Free Nyc Uxrb Form in PDF

Businesses operating within New York City as common carriers, including railroads and bus companies (excluding trucking companies), have an essential obligation to comply with local taxation laws, notably through the New York City Department of Finance UXRB form. This document is a comprehensive guide for reporting excise taxes by utilities, crucial for maintaining transparency and accountability in financial affairs. The form caters to various types of business entities such as corporations, partnerships, and individuals, requiring them to specify their business nature by ticking the appropriate box that corresponds to their operation. It allows for the declaration of gross income from transportation and other sources without any deductions, with a detailed breakdown including passenger, freight, and miscellaneous revenue. Moreover, the form includes sections for computing the tax due based on specific percentages applicable to the type of utility service provided, alongside provisions for amendments, initial returns, and the closure of businesses. It mandates the certification by an authorized individual, ensuring the accuracy and completeness of the information provided. With sections designed for penalties and the inclusion of interest for late payments, it emphasizes the legal obligations of operating entities. Additionally, information on payment and mailing, alongside certifications and preparer authorizations, encapsulates the need for diligent financial and operational reporting within the stipulated time frames. This not only underscores the importance of compliance with municipal tax laws but also reflects the detailed process entities must navigate to adhere to the financial regulations of New York City.

Nyc Uxrb Sample

*70211091*

NEWYORK CITYDEPARTMENT OF FINANCE |

RETURNOFEXCISETAXBYUTILITIES |

|||||||||||||||||||

|

NYC |

FORUSEBYRAILROADS,BUSCOMPANIES,ANDOTHERCOMMONCARRIERSOTHERTHANTRUCKINGCOMPANIES |

||||||||||||||||||

FINANCE |

UXRB |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

● ■Corporation |

● ■Partnership |

|

● ■Individual |

|||||||||||||||||

Check type of business entity: |

|

|||||||||||||||||||

Check type of return: |

● ■Initial return |

● ■Amended return |

|

● ■Final return |

||||||||||||||||

Date business began in NYC |

● |

Date business ended in NYC ● |

||||||||||||||||||

Name: |

|

|

DATE: |

|||||||||||||||||

|

|

|

||||||||||||||||||

__________________________________________________________________________________________ |

EIN/SSN: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Address (number and street): |

|

|

ACCOUNT TYPE: |

UXRB |

||||||||||||||||

__________________________________________________________________________________________ |

ACCOUNT ID: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

PERIOD BEGINNING: |

||||||||||||||||||||

City and State: |

|

Zip: |

||||||||||||||||||

|

|

|

PERIOD ENDING: |

|||||||||||||||||

__________________________________________________________________________________________ |

DUE DATE: |

|||||||||||||||||||

Business Telephone Number: |

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

FEDERAL BUSINESS CODE:

|

|

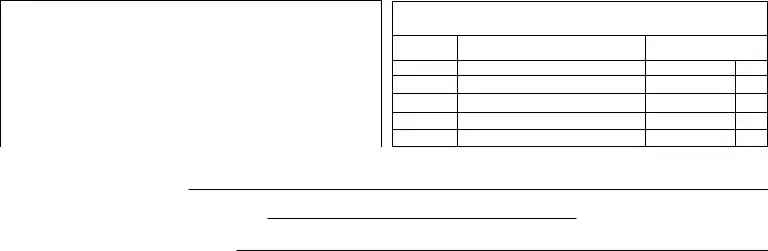

SCHEDULE A |

Computation of Gross Income (See instructions) |

|

|

|

|

|

|

|

|

|

Payment Enclosed |

|

|

||

|

|

|

|

|

|

|

|

|

A. Payment |

...............Payamountshownonline32 - Makecheckpayableto: NYCDepartmentofFinance |

● |

|

|

|

|

||

▼ G R O S S I N C O M E ▼

REVENUEFROMTRANSPORTATION(withoutanydeductions) |

|

|

|

|

|

|

|

1. |

Passengerrevenue (see instructions) |

● 1a. |

|

|

● 1b. |

|

|

2. |

Freightrevenue(nottobeincludedbyrailroads) |

|

|

● 2. |

|

|

|

3. |

Mailrevenue |

|

|

● 3. |

|

|

|

4. |

Expressrevenue |

|

|

● 4. |

|

|

|

5. |

Miscellaneoustransportationrevenue(explaininScheduleC,page2) |

|

|

● 5. |

|

|

|

REVENUEOTHERTHANFROMTRANSPORTATION(withoutanydeductions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

6. |

Advertising |

|

|

● 6. |

|||

7. |

Carandstationprivileges |

|

|

● 7. |

|||

8. |

Rentoffacilitiesusedinthepublicservice |

|

|

● 8. |

|||

9.RentderivedfromoperationofterminalfacilitiesinexcessofauserproportionofNewYorkCityrealpropertyand

|

specialfranchisetaxesandexpensesofmaintenanceandoperation |

● 9. |

||

10. |

Saleofpower |

● 10. |

||

11. |

Miscellaneous(explaininScheduleC) |

● 11. |

||

|

|

|

|

|

|

Interestfrompersonsotherthancorporations |

|

|

|

12. |

|

|

||

13. |

Royalties |

● 13. |

|

|

14. |

Profitfromthesaleofsecurities |

● 14. |

|

|

15. |

Profitfromthesaleofrealproperty |

● 15. |

|

|

16. |

Profitfromsaleofpersonalproperty (other than property of a kind which would properly be included in the inventory of the taxpayer) |

● 16. |

|

|

17. |

Miscellaneous(includinggainsorprofitsfromanysourcewhatsoever)(explaininScheduleC) |

● 17. |

|

|

18. |

TOTAL(addlines1bthrough17) |

● 18. |

|

|

▼ COMPUTATIONOFAMOUNTDUE ▼

19.Taxat3.52% - personsoperatingorleasingsleepingandparlorrailroadcarsoroperatingrailroads other than streetsurface,

|

rapidtransit,subwayandelevatedrailroads |

|

● 19. |

|

|

|

20. |

Taxat2.35% - personsoperatingorleasingstreetsurface,rapidtransit,subwayandelevatedrailroads |

● 20. |

|

|

||

21. |

Taxat1.17% - personsoperatingomnibusesandsubjecttothesupervisionoftheDepartmentofPublicService |

● 21. |

|

|

||

22. |

Taxat0.1% - personsoperatinglimitedfareomnibuscompanies,onamountfromline1a |

● 22. |

|

|

||

23. |

Salesandusetaxrefunded |

|

● 23. |

|

|

|

24. |

TOTALTAX(addlines19through23) |

|

● 24. |

|

|

|

25a. |

● 25a. |

|

|

|

|

|

25b. |

● 25b. |

|

|

|

|

|

25c. |

Previouspayment |

● 25c. |

|

|

|

|

26. |

TOTALPAYMENTSANDCREDITS(addlines25athrough25c) |

|

● 26. |

|

|

|

27. |

Ifline24islargerthanline26,enterbalancedue |

|

● 27. |

|

|

|

28. |

Ifline24issmallerthanline26,enteroverpayment |

|

● 28. |

|

|

|

29. |

Amountofline28toberefunded |

|

● 29. |

|

|

|

30. |

Interest (see instructions) |

|

● 30. |

|

|

|

31. |

Penalty (see instructions) |

|

● 31. |

|

|

|

32. |

TOTALREMITTANCE DUE (addlines27,30and31)(EnterpaymentonlineAabove) |

............................................................................................ |

|

● 32. |

|

|

CERTIFICATION OF ▼TAXPAYER ▼

I hereby certify that this return, including any accompanying schedules or statements, has been examined by me, and is, to the best of my knowledge and belief, true, correct and complete.

I authorize the Dept. of Finance to discuss this return with the preparer listed below. (see instructions) |

.................YES |

■ |

|||||||||||||||

|

|

|

|

|

Preparer's Social Security Number or PTIN |

||||||||||||

|

|

|

|

● |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Signature of owner, partner or officer of corporation ▲ |

Title ▲ |

Date ▲ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Preparer's signature ▲ |

Preparerʼs printed name ▲ |

Date ▲ |

Check if self- |

Firm's Employer Identification Number |

|

● |

|||||

● |

|

|

employed ✔ |

||

|

|

■ |

|

||

Firm's name ▲ |

Address ▲ |

Zip Code ▲ |

|

70211091 |

SEE INSTRUCTIONS FOR MAILING AND PAYMENT INFORMATION |

Form |

|

|

Page 2 |

|

|

|

|

SCHEDULE B |

|

|

|

|

SCHEDULE C |

|

|

|

|

|

|

Enter below all income received during the period covered by this return and NOT reported in ScheduleA.

EXPLANATION |

AMOUNT |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Details of miscellaneous income, lines 5,11 and 17 reported in ScheduleA.

REFER TO LINE |

EXPLANATION |

AMOUNT |

#ON PAGE 1 |

ADDITIONALINFORMATIONREQUIRED

A.State kind and nature of business

B.Telephone number (_____) _________ - _________________

C.If a corporation, in what state did you incorporate?

D. Does this return cover business at more than one location? |

■Yes ■No (IF YES, YOU MUST ATTACH A SCHEDULE LISTING ADDRESS AND GROSS INCOME APPLICABLE TO EACH LOCATION.) |

E.The books of the taxpayer are in the care of:

Name ▲ |

Address ▲ |

Telephone ▲ |

|

|

|

*70221091*

70221091

NEWYORK CITYDEPARTMENT OF FINANCE

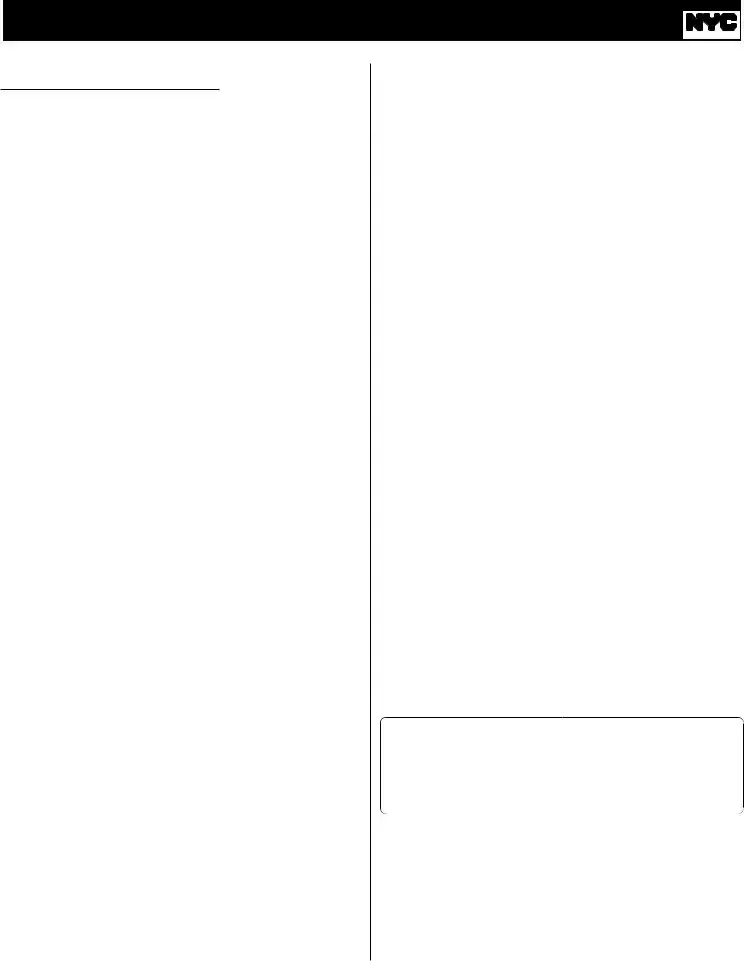

Instructions for Form

FINANCE

GENERAL INFORMATION

HIGHLIGHTS OFRECENTLEGISLATION

The law was amended in 2009 to provide taxpayers with additional time to applyforarefundoftheUtilityTax. FortaxyearsbeginningonorafterJan- uary 1, 2009, UtilityTax refunds may be claimed up to three years from the time the return is filed or two years from the time the tax is paid, the same as the period applying to refunds of General Corporation Tax, the Unincor- porated Business Tax, and the Bank Tax. Administrative Code section 11- 1108(a), as amended by Chapter 201 of the Laws of 2009, section 35.

BeginningJanuary1,2006,meteredsalesofenergytotenantsofcertainco- operative housing corporations are exempted from the City utility tax. The exemptionappliestocooperativecorporationswithatleast1,500apartments that own or operate a cogeneration facility that was in place before January 1, 2004 (or that replaces such a facility), and that make metered sales of the energy produced for the development’s tenants or occupants. SeeAd. Code

TheRelocationEmploymentAssistanceProgram(REAP)hasbeenreinstated and a program granting similar benefits to businesses that relocate to lower Manhattan(LMREAP)hasbeenenacted. BoththereinstatementoftheREAP programandtheenactmentoftheLMREAPprogramareeffectiveasofJuly 1, 2003. SeeAdministrative Code sections

EffectivefortaxperiodsbeginningonandafterAugust1,2002,entitiesthat receive eighty percent or more of their gross receipts from charges for the provisionofmobiletelecommunicationsservicestocustomerswillbetaxed as if they were regulated utilities for purposes of the NewYork City Utility Tax,GeneralCorporationTax,BankingCorporationTaxandUnincorporated BusinessTax. Thus, such entities will be subject to only the NewYork City Utility Tax. The amount of gross income subject to tax has been amended toconformtotheFederalMobileTelecommunicationsSourcingActof2000. Inaddition,ifanysuchentityisapartnership,itspartnerswillnotbesubject to the NewYork City UtilityTax on their distributive share of the income of anysuchentity. Finally,fortaxyearsbeginningonandafterAugust1,2002, partners in any such entity will not be subject to General Corporation Tax, Banking CorporationTax or Unincorporated BusinessTax on their distribu- tive share of the income of any such entity. Chapter 93, Part C, of the Laws of NewYork, 2002.

SCHEDULEA- COMPUTATION OFGROSS INCOME Enterinline1ballgrossincome,withoutanydeductions,derivedfrompas- senger revenue wholly earned within the territorial limits of the City.

Only Limited Fare Omnibus Companies as defined by Section 11- 1101.10 of the NYC Administrative Code, must report revenue from commuterservicesinline1a. Commuterservicesisdefinedasmasstrans- portation service (exclusive of limited stop service to airports, racetracks or anyotherplacewhereentertainment,amusement,orsportsactivitiesareheld or where recreational activities are supplied) provided pursuant to a fran- chise with, or consent of, the City of New York. Limited Fare Omnibus Companies must report all other passenger revenue in line 1b. Report other gross income, without any deductions, from transportation and other than transportation in the appropriate lines in ScheduleA.

GROSS INCOME

INCLUDE:

●all receipts from any sale made, including receipts from the sales of residuals and

the sale is made or the service is rendered for profit) without any de- duction for any cost, expense or discount paid;

●receipts from interest, dividends and royalties (other than interest and dividends received from corporations) without deduction for any ex- pense;

●profit from the sale of real property;

●profit from the sale of securities;

●

●gains or profits from any source whatsoever except as specifically ex- cluded below.

DO NOT INCLUDE:

●gross income from the operation of hotels, multiple dwellings or office buildings by railroads;

●rents,exceptthosederivedfromfacilitiesusedinthepublicservice,modifiedas providedinAd. Code

●gross income from sales for resale other than sales of gas, electricity, steam, water or refrigeration or gas, electric, steam, water or refrigera- tion service to a vendor of utility services for resale to tenants; and

●fortaxperiodsbeginningonorafterAugust1,2002,thetaxpayer’sdis- tributiveshare,ifany,ofincome,gains,lossesanddeductionsfromany partnership subject to the NYC UtilityTax as a utility or vendor of util- ity services, including its share of separately reported items. (SEE “UTILITY” defined below).

SCHEDULE B

Enter all other income in Schedule B, page 2.

UTILITY

EverypersonsubjecttothesupervisionoftheDepartmentofPublicService of the State of New York. Effective for tax periods beginning on and after August1,2002,entitiesthatreceiveeightypercentormoreoftheirgrossre- ceiptsfromchargesfortheprovisionofmobiletelecommunicationsservices to customers will be taxed as if they were subject to the supervision of the Department of Public Service of the State of NewYork and will not be con- sidered vendors of utility services.

IMPOSITION/BASIS/RATE OFTAX

The tax is imposed on every utility for the privilege of exercising a fran- chise or franchises, holding property or doing business in NewYork City.

Autility is taxable on gross income as defined above. The chart below pro- vides the rates.

CLASS ▼ |

RATE ▼ |

|

|

◆Omnibus operators subject to Department of Public

|

Service supervision |

1.17% of gross income |

◆ Limited fare omnibus operators - commuterserviceonly |

00.1% of gross income |

|

◆ |

Railroads |

3.52% of gross income |

◆ |

All other utilities |

2.35% of gross income |

Lines19,20and21

Multiply the amount on line 18 by the rate given on line 19, 20 or 21, whichever is appropriate.

If you received a refund in the current period of any sales and use taxes for whichyouclaimedacreditinapriorperiod,entertheamountofsuchrefund on line 23.

Form |

Page 2 |

EnteronthislinethecreditagainsttheUtilityTaxfortherelocationandem- ployment assistance program. (Attach Form

Enter on this line the credit against the Utility Tax for the new Lower Man- hattanrelocationandemploymentassistanceprogram. (AttachFormNYC- 9.8.UTX)

INTEREST

If the tax is not paid on or before the due date, interest must be paid on the amount of the underpayment from the due date to the date paid. For infor- mation as to the applicable rate of interest, visit the Finance website at nyc.gov/financeor call 311. Interest amounting to less than $1 need not be paid.

PENALTIES

a)If you fail to file a return when due, add to the tax (less any payments made on or before the due date or any credits claimed on the return) 5% for each month or partial month the form is late, up to 25%, unless the failure is due to reasonable cause.

b)Ifthisformisfiledmorethan60dayslate,theabovelatefilingpenaltycan- notbelessthanthelesserof(1)$100or(2)100%oftheamountrequiredto be shown on the form (less any payments made by the due date or credits claimed on the return).

c)If you fail to pay the tax shown on the return by the prescribed filing date, add to the tax (less any payments made) 1/2% for each month or partial month the payment is late up to 25%, unless the failure is due to reasonable cause.

d)Thetotaloftheadditionalchargesina)andc)maynotexceed5%forany one month except as provided for in b).

e)Additional penalties may be imposed on any underpayment of the tax.

If you claim not to be liable for these additional charges, a statement in sup- port of your claim should be attached to the return.

SIGNATURE

This report must be signed by an officer authorized to certify that the state- mentscontainedhereinaretrue. Ifthetaxpayerisapartnershiporanotherun- incorporatedentity,thisreturnmustbesignedbyapersondulyauthorizedto act on behalf of the taxpayer.

FILINGARETURNAND PAYMENTOFTAX

Returns are due on or before the 25th day of each month, if filing on a monthly basis, covering gross income for the preceding calendar month. However, if the tax liability is less than $100,000 for the preceding calendar year, determined on an annual or annualized basis, returns are due for the current tax year on a

PaymentmustbemadeinU.S.dollars,drawnonaU.S.bank. Checksdrawn on foreign banks will be rejected and returned. Make remittance payable to the order of NYC DEPARTMENT OF FINANCE.

For further information, call 311. If calling from outside the five NYC bor- oughs, call

PreparerAuthorization: If you want to allow the Department of Finance to discuss your return with the paid preparer who signed it, you must check the "yes" box in the signature area of the return. This authorization applies only to the individual whose signature appears in the "Preparer's Use Only" sectionofyourreturn. Itdoesnotapplytothefirm,ifany,showninthatsec- tion. By checking the "Yes" box, you are authorizing the Department of Fi- nance to call the preparer to answer any questions that may arise during the

processing of your return. You are also authorizing the preparer to:

●Give the Department any information missing from your return,

●Call the Department for information about the processing of your re- turn or the status of your refund or payment(s), and

●Respond to certain notices that you have shared with the preparer aboutmatherrors,offsets,andreturnpreparation. Thenoticeswillnot be sent to the preparer.

Youarenotauthorizingthepreparertoreceiveanyrefundcheck,bindyou to anything (including any additional tax liability), or otherwise represent you before the Department. The authorization cannot be revoked; however, the authorization will automatically expire twelve (12) months after the due date (without regard to any extensions) for filing this return. Failure to

checktheboxwillbedeemedadenialofauthority.

MAILREMITTANCEAND RETURNTO:

NYC DEPARTMENT OF FINANCE

P. O. BOX 5110

KINGSTON, NY

TOAVOIDTHE IMPOSITION OFPENALTIES,thisreturnmustbefiledwithyourre- mittanceinfullfortheamountofthetaxpostmarkedwithin25daysafterthe endoftheperiodcoveredbythereturn.

File Overview

| Fact | Detail |

|---|---|

| Form Type | NYC UXRB |

| Governing Body | New York City Department of Finance |

| Purpose | Return of Excise Tax by Utilities for use by Railroads, Bus Companies, and other Common Carriers other than Trucking Companies |

| Applicable Entities | Corporation, Partnership, Individual |

| Return Types | Initial, Amended, Final |

| Taxable Activities | Includes revenue from transportation, advertising, rent of facilities used in the public service, and sales of power among others |

| Governing Law(s) | Administrative Code section 11-1108(a), as amended by Chapter 201 of the Laws of 2009, section 35 |

| Filing Frequency | Monthly or Semi-Annual, based on the previous calendar year's tax liability |

| Due Date | On or before the 25th day of each month (for monthly filers) or July 25th and January 25th (for semi-annual filers) |

| Mailing Instructions | NYC Department of Finance, P.O. Box 5110, Kingston, NY 12402-5110 |

Nyc Uxrb: Usage Guidelines

Filling out the NYC-UXRB form is a critical step for railroads, bus companies, and other common carriers, excluding trucking companies, operating within New York City. This form is used to report and remit excise taxes to the New York City Department of Finance. Proper completion and timely submission of this form ensure compliance with the city's tax obligations and help avoid potential penalties. Below are the steps to fill out this form accurately.

- Identify the Type of Entity: Mark the appropriate box indicating if your business is a Corporation, Partnership, or Individual.

- Specify the Type of Return: Check whether this is an Initial return, Amended return, or Final return.

- Enter the Date Business Began in NYC and Date Business Ended in NYC if applicable, in the format MM-DD-YYYY.

- Fill in the Name, Date (current date), EIN/SSN, and Address (number and street, city, state, zip) of your business.

- Specify your Business Telephone Number, Federal Business Code, Account Type (UXRB), Account ID, and the Period Beginning and Ending Dates related to the excise tax return.

- Write down the Due Date for this submission.

- In Schedule A, accurately compute the Gross Income from various sources including passenger revenue, freight revenue, and other non-transportation income, without any deductions, following the specific instructions provided for each line.

- Calculate the Total Tax Amount Due by applying the specified tax rates (3.52%, 2.35%, 1.17%, or 0.1%) to your gross income and adding any sales and use tax refunded.

- List any applicable credits such as REAP Credit or LMREAP Credit, previous payments, and sum these under Total Payments and Credits.

- Determine the balance due or overpayment by comparing the total tax and total payments and credits.

- Enter the Total Remittance Due, adding any required interest or penalties, in Section A designated for payment enclosed.

- Certify the form by providing the signature of the owner, partner, or corporate officer, their title, and the date. If a preparer completed the form, include the preparer’s information as well.

- Complete Schedule B and C if there is additional income to report or miscellaneous income that needs detailed explanation.

- Provide any additional information required, such as the nature of the business, telephone number, state of incorporation, whether the return covers more than one location, and who is responsible for the company's books.

After completing the form, make a payment check payable to the NYC Department of Finance, and mail the form and your remittance to the specified address. Ensure everything is accurate and submitted by the due date to fulfill your business's tax obligations and maintain good standing with the New York City Department of Finance.

FAQ

What is the NYC UXRB form?

The NYC UXRB form is a document mandated by the New York City Department of Finance, specifically for utilities including railroads, bus companies, and other common carriers excluding trucking companies. This form is utilized for the reporting and payment of excise taxes based on the gross income from transportation and other related activities conducted within New York City. It allows entities to declare various types of income, compute their tax liabilities, and claim any applicable credits or payments.

Who needs to file the NYC UXRB form?

The UXRB form is required to be filed by businesses classified as utilities, which cover railroads, bus companies, and other common carriers, with the key exclusion of trucking companies. This classification is broad and includes any entity subject to the supervision of the Department of Public Service of the State of New York, as well as those deriving a significant part of their gross receipts from charges for the provision of mobile telecommunication services to customers.

What information is required when filling out the NYC UXRB form?

When completing the NYC UXRB form, entities must provide a comprehensive account of their business, including the type of business entity (corporation, partnership, individual), the nature of the return (initial, amended, final), and the start or end dates of business within NYC. Additionally, detailed financial data on gross income from various sources such as passenger, freight, mail, and express revenue, alongside other income like advertising, rent from public service facilities, and profits from the sales of securities or real property, must be meticulously recorded. Information about payments and credits, including excise tax computations and any applicable rebates or credits, is also required.

When is the NYC UXRB form due?

Submission deadlines for the NYC UXRB form depend on the reporting schedule of the taxpayer. Those with a tax liability under $100,000 for the preceding calendar year, on an annual or annualized basis, are permitted to file semi-annually with due dates on or before July 25th and January 25th, for the respective tax periods of January-June and July-December. Others must file monthly, with forms due on or before the 25th day of each month, covering the preceding calendar month's activities. It's crucial to adhere to these deadlines to avoid penalties.

How are payments made for the tax due on the NYC UXRB form?

Payments for the tax due as calculated on the NYC UXRB form must be made in U.S. dollars, drawn from a U.S. bank. The checks or remittances should be made payable to the NYC Department of Finance. It's important to ensure that payments are correctly calculated and submitted by the due date to prevent interest charges and penalties for late payments. Detailed instructions for payment, including the mailing address for the Department of Finance, are provided in the form instructions to facilitate compliance.

Common mistakes

When completing the NYC UXRB form, individuals and businesses commonly make mistakes that can result in incorrect filings or delays. Understanding these pitfalls can ensure a smoother process and accurate compliance with tax obligations.

- Not selecting the correct type of business entity: The form requires you to specify whether you're filing as a Corporation, Partnership, or Individual. Mistakingly checking the wrong box can lead to improper tax calculations or rejections of the form.

- Failing to indicate the type of return: You must check whether it's an Initial, Amended, or Final return. An incorrect designation can confuse the tax authorities about the stage or status of your business’s tax affairs.

- Incorrectly reporting the date business began or ended in NYC: These dates are crucial for determining your tax period. Providing inaccurate dates may result in incorrect tax assessments.

- Not accurately computing gross income: Schedule A requires a detailed computation of gross income from various sources without deductions. Often, income is underreported by not thoroughly including all required categories, such as passenger revenue or miscellaneous transportation revenue explained in Schedule C.

- Omitting information in Schedule C: This section requires explanations for miscellaneous income. Neglecting to provide details or not listing all income sources can lead to an incomplete return and possible penalties.

- Overlooking additional required information: The UXRB form asks for specific additional information about your business, such as the nature of the business and if the return covers more than one location. Missing this information can lead to an incomplete submission.

- Incorrect calculation of taxes due: The tax computation section is complex, involving multiple tax rates for different types of utility services. Incorrect calculations here can lead to either an overpayment or underpayment of taxes.

- Forgetting to sign and date the certification: The certification of the taxpayer at the end of the form is a legal affirmation that the information is true and complete. Failure to sign, date, or check the preparer's authorization can invalidate the form.

By avoiding these common mistakes and paying close attention to the detailed instructions provided with the NYC UXRB form, filers can ensure accurate and timely submission. Remember, when in doubt, consulting with a professional knowledgeable in New York City tax law can help navigate these and other filing complexities.

Documents used along the form

Understanding the intricacies of tax documentation can be crucial for businesses, especially those operating within specific sectors like utilities in New York City. The NYC UXRB form is specifically designed for utilities such as railroads, bus companies, and other common carriers, excluding trucking companies. This form facilitates the return of excise taxes, providing a structured way for businesses to report their earnings and calculate the taxes due. However, the UXRB form doesn't stand alone in the realm of tax and administrative documentation. Several other forms often accompany it to ensure comprehensive compliance and accurate reporting.

- Form NYC-9.5 UTX: This form is essential for businesses seeking to claim the Relocation and Employment Assistance Program (REAP) credit against their utility tax. By providing detailed information about the business relocation and employment numbers, companies can leverage this form to reduce their overall tax liability under the REAP guidelines.

- Form NYC-9.8 UTX: Similar to the 9.5 UTX, this form caters to businesses that have moved to Lower Manhattan, offering them a chance to claim tax credits for relocation under the Lower Manhattan Relocation and Employment Assistance Program (LMREAP). It's another avenue for businesses to lessen their tax burden while contributing to the economic revitalization of Lower Manhattan.

- Schedule C: As part of the broader NYC UXRB documentation, Schedule C provides a space for utilities to explain miscellaneous transportation revenue, miscellaneous income, and any other earnings that do not fit neatly into predefined categories. This supplemental schedule ensures that all sources of income are correctly accounted for and taxed appropriately.

- Schedule B: This schedule is used to report any income received during the period that is not accounted for in Schedule A. It's crucial for capturing a comprehensive view of a company’s financial activities, offering a place to include additional income sources that might be taxable under the NYC utility tax regulations.

Together, these forms and schedules create a cohesive framework for utilities and similar businesses to report their income and calculate taxes in a manner consistent with New York City's Department of Finance requirements. By providing specific avenues for different types of income and possible tax credits, the documentation ensures both compliance with tax laws and opportunities for businesses to benefit from city-specific tax relief programs. Understanding and utilizing these forms correctly is essential for any business in the utility sector operating within New York City.

Similar forms

The NYC UXRB form, utilized by various transportation entities including railroads and bus companies for reporting excise tax, has counterparts in other tax reporting contexts that share similarities in structure, purpose, and required information. Understanding these documents can provide insights into the broader landscape of tax and regulatory reporting for different types of businesses and activities.

One comparable document is the Form 940, used by employers to report federal unemployment tax (FUTA). Similar to the NYC UXRB form, Form 940 requires businesses to calculate liabilities based on their operations—in this case, unemployment contributions rather than excise taxes. Both forms require detailed financial information to ensure accurate tax assessment and include sections for adjustments and credits.

Another similar document is the Form 1120, the U.S. Corporation Income Tax Return. Like the UXRB form, Form 1120 is used by corporations to report their income, gains, losses, deductions, and credits to calculate their federal income tax liability. Both forms are critical for compliance with tax regulations and help entities manage their financial responsibilities to government agencies.

The Sales and Use Tax Returns, found in various formats across states, also share similarities with the NYC UXRB form. These returns calculate tax due based on the sale of goods and services, requiring detailed reporting of gross receipts and applicable deductions and exemptions. Like the UXRB, these forms ensure businesses contribute their fair share to public resources based on their economic activities.

The Highway Use Tax Return, required for businesses operating motor vehicles on public highways, parallels the UXRB form in its focus on a specific industry sector. This form requires detailed vehicle and operational information to calculate tax based on mileage, weight, and type of vehicle, showcasing another aspect of industry-specific taxation.

The Form 8300, Report of Cash Payments Over $10,000 Received in a Trade or Business, though distinct in purpose from the NYC UXRB form, shares the principle of reporting financial activities to government agencies for regulatory purposes. This form focuses on large cash transactions, aiming to prevent money laundering and ensure financial transparency.

Last is the Property Tax Return, required by many local jurisdictions for the assessment of property taxes. Although focused on real estate rather than business activities, like the UXRB, these returns require detailed property and ownership information to accurately assess taxes due, reflecting the broader theme of periodic reporting to support public finances.

In conclusion, while each of these documents serves different aspects of tax and regulatory reporting, they collectively embody the principle of financial accountability and compliance. From excise taxes on transportation services to income, sales, and property taxes, these forms facilitate a structured approach to funding government services and infrastructure, crucial for societal development and welfare.

Dos and Don'ts

Filling out forms for legal or tax purposes can seem daunting at first glance, but with attention to detail and a clear understanding of the requirements, it can be completed accurately and efficiently. When filling out the NYC UXRB form, a document required for utilities to report excise tax in New York City, there are specific dos and don'ts that individuals and businesses should be mindful of to ensure the process goes smoothly.

Things you should do:

- Review the entire form before beginning: Understand each section to ensure you have all the necessary information ready.

- Double-check the type of business entity and type of return boxes: Accurately indicating whether your business is a corporation, partnership, or individual entity, along with the type of return (initial, amended, or final), is crucial for proper processing.

- Use accurate and current information: Ensure that the business name, EIN/SSN, address, and other pertinent details are current and correctly entered.

- Compute gross income carefully: Pay close attention to Schedule A, where you detail your gross income. This section is critical for determining how much tax you owe.

- Sign and date the form: The certification section at the end of the form must be signed and dated by an authorized person to validate the return.

Things you shouldn't do:

- Leave fields blank: If a section does not apply to you, clearly mark it as "N/A" instead of leaving it blank. This demonstrates that you didn't overlook the section.

- Estimate figures: Provide exact numbers wherever possible. Estimations can lead to inaccuracies and potential issues with the Department of Finance.

- Forget to include supporting documentation: If claiming credits or deductions, be sure to attach the necessary forms or schedules, such as the NYC-9.5UTX for the REAP credit.

- Ignore the due date: Submitting your form late can result in penalties. Be mindful of the due date and consider mailing it in advance to account for any postal delays.

- Make the payment to the wrong entity or in the incorrect format: Payments should be made in U.S. dollars and drawn on a U.S. bank. Ensure the check is payable to NYCDepartmentofFinance as indicated on the form.

By following these guidelines, the process of filling out the NYC UXRB form can be significantly more straightforward and less susceptible to errors that could result in penalties or delays. Always remember to keep a copy of the completed form and any correspondence for your records.

Misconceptions

When it comes to the New York City Utility Excise Tax Return (NYC UXRB form), there are many misconceptions about its requirements, purpose, and who it affects. Understanding these misconceptions can help ensure compliance and avoid any unnecessary complications.

Only applicable to large utility companies: A common misconception is that the NYC UXRB form is only relevant to large utility operators. However, it applies to a range of businesses including railroads, bus companies, and other common carriers, excluding trucking companies.

Personal information isn’t necessary: The form requires both business and personal identification information, including EIN/SSN, underscoring the importance of including personal information for individual operators or partnerships.

Only for businesses permanently in NYC: Some believe that only businesses with a permanent presence in NYC need to file. In fact, any entity conducting applicable business activities within NYC needs to file, regardless of their business’s physical location.

Gross income is not clearly defined: There’s a misconception that what constitutes gross income is vague. The form clearly specifies types of revenues that must be reported, including passenger, freight, and miscellaneous transportation revenues, without any deductions.

Single filing is enough: The belief that a single filing is sufficient is incorrect. Entities must file an initial return, and if necessary, amended and/or final returns, indicating the tax period and any changes in the business operation.

It’s only about reporting revenue: While reporting revenue is a significant part of the form, it also involves claiming possible tax credits, computing the amount of tax due, and certifying the accuracy of the information provided.

Penalties and interest are not a major concern: Underestimating the impact of late filings or incorrect payments is a mistake. The form outlines potential penalties and interests for late or inaccurate filings, emphasizing the need for timeliness and accuracy.

Manual submission is mandatory: This is outdated information. While manual submission through mail is an option, the form and instructions provide information on electronic filing methods, reflecting modernization efforts.

No authorization for discussion with preparers: A unique aspect often overlooked is the option to authorize the Department of Finance to discuss the return with the preparer. This option facilitates the resolution of issues but requires explicit authorization on the form.

Understanding these misconceptions about the NYC UXRB form can lead to better compliance practices, ensuring that businesses fulfill their tax obligations accurately and on time.

Key takeaways

Understanding how to correctly complete and utilize the NYC UXRB form is essential for railroad, bus companies, and other common carriers, excluding trucking companies, operating within New York City. Here are nine key takeaways to ensure compliance with the Department of Finance's requirements:

- Identify your business entity type accurately on the form. You'll need to check whether your business operates as a Corporation, Partnership, or as an Individual.

- Specify the type of return you are filing - Initial, Amended, or Final. This classification helps the Department of Finance process returns efficiently.

- It's crucial to record the dates your business began and ended its operations in NYC, ensuring accurate taxation periods are accounted for.

- The form requires detailed information on your business and contact details, including the Employer Identification Number (EIN) or Social Security Number (SSN), business address, and telephone number.

- Schedule A of the form asks for a computation of Gross Income from various sources without any deductions. This includes revenue from transportation like passenger and freight services, and revenue other than from transportation, such as advertising and rent of facilities used in the public service.

- Any payments and credits, including REAP and LMREAP credits, should be accurately calculated and included. This ensures that any tax incentives or programs your business qualifies for are properly accounted for.

- The form also requires the disclosure of interest and penalties if applicable. Understanding how these are calculated based on your submission can help avoid unnecessary costs.

- Certification by the taxpayer confirms that the information provided is complete and accurate to the best of their knowledge. This is a legal declaration and must be treated with the seriousness it warrants.

- Finally, it is essential to adhere to due dates and payment instructions provided in the instructions to avoid penalties. The filing and payment must be postmarked within 25 days after the end of the period covered by the return.

Compliance with the New York City Department of Finance's guidelines ensures that your business meets its legal obligations and avoids potential penalties associated with the NYC UXRB form.

Common PDF Documents

Ny Dmv Return Plates - Delve into the procedural aspects of appealing a TVB ticket decision in New York, emphasizing the AA-33 form’s role.

Primary Beneficiary Designation - The document advises on the contingency of assigning a Contingent Beneficiary, who would only receive benefits if all Primary Beneficiaries are deceased.