Free Nyc Rp 602C Form in PDF

In navigating the complexities of real estate and property tax matters within New York City, individuals and professionals alike may find themselves encountering the NYC RP-602C form. This pivotal document serves a crucial role in the landscape of property-related procedures, acting as a necessary tool for the correction of property taxes or the application for certain tax benefits. Its importance cannot be understated, as it allows property owners to ensure their tax assessments reflect accurate information, potentially leading to significant financial adjustments. As the city's regulations and policies governing property taxes continue to evolve, understanding the intricacies of the NYC RP-602C form becomes indispensable. This form not only facilitates a smoother interaction with municipal tax authorities but also empowers property owners with the knowledge and means to advocate for their rights within the legal framework of New York City's tax system.

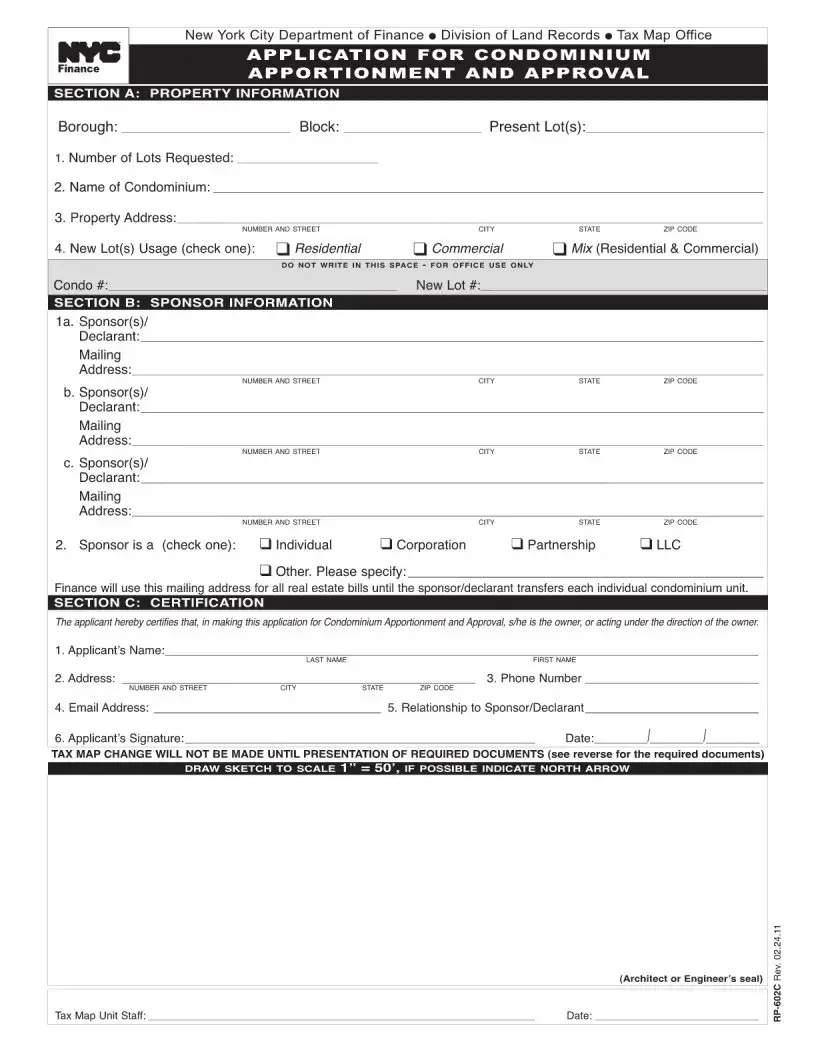

Nyc Rp 602C Sample

File Overview

| Fact | Detail |

|---|---|

| 1. Form Name | Nyc Rp 602C Form |

| 2. Purpose | Used for reporting and certifying real property and cooperative unit addresses in New York City. |

| 3. Governing Law | New York State Real Property Tax Law |

| 4. Users | Property owners and managers in New York City. |

| 5. When to File | Annually, by a specified deadline as required by the Department of Finance. |

| 6. Where to File | Filed with the New York City Department of Finance. |

| 7. Availability | Available on the New York City Department of Finance website or at its offices. |

| 8. Submission Method | Can be submitted online, via mail, or in person. | #9: Eligibility

| 9. Eligibility | Must be an owner or manager of real property or a cooperative unit within New York City. |

| 10. Important Sections | Includes sections for property identification, owner or managing agent information, and certification by the owner/agent. |

Nyc Rp 602C: Usage Guidelines

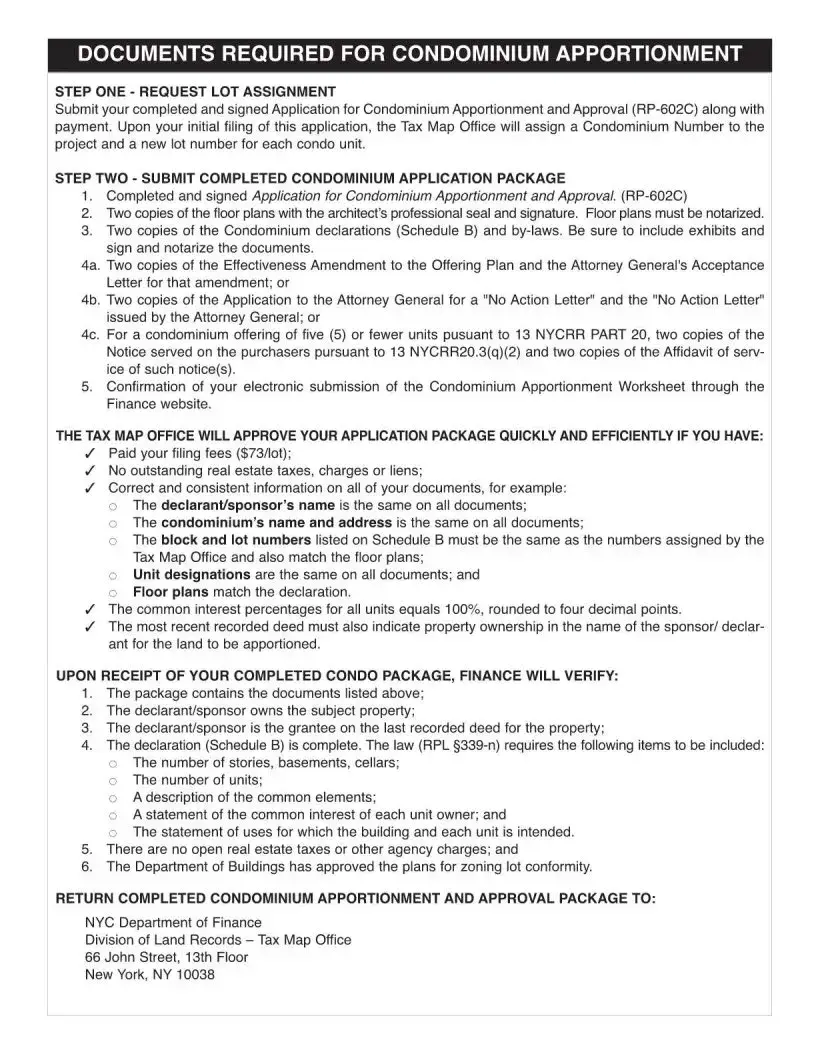

Filling out the NYC RP-602C form is a crucial step for individuals seeking certain property-related benefits in New York City. This procedure, while straightforward, requires attention to detail to ensure all provided information is accurate and complete. Doing so ensures that the application process progresses smoothly, minimizing delays. Once this form is correctly filled out and submitted, it will be reviewed by the appropriate city department, which will then determine eligibility for the sought-after benefits. It is vital for individuals to follow each step carefully to avoid common mistakes that can lead to unnecessary complications.

- Begin by entering the current date in the specified format at the top of the form.

- In the section labeled "Applicant Information," fill in your full name (last, first, middle initial), ensuring it matches the name on your property deed.

- Provide your complete property address in the "Property Information" section. This includes the street address, borough, block, lot, and any apartment or unit number.

- Answer the ownership and residency questions in the following section. Check the appropriate box to indicate whether you own the property and if it is your primary residence.

- Under "Contact Information," list your primary phone number, an alternate phone number if available, and your email address. Ensure these are current as they will be used for any necessary communication regarding your application.

- For the section on property designation, indicate the type of property (e.g., single-family home, condominium, cooperative apartment) by checking the appropriate box.

- If applicable, complete the area concerning co-op or condo management company details, including the company name, address, and contact information.

- Review the form for accuracy. Before signing, double-check all entered information for completeness and correctness. This includes verifying the accuracy of dates, names, property details, and contact information.

- Sign and date the form in the designated area at the bottom of the page. If you are completing this form on behalf of a corporation or partnership, include your title or position next to your signature.

- Prepare any required supporting documentation specified in the form instructions. This may include proof of residence, ownership documents, or other legal forms that verify the information provided in your application.

- Submit the completed form and all supporting documents to the address provided in the form instructions. Ensure that your submission meets any specified deadlines to retain eligibility for the benefits.

Upon submission, the form undergoes a review process, whereby the information provided is verified and assessed for eligibility. Applicants should be prepared for possible follow-up inquiries or requests for additional information. Timely and responsive communication during this review phase is essential for a favorable outcome. Successfully navigating this process is the first step toward securing the benefits associated with the NYC RP-602C form.

FAQ

-

What is the NYC RP-602C Form?

The NYC RP-602C form is a document used in New York City for property owners who wish to apply for certain tax benefits related to co-op or condominium abatements. This form plays a crucial role in ensuring homeowners receive the tax reductions they are eligible for, which can significantly impact their annual tax obligations. The form requires detailed information about the property and its ownership to verify eligibility for the abatement.

-

Who needs to fill out the NYC RP-602C Form?

Typically, this form must be filled out by co-op boards or managing agents on behalf of the co-op or condominium. However, individual co-op or condominium unit owners may also need to submit this form if directed by their co-op board or managing agent, especially in situations where specific information about the unit is required that only the homeowner can provide.

- - Co-op Boards or Managing Agents

- - Individual Co-op or Condominium Owners

The following parties might need to complete the form:

-

What kind of information do you need to provide in the NYC RP-602C Form?

Filling out the NYC RP-602C form requires detailed and accurate information regarding the property and ownership. Key pieces of information include the block and lot number of the property, the total number of units, the names and addresses of all owners, and specific details about the unit for which the abatement is sought. Additionally, the form may ask for financial information related to the property to ensure proper calculation of eligible benefits.