Free Nyc 5Ub Form in PDF

The NYC 5UB form is a vital document for partnerships, joint ventures, and similar entities operating within New York City, necessary for the computation and payment of the Estimated Unincorporated Business Tax for either the calendar year 2012 or a fiscal year beginning and ending in specified periods. Crafted by the New York City Department of Finance, this form serves as a declaration of estimated taxes due, aiming to facilitate current basis tax payments by these entities, excluding individuals, estates, and trusts. The necessity to file this declaration arises when the estimated tax, after considering applicable credits and overpayments from the previous year, exceeds $3,400. The form lays down specific payment installments due on predefined dates throughout the fiscal period, offering a systematic method for entities to comply with their tax obligations. Failure to accurately estimate and timely pay these taxes may lead to penalties, underlining the importance of the NYC-5UB in ensuring financial and legal compliance. Furthermore, the form includes detailed instructions on estimating taxable business income, exemptions, and applicable tax credits, underscoring its role as a comprehensive guide for partnership entities navigating the complexities of New York City's tax landscape.

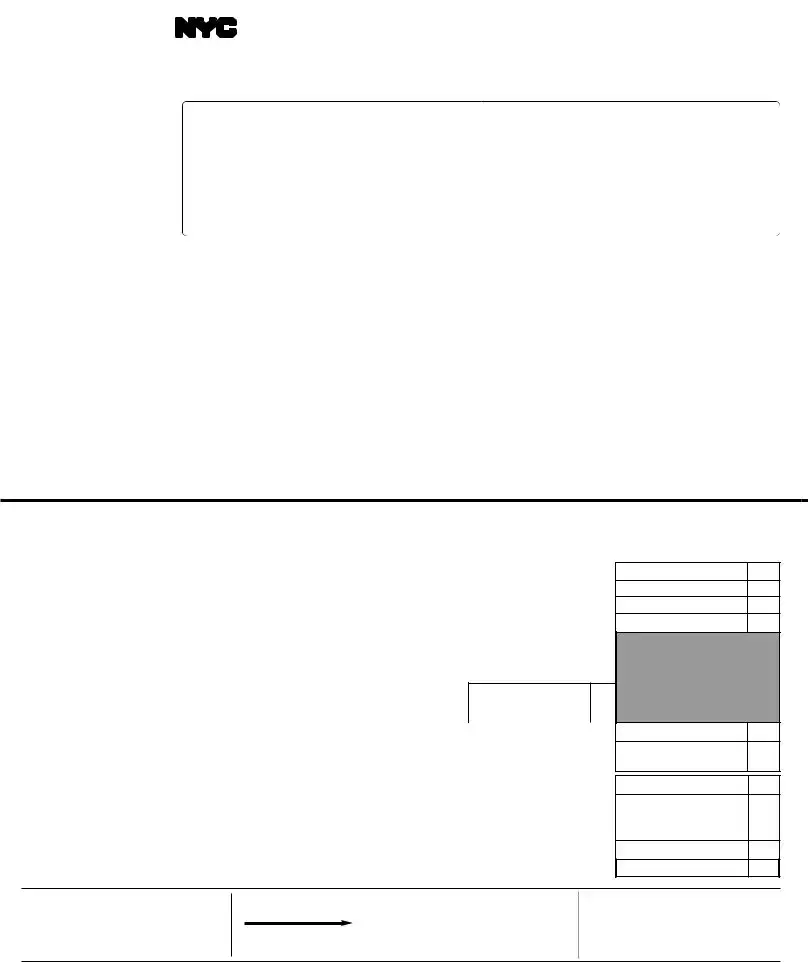

Nyc 5Ub Sample

|

*60511291* |

▼ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NEWYORKCITYDEPARTMENTOFFINANCE |

PARTNERSHIP DECLARATION OF |

|

|

|

|

|

|

|

2012 |

|

||||||||||||||||||

|

|

|

|

- 5UB |

ESTIMATED UNINCORPORATED BUSINESS TAX |

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

FINANCE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

For CALENDAR YEAR 2012 or FISCAL YEAR beginning _________________ , _______ and ending __________________ , ________ |

||||||||||||||||||||||||||

|

|

|

|

Business name |

|

|

|

|

|

|

|

Employer Identification Number |

||||||||||||||||||

|

|

▼ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Typeor |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

In Care of |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Business address (number and street) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

BusinessCodeNumberasperFederalReturn |

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City and State |

|

|

|

|

Zip Code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Business Telephone Number |

|

Taxpayerʼs Email Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Payment Enclosed |

|

|

|

|

|

|||||||

A. |

Payment |

Pay amount shown on line 4 - Make check payable to: NYC Department of Finance ● |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

1a. Partnership's 2011 Unincorporated Business Tax |

|

|

|

|

1b. Estimate of 2012 tax.........1b. ● |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

COMPUTATION OF INSTALLMENT - (✔) Check proper box below and enter amount indicated. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

2. |

If this declaration |

■ April 17, 2012, enter 1/4 of line 1b |

■ Sept. 17, 2012, enter 1/2 of line 1b |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

is due on: |

■ June 15, 2012, enter 1/3 of line 1b |

■ Jan. 15, 2013, enteramountofline1b}................. 2. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

3. |

Enteramountofoverpaymenton2011returnwhichyouelectedtohaveappliedasacreditagainst2012estimatedtax......... 3. ● |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

4. |

Amount to be paid with this declaration (line 2 less line 3) (Payable to: NYC DEPARTMENT OF FINANCE)...................... 4. ● |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Signature of taxpayer: _________________________________________________________________________________ Title: _________________________________________ Date: ____________________________

60511291 |

To receive proper credit, you must enter your correct Employer Identification Number on your declaration and remittance. |

DETACHONDOTTEDLINE&SENDUPPERPORTIONINASEPARATEENVELOPE.RETAINLOWERPORTIONFORYOURRECORDS

ESTIMATED TAX WORKSHEET

▼ KEEP THIS PORTION FOR YOUR RECORDS ▼

1. |

Net income from business expected in 2012 (see instructions) |

1. |

2. |

Exemption (see instructions) |

2. |

3. |

Line 1 less line 2 (estimated taxable business income) |

3. |

4. |

Tax - enter 4% of line 3 (see instructions) |

4. |

5a. |

Business Tax Credit (✔) (Check applicable box below and enter credit amount) |

|

❑Tax on line 4 is $3,400 or less. Your credit is the entire amount of tax on line 4.

❑Tax on line 4 is $5,400 or over. No credit is allowed. Enter "0".

❑Tax on line 4 is over $3,400 but less than $5,400, use formula for credit amount:

Tax on line 4 x ($5,400 minus tax on line 4) |

.......................................................................5a. |

|

$2,000 |

|

|

5b. Other credits (see instructions) |

5b. |

|

5c. Total credits (add lines 5a and 5b) |

5c. |

|

6.Estimated 2012 Unincorporated BusinessTax (line 4 less line 5c)

|

Enter here, online 7b, and on line 1bof declaration above |

............................................................................................................................ |

|

|

6. |

||

7a. |

Partnership's 2011 Unincorporated BusinessTax 7a. |

|

|

|

7b. Estimateof2012taxfromline6 |

7b. |

|

|

|

|

|||||

|

COMPUTATION OF INSTALLMENT - (✔) Check proper box below and enter amount indicated. Fiscal year taxpayers see instructions. |

|

|||||

8. |

If this declaration |

■ April 17, 2012, enter 1/4 of line 7b |

■ Sept. 17, 2012, enter 1/2 of line 7b |

} 8. |

|||

|

is due on: |

■ June 15, 2012, enter 1/3 of line 7b |

■ Jan. 15, 2013, enter amount of line 7b |

||||

9.Enter amount of overpayment on 2011 return which you elected to have applied as a credit against 2012 estimated tax. 9.

10. Amount to be paid with this declaration (line 8 less line 9) (Payable to: NYC DEPARTMENT OF FINANCE) |

10. |

Make remittance payable to the order of:

NYC DEPARTMENT OF FINANCE

Payment must be made in U.S. dollars, drawn on a U.S. bank.

M A I L I N G

INSTRUCTIONS

DECLARATIONS WITH REMITTANCES

NYC DEPARTMENT OF FINANCE UNINCORPORATED BUSINESS TAX P. O. BOX 5070

KINGSTON, NY

ALL OTHERS

NYC DEPARTMENT OF FINANCE UNINCORPORATED BUSINESS TAX P. O. BOX 5080

KINGSTON, NY

Form |

Page 2 |

|

|

NOTE

IfanyduedatefallsonSaturday,Sundayorlegalholiday,filingwillbetimelyifmade bythenextdaywhichisnotaSaturday,Sundayorholiday.

PURPOSEOFDECLARATION

ThisdeclarationformprovidesameansofpayingUnincorporatedBusinessTaxonacurrent basis for partnerships, joint ventures and similar entities (other than individuals, estates and trusts)engagedincarryingonanunincorporatedbusinessorprofession,asdefinedinSection

Everyunincorporatedbusinessmustfileanincometaxreturnafterthecloseofitstaxableyear and pay any balance of tax due. If the tax has been overpaid, adjustment will be made only after the return has been filed.

WHOMUSTMAKEADECLARATION

A2012 declaration must be made by every partnership carrying on an unincorporated busi- nessorprofessioninNewYorkCityifitsestimatedtax(line6oftaxcomputationschedule) can reasonably be expected to exceed $3,400 for the calendar year 2012 (or, in the case of a fiscal year taxpayer, for the partnership fiscal year beginning in 2012).

WHENANDWHERETOFILEDECLARATION

You must file the declaration for the calendar year 2012 on or beforeApril 17, 2012, or on the applicable later dates specified in these instructions.

- Allotherdeclarations- |

|

NYCDepartmentofFinance |

NYCDepartmentofFinance |

UnincorporatedBusinessTax |

UnincorporatedBusinessTax |

P.O.Box5070 |

P.O.Box5080 |

Fiscal year taxpayers, read instructions opposite regarding filing dates.

HOWTOESTIMATEUNINCORPORATEDBUSINESSTAX

The worksheet on the front of this form will help you in estimating the tax for 2012.

LINE1-

Theterm“netincomefrombusinessexpectedin2012”meanstheamountthepartnershipes- timatestobeitsincomefor2012computedbeforethespecificexemption.RefertoSchedule A, line 14 of the 2011 Partnership Return (Form

The amount of the allowable exemption may be determined by referring to the instructions for the 2011 Form

If you expect to receive a refund or credit in 2012 of any sales or compensating use tax for which a credit was claimed in a prior year underAdministrative Code Sections

Enter on line 5b the amount estimated to be the sum of any credits allowable for 2012 under

DECLARATION

Online1aofthedeclaration(line7aoftheEstimatedTaxWorksheet),entertheamountthe partnership reported on line 25 of its 2011 Form

PAYMENTOFESTIMATEDTAX

Exceptasspecifiedelsewhereintheseinstructions,theestimatedtaxonline1bofthedeclaration ispayableinequalinstallmentsonorbeforeApril17,2012,June15,2012,September17,2012 andJanuary15,2013. Thefirstinstallmentpaymentmustaccompanythedeclaration.However, theestimatedtaxmaybepaidinfullwiththedeclaration.

Iftherewasanoverpaymentonthe2011PartnershipTaxReturnandonline32boftheNYC- 204 or line 13 of the

Make remittance payable to NYC DEPARTMENT OF FINANCE. All remittances must be

payableinU.S.dollarsdrawnonaU.S.bank. Checksdrawnonforeignbankswillberejected and returned.Aseparate check for the declaration will expedite processing of the payment.

AMENDEDDECLARATION

If,afteradeclarationisfiled,theestimatedtaxincreasesordecreasesbecauseofachangein income, deductions, or allocation, you should file an amended declaration on or before the next date for payment of an installment of estimated tax. This is done by completing the

CHARGEFORUNDERPAYMENTOFINSTALLMENTSOFESTIMATEDTAX

Acharge is imposed for underpayment of an installment of estimated tax for 2012. For in- formationregardinginterestrates,call311. IfcallingfromoutsideofthefiveNYCboroughs, please call

PENALTIES

The law imposes penalties for failure to make a declaration or pay estimated tax due or for making a false or fraudulent declaration or certification.

FISCALYEARTAXPAYERS

InthecaseofapartnershipthatfilesitsUnincorporatedBusinessTaxReturnonafiscalyear basis,substitutethecorrespondingfiscalyearmonthsforthemonthsspecifiedintheinstruc- tions. For example, if the fiscal year begins onApril 1, 2012, the Declaration of Estimated Unincorporated Business Tax will be due on July 16, 2012, together with payment of first quarterestimatedtax.Inthiscase,equalinstallmentswillbedueonorbeforeSeptember17, 2012, December 17, 2012, andApril 16, 2013.

CHANGESININCOME

EventhoughonApril17,2012,apartnershipdoesnotexpectitsunincorporatedbusinesstax toexceed$3,400,achangeinincome,allocationorexemptionmayrequirethatadeclaration be filed later. In this event the requirements are as follows:

|

|

File |

Amountof |

|

Installment |

Ifrequirementforfilingoccurs: |

declaration |

estimated |

|

payment |

|

|

|

by: |

taxdue |

|

dates |

AFTER |

BUT BEFORE |

|

|

|

|

|

|

|

|

|

|

April 1, 2012 |

June 2, 2012 |

June 15, 2012 |

1/3 |

(1) |

June 15, 2012 |

....................................... |

|

|

|

(2) |

Sept. 17, 2012 |

....................................... |

|

|

|

(3) |

Jan. 15, 2013 |

June 1, 2012 |

Sept. 2, 2012 |

Sept. 17, 2012 |

1/2 |

(1) |

Sept. 17, 2012 |

....................................... |

|

|

|

(2) |

Jan. 15, 2013 |

|

|

|

|

|

|

Sept. 1, 2012 |

Jan. 1, 2013 |

Jan. 15, 2013 |

100% |

None |

|

If the partnership files its 2012 Unincorporated BusinessTax Return by February 15, 2013, andpaysthefullbalanceoftaxdue,itneednot:(A) fileanamendeddeclarationoranoriginal declarationotherwisedueforthefirsttimeonJanuary15,2013,or(B) paythelastinstallment of estimated tax otherwise due and payable on January 15, 2013.

CAUTION

AnextensionoftimetofileyourfederaltaxreturnorNewYorkStatepartnershipinformation return does NOTextend the filing date of your NewYork City tax return.

NOTE

Filing a declaration or an amended declaration, or payment of the last installment on January 15,2013,orfilingataxreturnbyFebruary15,2013,willnotsatisfythefilingrequirementsif thepartnershipfailedtofileorpayanestimatedtaxwhichwasdueearlierinthetaxableyear.

ELECTRONICFILING

Note:Registerforelectronicfiling. Itisaneasy,secureandconvenientwaytofileandpayan extension

For more information log on to nyc.gov/nycefile.

To receive proper credit, you must enter your correct Employer Identification Number on your declaration and remittance.

File Overview

| Fact Name | Description |

|---|---|

| Form Purpose | The NYC-5UB form is used for the Declaration of Estimated Unincorporated Business Tax specifically for partnerships operating within New York City. |

| Governing Law | This form is governed by Section 11-502 of the Administrative Code of New York City. |

| Payment Installments | The estimated tax can be paid in equal installments on or before April 17, June 15, September 17 of the current year, and January 15 of the following year. |

| Eligibility for Declaration | A declaration must be made by every partnership engaged in an unincorporated business or profession in NYC if its estimated tax can reasonably be expected to exceed $3,400 for the year 2012 or for the fiscal year beginning in 2012. |

| Filing and Payment Information | Declarations with payments are to be mailed to the NYC Department of Finance Unincorporated Business Tax, P.O. Box 5070, Kingston, NY 12402-5070. For all other declarations, the address is P.O. Box 5080, Kingston, NY 12402-5080. |

Nyc 5Ub: Usage Guidelines

After a productive year, it's time to settle up with the New York City Department of Finance for any unincorporated business tax that your partnership might owe. Doing so is not only a matter of civic responsibility but also a legal requirement for many partnerships operating within the city. Given the complexity of tax forms, the NYC 5UB form can come across as daunting at first glance. However, by breaking down the steps required to fill it out, the process can be quite manageable. Here's how you can tackle this task with confidence:

- Start by entering the calendar year or the fiscal year for which this declaration is being made at the top of the form, specifying the beginning and end dates.

- Under the section labeled “Business name,” input the full legal name of your partnership.

- Write your Employer Identification Number in the space provided.

- In the “Business address” section, enter the street number and name, city, state, and ZIP code where the business is located.

- Fill in your business’s primary telephone number and taxpayer’s email address in the corresponding fields for contact information.

- Enter the Business Code Number as per your federal return to categorize the nature of your business accurately.

- In section A, labeled “Payment,” input the amount you are declaring to pay. This requires calculating an estimate of your 2012 tax, entered on line 1b.

- Choose the correct computation of installment for your payment schedule under “COMPUTATION OF INSTALLMENT” by checking the appropriate box and entering the amount due based on the schedule you're adhering to (e.g., April 17, 2012, enter 1/4 of line 1b).

- If applicable, document any overpayment from the 2011 return that you wish to apply as a credit against your 2012 estimated tax in the space provided on line 3.

- Calculate the amount to be paid with this declaration (line 2 minus line 3) and enter this figure on line 4. This is the net amount owing for this installment.

- Print your name and title, then sign and date the form in the designated area at the bottom.

- Detach the form on the dotted line, keeping the bottom section for your records and mailing the top portion with your payment (if applicable) to the address provided for declarations with remittances.

By following these steps, you'll ensure that your partnership remains in good standing with the New York City Department of Finance, avoiding any unnecessary penalties for underpayment or late submissions. Remember, accurate and timely filing is key to maintaining the integrity of your business's financial obligations.

FAQ

FAQs about the NYC-5UB Form

- What is the NYC-5UB form used for?

The NYC-5UB form is a declaration of estimated unincorporated business tax designed specifically for partnerships operating in New York City. Its main purpose is to allow these partnerships to pay their Unincorporated Business Tax on a current basis for either the calendar year 2012 or a fiscal year that begins and ends in specified dates. This form is crucial for ensuring that partnerships comply with local tax regulations by estimating and paying their taxes promptly.

- Who needs to fill out the NYC-5UB form?

Any partnership engaged in carrying on an unincorporated business or profession within New York City needs to complete the NYC-5UB form if their estimated tax for the year 2012 is expected to exceed $3,400. This requirement applies to a range of business entities, including joint ventures and similar entities, but does not include individuals, estates, and trusts, which use a different form for their declarations.

- When and where should the NYC-5UB form be filed?

For the calendar year 2012, the initial filing date was April 17, 2012. Subsequent installment due dates were June 15, 2012, September 17, 2012, and January 15, 2013. If operating on a fiscal year basis, different dates apply, and individuals should consult the form instructions for specific deadlines relevant to their fiscal schedule. Declarations with payments should be sent to the NYC Department of Finance at the Unincorporated Business Tax address listed for remittances in Kingston, NY.

- How is the estimated tax on the NYC-5UB form calculated?

To estimate the tax, partnerships must complete the worksheet provided with the NYC-5UB form. This process involves determining the net income from business expected for the year, applying the relevant exemption, and calculating the remaining taxable business income. The Unincorporated Business Tax is then computed as 4% of the adjusted income. Additionally, partnerships can apply for certain tax credits and adjustments based on overpayments from the previous year or other eligible credits, which may reduce the amount owed.

For any specific scenarios or unusual circumstances not covered in these FAQs, partnerships are advised to consult the detailed instructions provided with the NYC-5UB form or seek professional advice.

Common mistakes

Filling out NYC Form 5UB, the partnership declaration for estimated unincorporated business tax, is crucial for any business operating within New York City. It's easy to make mistakes, especially if you're doing it for the first time. Let's go through some common pitfalls people face with this form.

- Incorrect Business Information: It might seem straightforward, but mistyping the business name, address, or Employer Identification Number (EIN) is a common mistake. These details must exactly match official records, as inconsistencies can lead to processing delays or misdirected correspondence.

- Business Code Number Errors: The Business Code Number should align with the federal return's categorization of your business. Choosing the wrong code can lead to incorrect tax assessments or questions from the Department of Finance.

- Miscalculating Tax Payments: When calculating estimated tax payments, errors can stem from incorrect income estimates or misapplication of exemptions and credits. Ensuring accurate calculations in these areas is critical for determining the correct installment payments.

- Payment Schedule Confusion: The form offers multiple payment schedules based on specific dates. Failing to check the correct box or calculate the respective amount due for each installment can result in underpayment penalties.

- Overpayment Credit Missteps: If you had an overpayment from the previous year and elected to apply it as a credit, it's essential to report this amount correctly on the form. Incorrect reporting can affect the calculation of the current year's tax liability.

Signature Omissions: A common yet critical mistake is forgetting to sign the form. An unsigned form is considered incomplete and will not be processed until corrected, potentially causing delays in meeting filing deadlines.- Incorrect Payment Details: Making the payment payable to the wrong entity or in an incorrect format can lead to processing issues. Ensuring that checks are payable to the NYC Department of Finance and drawn on a U.S. bank in U.S. dollars is vital.

When filling out the NYC-5UB form, it's not just about avoiding mistakes; it's about understanding the importance of accuracy and timeliness in tax compliance. A business's ability to navigate these requirements reflects its overall operational efficiency and commitment to regulatory adherence. Always double-check your entries and consult the instructions or a tax professional if you have any uncertainties.

Documents used along the form

When dealing with the New York City Department of Finance, especially for partnerships declaring estimated unincorporated business tax via the NYC 5UB form, a variety of other forms and documents often accompany the main declaration. These documents are crucial for ensuring compliance and accuracy in financial reporting to the city's finance department. Below is a list of these forms, each with a brief description to help understand their purpose and importance in the filing process.

- Form NYC-204: This is the Unincorporated Business Tax Return for Partnerships, including Limited Liability Companies (LLCs) treated as partnerships. It's used to report income, deductions, and the associated unincorporated business tax due to New York City.

- Form NYC-5UBTI: This form serves individuals, estates, and trusts to declare and pay estimated unincorporated business tax. It parallels the NYC-5UB for partnerships but is tailored to other entities involved in business activities.

- Schedule A: Often attached to the NYC-204 form, this schedule details the computation of net income from business operations, critical for determining the tax base for the unincorporated business tax.

- Form NYC-B100: This is the Amended Declaration of Estimated Unincorporated Business Tax. It allows partnerships to adjust previously filed estimated tax declarations due to changes in income, deductions, or tax credits.

- Form NYC-221: Utilized to calculate interest charges on underpayment of estimated tax installments. It helps ensure partnerships comply with payment schedules and avoid penalties.

- Form NYC-114.5, NYC-114.6, NYC-114.7, and so on: These forms are used to claim specific tax credits such as the Real Estate Tax Escalation Credit, Employment Opportunity Relocation Costs Credit, and others that might apply to reduce the unincorporated business tax liability.

- Form NYC-EXT: This is the Application for Automatic Extension of Time to File Business Income Tax Returns. It's necessary when a partnership needs more time to gather information and complete its unincorporated business tax return accurately.

- Form NYC-202: The Unincorporated Business Tax Estimated Tax Payment Voucher for making installment payments on the estimated tax liability. It's used alongside the NYC-5UB form for those payments not made electronically.

- Form NYC-9.7: Claim for Made in NY Tax Credit. Relevant for businesses qualified under the Made in New York program, offering a tax incentive for certain production activities.

- Form NYC-579-UBTP: Payment Voucher for Unincorporated Business Tax for Partnerships and Disregarded Entities. It is used for submitting any tax payments due with or after the filing of the return.

This collection of documents ensures that partnerships and other business entities can accurately declare, pay, and, if necessary, amend their estimated unincorporated business tax. They cover a wide range of scenarios from initial filing, amending previous submissions, claiming tax credits, to requesting filing extensions. Understanding each form’s specific use aids in maintaining compliance with New York City's tax regulations. Knowing when and how to use these documents can make the tax filing process smoother and help avoid potential issues with the Department of Finance.

Similar forms

The Form 1040-ES, "Estimated Tax for Individuals," is quite similar to the NYC 5UB form in its fundamental purpose. Both forms are designed to facilitate the payment of estimated taxes, albeit for different tax entities and jurisdictions. The Form 1040-ES is utilized by individuals to pay estimated federal income taxes. Both forms require taxpayers to estimate their income for the current year, apply relevant deductions or exemptions, and calculate the anticipated tax liability. Payments are made in four equal installments, with similar provisions for adjusting estimates as the year progresses and for applying overpayments from previous years.

The Form 1120-W, "Estimated Tax for Corporations," shares similarities with the NYC 5UB form by serving the corporate sector for the estimation and payment of taxes on a quarterly basis. Both forms require entities to project their annual income and make tax payments in installments throughout the fiscal year. While the NYC 5UB is designed for unincorporated businesses operating within New York City, the Form 1120-W applies to incorporated entities on a federal level, reflecting their estimated corporate income tax liability. Like the NYC 5UB, corporations can adjust their estimated payments during the year if their financial outlook changes.

The Form 1065-B, "U.S. Return of Income for Electing Large Partnerships," albeit a return rather than an estimated tax form, shares certain operational parallels with the NYC 5UB form. Both are concerned with partnerships, with the NYC 5UB focusing on the estimated taxes for partnerships in New York City. The Form 1065-B is used by large partnerships to report their income, gains, losses, and deductions to the IRS. Both forms tackle the aspect of partnership financial activities and their implications for tax responsibilities. They underscore the necessity for partnerships to manage and report their income for tax purposes accurately.

The Schedule SE (Form 1040), "Self-Employment Tax," while primarily used for calculating the tax due on net earnings from self-employment, shares a conceptual congruence with the NYC 5UB form on the basis of addressing tax obligations outside the traditional employer-employee payroll system. The NYC 5UB caters to unincorporated businesses, including partners and joint ventures in New York City, requiring them to estimate and pay taxes on their business income. Both documents underscore the individual's or entity's responsibility to proactively manage and contribute to their tax obligations based on generated income.

NYC-3L, "General Corporation Tax Return," although specifically a tax return form for corporations within New York City, shares the underlying principle of tax responsibility with the NYC 5UB form. The NYC-3L form is used by corporations to file their taxes based on income generated within the city. Similar to the NYC 5UB's purpose for unincorporated businesses, it ensures that entities operating within New York City's jurisdiction contribute to the city's fiscal health through tax payments. Both forms highlight the city's approach to taxing entities based on their business activities within its borders, ensuring compliance and fairness in tax contributions.

Dos and Don'ts

Filling out the NYC-5UB form, a document used to declare estimated unincorporated business tax for partnerships in New York City, requires careful attention to detail and compliance with specific guidelines. Here is a structured list of do's and don'ts to assist in completing this form accurately:

- Do ensure that you have the correct form for the correct tax year. Tax forms and regulations may change, so it's essential to use the most current form which matches the tax year you are filing for.

- Do enter the partnership's Employer Identification Number (EIN) accurately. This number is critical for identification and must match the IRS records.

- Do calculate your estimated tax carefully, using the provided worksheet. This calculation must be based on the partnership’s expected net income and allowable deductions.

- Do check the appropriate computation box for the installment due date when making payments. Misidentifying the date could result in misapplied payments.

- Do sign and date the form. An unsigned form is considered incomplete and may not be processed.

- Do make your payment payable to the NYC Department of Finance and ensure that it is in U.S. dollars drawn on a U.S. bank.

- Do file your form and payment by the due date to avoid any penalties or interest charges for late payments.

- Don’t round off figures. Provide exact amounts as calculated on your worksheet to ensure accurate tax estimations.

- Don’t neglect the overpayment credit from the previous year. If you had an overpayment that you elected to apply to the current year's tax, make sure to include this amount on line 3 of the form.

- Don’t overlook applicable credits and deductions. Be diligent in reviewing the instructions to correctly apply any business tax credits or other deductions that may reduce your overall tax liability.

- Don’t forget to include your contact information, such as the taxpayer’s email address and business telephone number. This information is essential for potential follow-up or clarification.

- Don’t file the form without reviewing it for completeness and accuracy. Errors or omissions can delay processing and could result in underestimation penalties.

- Don’t use international bank checks for your payment. Payments must be made through U.S. financial institutions to be accepted.

- Don’t ignore the requirement to amend your declaration if your estimated tax changes. Failing to adjust your estimated payments could result in penalties for underpayment.

Misconceptions

There are several common misconceptions about the NYC 5UB form, also known as the Partnership Declaration for Estimated Unincorporated Business Tax in New York City. Understanding these misconceptions is crucial for partnerships operating within the city to ensure compliance and avoid penalties. Here are ten misconceptions and their clarifications:

Paying Estimated Taxes Isn’t Necessary for Small Businesses: Even small partnerships anticipating to owe more than $3,400 in unincorporated business tax must file and pay estimated taxes.

The NYC 5UB Form Is Complex to Fill Out: Although it appears complex, the form guides partnerships through estimating their tax liability and calculating payments.

All Partnerships Must Pay Equal Installments: While the default is equal quarterly payments, underpayment penalties can be avoided through accurate estimation and adjusting payments as income fluctuates.

The Form Is Only for Fiscal Year Taxpayers: The form is required for both calendar and fiscal year taxpayers, with specific deadlines for each.

Previous Year’s Tax Overpayment Cannot Be Applied: Overpayments from the previous year’s tax can indeed be elected to apply as a credit against the current year’s estimated tax.

Electronic Filing Isn’t an Option: Partnerships are encouraged to file electronically, which is a convenient and secure method to submit the declaration and payment.

Late Payment Is Always Penalized: If a partnership has a reasonable cause for late payment, penalties may be waived, though interest may still accumulate.

Only Net Profit from Business Activities Is Taxable: The form requires estimating all income, including any refunds or credits for sales or compensating use taxes, which could affect the taxable income estimate.

Amending the Declaration Is Not Allowed: Amendments to the estimated tax declaration are permitted and encouraged if there is a significant change affecting the tax due.

Filing This Form Extends the Deadline for Federal or State Returns: Filing the NYC 5UB form does not grant an extension for filing federal or state tax returns.

Carefully addressing these misconceptions ensures that partnerships comply with the Unincorporated Business Tax requirements in New York City, avoiding unnecessary penalties and fostering a more predictable financial environment for their business operations.

Key takeaways

Filling out the NYC 5UB form, a vital document for partnerships and similar entities in New York City to manage their Unincorporated Business Tax, requires attention to detail and an understanding of its key components. Here are eight crucial takeaways to assist you in navigating this process successfully:

- Every partnership conducting an unincorporated business or profession within New York City must submit the NYC 5UB form if their estimated tax exceeds $3,400 for the year. This ensures that businesses pay their fair share towards the city's revenue, helping to fund essential public services.

- The due date for filing varies depending on whether the business follows a calendar year or a fiscal year. For calendar year filers, the form must be submitted by April 17, 2012, with additional dates applicable for fiscal year filers. Adhering to these deadlines prevents late fees and complications.

- Payments can be made in installments, with specific dates outlined for each portion. This flexible payment option aids businesses in managing their finances without the burden of a lump sum payment.

- Estimations of the tax due are calculated based on expected net income from business activities, minus allowable exemptions and deductions. By carefully projecting your business's income, you can ensure that your estimated payments are as accurate as possible.

- The form offers provision for applying overpayment from the previous year’s tax towards the current year's estimated tax. Utilizing this option could ease your tax burden and streamline the payment process.

- Several credits may reduce your tax liability, including business tax credit, real estate tax escalation credit, and credits for employment opportunity relocation costs, among others. Understanding and claiming applicable credits can significantly reduce the amount of tax owed.

- Should your estimated tax change due to alterations in income, deductions, or allocations, an amended declaration needs to be filed. Keeping the Department of Finance informed of such changes prevents inaccuracies and potential underpayment charges.

- Failure to file, late filing, or underpayment results in penalties. Thus, maintaining accurate records and staying on top of deadlines is imperative to avoid unnecessary fees.

It's clear that managing your Unincorporated Business Tax through the NYC 5UB form is a multifaceted process, emphasizing the importance of due diligence, timely payment, and accurate reporting. Responsible handling of these obligations reflects positively on your business's commitment to legal compliance and financial health.

Common PDF Documents

Irc 125 on W2 - Emphasizes the importance of accurately reporting and documenting New York State entire net income for C Corporations.

Gen 215b - Advises on the selection and installation of New York State Department of Health approved backflow devices in NYC.

Nyc Corp Tax Rate - The form serves as a formal request for extra time, highlighting the importance of adherence to financial reporting deadlines.