Free Nyc Payroll Form in PDF

The New York City Payroll Form serves as a pivotal tool in maintaining transparent and efficient payroll practices for contractors and subcontractors within construction projects. Offered by the Department of Labor Bureau of Public Work, its usage is optional yet fulfills crucial payroll notification requirements. The form records comprehensive details including the contractor's name, subcontractor information, project location, and employee data such as names, addresses, social security numbers, and withholding status. Additionally, it categorizes employees' work classification along with tracking daily and total hours worked, rates of pay, gross earnings, deductions, and net wages paid for the week. Also noteworthy is the certification section, which the contractor or subcontractor must complete, attesting to the accuracy of the payroll, compliance with applicable wage rates, proper classification of labor, and the legitimacy of apprenticeship programs. The form also distinguishes between fringe benefits paid directly to employees or to approved plans, funds, or programs, ensuring all financial compensations are adequately reported. Strict warnings against the willful falsification of information underscore the form's role in safeguarding the integrity of labor practices and the potential legal repercussions for misconduct. By encapsulating a vast array of payroll elements, this form plays a key role in promoting fair labor standards and ensuring workers on public work projects are compensated in accordance with state and federal regulations.

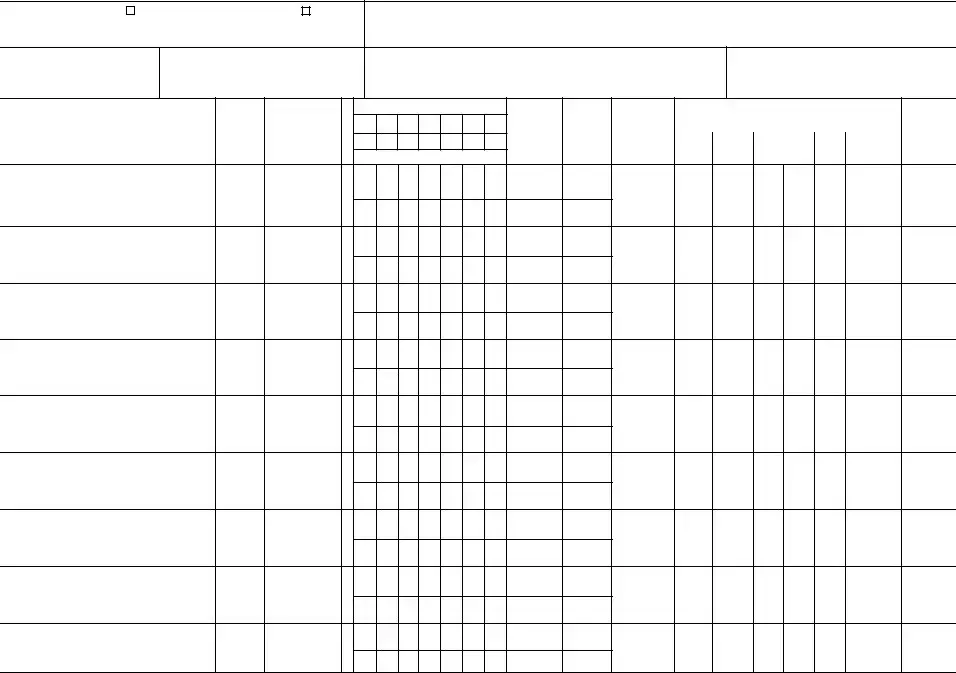

Nyc Payroll Sample

Department of Labor Bureau of Public Work

WEEKLY PAYROLL

For Contractor's Optional Use. The use of this form meets payroll notification requirements; as stated on the Payroll Records Notification.

NAME OF CONTRACTOR

SUBCONTRACTOR

ADDRESS

FEIN

FOR WEEK ENDING

PROJECT AND LOCATION

PROJECT OR CONTRACTOR NO.

(1)

NAME, ADDRESS, AND

LAST 4 DIGITS OF SOCIAL SECURITY NUMBER

OF EMPLOYEE

(2)

NO. OF

WITH-

HOLDINGS

(3)

WORK

CLASSIFICATION

ST

or

OT

4) DAY AND DATE

HOURS WORKED EACH DAY

(5)

TOTAL

HOURS

(6)

RATE

OF

PAY

(7) GROSS

AMOUNT

EARNED

(a)

|

|

DEDUCTIONS |

|

|

|

|

|

|

WITH- |

|

TOTAL |

|

HOLDING |

|

|

|

|

|

|

FICA |

Tax |

|

OTHER DEDUCTIONS |

|

|

||

(9)

NET WAGES

PAID

FOR WEEK

S

0

S

0

S

0

S

0

S

0

S

0

S

0

S

0

S

0

PW

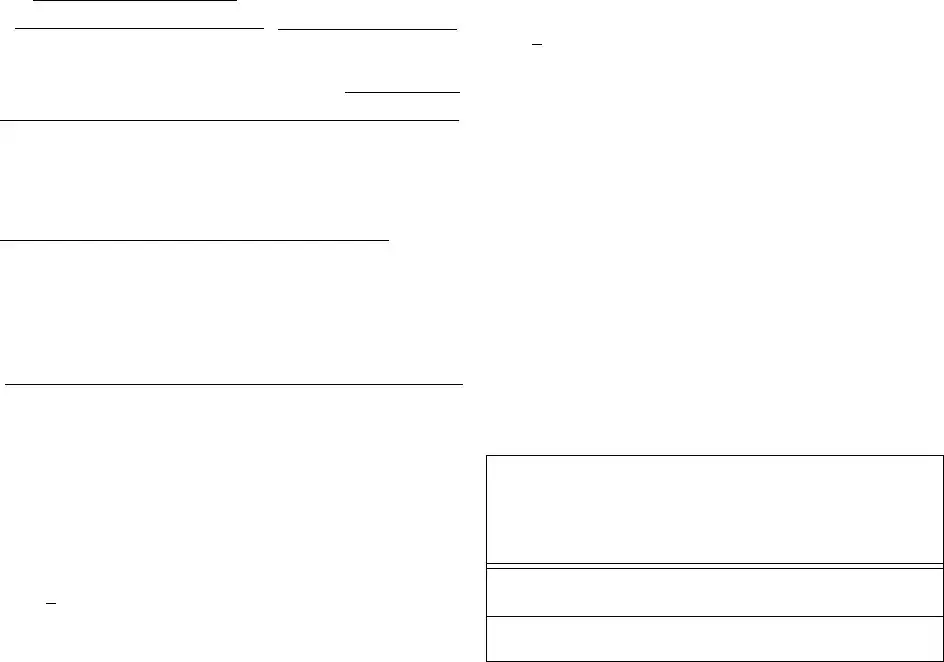

THIS CERTIFICATION MUST BE COMPLETED ON EACH WEEKLY PAYROLL FORM USED BY THE CONTRACTOR OR SUBCONTRACTOR

Date

I

(Name of signatory party) |

(Title) |

do hereby state:

(1) That I pay or supervise the payment of the persons employed by

|

|

|

(Contractor or Subcontractor) |

|

|

|

|

|

|

|

|

, that during the payroll period commencing on the |

|

||||

day of |

|

, 20 , and ending the |

|

day of |

|

|

20 |

|

all persons employed on said project have been paid the full weekly wages earned, that no rebates have been or will be made either directly or indirectly to or on behalf of said

from the full

(Contractor or Subcontractor)

weekly wages earned by any person and that no deductions have been made either directly or indirectly from the full wages earned by any person, other than permissible deductions as defined in Articles 8 and 9 and described below:

(2)That any payrolls submitted for the above period are correct and complete; that the wage rates for laborers, workers, or mechanics contained therein are not less than the applicable wage rates contained in any wage determination incorporated into the contract; that the classifications set forth therein for each laborer, worker or mechanic conform with the work he/she performed.

(3)That any apprentices employed in the above period are duly registered in a bona fide apprenticeship program registered with a State apprenticeship agency recognized by the Bureau of Apprenticeship and Training, United States Department of Labor, or if no such recognized agency exists in a State, are registered with the Bureau of Apprenticeship and Training, United States Department of Labor.

(4)That:

(a) WHERE FRINGE BENEFITS ARE PAID TO APPROVED PLANS, FUNDS, OR PROGRAMS

- In addition to the basic hourly wage rates paid to each laborer, worker or mechanic listed in the above referenced payroll, payments of fringe benefits as listed in the contract have been or will be made to appropriate programs for the

- In addition to the basic hourly wage rates paid to each laborer, worker or mechanic listed in the above referenced payroll, payments of fringe benefits as listed in the contract have been or will be made to appropriate programs for the

benefit of such employees, except as noted in Section 4(c).

(b) WHERE FRINGE BENEFITS ARE PAID IN CASH

- Each laborer, worker, or mechanic listed in the

- Each laborer, worker, or mechanic listed in the

(c) EXCEPTIONS

EXCEPTION (CRAFT) |

EXPLANATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

REMARKS:

SIGNATURE

THE WILLFUL FALSIFICATION OF ANY Of THE ABOVE STATEMENTS MAY SUBJECT THE CONTRACTOR OR SUBCONTRACTOR

TO CIVIL OR CRIMINAL PROSECUTION. SEE ARTICLES 8 AND 9.

File Overview

| Fact | Description |

|---|---|

| Form Use | For Contractor's Optional Use, fulfilling payroll notification requirements. |

| Governing Body | Department of Labor Bureau of Public Work. |

| Contents Required | Contractor/Subcontractor information, employee details including SSN and wages, deductions, and net wages paid. |

| Governing Law(s) | Subject to Articles 8 and 9 which define permissible deductions among other regulations. |

| Additional Obligations | Certification by contractor/subcontractor confirming compliance with wage payment and classification correctness. |

| Apprenticeship Clause | Any apprentices must be registered with a recognized apprenticeship program. |

| Penalties for Falsification | Willful falsification of the payroll form may lead to civil or criminal prosecution. |

Nyc Payroll: Usage Guidelines

Filling out the NYC Payroll form is a straightforward process that ensures compliance with payroll notification requirements as mandated by the Department of Labor Bureau of Public Work. It's an important tool for contractors or subcontractors to clearly record weekly wages, deductions, and net wages paid to their employees. By accurately completing this form, companies can maintain transparency and adherence to labor laws concerning wage payments. Let's walk through the process step-by-step.

- Start by entering the NAME OF CONTRACTOR or SUBCONTRACTOR at the top of the form, followed by the ADDRESS and the Federal Employer Identification Number (FEIN).

- Fill in the FOR WEEK ENDING section with the ending date of the specific week for which the payroll is being recorded.

- Under PROJECT AND LOCATION, provide details of the project and its location, followed by the PROJECT OR CONTRACTOR NO. if applicable.

- For each employee, list their NAME, ADDRESS, AND LAST 4 DIGITS OF SOCIAL SECURITY NUMBER in the designated area (1).

- Enter the NO. OF WITHHOLDINGS for each employee in area (2).

- Specify the WORK CLASSIFICATION (ST for Straight Time or OT for Overtime) for each worker in area (3).

- Record the DAY AND DATE, HOURS WORKED EACH DAY, and TOTAL HOURS for the week in the corresponding fields (4, 5, 6).

- Fill in the RATE OF PAY and GROSS AMOUNT EARNED for each employee (7).

- Document all applicable DEDUCTIONS including withholding, FICA Tax, and any other deductions, then calculate the NET WAGES PAID for the week (9).

- Complete the certification at the bottom of the form, stating your name and title. Verify that all employees have been paid their full weekly wages, mention any payroll exceptions, and sign the declaration to confirm the truthfulness and accuracy of the information provided.

After filling out the form meticulously, ensure to review all the information for accuracy and completeness. This step is crucial to avoid potential errors or discrepancies. Once completed, the form should be kept on file for record-keeping and compliance purposes. It's also essential to be prepared to submit this documentation to the Department of Labor Bureau of Public Work or other authorities when requested. Filling out the NYC Payroll form accurately helps protect both the employer and employees, ensuring that labor rights are respected and upheld.

FAQ

-

What is the purpose of the NYC Payroll form?

The NYC Payroll form, designed by the Department of Labor Bureau of Public Work, serves a dual purpose. First, it facilitates contractors and subcontractors in systematically recording weekly wages paid to their employees. This includes detailed information such as employee names, social security numbers (last 4 digits), classifications, hours worked, and earnings. Second, it ensures compliance with payroll notification requirements as stated on the Payroll Records Notification. By using this form, employers can verify that they have paid their employees the full wages earned for the week, including any applicable fringe benefits or deductions as per legal standards.

-

Are there any specific details I need to include about my employees on the form?

Yes, the form requires detailed information about each employee for the payroll period. This includes the employee's name, address, the last four digits of their social security number, number of withholdings, work classification (standard or overtime), days and dates of work, total hours worked, rate of pay, gross amount earned, deductions (including withholding and FICA tax), and net wages paid for the week. This comprehensive data collection ensures accurate record-keeping for both wage payment and compliance purposes.

-

How does the certification process work on the form?

At the end of the NYC Payroll form, there is a certification section that must be completed by the contractor or subcontractor responsible for payment. The person completing the form must state their name and title, certifying that all employees have been paid their full weekly wages without any unlawful deductions or rebates. They must also confirm that the wage rates are not less than the applicable wage rates detailed in any wage determination part of the contract, and that the work classifications accurately reflect the work performed. Additionally, any apprentices must be registered in a recognized apprenticeship program. The certification ensures accountability and compliance with labor laws.

-

What are the consequences of falsifying information on this form?

The form sternly warns that the willful falsification of any statements within can subject the contractor or subcontractor to civil or criminal prosecution under Articles 8 and 9. This highlights the importance of accurate and truthful reporting on the payroll form, ensuring transparency and adherence to labor standards. Falsifying information undermines labor laws and can lead to significant legal penalties, reinforcing the form's role in promoting fair labor practices.

Common mistakes

Completing the New York City Payroll form accurately is vital for compliance with Department of Labor regulations. Despite this importance, common mistakes are frequently made, which can lead to significant issues for both the employee and the employer. Understanding these errors is the first step toward avoiding them.

One of the most prevalent errors occurs with the employee identification information. When filling out the form, it's crucial to include the correct name, address, and the last four digits of the employee’s Social Security Number. Mistakes in this area can lead to payroll discrepancies and problems with employee identification within governmental records.

Another common issue lies in accurately reporting hours worked and pay rate. Each day's hours, along with the total hours for the week, must be meticulously recorded to ensure employees are compensated correctly. This includes distinguishing between standard (ST) and overtime (OT) hours. Furthermore, correctly entering the rate of pay is critical, as this affects the calculation of gross wages. Overlooking these details can result in incorrect payments and potential disputes.

- Incorrect Employee Identification Information

- Inaccurate Hours Worked and Pay Rate Reporting

- Failure to Properly Document Deductions

- Omitting or Misreporting Fringe Benefits

The third area where errors often occur is in documenting deductions. The form requires a detailed listing of deductions, including withholding taxes and FICA, among others. Failing to accurately report these deductions can affect an employee's net wages and lead to complications with tax liabilities.

Last but certainly not least, is the mistake of either omitting or misreporting fringe benefits. The form allows for the indication of fringe benefits paid to plans, funds, or programs, or in cash directly to the employees. It's essential to correctly document this section to fulfill contractual and regulatory obligations regarding employee benefits. Through careful attention to these details, employers can ensure their payroll processes are compliant and accurate, avoiding potential legal and financial pitfalls.

- Ensure employee identification information is correct and complete.

- Accurately record all hours worked, distinguishing between standard and overtime hours, and properly enter the rate of pay.

- Document all deductions meticulously to correctly calculate net wages.

- Do not omit or misreport any fringe benefits provided to employees.