Free Nyc Uxs Form in PDF

In the bustling metropolis of New York City, vendors of utility services other than limited fare omnibus companies navigate the complexities of excise tax through the NYC UXS form. This document serves as a fundamental tool for reporting and paying excise taxes on the provision of essential utilities, including gas, electricity, steam, water, refrigeration, and telecommunications services. Structured around a periodical reporting system, the form outlines specific sections for detailing the gross operating income from sales and services, without any deductions, across various utility categories. Importantly, it distinguishes between taxable amounts at differential rates, highlighting a nuanced approach to taxing entities based on the nature of their operations. Moreover, the inclusion of credits such as REAP and LMREAP against the utility tax underscores the city's effort to incentivize certain business activities within its jurisdiction. The form also accounts for changes in business details, operational status, and facilitates the application of rebates and adjustments, ensuring a comprehensive fiscal tool for both the city and its utility service vendors. It's crucial for businesses operating in this space to accurately complete and timely submit the NYC UXS form to comply with local tax regulations and avoid penalties, thus contributing to the city's economic ecosystem while ensuring the continued provision of vital utilities to its residents and businesses.

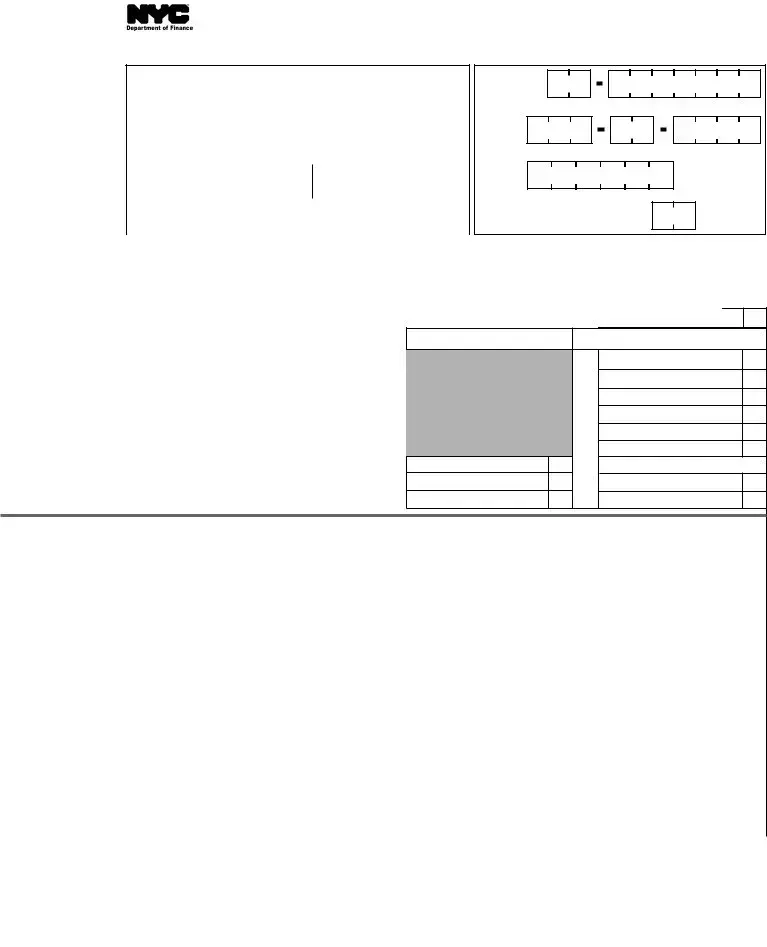

Nyc Uxs Sample

|

RETURN OF EXCISE TAX BY VENDORS OF UTILITY SERVICES |

||

|

FORUSEBYPERSONS(OTHERTHANALIMITEDFAREOMNIBUSCOMPANY)NOTSUBJECTTOTHESUPERVISION |

||

|

|

OFTHEDEPARTMENTOFPUBLICSERVICEWHOFURNISHORSELLUTILITYSERVICESOROPERATEOMNIBUSES |

|

|

|

|

|

|

Period beginning |

Period ending |

|

*70312391*

Name: |

Name |

n |

|

||

|

Change |

__________________________________________________________________________________________

In Care of:

__________________________________________________________________________________________

Address (number and street): |

Address |

n |

|

||

|

Change |

__________________________________________________________________________________________

City and State: |

Zip: |

Country (if not US): |

__________________________________________________________________________________________ |

|

|

Business Telephone Number: |

Taxpayer’s Email Address |

|

|

|

|

EMPLOYER

IDENTIFICATION

NUMBER:

OR

SOCIAL

SECURITY

NUMBER:

FEDERAL

BUSINESS

CODE:

Check type of business entity: nCorporation nPartnership |

nIndividual |

nAmended return |

nInitial return: Date business began |

nFinal return: Date business ended |

|

|

(Check this box if you have ceased operations in NYC) |

|

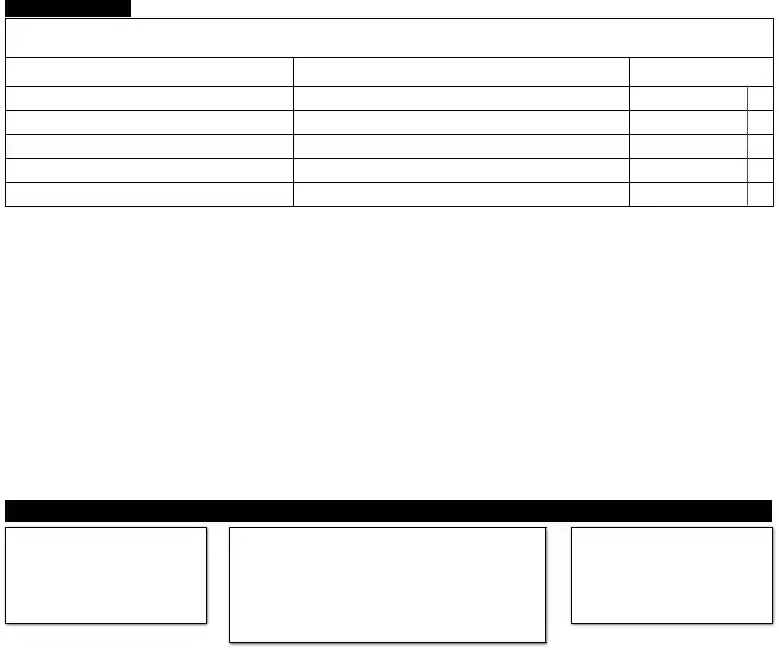

SCHEDULE A Computation of Gross Operating Income (See instructions)

A. Payment |

..................................................Amount being paid electronically with this return |

A. |

|

|

|

|

|

Payment Amount

t GROSS OPERATING INCOME t (see instructions)

RECEIPTS FROM SALESAND SERVICES(withoutanydeductions)

1.Gas ·································································································································································· 1.

2.Electricity ·················································································································································· 2.

3.Steam ··························································································································································· 3.

4.Water ···························································································································································· 4.

5.Refrigeration ······································································································································· 5.

6.Telecommunications Services ························································································ 6.

7.Passenger revenue (omnibus operation) ························································· 7.

8.Miscellaneous (attach schedule) ················································································ 8.

9.TOTAL GROSS OPERATING INCOME ···························································· 9.

COLUMNA - TAXABLEAT 1.17%

1.

2.

3.

4.

5.

6.

7.

8.

9.

COLUMN B - TAXABLEAT 2.35%

t COMPUTATION OFAMOUNT DUE t

10. |

line 9, Column A X 1.17% ······································································································································································································· |

10. |

|

|

|

|||

11. |

line 9, Column B X 2.35% ······································································································································································································· |

11. |

|

|

|

|||

12. |

Add lines 10 and 11 ························································································································································································································ |

12. |

|

|

|

|||

13. |

Sales and use tax refunded ······································································································································································································ |

13. |

|

|

|

|||

14. |

TOTAL TAX (Add lines 12 and 13)················································································································································································· |

14. |

|

|

|

|||

15a. |

......REAP Credit (from |

15a. |

|

|

|

|

|

|

15b. |

...LMREAP Credit (from Form |

15b. |

|

|

|

|

|

|

15c. |

Credit for rebates and discounts of charges for energy users (attachschedule). |

15c. |

|

|

|

|

|

|

15d. |

Previous payment |

15d. |

|

|

|

|

|

|

16. |

TOTAL PAYMENTS AND CREDITS (add lines 15a through 15d) ························································································· |

16. |

|

|

|

|||

17. |

If line 14 is larger than line 16, enter balance due ··································································································································· |

17. |

|

|

|

|||

18. |

If line 14 is smaller than line 16, enter overpayment ···································································································································· |

18. |

|

|

|

|||

19. |

Amount of line 18 to be applied to: |

(a) Refund············································································································································ |

19a. |

|

|

|||

|

|

(b) Corporation Tax, or················································································································· |

19b. |

|

|

|||

|

|

(c) Unincorporated Business Tax ········································································· |

19c. |

|

|

|||

20. |

Interest (see instructions) ······································································································································································································ |

20. |

|

|

|

|||

21. |

Penalty (see instructions) ····································································································································································································· |

21. |

|

|

|

|||

22. |

TOTAL REMITTANCE DUE (line 17 plus lines 20 and 21)··········································································································· |

22. |

|

|

|

|||

CERTIFICATION OF t TAXPAYER t

I hereby certify that this return, including any accompanying schedules or statements, has been examined by me, and is, to the best of my knowledge and belief, true, correct and complete. |

|

Firm's Email Address: |

|||||||||||||||||||||||||||||||

I authorize the Dept. of Finance to discuss this return with the preparer listed below. (see instructions) .................YES |

n |

|

__________________________________________ |

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

Preparer's Social Security Number or PTIN |

|||||||||||||||||||||||

Signature of owner, partner |

or officer of corporation s |

Title s |

Date s |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

Preparer's signature s |

Preparer’s printed name s |

Date s |

|

Check if self- |

Firm's Employer Identification Number |

||||||||||||||||||||||||||||

|

|

|

|

|

employed ✔ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

n |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Firm's name s |

Address s |

|

Zip Code s |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

70312391 |

SEE PAGE 2 FOR MAILING AND PAYMENT INFORMATION |

Form |

Page 2 |

SCHEDULE B

Enter below the names and addresses of all locations where the taxpayer conducts business covered by this return and the amount of gross operating income applicable to each location. Attach rider if additional space is needed.

NAME

ADDRESS

GROSS OPERATING

INCOME

ADDITIONALINFORMATION REQUIRED

A.State kind and nature of business__________________________________________________________________________________________________

B.Telephone number (_______) ________ - __________________

C.If a corporation, in what state did you incorporate? _____________________________________

D. Does this return cover business at more than one location? |

......................nYES nNO (IF YES, YOU MUST COMPLETE SCHEDULE B ABOVE) |

E.The books of the taxpayer are in the care of: _________________________________________________________________________________________

|

Name s |

Address s |

Telephone s |

|

F. |

Does this taxpayer pay rent greater than $200,000 for any premises in NYC in the borough of Manhattan south of |

|

|

|

|

96th Street for the purpose of carrying on any trade, business, profession, vocation or commercial activity? |

nYES |

nNO |

|

G. If "YES", were all required Commercial Rent Tax Returns filed? |

.................................................................................................................................................................................... |

nYES |

nNO |

|

Please enter Employer Identification Number which was used on the Commercial Rent Tax Return:___________________________

ALLRETURNSEXCEPTREFUNDRETURNS

NYC DEPARTMENT OF FINANCE

UTILITY TAX

P.O. BOX 5564

BINGHAMTON, NY

MAILING INSTRUCTIONS

REMITTANCES

PAY ONLINE WITH FORM

AT NYC.GOV/ESERVICES

OR

NYC DEPARTMENT OF FINANCE

P.O. BOX 3933

NEW YORK, NY

RETURNSCLAIMINGREFUNDS

NYC DEPARTMENT OF FINANCE

UTILITY TAX

P.O. BOX 5563

BINGHAMTON, NY

*70322391*

70322391

NEW YORK CITY DEPARTMENT OF FINANCE

Instructions for Form

Payments may be made on the NYC Department of Finance website at nyc.gov/eservices, or via check or money order. If paying with check or money order, do not include these payments with your NewYork Cityreturn. Checks and money orders must be accompanied by

GENERAL INFORMATION

HIGHLIGHTS OFLEGISLATION

For tax periods beginning on or after January 1, 2009, Utility Tax re- funds may be claimed up to three years from the time the return is filed or two years from the time the tax is paid, the same as the period apply- ing to refunds of General Corporation Tax, Business Corporation Tax, the Unincorporated Business Tax, and the Bank Tax. Administrative Code section

Beginning January 1, 2006, metered sales of energy to tenants of cer- tain cooperative housing corporations are exempted from the City util- ity tax. The exemption applies to cooperative corporations with at least 1,500 apartments that own or operate a cogeneration facility that was in place before January 1, 2004 (or that replaces such a facility), and that make metered sales of the energy produced for the development’s ten- ants or occupants. See Ad. Code

ForinformationconcerningtheRelocationEmploymentAssistanceProgram (REAP)seetheDepartmentofFinancewebsiteat:

Effective for tax periods beginning on and afterAugust 1, 2002, entities that receive eighty percent or more of their gross receipts from charges for the provision of mobile telecommunications services to customers will be taxed as if they were regulated utilities for purposes of the New York City Utility Tax, General Corporation Tax, Business Corporation Tax,Banking CorporationTax and Unincorporated BusinessTax. Thus, such entities will be subject to only the NewYork City Utility Tax. The amount of gross income subject to tax has been amended to conform to the Federal Mobile Telecommunications Sourcing Act of 2000. In ad- dition, if any such entity is a partnership, its partners will not be subject to the New York City Utility Tax on their distributive share of the in- comeofanysuchentity. Finally,fortaxyearsbeginningonandafterAu- gust 1, 2002, partners in any such entity will not be subject to General Corporation Tax, Business Corporation Tax, Banking Corporation Tax orUnincorporatedBusinessTaxontheirdistributiveshareoftheincome of any such entity. Laws of New York of 2002, Chapter 93, Part C and Laws of New York of 2015, Chapter 60, Part D.

NOTE:TherehavebeensubstantialchangestotheEnergyCostSavings Program. For information, call 311 or, if outside New York City, 212-

Taxpayers first becoming subject to the utility tax must file monthly re- turns for every month of the calendar year in which they first become subject to tax.

SpecialConditionCodes

Check the Finance website for applicable special condition codes. If ap- plicable, enter the two character code in the box provided on the form.

GENERALDEFINITIONS

1.“Grossoperatingincome”includes (1) receipts from furnishing or sell- ing gas, electricity, steam, water or refrigeration, or furnishing or selling gas, electric, steam, water, refrigeration or telecommunications services,

(2)receipts from omnibus services (except limited fare omnibus compa- nies,seeItem3),whetherornotaprofitisrealized,withoutdeductionfor any cost, expense or discount paid or 3) for tax periods beginning on or afterAugust 1, 2002, 84 percent of ALLcharges for mobile telecommu- nicationsservicestocustomerswheretheplaceofprimaryuseofthecus- tomerisintheCity. Suchreceiptsaredeemedtobederivedfrombusiness

2.“Vendor of Utility Services” Every person (1) not subject to the supervisionoftheNewYorkStateDepartmentofPublicServicewho furnishes or sells gas, electricity, steam, water or refrigeration or fur- nishes or sells gas, electric, steam, water, refrigeration or telecommuni- cations services, or (2) who operates omnibuses (including school buses), whether or not the operation is on the public streets and re- gardlessofwhetherthefurnishing,sellingoroperationconstitutesthe mainactivityoftheperson. Effectivefortaxperiodsbeginningonand after August 1, 2002, entities that receive eighty percent or more of theirgrossreceiptsfromchargesfortheprovisionofmobiletelecom- munications services to customers will be taxed as if they were sub- jecttothesupervisionoftheDepartmentofPublicServiceoftheState ofNewYorkandwillNOTbeconsideredvendorsofutilityservices.

3.“Limited Fare Omnibus Companies” Omnibus companies fran- chised by the City whose principal source of revenue is from trans- porting passengers daily within the City over fixed routes at fares no higher than those charged by the New York City Transit Authority. Limited fare omnibus companies are required to file

If you received a refund in the current period of any sales and use taxes forwhichyouclaimedacreditinapriorperiod,entertheamountofsuch refund on line 13.

Enter on this line the credit against the Utility Tax for the relocation and employment assistance program. (Attach Form

Enter on this line the credit against the Utility Tax for the new Lower Manhattanrelocationandemploymentassistanceprogram. (AttachForm

IMPOSITION/BASIS/RATE OFTAX

Thetaxisimposedoneveryvendorofutilityservicesfortheprivilegeof

Form |

Page 2 |

|

|

exercising a franchise or franchises, holding property or doing business in NewYork City.

A vendor of utility services is taxable on gross operating income as de- fined above. The following chart provides the rates.

CLASS t |

RATE t |

lVendors of utility services other than

omnibus operators...................................................................2.35% of gross operating income

lOmnibus operators not subject to

Department of Public Service supervision ...............1.17% of gross operating income

INTEREST

If the tax is not paid on or before the due date, interest must be paid on the amount of the underpayment from the due date to the date paid. For information as to the applicable rate of interest visit the Finance website at nyc.gov/finance or call 311. Interest amounting to less than $1 need not be paid.

PENALTIES

a)A late filing penalty is assessed if you fail to file this form when due, unless the failure is due to reasonable cause. For every month or partial month that this form is late, add to the tax (less any pay- ments made on or before the due date) 5%, up to a total of 25%.

b)If this form is filed more than 60 days late, the above late filing penalty cannot be less than the lesser of (1) $100 or (2) 100% of the amount required to be shown on the form (less any payments made by the due date or credits claimed on the return).

c)Alatepaymentpenaltyisassessedifyoufailtopaythetaxshownon this form by the prescribed filing date, unless the failure is due to rea- sonable cause. For every month or partial month that your payment is late,addtothetax(lessanypaymentsmade)1/2%,uptoatotalof25%.

d)The total of the additional charges in a and c may not exceed 5% for any one month except as provided for in b.

e)Additionalpenaltiesmaybeimposedonanyunderpaymentofthetax.

If you claim not to be liable for these additional charges, attach a state- ment to your return explaining the delay in filing, payment or both.

FILINGARETURNAND PAYMENTOFTAX

Returns are due on or before the 25th day of each month, if filing on a monthly basis, covering gross operating income for the preceding calen- dar month. However, if the tax liability is less than $100,000 for the pre- cedingcalendaryear,determinedonanannualorannualizedbasis,returns are due for the current tax year on a

Payment must be made in U.S. dollars, drawn on a U.S. bank. Checks drawn on foreign banks will be rejected and returned. Make remittance payable to the order of: NYC DEPARTMENT OF FINANCE.

SIGNATURE

This report must be signed by an officer authorized to certify that the statements contained herein are true. If the taxpayer is a partnership or anotherunincorporatedentity,thisreturnmustbesignedbyapersonduly authorized to act on behalf of the taxpayer.

For further information, call 311. If calling from outside the five bor- oughs, call

PreparerAuthorization: If you want to allow the Department of Fi- nance to discuss your return with the paid preparer who signed it, you must check the "yes" box in the signature area of the return.This author- izationappliesonlytotheindividualwhosesignatureappearsinthe"Pre- parer's Use Only" section of your return. It does not apply to the firm, if any, shown in that section. By checking the "Yes" box, you are author- izing the Department of Finance to call the preparer to answer any ques- tions that may arise during the processing of your return. Also, you are authorizing the preparer to:

lGive the Department any information missing from your return,

lCall the Department for information about the processing of your return or the status of your refund or payment(s), and

lRespondtocertainnoticesthatyouhavesharedwiththepreparer about math errors, offsets, and return preparation. The notices will notbe sent to the preparer.

Youarenotauthorizingthe preparer to receive any refund check, bind you to anything (including any additional tax liability), or otherwise rep- resent you before the Department. The authorization cannot be revoked, however, the authorization will automatically expire twelve (12) months aftertheduedate(withoutregardtoanyextensions)forfilingthisreturn.

Failuretochecktheboxwillbedeemedadenialofauthority.

MAILING INSTRUCTIONS

All returns, except refund returns:

NYC Department of Finance

UtilityTax

P.O. Box 5564

Binghamton,

Remittances - Pay online with Form

NYC Department of Finance

P.O. Box 3933

NewYork, NY

Returns claiming refunds:

NYC Department of Finance

UtilityTax

P.O. Box 5563

Binghamton,

TOAVOID THE IMPOSITION OFPENALTIES,youramountofthetaxduemustbe

paid in full and this return must be filed and postmarked within 25 days aftertheendoftheperiodcoveredbythereturn.

File Overview

| Fact Name | Description |

|---|---|

| Form Purpose | The NYC-UXS form is used for the return of excise tax by vendors of utility services not subject to the supervision of the Department of Public Service in New York City. |

| Applicable Entities | This form is applicable to entities that furnish or sell utility services, such as gas, electricity, steam, water, refrigeration, and telecommunications services, or operate omnibuses in NYC outside of Department of Public Service supervision. |

| Reporting Period | Vendors must indicate the specific period beginning and ending dates for which they are filing the return, allowing for accurate tax reporting and calculation for that time frame. |

| Governing Law | The form is governed by the New York City Administrative Code, which outlines the tax rates, exemptions, and obligations related to the utility tax for different types of services provided within the city limits. |

Nyc Uxs: Usage Guidelines

Filling out the NYC UXS Form, required by vendors of utility services in New York City, is an essential step in ensuring compliance with local tax obligations. This document is designed for businesses offering utilities or operating omnibuses not under the Department of Public Service’s supervision. Completing it accurately helps ensure that the appropriate excise taxes are calculated and remitted to the city's Department of Finance. The process involves detailing your business's gross operating income from various utility services within a specific period and calculating taxes owed based on those figures. Here is a step-by-step guide to assist you in filling out the form correctly.

- Fill in the period's beginning and ending dates at the top of the form.

- Enter your business name. If there has been a name change, tick the “Name n Change” box.

- Provide the “In Care of” name, if applicable.

- List your business’s physical address, including the street number and name, city, state, and zip code. Mark “Address n Change” if there’s been a change.

- Indicate your country if not based in the US.

- Enter your business telephone number and taxpayer’s email address.

- Provide your Employer Identification Number (EIN) or Social Security Number (SSN).

- Fill in your Federal Business Code.

- If applicable, enter the 2-Character Special Condition Code (see instructions).

- Check the appropriate box to indicate your type of business entity (Corporation, Partnership, Individual).

- Indicate if this is an amended or initial return. If it's a final return due to ceasing operations in NYC, also mark the corresponding box.

- In Schedule A, compute your Gross Operating Income based on the instructions provided, entering amounts for gas, electricity, steam, water, refrigeration, telecommunications services, passenger revenue, and any miscellaneous income.

- Calculate the tax rate applied to your total gross operating income as per instructions for Column A and Column B.

- Complete the Computation of Amount Due section, which includes calculation of the tax due based on applicable rates and gross operating income.

- List any credits, rebates, or previous payments in the designated section.

- Enter the total payments and credits, then determine if there's a balance due or an overpayment.

- Decide how any overpayment will be applied: towards a refund, corporation tax, or unincorporated business tax.

- Calculate and enter any interest and penalties due according to the instructions.

- Provide certification by signing the form as the taxpayer, including the title and date. If prepared by someone else, their information and signature should also be included.

- On the second page, Schedule B, list all locations where your business operates covered by this return, along with the applicable gross operating income.

- Fill in additional information as requested about the nature of your business, contact numbers, incorporation details, and whether you are filing for multiple locations.

After carefully reviewing the information provided, ensure that your form is signed and dated, then follow the mailing instructions based on whether you are making a payment or claiming a refund. Paying attention to deadlines and accurate detail entry is crucial to avoid any penalties or processing delays. If you have questions or need clarification on specific sections, consulting the form's instructions or seeking professional advice can provide further assistance.

FAQ

What is the purpose of the NYC UXS Form?

The NYC UXS Form is designed for vendors of utility services who are not subject to the supervision of the Department of Public Service in New York City. It serves as a way for these vendors to report and return excise taxes on utility services such as gas, electricity, steam, water, refrigeration, and telecommunications, as well as for reporting passenger revenue from omnibus operations. This form ensures that businesses accurately report their gross operating income and pay the appropriate taxes to the city.

Who needs to file the NYC UXS Form?

Any business that furnishes or sells utility services in New York City and is not supervised by the Department of Public Service must file the NYC UXS Form. This includes entities operating omnibuses (excluding limited fare omnibus companies), and vendors providing gas, electricity, steam, water, refrigeration, and telecommunications services. Additionally, businesses that derive the majority of their gross receipts from mobile telecommunications services to customers within the city must also file this form, treating their income as taxable under the utility tax.

How are the taxes calculated on the NYC UXS Form?

Taxes are calculated based on the gross operating income of the business. This income includes all receipts from the sales and services provided without any deductions for costs, expenses, or discounts. Two tax rates are applied depending on the type of utility service: 2.35% for general utility service vendors and 1.17% for omnibus operators not under the Department of Public Service supervision. The form provides specific sections for listing gross income from various services and then applying the appropriate tax rates to compute the amount due.

What happens if the NYC UXS Form is filed or paid late?

Should the form be filed or the tax payments made after the due date, interest and penalties will be applied. The interest accumulates from the due date to the payment date based on the underpaid amount. Penalties for late filing include a charge of up to 25% of the unpaid tax for each month or partial month the return is late. Additionally, a minimum penalty might apply if the return is filed more than 60 days late. To avoid these charges, it is crucial to ensure that the form is filed and any taxes due are paid within the specified deadlines.

Common mistakes

Filling out the NYC UXS form, a critical document for vendors of utility services in New York City, requires careful attention to detail. Yet, mistakes are common and can lead to unnecessary headaches, delays, or even penalties. Below are nine frequent missteps people make when completing this form, offering a roadmap for vendors to navigate through this bureaucratic requirement more smoothly.

- Incorrect or Incomplete Identification Information: The form starts with basic yet crucial information - the name, address, and identification numbers. A typical oversight is providing outdated or incorrect information. Any change, such as a new address or a change in ownership, must be reflected accurately on the form.

- Failing to Specify the Type of Business Entity: A checkbox section requires vendors to identify their business type (e.g., Corporation, Partnership, Individual). Missing or incorrectly marking this can misrepresent the business's legal structure, affecting tax obligations and liabilities.

- Erroneous Period Dates: The form mandates vendors to specify the period for which they are filing. Mixing up the beginning and ending dates or providing vague periods can lead to administrative confusion, affecting the accuracy of the tax computation.

- Incorrect Gross Operating Income: A common error is misreporting the gross operating income. Overlooking some revenue streams or mistakenly deducting expenses at this stage distorts the taxable amount, leading to underpayments or overpayments.

- Omitting Sales and Service Receipts: Each utility service provided (e.g., Gas, Electricity, Steam) must have its receipts entered separately. Consolidating these or omitting some affects the total taxable income, misleading the tax authorities about the business volume.

- Improper Computation of Taxes Due: The form requires detailed calculations, applying specific rates to the gross operating income. A miscalculation here can significantly affect the tax due, leading to penalties for underpayment or the loss of funds through overpayment.

- Overlooking Credits and Previous Payments: Vendors often miss deducting eligible credits (e.g., REAP Credit, LMREAP Credit) and previous payments, leading to an inaccurate presentation of the net amount due.

- Neglecting Signature and Certification: An unsigned form is invalid. Moreover, failing to certify the accuracy of the information provided, intentionally or unintentionally, can lead to legal trouble, including charges of fraud or misrepresentation.

- Incorrect Mailing Address: Using an outdated or incorrect mailing address for submission can delay processing times or result in lost documents, complicating compliance efforts.

In conclusion, diligence and attention to detail are paramount when filling out the NYC UXS form. By avoiding these common mistakes, vendors can ensure a smoother interaction with tax authorities, stay compliant, and possibly avoid unnecessary penalties or interest on late payments. It's always advisable to review the form carefully before submission or consult with a tax professional if uncertainties arise.

Documents used along the form

Filing taxes and complying with tax laws can seem like navigating through a maze without a map, especially for businesses in New York City dealing with utility services. Understanding the crucial documents that accompany the NYC UXS form can demystify this process, ensuring compliance is met efficiently. Here's a simplified guide to the important forms and documents often used in conjunction with the NYC UXS form, typically required by vendors of utility services who are not supervised by the Department of Public Service.

- Form NYC-200V Payment Voucher: This is used for making payments for taxes due on the NYC UXS. It's particularly handy when paying by check or money order, ensuring payments are processed correctly.

- Form NYC-9.5UTX: Relevant for businesses claiming the Relocation and Employment Assistance Program (REAP) credit, this form must be attached if this credit is being claimed on the NYC UXS return.

- Form NYC-9.8UTX: Similar to the NYC-9.5UTX, this form is used to claim the Lower Manhattan Relocation Employment Assistance Program (LMREAP) credit on the utility tax return.

- Schedule B: An attachment to the NYC UXS, detailing names, addresses, and gross operating income of all locations where business is conducted. If more space is needed, additional sheets are attached.

- Sales and Use Tax Refund Documents: If a refund for sales and use taxes has been received, documentation supporting the refund amount must be maintained and could be required to substantiate the amounts entered on the NYC UXS.

- Commercial Rent Tax Returns: For businesses paying rent over $200,000 for premises in Manhattan south of 96th Street, proof of filed Commercial Rent Tax Returns may be necessary, especially if this affects utility tax liabilities.

- Energy Cost Savings Program Documentation: Businesses participating in city energy cost savings programs must keep related documents on hand, which could impact utility tax credits or exemptions.

- Authorization of Representative Forms: If a preparer or another individual is authorized to discuss the return with the NYC Department of Finance, proper authorization forms must be completed, ensuring they have the necessary permissions.

When it comes to handling your utility tax obligations in New York City, being well-prepared with the right forms and documentation can make all the difference. Keeping track of these additional forms ensures that vendors can accurately compute taxes, claim rightful credits, and effectively report their business operations. It's all about staying organized and informed, ensuring that you meet your tax obligations with confidence and accuracy.

Similar forms

The New York City Commercial Rent Tax (CRT) Return is similar to the NYC UXS form in its function to compute taxes on a specific business activity within New York City. Both require detailed data on gross incomes, albeit for different sectors - the CRT focuses on rental income from properties, while the UXS form accounts for utility services. They share a format of itemized income reporting and tax rate application based on specified criteria. In addition, both forms involve adjustments for credits and exemptions, emphasizing the tailored tax obligations of specialized business operations within NYC.

The Sales and Use Tax Return, typically filed with state and local tax authorities, mirrors the NYC UXS form by itemizing taxable sales, applying multiple tax rates, and deducting allowable credits. This similarity extends to the delineation between different types of goods and services – in the NYC UXS for various utility services, and in the Sales and Use Tax Return for different categories of tangible personal property and services. Both forms calculate the total tax due after adjustments and reflect the complexity of tax compliance for businesses operating in jurisdictions with diverse tax obligations.

The Federal Quarterly Excise Tax Return (Form 720) is analogous to the NYC UXS form in targeting specific sectors for excise taxation. Just as the NYC UXS form applies to vendors of utility services, Form 720 encompasses a broad range of goods and services subject to federal excise taxes, such as fuel, communications, and environmental services. Each requires detailed reporting of applicable operations over the period and employs a calculated approach to tax due, integrating credits and payments against gross liabilities. This reflects the tailored application of excise taxes to specialized industries both at the federal and municipal levels.

The Unincorporated Business Tax (UBT) Return for New York City is another document with similarities to the NYC UXS form, especially in its focus on New York City businesses. Like the UXS form, it applies to businesses operating within NYC but focuses on unincorporated entities. Both documents require detailed financial disclosures and calculate tax based on operational incomes, with specific exclusions, deductions, and credits applicable to lower the taxable amounts. They exemplify the city's taxation of diverse business activities, from utility services to general business operations of unincorporated entities.

The Metropolitan Commuter Transportation Mobility Tax (MCTMT) Return, while focused on the payroll expense of employers in certain geographical areas, shares conceptual frameworks with the NYC UXS form in terms of regional specificity and targeted tax collection mechanisms. Both forms serve as fiscal tools aimed at funding specific public goods – the UXS for utility infrastructure and regulation, and the MCTMT for transportation infrastructure. They require registrants to report detailed operational metrics within a defined period, calculate tax liabilities under specific rates, and adjust for allowable credits, highlighting the tailored approaches to tax assessment and collection within New York's diverse economic landscape.

Dos and Don'ts

When completing the NYC UXS form, it's important to follow guidelines to ensure accurate and timely filing. Below are things you should and shouldn't do.

- Do double-check the period start and end dates to ensure they are correctly filled out.

- Don't leave the name or address fields blank, even if there haven't been any changes since your last filing.

- Do accurately report your gross operating income for each utility service provided, without any deductions.

- Don't forget to attach any schedules or forms that are mentioned in the form, including Schedule A and any applicable credit forms.

- Do carefully choose the correct type of business entity, and check the appropriate box for an amended or initial return.

- Don't mishandle the calculation of taxes due in the computation section; use the percentages as instructed for each service type.

- Do sign and date the form in the certification section, and if applicable, authorize the Dept. of Finance to discuss this return with the preparer.

- Don't ignore the mailing and payment instructions specified for different types of returns; ensure your payment methods and addresses are correct.

Filling out the NYC UXS form accurately is crucial for compliance and avoiding any potential fines or penalties. Ensuring all information is correct and submitting the form on time helps maintain your business's good standing.

Misconceptions

Understanding legal and financial documents can be complex, and the NYC UXS form is no exception. Here's a list of six common misconceptions about the NYC UXS form clarified to help vendors of utility services navigate its specifics more accurately:

- Misconception 1: Only conventional utilities need to file the NYC UXS form. The reality is that any vendor providing utility services such as gas, electricity, steam, water, refrigeration, and telecommunications services who is not under the supervision of the Department of Public Service must file this form, including entities operating omnibuses that aren't limited fare omnibus companies.

- Misconception 2: Gross operating income includes deductions for costs and expenses. On the contrary, the gross operating income reported in Schedule A should include receipts from sales and services without any deductions for costs or expenses.

- Misconception 3: The form is only for reporting purposes, and no payment is associated with it. The NYC UXS form is not only for reporting purposes but also used to calculate and remit excise tax due on the gross operating income derived from providing utility services within New York City.

- Misconception 4: It's unnecessary to file a final return if the business ceases operations within NYC. If a business providing utility services ceases operations, it must indicate this by checking the "Final return" box on the form, signifying the end of its tax liability within the NYC jurisdiction.

- Misconception 5: Sales and use tax refunded cannot affect the utility tax calculation. Actually, if a refund of sales and use tax previously claimed as a credit is received, it has to be reported and can adjust the tax calculation, as indicated on line 13 of the form.

- Misconception 6: Utility tax credits, such as REAP and LMREAP, cannot be applied towards the utility tax due. Credits like REAP and LMREAP are available for eligible businesses, and if applicable, should be claimed on the NYC UXS form, potentially reducing the amount of utility tax due.

Clarifying these misconceptions is crucial for accurate compliance and avoiding potential penalties associated with the misinterpretation of filing requirements. Entities providing utility services in New York City must familiarize themselves with these details to ensure correct form submission and tax payment.

Key takeaways

Understanding the NYC UXS form is key to correctly reporting excise taxes for utilities services by vendors in New York City. Here are some crucial takeaways to ensure compliance and make the most of potential credits.

- Timely Filing Is Crucial: The NYC UXS form must be submitted by the 25th day of the month following the tax period. Late submissions could lead to penalties, so it's important to stay on top of deadlines to avoid unnecessary charges.

- Payment Procedures: All payments accompanying the form should be made in U.S. dollars and drawn on a U.S. bank. For ease and security, payments may also be made online via the NYC Department of Finance website.

- Understanding Gross Operating Income: Gross operating income includes all receipts from furnishing or selling specified utility services without deductions for any costs or expenses. It's vital to accurately report this income to ensure the correct tax amount is applied.

- Applicable Credits: Various credits, such as the REAP and LMREAP credits, can be applied against the utility tax. It's essential to attach the appropriate forms and documentation to claim these credits effectively.

- Signature and Certification: The form must be certified and signed by an authorized person. This certification asserts the truthfulness and completeness of the information provided. If you're allowing the Department of Finance to discuss the return with your preparer, remember to mark the corresponding box.

- Mailing Instructions: Depending on whether you're making a payment, claiming a refund, or submitting the return, there are different addresses provided for mailing in the instructions. Utilizing the correct address ensures your documents and payments are processed efficiently.

Thoroughly reviewing and understanding the NYC UXS form instructions guarantees that vendors can fulfill their tax obligations while taking advantage of available credits and deductions. Proper filling out and timely submission of the form help avoid penalties and interest on late payments.

Common PDF Documents

Ccd1 - Includes a mandatory declaration section for the applicant to affirm the accuracy and completeness of the information provided.

Letters of Administration New York Surrogate's Court - It clarifies the steps required for legal endorsement of settlements and distributions related to wrongful death claims.