Free Nyc 5Ubti Form in PDF

The intricacies of tax obligations portray a labyrinth of requirements for individuals, estates, and trusts engaged in unincorporated businesses, distilled into the structure of the NYC-5UBTI form for the year 2012 as mandated by the New York City Department of Finance. This declaration form, serving as a critical conduit for estimating and remitting Unincorporated Business Tax, not only outlines a taxpayer’s projected fiscal responsibilities but also encapsulates a slew of pertinent details ranging from personal identifiers to precise instructions on tax computation and payment schedules. Embedded within its framework are mechanisms for calculating estimated taxes due, incorporating previous overpayments as credits towards current year liabilities, and delineating specific installment payment dates to accommodate varying fiscal year schedules. Additionally, this document provides essential guidelines on eligibility, exemptions, and the accrual of potential credits against the calculated tax, underscoring the necessity for accurate income and expenditure forecasting. Critically, it also touches upon the consequences of underpayment or misdeclaration, reminding filers of the potential financial penalties. Therefore, the NYC-5UBTI form embodies a comprehensive tool for navigating the fiscal landscape of unincorporated business taxation within New York City, emphasizing thoroughness, precision, and adherence to designated deadlines to facilitate the statutory compliance process.

Nyc 5Ubti Sample

|

- 5UBTI |

DECLARATION OF ESTIMATED |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2022 |

|

|||||||||

|

UNINCORPORATED BUSINESS TAX |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

(FOR INDIVIDUALS, ESTATES AND TRUSTS) |

|

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For CALENDAR YEAR 2022 beginning ___________________________ and ending ____________________________ |

|

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

First name and initial |

|

Last name |

Name |

n |

|

|

|

|

|

SOCIAL SECURITY NUMBER |

|

|||||||||||||||||||

Typeor |

|

|

|

|

Change |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Business name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

BUSINESS CODE NUMBER AS PER FEDERAL RETURN |

|

||||||||||||||||||||

Business address (number and street) |

|

|

|

Address |

n |

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

Change |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City and State |

|

|

Zip Code |

Country (if not US) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ESTATES AND TRUSTS ONLY, ENTER EMPLOYER IDENTIFICATION NUMBER |

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Business Telephone Number |

|

|

Taxpayer’s Email Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

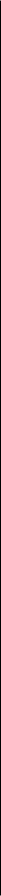

A.Payment

Amount included with form - Make payable to: NYC Department of Finance |

A. |

|

|

Payment Amount

1. |

Estimate of 2022 tax |

1. |

2. |

Amount to be paid with this declaration (Payable to: NYC DEPARTMENT OF FINANCE) |

2. |

|

|

|

Signature of taxpayer _______________________________________________________________________ Title __________________________________________________ Date ______________________

To receive proper credit, you must enter your correct Social Security Number or Employer Identification Number on your declaration and remittance.

DETACH ON DOTTED LINE & MAIL UPPER PORTION. RETAIN LOWER PORTION FOR YOUR RECORDS

|

ESTIMATED TAX WORKSHEET |

|

|

t KEEP THIS PORTION FOR YOUR RECORDS t |

|

1. |

Net income from business expected in 2022 (see instructions) |

1. |

2. |

Exemption (see instructions) |

2. |

3. |

Line 1 less line 2 (estimated taxable business income) |

3. |

4. |

Tax - enter 4% of line 3 (see instructions) |

4. |

5a. |

Business Tax Credit (4) (Check applicable box below and enter credit amount) |

|

qTax on line 4 is $3,400 or less. Your credit is the entire amount of tax on line 4.

qTax on line 4 is $5,400 or over. No credit is allowed. Enter "0".

qTax on line 4 is over $3,400 but less than $5,400, use formula for credit amount:

|

Tax on line 4 x ($5,400 minus tax on line 4) |

|

5a. |

|

|

|

|

|

|

|||||

5b. |

|

.........................................................................................................$2,000 |

|

|

|

|

5b. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Other credits (see instructions) |

|

|

|

|

|

|

|

|

||||||

5c. |

Total credits (add lines 5a and 5b) |

|

|

|

|

5c. |

||||||||

6. |

Estimated 2022 Unincorporated Business Tax (line 4 less line 5c) |

|

|

6. |

|

|

||||||||

|

Enter here, on line 7b, and on line 1 of declaration above |

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|||||||

7a. 2021 Unincorporated Business Tax..7a. |

|

|

|

|

|

7b. Estimate of 2022 tax from line 6..7b. |

|

|

||||||

|

COMPUTATION OF INSTALLMENT - (4) Check proper box below and enter |

amount indicated. Fiscal year taxpayers see instructions. |

|

|

|

|||||||||

8. |

If this declaration |

n April 18, 2022, enter 1/4 of line 7b |

n Sept. 15, 2022, enter 1/2 of line 7b |

...... |

|

|

|

|||||||

|

is due on: |

n June 15, 2022, enter 1/3 of line 7b |

n Jan. 17, 2023, enter amount of line 7b } |

8. |

|

|

||||||||

|

|

|

|

|

||||||||||

9. Enter amount of overpayment on 2021 return which you elected to have applied as a credit against 2022 estimated tax ...9. |

|

|||||||||||||

10. |

Amount to be paid with this declaration (line 8 less line 9) (Payable to: NYC DEPARTMENT OF FINANCE) .........10. |

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|||||

|

Make remittance payable to the order of: |

|

|

|

|

|

MAILING INSTRUCTIONS |

|||||||

|

|

|

|

|

|

MAIL YOUR DECLARATION FORM TO: |

||||||||

|

NYC DEPARTMENT OF FINANCE |

|

|

|

|

|

||||||||

|

|

|

|

|

|

NYC DEPARTMENT OF FINANCE |

||||||||

|

Payment must be made in U.S. dollars, |

|

|

|

|

|

UNINCORPORATED BUSINESS TAX |

|||||||

|

|

|

|

|

|

P. O. BOX 3923 |

|

|

|

|||||

|

drawn on a U.S. bank. |

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

NEW YORK, NY |

||||||||

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Form |

Page 2 |

NOTE

If any due date falls on Saturday, Sunday or legal holiday, filing will be timely if made by the next day which is not a Saturday, Sunday or holiday.

PURPOSE OF DECLARATION

This declaration form provides a means of paying Unincorporated Business Tax on a current basis for individuals, estates and trusts engaged in carrying on an unincorporated business or profession, as defined in Section

Every unincorporated business must file an income tax return after the close of its taxable year and pay any balance of tax due. If the tax has been overpaid, adjustment will be made only after the return has been filed.

WHO MUST MAKE A DECLARATION

A 2022 declaration must be made by every individual, estate and trust carrying on an unincor- porated business or profession in New York City if its estimated tax (line 6 of tax computation schedule) can reasonably be expected to exceed $3,400 for the calendar year 2022 (or, in the case of a fiscal year taxpayer, for the fiscal year beginning in 2022).

WHEN AND WHERE TO FILE DECLARATION

You must file the declaration for the calendar year 2022 on or before April 18, 2022, or on the applicable later dates specified in these instructions.

Mail your declaration form with or without remittance to:

NYC Department of Finance

Unincorporated Business Tax

P. O. Box 3923

New York, NY

Fiscal year taxpayers, read instructions opposite regarding filing dates.

HOW TO ESTIMATE UNINCORPORATED BUSINESS TAX The worksheet on the front of this form will help you in estimating the tax for 2022.

LINE 1 -

The term “net income from business expected in 2022” means the amount estimated to be the 2022 net income from business, including professions, before the unincorporated business ex- emption. See Schedule A, line 14 of the 2021 Unincorporated Business Tax Return and related instructions (Form

LINE 2 - EXEMPTION

For the amount of the allowable exemption, see the instructions for the 2021 Form

LINE 4 - UNINCORPORATED BUSINESS TAX

If you expect to receive a refund or credit in 2022 of any sales or compensating use tax for which a credit was claimed in a prior year under Administrative Code Section

LINE 5b - OTHER CREDITS

Enter on line 5b the amount estimated to be the sum of any credits allowable for 2022 under Ad- ministrative Code Sections

Make remittance payable to NYC DEPARTMENT OF FINANCE. All remittances must be payable in U. S. dollars drawn on a U. S. bank. Checks drawn on foreign banks will be rejected and returned. A separate check for the declaration will expedite processing of the payment.

AMENDED DECLARATION

If, after a declaration is filed, the estimated tax increases or decreases because of a change in income, deductions, or allocation, you should file an amended declaration on or before the next date for payment of an installment of estimated tax.

CHARGE FOR UNDERPAYMENT OF INSTALLMENTS OF ESTIMATED TAX

A charge is imposed for underpayment of an installment of estimated tax for 2022. For infor- mation regarding interest rates, call 311. If calling from outside of the five NYC boroughs, please call

PENALTIES

The law imposes penalties for failure to make a declaration or pay estimated tax due or for making a false or fraudulent declaration or certification.

FISCAL YEAR TAXPAYERS

A taxpayer filing its Unincorporated Business Tax Return on a fiscal year basis should substi- tute the corresponding fiscal year months for the months specified in the instructions. For ex- ample, if the fiscal year begins on April 1, 2022, the Declaration of Estimated Unincorporated Business Tax will be due on July 15, 2022, together with payment of first quarter estimated tax. In this case, equal installments will be due on or before September 15, 2022, December 15, 2022, and April 18, 2023.

CHANGES IN INCOME

Even though on April 18, 2022, you do not expect your unincorporated business tax to exceed $3,400, a change in income, allocation or exemption may require that a declaration be filed later. In this event the requirements are as follows:

If requirement for filing occurs: |

File |

Amount of |

|

Installment |

|

declaration by: |

estimated |

|

payment |

||

|

|

|

tax due |

|

dates |

after |

but before |

|

|

|

|

|

|

|

|

|

|

April 1, 2022 |

June 1, 2022 |

June 15, 2022 |

1/3 |

(1) |

June 15, 2022 |

|

|

|

|

(2) |

Sept. 15, 2022 |

|

|

|

|

(3) |

Jan. 17, 2023 |

June 1, 2022 |

Sept. 1, 2022 |

Sept. 15, 2022 |

1/2 |

(1) |

Sept. 15, 2022 |

|

|

|

|

(2) |

Jan. 17, 2023 |

|

|

|

|

|

|

Sept. 1, 2022 |

Jan. 1, 2023 |

Jan. 17, 2023 |

100% |

|

None |

|

|

|

|

|

|

If you file your 2022 Unincorporated Business Tax Return by February 15, 2023, and pay the full balance of tax due, you need not: (a) file an amended declaration or an original declaration otherwise due for the first time on January 17, 2023, or (b) pay the last installment of estimated tax otherwise due and payable on January 17, 2023.

CAUTION

An extension of time to file your federal tax return or New York State personal income tax re- turn does NOT extend the filing date of your New York City tax return.

ELECTRONIC FILING

Note: Register for electronic filing. It is an easy, secure and convenient was to file a declara- tion and an extension and pay taxes

For more information log on to NYC.gov/eservices

NOTE

Filing a declaration or an amended declaration, or payment of the last installment on January 17, 2023, or filing a tax return by February 15, 2023, will not satisfy the filing requirements if you failed to file or pay an estimated tax which was due earlier in the taxable year.

PRIVACY ACT NOTIFICATION

The Federal Privacy Act of 1974, as amended, requires agencies requesting Social Security Numbers to in- form individuals from whom they seek this information as to whether compliance with the request is vol- untary or mandatory, why the request is being made and how the information will be used. The disclosure of Social Security Numbers for taxpayers is mandatory and is required by section

To receive proper credit, you must enter your correct Social Security Number or Employer Identification Number on your declaration and remittance.

File Overview

| Fact | Detail |

|---|---|

| Purpose | The form serves as a declaration for paying Unincorporated Business Tax on a current basis for individuals, estates, and trusts engaging in unincorporated businesses or professions in New York City. |

| Governing Law | The form is governed by Section 11-502 of the Administrative Code of the City of New York. |

| Who Must File | Every individual, estate, and trust conducting an unincorporated business or profession in New York City, whose estimated tax can reasonably be expected to exceed $3,400 for the year 2012. |

| Filing Dates | For calendar year filers, the form was due on April 17, 2012, with subsequent deadlines for fiscal year taxpayers specified in the instructions. |

| Payment Method | Payment, including any estimated tax due, was to be made payable to the NYC Department of Finance, in U.S. dollars, drawn on a U.S. bank. |

| Penalties | Penalties apply for failure to file, pay the estimated tax due, or for submitting a false or fraudulent declaration or certification. |

| Amendments | If estimated tax increases or decreases due to changes, an amended declaration must be filed before the next installment payment date using the amended schedule of the Notice of Estimated Tax Payment Due (Form NYC-B100). |

Nyc 5Ubti: Usage Guidelines

Filling out the NYC-5UBTI form correctly is essential for individuals, trusts, and estates engaged in unincorporated businesses in New York City to estimate and pay their Unincorporated Business Tax. This process involves reporting expected income, computing the tax based on that income, and making timely payments to avoid penalties. Detailing personal and business information accurately ensures the NYC Department of Finance can process your declaration efficiently. Follow these steps to complete the form:

- Enter the fiscal year for your business operation if it doesn't align with the calendar year, specifying the starting and ending dates.

- Provide your first name, initial, and last name in the designated fields.

- Fill in the business name, address, including city, state, and zip code, as well as business telephone number and email address.

- Enter your Social Security Number. Estates, trusts, and LLCs must provide their Employer Identification Number instead.

- Record the Business Code Number as per your federal return.

- In section A, Payment, indicate the payment enclosed with this form based on the calculated estimated tax.

- For the computation of the installment, tick the appropriate box corresponding to the due date of your declaration and enter the applicable amount.

- Input any overpayment amount from your 2011 return you've elected to apply as a credit against your 2012 estimated tax.

- Calculate the amount to be paid with this declaration by subtracting your credit (if any) from the installment amount, and write it down.

- Sign the form, provide your title if applicable, and date it to affirm the information provided is accurate and complete.

After completing the form, detach the upper portion and mail it with your payment to the NYC Department of Finance at the address provided for declarations with remittances. Keep the lower portion for your records. Remember, your declaration helps ensure that you remain compliant with NYC's tax requirements, streamlining your financial obligations and avoiding potential penalties for underpayment or late payment of estimated taxes.

FAQ

-

What is the NYC-5UBTI form used for?

The NYC-5UBTI form serves as a declaration for estimated Unincorporated Business Tax (UBT) for individuals, estates, and trusts engaged in any unincorporated business within New York City. Its primary purpose is to facilitate the payment of estimated taxes on a current basis throughout the tax year. This helps taxpayers in managing their tax liabilities by spreading payments over the year instead of facing a lump sum payment at the year's end.

-

Who needs to file the NYC-5UBTI form?

Every individual, estate, and trust carrying on an unincorporated business or profession in New York City must file the NYC-5UBTI form if their estimated Unincorporated Business Tax exceeds $3,400 for the 2012 calendar year or for their fiscal year beginning in 2012. It's important to note that partnerships have a different form for filing their declarations.

-

When and where should the NYC-5UBTI form be filed?

- For calendar year taxpayers, the declaration for 2012 needed to be filed on or before April 17, 2012. Subsequent deadlines included June 15, 2012, September 17, 2012, and January 15, 2013, for quarterly payments.

- Fiscal year taxpayers had dates adjusted according to their specific fiscal year but followed a similar pattern of quarterly payments.

- Declarations with payments were to be mailed to the NYC Department of Finance at the specified P.O. Box in Kingston, NY, while all others had a different mailing address in the same city.

Always refer to the form's instructions for specific deadlines related to your situation, as they may change for subsequent years.

-

How can an individual estimate their Unincorporated Business Tax and complete the NYC-5UBTI form?

To estimate the Unincorporated Business Tax, individuals should utilize the Estimated Tax Worksheet provided with the NYC-5UBTI form. This worksheet assists in estimating 2012 net income from the business and applying exemptions and credits to calculate the estimated tax. Key steps include:

- Estimating net income from the business for the current year.

- Deducing any applicable exemption and business tax credits.

- Computing the estimated tax based on the net income.

Correct Social Security Number (SSN) or Employer Identification Number (EIN) must be included with the declaration and any remittance to ensure proper credit. Should any changes to the estimated tax occur after filing, an amended declaration may be necessary.

Common mistakes

Filling out tax forms can often be complex and tedious, especially when dealing with specific forms like the NYC-5UBTI for Unincorporated Business Tax. People commonly make mistakes that can lead to delays or incorrect tax assessments. Highlighted below are six common mistakes to avoid when completing the NYC-5UBTI form.

Incorrect or Missing Social Security Numbers or Employer Identification Numbers: It is imperative to ensure that the correct Social Security Number (SSN) or Employer Identification Number (EIN) is entered on the form. This information is crucial for tax administration purposes and helps in identifying the taxpayer.

Failing to Report Accurate Business Codes: The Business Code Number as per the federal return should accurately reflect the type of business or profession. This code is essential for classification and ensuring that the tax calculations and credits applied are appropriate for the type of business.

Incorrect Calculation of Estimated Tax Payments: When computing estimated tax payments, errors can occur in calculating the amounts due for each installment. It’s important to follow the guidelines and formulas provided to avoid underestimation or overestimation of taxes.

Not Applying Overpayments Correctly: If there was an overpayment from the previous year that you elected to apply as a credit against the current year's estimated tax, it must be accurately reported. Failure to do so can result in an inaccurate calculation of the amount due.

Omitting Payment Information: When making a payment, details such as the check number, amount, and date should be included. Payments must be made in U.S. dollars drawn on a U.S. bank. Ensuring that the payment information is complete and accurate helps in processing the payment correctly.

Incorrect Filing Status for Fiscal Year Taxpayers: If filing for a fiscal year rather than the calendar year, it's important to adjust the dates accordingly on the form. Using the wrong dates for the fiscal year can lead to incorrect tax period assessments.

To circumvent these errors, it’s recommended to review the form carefully before submission and consult the instructions provided. Additionally, double-check calculations and ensure that all required fields are filled out accurately. Making use of electronic filing options can also help reduce the risk of errors and facilitate the processing of the tax declaration and payment.

Documents used along the form

When preparing or working with the NYC-5UBTI form, there are several other documents and forms that often play a crucial role in ensuring compliance and accuracy in the declaration and payment process. These documents are essential for individuals, estates, and trusts engaged in unincorporated business activities within New York City. Understanding each form's purpose will streamline the process and avoid any potential issues.

- Form NYC-202: Unincorporated Business Tax Return for Individuals, Estates, and Trusts. This form is used to report the unincorporated business income after the close of the tax year. It calculates the tax due based on the net income from the business and allows for any applicable deductions and exemptions.

- Form NYC-202S: Simplified Unincorporated Business Tax Return. Designed for smaller businesses, this form is a shorter version of the NYC-202 form. It's intended for use by those who meet certain criteria, making the filing process more straightforward.

- Form NYC-114.5, NYC-114.6, and NYC-114.8: These forms are related to various credits that unincorporated businesses in New York City may be eligible for, such as the Real Estate Tax Escalation Credit, Employment Opportunity Relocation Costs Credit, and Relocation and Employment Assistance Program (REAP) Credit. Eligible businesses can use these forms to claim credits that reduce their overall tax liability.

- Form NYC-1: Payment Voucher. This form accompanies your payment if you owe taxes when filing your unincorporated business tax return. It ensures that your payment is processed correctly and applied to your account.

- Form NYC-B100: Notice of Estimated Tax Payment Due. Used by businesses to report changes in estimated taxes or to amend previous estimates. This form is essential for adjusting your payments if your business income or deductible expenses change during the tax year.

These forms collectively ensure that unincorporated businesses in New York City comply with local tax laws, accurately report their income, and take advantage of available tax credits. By familiarizing yourself with these documents, you can navigate the complexities of the unincorporated business tax system more effectively.

Similar forms

The NYC-202 Unincorporated Business Tax Return for Individuals, Estates, and Trusts is similar to the NYC-5UBTI form in that both are used by individuals, trusts, and estates engaged in unincorporated businesses within New York City. They aim to calculate and remit taxes due on income generated from such enterprises, guiding taxpayers through a systematic process to declare their estimated earnings and calculate tax liabilities accordingly.

The Federal 1040-ES, Estimated Tax for Individuals, parallels the NYC-5UBTI form, as both serve the purpose of allowing individuals to calculate and pay their estimated taxes in advance. This aspect is crucial for taxpayers who do not have taxes withheld from their income sources, ensuring they meet their tax obligations proactively to avoid penalties.

Form W-9, Request for Taxpayer Identification Number and Certification, shares similarities with the NYC-5UBTI form by requiring the taxpayer’s identification information, including Social Security Numbers or Employer Identification Numbers. This fundamental data is crucial for tax processing and identification purposes, underlining the emphasis on taxpayer information accuracy in both documents.

The Schedule C (Form 1040), Profit or Loss from Business, is akin to the NYC-5UBTI because both are aimed at individuals who operate unincorporated businesses or are self-employed. They are integral in reporting income or loss from business operations, guiding taxpayers in determining their taxable business income which influences their overall tax responsibilities.

The Schedule SE (Form 1040), Self-Employment Tax, resembles the NYC-5UBTI form as it concerns individuals with earnings from self-employment, requiring them to calculate the tax due on their net earnings. Both forms emphasize the taxpayer's responsibility to contribute to tax systems based on their business income.

Form 1120, U.S. Corporation Income Tax Return, while primarily for corporations, shares a common goal with the NYC-5UBTI of calculating and paying taxes on income. Both documents necessitate a detailed account of income and allowable deductions to accurately assess tax liabilities.

The Form 1065, U.S. Return of Partnership Income, is akin to the NYC-5UBTI because both are used by entities (partnerships for Form 1065 and unincorporated businesses for NYC-5UBTI) to report income, gains, losses, deductions, and credits to the IRS or NYC Department of Finance, respectively.

Form 941, Employer's Quarterly Federal Tax Return, and the NYC-5UBTI form similarly necessitate regular tax filings and payments. Form 941 focuses on reporting employee wages and withholding taxes quarterly, while NYC-5UBTI deals with estimated business income taxes, emphasizing ongoing tax obligations for different taxpayer categories.

Form 990, Return of Organization Exempt From Income Tax, although specifically for tax-exempt organizations, shares the concept of reporting income and expenses with the NYC-5UBTI form. This ensures compliance with tax regulations, maintaining their tax-exempt status or calculating taxable activities respectively.

The UBTI (Unrelated Business Taxable Income) sections within Form 990-T, Exempt Organization Business Income Tax Return, directly connect to the NYC-5UBTI form’s purpose. Both documents focus on income generated from business activities that may be taxable, guiding tax-exempt entities and unincorporated business owners through calculating and remitting taxes on such income.

Dos and Don'ts

When completing the NYC 5UBTI form, there are specific steps and precautions to consider for accurate and timely submission. Below are essential dos and don'ts:

- Do ensure that all the information provided on the form is legible and accurately reflects your business activities for the year. Incorrect information can lead to processing delays or errors in tax calculation.

- Don't overlook the importance of including your Social Security Number (SSN) or Employer Identification Number (EIN), as these are crucial for proper identification and processing of your form.

- Do calculate your estimated tax with diligence to avoid underpayment penalties. Utilize the estimated tax worksheet provided with the form to guide you through the process.

- Don't forget to sign and date the declaration. An unsigned form is considered incomplete and can delay processing.

- Do check the appropriate boxes and fill in the correct amounts on the computation of installment section to ensure you are paying the right amount of tax at the right times.

- Don't hesitate to apply any overpayment from the previous year's tax return towards this year's estimated tax, if available. This can help reduce the amount you need to pay out of pocket.

- Do mail the form and any payment due to the correct address provided by the NYC Department of Finance to avoid misplacement or delays in processing your estimated tax payment.

Following these guidelines will help ensure that your NYC 5UBTI form submission is accurate and timely, ultimately aiding in the smooth calculation and payment of your estimated unincorporated business tax.

Misconceptions

Understanding the NYC-5UBTI form can often be clouded by misconceptions. Here's a clarification of the major ones:

- Misconception #1: Only individuals need to file the NYC-5UBTI form. In reality, estates and trusts engaged in carrying on an unincorporated business or profession in New York City must also file this form, not just individuals.

- Misconception #2: The form is required for all businesses. The declaration must be made by entities whose estimated tax can reasonably be expected to exceed $3,400 for the calendar year 2012 or for their fiscal year beginning in 2012. It's not a requirement for all businesses.

- Misconclusion #3: The due dates are fixed. The form outlines specific due dates; however, if any due date falls on a Saturday, Sunday, or legal holiday, filing will be timely if made by the next day which is not a Saturday, Sunday, or holiday. This detail offers flexibility that may be overlooked.

- Misconception #4: Payment cannot be split into installments. Contrary to this belief, the estimated tax can be paid in equal installments on or before the specified dates in April, June, September, and January, or paid in full with the declaration.

- Misconception #5: Amendments cannot be made once the declaration is filed. If the estimated tax increases or decreases because of a change in income, deductions, or allocation, an amended declaration can and should be filed before the next payment installment due date.

- Misconception #6: Electronic filing is not available for the NYC-5UBTI form. The form points to electronic filing as an easy, secure, and convenient option, which is contrary to the belief that filings must always be done through paper submissions.

- Misconception #7: Overpayment on previous taxes cannot be applied to the current year's tax. If there was an overpayment on the 2011 Unincorporated Business Tax Return, it can be elected to have that overpayment applied as a credit towards the 2012 estimated tax.

It's important to navigate the specifics of such forms with accurate information to ensure compliance with tax obligations in a way that is beneficial for both individuals and entities alike. Misinterpretations can lead to mistakes in filing and financial implications, highlighting the importance of understanding the requirements and opportunities the form presents.

Key takeaways

Understanding the NYC 5UBTI form is crucial for individuals, estates, and trusts engaged in carrying on an unincorporated business or profession in New York City. Here are five key takeaways to ensure compliance and make the most out of the filing process:

- Who Needs to File: The NYC 5UBTI form must be completed by any individual, estate, or trust that operates an unincorporated business or profession in New York City and expects its estimated tax to exceed $3,400 for the year.

- Payment Schedule: Estimated taxes must be paid in four installments throughout the year. These payments are due on or before April 17, June 15, September 17 of the current year, and January 15 of the following year. The exact timeline depends on when the declaration is due, aligning with your fiscal year if it does not start on January 1.

- Calculating Your Payment: To accurately estimate the tax owed, use the estimated tax worksheet provided with the form. This involves calculating the net income from the business, applying the allowable exemption, and determining the estimated tax due after credits.

- Credits: The form allows for certain credits, including a business tax credit based on the calculated tax. No credit is allowed if the tax on line 4 of the tax computation schedule is $5,400 or over. Understanding these credits can significantly reduce the amount owed.

- Making Amendments: If there's a change in income, deductions, or allocation that affects the estimated tax, an amended declaration should be filed before the next installment due date. This adjustment ensures you don't underpay or overpay your estimated tax.

Filing the NYC 5UBTI form correctly is vital for compliance and avoiding penalties. By understanding who must file, payment deadlines, how to calculate payments, and when to make amendments, individuals, estates, and trusts can navigate the process more effectively.

Common PDF Documents

Nys S Corp Minimum Tax - This document encompasses details spanning from maintenance fees to the nature of business activities, offering a thorough account of a corporation's operations in New York.

Wage Theft Prevention Act Notice - Ensures employees are aware it's unlawful to be paid less than an employee of the opposite sex for equal work, promoting fairness and equality.

Form 351 - The affidavit assists NYCERS in identifying income earned outside of pension payments, Social Security, and other specified exclusions, safeguarding benefit integrity.