Free Nyc Rpt Form in PDF

In the bustling metropolis of New York City, the real estate market is as vibrant and complex as the city itself. Central to this complexity is the New York City Real Property Transfer (NYC RPT) form, a critical document for anyone involved in the exchange of real property. This form serves various key roles - from the documentation of sales and transfers of real property within the city's limits to ensuring the accurate calculation and collection of transfer taxes. The NYC RPT form is essential not only for legal compliance but also for maintaining the integrity of the city's real estate records. Its implications extend beyond mere paperwork; the form plays a pivotal role in the fiscal health of New York City, directly impacting its capacity to fund public services. For buyers, sellers, and real estate professionals, understanding the form's requirements, the details it must contain, and the deadlines for its submission is pivotal. Through its comprehensive structure, it creates a transparent record of real estate transactions, thereby safeguarding all parties involved while ensuring that the city's tax revenues reflect the dynamism of its property market.

Nyc Rpt Sample

File Overview

| Fact | Detail |

|---|---|

| Name of the Form | Nyc Rpt Form |

| Purpose | Used for reporting and documenting real property transactions in New York City. |

| Who Must File | Individuals or entities involved in the sale or transfer of real property in New York City. |

| When to File | Must be filed at the time of the real estate transaction, alongside the deed or lease agreement. |

| Governing Law | New York State laws and regulations, with specific provisions and requirements set by New York City administrative codes. |

| Accessibility | The form is available through the New York City Department of Finance website and can be submitted electronically or in paper form. |

| Associated Fees | Fees may vary based on the property's sale price and type of transaction; specific fee schedules are provided by the Department of Finance. |

Nyc Rpt: Usage Guidelines

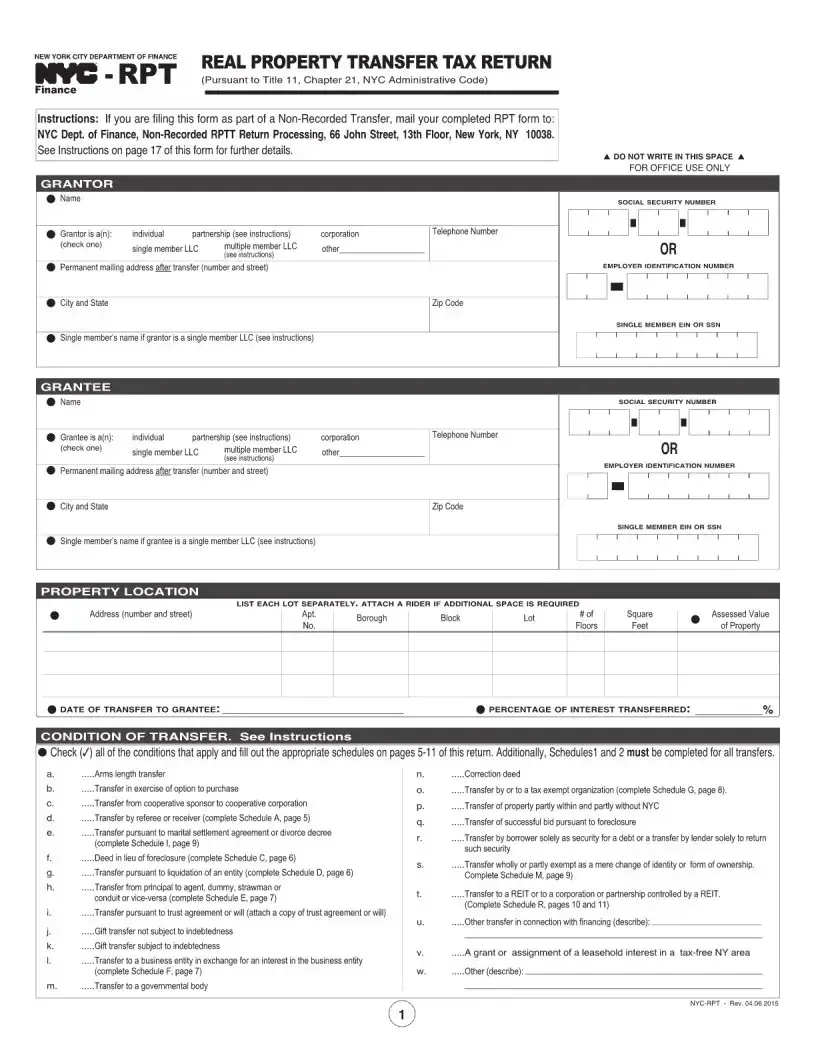

Filling out the NYC RPT form is a critical step for residents or entities involved in certain transactions within New York City. This document is essential for documenting and processing specific types of transactions, ensuring compliance with local regulations. It's important to approach this task with attention to detail to avoid any unnecessary delays or complications. Follow these steps carefully to ensure the form is completed accurately.

- Start by downloading the most recent version of the NYC RPT form from the official website of New York City's Department of Finance. This ensures you are using the correct form.

- Read through the entire form first before you start filling it out. This preliminary step will help you understand the type of information required and gather all necessary documents.

- Enter the required identification details of the property involved in the transaction, including the block number, lot number, and address. These details must be accurate to properly identify the property.

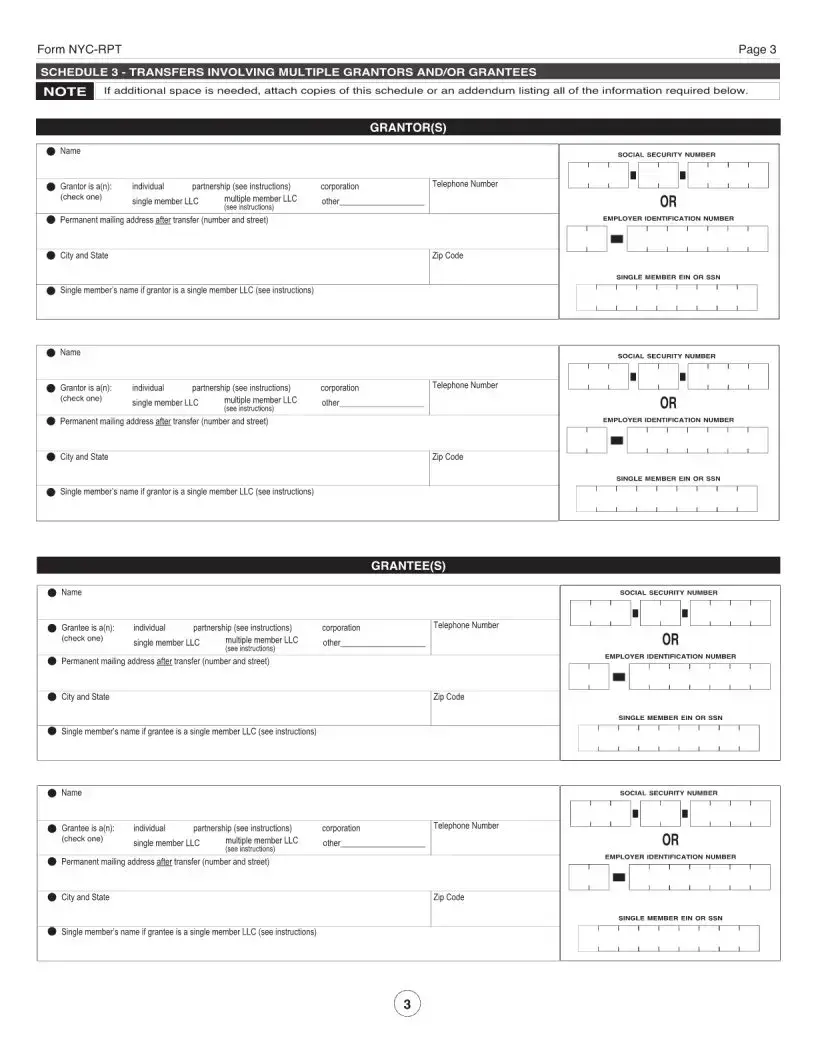

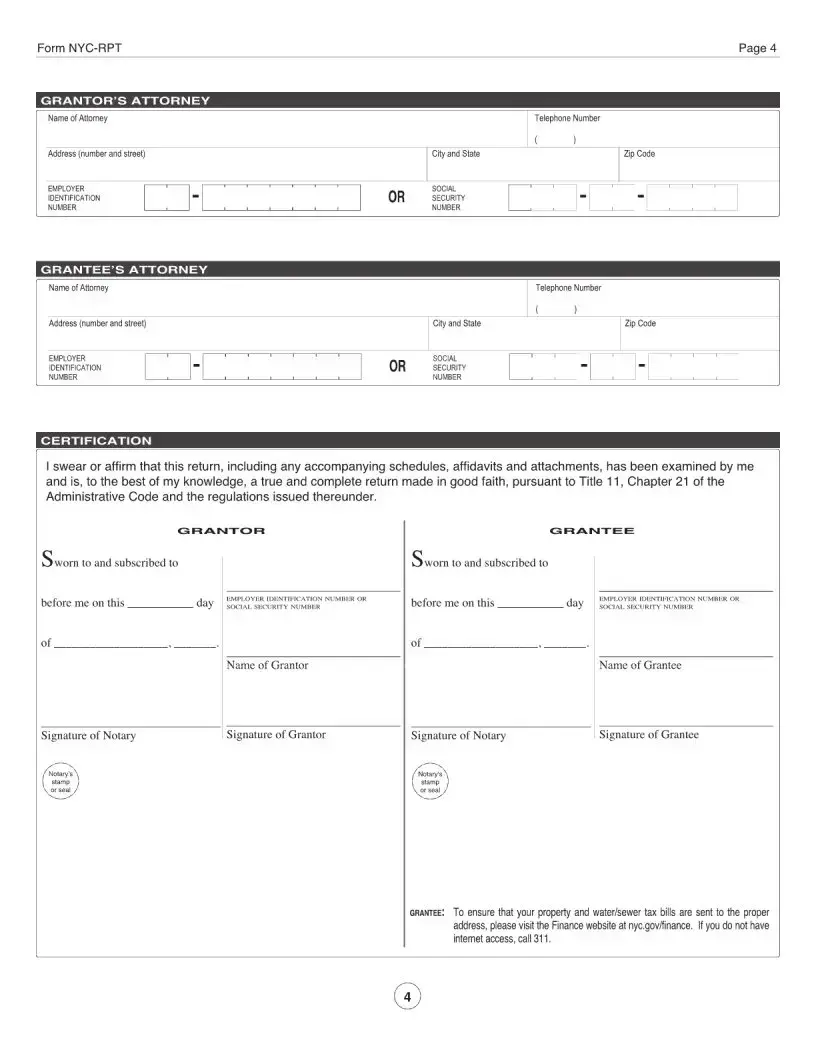

- Provide full names and addresses of all parties involved in the transaction. This includes not just the seller and buyer, but any attorneys or representatives as well.

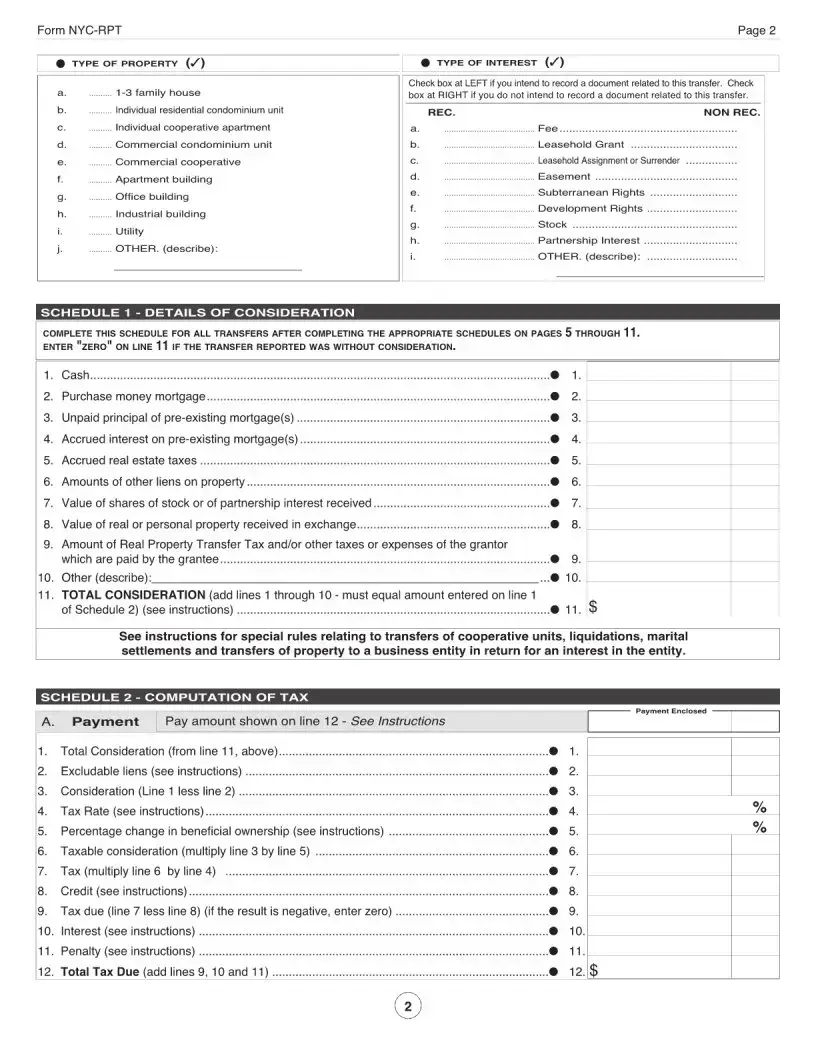

- Indicate the type of transaction by selecting the appropriate box on the form. This section categorizes the nature of your transaction, so choose the option that best describes your situation.

- Detail the consideration paid for the property. This includes not only the sale price but also any other financial arrangements that were part of the transaction.

- If applicable, fill out any sections related to mortgages on the property. This includes new mortgages taken as part of the transaction or existing ones.

- Review all the sections of the form to ensure that the information provided is accurate and complete. It's crucial to double-check this information to avoid errors.

- Sign and date the form where indicated. The form usually requires signatures from all parties involved in the transaction, including witnesses or notaries if necessary.

- Submit the completed NYC RPT form to the designated office or department as instructed. Make sure to keep a copy for your records.

After submitting the form, the NYC Department of Finance will review the submitted information. If everything is in order, the transaction will be processed further. It's vital to ensure all provided information is accurate and complete to avoid any potential issues. Don't hesitate to seek professional help if you encounter any difficulties completing the NYC RPT form. Remember, this form is an important document and must be handled with care.

FAQ

-

What is the NYC RPT form?

The NYC RPT form, short for the New York City Real Property Transfer Tax Form, is a document required for the legal transfer of real property within New York City's five boroughs. This form helps the city assess and collect transfer taxes that are applicable whenever real estate property changes hands, unless specific exemptions apply.

-

Who needs to file the NYC RPT form?

Generally, the responsibility to file the NYC RPT form falls on the shoulders of the seller or grantor of the property. However, if the seller fails to fulfill this obligation, the buyer or grantee may then be required to file the form. It's imperative for parties involved in the transfer of real property to understand their obligations under local law to ensure compliance and avoid possible penalties.

-

Where can I find the NYC RPT form?

The NYC RPT form is available through the New York City Department of Finance's website. Individuals can download the form directly from the site and should ensure they are accessing the most current version, as updates may occur that could affect the information required or how it's submitted.

- Ensure you’re connected to a reliable internet source.

- Visit the official NYC Department of Finance website.

- Look for the forms or documents section and search for the NYC RPT form.

-

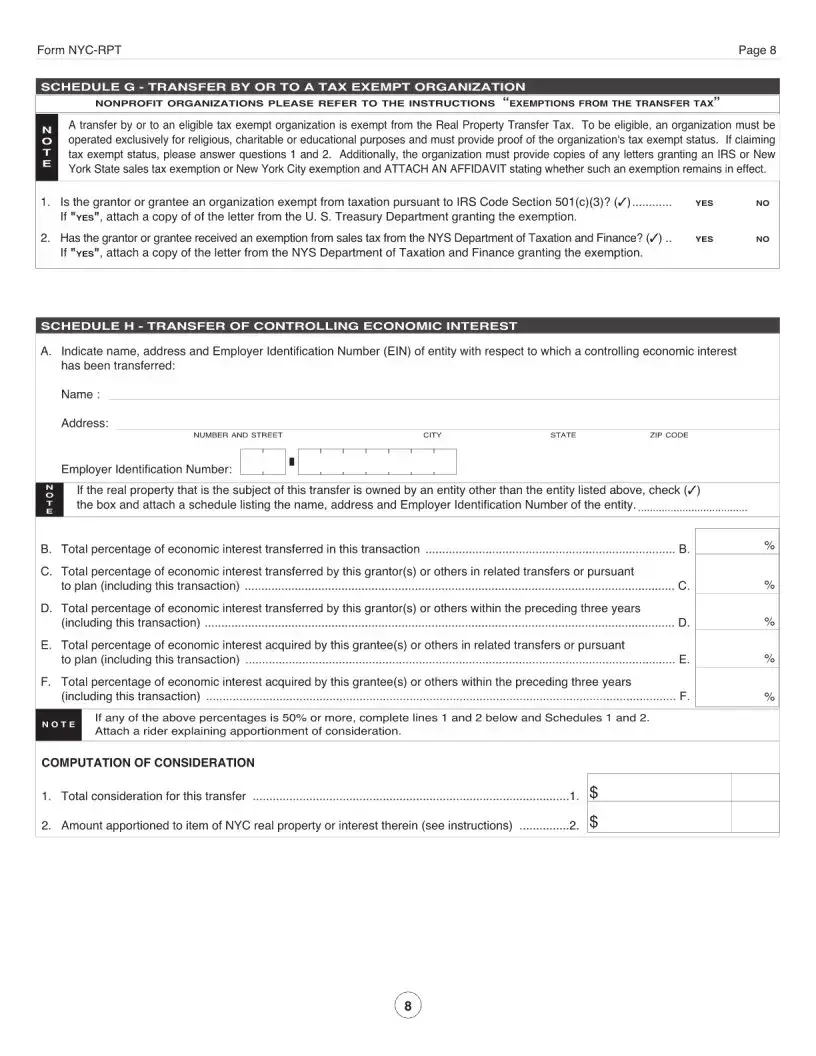

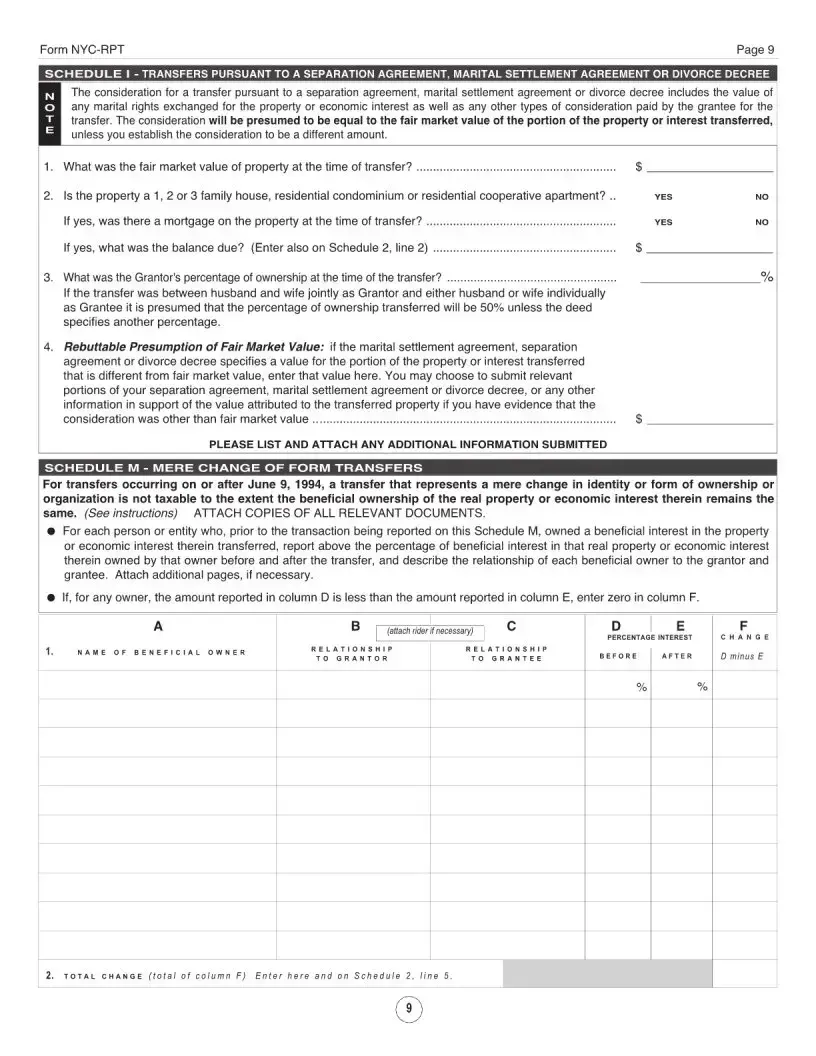

Are there any exemptions to the transfer tax?

Yes, there are certain situations in which the transfer of real property is exempt from the real property transfer tax. These exemptions can vary widely but often include transfers to government entities, certain non-profit transfers, and the transfer of property between family members under specific conditions. Given the complexity of tax law, it's advisable to consult with a professional to determine if your property transfer qualifies for an exemption.

-

What happens if I don’t file the NYC RPT form on time?

Failing to file the NYC RPT form in a timely manner can result in penalties, including fines and interest on the unpaid tax amount. The severity of these consequences can escalate the longer the form goes unfiled. It's important to prioritize the filing of the NYC RPT as soon as possible after the transfer of property to avoid these additional costs.

Common mistakes

Filling out forms, particularly for government-related processes, requires attention to detail and an understanding of what's being asked. When it comes to filling out the NYC RPT form, a document necessary for recording property transactions in New York City, people often make mistakes that can delay or even complicate the process. By being aware of these common errors, filers can enhance the accuracy and efficiency of their submissions.

Here are six mistakes frequently made on the NYC RPT form:

- Incorrect or incomplete property information: One of the most common mistakes is not providing the full and accurate details of the property involved in the transaction. This includes incorrect block and lot numbers, which are critical for identifying the property within the city's records.

- Failing to attach necessary documents: The RPT form requires certain documents to be attached for the transaction to be properly recorded. These include deeds, contracts, and other legal documents relevant to the property transfer. Failure to include these can result in the rejection of the submission.

- Not filling out the buyer’s and seller’s information correctly: Both parties' details must be accurately recorded, including names, addresses, and identification numbers. Mistakes or incomplete information in this section can lead to issues with the property’s legal standing.

- Overlooking the declaration of the sale price: The actual sale price of the property, or its fair market value if the property is not sold in an arm's length transaction, must be declared. Sometimes people either forget to include this information or report it inaccurately, which could have tax implications.

- Incorrect calculation of taxes or fees: The NYC RPT form requires the calculation of taxes or fees based on the transaction. Errors in this calculation can not only delay the process but also result in penalties or additional charges being levied against the involved parties.

- Not reviewing the form for errors before submission: Lastly, a simple yet critical mistake is not thoroughly checking the form for errors or omissions before submitting it. This step can catch and correct many of the mistakes mentioned above, thereby smoothing the processing of the form.

When submitting the NYC RPT form, individuals should take care to:

- Gather all necessary documentation before starting the form.

- Double-check all entered information for accuracy.

- Ensure all calculations, particularly those related to financial aspects, are correct.

- Review the entire form and attached documents to confirm that no required details have been missed.

By avoiding these common errors, filers can ensure a more efficient and error-free submission process, facilitating a smoother transaction recording experience.

Documents used along the form

When dealing with the NYC RPT form, which is essential for documenting real estate transactions in New York City, it's often just one piece of the puzzle. To complete a real estate transaction or to ensure compliance with local regulations, several other forms and documents may be required. Understanding these additional documents can make the process smoother and help ensure that all legal bases are covered.

- Title Insurance Policy: This document provides protection to property buyers and mortgage lenders against losses resulting from disputes over the title of a property. It is crucial for verifying the clear transfer of ownership and for protecting against any claims or liens against the property.

- Certificate of Occupancy: This certificate is required for any new building or after certain types of renovations to ensure that the property complies with all building codes and zoning laws. It confirms the legal use of the property and that it is safe for occupancy.

- Property Deed: The property deed is the official document that transfers ownership of the property from the seller to the buyer. It includes a description of the property, the names of the old and new owners, and is recorded with the county clerk or land registry office.

- Mortgage Agreement: For buyers not paying the full price upfront, a mortgage agreement outlines the terms of the loan used to purchase the property, including the loan amount, interest rate, repayment schedule, and the rights and responsibilities of both the lender and borrower.

- Property Tax Bill: This bill details the annual property taxes assessed by local governments. Property owners or those considering purchasing a property should review this to understand the tax obligations associated with the property.

- Building Plans: For transactions involving new constructions or substantial renovations, detailed building plans approved by the city's building department are essential. These plans verify that the construction complies with local building codes and zoning regulations.

Knowing which documents need to accompany the NYC RPT form, and understanding the purpose of each, can significantly streamline the process of buying or selling property in New York City. Ensuring that all the necessary paperwork is in order helps to avoid delays and ensures compliance with all local laws and regulations.

Similar forms

The NYC RPT form, or Real Property Transfer Form, shares similarities with the HUD-1 Settlement Statement. Both documents are integral in real estate transactions, providing detailed financial information. The HUD-1 Settlement Statement, used primarily in closing residential real estate deals, itemizes all charges imposed on borrowers and sellers during the transaction. Like the NYC RPT form, it ensures transparency and allows parties to review their financial obligations and credits during the property transfer process.

Similar to the NYC RPT form, the Warranty Deed is another important document in the conveyance of real estate. The Warranty Deed guarantees that the seller holds clear title to a property and has the right to sell it, free from any liens or encumbrances. This document parallels the NYC RPT form in its role of certifying the legal transfer of property ownership, although the RPT form is more focused on the tax implications of the transfer rather than the conveyance of clear title.

The Grant Deed is another document related to the NYC RPT form. While the Grant Deed transfers ownership and guarantees that the property has not been sold to someone else, it does not necessarily guarantee that the property is free of all encumbrances. Like the NYC RPT form, a Grant Deed is an essential part of property transactions, ensuring the legal transfer of the title. However, the RPT form's unique aspect is its emphasis on recording the transfer for taxation purposes.

Lastly, the 1099-S form is similar to the NYC RPT form in the context of reporting real estate transactions to the government, specifically for tax purposes. The 1099-S form is used to report proceeds from real estate transactions to the IRS, ensuring that all capital gains taxes are accurately collected. The RPT form echoes this purpose on a municipal level, recording the transfer of real property to accurately assess and apply transfer taxes, thereby supporting local fiscal requirements. Both documents serve to formalize the reporting of property transactions, albeit at different governmental levels.

Dos and Don'ts

Filling out the NYC RPT form, a requirement for recording property transactions in New York City, demands attention to detail to ensure accuracy and compliance. Here are some guidelines to help you navigate this process effectively:

- Do review the form instructions carefully before you start. Understanding the requirements can save you from making common mistakes.

- Don't rush through the process. Take your time to fill out each section accurately to avoid errors that could delay the transaction.

- Do double-check all the information you enter against your official documents to ensure there are no discrepancies.

- Don't leave any fields blank that are applicable to your situation. If a section does not apply, indicate with an “N/A” rather than leaving it empty to show that you didn't overlook it.

- Do use a black or blue ink pen if you're filling out the form by hand, as these colors are generally required for official documents.

- Don't make corrections or use white-out on the form. If you make a mistake, it is better to start fresh with a new form to maintain a clean, legible document.

- Do include all required attachments, such as property deeds or proof of identity, as specified in the form instructions.

- Don't forget to sign and date the form where indicated. An unsigned form is incomplete and will not be processed.

- Do keep a copy of the completed form and all attachments for your records. Having a copy can be invaluable if there are questions or issues down the line.

Approaching the NYC RPT form with a methodical attention to detail will help ensure a smoother transaction process and prevent unnecessary delays or complications.

Misconceptions

The NYC RPT form, essential in real estate transactions within New York City, is often misunderstood. Various misconceptions exist regarding its purpose, requirements, and implications. The following list aims to clarify the most common misunderstandings:

- It's only for residential properties: Contrary to widespread belief, the NYC RPT form is requisite for both residential and commercial property transactions. Its applicability spans a wide range of real estate dealings, not limited to residences.

- Filing is optional: Some parties mistakenly think that filing this form is discretionary. However, the submission is mandatory for all eligible real estate transactions within NYC limits. Failure to file can result in penalties and complications in property ownership records.

- It's purely a city tax form: Though it plays a role in assessing transfer taxes, the NYC RPT form's purpose transcends tax collection. It provides essential information on property transactions, serving as a vital record for both tax and property history documentation.

- Personal information is extensively disclosed: Potential filers often worry about the extent of personal information required. In reality, while the form does necessitate details relevant to the transaction, stringent privacy regulations protect this data, limiting its exposure.

- Only sellers need to worry about it: It's a common misconception that only the seller is affected by the requirements of the NYC RPT form. In fact, both buyers and sellers should be aware of and understand the form, as it comprises obligations and information pertinent to both parties.

- Amendments are not permissible: Once filed, some think the document is set in stone. However, amendments can be made to rectify errors or update information on the NYC RPT form, though such corrections must follow specific procedures and might require justification.

- Electronic filing is universally available: While electronic submission is an option, it isn't universally accessible for all transactions. The capability to file electronically depends on the transaction's nature and at times, it may still be necessary to file paper documents.

- It solely benefits the government: Lastly, there's the erroneous idea that the form serves only bureaucratic purposes without benefiting the involved parties. On the contrary, the NYC RPT form ensures transparency in transactions, aids in the accurate recording of property histories, and contributes to the clear transfer of ownership, providing security and clarity for all parties involved.

Understanding the NYC RPT form thoroughly dispels misconceptions and prepares individuals better for real estate transactions within New York City. It's vital for buyers, sellers, and professionals in the real estate industry to acquaint themselves with the form's requirements and significance.

Key takeaways

The NYC RPT form, crucial for reporting real property transfers within New York City, requires careful attention to detail. Below are key takeaways to ensure its accurate completion and use:

- Understanding the form's purpose is crucial, as it's used to report real property transactions to the New York City Department of Finance. This includes sales, exchanges, and transfers of real property.

- Ensuring accurateness in reporting the sale price, as this directly influences the calculation of real property transfer taxes. This requires a truthful disclosure of the full transaction value.

- Identifying all parties correctly is essential. This includes full legal names of buyers, sellers, and representatives, if applicable, to avoid processing delays or legal complications.

- Familiarizing oneself with the specific sections that must be completed, depending on the transaction type. The form has different requirements for residential, commercial, and mixed-use properties.

- Attaching required documentation, such as the deed or transfer document, proof of payment for the transfer tax, and any applicable exemption documents. This supports the details entered on the form.

- Calculating and remitting the correct amount of Real Property Transfer Tax (RPTT). This tax is based on the property's sale price or consideration, with rates varying based on the property type and sale price.

- Seeking professional advice if there are complications or uncertainties about how to report certain aspects of the transaction. Legal or tax professionals can provide guidance tailored to the specific situation.

- Paying attention to deadlines for filing is vital. Late submissions can result in penalties and interest charges, adding unnecessary costs to the transaction.

- Checking for any updates to the form or related laws since both can change. Staying informed about current requirements helps ensure compliance.

- Using the online submission option if available, as it can streamline the process and provide immediate acknowledgment of receipt, reducing the risk of delays or loss of documentation.

By thoroughly understanding and following these guidelines, individuals and professionals can navigate the complexities of the NYC RPT form more effectively, ensuring that real property transactions are recorded accurately and in compliance with local regulations.

Common PDF Documents

Broker Dealer Registration Requirements - Crucially, businesses must disclose any changes in status or updates to the information provided within 30 days, ensuring current data for regulatory oversight.

Dissolution of Llc - Facilitates a formal cessation of operations, recognizing the significance of accurately documenting such decisions.