NYS-1 form, it's integral for employers to fulfill their tax-related responsibilities. Both play crucial roles in the broader context of employment tax compliance, albeit targeting distinct tax categories.

Dos and Don'ts

Filling out the New York State Form NYS-1, the Return of Tax Withheld, requires careful attention to detail and strict adherence to specific guidelines. The following are eight essential dos and don’ts to consider when completing this form:

- Do download the latest version of the form from the New York State Department of Taxation and Finance website to ensure the submission of correct and up-to-date information.

- Do print or type in black ink only, as other colors or pencil may not be accepted and can lead to processing delays or errors in your filing.

- Do accurately enter your withholding identification number and employer’s legal name, as these are crucial for associating your submission with the correct account and business entity.

- Do double-check the payroll dates entered in sections labeled "Last payroll date" and, if applicable, "Date of final payroll," to avoid discrepancies that may trigger inquiries from the tax department.

- Do not submit a copy of Form NYS-1; always ensure the submission of the original document as requested by the New York State Department of Taxation and Finance.

- Do not overlook marking the appropriate boxes for additional payment or changes in employer information or address; these details are important for accurate record-keeping and communications.

- Do not forget to calculate the total tax due correctly by adding the withheld taxes (lines 1, 2, and 3) and subtracting any credits claimed. This total must be accurately reflected in the final amount due to avoid underpayment or overpayment.

- Do not fail to cut along the dotted lines before filing if you are submitting a paper return. This ensures the form is processed efficiently and reduces the risk of misfiling or loss.

Adherence to these guidelines can streamline the process, ensure compliance with New York State tax laws, and prevent common errors that could delay processing or lead to penalties. When in doubt, consulting with a tax professional can provide clarity and ensure that you fulfill your tax obligations accurately.

Misconceptions

There are several misconceptions about the Form NYS-1, also known as the "Return of Tax Withheld", that need to be clarified to ensure accurate completion and submission. Below are four common misunderstandings and the facts that correct them.

- Misconception #1: The Form NYS-1 Can Be Submitted in Pencil

It is a common belief that forms can be filled out in pencil due to the need for possible corrections. However, the NYS-1 form explicitly requires that all information be printed or typed in black ink. This requirement ensures that the information remains legible and permanent for official records. - Misconception #2: Copies of Form NYS-1 are Acceptable for Filing

Some may think that submitting a photocopy of the completed form is sufficient. On the contrary, the New York State Department of Taxation and Finance mandates that the original Form NYS-1-MN must be filed, not a copy. This requirement helps in avoiding the processing issues that can occur with copies, such as readability problems. - Misconception #3: The Form is Only for New York State Tax Withheld

Although titled for New York State, the form also includes sections for reporting New York City and Yonkers tax withholdings. It's crucial to note that this single form consolidates the reporting for three separate jurisdictions, which simplifies the process for employers but can be overlooked if not understood correctly. - Misconception #4: Form NYS-1 Does Not Need to Be Filed if No Taxes Were Withheld

There's a belief among some employers that if no taxes were withheld during the period, filing Form NYS-1 isn't necessary. This is not the case. The form serves as a return of tax withheld, and if there were periods where no taxes were withheld, it's still important to document this through the proper channels, as required by the New York State Department of Taxation and Finance.

Understanding these aspects of Form NYS-1 helps ensure compliance with the New York State Department of Taxation and Finance's requirements and avoids potential issues arising from common misconceptions.

Key takeaways

- The NYS-1 form is designed specifically for reporting and returning tax withheld by employers in New York State. It is important for ensuring compliance with state tax laws.

- Employers should fill out this form meticulously, using black ink and providing all the required information to avoid any processing delays or errors.

- This form accommodates various types of withholding taxes, including New York State tax, New York City tax, and Yonkers tax, which should be calculated and reported separately.

- Employers must print the original form on two separate sheets of paper or utilize two-sided printing, which implies the importance of the physical quality of the submission.

- Before filing, it's crucial to cut the form on the dotted lines as indicated, which suggests that the form's format is as essential as the content for proper processing.

- Any changes to the employer's address or a new employer status should be clearly marked, ensuring that the state's tax records are up to date.

- If the assistance of a paid preparer or payroll service is used, their information must be filled out in the designated section to ensure accountability and the possibility of follow-up for clarifications.

- Payments should be made out to NYS Income Tax and sent to a specific address, with careful attention paid to the correct mailing address to avoid misdirected payments.

- The form provides space for claiming credits against total tax due, which highlights the opportunity for employers to reduce the amount owed through applicable credits.

Common PDF Documents

Nys Cef - The inclusion of contact information such as email and phone numbers facilitates efficient communication between the applicant and the hiring officials.

Nycers F380 - The F380 form outlines the consequence of erroneous transfers, including the return of funds to NYCERS and possible reimbursement procedures.

Motor Vehicle Accident Claim - The NYS NF-7 form is used for verifying an individual's wage and salary history as part of an insurance claim process.