Free Nycers F380 Form in PDF

The NYCERS F380 form serves as a pivotal document for members wishing to utilize Electronic Fund Transfer (EFT) for the deposit of their monthly retirement allowances directly into their bank accounts, be it savings or checking. By completing and submitting this form to the New York City Employees' Retirement System (NYCERS), members facilitate the smooth transition of their retirement allowances, ensuring a secure and timely deposit of funds. It's essential for members to carefully read the instructions and understand the conditions outlined in the form, alongside providing accurate personal and banking information as required. The process also mandates the attachment of a preprinted personal check, savings deposit slip, or a bank statement for verification purposes. Additionally, the form highlights the course of action if funds are transferred in error, detailing the responsibilities of the bank, the depositor, and NYC the RS, to rectify such situations. Implementation of this EFT authorization provides a straightforward, reliable method for receiving monthly retirement allowances, streamlining financial management for retirees under the jurisdiction of the New York City Comptroller's Office.

Nycers F380 Sample

NYCERS USE ONLY |

F380 |

|

Mail completed form to: *380*

Long Island City, NY 11101

Authorization for Electronic Fund Transfer (EFT) of Monthly

Retirement Allowance

Complete this form if you wish to have your NYCERS check automatically deposited into your bank (checking or savings) account by Electronic Fund Transfer (EFT). Be sure to read the instructions on the back of this form before submitting it to NYCERS. NOTE: If the address you provide on this form is different from your address in our system, the new address will become your official address in our records. Should you have any questions, please contact our Call Center at

Member Number OR |

Pension Number |

|

Last 4 Digits of SSN |

|

Daytime Phone |

|||

|

|

|

|

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|

First Name |

|

M.I. |

|

Last Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

Address |

|

|

|

|

|

|

Apt. Number |

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

State |

|

Zip Code |

|

|

|

|

|

|

|

|

|

|

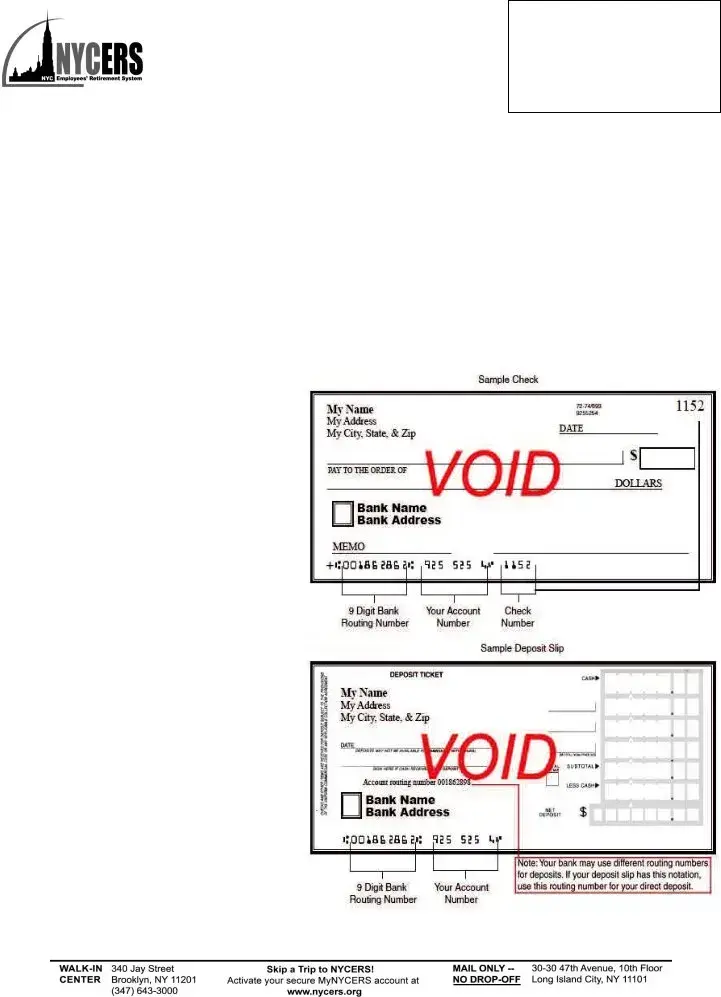

Provide the banking information below and attach a preprinted personal check or deposit slip or a copy of your checking or savings account bank statement. Your name must appear on the preprinted check or bank document and it must match the name in NYCERS' records exactly in order for us to process this request.

I wish to deposit my monthly retirement allowance in my |

Checking or |

Savings |

account. I have read and understand the |

conditions on page 2 of this form and hereby authorize NYCERS to send my monthly retirement allowance via EFT.

BANKING INFORMATION (please print): |

|

Bank Name |

Phone Number |

Branch Address

|

City |

|

|

|

|

|

|

|

|

|

|

State |

|

Zip Code |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Account Number |

|

|

Bank Routing Number |

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Signature of Member |

|

|

|

|

|

|

|

Date |

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

This form must be acknowledged before a Notary Public or Commissioner of Deeds |

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

State of |

|

County of |

|

|

|

On this |

|

day of |

|

|

|

2 0 |

|

, personally appeared |

|||

before me the above named, |

|

|

|

|

|

|

, to me known, and known to |

||||||||||

me to be the individual described in and who executed the foregoing instrument, and he or she acknowledged to me that he or she

executed the same, and that the statements contained therein are true. |

If you have an official seal, affix it |

||||

Signature of Notary Public or |

|

||||

|

|||||

Commissioner of Deeds |

|

||||

|

|

|

|

|

|

Official Title |

|

||||

|

|

|

|

|

|

Expiration Date of Commission |

|

||||

|

|

|

|

|

|

If payments are transferred in error by NYCERS, the bank will return such payments to NYCERS as authorized by the depositor. The bank also agrees to apply the same procedures described in 31 CFR 210 to such transfers, and agrees to reimburse NYCERS to the same extent as Federal agencies are reimbursed under 31 CFR 210.

R12/16 |

Page 1 of 2 |

NYCERS USE ONLY |

F380 |

|

Mail completed form to:

Filling out this form and submitting it to NYCERS authorizes:

1.The Office of the Comptroller of the City of New York, on behalf of the New York City Employees' Retirement

System (NYCERS) to send my monthly retirement allowance via Electronic Fund Transfer (EFT) to the bank* designated on this form for deposit in my account.

2.My bank: (a) to receive my monthly retirement allowance via EFT for deposit in my account AND

(b)to deduct from my designated account or deposits in my name at this bank all amounts transferred in error by NYCERS or any amounts sent after my death and to reimburse NYCERS to the extent of such deductions, applying the same procedures described in 31 CFR 210 to such transfers in error and reimbursing NYCERS to the same extent as Federal agencies are reimbursed under 31 CFR 210.

3.My heirs, my estate and designated beneficiaries of my monthly retirement allowance, respectively, to reimburse NYCERS for any

amount deposited in error after my death, in event that my account is closed or contains an insufficient balance to reimburse

NYCERS.

This EFT authorization will remain in effect until I have given written notice to NYCERS canceling the EFT.

* The bank you name must be a member of the Automated Clearing House in order for your funds to be deposited electronically.

HOW EFT WORKS:

1.Your net retirement allowance is automatically credited to your bank account on the last day of each month providing it's a business day; if the last day is a weekend or holiday, the funds are deposited on the next business day.

2.Your monthly net retirement allowance will appear on your bank statement.

3.A quarterly statement, issued by the Office of the Comptroller, will be mailed to your home address. It will reflect details of your monthly retirement allowance, including deductions for union dues, health insurance and federal income tax withheld during the

Your monthly retirement allowance can be deposited in either your checking or savings account - NOT split between both.

TO AUTHORIZE EFT:

•Provide your personal and banking information on page 1.

•Attach a preprinted personal check

(name must appear on check) or preprinted savings deposit slip to this page. If your bank no longer provides personal checks or preprinted savings deposit slips, attach a copy of the top portion of your Checking or Savings Account Bank Statement.

•If submitting a preprinted check or deposit slip write VOID (in large letters) across the face, as indicated in the sample.

•Do NOT sign the check that you are attaching to this page.

•The name on your bank account must match exactly your name in NYCERS' records.

Note: It may take up to 45 days from receipt of this form for the account to be processed for EFT.

R12/16 |

Page 2 of 2 |

File Overview

| Fact | Detail |

|---|---|

| Purpose of the Form | The F380 form is used to authorize the transfer of a NYCERS monthly retirement allowance to a member's bank account via Electronic Fund Transfer (EFT). |

| Required Information | Members must provide personal details, bank account information, and a preprinted personal check or bank statement for verification. |

| Processing Time | It may take up to 45 days from the date of receipt for the EFT account setup to be processed. |

| Governing Law | Transactions and corrections are governed by 31 CFR 210, which also covers the reimbursement protocol for funds transferred in error. |

| Conditions for Authorization | The authorization for EFT remains in effect until written notice of cancellation is provided to NYCERS. Additionally, the bank must be a member of the Automated Clearing House. |

Nycers F380: Usage Guidelines

Filling out the NYCERS F380 form is a critical step for retirees who wish to have their monthly retirement allowances deposited directly into their bank accounts through Electronic Fund Transfer (EFT). This process not only ensures timely access to funds but also offers a secure way to receive payments without the need for physical checks. Detailed below are the steps required to properly complete the form and initiate the EFT process. An essential part of completing the form is understanding that it enables the City of New York Comptroller's Office, on behalf of NYCERS, to deposit your retirement allowance directly into your designated bank account. It's also an agreement that your bank will handle any erroneous payments as per federal guidelines.

- Locate the section labeled Member Information at the top of the form. Enter your Member Number or Pension Number, the last 4 digits of your SSN, and your contact information, including your daytime phone number, first name, middle initial, last name, address, apartment number, city, state, and zip code.

- Under the Authorization for Electronic Fund Transfer (EFT) of Monthly Retirement Allowance header, read the instructions carefully before proceeding. This ensures you understand the terms and conditions of authorizing EFT.

- In the BANKING INFORMATION section, print the name of your bank, the phone number, branch address, city, state, and zip code. Also, include your specific account number and the bank’s routing number where you wish to receive your deposits.

- Ensure you have a preprinted personal check or a deposit slip available. If your bank does not offer these, a copy of the top portion of your bank statement can suffice. Make sure your name is clearly printed on whichever document you choose to attach and matches the name on NYCERS' records.

- If using a preprinted check or deposit slip, write "VOID" across the front in large letters to prevent misuse, then attach it to the form as instructed.

- Once all the required information is filled in, read through the statement under the banking information section. It outlines your authorization for NYCERS to deposit your monthly retirement allowance via EFP and your understanding of the conditions.

- Sign and date the form in the designated area to verify the information and your agreement to the terms.

- The last step involves the notarization of the form. Present the completed form to a Notary Public or Commissioner of Deeds for acknowledgment. They will sign and provide their official title and the expiration date of their commission. Their official seal should be affixed if available.

After the form is fully completed and notarized, it should be submitted to NYCERS for processing. Remember, it may take up to 45 days from the receipt of the form for the EFT authorization to take effect. During this period, stay in communication with NYCERS for any updates or additional information they may require to process your request efficiently.

FAQ

What is the NYCERS F380 form?

The NYCERS F380 form is an Authorization for Electronic Fund Transfer (EFT) document. It allows your New York City Employees' Retirement System (NYCERS) monthly retirement allowance to be directly deposited into either your checking or savings bank account. This automation ensures a swift and secure transfer of funds. Completing and submitting this form to NYCERS is essential for setting up the EFT for your retirement checks.

How do I complete the F380 form?

To complete the F380 form, provide your personal details, including your Member or Pension Number, the last four digits of your Social Security Number, and your contact information. Additionally, input your banking information: bank name, phone number, branch address, city, state, zip code, account number, and bank routing number. You are also required to attach a preprinted personal check or savings deposit slip—or a copy of your bank statement—with "VOID" written across it to the form, ensuring your name is printed and matches the name in NYCERS' records. Lastly, sign the form before a Notary Public or Commissioner of Deeds.

Why do I need to provide a Voided Check or Bank Statement?

Providing a voided check or a copy of your bank statement is necessary to confirm your bank account details. This step ensures that your banking information matches what is on file and that funds are deposited into the correct account. It is a safeguard against errors in electronic fund transfers.

What happens after I submit the form?

Once your completed F380 form is received by NYCERS, it may take up to 45 days to process your request for EFT. Upon successful processing, your monthly retirement allowance will be automatically credited to your designated bank account. Payments are deposited on the last business day of every month, or the next business day if the last is a weekend or holiday.

Can I split my monthly retirement allowance between a savings and a checking account?

No, your monthly retirement allowance must be deposited into one account only, either checking or savings. It cannot be split between both accounts.

Is EFT safe and secure for receiving my retirement payments?

Yes, EFT is a safe and secure method for receiving your retirement payments. It eliminates the risk of lost or stolen checks by directly depositing funds into your bank account. Additionally, errors are less common with EFT, and if an error does occur, there are established procedures for correcting it.

What if my bank account information changes?

If your bank account information changes, you must promptly inform NYCERS by completing a new F380 form with your updated information to ensure uninterrupted service of your EFT payments.

How do I cancel EFT authorization?

To cancel EFT authorization, you must submit written notice to NYCERS, indicating your decision to discontinue the electronic deposit of your retirement checks. It is important to provide sufficient notice to stop the service before the next payment cycle.

Who can I contact if I have questions about completing the form?

If you have any questions about completing the F380 form, you should contact the NYCERS Call Center at 347-643-3000. Representatives are available to assist with any inquiries you may have regarding the form or the EFT process.

Common mistakes

Filling out the NYCERS F380 form, which authorizes Electronic Fund Transfers (EFT) for monthly retirement allowances, seems straightforward, but errors can complicate the process. Awareness of common mistakes helps ensure smooth transactions.

The most common mistakes include:

- Not reading the instructions carefully. The guidelines on the form are designed to help complete it correctly and avoid processing delays.

- Incomplete personal information. Every field, from the member or pension number to the contact details, is crucial for accurate processing.

- Banking information errors. Incorrect account or routing numbers can misdirect funds, causing significant inconvenience and potential financial issues.

- Discrepancies between names. The name on the bank account must exactly match the name on NYCERS' records to process the request efficiently.

- Omitting to attach the required bank document. A preprinted check, deposit slip, or bank statement snippet is essential for verifying the account.

- Forgetting to write "VOID" on the attached check or deposit slip. This crucial step prevents the accidental use of the check or slip for payments.

- Signature omissions. A missing signature on the form or acknowledgement before a Notary Public can invalidate the authorization.

- Not considering the processing time. It can take up to 45 days to set up EFT, so planning and patience are necessary.

- Not using a bank that’s a member of the Automated Clearing House. This membership is a prerequisite for the direct deposit of funds.

Avoiding these pitfalls ensures the prompt and accurate handling of your retirement funds. Taking the time to double-check entries and comply with instructions makes a difference. Moreover, clarifications or assistance are readily available through the NYCERS Call Center for those who encounter difficulties.

By sidestepping these common errors, retirees can enjoy the benefits of EFT—reliable and timely access to their funds without the need for manual check handling. Remember, accuracy and attention to detail when completing the NYCERS F380 form are key to a hassle-free experience.

Documents used along the form

When preparing for retirement or managing your pension, submitting a NYCERS F380 form to authorize Electronic Fund Transfer (EFT) of your monthly retirement allowance is a crucial step. This process ensures that your retirement funds are securely and efficiently deposited into your bank account, providing you with immediate access to your money without the need for physical checks. However, to streamline your retirement management and safeguard your interests, several other forms and documents are often used alongside the NYCers F380 form. Understanding these documents can enhance your preparedness and ensure you have all necessary information on hand.

- Direct Deposit Enrollment Form: Similar to the F380 but used for federal benefits like Social Security or Veterans Affairs benefits. This form authorizes the deposit of your benefits into your bank account.

- IRS Form W-4P: A Withholding Certificate for Pension or Annuity Payments. It determines the amount of federal income tax to be withheld from your pension or annuity payments.

- Designation of Beneficiary Form: Allows you to designate or change the beneficiary(ies) of your retirement account, ensuring your assets are distributed according to your wishes in the event of your death.

- Proof of Birth: Essential for verifying your age for eligibility and calculation of retirement benefits. Examples include a birth certificate, passport, or a baptismal certificate.

- Loan Application Form: If applicable, this form permits you to borrow against your pension or retirement savings plan before retirement under certain conditions.

- Pension Adjustment Form: Used to request changes to your pension payments, such as adjusting tax withholding or changing your plan option.

- Change of Address Form: Keeps your contact information up to date with NYCERS, ensuring you receive all correspondence and important documents regarding your retirement account.

- Marriage Certificate: Required for spousal benefits or if your pension plan payout options depend on your marital status.

- Death Certificate: In the unfortunate event of the death of a beneficiary or pensioner, this document is necessary to process claims and adjust benefits accordingly.

Employing these forms in conjunction with the NYCERS F380 form can significantly smoothen the management of your retirement benefits. Whether it's adjusting your deduction options, updating personal information, or preparing for the unexpected, each document plays a vital role in securing your financial future in retirement. It is always advisable to seek guidance from NYCERS or a financial advisor to ensure all paperwork is completed accurately and timely, protecting your interests and those of your loveden ones.

Similar forms

The Social Security Administration's (SSA) form for setting up or changing direct deposit information bears a resemblance to the NYCERS F380 form. Both documents are designed to facilitate the electronic transfer of funds to an individual's bank account, albeit for different reasons. The SSA form is used to manage payments for social security benefits, reflecting a similar intent to ensure beneficiaries receive their funds securely and efficiently. Both forms require the beneficiary's personal information, bank account details, and a clear authorization to initiate or modify the electronic fund transfer process, underscoring the shared goal of streamlining payment processes for government-related benefits.

Similarly, the Internal Revenue Service's (IRS) Direct Deposit form used for tax refunds is analogous to the NYCERS F380 form. They both function to expedite the transfer of funds from a federal or municipal entity directly into an individual’s bank account. The IRS form captures essential data such as taxpayer identification, bank account, and routing numbers, much like the F380 form requires for the disbursement of NYCERS benefits. This parallel structure is vital for the accuracy and security of direct deposit transmissions, highlighting the efficiency of electronic fund transfers in disbursing various types of government payments.

The Direct Deposit Enrollment/Change Form typically used by private sector employers for payroll processing shares commonalities with the F380 form too. Although one is for retirement benefits and the other for salary disbursement, both documents gather critical banking details from the recipient to set up or amend direct deposit information. This includes account and routing numbers, bank name, and proof of account ownership. Each form serves as an authorization from the account holder to permit the deposit of funds, thereby streamlining the receipt of monthly allowances or paychecks through an automated clearing house (ACH) system.

The Veterans Affairs (VA) form for Direct Deposit Enrollment likewise parallels the NYCERS F380 form in purpose and content. Designed for veterans to receive their benefits through direct deposit, the VA form and the F380 share the essential function of securing safe and prompt delivery of funds into a designated bank account. Personal and banking information, alongside the necessary authorization for electronic transfers, are core requirements on both forms. This similarity highlights the broader adoption of electronic fund transfers (EFT) across different government departments and agencies to enhance the efficiency and security of benefit disbursement processes.

Dos and Don'ts

When completing the NYCERS F380 form for the Authorization for Electronic Fund Transfer (EFT) of your Monthly Retirement Allowance, there are key actions you should and should not do to ensure the process is executed correctly and efficiently. Below are the guidelines to follow:

Do:- Review the instructions on the back of the form carefully before filling out the form to understand all requirements.

- Provide accurate personal and banking information, including your member number or pension number, last four digits of your SSN, and detailed banking information as requested on the form.

- Attach a preprinted personal check or deposit slip or a copy of your bank statement. Ensure your name is clearly printed on this document and matches the name NYCERS has on file for you.

- Sign and date the form at the designated area after carefully reviewing all the information you have provided to ensure accuracy.

- Have the form notarized, as required, to validate your identity and your acknowledgment of the authorization you are providing.

- Contact NYCERS directly if you have any questions or concerns about completing the form or the EFT process, using the call center number provided.

- Overlook the necessity to have the form notarized. This is a crucial step in the process and is required for the form to be processed.

- Sign the check or deposit slip you are attaching to the form. Instead, write "VOID" across the document to prevent it from being used improperly.

- Provide incorrect or incomplete banking information. Double-check bank account and routing numbers for accuracy to ensure your retirement allowance is deposited into the correct account.

- Use a bank account name that does not match the name NYCERS has on file for you, as discrepancies can lead to processing delays or rejections.

- Disregard the processing time, knowing it may take up to 45 days for the EFT authorization to be processed.

- Assume the form submission is the final step. Keep an eye on your bank statements to confirm the EFT transactions are occurring as expected and contact NYCERS if there are any issues.

Misconceptions

Understanding the nuances of the NYCERS F380 form can be challenging, and there are several misconceptions about its purpose and the process it entails. Let's debunk some of these misunderstandings to ensure clear and accurate information is available.

It's only for checking accounts. A common misconception is that the F380 form is exclusively for depositing funds into a checking account. In reality, retirees can use it to arrange electronic fund transfers to both checking and savings accounts.

It allows for splitting the deposit between accounts. Contrary to what some believe, the form does not permit the monthly retirement allowance to be split between a checking and a savings account. The allowance must be deposited into one account type only.

Any bank can be used. While it's partially true that many banks can be used, the specified bank must be a member of the Automated Clearing House (ACH) to facilitate the electronic transfer of funds.

Name discrepancies are minor issues. In fact, it's crucial that the name on the bank account matches the name in NYCERS' records exactly. Any discrepancy can lead to delays in processing or the outright rejection of the EFT authorization request.

Electronic authorization is an instantaneous process. Although electronic, the process isn't immediate. It may take up to 45 days from the receipt of the F380 form for the EFT authorization to be processed and implemented.

Once set, the authorization cannot be canceled. This is incorrect. The EFT authorization will remain in effect until NYCERS receives written notice from the member requesting its cancellation. This flexibility allows for changes in bank accounts or personal preferences.

There are no provisions for errors in transfers. Actually, the form outlines clear procedures for the correction of any transfer errors. This includes provisions for the bank and NYCERS to rectify any mistakes, ensuring that any funds transferred in error are returned or compensated for accordingly.

Clear understanding and accurate implementation of the NYCERS F380 form are vital for the seamless processing of monthly retirement allowances via EFT. Dispelling these misconceptions helps retirees ensure that their transition to electronic fund transfers is as smooth and error-free as possible.

Key takeaways

When choosing to have your monthly retirement allowance deposited directly into your bank account through the New York City Employees' Retirement System (NYCERS), the Authorization for Electronic Fund Transfer (EFT) Form F380 is essential. Here are key takeaways to ensure a smooth and error-free process:

- Filling out the F380 form authorizes NYCERS to deposit your monthly retirement allowance via EFT directly into the bank account you designate on this form.

- You must provide both personal and banking information on the form, including attaching a preprinted personal check or deposit slip, or a copy of your bank statement that shows your name and account information.

- The name on your bank account must exactly match your name in NYCers' records to process the EFT request successfully.

- Your banking institution must be a member of the Automated Clearing House (ACH) to receive funds electronically from NYCERS.

- Upon successful setup, your net retirement allowance is automatically credited to your bank account on the last day of each month, or the next business day if the last day falls on a weekend or holiday.

- This EFT authorization will remain in effect until NYCERS receives written notice from you canceling the EFT service.

- In the event that payments are transferred in error by NYCERS, or after your death, your bank is authorized to return such payments to NYCERS. Additionally, your heirs, estate, and designated beneficiaries will need to reimburse NYCERS for any amounts deposited erroneously after your death if your account is closed or lacks sufficient funds for reimbursement.

- It may take up to 45 days from receipt of the completed form for the EFT to be processed and for your account to start receiving funds electronically.

Ensuring all information on the form is accurate and that all required documents are correctly attached supports a smooth transition to receiving your retirement allowance through EFT with NYCERS.

Common PDF Documents

Nys 3 Dwi in 25 Years - By completing the form, sellers comply with federal and state regulations regarding vehicle sales and odometer disclosure.

Resale Permit - Guides Family Court proceedings where a relative seeks to foster a child, ensuring legal standards and child welfare principles are applied.