Free Nycers F349 Form in PDF

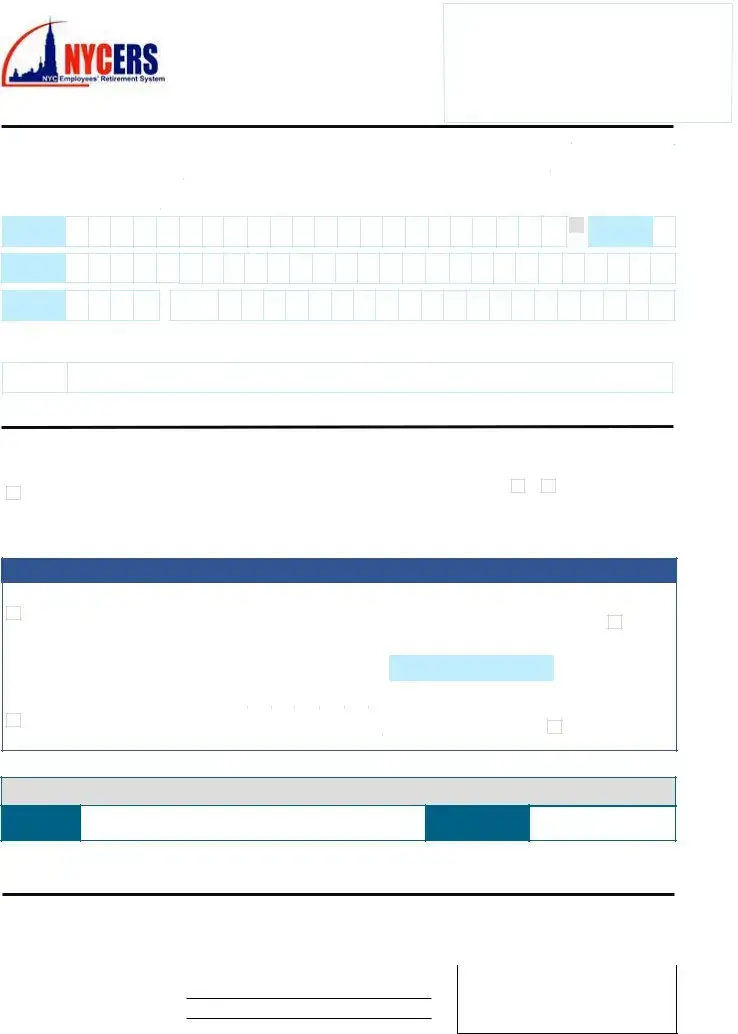

Navigating pension payments and their implications for federal income tax can be complex, yet the NYCERS F349 Form simplifies this process for retirees and beneficiaries alike. This critical document serves as the conduit for instructing the New York City Employees' Retirement System (NYCERS) on preferences regarding federal income tax withholdings from pension payments. At its core, the F349 offers the choice between having taxes withheld based on the number of exemptions and marital status or opting not to have any tax withheld. The form's clear cut design requires participants to print their details in capital letters, ensuring legibility and reducing the potential for processing errors. Additionally, for those who wish to withhold an extra amount beyond the calculated exemptions, there’s a provision to specify this additional sum. It's mandatory for the form to be acknowledged in the presence of a Notary Public or Commissioner of Deeds, adding a layer of officiality and security to the process. With options to submit this document either through mail or by visiting Client Services in Long Island City or Brooklyn, the F349 form exemplifies NYCERS' commitment to accommodating its members’ varying needs while ensuring compliance with federal tax laws.

Nycers F349 Sample

NYCERS USE ONLY

Mail completed form to: |

or Visit Client Services |

340 Jay Street |

|

Long Island City, NY 11101 |

Brooklyn, NY |

www.nycers.org |

(347) |

Federal I ncome Tax Withholding Change - - W - 4P

[ Print clearly in CAPI TAL letters. See reverse for information and instructions. ]

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

M M |

|

D D |

|

|

|

Y Y Y Y |

|||||||

|

PENSION # |

|

|

|

|

|

|

- |

|

|

|

|

|

LAST 4 |

|

|

|

|

|

|

|

|

|

|

|

DATE OF |

|

|

|

- |

|

|

|

|

- |

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

SSN |

|

|

|

|

|

|

|

|

|

|

|

BIRTH |

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

FIRST NAME |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MIDDLE |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

INITIAL |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LAST NAME |

1 |

ADDRESS IS |

|

FOREIGN |

ADDRESS |

APT |

CITY |

STATE |

|

|

|

ZIP CODE |

|

|

|

|

|

|

DAYTIME |

|

( |

|

|

|

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PHONE # |

|

|

|

|

|

|

|

|

|

|

|

[ Choose your tax- w ithholding option below . Place an X or a number in the box( es) to indicate your choice( s) .]

DO NOT WI THHOLD TAX |

[ Complete this section if you do not want NYCERS to withhold any |

|||||||||

|

|

|

|

|

|

Federal income tax from your pension payments. If you check this |

||||

|

|

|

|

|

|

box, DO NOT COMPLETE Section |

|

or |

|

below. ] |

|

|

|

|

|

|

3 |

4 |

|||

|

2 |

|

DO NOT WITHHOLD FEDERAL TAX |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OR

WI THHOLD TAX BASED ON EXEMPTI ONS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

[Enter total number of allowances (exemptions) and |

||||||||||||||

|

|

NUMBER OF |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

3 |

|

ALLOWANCES |

|

|

|

NUMBER OF ALLOWANCES YOU ARE |

|

|

|

|

|

|

|

|

your marital status. If you would like to withhold an |

|||||||||||||||||||||||||||

|

|

(REQUIRED) |

|

|

|

CLAIMING |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

additional amount, enter the amount in Section |

4 |

. ] |

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MARITAL |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

STATUS |

|

|

|

|

SINGLE |

|

|

OR |

|

MARRIED |

|

|

OR |

MARRIED, BUT WITHHOLD AT HIGHER |

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

|

|

(REQUIRED) |

|

|

|

|

|

|

|

|

SINGLE RATE |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

[ If you enter an amount |

||||||||||||

|

|

ADDITIONAL |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DOLLARS |

|

|

|

|

CENTS |

|

|

|||||||||||||||||

|

4 |

AMOUNT |

|

|

|

ADDITIONAL AMOUNT TO |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

|

|

|

|

here, you must also complete |

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Section |

3 |

above.] |

|||||||||||||||||

|

|

(OPTIONAL) |

|

|

WITHHOLD PER MONTH |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

I have completed this form and represent that all information is true and accurate.

DATE

(MM/DD/YYYY)

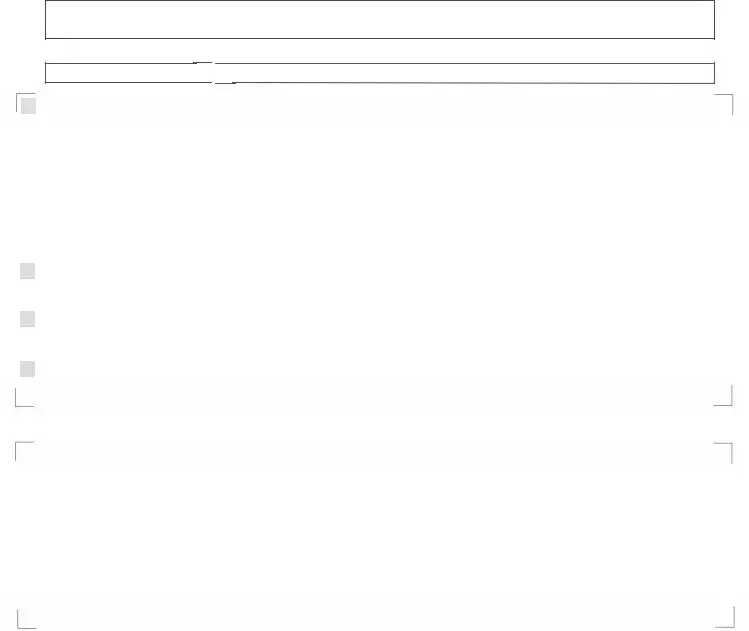

This form must be acknow ledged before a Notary Public or Commissioner of Deeds

State of |

|

County of |

|

|

On this |

|

day of 20 |

|

, personally appeared before me the above |

|

named, |

|

|

|

|

, to me known, and known to me to be the individual described in and who |

|||||

executed the foregoing instrument and he or she acknowledged to me that he or she executed the same, and that the statements contained therein are true.

Signature of Notary Public or |

|

|

If you have an official seal, affix it |

|

|

|

|

Commissioner of Deeds |

|

|

|

|

|

|

Official Title

RExpiration Date of Commission

08/06/15

F3 4 9

*349*

R 08/06/15

Information and Instructions

This form is for NYCERS pensioners and beneficiaries who wish to change the amount of Federal income tax withheld from their monthly pension payments.

Print clearly in CAPITAL letters. Use black or blue ink only. Leave blank spaces between words and numbers.

1

2

2  3

3 4

4

5

5 6

6 7

7 8

8 9

9

0

0

A

A  B

B C

C D

D E

E F

F G

G

H

H I

I  J

J  K

K L

L  M

M N

N O

O  P

P Q

Q

R

R  S

S T

T  U

U

V

V  W

W X

X  Y

Y  Z

Z

1If your address is foreign:

Put an ‘X’ in the box labeled "Address is Foreign" and enter the address as follows:

Enter your street address or post office box number, City or Town, other principal subdivision (e.g., province, state, county) and postal code, if

Address Field: |

known. (The postal code may precede the city or town.). |

|

2

3

4

City: |

Enter the entire country name in the City field. |

State/Zip Code Fields: |

Leave these fields blank. |

Select this option if you do not want NYCERS to withhold any Federal income tax from your pension payments. If you check this box, DO NOT COMPLETE Section 3 or 4.

Enter total number of allowances (exemptions) and your marital status.

If you would like to withhold additional monies, enter the amount in Section 4.

If you enter an amount here, you must also complete Section 3.

Sign this form before a Notary and return it to NYCERS at the address shown. Keep a copy for your records.

Use this form to indicate to NYCERS the amount of Federal income tax to withhold. You may also use this form to choose:

(a) not to have any Federal income tax withheld from the payment, or (b) to have an additional amount of Federal income tax withheld.

Pensioners with a MyNYCERS account and a registered Personal Identification Number (PIN) may log in at www.nycers.org and change their tax withholding online instead of filing this paper form.

NYCERS cannot counsel you on tax matters. If you need assistance in determining which tax withholding selections to make, please consult with a professional tax preparer or the Internal Revenue Service (IRS).

NOTE: If the address you provide on this form is different from your address in our system, the new address will become your official address in our records.

File Overview

| Fact | Detail |

|---|---|

| Form Name | F349 |

| Purpose | Change of Federal Income Tax Withholding |

| Agency | New York City Employees' Retirement System (NYCERS) |

| How to Submit | Mail to the address listed or visit Client Services at designated locations |

| Key Sections to Complete | Tax withholding option, number of allowances, marital status, additional amount (if applicable) |

| Notarization | Required before a Notary Public or Commissioner of Deeds |

| Governing Law | Federal tax regulations, New York State law |

Nycers F349: Usage Guidelines

Filling out the NYCERS F349 form, officially known as the Federal Income Tax Withholding Change form, is an essential step for pension recipients looking to adjust their tax withholding preferences. Whether you wish to alter the amount withheld from your pension payments for federal income taxes, or if you decide not to have taxes withheld, this form empowers you to tailor these withholdings to suit your financial situation. The following instructions offer a clear roadmap for completing the form correctly.

- Start by obtaining the form from the official NYCERS website or visiting one of their Client Services locations.

- Ensure you have clear information on hand regarding your desired tax withholding status and if applicable, the number of allowances and additional amount you want withheld.

- Using a blue or black ink pen, print clearly in CAPITAL letters all requested information on the form.

- In the section titled “DO NOT WITHHOLD TAX,” place an X in the box if you do not want any federal income tax withheld from your pension payments. If you select this option, skip sections 3 and 4.

- If opting for tax withholding, proceed to section 3 titled “WITHHOLD TAX BASED ON EXEMPTIONS’’ and fill in the number of allowances you are claiming in the “NUMBER OF ALLOWANCES (REQUIRED)” box.

- Indicate your MARITAL STATUS in the provided box – this information is required to accurately withhold taxes based on your exemptions.

- If you wish to have an additional amount withheld beyond the standard calculation, enter this amount in Section 4 under “ADDITIONAL AMOUNT (OPTIONAL).” Remember, completing Section 3 is a prerequisite for Section 4.

- After filling out the form, it must be acknowledged before a Notary Public or Commissioner of Deeds. This certification involves signing the form in their presence and having them validate your identity and signature.

- Record the date on which the form is notarized, ensuring the notary public or commissioner of deeds also fills in their official title and the expiration date of their commission.

- Once duly completed and notarized, mail the form to the relevant NYCERS address provided on the document.

After you submit the NYCERS F349 form, NYCERS will process your request and adjust your federal income tax withholding based on the selections you've made. Keep a copy of the completed form for your records. Should your financial situation or preferences change, you can submit a new form at any time to update your withholding preferences. Tailoring your tax withholding can help manage your taxes more effectively throughout the year, potentially avoiding surprises during tax season.

FAQ

- What is the NYCERS Form F349 and why do I need to use it?

- How do I indicate that I do not want taxes withheld from my pension payments using the F349 form?

- What information is required if I want to adjust my tax withholding based on exemptions and marital status?

- Can I choose to have an additional amount withheld, and how do I do this?

- What are the steps for acknowledging the F349 form before a Notary Public or Commissioner of Deeds?

- Where can I submit the completed NYCERS F349 form, and is there a deadline?

The NYCERS Form F349, also known as the Federal Income Tax Withholding Change form, is utilized by retirees or beneficiaries of the New York City Employees' Retirement System who wish to adjust how federal income tax is withheld from their pension payments. This form becomes necessary when individuals want to change their tax withholding preferences, for example, due to a change in marital status, financial situation, or for the purpose of optimizing tax outcomes. It allows for a customized approach to tax withholding, empowering retirees to make informed decisions that best suit their personal financial scenarios.

To indicate that you do not want NYCERS to withhold any federal income tax from your pension payments, you should complete the specific section on the form designated for this preference. This involves checking the box that clearly states "DO NOT WITHHOLD TAX". It's crucial to note that if you choose this option, you should not fill out the sections regarding tax withholding based on exemptions or the additional amount to be withheld. This choice might affect your annual tax liabilities, so it's often recommended to consult with a tax professional before making this decision.

If you decide to adjust your tax withholding based on allowances (exemptions) and marital status, you will need to fill out the section of the form labeled accordingly. This requires you to enter the total number of allowances you're claiming. The number of allowances typically corresponds to individual or dependent exemptions that you are eligible to claim. Additionally, you must indicate your marital status, as it plays a crucial role in determining the amount of tax to be withheld. Remember, claiming allowances accurately is vital for ensuring that the correct amount of tax is withheld, preventing potential underpayment or overpayment.

Yes, you have the option to have an additional amount of tax withheld from your pension payments. To do this, fill out the section of the F349 form that asks for an "ADDITIONAL AMOUNT" to be withheld. It's important to note you must also complete the section regarding tax withholding based on exemptions and marital status if you choose to withhold an additional amount. Specifying an additional amount can be particularly useful if, for example, you have other sources of income or specific financial goals that require a more customized approach to tax withholding.

Once you have completed the F349 form, acknowledging it before a Notary Public or Commissioner of Deeds is a required step. This process involves presenting the filled-out form to the Notary or Commissioner and verifying your identity, usually with a government-issued ID. You will then sign the form in their presence. The Notary or Commissioner will verify the document, sign it, and stamp it with an official seal. This acknowledgment is a legal assurance that the individual completing the form is indeed the person they claim to be, adding a layer of authenticity and security to the document.

The completed NYCERS F349 form can be submitted either by mailing it to the specified address on the form or by visiting NYCERS Client Services at one of their physical locations. As for deadlines, while there may not be a fixed date by which this form must be submitted, it is advisable to submit changes to your tax withholding preferences as soon as your financial situation changes or before the year-end tax processing deadlines. Early submission ensures that the adjusted withholding rate is applied to your pension payments in a timely manner, helping you manage your finances better throughout the year.

Common mistakes

Filling out the NYCERS F349 form, related to Federal Income Tax Withholding Change for pension payments, requires close attention to detail. Mistakes can have financial implications and may lead to unexpected tax liabilities. Here are five common errors to avoid to ensure the process is completed accurately and efficiently.

- Not choosing a withholding option. A critical step is selecting whether taxes should be withheld from your pension payments. Failing to mark a choice in the designated area can lead to default tax treatments that might not align with your financial situation.

- Incorrect number of allowances. When opting for tax withholding based on exemptions, accurately entering the total number of allowances and your marital status in Section 3 is essential. Miscounting allowances could result in under- or over-withholding, leading to tax dues or reduced refund potential.

- Omitting the additional amount when necessary. If you wish to withhold an additional amount of tax beyond the standard calculations, specifying this in Section 4 is crucial. Neglecting to complete this section when additional withholdings are desired can impact your annual tax responsibilities.

- Forgetting to sign in the presence of a Notary Public or Commissioner of Deeds. The form's validity hinges on it being acknowledged before a Notary Public or Commissioner of Deeds. Overlooking this requirement or improperly completing the acknowledgment can render the submission invalid.

- Illegible handwriting. While it may seem trivial, filling out the form in clear, capital letters as instructed ensures the information is accurately captured and processed. Unclear handwriting can lead to misinterpretation of your intentions and subsequent errors in your withholding.

To avoid these common pitfalls, thoroughly review the NYCERS F349 form instructions and double-check your entries before submission. Consider consulting with a tax professional to determine the most advantageous withholding strategy for your individual financial situation. This proactive approach can help you manage your taxes effectively and avoid surprises during tax season.

Remember that the information you provide on this form directly impacts the amount of federal income tax withheld from your pension payments. Making informed choices and accurate entries is therefore not only about compliance but also about financial planning. By avoiding these mistakes, you can help ensure that your pension payments align with your broader tax strategy.

Documents used along the form

When processing the Nycers F349 form, a Federal Income Tax Withholding Change form for pension payments, several additional documents often come into play to ensure the smooth management of an individual's pension and tax details. These documents are pivotal for various purposes, from verifying the pensioner's identity to ensuring compliance with legal and tax obligations.

- Form W-4P: This form, Withholding Certificate for Pension or Annuity Payments, is essential for individuals who wish to change their tax withholding preferences. It allows pension recipients to specify the amount of federal income tax to be withheld from each payment.

- Birth Certificate Copy: A copy of the birth certificate is often required for the verification of age and identity. This document supports pension calculations and ensures the accuracy of beneficiary information.

- Proof of Address: Documents such as a utility bill or a bank statement help confirm the current address of the pensioner. This ensures correspondence and important documents reach the right place.

- Marriage Certificate Copy: For those who are married, a marriage certificate can be crucial, especially if spousal benefits are applicable or if marital status affects tax withholding rates.

- Government-Issued Photo ID: A photo ID, such as a driver's license or a passport, is often required to verify the identity of the individual submitting the Form F349. This prevents unauthorized changes to pension and tax withholding details.

- Death Certificate Copy (if applicable): In the event of the pension recipient’s death, a death certificate is necessary to process the continuation of benefits to eligible survivors or beneficiaries, or to halt pension payments.

Together, these documents work alongside the Nycers F349 form to create a comprehensive file that helps manage pensioners' accounts effectively, ensuring both the integrity of the pension system and compliance with federal tax laws. Ensuring these documents are accurate and promptly submitted enables a smoother administration process and prevents potential issues with payments and taxation.

Similar forms

The W-4P Form, officially known as the Withholding Certificate for Pension or Annuity Payments, shares a direct link to the NYCERS F349 form's primary function. Both documents allow individuals receiving pension payments to specify their preferences for federal income tax withholding. These forms prevent the need for pension recipients to adjust their tax withholding amounts later by accurately estimating and applying their tax rates to pension disbursements upfront. This proactive approach helps manage tax liabilities and ensures individuals are not caught off-guard by unexpected tax obligations come tax season.

Similarly, the W-4 Form, or Employee's Withholding Certificate, parallels the objectives of the NYCERS F349 form albeit in the context of employment income. While the F349 form is used by pension recipients to determine their tax withholding rate, the W-4 form performs the same role for employees. Both documents require individuals to declare their filing status, number of allowances, and any additional amount they wish to have withheld. The key difference lies in the type of income each form pertains to, yet their underlying purpose to streamline tax withholding processes remains unified.

The Form 4852, Substitute for Form W-2, Wage and Tax Statement, or Form 1099-R, mirrors the NYCERS F349 in its relevance to reporting income and managing tax withholdings, albeit under different circumstances. While the F349 form is conducted voluntarily by the pension recipient to adjust withholdings, Form 4852 is utilized as a substitute when an individual does not receive a W-2 or 1099-R form. Although employed under distinctive conditions, both advocate for accurate income reporting to the IRS and ensure the taxpayer's compliance with federal tax regulations.

The IRS Form 1040-ES, Estimated Tax for Individuals, similarly echoes the proactive nature of the NYCERS F349 form. Taxpayers use Form 1040-ES to pay estimated taxes on income that is not subject to withholding taxes, like earnings from self-employment, interest, dividends, and other sources. By contrast, the F349 form pertains to adjusting withholdings on pension income specifically. Both forms cater to the necessity of managing tax payments in advance, thereby preventing underpayment penalties and ensuring that taxpayers meet their tax obligations efficiently.

The State Tax Withholding Forms, which vary by state, offer a counterpart to the NYCERS F349 form on a state level. While the F349 form allows pension recipients to adjust their federal tax withholding, these state-specific forms enable adjustments to be made for state tax withholdings. The essence of both forms lies in giving individuals the control and flexibility to manage their tax liabilities based on their personal financial situations and preferences. By providing this option, the forms play integral roles in the broader framework of tax planning and compliance.

Dos and Don'ts

When filling out the NYCERS F349 form, a Federal Income Tax Withholding Change form, it's crucial to approach the process with attention to detail and awareness of the following dos and don'ts:

Do:- Read the instructions on the reverse side of the form carefully. Before filling out the form, understanding every section's requirement will ensure that you complete it accurately, avoiding common mistakes.

- Print clearly in CAPITAL letters. To ensure your information is legible and processed without delays, always use capital letters. This enhances clarity and prevents misinterpretation of your details.

- Decide on your tax withholding preference. Make a clear decision on whether you want taxes withheld from your pension payments and indicate your choice appropriately on the form. This decision impacts your taxable income and requires careful consideration.

- Have the form notarized. Remember that the completion of the form necessitates acknowledgment before a Notary Public or Commissioner of Deeds. This step validates your identity and the authenticity of your signature, a requirement for processing the form.

- Complete sections that are not applicable. If you opt not to have tax withheld by selecting the "DO NOT WITHHOLD TAX" section, do not fill out the subsequent sections. This avoids confusion and ensures your intentions are clear.

- Forget to enter your marital status and the number of allowances in Section 3, if applicable. These details are crucial for calculating the correct amount of tax to withhold based on exemptions.

- Leave the notary section at the bottom of the form blank. The form must be acknowledged and signed by a Notary Public or Commissioner of Deeds, including their official title and commission expiration date, to be considered valid and complete.

- Sign the form without reviewing your information. Before signing, recheck all entered information for accuracy. Once acknowledged by a notary, making corrections becomes more complicated.

Misconceptions

There are many misconceptions about the NYCERS (New York City Employees' Retirement System) F349 form, which is crucial for managing federal income tax withholding for pension payments. Here are nine common misunderstandings corrected for better clarity:

- The form is complex and requires professional assistance to complete. In reality, the F349 form is straightforward if you read the instructions carefully. It's designed for pension recipients to easily indicate their tax withholding preferences.

- You must fill out every section of the form. This is not true. If you choose not to have taxes withheld, you simply mark the appropriate box in the first section and do not complete the remaining sections. This simplicity is designed to save time and reduce confusion.

- Changing withholding preferences is a lengthy process. Actually, adjustments can be made relatively quickly by submitting a new F349 form, allowing pensioners to adapt to personal or financial changes without unnecessary delay.

- You can't specify an exact amount for withholding. Contrary to this belief, the form allows for precise control over tax withholding by permitting you to specify an additional amount to be withheld, ensuring more personalized financial management.

- Marital status and number of exemptions have little impact on withholding amounts. This misconception overlooks the fact that these factors significantly influence federal tax obligations and, consequently, the amount withheld from pension payments, underscoring the importance of accurate completion.

- Submitting the form guarantees no federal taxes will be due during tax season. While the F349 form helps manage withholding, it doesn't guarantee that the amount withheld will perfectly match your tax liability. Taxpayers should review their situation annually to avoid surprises.

- The form must be notarized or acknowledged before submission. This statement is accurate; acknowledgment before a Notary Public or Commissioner of Deeds ensures the validity of the pension recipient's signature and helps prevent fraud.

- Nycers will automatically adjust your withholding each year. This is incorrect. Pension recipients must submit a new F349 form if they wish to adjust their withholding preferences, as NYCERS does not make automatic adjustments based on tax law changes or inflation.

- Once submitted, you cannot change your withholding decision until the next tax year. This is another misconception. Pension recipients can submit a new F349 form at any time during the year to change their withholding preferences, offering flexibility to respond to changing financial circumstances.

Understanding these aspects of the NYCERS F349 form is critical for managing federal income tax withholding effectively, ensuring that pension recipients can make informed decisions about their financial well-being.

Key takeaways

Filling out and using the NYCERS F349 form is important for managing how federal income tax is withheld from your pension payments. Here are seven key takeaways to help you navigate this process:

- Location and Contact Information: The form can be mailed to the NYCERS offices in Long Island City or Brooklyn. Assistance is also available via the NYCERS website or by phone.

- Defined Purpose: The primary purpose of the NYCERS F349 form is to change the amount of federal income tax withheld from your pension payouts.

- Completion Requirements: If you do not wish to have taxes withheld from your pension, you can indicate this preference and skip sections related to withholding amounts based on exemptions and additional amounts.

- Sections to Note: Make sure to accurately complete the section on tax withholdings based on your marital status and the number of allowances you are claiming. An additional amount to withhold can be specified if desired.

- Notarization: The form requires notarization, so plan to sign it in the presence of a Notary Public or Commissioner of Deeds who can confirm your identity and your acknowledgment of the form's content.

- Accuracy is Crucial: Ensure all information is printed clearly in capital letters and double-check for accuracy, as mistakes could affect your tax withholdings and potentially lead to issues with the IRS.

- Updating Your Information: Consider periodically reviewing and, if necessary, updating the information on this form to reflect any changes in your personal or financial situation that might impact your tax withholding preferences.

Properly managing your tax withholdings through the NYCERS F349 form can provide peace of mind and financial predictability in ensuring that you're not under or overpaying on your taxes throughout the year.

Common PDF Documents

Nyc Retirement System - Enables NYCERS members to make informed choices about their pension payments, considering the long-term impact on their beneficiaries.

Demand Letter to Landlord - For tenants facing unreturned deposits after moving out, the Cfb003Nyc form is the bridge to possibly getting your money back.

Complaints Auto Insurance - Keeps consumers informed about the progress of their complaint with a written acknowledgment, facilitating a transparent process.