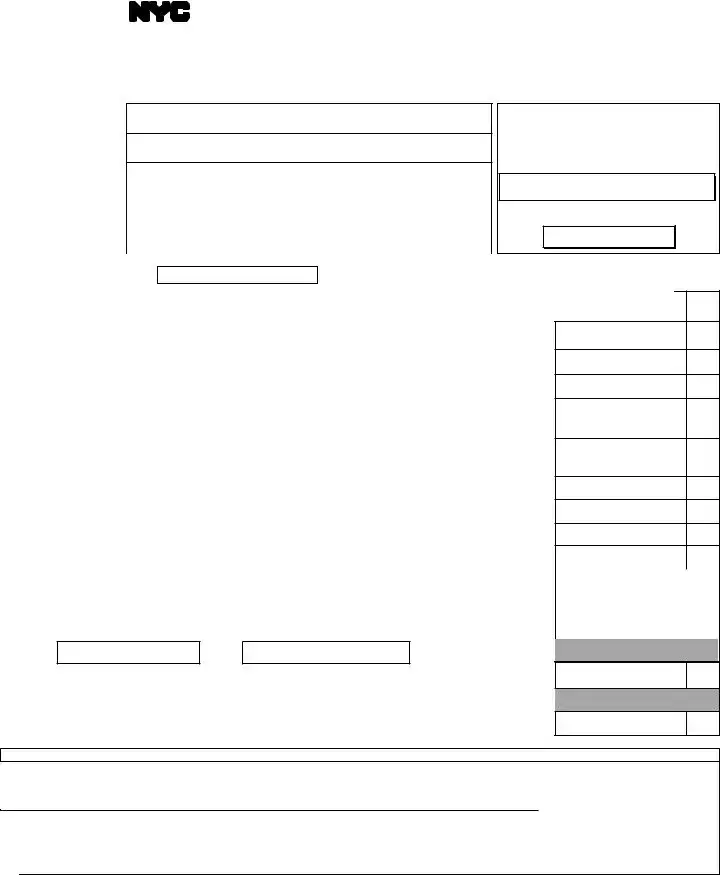

Free Nyc 4S Ez Form in PDF

In the bustling economic landscape of New York City, the General Corporation Tax Return for 2012, known as Form NYC-4S-EZ, stands out as a crucial document for businesses. Administered by the New York City Department of Finance, this form targets corporations operating within the city, capturing key financial details necessary for accurately computing the corporation tax due. At its core, the NYC-4S-EZ form is meticulously designed to streamline the tax filing process for entities, allowing for a declaration of net income, computation of the applicable tax, and management of payments or refunds. It caters to businesses adhering to both calendar and fiscal year reporting, providing flexibility and ensuring compliance across diverse financial timelines. Key sections of this form encompass the compilation of gross receipts, actionable steps for determining the tax based on net income or a minimum tax threshold, and precise protocols for handling overpayments, including options for refunds or credits towards future tax liabilities. Additionally, the provision for indicating a cessation of operations or amending previous returns underscores the form's comprehensive approach to addressing various corporate circumstances. With mandatory attachments like a copy of the federal tax return and stringent requirements on payment methods, Form NYC-4S-EZ encapsulates a blend of precision and due diligence in maintaining the fiscal health of New York City's corporate sector.

Nyc 4S Ez Sample

*31111293*

NEWYORK CITYDEPARTMENT OF FINANCE

EZ

FINANCE

|

|

Check box if you are filing |

For CALENDAR YEAR 2012 or FISCAL YEAR beginning _______________ 2012 and ending ___________________ ● ■ a52- |

||

● ■ Amended return |

● ■ Final return - Check box if the corporation has ceased operations. |

● ■ Special |

Name

In Care Of

Address (number and street)

City and State |

Zip Code |

|

|

Business Telephone Number |

Date business began in NYC |

|

|

Taxpayer’s Email Address:

__________________________________________

EMPLOYER IDENTIFICATION NUMBER

BUSINESS CODE NUMBER AS PER FEDERAL RETURN

SCHEDULE A Computation of Tax

BEGIN WITH SCHEDULES B1 or B2 ON PAGE 2. TRANSFER APPLICABLE AMOUNT TO SCHEDULE A.

A. Payment |

Amount included with form - Make payable to: NYC Department of Finance |

● |

|

|

|

|

|

Payment Enclosed

1. |

Netincome(fromScheduleB1,line3orB2,line6)● 1. |

|

|

|

|

X .0885 |

.. ● 1. |

|

|

2. |

|

|

|

|

............... |

● 2. |

|

|

|

|

|

|

|

|

|

|

|||

3. |

Tax (line 1 or 2, whichever is larger) |

|

|

|

● 3. |

|

|

||

4. |

First installment of 2013 estimated tax: |

|

|

|

|

|

|

|

|

|

(a) If application for extension has been filed, enter amount from line 2 of Form |

● 4a. |

|

|

|||||

|

(b) If application for extension has not been filed and line 3 exceeds $1,000, |

|

|

|

|||||

|

enter 25% of line 3 (see instructions) |

|

|

|

● 4b. |

|

|

||

5. |

Total before prepayments (add lines 3 and 4a or 4b) |

|

|

|

● 5. |

|

|

||

6. |

Prepayments (see instructions) |

|

|

|

● 6. |

|

|

||

7. |

Balance due (line 5 less line 6) |

|

|

|

● 7. |

|

|

||

8. |

Overpayment (line 6 less line 5) |

|

|

|

● 8. |

|

|

||

9. |

Interest (see instructions) |

9. |

|

|

|

|

|

|

|

10. |

Amount of line 8 to be: (a) Refunded - ■ Direct deposit - fill out line 10c |

...OR ■ Paper check |

● 10a. |

|

|

||||

|

.........................................................(b) Credited to 2013 estimated tax |

|

|

|

● 10b. |

|

|

||

10c. Routing

Number

Account Number

ACCOUNT TYPE

Checking ■ Savings ■ ●

11. TOTAL REMITTANCE DUE (see instructions) Enter payment amount on lineAabove |

............... ● 11. |

|

12. |

Federal return filed: ● ■ 1120 ● ■1120C ● ■ 1120S ● ■ 1120H |

● ■ 1120F |

13. |

Gross income |

● 13. |

SIGN HERE USE ONLY

PREPARER'S

CERTIFICATION OF AN ELECTED OFFICER OF THE CORPORATION

Iherebycertifythatthisreturn,includinganyaccompanyingrider,is,tothebestofmyknowledgeandbelief,true,correctandcomplete. |

Firm'sEmailAddress: |

|||||||||

I authorize the Dept. of Finance to discuss this return with the preparer listed below. (see instructions)...YES ■ |

● |

|||||||||

Officerʼs |

|

|

|

|

|

____________________________________ |

||||

|

|

|

|

|

|

● Preparer'sSocialSecurityNumberorPTIN |

||||

signature: |

|

Title: |

|

|

Date: |

|

||||

|

Checkifself- |

■ |

|

|

|

|

|

|||

Preparer's |

Preparerʼs |

|

|

|

|

|

|

|||

signature: |

printed name: |

employed: |

Date: |

|

● Firm's Employer Identification Number |

|||||

|

|

|

||||||||

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

▲ Firm's name (or yours, if |

▲ Address |

|

|

▲ Zip Code |

||||||

|

|

|

|

|

|

|

|

|

|

|

Make remittance payable to the order of: NYC DEPARTMENT OF FINANCE. Payment must be made in U.S.dollars, drawn on a U.S. bank.

Attach copy of all pages of your federal tax return or pro forma federal tax return.

To receive proper credit, you must enter your correct Employer Identification Number on your tax return and remittance.

31111293 |

ATTACH REMITTANCE TO THIS PAGE ONLY |

Form |

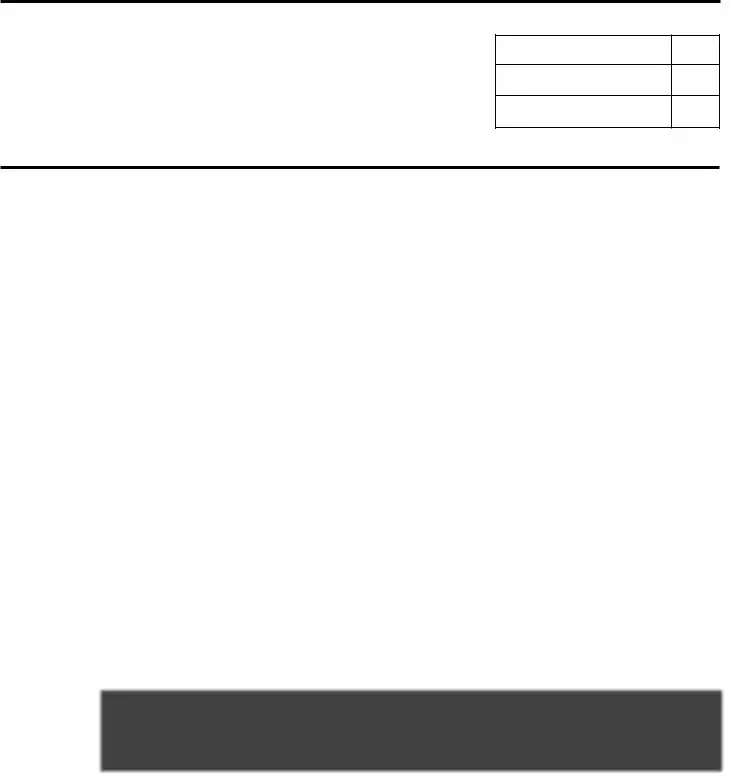

Page 2 |

NAME _______________________________________________________________________ |

EIN _______________________________________ |

SCHEDULE B1

To be used by New York State C Corporations that elect to use NYS entire net income. See instructions.

1. |

New York State Entire Net Income |

1. |

2. |

General Corporation Tax deducted in computing amount on line 1 |

2. |

3. |

Total of lines 1 and 2 (Enter on page 1, ScheduleA, Line 1) |

3. |

SCHEDULE B2

To be used by New York State S Corporations and C Corporations that do not elect to use Schedule B1. See instructions.

1. |

Federal Taxable Income before net operating loss deduction and |

|

|

|

|

|

special deductions |

1. |

|

|

|

2. |

State and local income and MTAtaxes deducted on federal return |

|

|

|

|

|

(see instructions) |

2. |

|

|

|

3. |

Total of lines 1 and 2 |

3. |

|

|

|

4. |

New York City net operating loss deduction (see instructions) |

4. |

|

|

|

5. |

New York City and New York State income tax refunds included in |

|

|

|

|

|

Schedule B2, line1 |

5. |

|

|

|

6. |

Taxable net income. Line 3 less the sum of lines 4 and 5. |

|

|

|

|

|

(Enter on page 1, ScheduleA, Line 1) |

6. |

|

|

|

|

|

|

|

||

|

ADDITIONAL REQUIRED INFORMATION - See Instructions |

|

|

|

|

|

|

|

|

|

|

1. |

Is this taxpayer subject to the Commercial Rent Tax? |

● |

■ YES |

■ NO |

|

2. |

If "YES", were all required Commercial Rent Tax Returns filed? |

● |

■ YES |

■ NO |

|

*31121293*

|

RETURNS WITH REMITTANCES |

|

RETURNS CLAIMING REFUNDS |

|

ALL OTHER RETURNS |

|

|

|

|||

MAILING |

NYC DEPARTMENT OF FINANCE |

|

NYC DEPARTMENT OF FINANCE |

|

NYC DEPARTMENT OF FINANCE |

INSTRUCTIONS: |

GENERAL CORPORATION TAX |

|

GENERAL CORPORATION TAX |

|

GENERAL CORPORATION TAX |

|

PO BOX 5040 |

|

PO BOX 5050 |

|

PO BOX 5060 |

|

KINGSTON, NY |

|

KINGSTON, NY |

|

KINGSTON, NY |

|

|

|

|

|

|

|

|

|

|

|

|

The due date for the calendar year 2012 return is on or before March 15, 2013.

For fiscal years beginning in 2012, file on or before the 15th day of the third month after the close of the fiscal year.

31121293

File Overview

| Fact | Detail |

|---|---|

| Purpose | The form serves as the General Corporation Tax Return for New York City in the year 2012. |

| Governing Body | New York City Department of Finance. |

| Application | Used by corporations operating in NYC for the calendar or fiscal year beginning and ending in 2012. |

| Key Features | Includes options for filing amended, final, or special short-period returns, and for a 52-53 week taxable year. |

| Payment Details | Payment must be made payable to the NYC Department of Finance, in U.S. dollars, and drawn on a U.S. bank. |

| Submission Information | Different mailing addresses are provided based on whether the returns are with remittances, claiming refunds, or all other returns. |

| Calculation of Tax | The form involves computing tax based on the net income or New York City gross receipts, with specifics on prepayments and balances due or overpayment. |

| Due Date | The 2012 calendar year return was due on or before March 15, 2013. For fiscal years beginning in 2012, it was due by the 15th day of the third month after the fiscal year closed. |

| Additional Requirements | Corporations needed to attach a copy of all pages of their federal tax return or pro forma federal tax return along with this form. |

| Compliance Questions | The form asks if the taxpayer is subject to the Commercial Rent Tax and if all required returns have been filed for it. |

Nyc 4S Ez: Usage Guidelines

Filling out the NYC 4S Ez form is a straightforward process, requiring careful attention to detail to ensure accuracy and compliance. The form serves as a general corporation tax return for businesses operating within New York City, capturing both financial details and specific tax calculations. Following a step-by-step guide simplifies the completion process, ensuring that all necessary information is correctly entered and the form is adequately prepared for submission.

- Begin by checking the appropriate box for your filing status: calendar year, fiscal year, 52-53 week taxable year, amended return, final return, or special short-period return, if the corporation has ceased operations.

- Under the section labeled "Name In Care Of Address", enter the legal name of the corporation, the address, city, state, zip code, and business telephone number.

- Fill in the date the business began operations in NYC.

- Provide the taxpayer’s email address.

- Enter the Employer Identification Number (EIN), and Business Code Number as per your federal return.

- Proceed to Schedule A. You will need to complete either Schedule B1 or B2 on page 2 before filling out Schedule A. Choose the schedule that corresponds to your corporation type (New York State C Corporations fill out B1, while S Corporations and others not using B1 fill out B2).

- For Schedule B1 or B2, enter the relevant income and tax information as instructed on the form and transfer the applicable amounts to Schedule A.

- In Schedule A, calculate the tax by following the steps outlined, including computing the payment amount, minimum tax, and total before prepayments.

- Enter prepayments and calculate the balance due or overpayment.

- If applicable, fill out the section for direct deposit of refunds including routing number, account number, and account type.

- Under the SIGN HERE section, an elected officer of the corporation must certify the return. Include the officer's signature, title, and date. If prepared by someone other than the officer, the preparer’s information should also be included.

- Ensure the remittance is payable to NYC Department of Finance and attach it to the designated area on the form page.

- Finally, attach a copy of all pages of your federal tax return or pro forma federal tax return.

After completing the NYC-4S-EZ form, it's essential to review the form for accuracy and completeness. Once you are satisfied with the information provided, mail the form to the appropriate address as indicated on the instruction page of the form. The address will differ depending on whether you are making a payment, claiming a refund, or neither. Timely submission is crucial to avoid penalties and interest for late filing. Keeping a copy of the form and any correspondence with the Department of Finance for your records is advisable.

FAQ

FAQ Section About the NYC 4S EZ Form

- What is the NYC 4S EZ form?

- Who is eligible to file the NYC 4S EZ form?

- How can a corporation calculate its tax using the NYC 4S EZ form?

- To calculate the tax, a corporation must first determine its taxable base, which could be the net income or the New York City gross receipts, depending on which schedule of the form they are eligible to fill out.

- For corporations using Schedule B1, the taxable base is the New York State entire net income adjusted for any General Corporation Tax deducted.

- For corporations using Schedule B2, the taxable base includes the federal taxable income adjusted for state and local income taxes deducted, among other adjustments specified in the instructions.

- Once the applicable income is determined, the calculated tax is the greater of the tax on net income or the minimum tax based on NYCG gross receipts, computed at the rate of .0885 as specified in the form instructions.

- How and when should the form be filed?

- What should a corporation do if it needs to amend a previously filed NYC 4S EZ?

The NYC 4S EZ form, also known as Form NYC-4S-EZ, is a tax return document specifically designed for general corporations operating within New York City. This form is used to calculate and report the General Corporation Tax (GCT) due to the NYC Department of Finance. It simplifies the process for corporations that meet certain criteria, allowing a more straightforward computation of their tax obligations.

Eligibility to file the NYC 4S EZ form is primarily determined by the corporation's tax election status and its gross income level. Specifically, New York State C Corporations that elect to use NYS entire net income can use Schedule B1 of the form, while New York State S Corporations and C Corporations that do not make this election should use Schedule B2. Additionally, specific instructions on the form may provide further elaboration on eligibility criteria, including any thresholds related to gross receipts or the payment of the minimum tax.

The NYC 4S EZ form, along with any payment due, must be filed with the NYC Department of Finance. For calendar year filers, the form is due on or before March 15th of the following year. For fiscal year filers, it is due on the 15th day of the third month after the close of the fiscal year. Payments can be made by check or money order payable to the NYC Department of Finance. The form provides specific addresses for mailing based on whether the return includes a payment, is claiming a refund, or neither.

If a corporation discovers errors or omissions in a previously filed NYC 4S EZ form, it can file an amended return. To do so, the corporation should mark the "Amended return" checkbox at the top of the form and correct any information as necessary. It's important to provide a clear explanation of the changes and attach any relevant documentation. The amended return should be filed as soon as the errors are discovered to avoid or minimize potential interest and penalties.

Common mistakes

Filling out tax forms can be daunting, and the NYC-4S-EZ form is no exception. While it’s designed to be easier for certain corporations, there are common mistakes people often make. These errors can lead to delays, inaccurate tax liabilities, or even fines. Understanding these pitfalls can help ensure the process goes smoothly.

One of the first mistakes is incorrectly choosing the tax year. The form allows for the specification of the calendar year or a fiscal year. Mixing these up or selecting the wrong option can cause significant confusion and result in the filing of an amended return.

Another common oversight is forgetting to check the applicable boxes at the beginning of the form, such as those for amended or final returns. These checkboxes provide critical information about the nature of the return and are easy to overlook.

A third error involves the identification section. Incorrectly entered Employer Identification Numbers (EIN) or business codes as per the federal return can misdirect or delay the processing of the form.

When it comes to financial information, mistakes often occur in Schedule A's computation of tax. Taxpayers sometimes transfer the wrong amounts from Schedules B1 or B2 or incorrectly calculate the tax due based on net income or minimum tax requirements. Precise calculations and transferring the correct figures are crucial.

The payment section also sees frequent errors. People often mistakenly calculate the total remittance due or forget to include payment for the first installment of estimated tax for the next year. This oversight could lead to underpayment penalties.

Regarding prepayments and overpayments, some taxpayers miscalculate the balance due or overpayment amount. This can result from incorrect application of prepayments to the total tax before these payments.

An additional common error lies in the handling of the direct deposit information. For those expecting a refund and preferring a direct deposit, incorrectly entered routing or account numbers can delay access to the refund.

The signatory section also frequently encounters mistakes, particularly with unauthorized or incorrect signatures. Only an elected officer of the corporation or an authorized agent should sign the form. Incorrect or missing certification can invalidate the submission.

Lastly, a frequent oversight is not attaching a copy of all pages of the federal tax return. This documentation is essential for cross-referencing and verification, and its absence can halt the processing of the form.

In sum, careful attention to these areas when completing the NYC-4S-EZ form can prevent common mistakes and ensure a smoother filing process.

Documents used along the form

When handling business taxes in New York City, especially for entities required to submit the Form NYC-4S EZ, it's essential to be prepared with all necessary documentation. The Form NYC-4S EZ, known for its streamlined approach to filing General Corporation Tax returns, often doesn't stand alone in the submission process. A handful of other forms and documents typically accompany or directly relate to it, ensuring compliance and a thorough reporting of a corporation's financial standing for the fiscal year.

- Form NYC-EXT: This form serves as an application for an extension of time to file the corporation tax return. It is crucial for entities that need additional time beyond the original deadline to gather their financial information and complete their tax filings accurately.

- Form NYC-2: Required for corporations that do not qualify to file using the Form NYC-4S EZ due to their size or income complexity. This form provides a more detailed accounting of income, deductions, and tax calculations, suitable for larger corporations with more complex financial structures.

- Form NYC-202: Aimed at unincorporated businesses within New York City, this form is pertinent for entities classified as partnerships or sole proprietorships. Although not directly related to corporate tax, it's often required for businesses operating alongside their corporate counterparts, providing a comprehensive view of the business owner's tax obligations.

- Schedule B/C/M: These schedules are attachments to the main tax forms, including the NYC-4S EZ, detailing specific types of income, deductions, and credits. Depending on the corporation's activities throughout the fiscal year, one or more of these schedules may be necessary to accurately report the financial details the Department of Finance requires.

Filing taxes in New York City involves navigating through an array of forms and schedules designed to capture different aspects of a business's financial activities. Understanding the purpose of each and ensuring their accurate completion plays a pivotal role in achieving compliance and optimizing the tax filings process. It's not just about filling out the form but understanding which documents complement it to paint a full picture of the business's economic reality over the fiscal period.

Similar forms

The Form 1120, known as the U.S. Corporation Income Tax Return, bears a resemblance to the NYC 4S EZ form in its core function of reporting income, gains, losses, deductions, and credits to calculate the income tax liability of corporations. Both forms serve as the tax filing mechanism for corporations within their respective jurisdictions, with the Form 1120 fulfilling this role at the federal level. Each document requires details on the corporation's financial performance over the tax year and provides a schedule for computing taxable income and applicable taxes, ensuring compliance with tax regulations.

The Form 990, or Return of Organization Exempt From Income Tax, shares a common purpose with the NYC 4S EZ form in reporting financial information. Although the Form 990 is specifically designed for tax-exempt organizations, it parallels the NYC 4S EZ form in its attempt to ensure fiscal transparency and accountability. Both forms collect data on revenue and expenses, effectively assessing the entity's financial health during the fiscal period. They play key roles in maintaining the integrity of financial reporting within different segments of the tax environment.

The Form 1120S, the tax return for S Corporations, aligns closely with the NYC 4S EZ form in its target audience and reporting requirements. Like the NYC 4S EZ form, the 1120S is tailored for a specific type of corporation, in this case, S Corporations, which pass corporate income, losses, deductions, and credits through to their shareholders for federal tax purposes. Both documents detail the income and deductions of the corporation, facilitating the correct calculation of tax liability in accordance with the respective governance – federal for Form 1120S and municipal for NYC 4S EZ.

State Income Tax Returns for corporations, while varying by state, share the general aim and structure of the NYC 4S EZ form by requiring corporations to report income, deductions, and calculate tax due at the state level. These forms, much like the NYC 4S EZ, address the locality-specific obligations of corporations, focusing on the revenue generated and business conducted within state borders. Each form acts as a vehicle for compliance, enabling corporations to fulfill their tax responsibilities within their operating jurisdictions.

The NYC UBT (Unincorporated Business Tax) Return, although directed towards unincorporated businesses as opposed to corporations, mirrors the NYC 4S EZ form in its function of determining tax liability based on business income generated within New York City. Both forms ensure that businesses contribute their fair share to city finances through a methodical calculation of taxable income and application of specific tax rates. The emphasis on city-level tax obligations highlights the role of both documents in the broader framework of local tax administration.

The Commercial Rent Tax (CRT) Return, distinct yet related to the NYC 4S EZ form, focuses on the rental income aspect for businesses operating within certain areas of New York City. While the NYC 4S EZ captures a broader range of corporate tax liabilities, the CRT Return zeroes in on businesses paying rent for their premises as part of the city's unique tax requirements. Both serve to assess and collect revenue critical to the city's budget, albeit through examining different aspects of business operations.

The Form NYC-EXT, Application for Automatic Extension of Time to File, parallels the NYC 4S EZ form in its facilitation of tax compliance, specifically regarding filing deadlines. While the NYC 4S EZ form is a vehicle for completing the tax return itself, the NYC-EXT serves as an acknowledgment of unforeseeable circumstances or other valid reasons that may prevent timely filing. Both forms interact within the tax administration ecosystem, ensuring that entities can remain compliant while managing their operational realities.

Dos and Don'ts

When filling out the NYC 4S EZ form, it's important to pay attention to details to ensure accuracy and compliance. Here are some dos and don'ts to guide you through the process:

Do:- Check the correct boxes at the top of the form to indicate if you are filing for a calendar year, fiscal year, a 52-53-week taxable year, an amended return, or a final return.

- Ensure the name and address of the corporation, including the Employer Identification Number (EIN) and Business Code Number as per federal return, are filled out accurately.

- Calculate the tax due carefully, starting with Schedule B1 or B2, and transfer the applicable amount to Schedule A.

- Sign the preparer's certification section if you are authorized, and include the date, your title, and, if applicable, your contact information.

- Attach a copy of all pages of your federal tax return or pro forma federal tax return, along with the payment, if due, to ensure proper processing.

- Leave any sections blank. If a section does not apply to your corporation, mark it as such following the form’s instructions.

- Forget to include the payment amount with the form if you owe taxes. Make the check payable to NYC Department of Finance and ensure it’s in U.S. dollars from a U.S. bank.

- Mix up the due dates. Remember, for calendar year filings, the due date is on or before March 15, 2013. For fiscal years beginning in 2012, submit the form on or before the 15th day of the third month after the fiscal year ends.

- Overlook the signature and certification at the end of the form. It’s important to certify the accuracy of the information provided.

- Send the form to the wrong address. Make sure to use the correct mailing address depending on your filing condition – whether your return has remittances, is claiming refunds, or falls under other returns.

Misconceptions

Understanding the complexities of tax forms can be quite the task, especially when dealing with forms like the NYC-4S-EZ. It's surrounded by misconceptions that can lead businesses into making costly mistakes. Let's debunk some of these myths to pave the way for clearer skies in the realm of tax obligations.

- Only applicable for small businesses: A common misconception is that the NYC-4S-EZ form is exclusively for small businesses. While it is designed to simplify the tax filing process, the criteria for its use are not solely based on the size of the business but rather on the specific tax status and the financial transactions of the corporation within the fiscal year. Both New York State C Corporations and S Corporations can utilize this form depending on certain qualifications laid out by the Department of Finance.

- Substitutes for detailed financial reporting: Another mistake is thinking that filing this form negates the need for detailed financial reporting. While the NYC-4S-EZ is an abbreviated form, corporations are still required to maintain comprehensive financial records. These records are crucial for accurately completing schedules B1 or B2, which are requisite for determining the correct amount of tax payable or refundable.

- No prepayments necessary if using this form: There's a notion out there that if a corporation files using the NYC-4S-EZ, it is not required to make estimated tax payments. However, if line 3 of the form exceeds $1,000, corporations are required to include the first installment of the estimated tax for the following year (25% of line 3). This misconception can lead to unwelcome surprises and penalties for those unaware of their prepayment obligations.

- The form covers all tax liabilities in NYC: A particularly risky misunderstanding is that by filing the NYC-4S-EZ form, a corporation has fulfilled all its tax liabilities in New York City. This form only covers the general corporation tax. Corporations might still be subject to other taxes such as the Commercial Rent Tax, depending on their specific circumstances, such as their location and the nature of their business operations. Not adequately addressing all applicable taxes can result in significant penalties.

Dispelling these myths is critical to ensure that your corporation complies with the City's tax regulations efficiently and effectively. Understanding the intricacies of the NYC-4S-EZ form not only aids in accurate and timely filing but safeguards against the pitfalls of misconceptions. Remaining vigilant and informed about tax obligations is paramount in navigating the complex landscape of corporate taxation in New York City.

Key takeaways

Filing the NYC-4S-EZ form is an essential task for corporations operating within New York City, aimed at computing their General Corporation Tax (GCT). This simplified form is designed to streamline the process for smaller corporations by focusing on their net income and gross receipts. Here are some key takeaways to ensure accurate and efficient filing:

- Determine eligibility: The form is intended for corporations that qualify for a simplified tax computation process. Ensure your corporation meets the criteria before proceeding.

- Fiscal year reporting: The form allows for reporting based on the calendar year or a fiscal year. Mark the appropriate box to indicate your corporation's reporting period.

- Amendments and final returns: There are options to file an amended return if previous filings need corrections or to indicate that the corporation has ceased its operations with a final return.

- Payment information: Include the payment amount with the form, payable to the NYC Department of Finance. It's crucial to ensure the payment is made accurately and on time to avoid penalties.

- Calculation of tax: Tax is calculated based on net income or a minimum tax rate, depending on which figure is larger, highlighting the importance of accurate income reporting and understanding the applicable tax rates.

- Estimated tax payments: Corporations are required to make estimated tax payments for the following year, calculated as a percentage of their current tax liability or an amount specified if an extension was filed.

- Prepayments and balance: Any prepayments made during the tax year should be calculated against the total tax liability to determine the balance due or overpayment to be refunded or credited towards future taxes.

- Documentation: A copy of all pages of your federal tax return or a pro forma federal tax return should be attached. This ensures coherence between federal and city tax filings and can aid in the verification process.

Accurate completion and timely submission of the NYC-4S-EZ form are vital for compliance with the city's tax regulations. Understanding these key points will help corporations navigate the process more smoothly and ensure they meet their tax obligations correctly.

Common PDF Documents

Nycers F501 - Ensure your loved ones are financially secured by nominating beneficiaries for a post-retirement benefit via the F501 form.

Utilities in Business - Must be submitted by vendors supplying gas, electricity, steam, water, refrigeration, and telecommunications services.