Free Nyc 4S Form in PDF

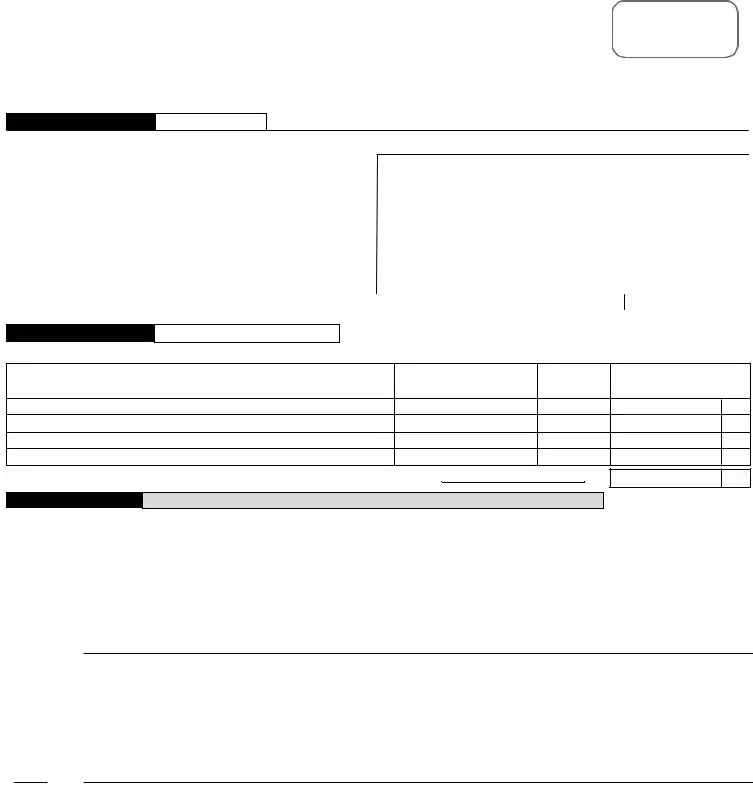

The New York City General Corporation Tax (GCT) Return, known as the NYC-4S form, occupies a crucial position within the financial and regulatory framework governing corporations operating within the city's precincts. Encompassing a comprehensive scope, this document intricately outlines the process for reporting income, computing taxes due, and claiming allowable deductions and credits, including specifically designated provisions for 9/11-related federal tax benefits. Notably, the form facilitates corporations in proclaiming their fiscal attributes for either the calendar year or a specific fiscal period, thus accommodating the diverse temporal dimensions aligning with businesses' unique operational timelines. Entries on the form span various segments, including but not limited to, detailed delineations of net income calculations, capital assessments, stockholder compensation, alternative tax computations, and minimum tax obligations, embedding within these delineations specific instructions for entities like cooperatives and professional corporations. Additionally, the form extends its purview to encapsulate estimated tax payments, adjustments pertaining to prepayments, and delineates protocols for addressing overpayments, underpayments, and pertinent penalties. Significantly, the inclusion of sections dedicated to rentals, federal return correlations, gross receipts, and a certification section underscores the form's integral role in ensuring compliance, facilitating fiscal accountability, and fostering an informed engagement with the city’s tax regulations.

Nyc 4S Sample

*30410391*

|

NYC GENERAL CORPORATION |

|

|

|

|

|

|

|

|

|

|

||||||

F I N A N C E 4 S |

T A X R E T U R N |

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

NEW ● YORK |

|

|

|

|

|

|

|

▲ DO NOT WRITE IN THIS SPACE - FOR OFFICIAL USE ONLY ▲ |

|

||||||||

www.nyc.gov/ finance |

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

||||||||

For CALENDAR YEAR 2003 or FISCAL YEAR beginning ___________________2003 and ending ___________________ |

2003 |

|

|||||||||||||||

Check "yes" if you claim any |

|

|

|

|

|||||||||||||

● ■ Am ended return |

● ■ Final return .Check box if the corporation has ceased operations. |

|

● ■ Special short period return (see inst.) |

|

|||||||||||||

▼ |

Nam e |

|

|

|

|

|

|

|

|

|

|

EM PLOYER IDENTIFICATION NUM BER |

|

||||

here |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

label |

Address (num ber and street) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

mailing |

|

|

|

|

|

|

|

|

|

|

|

BUSINESS CODE NUM BER AS PER FEDERAL RETURN |

|

|

|||

Affix |

City and State |

|

|

|

|

Zip Code |

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Business Telephone Num ber |

|

|

|

Date business began in NYC |

|

|

|

|

|

|

|

|

|

||||

▼ |

|

|

|

|

|

|

IMPORTANT: Corporations licensed and/or regulated by the NYC Taxi and |

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

Limousine Commission use business code 999900 in lieu of federal code. |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

S C H E D U LE A |

|

Com putation of Tax |

|

BEGIN WITH SCHEDULES B THROUGH E ON PAGE 2. TRANSFER APPLICABLE AM OUNTS TO SCHEDULE A. |

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Payment Enclosed |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A. |

Payment |

Pay amount shown on line 15 - Make check payable to: NYC Department of Finance |

|

● |

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

||||||||||||||||||||||||

1. |

Net income (from Schedule B, line 8) |

|

|

|

|

● 1. |

|

|

|

|

|

|

|

|

|

X .0885 |

|

● 1. |

|

|

|

|

|

|||||

|

|

........................................ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

2a. |

Total capital (from Schedule C, line 7) (see instructions) |

● 2a. |

|

|

|

|

|

|

|

|

|

X .0015 |

|

● 2a. |

|

|

|

|

|||||||||

|

2b. |

Total capital - Cooperative Housing Corps. (see instructions) .... |

● 2b. |

|

|

|

|

|

|

|

|

|

X .0004 |

|

● 2b. |

|

|

|

|

|||||||||

|

2c. |

Cooperatives - enter: |

● BORO |

|

|

|

● BLOCK |

|

|

|

|

|

|

● LOT |

|

|

|

|

|

|

|

|||||||

|

3a. |

Compensation of stockholders |

(from Schedule D, line 1) |

● |

3a. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

3b. |

Alternative tax (applies to corporations including professional corporations) |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

(see instructions for worksheet) |

......................................................................................................... |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

● 3b. |

|

|

|

|

||||

4. |

Minimum tax - No reduction is permitted for a period of less than 12 months |

...................................... |

|

|

|

|

4. |

|

300 |

00 |

||||||||||||||||||

5. |

Tax (line 1, 2a, 2b, 3b or 4, whichever is largest) |

|

|

|

|

|

|

|

|

|

|

|

|

|

● 5. |

|

|

|

|

|||||||||

6. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

First installment of estimated tax for period following that covered by this return: |

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

( a) If application for extension has been filed, enter amount from line 4 of Form |

....... |

● 6a. |

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

( b) If application for extension has not been filed and line 5 exceeds $1,000, |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

7. |

enter 25% of line 5 (see instructions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

● 6b. |

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

Total before prepayments (add lines 5 and 6a or 6b) |

......................................................................... |

|

|

|

|

|

|

|

|

|

|

|

|

|

● 7. |

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

8. |

Prepayments (from Prepayments Schedule, line E) (see instructions) |

|

|

|

|

|

● 8. |

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

9. |

Balance due (line 7 less line 8) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

● 9. |

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

10. |

Overpayment (line 8 less line 7) |

|

|

|

|

|

|

|

|

|

|

|

|

|

● 10. |

|

|

|

|

|||||||||

|

11a. |

...................................................................Interest (see instructions) |

|

|

|

|

|

|

11a. |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

11b. |

...................................................Additional charges (see instructions) |

|

|

|

11b. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

11c. |

Penalty for underpayment of estimated tax (attach Form |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

12. |

Total of lines 11a, 11b and 11c |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

● 12. |

|

|

|

|

|

|||||

13. |

Net overpayment (line 10 less line 12) |

|

|

|

|

|

|

|

|

|

|

|

|

|

● 13. |

|

|

|

|

|||||||||

14. |

...........................................................................................Amount of line 13 to be: ( a) Refunded |

|

|

|

|

|

|

|

|

|

|

|

|

● 14a. |

|

|

|

|

||||||||||

|

|

|

|

|

( b) Credited to 2004 estimated tax |

......................................................... |

|

|

|

|

|

|

|

|

|

● 14b. |

|

|

|

|

||||||||

15. |

..................TOTAL REMITTANCE DUE (see instructions) Enter payment amount on line A above |

● 15. |

|

|

|

|

||||||||||||||||||||||

16. |

NYC rent deducted on federal return (see instr. ) THIS LINE M UST BE COM PLETED. |

... ● 16. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

17. |

Federal return filed: |

● ■ 1120 |

|

● ■ |

|

|

● ■ 1120S |

|

|

|

● ■ 1120F |

|

|

|

|

|

|

|

|

||||||||

|

18. |

Gross receipts or sales from federal return |

|

|

|

|

|

|

|

|

|

|

|

|

|

● 18. |

|

|

|

|

|

|||||||

|

19. |

Total assets from federal return |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

● 19. |

|

|

|

|

|

||||

CERTIFICATION OF AN ELECTED OFFICER OF THE CORPORATION

SIGN →

HERE

PREPARER'S USE →

ONLY

I hereby certify that this return, including any accompanying rider, is, to the best of my knowledge and belief, true, correct and complete.

I authorize the Dept. of Finance to discuss this return with the preparer listed below. (see instructions) .................YES ■ |

|

|

|

||||||

Signature of officer |

|

Title |

|

Date |

Preparer's Social Security Number or PTIN |

||||

|

|

||||||||

|

|

|

Check if self- |

■ |

|

● |

|

|

|

Preparer's signature |

|

Date |

|

|

|

||||

|

employed ✔ |

Firm's Employer Identification Number |

|||||||

|

|

|

|

|

|

● |

|||

|

|

|

|

|

|

|

|

|

|

▲ Firm's name (or yours, if |

▲ Address |

|

▲ Zip Code |

|

|

|

|||

|

|

|

|

||||||

Attach copy of all pages of your federal tax |

M ake remittance payable to the order of: |

return or pro forma federal tax return. |

NYC DEPARTM ENT OF FINANCE. |

|

Payment must be made in U. S. dollars, drawn on a U. S. bank. |

To receive proper credit, you must enter your correct Employer Identification Number on your tax return and remittance.

30410391 |

AT TA C H R E M I T TA N C E T O T H I S PA G E O N LY |

|

Form |

NAME _____________________________________________________________ EIN __________________________ |

Page 2 |

||||||||

|

|

|

|

|

|

|

||||

S C H E D U LE B |

Com putation of N YC Taxable N et Incom e |

|

|

|

|

|

||||

|

|

|

|

|

1. |

|

|

|

||

1. |

Federal taxable income before net operating loss deduction and special deductions (see instructions) .. |

|

|

|

||||||

2. |

.................................Interest on federal, state, municipal and other obligations not included in line 1 |

|

|

|

||||||

|

|

|

||||||||

3a. |

NYS Franchise Tax and other income taxes, including MTA surcharge, deducted on federal return (see instr.) |

3a. |

|

|

|

|||||

|

|

|

||||||||

3b. |

NYC General Corporation Tax deducted on federal return (see instructions) |

3b. |

|

|

|

|||||

|

|

|

||||||||

4. |

ACRS depreciation and/or adjustment (attach Form |

4. |

|

|

|

|||||

|

|

|

||||||||

5. |

Total (sum of lines 1 through 4) |

|

|

5. |

|

|

|

|||

6a. |

..........New York City net operating loss deduction (see instructions) |

6a. |

|

|

|

|

|

|

||

6b. |

Depreciation and/or adjustment calculated under |

|

|

|

|

S CORPORATIONS |

||||

|

|

|

|

|||||||

|

pre - 9/11/01 rules (attach Form |

6b. |

|

|

|

see instructions |

||||

6c. |

NYC and NYS tax refunds included in Schedule B, |

|

|

|

|

for line 1 |

||||

|

|

|

|

|

|

|

||||

|

line 1 (see instructions) |

6c. |

|

|

|

|

|

|

||

7. |

.........................................................................................................Total (sum of lines 6a through 6c) |

|

|

7. |

|

|

|

|||

|

|

|

|

|

|

|||||

8. |

Taxable net income (line 5 less line 7) (enter on page 1, Schedule A, line 1) (see instructions) |

8. |

|

|

|

|||||

S C H E D U LE C

Total Capital

Basis used to determine average value in column C. CHECK ONE. (ATTACH DETAILED SCHEDULE)

■ - Annually |

■ - |

■ - Quarterly |

|

COLUMN A |

|

COLUMN B |

|

COLUMN C |

|||||

|

|

|

|

|

|

Beginning of Year |

|

End of Year |

|

Average Value |

|||

■ |

- Monthly |

■ - Weekly |

■ - Daily |

||||||||||

|

|

|

|

|

|

|

|

||||||

1. |

Total assets from federal return |

1. |

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|||||||

2. |

Real property and marketable securities included in line 1 |

2. |

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|||||||

3. |

Subtract line 2 from line 1 |

3. |

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|||||||

4. |

Real property and marketable securities at fair market value |

4. |

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|||||||

5. |

Adjusted total assets (add lines 3 and 4) |

5. |

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|||||||

6. |

Total liabilities (see instructions) |

6. |

|

|

|

|

|

|

|

||||

7. |

Total capital (column C, line 5 less column C, line 6) (enter on page 1, Schedule A, line 2a or 2b) |

.......................... |

7. |

|

|

||||||||

|

|

|

|||||||||||

S C H E D U LE D

Cer tain Stockhold ers

Include all stockholders owning in excess of 5% of taxpayer's issued capital stock who received any compensation, including commissions.

Name and Address - Give actual residence (Attach rider if necessary)

Social Security Number

Official Title

Salary & All Other Compensation

Received from Corporation

(If none, enter "0")

1. Total, including any amount on rider (enter on page 1, Schedule A, line 3a) |

1. |

S C H E D U LE E

The following infor m ation m us t be entered for this retur n to be com plete .

1.

2.

3.

*30420391*

New York City principal business activity |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

Does the corporation have an interest in real property located in New York City? (see instructions) |

YES |

■ |

NO |

■ |

|||

If "YES": (a) |

Attach a schedule of such property, including street address, borough, block and lot number. |

|

■ |

|

■ |

||

(b) Was a controlling economic interest in this corporation (i.e., 50% or more of stock ownership) transferred during the tax year?.... |

YES |

NO |

|||||

4. |

Does the corporation have one or more qualified subchapter s subsidiaries (QSSS)? |

YES |

■ |

NO |

■ |

||

If "YES" Attach a schedule showing the name, address and EIN, if any, of each QSSS and indicate whether the QSSS filed or was required to file a City business income tax return. See instructions.

|

PREPAYMENTS CLAIMED ON SCHEDULE A, LINE 8 |

|

DATE |

|

AMOUNT |

|

TWELVE DIGIT TRANSACTION ID CODE |

|||

|

....A. Mandatory first installment paid with preceding year's tax |

|

|

|

|

|

|

|

|

|

|

.............Payment with declaration, Form |

|

|

|

|

|

|

|

|

|

|

B. Payment with Notice of Estimated Tax Due, (2) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Payment with Estimated Tax Due (3) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

C.Payment with extension, Form |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

D.Overpayment credited from preceding year |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

E. TOTAL of A, B, C and D (enter on Schedule A, line 8) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

M A I L I N G |

RETURNS WITH REMITTANCES |

RETURNS CLAIMING REFUNDS |

ALL OTHER RETURNS |

2003 |

|||||

|

NYC DEPARTMENT OF FINANCE |

NYC DEPARTMENT OF FINANCE |

NYC DEPARTMENT OF FINANCE |

|||||||

|

INSTRUCTIONS |

PO BOX 5040 |

PO BOX 5050 |

|

|

|

|

- |

||

|

|

PO BOX 5060 |

||||||||

|

|

KINGSTON, NY |

KINGSTON, NY |

KINGSTON, NY |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

30420391 The due date for the calendar year 2003 return is on or before March 15, 2004. For fiscal years beginning in 2003, File within 2 1/2 months after the close of fiscal year. |

|||||||||

|

|

|||||||||

File Overview

| Fact | Detail |

|---|---|

| Form Type | NYC GENERAL CORPORATION FINANCE 4S TAX RETURN |

| For Use By | Corporations operating in New York City |

| Governing Law | New York City Administrative Code |

| Tax Year | Applicable for Calendar Year 2003 or Fiscal Year beginning and ending in 2003 |

| 9/11/01-Related Tax Benefits | Includes option to claim 9/11-related federal tax benefits |

| Special Instructions for | Corporations licensed and/or regulated by the NYC Taxi and Limousine Commission should use business code 999900 |

| Payment Information | Payment to be made to NYC Department of Finance with specific instructions on computation and submission |

| Submission Details | Includes requirements for estimated tax payments, prepayments, and details for mailing returns with remittances or claiming refunds |

Nyc 4S: Usage Guidelines

After deciding to file the NYC General Corporation Tax Return (Form NYC-4S), it's essential to approach the process methodically to ensure accuracy and compliance. Understanding the parts of the form and completing them in the right sequence can help streamline the task. Below are detailed steps designed to guide you through filling out the form correctly. Remember, careful attention to each part will not only help avoid common mistakes but ensure your corporation meets its tax obligations effectively.

- Identify the tax year and fiscal period your corporation is filing for at the top of the form, marking it as a calendar year or specifying the fiscal year beginning and ending dates.

- If applicable, check the appropriate box to indicate if you are claiming any 9/11/01-related federal tax benefits, filing an amended return, marking as final return, or noting the corporation has ceased operations.

- Provide the corporation's name, Employer Identification Number (EIN), address, business code number as per federal return, and the city, state, and zip code. If your business is regulated by the NYC Taxi and Limousine Commission, use business code 999900.

- Enter the date the business began operations in New York City.

- On Schedule A, begin with Schedules B through E to fill in relevant financial information before calculating the tax on Schedule A.

- For Schedule B, compute New York City Taxable Net Income starting with your federal taxable income before specific deductions and adjustments, then applying New York City-specific deductions and adjustments.

- On Schedule C, detail your corporation's capital, providing information at the beginning and end of the year, or following another applicable schedule, and calculate the total capital.

- In Schedule D, list any stockholders owning more than 5% of the issued capital stock, including their compensation.

- Complete Schedule E with details about your corporation's principal business activity, interests in real property in New York City, and any Qualified Subchapter S Subsidiaries (QSSS).

- Calculate your tax payable using the information provided in Schedules B through E, entering the totals on Schedule A and determining whether you owe tax or are due a refund.

- Enter prepayments, interest, additional charges, and underpayment penalties if applicable on Schedule A, and decide whether the net overpayment will be refunded or credited.

- Ensure an elected officer of the corporation signs and dates the form, certifying its accuracy. If prepared by someone other than an officer, the preparer’s details must also be included.

- Attach a copy of all pages of your federal tax return or pro forma federal tax return and make any payment due payable to the NYC Department of Finance, including your correct Employer Identification Number on the remittance.

- Review the entire form for accuracy before mailing it to the specified address for your type of return, ensuring you meet the specified deadline for submission.

By following these steps, you will navigate the complexities of the NYC-4S form more smoothly, ensuring that your corporation complies with the tax requirements and avoids potential issues due to inaccuracies or missed deadlines. Remember, when in doubt, seeking advice from a tax professional can provide additional clarity and support.

FAQ

Frequently Asked Questions about the NYC 4S Tax Form:

-

What is the NYC 4S Tax Form used for?

The NYC 4S Tax Form is used by general corporations operating within New York City to report and pay their general corporation tax for a specific tax year. It covers either the calendar year or a fiscal year as defined by the corporation.

-

Who needs to file this form?

Any corporation conducting business, employed, or owns capital or property in New York City is required to file this form. This includes corporations that are licensed and/or regulated by the NYC Taxi and Limousine Commission, although they should use business code 999900 instead of their federal code.

-

Can I file this form if my corporation started or ceased operations within the tax year?

Yes, corporations that have started operations in NYC or ceased operations within the tax year need to fill out this form accordingly. There are specific boxes to check for amended returns, final returns, or special short period returns in such cases.

-

How is the tax on the NYC 4S Form calculated?

Tax is calculated based on net income, total capital, compensation of stockholders, and a minimum tax rate. The specific calculations are detailed in various schedules within the form, leading to the determination of the tax owed or an overpayment.

-

What if I need to amend a return?

If corrections are needed after filing your NYC 4S Form, you can file an amended return. Ensure to check the "Amended return" box and accurately report the corrected figures.

-

Are there any special considerations for corporations affected by the 9/11/01 events?

Corporations claiming any 9/11/01-related federal tax benefits should indicate this by checking the appropriate box on the form.

-

What is the deadline for filing this form?

For the calendar year 2003, the due date is on or before March 15, 2004. For fiscal years beginning in 2003, the form should be filed within 2 1/2 months after the close of the fiscal year.

-

Where should payments be made?

Payments should be made payable to the NYC Department of Finance. The form and any accompanying payment must be made in U.S. dollars and drawn on a U.S. bank.

-

Can this form be filed electronically?

The document does not specify electronic filing options. For the most current filing methods, including electronic submissions, it's recommended to visit the official website of the NYC Department of Finance or contact them directly.

-

How do I determine the business code number as per the federal return?

The business code number as per the federal return should be identified based on the principal business activity of the corporation. The instructions specify that corporations licensed and/or regulated by the NYC Taxi and Limousine Commission must use business code 999900 in lieu of their federal code.

Common mistakes

Filling out the NYC-4S form, the General Corporation Tax Return for New York City, can be a daunting task. Complex instructions and the pressure to avoid errors can lead to common mistakes. By understanding these pitfalls, corporations can better navigate the filing process and ensure compliance with local tax laws. Here are nine common mistakes to avoid:

Incorrect Employer Identification Number (EIN): An EIN is a unique nine-digit number assigned by the IRS to businesses operating in the United States. Ensuring the correct EIN is crucial, as it helps in identifying the corporation for tax purposes. Errors or omissions in this field can lead to processing delays or misidentification.

Mistakes in the Beginning and Ending Dates for Fiscal Year Filers: The form requires specification of the fiscal year for corporations not following the calendar year. Incorrectly filling out these dates might lead to the return being considered for the wrong tax period.

Incorrect Business Code Number: The business code number should reflect the corporation’s primary business activity as per the federal return. Using an incorrect code can lead to classification errors, potentially affecting tax computations.

Omitting the Payment Information: The form requires detailed information about payments made, including estimated taxes and prepayments. Failure to accurately report these payments can result in discrepancies and potential penalties.

Not completing the Schedule B accurately: Schedule B deals with the computation of NYC Taxable Net Income. Errors in this section could directly impact the tax liability, leading to underpayments or overpayments of tax.

Forgetting to Attach Required Schedules and Forms: The NYC-4S form often requires additional schedules and forms to be attached, based on specific circumstances of the corporation. Forgetting to attach these documents can make the return incomplete.

Failure to Sign and Date the Form: An unsigned form is considered invalid. The certification section at the end of the form must be signed and dated by an authorized individual to attest to the accuracy of the information provided.

Incorrect Calculation of Tax: The computation of tax, including net income, total capital, and the application of the relevant tax rates, must be done meticulously. Errors in tax calculation can lead to incorrect tax amounts being reported.

Not Reporting or Incorrectly Reporting NYC Rent Deduction: Line 16 specifically asks for NYC rent deducted on the federal return. This is a crucial detail that needs correct reporting, as it affects the tax calculation.

In conclusion, while the NYC-4S form is intricate, being mindful of these common mistakes can significantly ease the filing process. Corporations are encouraged to review their forms thoroughly, seek clarification when in doubt, and consider professional assistance to ensure accurate and compliant filing.

Documents used along the form

When businesses prepare to submit the NYC GENERAL CORPORATION FINANCE TAX RETURN (Form NYC-4S) for either the calendar year or their specific fiscal year, they frequently need to complete and submit several additional forms and documents to provide a comprehensive overview of their financial activities and obligations in New York City. These additional documents may vary based on the corporation’s activities, assets, and specific tax situations.

- Form NYC-1: This form is used by banking corporations for calculating and reporting their franchise tax based on entire net income or capital, whichever is greater. It includes specific calculations for interest income and deductions, aligning with the unique financial structures of banks and similar financial institutions.

- Form NYC-2: Required for general corporations (other than S Corporations), this form details the computation of the Business Corporation Tax. It includes inputs for net income, deductions, and tax credits. Corporations with complex structures or multiple lines of business often need to fill out this form alongside Form NYC-4S.

- Form NYC-3L: Utilized by corporations and partnerships to report their General Corporation Tax, this document addresses income, deductions, and credits with specifics for various types of entities. It is particularly relevant for larger entities with significant operations in or income from New York City.

- Form NYC-222: This form is the Underpayment of Estimated Tax by Corporations, which must be filled out and submitted by corporations that did not pay enough tax through withholding or estimated tax payments. It's an essential document for avoiding penalties related to the underpayment of estimated taxes.

- Form NYC-399: Schedule of Depreciation Adjustment is used to adjust depreciation values calculated under the federal Modified Accelerated Cost Recovery System (MACRS) to their New York City values. This adjustment is necessary for the proper determination of taxable income under NYC tax code.

Each of these forms plays a crucial role in ensuring corporations accurately report their income, deductions, and taxable amounts to New York City. By properly completing and submitting these forms along with Form NYC-4S, businesses can maintain compliance with city tax regulations and potentially avoid penalties for underpayment, late payments, or inaccurate reporting. These documents collectively provide a detailed picture of a corporation’s financial engagements within New York City for a given tax year.

Similar forms

The NYC-4S form, required for General Corporation Tax returns in New York City, shares similarities with the Federal Form 1120, employed for U.S. Corporation Income Tax Return. Both forms are designed to report income, gains, losses, deductions, and credits to determine the entity's income tax liability. Whereas the NYC-4S focuses on corporations operating within New York City, capturing city-specific tax obligations and benefits, Form 1120 caters to the broader federal income tax obligations of corporations operating across the United States. Each form requires detailed financial information, including income statements, balance sheets, and schedules detailing specific types of income or deductions, ensuring accurate tax assessment tailored to their respective tax jurisdictions.

Another document similar to the NYC-4S form is the Form NYC-3L, used by larger corporations within New York City to file their General Corporation Tax. Both the NYC-4S and NYC-3L gather comprehensive information on a corporation’s income, deductions, and tax credits to calculate the tax dues specific to New York City’s tax regulations. However, the NYC-3L is tailored for corporations with more complex tax profiles or higher income, necessitating detailed disclosures and computations. Each of these forms adjusts taxpayers' obligations based on local tax laws, underscoring the city’s prerogative to customize tax assessment criteria based on the scale and complexity of business operations.

Further, the NYC-4S form mirrors the Form NYC-2, which is the Business Corporation Tax Return for New York City. Both forms serve the purpose of computing tax liabilities for corporations, but the NYC-2 is specifically designed for C Corporations operating within the city. Like the NYC-4S, Form NYC-2 requires detailed information on the corporation’s financial activities, including income, deductions, and applicable credits, to ascertain the correct city tax owed. These documents ensure that businesses contribute to New York City's revenue in accordance with their financial activities and the local tax code provisions.

The Schedule A of the NYC-4S form, detailing the computation of tax based on net income, capital, and other factors, can be likened to Schedule M-3 (Form 1120), which reconciles financial statement income with tax return income for federal purposes. While Schedule M-3 serves to reconcile book and tax differences on a federal level, Schedule A of NYC-4S performs a similar function within the specific context of New York City taxation, adjusting local tax computations to reflect accurate taxable income and financial position according to city regulations. Both schedules ensure transparency and compliance, bridging the gap between accounting practices and tax obligations.

Lastly, the similarity extends to the NYC-1 form, the Banking Corporation Tax Return in New York City. Though designed for banking institutions, the NYC-1 shares the NYC-4S's fundamental objective of reporting and calculating tax based on income, deductions, and credits under New York City's tax laws. Each of these forms caters to different sectors, but collectively, they illustrate the city's framework for taxing various forms of corporate entities according to specialized rules, ensuring that each entity is taxed fairly and in accordance with its specific industry and income characteristics.

Dos and Don'ts

When filling out the NYC 4S form, it's critical to pay attention to the details to ensure accurate and compliant submission. Here are six things you should and shouldn't do:

- Do: Ensure all the information you provide matches your federal return data, especially your business code number and employer identification number.

- Do: Accurately calculate your tax by following the Schedule A computation instructions carefully to avoid errors in your tax liability.

- Do: Check the box that applies to your return status – whether it's an amended, final, or special short period return – to keep your records accurate and up-to-date.

- Don't: Leave the mandatory "NYC rent deducted on federal return" line blank, as this is crucial for determining certain tax liabilities.

- Don't: Forget to attach a copy of all pages of your federal tax return or pro forma federal tax return. This is necessary for cross-verification.

- Don't: Ignore filling out Schedule E if it applies to you, especially regarding interests in real property located in New York City or qualified subchapter S subsidiaries (QSSS).

Following these guidelines will help streamline the process and decrease the chances of errors or delays with your NYC 4S Tax Return. Accurate and complete submissions are essential for compliance with New York City tax regulations..

Misconceptions

There are several misconceptions regarding the NYC-4S form, which is essential for corporations operating within New York City. Understanding these misconceptions can help ensure compliance and accuracy when dealing with corporate taxes. Below are nine common misunderstandings about the NYC-4S form and explanations to clarify these points.

Many believe that the NYC-4S form is exclusively for corporations that started their business in New York City in the current tax year. In reality, this form is required for all general corporations doing business, employing capital, owning or leasing property, or maintaining an office in the city, regardless of when they began operations.

Another misconception is that corporations can use any business code when filling out their NYC-4S form. However, corporations licensed and/or regulated by the NYC Taxi and Limousine Commission must use the business code 999900 in place of their federal code.

Some think that indicating a cessation of operations on the NYC-4S form is optional and has no legal implications. Yet, checking the box that the corporation has ceased operations is a significant indication for tax purposes and must be done accurately to avoid penalties or misunderstandings with the Department of Finance.

It's commonly misunderstood that the compensation of stockholders owned by individuals holding less than 5% of the issued share is irrelevant to the NYC-4S form. Contrarily, compensation details of all significant stockholders (those owning more than 5%) need to be accurately reported.

A misconception exists that the NYC-4S form doesn’t require detailed capital computation. The truth is, Schedule C of the form demands a comprehensive report on the company's total capital, including real property and marketable securities, at both the beginning and end of the year. This information is critical in calculating the tax base.

There's a false perception that the alternative tax calculation (for corporations, including professional corporations) is a straightforward flat rate. Instead, it involves a detailed worksheet, considering several factors to determine the correct tax amount under alternative tax rules.

Some believe that all corporations must pay the minimum tax amount listed on the form. However, the minimum tax only applies to entities subject to it based on their specific circumstances, and no reduction is permitted for periods of less than 12 months.

Many mistakenly think details about a corporation’s principal business activity, real property interest in NYC, or qualified subchapter s subsidiaries (QSSS) aren’t crucial on the NYC-4S. In contrast, these details are vital for assessing the tax responsibilities and benefits applicable to the corporation.

Lastly, a common misunderstanding is that only the payment enclosed with the NYC-4S form matters for tax purposes. However, prepayments, estimated tax payments, and other adjustments are also significant contributors to the final tax calculation and must be accurately reported on the form.

Correcting these misconceptions ensures that the NYC-4S tax return is completed with the necessary diligence, ultimately aiding corporations in their compliance with New York City's tax regulations.

Key takeaways

Filling out the NYC 4S form correctly is crucial for corporations to comply with New York City's tax requirements. Here are six key takeaways to keep in mind:

- Before beginning the NYC 4S Form, corporations should prepare by gathering their federal return information, as the business code number and tax calculations are derived from the federal return.

- The form allows for adjustments based on specific New York City tax laws, such as the inclusion of interest on federal, state, municipal, and other obligations not included in the federal taxable income. This emphasizes the importance of understanding local tax regulations in addition to federal ones.

- Special considerations are given to corporations that have operations tied to the NYC Taxi and Limousine Commission or those claiming 9/11-related federal tax benefits. Such statuses should be clearly indicated as they can affect the tax computation.

- Calculating the correct amount of tax involves several schedules that must be completed in sequence, beginning with Schedules B through E, before summarizing on Schedule A. This structured approach ensures that the corporation's net income, capital, and any alternative tax calculations are accurately captured.

- For corporations that have ceased operations, filed an amended return, or are filing for a short period, the form provides specific boxes to check. This illustrates the city’s tax department's flexibility in accommodating various corporate situations.

- Upon completion, the form requires certification by an elected officer of the corporation, underscoring the necessity for accuracy and the legal responsibility of the information provided.

For corporations operating within New York City, careful attention to the details of the NYC 4S form is essential to ensure compliance with the city’s tax obligations and to avoid potential penalties for inaccuracies or omissions.

Common PDF Documents

Form It-203-b - The comprehensive scope of VENDEX, identifying vendor affiliations and control relationships, ensures that the city's contractual engagements are transparent and conflict-free.

Letters of Administration New York Surrogate's Court - It prompts administrators to account for any outstanding bills or claims against the estate, ensuring a clear path for settlement.

It-2 Form - Allocations for local wages and income tax withholdings are specified by locality codes, demanding attention to detail.