Free Nyc Ext 1 Form in PDF

In navigating the complexities of tax compliance and extensions within New York City, individuals and businesses alike turn to the NYC EXT 1 form for relief. This pivotal document plays a crucial role in seeking additional time to file one's taxes, laying out a process that, while straightforward on the surface, requires keen attention to guidelines and deadlines. Intended for use within the vibrant and bustling business environment of NYC, the form offers a lifeline to those who find themselves unable to meet the standard filing deadline. It acts not just as a request for extension but also stands as a testament to the city's understanding of the unpredictable nature of business and personal affairs. By providing essential details about how to properly fill out and submit the form, applicable deadlines, and the implications of its usage, entities can ensure they take full advantage of the extended timeframe without falling foul of regulations. Moreover, this extension doesn’t apply to the payment of taxes, emphasizing the importance of understanding the distinction between filing an extension and postponing tax payments. Through this form, New York City offers a manageable way for taxpayers to navigate through their fiscal responsibilities, ensuring that every individual and business has the opportunity to comply with tax laws without unnecessary hardship.

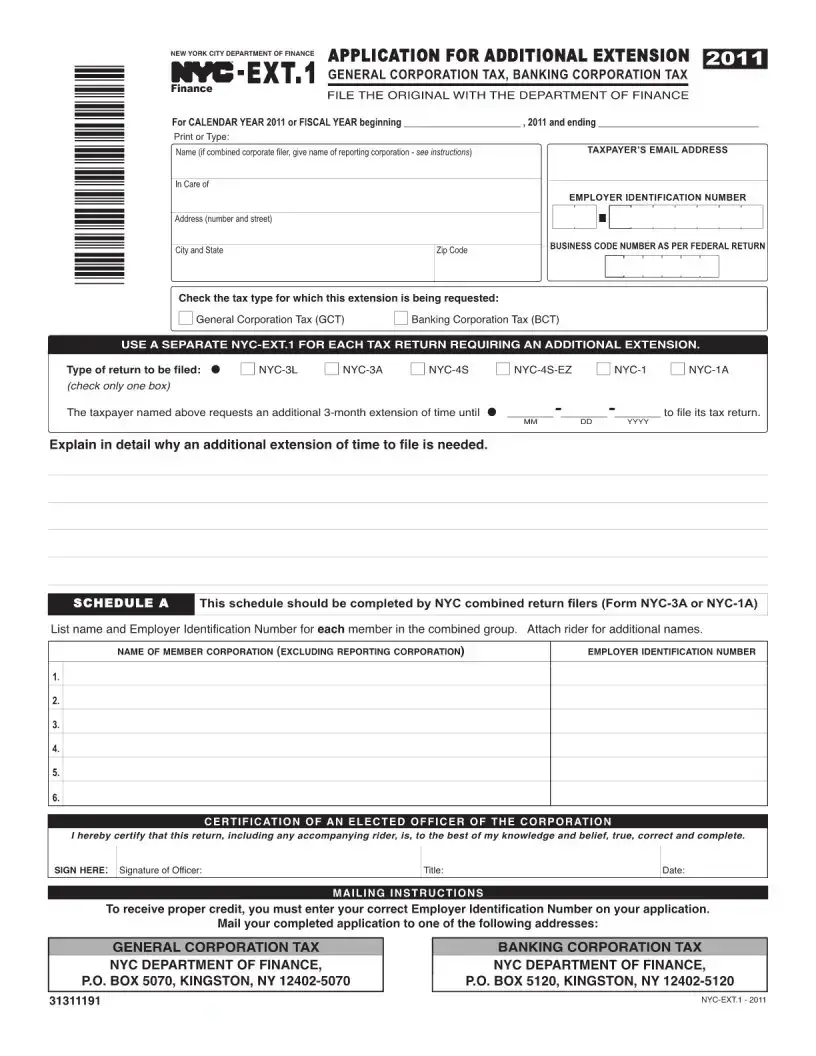

Nyc Ext 1 Sample

File Overview

| Fact Name | Description |

|---|---|

| 1. Purpose | The NYC EXT 1 form is used to request an extension of time to file a New York City tax return. |

| 2. Filing Requirement | This form is necessary for taxpayers who cannot file their city tax return by the due date. |

| 3. Governing Law | This form is governed by New York City's administrative codes and tax laws. |

| 4. Eligibility | Both individuals and businesses in New York City may use this form if they meet the requirements for an extension. |

| 5. Due Date | The completed form must be filed by the original due date of the tax return for which an extension is being requested. |

| 6. Extension Period | Filing this form grants an additional six months to file the New York City tax return. |

| 7. Payment with Submission | Applicants must pay any estimated taxes due by the original filing deadline when submitting this form. |

| 8. Electronic Filing | The NYC EXT 1 form can be filed electronically, which is encouraged for faster processing. |

| 9. Penalties for Late Filing | Failure to file the extension form or pay estimated taxes by the deadline can result in penalties. |

| 10. Availability | This form is available through the official website of the New York City Department of Finance. |

Nyc Ext 1: Usage Guidelines

The NYC EXT 1 form is an essential document for those who need more time to file a specific tax return in New York City. Before starting, make sure you have all the necessary information, such as your tax identification number and details about the tax year for which you are requesting an extension. Although this may seem like a daunting task, following these simple steps will help ensure your form is completed accurately and promptly.

- Start by entering your Full Legal Name at the top of the form, ensuring that it matches the name on your tax return.

- Next, fill in your Current Address, including the city, state, and ZIP code, to ensure any correspondence can reach you without delay.

- Provide your Social Security Number (SSN) or Employer Identification Number (EIN) in the designated space. This is crucial for identifying your tax records.

- Indicate the tax year for which you're requesting an extension in the space provided. This helps clarify the period the extension covers.

- If you are filing for an individual extension, check the appropriate box to indicate this. If the extension is for a business, make sure to check the corresponding box.

- Calculate and enter any estimated tax payments you've made for the tax year. This information is necessary for processing your extension request accurately.

- Sign and date the form at the bottom. This verifies that the information provided is accurate and complete to the best of your knowledge.

- Review the entire form to ensure all information is correct and no sections have been accidentally overlooked.

- Lastly, submit the form to the designated address or through the appropriate electronic filing system as per the instructions provided by NYC's tax authority.

By following these steps carefully, you can fill out the NYC EXT 1 form correctly, providing you with the extra time needed to gather all required information and documents to complete your tax return accurately and without rush.

FAQ

-

What is the NYC EXT 1 form?

The NYC EXT 1 form is an application for an extension of time to file a New York City tax return. It's used by taxpayers who need more time to prepare their city tax return beyond the original due date. This form does not extend the time to pay any taxes due.

-

Who is required to file the NYC EXT 1 form?

Any taxpayer, either individual or business, registered in New York City and unable to file their annual tax return by the due date is required to file the NYC EXT 1 form to avoid penalties by getting an extension of the filing deadline.

-

How does filing an NYC EXT 1 form affect tax payments?

Filing an NYC EXT 1 form only extends the time to file the return and does not grant additional time to pay taxes due. Taxpayers are required to estimate and pay any owed taxes by the original due date to avoid interest and penalties.

-

What is the deadline for filing the NYC EXT 1 form?

The deadline to file the NYC EXT 1 form is on or before the original due date of the New York City tax return. For most individuals, this would typically be April 15th, but dates may vary depending on tax year and specific circumstances.

-

Can the NYC EXT 1 form be filed electronically?

Yes, the NYC EXT 1 form can often be filed electronically through authorized e-filing providers or the official New York City tax website, depending on the specific requirements and available services for the tax year in question.

-

What information is needed to complete the NYC EXT 1 form?

To complete the NYC EXT 1 form, taxpayers will need their personal or business identification information, tax period for the extension, and an estimate of the tax due, if any. Additional details may be required based on the specific tax situation.

-

How long does the extension last?

The duration of the extension granted by filing an NYC EXT 1 form typically lasts six months from the original filing due date. However, specific terms may vary, so it's important to check the current year's guidelines.

-

Are there penalties for filing the NYC EXT 1 form late?

If the NYC EXT 1 form is not filed by the original due date, penalties may be applied for late filing of the tax return. These penalties are in addition to any interest and penalties on unpaid taxes owed by the original due date.

-

How can I check the status of my extension request?

After filing the NYC EXT 1 form, the status of the extension request can typically be checked online through the New York City tax website or by contacting the New York City Department of Finance directly. Verification may require the taxpayer's identification information and details about the extension request.

Common mistakes

Filling out government paperwork can often feel like navigating through a dense forest without a map. The NYC EXT 1 form, a critical document for those engaging with certain city-level extensions, is no exception. With its importance in various processes, filling it out correctly the first time around saves a lot of time and headaches later. Let's talk about some common slip-ups people make when completing this form.

One of the most frequent mistakes is not double-checking the form for the current year. Forms get updated, and using an outdated version can lead to an immediate rejection. Always ensure you're working with the most recent iteration by visiting the official website.

Another common error is incomplete fields. Every section of the NYC EXT 1 is important. Leaving a field blank might seem harmless, but it can lead to delays. If a question doesn’t apply, it’s much safer to write "N/A" than to leave it empty.

Incorrect information is a critical but common error. Whether it's a transposed number in an address or a misspelled name, these mistakes can misdirect correspondence or invalidate the form. Always proofread before submitting.

Failure to sign the form is an easy but significant oversight. An unsigned form is like an unread book – it simply won’t be processed. Make sure to sign in the designated area.

Skipping the date when the form was filled out might seem minor but is indeed crucial. The date provides a timeline for processing and needs to be accurate.

While errors can slow down the process, some omissions or mistakes can lead to more significant issues:

Not attaching necessary documents is a common misstep that can stall or derail the entire process. Always check for a list of required attachments before sending off your form.

Choosing the wrong filing status can lead to incorrect processing of the form. This decision can have ripple effects, so review the guidelines meticulously to ensure accurate selection.

Forgetting to check the box for any applicable exemptions not only could result in missing out on potential benefits but also could flag your submission for further review, delaying the process.

Using unclear handwriting might seem trivial, but if your form is being processed manually, illegibility can lead to misinterpretation or requests for clarification, slowing down your application.

In essence, filling out the NYC EXT 1 form requires attention to detail, patience, and a careful review before submission. Mistakes can be barriers to smooth processing but knowing what to look out for can mitigate these risks. A final look over your form for completeness, correctness, and clarity can make a significant difference. And remember, when in doubt, consulting with a professional for advice never hurts.

Documents used along the form

When applying for an extension of time to file a personal income tax return in New York City using the NYC EXT 1 form, individuals might need to prepare and submit additional documents. These documents ensure that the application is comprehensive and increases the likelihood of approval. Here is a list of forms and documents often used alongside the NYC EXT 1 form.

- Form IT-201: This is the Resident Income Tax Return form for New York State. It is necessary for determining your state income tax liability, which is crucial for the NYC EXT 1 form since the extension might affect your state tax filings.

- Form IT-203: Non-resident and Part-Year Resident Income Tax Return form is required if you're not a full-year resident of New York State but need to file taxes for income earned during the portion of the year you were a resident.

- Form W-2: This is the Wage and Tax Statement provided by your employer, showing the income you earned and the taxes withheld. It is essential for completing your income tax returns accurately.

- Form 1099: This form reports various types of income other than wages, such as freelance income, interest, and dividends. If applicable, it must be submitted along with your extension application to provide a full picture of your income.

- Form IT-370: The Application for Automatic Six-Month Extension of Time to File for Individuals; this is the state counterpart to the NYC EXT 1, needed for extending the deadline for your New York State income tax return.

- Estimated Tax Payment Records: If you have made any estimated tax payments during the year, having a record of these payments is crucial when applying for an extension, as it could impact the calculation of any taxes due or refundable.

- Form IT-2: This form summarizes W-2, 1099, and other Federal forms and is used to report wage and withholding information to New York State. It helps reconcile state and federal tax obligations.

- Proof of Identity: A valid photo ID, such as a driver’s license or passport, may be requested to verify your identity when submitting the NYC EXT 1 form.

Together with the NYC EXT 1 form, these documents form a thorough packet for requesting an extension of time to file your personal income tax return in New York City. Make sure to gather all the necessary paperwork before submitting your application to ensure the process is as smooth as possible. Individuals are encouraged to consult with a tax professional to ensure they meet all requirements and deadlines.

Similar forms

The NYC EXT 1 form is notably similar to the IRS Form 4868, which serves as an application for an automatic extension of time to file U.S. individual income tax returns. Like the NYC EXT 1, which offers New York City residents a grace period for filing their municipal tax returns, Form 4868 provides taxpayers across the nation with up to six additional months to submit their federal income tax documents, without needing to provide a reason for the delay. Both forms are designed to alleviate the pressure of the original filing deadline, though they don't extend the time to pay any taxes owed.

Another document resembling the NYC EXT 1 form is the IRS Form 7004, which is an application for an automatic extension of time to file certain business income tax, information, and other returns. Similar to the NYC EXT 1 that applies to individual residents in New York City, Form 7004 is aimed at businesses that require more time to compile and file their taxes accurately. Both forms are preventive measures against potential penalties for late submissions by providing additional time for filers to ensure their documentation is complete and accurate.

The New York State Form IT-370, Application for Automatic Six-Month Extension of Time to File for Individuals, also mirrors the purpose and functionality of the NYC EXT 1 form. By filling out Form IT-370, New Yorkers can obtain a six-month extension for their state tax return, akin to how the NYC EXT 1 grants additional time for city tax filings. Each form caters to a specific jurisdiction within New York, highlighting the layered tax obligations of residents and the available support structures to meet those obligations without penalty.

Additionally, the Form IT-204-LL, filed by certain limited liability companies, partnerships, and other entities in New York State, shares similarities with the NYC EXT 1 form in its focus on extending filing deadlines. Although IT-204-LL pertains to a specific subset of entities about their annual filing fee, the underlying principle of granting more time to prepare and submit required documents is a common thread. Both IT-204-LL and NYC EXT 1 recognize the complexities of financial and legal obligations, offering a mechanism to address these challenges through extensions.

Dos and Don'ts

When filling out the NYC EXT 1 form, certain practices should be followed to ensure accuracy and compliance. Similarly, avoiding common mistakes can prevent processing delays or the need for corrections. Below is a guide to what individuals should and should not do when completing this form.

Things to Do:

- Read all instructions carefully before beginning to fill out the form. This ensures you understand all requirements and provide the correct information where needed.

- Use black ink if filling out the form by hand. This makes the information easier to read and less likely to be misinterpreted during processing.

- Double-check all entries for accuracy, especially numbers and financial information. Mistakes can lead to processing delays or incorrect assessments.

- Sign and date the form in the designated sections. An unsigned or undated form may be considered incomplete and may not be processed.

Things Not to Do:

- Do not leave any required fields blank. If a section does not apply, it is better to mark it as "N/A" (not applicable) than to leave it empty.

- Avoid using any form of correction fluid or tape. If you need to make changes, it is better to start with a new form to maintain legibility and integrity.

- Do not guess on dates or amounts. If you are unsure, verify the information before entering it on the form to prevent inaccuracies.

- Avoid submitting the form without reviewing it for completeness. Missing information can lead to unnecessary delays in processing your request.

Misconceptions

The NYC EXT 1 form is often required in various transactions in New York City, but there are several misconceptions about its use and requirements. Understanding these misconceptions can help in properly completing and submitting the form.

Only for Businesses: One common misconception is that the NYC EXT 1 form is exclusively for businesses. In reality, this form is applicable to both individuals and businesses that need to request an extension of time for tax filings. It serves a broader audience than many initially believe.

Automatic Approval: Many people mistakenly think that submitting an NYC EXT 1 form guarantees an automatic extension. However, submitting this form is simply a request, and approval is not automatic. The reviewing authority evaluates each request on its own merits.

Extension for Payment: There's a false belief that the NYC EXT 1 form provides an extension for tax payment. The truth is, it only applies to the filing of the return. Taxes owed are still due by the original deadline, and this form does not grant more time to pay taxes without incurring interest or penalties.

One-Time Filing: People often think that filing an NYC EXT 1 form once covers them for future tax periods. Each tax period requires its own extension request. Filing an extension form for one period does not automatically extend future filings.

Online Filing Isn't Possible: A misconception exists that the NYC EXT 1 form can't be filed online. In this era of digital transactions, many forms, including the NYC EXT 1, can be submitted through online platforms provided by the city. This method is often quicker and more efficient than paper submissions.

No Deadline for Filing: Some believe that there is no strict deadline for submitting the NYC EXT 1 form. In fact, there is a specific deadline by which the form must be submitted, typically ahead of the original filing due date. Late submissions might not be accepted, leading to penalties.

Understanding these misconceptions about the NYC EXT 1 form can streamline the filing process and ensure compliance with the required tax regulations in New York City.

Key takeaways

Filling out the NYC EXT 1 form, which pertains to requesting an extension for filing certain tax returns in New York City, requires attention to detail and an understanding of the process. Here are ten key takeaways to guide you through this task effectively and avoid common pitfalls:

- Identify the specific taxes the extension applies to. The NYC EXT 1 form is not universally applicable to all tax forms. Knowing exactly which taxes you're requesting an extension for is crucial.

- Ensure you meet the filing deadline for the extension request. Even though you are asking for more time to file your actual tax return, the extension form itself has a submission deadline that must be adhered to.

- Accurately calculate your tax liability, if applicable. Some extensions require an estimate of the taxes owed for the period. Underestimating your liability could result in penalties and interest.

- Familiarize yourself with the documentary requirements for the extension. Supporting documentation may be necessary depending on your tax situation.

- Understand that filing an extension for your tax return does not grant you an extension for payment. Taxes owed are still due by the original deadline, even if an extension to file is granted.

- Utilize the correct submission method. Some forms may be submitted electronically, while others require mailing. Confirm the accepted submission methods for the NYC EXT 1 to ensure timely receipt by the authorities.

- Keep a copy of the submitted form and any other documents for your records. This documentation will be essential in case of discrepancies or queries from the tax authorities.

- Be aware of the specific provisions for different types of taxes. The rules and requirements for an extension can vary significantly between property taxes, sales taxes, and income taxes, among others.

- Seek professional advice if you are unsure about any aspects of the extension process. Mistakes can be costly and may jeopardize your request for additional filing time.

- Act promptly upon receiving notification about the status of your extension request. If there are any issues or further information is required, responding swiftly can help avoid delays with your tax return submission.

Adhering to these guidelines can help ensure that your request for an extension using the NYC EXT 1 form is processed smoothly and efficiently, giving you the additional time you need without unnecessary stress or complications.

Common PDF Documents

Nyc School Tax Credit - Important tax information provided aims to guide policyholders through potential tax consequences.

City Of Ny Affirmation - It ensures a level of due diligence is conducted, safeguarding public funds from being allocated to entities that might not fulfill their contractual obligations due to financial instability.

Ccd1 - Compulsory for initiating formal discussions regarding variations of the Multiple Dwelling Law specific to Article 7B buildings.