Free Nycers F131 Form in PDF

When thinking about the future and preparing for all eventualities, city employees in New York have a crucial task of designating beneficiaries for their benefits through the NYCERS F131 form, catering specifically to Tier 1 and Tier 2 members. This form empowers members to nominate individuals or their estate to receive death benefits and accumulated deductions in the unfortunate event of their passing while still in active service. With two distinct sections allocated for the ordinary death benefit and the accumulated deductions benefit, the F131 form offers flexibility in nominating one or more primary beneficiaries for each benefit, and even an optional contingent beneficiary. Interestingly, for those who prefer not to assign these benefits to specific individuals, there is the option to check the "Estate" box, simplifying the process for those who wish to have their estate receive the benefits directly. Additionally, the form includes provisions for nominating minor beneficiaries with the requirement of appointing a guardian, underscoring the form's accommodative design. Moreover, the NYCERS F131 form is just the beginning, as complexities arise with more beneficiaries than the form can accommodate or changes in beneficiary information, prompting the need for supplemental forms or updates. This comprehensive layout ensures that city employees' last wishes regarding their accrued benefits are carried out meticulously, offering peace and preparedness in equal measure.

Nycers F131 Sample

NYCERS USE ONLY |

F131 |

|

*131*

Designation of Beneficiary

Tier 1 and 2 Members Only

This application is for Tier 1 or Tier 2 members who wish to nominate one (or more) beneficiaries to receive a death benefit payable upon the death of a member who dies while in active City service . This benefit is actually two distinct benefits which can be designated to one or more beneficiaries, or to an Estate. To nominate an Estate, in lieu of a specific person or persons, check the Estate box within the specific section (Section A or Section B, or both) but DO NOT complete the name, address, relationship or percentage portion of those sections. The Fact Sheet on Page 4 contains a brief overview of these benefits. For any additional questions, please contact our Call Center at

Member Number |

Last 4 Digits of Social Security # |

Date of Birth [MM/DD/YYYY] |

||||||

|

|

|

|

/ |

|

/ |

|

|

|

|

|

|

|

|

|

|

|

First Name |

|

M.I. |

Last Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address |

|

|

|

|

|

Apt. Number |

||

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

State |

|

Zip Code |

|

|

|

|

|

|

|

|

|

|

Section A - Designation of Ordinary Death Benefit

Tell us who you want to receive your death benefit. You may nominate one or more Primary Beneficiaries, (or one optional Contingent Beneficiary, or your Estate. If you want to nominate more beneficiaries than this space allows, use

Form # 136 (Supplemental Form to Designate Beneficiaries). If you wish to nominate your Estate for this specific benefit,

:

check the Estate box below and DO NOT complete the name, address, etc. portion of Section A.

Estate

I wish to nominate my Estate for this specific benefit. If you check this box DO NOT name anyone as Primary or Contingent.

First NameM.I. Last Name

Beneficiary |

|

Full Social Security Number |

Date of Birth |

|

|

|

|

[MM/DD/YYYY] |

|||||

|

|

|||||

|

|

|

/ |

/ |

|

|

|

|

Address |

|

|

|

|

|

|

|

|

|

|

|

Primary |

|

City |

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

If this beneficiary is a minor, check here and complete the guardian information on Form 137

Relationship

Apt. Number

|

State |

Zip Code |

||

|

|

|

% |

|

Percentage |

|

|

||

|

|

|||

|

|

|

|

|

Sign this form and have it notarized, Page 4

R07/26/11 |

Page 1 of 4 |

NYCERS USE ONLY |

F131 |

|

Member Number |

Last 4 Digits of SSN |

|

|

|

|

|

|

|

First Name |

M.I. Last Name |

Beneficiary |

|

Full Social Security Number |

Date of Birth |

|

|

|

|

[MM/DD/YYYY] |

|||||

|

|

|||||

|

|

|

/ |

/ |

|

|

|

|

Address |

|

|

|

|

|

|

|

|

|

|

|

Primary |

|

City |

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

If this beneficiary is a minor, check here and complete the guardian information on Form 137

Relationship

Apt. Number

|

State |

Zip Code |

||

|

|

|

% |

|

Percentage |

|

|

||

|

|

|||

|

|

|

|

|

Read this before you nominate a Contingent Beneficiary: A Contingent Beneficiary is only eligible if all of the Primary Beneficiaries are deceased at the time this benefit is payable. You do not have to nominate a Contingent Beneficiary, it is strictly optional. If you need additional space - use Form # 136 (Supplemental Form to Designate Beneficiaries).

First NameM.I. Last Name

OPTIONAL BeneficiaryContingent |

|

Full Social Security Number |

Date of Birth |

|

|

|

|

[MM/DD/YYYY] |

|||||

|

|

|||||

|

|

|

/ |

/ |

|

|

|

|

Address |

|

|

|

|

|

|

|

|

|

|

|

City

If this beneficiary is a minor, check here and complete the guardian information on Form 137

Section B - Designation of Accumulated Deductions:

Relationship

Apt. Number

|

State |

Zip Code |

||

|

|

|

% |

|

Percentage |

|

|

||

|

|

|||

|

|

|

|

|

Tell us who you want to receive your accumulated deductions benefit. You may nominate one or more Primary Beneficiaries, (or one optional Contingent Beneficiary), or your Estate. If you want to nominate more beneficiaries than this space allows, use Form # 136 (Supplemental Form to Designate Beneficiaries). If you wish to nominate your Estate for this specific benefit, check the Estate box below and DO NOT complete the name, address, etc. portion of Section B.

Estate

I wish to nominate my Estate for this specific benefit. If you check this box DO NOT name anyone as Primary or Contingent.

Sign this form and have it notarized, Page 4

R07/26/11 |

Page 2 of 4 |

NYCERS USE ONLY |

F131 |

|

Member Number |

Last 4 Digits of SSN |

|

|

First Name |

M.I. Last Name |

Beneficiary |

|

Full Social Security Number |

Date of Birth |

|

|

|

|

|

[MM/DD/YYYY] |

||||||

|

|

||||||

|

|

|

/ |

|

|

/ |

|

|

|

Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

Primary |

|

City |

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

If this beneficiary is a minor, check here and complete the |

|

|

|||

|

|

|

|

||||

|

|

guardian information on Form 137 |

|

|

|

|

|

|

|

First Name |

|

|

M.I. |

|

Last Name |

Relationship

Apt. Number

|

State |

Zip Code |

||

|

|

|

% |

|

Percentage |

|

|

||

|

|

|||

|

|

|

|

|

Beneficiary |

|

Full Social Security Number |

Date of Birth |

|

|

|

|

[MM/DD/YYYY] |

|||||

|

|

|||||

|

|

|

/ |

/ |

|

|

|

|

Address |

|

|

|

|

|

|

|

|

|

|

|

Primary |

|

City |

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

If this beneficiary is a minor, check here and complete the guardian information on Form 137

Relationship

Apt. Number

|

State |

Zip Code |

||

|

|

|

% |

|

Percentage |

|

|

||

|

|

|||

|

|

|

|

|

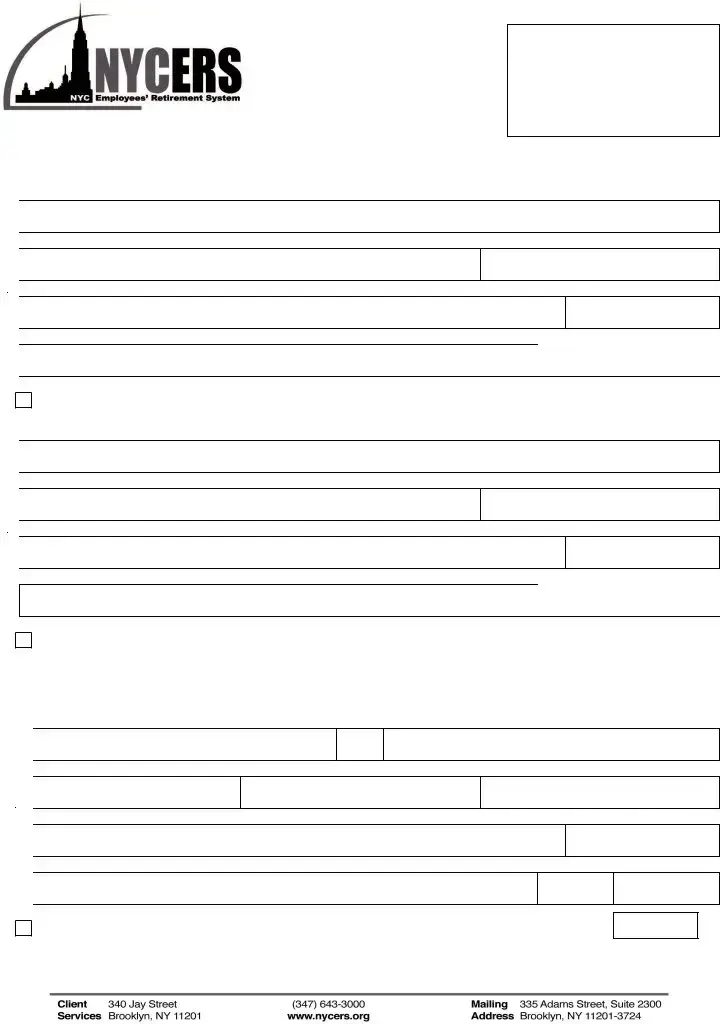

Read this before you nominate a Contingent Beneficiary: A Contingent Beneficiary is only eligible if all of the Primary Beneficiaries are deceased at the time this benefit is payable. You do not have to nominate a Contingent Beneficiary, it is strictly optional. If you need additional space - use Form # 136 (Supplemental Form to Designate Beneficiaries).

First Name |

M.I. Last Name |

OPTIONAL

Contingent Beneficiary

Full Social Security Number

Address

City

Date of Birth [MM/DD/YYYY] |

Relationship |

/ /

Apt. Number

State |

Zip Code |

If this beneficiary is a minor, check here and complete the |

Percentage |

|

guardian information on Form 137 |

||

|

Please read the Fact Sheet on Page 4. You must also sign this form and have it notarized before filing it with NYCERS. Sign this form and have it notarized, Page 4

%

R07/26/11 |

Page 3 of 4 |

NYCERS USE ONLY |

F131 |

|

FACT SHEET

Can you explain the two benefits?

If you should die while in active City service, the person you nominate as your beneficiary is eligible to collect a death benefit (typically some multiple of your annual salary) and the refund of your accumulated deductions (contributions) plus

the interest they have accrued.

Can the same person receive both benefits?

You do not have to name the same person, but you can - the choice is yours. You can nominate one or more people (or your Estate) to receive the death benefit and the refund of the accumulated deductions. If you nominate more than one person each will be paid according to the percentages you indicate on this form (combined percentages must total 100%). If no percentages are indicated, the benefits will be shared equally.

What happens if I want to nominate more beneficiaries than this form has allotted me?

This forms allows for only two Primary and one Contingent beneficiaries for each benefit. If you want to nominate more than that you can file Form # 136 which is the Supplemental Form to Designate Beneficiaries.

What happens if I want to nominate my estate rather than a person?

All you have to do is check off the Estate box in the appropriate Section (A or B or both). For example, you could nominate your Estate for the death benefit (Section A) and a specific person for the refund of your accumulated deductions (Section B). However, if you select Estate for either or both benefits you must leave the name, address and relationship information blank in each section.

Do the people I have listed here act as my nomination for all benefits?

No. You are nominating people (or your Estate) only for this specific benefit. Should your death be the result of an

How do I change my beneficiary on file?

To change an existing beneficiary nomination you must file another Designation of Beneficiary form. It is important that you always have a current beneficiary on file. You can check the status of your beneficiary on file when you receive your Annual Disclosure Statement. All active members receive this statement in February/March every year.

What happens if my beneficiary information is out of date?

You must change it right away. NYCERS is required to make payments to the person we have listed on file as your designated beneficiary.

Signature of Member |

Date |

|

|

|

|

This form must be acknowledged before a Notary Public or Commissioner of Deeds

State of |

|

County of |

|

|

On this |

|

day of |

|

|

2 0 |

|

, personally appeared |

before me the above named, |

|

|

|

|

|

|

, to me known, and known to |

|||||

me to be the individual described in and who executed the foregoing instrument, and he or she acknowledged to me that he or she executed the same, and that the statements contained therein are true.

Signature of Notary Public or Commissioner of Deeds

Official Title

Expiration Date of Commission

Sign this form and have it notarized, THIS PAGE

R07/26/11 |

Page 4 of 4 |

File Overview

| Fact | Detail |

|---|---|

| Purpose | This form is used by Tier 1 or Tier 2 members of NYCERS to nominate beneficiaries for death benefits. |

| Beneficiaries | Members can nominate one or more persons, or their estate, to receive a death benefit. |

| Benefit Types | There are two benefits: a death benefit and a refund of accumulated deductions, both of which can be designated to chosen beneficiaries. |

| Estate Nomination | Members can nominate their estate for one or both benefits by checking the Estate box and leaving personal information sections blank. |

| Additional Beneficiaries | If more beneficiaries are to be nominated than the form allows, Form #136 (Supplemental Form to Designate Beneficiaries) must be filed. |

| Changing Beneficiaries | To change a nominated beneficiary, another Designation of Beneficiary form must be filed. It’s crucial to keep beneficiary information up to date. |

Nycers F131: Usage Guidelines

Filling out the NYCERS F131 form is a straightforward process that allows Tier 1 or Tier 2 members to designate beneficiaries for specific benefits payable upon their death. Correctly completing this form ensures that your chosen beneficiaries or estate will receive the death benefit and accumulated deductions as per your wishes. Carefully follow each step to accurately nominate your beneficiaries. Remember, if additional beneficiaries are needed beyond what the form permits, or if special conditions apply, supplementary forms may be necessary. Here’s how to complete the form:

- Enter your Member Number and the Last 4 Digits of your Social Security Number at the top of the form.

- Fill in your Date of Birth, using the MM/DD/YYYY format.

- Provide your First Name, Middle Initial (M.I.), and Last Name in the designated fields.

- Complete your address details, including Apartment Number, City, State, and Zip Code.

- For Section A - Designation of Ordinary Death Benefit, decide who you want to receive your death benefit. If nominating more than one Primary Beneficiary, indicate the percentages next to their names (totals 100%). If you're nominating your Estate, tick the Estate box and skip the beneficiary details for this section.

- To nominate beneficiaries, provide their Full Name, Full Social Security Number, Date of Birth, Relationship to you, their Address, and designate their Percentage of the benefit (if more than one beneficiary).

- If the beneficiary is a minor, check the box indicating this status and fill out Form 137 for guardian information.

- For Section B - Designation of Accumulated Deductions, follow the same process as in Section A to nominate beneficiaries for your accumulated deductions benefit.

- Optional: Nominate a Contingent Beneficiary for each benefit who will receive the benefit only if all Primary Beneficiaries are deceased at the time the benefit is payable. Otherwise, use Form #136 for additional space.

- Read the information provided before nominating a Contingent Beneficiary and fill out their details as required.

- After completing both sections, read the Fact Sheet on Page 4 for a brief overview and instructions for the proper submission.

- Sign and date the form at the designated area on Page 4.

- The form must be notarized. Ensure that a Notary Public or Commissioner of Deeds signs, titles, and dates the form in the provided sections.

Once you have completed all these steps, your form is ready to be filed with NYCERS. Always ensure that your beneficiary information is up to date to reflect your current wishes. Should you need to make any changes in the future, fill out and submit a new Designation of Beneficiary form. This proactive step ensures that the benefits will be distributed according to your latest instructions.

FAQ

Frequently Asked Questions about the NYCERS F131 Form

- What are the two benefits mentioned in the F131 form?

The F131 form mentions two main benefits: a death benefit payable upon the member's death while in active City service, which is generally a multiple of the annual salary, and a refund of the accumulated deductions benefit, which includes contributions made by the member plus accrued interest. The member has the flexibility to nominate beneficiaries for these benefits, which can be the same or different individuals, or the member's estate.

- Can I nominate more beneficiaries than the space provided on the form allows?

Yes, if you want to nominate more beneficiaries than the form permits, you should use Form #136, which is the Supplemental Form to Designate Beneficiaries. This additional form allows for the nomination of extra beneficiaries beyond the primary and contingent spaces provided on the F131 form.

- How do I nominate my estate to receive the benefits?

To nominate your estate, simply check the 'Estate' box in the appropriate section(s) of the F131 form, either Section A (for the death benefit) or Section B (for the accumulated deductions), or both. Remember, if nominating your estate, do not fill out the name, address, or relationship sections for beneficiaries in those sections.

- Do the beneficiaries I list for these benefits act as my nominations for all benefits?

No, the nominations you make on this form are specific to the benefits mentioned. There are different provisions for on-the-job accidental death benefits, which follow a specific priority order. For members of the Uniformed Sanitation Force, there's an additional distinction regarding the accidental death benefit payable to a spouse, even if the spouse remarries.

- How can I change my beneficiary nomination?

To change your beneficiary nomination, you must complete and file another Designation of Beneficiary form with NYCERS. It's important to keep your beneficiary information current to ensure benefits are distributed according to your wishes. Active members can verify their current beneficiary nomination when they receive their Annual Disclosure Statement each February/March.

- What should I do if my beneficiary information is out of date?

If your beneficiary information is out of date, you should update it immediately by filing a new Designation of Beneficiary form. NYCERS will distribute benefits based on the most recent beneficiary information on file, emphasizing the importance of keeping this information current.

Common mistakes

When filling out the NYCERS F131 form, it's essential to avoid common mistakes to ensure the process goes smoothly. Here are nine mistakes to watch out for:

- Not checking the Estate box correctly in Sections A or B when intending to nominate an Estate, which leaves the form incomplete or incorrectly filled out.

- Filling out the name, address, relationship, and percentage sections after selecting the Estate option. This action contradicts the form’s instructions and creates confusion about the member's wishes.

- Forgetting to nominate a guardian for minor beneficiaries, which is crucial for the protection and proper management of the benefits until they come of age.

- Missing the signatures or not getting the form notarized, a critical final step that validates the form.

- Allocating percentages to beneficiaries without ensuring the total reaches 100%. This oversight can lead to issues in how the benefits are distributed.

- Leaving beneficiary information, such as the full social security number or date of birth, incomplete. Precise details are vital for the identification and verification of beneficiaries.

- Not utilizing Form # 136 (Supplemental Form to Designate Beneficiaries) when wishing to nominate more beneficiaries than the primary form allows.

- Overlooking the clear distinction between Primary and Contingent Beneficiaries and not understanding their roles and when they come into play.

- Failing to read the Fact Sheet provided on page 4, which contains essential information that could answer common questions and clarify procedures.

Being meticulous and attentive to these details can greatly affect the outcome and ensure that the intended beneficiaries are correctly nominated and recognized. It underscores the importance of carefully reviewing the entire form, including the Fact Sheet, to avoid common pitfalls that can arise during this process. Moreover, keeping beneficiary information up to date and understanding the specific rules for nominating estates or minor beneficiaries can prevent unnecessary complications in an already difficult time.

Ultimately, the objective is to ensure that benefits are distributed according to the member's wishes. A thorough and accurate completion of the NYCERS F131 form is a crucial step in safeguarding one's intentions for their beneficiaries. It's advisable for members to seek clarification on any sections they find confusing and consider consulting with a professional if needed to prevent these common mistakes.

Documents used along the form

Completing the NYCERS F131 Form, a Designation of Beneficiary for Tier 1 and Tier 2 members, often opens the doorway to a broader set of considerations and documentation for members. When planning for the future, especially within the areas of benefits and estate planning, a variety of forms and documents can come into play to ensure that one's wishes are fully documented and legally binding. Highlighted below are four prominent documents that are frequently used alongside the F131 Form.

- Form #136 (Supplemental Form to Designate Beneficiaries): When the space provided on the F131 is insufficient for nominating all desired beneficiaries, Form #136 serves as an extension. It allows NYCERS members to designate additional primary or contingent beneficiaries for both the ordinary death benefit and the accumulated deductions benefit.

- Form #137 (Designation of Guardian for Minor Beneficiary): In situations where a member designates a minor as a beneficiary, the completion of Form #137 is necessary. This form allows members to appoint a guardian for the minor beneficiary, ensuring that the minor's interests are adequately protected until they reach the age of majority.

- Notary Public Services: Though not a form, utilizing a Notary Public is a critical step in the completion of the F131 form and any supplemental documentation. A notary's seal and signature on these documents help to attest to the authenticity of the member's signature and intentions, making the documents legally binding.

- Last Will and Testament: While not a NYCERS-specific document, creating a Last Will and Testament is a critical step in comprehensive estate planning. This legal document complements forms like F131 by providing instructions on the distribution of one's assets and estate. It can specify how and to whom both personal and real property should be distributed, including any benefits received from NYCERS.

Together, these forms and documents work in concert to ensure that a NYCERS member's beneficiaries are designated according to their wishes, providing peace of mind to the member and clarity to the beneficiaries. It's important for members to review these documents periodically, especially after major life events such as marriage, birth of a child, or divorce, to ensure that their beneficiary designations remain aligned with their current intentions.

Similar forms

The NYCERS F131 form serves as a crucial document for Tier 1 and Tier 2 members who wish to designate beneficiaries for specific benefits should they pass away while in active City service. Similar in nature to other forms of beneficiary designation, it demonstrates a structured way to ensure that benefits are distributed according to the member's wishes. A comparable document is a Last Will and Testament, which also allows an individual to dictate how their assets are allocated upon death. Though broader in scope, covering everything from personal property to guardianship of minors, the Last Will parallels the F131 in its core function: ensuring personal wishes are honored posthumously.

The IRA Beneficiary Designation form is another similar document, specifically intended for retirement accounts. Like the F131 form, it enables account holders to name individuals or entities (such as estates) to receive the funds in the account upon the account holder's death. This form focuses solely on the retirement assets, underscoring the importance of designating beneficiaries to prevent the assets from going through probate, a feature shared with the F131's intent for pension-related benefits.

The Life Insurance Beneficiary Designation form shares similarities with the F131 form by allowing policyholders to name beneficiaries for their life insurance proceeds. This is crucial for ensuring the right person or people receive the financial benefits speedily and directly, bypassing the complex and time-consuming probate process. Both forms serve the overarching goal of facilitating the transfer of specific financial assets to chosen individuals or entities upon the policyholder's or member's death.

Transfer on Death (TOD) or Payable on Death (POD) account forms present another parallel. These forms allow account holders at financial institutions to specify beneficiaries who will receive the assets in the account without going through probate. Like the F131, TOD and POD designations simplify the process of transferring valuable assets, focusing on bank and investment accounts, thereby offering a straightforward method to pass on certain assets directly to beneficiaries.

The Employee Retirement Plan Beneficiary Designation form is directly comparable to the F131, as it is used by employees to nominate beneficiaries for retirement benefits specifically. This similarity extends to the purpose of managing and directing the distribution of retirement funds posthumously, underscoring the need for clear instructions to avoid potential disputes or misunderstandings among surviving relatives or other beneficiaries.

Trust Documents, while more complex, share a common purpose with the F131 form. Trusts are legal arrangements that allow a third party, or trustee, to hold assets on behalf of beneficiaries. The granular control over how and when assets are distributed through Trust Documents echoes the F131's aim to clearly designate who receives what benefits and potentially, under what conditions, offering a structured and legally enforceable method for asset distribution.

The Advanced Healthcare Directive, sometimes known as a "Living Will," is conceptually similar to the F131 form in that it allows individuals to make specific future decisions in advance—in this case, regarding medical treatment preferences rather than asset distribution. Although it addresses different needs, both documents underscore the importance of proactive planning and personal choice in affairs critically affecting the future.

Lastly, the Power of Attorney (POA) document, while primarily focused on authorizing another individual to make decisions on one's behalf, shares the F131's foundation in delegating critical responsibilities or benefits according to personal wishes. Whether for managing finances, healthcare decisions, or benefit disbursements, both forms emphasize the need for trust and clarity in designation to ensure one's preferences are followed when they cannot advocate for themselves.

Dos and Don'ts

When filling out the NYCERS F131 form, attention to detail is paramount. Here’s a concise guide to ensure the process is done correctly:

Do:- Review the Fact Sheet on Page 4 thoroughly before starting to understand the benefits and nomination process.

- Use black ink to fill out the form to ensure legibility and to avoid any scanning issues.

- If nominating more beneficiaries than the space provided, utilize Form #136 (Supplemental Form to Designate Beneficiaries).

- Check the Estate box in either Section A or Section B (or both) if you wish to nominate your Estate, and remember not to fill in the name, address, or relationship fields in those sections.

- Ensure all percentages for nominated beneficiaries total 100%; this is crucial for proper distribution.

- Sign the form in the presence of a notary public to validate your nomination.

- Keep a copy of the completed form for your records before submitting the original to NYCERS.

- Leave any sections incomplete if you are nominating a person or persons; all requested information must be provided.

- Forget to update your beneficiary information if there are any life changes; always submit a new form to reflect current wishes.

- Ignore the requirement to notarize the form; an unnotarized form will not be processed.

- Use pencil or any ink color other than black; this can lead to readability issues.

- Try to nominate a Contingent Beneficiary without understanding the eligibility conditions detailed on the form.

- Overlook the necessity of completing additional forms for minors listed as beneficiaries. Form 137 is required for guardian information.

- Mistake this form as a catch-all beneficiary designation for all NYCERS benefits. It's specific to the death benefit and accumulated deductions only.

Misconceptions

Misconceptions surrounding the NYCERS Form F131, which is pivotal for Tier 1 and Tier 2 members of the New York City Employees' Retirement System (NYCERS), can lead to confusion and errors in beneficiary designation. This form allows members to nominate beneficiaries for certain death benefits in the event of the member's death while in active City service. Clarifying these misconceptions is essential to ensure that members make informed decisions regarding their beneficiary designations. Below are four common misconceptions and the truths behind them:

- Only One Beneficiary Can Be Nominated: A common misconception is the belief that the form allows for the designation of only one beneficiary. In reality, members can nominate multiple primary beneficiaries and an optional contingent beneficiary for each of the two distinct benefits. This allows for greater flexibility in determining how benefits are distributed.

- An Estate Cannot Be a Beneficiary: Contrary to what some might think, members have the option to nominate their estate as a beneficiary. This is achieved by checking the Estate box in the relevant section(s) of the form and not filling in the name, address, relationship, or percentage portion. This option may be suitable for those who prefer their estate to manage the distribution of benefits according to their will.

- Designation Applies to All NYCERS Benefits: Another misconception is the belief that the beneficiary designation on the F131 form applies to all benefits provided by NYCERS. This designation specifically pertains to the death benefit payable upon the member's death in active service and the accumulated deductions benefit. It does not automatically apply to other benefits such as the accidental death benefit, which has its own order of precedence and procedures.

- Additional Forms Are Unnecessary for Extra Beneficiaries: Some members mistakenly believe that all beneficiary nominations can be completed on the F131 form itself, without the need for additional documentation. However, if a member wishes to nominate more beneficiaries than the form space allows, they must use Form #136 (Supplemental Form to Designate Beneficiaries). This ensures that all desired beneficiaries are properly documented and recognized.

Understanding these aspects of the NYCERS Form F131 ensures that Tier 1 and Tier 2 members can accurately plan for the distribution of their benefits. Members are encouraged to review their designations periodically, especially following life events such as marriage, divorce, or the birth of a child, and make any necessary updates using the appropriate forms to keep their beneficiary information current.

Key takeaways

Filling out the NYCERS F131 form correctly is crucial for members of Tier 1 and 2 to ensure their beneficiaries are accurately designated to receive benefits. Here are key takeaways to guide you through the process:

- The F131 form enables Tier 1 and 2 members to designate beneficiaries for two distinct death benefits in the event of their death while in active City service.

- Beneficiaries can be one or more persons, or the member's estate. To nominate an estate, you must select the Estate option and leave the beneficiary details sections blank.

- Primary and Contingent Beneficiaries can be named for each benefit. The Contingent Beneficiary is optional and will only receive benefits if all Primary Beneficiaries predecease the member.

- If more beneficiaries need to be designated than the form allows, supplemental Form #136 must be used for additional nominations.

- The distribution of benefits to multiple beneficiaries must total 100%. If percentages are not specified, benefits will be equally shared.

- This form is specific to the death benefit and the refund of accumulated deductions. It does not cover accidental death benefits, which have their own set of beneficiaries based on the member's status and job role.

- Beneficiary designations can be updated at any time by submitting a new F131 form. It is vital to keep beneficiary information current to ensure benefits are distributed according to the member's wishes.

- Before submission, the form must be signed and notarized. Failure to do so will render the form invalid, and the designations will not be processed.

Accurately filling out and updating the NYCERS F131 form ensures your beneficiaries are correctly listed and will receive the benefits intended for them without unnecessary complications or delays.

Common PDF Documents

How to Fill Out Anti Arson Application - Emphasizes the importance of truthful disclosure, underlining the fraud implications of concealing material facts.

Cpd-b - New hires must navigate sections on residency, affirming their living situation aligns with city policies, and provide proof if already residing in NYC.

Construction Rules and Regulations - A requirement for responsible parties to ensure accuracy and adherence to applicable NYC noise control rules.