Free Nyc 3L Form in PDF

Navigating the complexities of corporate taxation in New York City is a critical task for S Corporations operating within this jurisdiction, and the NYC 3L form plays a pivotal role in this process. Designed exclusively for S Corporations, this form facilitates the annual reporting and calculation of the General Corporation Tax for the calendar year 2021 or for a fiscal year that begins and ends within the specified timeframe. Corporations are required to detail their financial activities, including any changes in their corporate or contact information, providing a comprehensive overview of their taxable income, deductions, and the applicable tax rates. A distinct feature of the NYC 3L form is its attention to the allocation of income, capital, and subsidiary capital, alongside the calculation of tax credits and prepayments that may reduce the overall tax liability. Additionally, it addresses the finality of operations within NYC by including options for final and amended returns, catering to corporations that have ceased their activities or need to adjust previously submitted information. Moreover, it mandates the attachment of the federal tax return, ensuring coherence between federal and city tax obligations. The submission of this form, accompanied by any necessary schedules and documentation, is a critical compliance measure for S Corporations, enabling them to fulfill their local tax responsibilities effectively.

Nyc 3L Sample

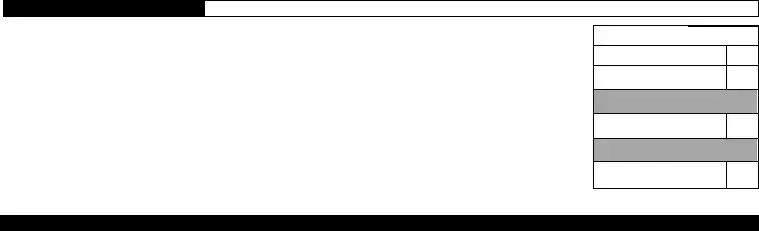

GENERAL CORPORATION TAX RETURN 2022

To be filed by S Corporations only. All C Corporations must file Form

For CALENDAR YEAR 2022 or FISCAL YEAR beginning _______________ 2022 and ending ___________________

Name |

|

Name |

n |

|

|

Change |

|

|

|

|

|

In Care Of |

|

|

|

|

|

|

|

Address (number and street) |

|

Address |

n |

|

|

Change |

|

City and State |

Zip Code |

Country (if not US) |

|

|

|

|

|

Business Telephone Number |

Date business began in NYC |

|

|

|

|

|

|

Taxpayer’s Email Address:

__________________________________________

EMPLOYER IDENTIFICATION NUMBER

BUSINESS CODE NUMBER AS PER FEDERAL RETURN

*30212291*

|

n Final return - Check this box if you have ceased operations in NYC |

n |

|

|

||

APPLY |

iinga |

eetaxabear |

||||

|

||||||

THAT |

n Special short period return (See Instr.) |

n |

prrfederareturnisattached |

|||

n aianatedfederataxbenefitseinst |

nn ter‑characterspeciacnditincdeifappicabeeinst |

|||||

ALL |

||||||

n ndedreturn |

|

nIRS change |

|

|||

CHECK |

If the purpose of the amended return is to report a |

Date of Final |

||||

federal or state change, check the appropriate box: |

nNYS change |

Determination |

||||

|

||||||

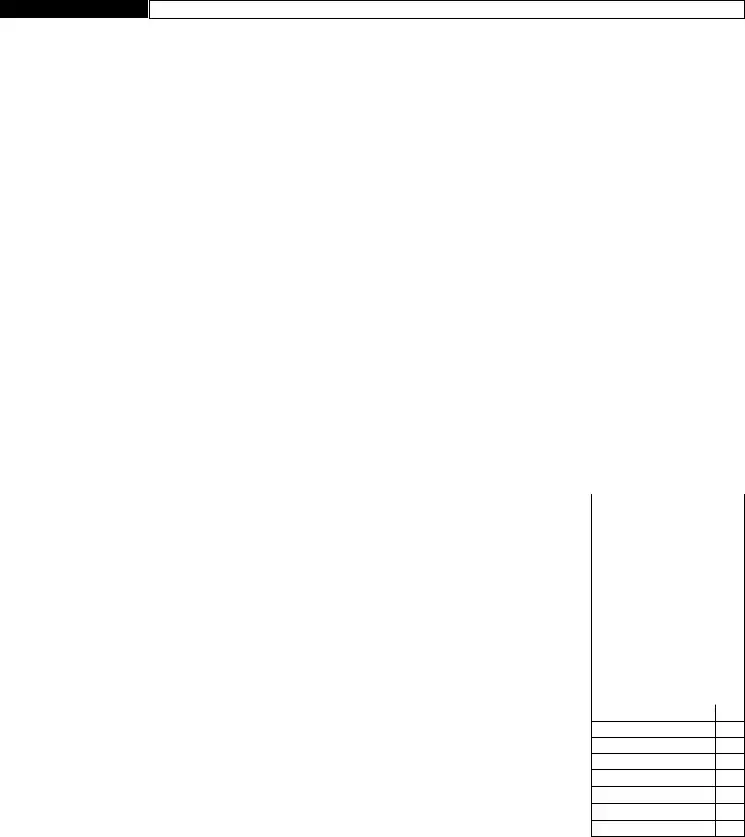

SCHEDULE A  Computation of Tax - BEGIN WITH SCHEDULE B ON PAGE 3. COMPLETE ALL OTHER SCHEDULES. TRANSFER APPLICABLE AMOUNTS TO SCHEDULE A.

Computation of Tax - BEGIN WITH SCHEDULE B ON PAGE 3. COMPLETE ALL OTHER SCHEDULES. TRANSFER APPLICABLE AMOUNTS TO SCHEDULE A.

A. Payment |

|

Amount being paid electronically with this return |

|

|

|

|

|

|

|

|

|

A. |

|

Payment Amount |

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

1. |

catednetincrSchedueine |

|

|

1. |

|

|

|

|

|

|

|

|

X .0885 |

1. |

|

|

|

|

|

|||||

2a. catedcapitarSchedueine |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

2a. |

|

|

|

|

|

|

|

|

X .0015 |

2a. |

|

|

||||||||||

2b. taacatedcapitaperativeusingrps |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

2b. |

|

|

|

|

|

|

|

|

X .0004 |

2b. |

|

|

||||||||||

2c. perativesenter |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

BORO |

|

|

BLOCK |

|

|

|

LOT |

|

|

|

|

|

|

|||||||||

3. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ternativeaxrternativeaxScheduenpage |

...................................(see instructions) |

|

|

|

|

|

3. |

|

|

|

|

|

||||||||||||

4. |

nitax |

einstructinsNY rssReceipts |

|

|

|

|

|

|

|

|

|

|

4. |

|

|

|

|

|

||||||

5. |

catedsubsidiarcapita |

|

see instructions |

5. |

|

|

|

|

|

|

|

X .00075 |

5. |

|

|

|

|

|

||||||

6. axineabrwhicheveris |

|

|

largest, PLUS ine |

|

|

|

|

|

|

|

6. |

|

|

|

|

|

||||||||

7. |

Paidredit |

|

(attach Form |

|

|

|

|

|

|

|

|

|

|

7. |

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

8. |

axafterreditineessine |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8. |

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

9a. |

Rredit |

(attach Form |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

9a. |

|

|

||||||||||||

9b. |

Lredit |

|

(attach Form |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

9b. |

|

|

|||||||||||

10a. |

ReaateaxatinntOpprtunitRecatinan |

|

|

|

|

dIreditsttachrNY |

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

10a. |

|

|

|||||||||||||

10b. |

Intentinaeftban |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10b. |

|

|

|||||||

10c. |

erPrductinredit |

|

(attach Form |

|

|

|

|

|

|

|

|

|

|

10c. |

|

|

||||||||

11. |

Nettaxaftercreditsineess |

ttafinesathrughc |

|

|

|

|

|

|

|

|

|

|

11. |

|

|

|

|

|

||||||

12. |

irstinstantfestitedtaxfrperidfwingthat |

cveredbthisreturn |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

(a) Ifappicatinfrextensinhasbeenfiedenteraunt |

frinefrNY |

|

|

|

|

|

............ |

|

12a. |

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

(b) Ifappicatinfrextensinhas |

notbeenfiedandineexceeds$enter%fi |

|

|

|

|

|

ne |

12b. |

|

|

|||||||||||||

13. tafinesaandb |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13. |

|

|

|

|

|

|||

14. |

PrepantsrPrepantsScheduepageine |

...........................(see instructions) |

|

|

|

|

|

14. |

|

|

|

|

|

|||||||||||

15. |

ancedueine |

|

essine |

|

|

|

|

|

|

|

|

|

|

|

|

15. |

|

|

|

|

|

|||

16. |

Overpantine |

|

essine |

|

|

|

|

|

|

|

|

|

|

|

|

16. |

|

|

|

|

|

|||

17a. |

.................................................................Interest (see instructions) |

|

|

|

|

17a. |

|

|

|

|

|

|

|

|

|

|

|

|

||||||

17b. |

ditinacharges |

(see instructions) |

|

|

17b. |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

17c. |

Penatfrunderpantfestitedtax |

(attach Form |

17c. |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

18. tafinesabandc |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

18. |

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

19. |

Netverpantineessine |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

19. |

|

|

|

|

|

|||

20. |

untfinetbe |

|

|

|

(a)Refunded n irectdepsit |

fill out line 20c OR |

|

n Paperchec |

20a. |

|

|

|

||||||||||||

|

|

|

|

|

|

(b)reditedtestitedtax |

|

|

|

|

|

|

|

|

|

|

20b. |

|

|

|

||||

20c. Routing Number

Account

Number

ACCOUNT TYPE

Checking n Savings n

21. TOTAL REMITTANCE DUE (see instructions) |

|

21. |

|

|

30212291 |

SEE PAGE 7 FOR MAILING INSTRUCTIONS |

|

NYL |

|

Form

SCHEDULE A - Continued

Computation of Tax - BEGIN WITH SCHEDULE B ON PAGE 3. COMPLETE ALL OTHER SCHEDULES. TRANSFER APPLICABLE AMOUNTS TO SCHEDULE A.

Computation of Tax - BEGIN WITH SCHEDULE B ON PAGE 3. COMPLETE ALL OTHER SCHEDULES. TRANSFER APPLICABLE AMOUNTS TO SCHEDULE A.

22. |

IssuersacatinpercentagerSchedueine |

|

|

|

|

|

|

|

22. |

|||||

23. |

NYrentdeductednfederataxreturnrNYrentfrSchedue |

Part |

(See instructions) |

23. |

||||||||||

24. |

rssreceiptsrsaesfrfederareturn |

|

|

|

|

|

|

|

24. |

|||||

25. |

N fParentrpratin |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

26. |

taassetsfrfederareturn |

|

|

|

|

|

|

|

26. |

|||||

27. |

NfnParentrpratin |

|

|

|

|

|

|

|

|

|

|

|

|

28. |

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||

28. |

ensatinfstcdersrSchedine |

|

|

|

|

|

|

|

||||||

%

COMPOSITION OF PREPAYMENTS SCHEDULE

|

PREPAYMENTS CLAIMED ON SCHEDULE A, LINE 14 |

|

DATE |

|

|

AMOUNT |

||||

ndatrfirstinstantpaidwithprecedingarstax |

|

|

|

|

|

|

|

|||

PantwithecaratinrNY |

|

|

|

|

|

|

|

|

||

PantwithNticefitedaxue |

|

|

|

|

|

|

|

|

||

PantwithNticefitedaxue |

|

|

|

|

|

|

|

|

||

PantwithextensinrNY |

|

|

|

|

|

|

|

|

||

Overpantfrprecedingarcreditedtthisar |

|

|

|

|

|

|

|

|||

G. TOTAL fthrughnternSchedueine |

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

ALTERNATIVE TAX SCHEDULE |

Refer to page 6 of instructions before computing the alternative tax |

|||||||||

|

|

|

|

|

|

|

|

|

||

Net income/loss einstructins |

|

|

|

|

1. |

$ |

__________________________ |

|||

Enter 100% of salaries and compensation for the taxable year paid to stockholders owning more than 5% of the taxpayer’s stock. (See instr.) |

2. |

$ |

__________________________ |

|||||||

Totalinepusine |

|

|

|

|

|

3. |

$ |

__________________________ |

||

Statutory exclusion - Enter $40,000. freturndesntcveranentirearexcusinstbeprrate |

dbasedntheperidcveredbthereturn |

4. |

$ |

__________________________ |

||||||

Net amount inenusine |

|

|

|

|

|

5. |

$ |

__________________________ |

||

15% of net amount inex% |

|

|

|

|

6. |

$ |

__________________________ |

|||

Investment income to be allocated untnSchedueinebx%ntenterreth |

antheauntnineabve |

|

|

|

|

|||||

ter |

ifntappicabe |

|

|

|

|

|

7. |

$ |

__________________________ |

|

Business income to be allocated inenusine |

|

|

|

8. |

$ |

__________________________ |

||||

Allocated investment income inexinvestntacatin%frSchedueine |

|

|

9. |

$ |

__________________________ |

|||||

Allocated business income inexbusinessacatin%frSchedueine |

|

|

10. |

$ |

__________________________ |

|||||

Taxable net incomeinepusine |

|

|

|

|

11. |

$ |

__________________________ |

|||

Tax rate |

|

|

|

|

|

12. |

|

% |

|

|

|

|

|

|

|

|

__________________________ |

||||

Alternative tax ine |

xine |

ransferaunttpage |

Schedueine |

|

|

13. |

$ |

__________________________ |

||

|

|

|

|

|

|

|

|

|

|

|

*30222291* 30222291

Form |

NAME: ______________________________________ EIN: __________________________________ |

Page 3 |

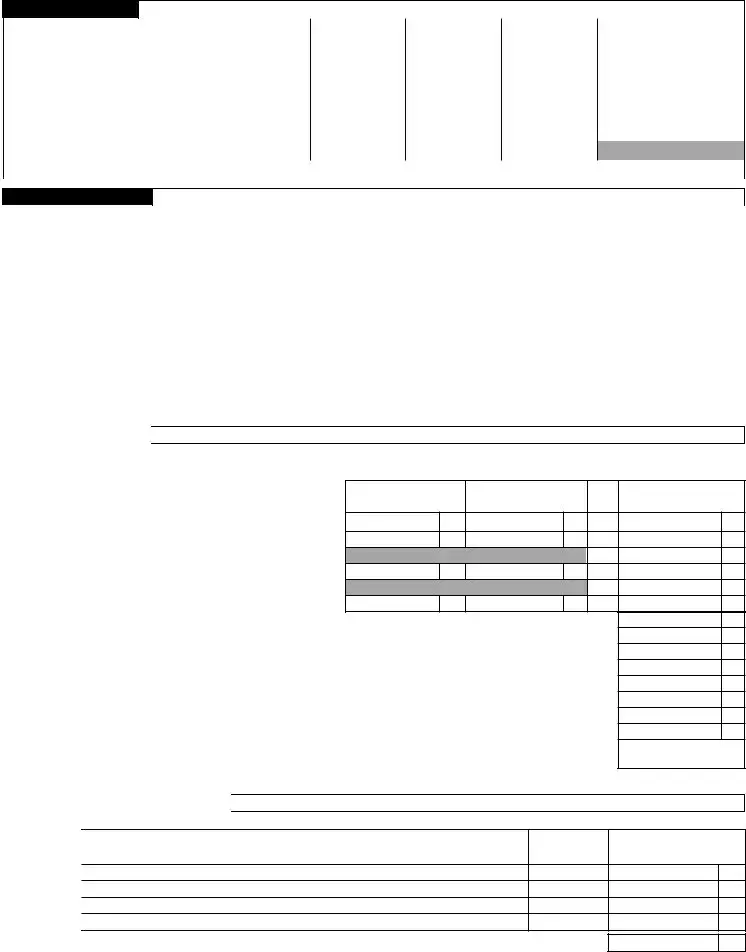

SCHEDULE B

Computation and Allocation of Entire Net Income

1. |

ederataxabeincbefrenetperatingssdeductina |

|

ndspeciadeductins |

(see instructions) |

1. |

|

|

||||||

2. |

Interestnfederastatenicipaandtherbigatin |

|

sntincudedinineabve |

(see instructions) |

2. |

|

|

||||||

3. |

eductinsdirectattributabetsubsidiarcapita |

(attach list) (see instructions) |

3. |

|

|

||||||||

4. |

eductinsindirectattributabetsubsidiarcapita |

|

(attach list) (see instructions) |

4. |

|

|

|||||||

5a. |

NYSranchiseaxincudingtaxesandtherbusinesstaxesded |

|

uctednthefederareturn |

ttachridereinstr |

5a. |

|

|

||||||

5b. |

NYenerarpratinaxdeductednfederareturn |

|

(see instructions) |

5b. |

|

|

|||||||

5c. |

NYSPasshrughtitaxandsiartaxesfrtherurisdicti |

|

|

nsdeductedfrederaaxabeInceinstr |

.. 5c. |

|

|

||||||

5d. |

NYPasshrughtitaxdeductedfrederaaxabeInc |

|

|

einstructins |

5d. |

|

|

||||||

6. |

NewYritadustntsreatingt |

|

(see instructions) |

|

|

|

|

|

|

|

|||

|

(antpprtunitrecatincstscreditandIcredit |

|

|

|

|

|

|

6a. |

|

|

|||

|

(b)Reaestatetaxescaatincredit |

|

|

|

|

|

|

|

6b. |

|

|

||

|

(c) RSdepreciatinandradustnt |

(attach Form |

6c. |

|

|

||||||||

7. |

ditins |

|

|

|

|

|

|

|

|

|

|

|

|

|

(a) Pantfrusefintangibes |

............................................................................................................. |

|

|

|

|

|

|

7a. |

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|||

|

(b) IntentinaOtted |

|

|

|

|

|

|

|

|

|

|

|

|

|

(c) Other (see instructions) (attach rider) |

|

|

|

|

|

|

7c. |

|

|

|||

8. |

tafinesthrughc |

|

|

|

|

|

|

|

|

8. |

|

|

|

9a. |

ividendsfrsubsidiarcapita |

(itemize on rider) (see instr.) |

9a. |

|

|

|

|

|

|||||

9b. |

Interestfrsubsidiarcapita |

..............................(itemize on rider) (see instructions) |

9b. |

|

|

|

|

|

|||||

9c. |

ainsfrsubsidiarcapita |

|

|

|

|

9c. |

|

|

|

|

|

||

10. |

%fdividendsfrnnsubsidiarcrpratins |

(see instructions) |

10. |

|

|

|

|

|

|

||||

11. |

NewYritnetperatingssdeductin |

|

11. |

|

|

|

|

|

|

||||

12. |

ainnsaefcertainprpertacquiredprirt |

|

(see instructions) |

12. |

|

|

|

|

|

|

|||

13. |

NYandNYStaxrefundsincudedinSchine |

(see instructions) |

13. |

|

|

|

|

|

|

||||

14. |

WagesandsaariessubecttIR§deductindisawa |

|

nce (see instr.) |

14. |

|

|

|

|

|

|

|||

15. |

epreciatinandradustntcacuatedunderpreRSrpre |

|

rues |

|

|

|

|

|

|

|

|||

|

(attach Form |

.............................................. |

15. |

|

|

|

|

|

|

||||

16a. ntributinsfcapitabgvernntaentitiesrcivicgrup |

|

s (seeinstructions). |

16a. |

|

|

|

|

|

|||||

..........................................16b. Otherdeductins (see instructions) (attach rider) |

|

16b. |

|

|

|

|

|

||||||

17. |

tadeductinsddinesathrughb |

|

|

|

|

|

|

|

|

17. |

|

|

|

18. |

tirenetincineessine |

|

(see instructions) |

|

|

|

|

|

18. |

|

|

||

19. |

Iftheauntnineisntcrrectentercrrectaunth |

|

ereandexpaininrider |

(see instr.) |

19. |

|

|

||||||

20. |

Investntinceteinesathrughhbew |

|

|

(see instructions) |

|

|

|

|

|

|

|

||

|

(a) |

ividendsfrnnsubsidiarstchedfrinvestnteinstructin |

|

s |

|

|

|

|

20a. |

|

|

||

|

(b) Interestfrinvestntcapitancudefederastateandn |

|

icipabigatins |

(itemize in rider) |

20b. |

|

|

||||||

|

(c)Netcapitagainssfrsaesrexchangesfnnsubsidiarsecu |

ritieshedfrinvestnt |

|

|

|

||||||||

|

tezenriderrattachederaSchedue |

|

|

|

|

|

|

|

20c. |

|

|

||

|

(d) |

IncfrassetsincudedninefSchedue |

|

|

|

|

|

|

|

20d. |

|

|

|

|

(e) |

dinesathrughdincusive |

|

|

|

|

|

|

|

|

20e. |

|

|

|

(f) |

eductinsdirectrindirectattributabetinvestntinc |

|

ttachisteinstructins |

|

20f. |

|

|

|||||

|

(g) |

anceineeessinef |

|

|

|

|

|

|

|

|

20g. |

|

|

|

(h) |

Interestnbanaccuntsincudedinincreprtednine |

|

d |

20h. |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

||||||

21. |

NewYritnetperatingssdeductinapprtinedti |

nvestntinc |

(attach rider)(see instr.) |

21. |

|||

22a. Investntincinegessine |

|

|

|

|

|

22a. |

|

22b. Investntinctbeacated |

(see instructions) |

|

|

|

|

22b. |

|

23. |

sinessinctbeacatedinerineessine |

b |

|

|

|

23. |

|

24. |

catedinvestntinc |

tipinebbtheinvestntacatinpercentagen |

SchedueLine |

(see instr.)... |

24. |

||

25a. catedbusinessinctipinebthebusinessaca |

tinpercentagenSchedueLine |

|

25a. |

||||

25b. Iftheauntnineaisntcrrectentercrrectaunt |

hereandexpaininrider |

(see instructions) |

25b. |

||||

26. |

taacatednetincinepusinearine |

bnteratSchedueine |

|

|

|

26. |

|

*30232291* 30232291

ATTACH ALL PAGES OF FEDERAL RETURN

Form |

NAME: ____________________________________ EIN: ___________________________________ |

Page 4 |

SCHEDULE C

Subsidiary Capital and Allocation

|

|

|

A |

|

|

B |

|

|

C |

|

D |

|

E |

|

F |

|

G |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

RIPIONOSIY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

%fVting |

|

|

verage |

|

LiabiitiesirectrIn |

|

NetverageVaue |

|

Issuer |

|

|

|

Vauecated |

|

|||

|

|

LISI |

|

|

OYIIIION |

|

|

Stc |

|

|

Vaue |

|

directtributabet |

|

unus |

|

catin |

|

|

|

tNY |

|

||

|

SRIINY |

|

|

N |

|

|

Owned |

|

|

|

|

Subsidiarapita |

|

cu |

|

Percentage |

|

|

u |

xcu |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

% |

|

|

|

|

|

|

|

|

% |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

tasandncudingitenrider |

1. |

|

|

|

|

|

|

|

|

|

2. |

taucatedsubsidiarcapitaransferthistt |

|

atSchedueine |

2. |

|

|

|

|

|

|

|

SCHEDULE D

Investment Capital and Allocation

|

|

|

|

A |

|

|

|

B |

|

|

C |

D |

|

|

|

E |

|

|

F |

|

G |

|

|

H |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

RIPIONOINV |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

rssInc |

|

|

|

|

|

|

|

|

NfShares |

|

|

verage |

|

Liabiitiesirectr |

|

|

|

NetverageVaue |

|

|

Issuer |

|

|

|

Vauecated |

|

|

|

||||

|

|

|

LISSOSRIY |

|

|

|

runtf |

|

|

Vaue |

|

Indirecttributabe |

|

|

|

unuscu |

|

|

catin |

|

|

|

tNY |

|

|

fr |

|

||

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

Securities |

|

|

|

tInvestntapita |

|

|

|

|

|

|

Percentage |

|

|

u |

xcu |

|

|

Investnt |

|

||||

|

|

|

|

SRIINY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

1. |

tasncudingitenrider |

1. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

2. |

Investntacatinpercentage |

inedividedbinerundedtthenearestnehun |

dredthfapercentagepint |

2. |

% |

|

|

|

|

|

|

|

|||||||||||||||||

3. |

ash |

(To treat cash as investment capital, |

3. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

you must include it on this line.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

4. |

InvestntcapitatafinesandenternSchedu |

|

|

eine |

|

4. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SCHEDULE E |

Computation and Allocation of Capital |

|

|||||

sisusedtdeterneaveragevaueincu |

Checkone.(Attachdetailedschedule.) |

|

|

||||

n - Annually |

n - |

n - Quarterly |

COLUMN A |

COLUMN B |

|||

|

|

|

|

|

|||

n - Monthly |

n - Weekly |

n - Daily |

|||||

Beginning of Year |

End of Year |

||||||

|

|

||||||

1.taassetsfrfederareturn

2.Reaprpertandrtabesecuritiesincudedinine

3. |

Subtractinefrine |

|

|

4. |

Reaprpertandrtabesecuritiesat |

fair market value |

|

5. |

ustedttaassetsddinesand |

|

|

6. |

taiabiities |

(seeinstructions) |

................................................... |

7.tacapitauineesscuine

8. Subsidiarcapitaeduecuine

|

9. |

sinessandinvestntcapitaineessine |

(seeinstructions) |

|

|||

|

10. |

Investntcapitaedueine |

|

(seeinstructions) |

|

|

|

*30242291* |

11. |

sinesscapitaineessine |

|

|

|

|

|

12. |

catedinvestntcapita |

tipinebtheinvestntacatinpercentagen |

|

SchedueLine |

|||

|

|

||||||

|

13. |

catedbusinesscapita |

tipinebthebusinessacatinpercentagenSche |

dueLine |

|||

|

14. |

taacatedbusinessandinvestntcapita |

inepusinenteratSchedueinearb |

|

|||

|

15. |

IssuersacatinpercentagefSchineandSch |

|

|

cine |

÷Schine |

|

|

|

rundedtthenearesthundredthfapercentnternpag |

e |

line22. SeeInstr. |

|||

|

|

Certain Stockholders |

|

|

|||

|

SCHEDULE F |

|

|

||||

|

Incudeastcderswninginexcessf |

5%ftaxparsissuedcapitastcwhreceivedancensatini |

ncudingcssins |

||||

|

|

Name, Country and US Zip Code (Attach rider if necessary) |

|

SciaSecuritNuer |

Officiaite |

||

|

|

|

|||||

|

|

|

|

|

|

|

|

COLUMN C

Average Value

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

13.

14.

15.%

SaarOtherensatin

Receivedfrrpratin

fnneenter

1. taincudinganauntnriderternSchedueine1.

30242291 |

ATTACH ALL PAGES OF FEDERAL RETURN |

|

Form |

NAME: ______________________________________ EIN: ____________________________________ |

Page 5 |

SCHEDULE G

Locations of Places of Business Inside and Outside New York City

taxparsstceteScheduePartsand

Part 1 - List location for each place of business INSIDE New York City (see instructions; attach rider if necessary)

|

etedress |

|

Rent |

Naturefivities |

Nfes |

WagesSaariesc |

uties |

||

|

|

|

|

|

|

|

|

|

|

N |

SR |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

IY |

|

S |

ZIP |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

N |

SR |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

IY |

|

S |

ZIP |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

N |

SR |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

IY |

|

S |

ZIP |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

N |

SR |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

IY |

|

S |

ZIP |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ta |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Part 2 - List location for each place of business OUTSIDE New York City (see instructions; attach rider if necessary) |

|

|

|||||||

|

etedress |

|

Rent |

Naturefivities |

Nfes |

WagesSaariesc |

uties |

||

|

|

|

|

|

|

|

|

|

|

N |

SR |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

IY |

|

S |

ZIP |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

N |

SR |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

IY |

|

S |

ZIP |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

N |

SR |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

IY |

|

S |

ZIP |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

N |

SR |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

IY |

|

S |

ZIP |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ta |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SCHEDULE H

Business Allocation - see instructions before completing this schedule

Taxpayers must report their Business Allocation Percentage in this schedule for this return to be accepted

axparswhdntacatebusinessincutsideNewYr |

itstenter%nSchedueine |

|

|

|

|

||

axparswhacatebusinessincbthinsideandutside |

NewYritstceteSchedueandenterpercentagen |

|

Schedueine |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COLUMN A - NEW YORK CITY |

COLUMN B - EVERYWHERE |

|

||

|

Receipts in the regular course of business from: |

|

|

|

|

|

|

1. |

Saesftangibepersnaprpert |

1. |

|

1. |

|

|

|

2. |

Servicesperfrd |

2. |

|

2. |

|

|

|

______________________________________________________________________ |

|

||||||

3. |

Rentasfprpert |

3. |

|

3. |

|

|

|

______________________________________________________________________ |

|

||||||

4. |

Rties |

4. |

|

4. |

|

|

|

5. |

Otherbusinessreceipts |

5. |

|

5. |

|

|

|

6. |

ta |

6. |

|

6. |

|

|

|

7. |

sinesscatinPercentageinecudividedbine |

curundedtthenearesthundredthfapercent |

|

|

|

|

|

|

IfusingSchedueIenterpercentagefrPartinerPa |

rtineSeeinstructins |

|

7. |

|

|

% |

*30252291* |

30252291 |

ATTACH ALL PAGES OF FEDERAL RETURN |

Form |

NAME: ______________________________________ EIN: ___________________________________ |

Page 6 |

SCHEDULE I

Business Allocation for Aviation Corporations and Corporations Operating Vessels

Part 1 |

sinessacatinfraviatincrpratins |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AVERAGE FOR THE YEAR |

|

|

|

||

|

|

|

|

|

COLUMN A - NEW YORK CITY |

|

COLUMN B - EVERYWHERE |

|

||

1. |

rcraftarrivasanddepartures |

|

1. |

|

|

|

|

|

|

|

2. |

NewYritpercentageudividedbcu |

|

2. |

|

|

|

|

|

% |

|

|

|

|

|

|

|

|||||

3. |

Revenuetnshanded |

|

3. |

|

|

|

|

|

|

|

4. |

NewYritpercentageudividedbcu |

|

4. |

|

|

|

|

|

% |

|

5. |

Originatingrevenue |

|

5. |

|

|

|

|

|

|

|

6. |

NewYritpercentageudividedbcu |

|

6. |

|

|

|

|

|

% |

|

|

|

|

|

|

|

|||||

7. |

tafinesand |

|

7. |

|

|

|

|

|

% |

|

8. |

catinpercentageinedividedbthreerundedtth |

enearestnehundredthfapercentagepintnternSche |

dueine |

8. |

|

% |

||||

|

|

|

|

|

|

|

|

|

||

Part 2 |

sinessacatinfrcrpratinsperatingvessesinfreignc |

|

rce |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

1. |

gregatenuerfwrngda |

1. |

|

2. |

catinpercentage |

udividedbcurundedtthenearestnehundre |

|

COLUMN A - |

NEW YORK CITY |

COLUMN B |

EVERYWHERE |

|

TERRITORIAL WATERS |

|

|

|

|

|

|

dthfapercentagepintnternSchedueine |

2. |

% |

|

SCHEDULE J

The following information must be entered for this return to be complete. (REFER TO INSTRUCTIONS BEFORE COMPLETING THIS SECTION.)

1a. |

NewYritprincipabusinessactivit____________________ |

_____________________________________________________________________ |

|

1b. |

Othersignificantbusinessactivities (attach schedule, see instructions__________________________________________________ _______________ |

||

2. |

radenafreprtingcrpratinifdifferentfrnaen |

terednpage___________________________________ |

|

3. |

Isthiscrpratinincudedinacnsidatedfederareturn |

n YES |

n NO |

|

Ifgiveparentsna |

______________________________________________ |

N |

___________________________ |

||||

|

|

|

|

|

|

|

enterhereandnpageine |

|

4. |

Isthiscrpratinaerfacntredgrupfcrpratin |

sasdefinedinIRsectin |

|

|

n YES |

|||

|

disregardinganexcusinbreasnfparagraphfthatsect |

in |

|

|

|

|||

|

If |

givecnparentcrpratin’snaifan ________________ |

|

_______________ |

N |

_______________________________ |

||

|

|

|

|

|

|

|

enterhereandnpageine |

|

5. |

astheInternaRevenueServicertheNewYrStateepartn |

tfaxatinandinance |

|

|

n YES |

|||

|

crrectedantaxabeincrthertaxbasereprtedinaprir |

arrareucurrentunderaudit |

|

|

||||

|

Ifbwh |

|

n Internal Revenue Service |

|

Stateperid |

|

g________________ |

d________________ |

|

|

|

|

|

|

|

YY |

YY |

|

|

|

n New York State Department of Taxation and Finance |

Stateperid |

|

g________________ |

d________________ |

|

|

|

|

|

|

|

|

YY |

YY |

6.If“Ytquestin

|

6a.rarsprirthasrNYeprtfedera |

|

|

Statehangeinaxsebeenfied |

|

|

n YES |

||||||

|

6b. rarsbeginningnrafterhasanandedreturn |

|

beenfied |

|

|

|

|

n YES |

|||||

7. |

idthiscrpratinanpantstreatedasinterestinthe |

cutatinfentirenetinctsharehders |

|

wningdirectr |

|

||||||||

|

indirectindividuarintheaggregaterethan% |

fthecrpratin’sissuedandutstandingcapitastcIf |

|

“Y |

n YES |

||||||||

|

cetethefwingfrethanneattachseparatesh |

eet |

|

|

|

|

|

||||||

|

Sharehder’sna___________________________________ |

______SSNN________________________________ |

__ |

||||||||||

|

InterestpaidtSharehder |

|

_______________ |

taIndebtednesstsharehderdescribedabve |

________________ |

tainterestpaid |

_______________ |

||||||

8. |

Wasthiscrpratinaerfapartnershiprintventured |

uringthetaxar |

|

|

|

n YES |

|||||||

|

IfattachschedueistingnaandrIdentificatin |

|

Nuer |

|

|

|

|

|

|||||

|

|

9. |

antiduringthetaxabeardidthecrpratinhave |

aninterestinreaprpert |

ncudingaeasehdinterest |

n YES |

|||||||

|

|

|

catedinNYracntringinterestinanentitwnin |

gsuchreaprpert |

|

|

|

||||||

*30262291* |

10. |

a) |

If |

t |

attachascheduefsuchprpertindicatingthenaturef |

theinterestandincudingthestreet |

|

||||||

|

addressbrughbcandtnuer |

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

b) WasanNYreaprpertncudingaeasehdinterestrcnt |

|

ringinterestinanentitwningNYrea |

|

n YES |

||||||

|

|

|

prpertacquiredrtransferredwithrwithutcnsiderati |

|

n |

|

|

|

|||||

|

|

|

c) |

Wasthereapartiarceteiquidatinfthecrprati |

n |

|

|

|

|

n YES |

|||

|

|

|

d) Was%rrefthecrpratin’swnershiptransferredduring |

thetaxarverathreearperidraccrdingtapa |

n |

n YES |

|||||||

|

|

11. |

IftbcrdwasaReaPrpertransferaxReturn |

|

rNYPfied |

|

|

|

n YES |

||||

|

|

12. |

IfOtexpain______________________________ |

____________________________________________ |

|||||||||

|

|

13. |

esthecrpratinhavenerrequaifiedsubchapterSsub |

|

sidiaries |

|

|

|

n YES |

||||

|

|

|

If“YtachaschedueshwingthenaaddressandNif |

|

anfeachQSSSandindicatewhether |

|

|

||||||

|

|

|

theQSSSfiedrwasrequiredtfieaitbusinessincta |

|

xreturn (see instructions) |

|

|

|

|||||

|

|

14. |

terthenuerfedreturnsattached________________ |

|

______________________ |

|

|

||||||

|

|

15. |

esthistaxparparentgreaterthan$franprese |

|

sinNYinthebrughfnhattansuth |

|

n YES |

||||||

|

|

|

fthStreetfrthepurpsefcarrngnantradebusine |

|

ssprfessinvcatinrcrciaactivit |

|

|||||||

|

|

16. |

IfwerearequiredrciaRentaxReturnsfied |

|

|

|

|

|

n YES |

||||

30262291 |

|

PeaseenterrIdentificatinNuerwhichwasusednth |

|

erciaRentaxReturn ____________________________ |

|||||||||

nNO

nNO

nNO

nNO

nNO

nNO

nNO

nNO

nNO

nNO

nNO

nNO

nNO

nNO

__

Form |

NAME: ______________________________________ EIN: ___________________________________ |

Page 7 |

SCHEDULE K

Federal Return Information

The following information must be entered for this return to be complete.

Enter on lines 1 through 10 in the Federal Amount column the amounts reported on your federal Form 1120S. (See instructions)

Federal 1120S |

|

t Federal Amount t |

||

|

|

|

____________________________________________ |

|

1. |

ividends |

1. |

____________________________________ |

|

2. |

Interestinc |

2. |

____________________________________ |

|

3. |

apitagainnetinc |

3. |

____________________________________ |

|

4. |

Otherinc |

4. |

____________________________________ |

|

5. |

tainc |

5. |

____________________________________ |

|

6. |

ddebts |

6. |

____________________________________ |

|

7. |

Interestexpense |

7. |

____________________________________ |

|

8. |

Otherdeductins |

8. |

____________________________________ |

|

9. |

tadeductins |

9. |

____________________________________ |

|

10. |

Netperatingssdeductin |

10. |

____________________________________ |

|

CERTIFICATION OF AN ELECTED OFFICER OF THE CORPORATION

I hereby certify that this return, including any accompanying rider, is, to the best of my knowledge and belief, true, correct and complete. I authorize the Dept. of Finance to discuss this return with the preparer listed below. (See instructions) ......YES n

irsidress

_______________________________________

|

SIGN |

|

|

Signatureffficer |

|

|

|

|

ite |

|

ate |

PreparersSciaSecuritNuerrPIN |

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

|

HERE: |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

PREPARER'S |

|

PreparersPreparer’s |

|

|

|

|

hecifsef |

|

n |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

USE |

’ |

|

|

signatureprinted |

na |

ate |

|

✔ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

ONLY |

|

|

|

ed |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

irrIdentificatinNuer |

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

s irsna |

rursifsefd |

s dress |

|

|

|

|

|

s Zipde |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

MAILING INSTRUCTIONS

ATTACH COPY OF ALL PAGES OF YOUR FEDERAL TAX RETURN 1120S.

Make remittance payable to the order of NYC DEPARTMENT OF FINANCE. Payment must be made in U.S. dollars and drawn on a U.S. bank.

To receive proper credit, you must enter your correct Employer Identification Number on your tax return and remittance.

The due date for the calendar year 2022 return is on or before March 15, 2023.

For fiscal years beginning in 2022, file on or before the 15th day of the 3rd month following the close of the fiscal year.

ALLRETURNSEXCEPTREFUNDRETURNS

NYOIN

ORPORION

POX

NONNY

REMITTANCES

PAY ONLINE WITH FORM

AT NYC.GOV/ESERVICES

OR

Mail Payment and Form

NYOIN

POX

NYORNY

RETURNS CLAIMING REFUNDS

NYOIN

ORPORION

POX

NONNY

*30272291*

30272291

File Overview

| # | Fact Name | Description |

|---|---|---|

| 1 | Form Type | NYC 3L General Corporation Tax Return for 2021 |

| 2 | Filing Requirement | To be filed by S Corporations; C Corporations file different forms (NYC-2, NYC-2S, or NYC-2A) |

| 3 | Applicable Periods | For Calendar Year 2021 or Fiscal Year beginning in 2021 |

| 4 | Need to Indicate Address Change | Options to indicate change in address are included |

| 5 | Business Telephone Number & Email | Required to provide both business telephone number and taxpayer’s email address |

| 6 | Tax Payment and Credits | Sections to report computed tax, payments made electronically, and various tax credits |

| 7 | Final and Amendment Options | Options to file as a final return or amend a previous return due to federal or state changes |

| 8 | Governing Law | State-specific form governed by New York City tax law |

Nyc 3L: Usage Guidelines

Filing the NYC-3L form is an essential step for S Corporations operating in New York City, focusing on their General Corporation Tax Return for the 2021 tax year. The process demands attention to detail and the accurate presentation of financial data related to income, deductions, and tax credits. Following these organized steps will streamline the filing process, ensuring compliance with NYC’s Department of Finance requirements.

- Start with the "General Information" section at the top of the form. Fill in the fiscal year or calendar year covered by the return, your corporation’s name, address (include any changes), city, state, zip code, and country if not the U.S. Also, provide your business telephone number, the date business began in NYC, and the taxpayer’s email address.

- Enter your corporation's Employer Identification Number (EIN) and the Business Code Number as per federal return in the designated spaces.

- Check the appropriate boxes that apply to your return status, such as “Final return” if ceasing operations in NYC, “Special short period return,” or if an amended return, specifying the reason.

- Proceed to Schedule A and begin with the computation of tax by first completing Schedule B (found on page 3) and all other required schedules, transferring applicable amounts to Schedule A as instructed.

- Calculate and enter your payments and computed tax amounts in the fields provided from lines 1 through 21, including electronic payment information if applicable.

- Fill out Schedules B through H in sequential order, carefully following the specific instructions for each section to compute entire net income, subsidiary capital, investment capital, and allocations as necessary.

- On Schedule I, if applicable, detail your business's allocation percentage based on the instructions provided, ensuring to accurately reflect the portion of business conducted within and outside of New York City.

- If your return includes any credits from Forms NYC-9.7, NYC-9.5, NYC-9.8, or NYC-9.12, make sure these are correctly calculated and entered on Schedule A as these can impact the total tax due or overpayment to be refunded or credited.

- Review all completed sections for accuracy and completeness. Attach all pages of your federal return as required.

- Sign and date the form. If prepared by someone other than the taxpayer, the preparer must also sign and provide their information at the designated section.

- Follow the mailing instructions provided on Page 7 of the form to send your completed NYC-3L form to the NYC Department of Finance by the filing deadline.

Ensuring that every piece of information is accurate and every required document is attached is crucial for the timely processing of your General Corporation Tax Return. Double-check your work before submission to avoid any potential delays or issues.

FAQ

Who needs to file the NYC-3L form?

The NYC-3L form is specifically designed for S Corporations operating within New York City. C Corporations, on the other hand, must file using Form NYC-2, NYC-2S, or NYC-2A depending on their specific circumstances.

What period does the 2021 NYC-3L form cover?

This form covers either the calendar year of 2021 or a fiscal year that begins in 2021 and ends in the following year. Filers must specify their applicable tax year on the form.

Can the NYC-3L form be used for amended returns?

Yes, there is an option to mark the return as amended if there are revisions to be made to a previously filed return due to federal or state changes, among other reasons.

What are the key schedules within the NYC-3L form?

The form includes various schedules to be completed, starting with Schedule B on page 3. These schedules cover the computation of tax, subsidiary and investment capital, business and investment income allocation, and more. Completing all relevant schedules is necessary for accurately determining tax liability.

How is the tax calculated on the NYC-3L form?

Tax calculation begins with Schedule B and involves detailed computations that include, but are not limited to, allocated entire net income, subsidiary capital, and investment income. Specific rates and percentages are applied to the computed base amounts to determine the tentative tax before credits and other deductions.

What are the attachment requirements for the NYC-3L form?

All pages of the federal return must be attached along with other required documents, such as Form NYC-9.7 for tax credits and NYC-222 for penalties for underpayment of estimated taxes, if applicable.

How can a refund or overpayment be processed through the NYC-3L form?

Taxpayers can direct the New York City Department of Finance to either refund the overpayment or credit it towards estimated taxes for the following period. They must indicate their preference on the form and provide the necessary bank account information if they choose a direct deposit refund.

What information is required for the business allocation schedule?

Schedule H requires businesses to report their Business Allocation Percentage, which is a measure of the amount of business income attributable to New York City. This involves reporting receipts, payroll, and other factors both within and outside the city.

Where should the completed NYC-3L form be mailed?

The last page of the instructions for the form provides the mailing address for the NYC Department of Finance. Filers must ensure that all pages of the form and attachments are included in their submission.

Below addresses frequently asked questions regarding the NYC-3L General Corporation Tax Return for the year 2021.

Common mistakes

Not confirming the eligibility for filing the NYC-3L form can lead to incorrect filings. It's critical to ensure that your business qualifies as an S Corporation under NYC's specific tax definitions, as opposed to C Corporations which are required to file different forms (NYC-2, NYC-2S, or NYC-2A).

Incorrectly marking the status checkboxes at the beginning of the form, such as 'Final return' or 'Special short period return,' can cause significant processing delays. Each box reflects a unique filing circumstance and must be selected with care to convey accurate information about the tax period and corporate status.

Business code numbers assigned based on the federal return can often be entered inaccurately. Matching the right business code number as per the federal return is crucial for the NYC-3L form since it determines the classification of your business's primary activity, affecting tax calculations.

Calculation errors in the Computation of Tax section, especially in Schedules A, B, and C, are common. These schedules involve detailed financial data and tax rate applications. Misinterpretations or miscalculations can lead to either underpayment or overpayment of taxes.

Omitting or incorrectly calculating deductions and credits, as outlined in the various sections and schedules of the form, particularly in Deductions (Schedule B) and Credits (Schedule A), is a frequent oversight. Accurately claiming all eligible deductions and credits is crucial for an accurate tax return.

Failing to attach all required documentation, such as pages from the federal return or documentation for claimed credits and deductions, can invalidate or delay the processing of the return. The NYC-3L form requires comprehensive supporting documentation to substantiate the reported figures.

Incorrectly detailing payroll expenses and allocation of income in the Computation and Allocation of Entire Net Income can lead to discrepancies. Businesses must carefully allocate payroll and income between New York City and other jurisdictions, if applicable, to correctly compute their tax obligations.

Not utilizing the precise percentages for allocated business income, investment income, and subsidiary capital as required in the allocation schedules could result in mathematical and compliance errors. Ensuring accuracy in these percentages is crucial for the correct allocation of income and tax liabilities.

Understanding these common mistakes can significantly affect the accuracy and compliance of the NYC-3L tax return. Businesses are encouraged to pay careful attention to each section of the form, seek clarification when in doubt, and consider professional assistance to navigate the complexities of NYC's corporation tax requirements. Ensuring accuracy in filing not only aids in avoiding penalties but also in harnessing potential tax benefits."

Documents used along the form

The Form NYC-3L is a vital document for S Corporations operating within New York City, guiding them on how to report and pay their general corporation tax. Alongside the NYC-3L form, there are several other forms and documents that businesses may need to complete their tax obligations fully. Understanding these additional documents can help ensure compliance with all tax requirements and avoid potential issues.

- Form NYC-2: Used by C Corporations to file their general corporation tax return. It differs from the NYC-3L form, which is specifically for S Corporations.

- Form NYC-2S: Filed by C Corporations that meet specific criteria, offering a simplified reporting method.

- Form NYC-2A: Allows C Corporations to report and calculate their tax based on an alternative base.

- Form NYC-9.7: Used to claim any paid credits that a business might be eligible for. It needs to be attached to the main form if applicable.

- Form NYC-9.5: Another form for claiming specific tax credits, depending on the nature of the business and its operations.

- Form NYC-9.8: Used by businesses to claim certain credits related to utilities or energy consumption.

- Form NYC-222: This form is required if the business is paying penalties due to underpayment of estimated tax.

- Form NYC-399 and NYC-399Z: These forms are used for adjusting depreciation and amortization deductions on the return.

- Form NYC-NOLD-GCT: Filed to carryover or carryback net operating losses for general corporation tax purposes.

- Schedule B, C, D, E, F, G, H, and I: Various schedules that may need to be completed as part of the NYC-3L return, depending on the specific revenues, capital, and business activities of the S Corporation.

Ensuring accuracy and completeness when filing the NYC-3L form and its accompanying documents is essential for S Corporations to meet their tax obligations. By familiarizing themselves with these forms, S Corporations can navigate the tax filing process more smoothly, avoid potential fines for non-compliance, and optimize their tax positions. Business owners and tax professionals should carefully review all instructions and requirements specific to each form and schedule to ensure compliance with New York City's tax regulations.

Similar forms

The NYC 3L form, focused on General Corporation Tax Return for S Corporations within New York City, shares similarities with the IRS Form 1120S, utilized on a federal level. Both documents are designed specifically for S Corporations, detailing income, losses, deductions, and credits to determine the entity's tax liability. The fundamental purpose of these forms is to ensure the accurate reporting of financial activities within the specified tax year, thereby calculating the tax dues or refunds appropriately. They also accommodate deductions and credits unique to S Corporations, reflecting the distinct tax treatment these entities receive under the law. Furthermore, they provide spaces for reporting payments and prepayments, which are integral to settling the corporation's tax obligations efficiently.

Comparable to the NYC 3L form is the Schedule K-1 (Form 1120S), an essential document for reporting a shareholder's share of income, deductions, and credits from an S Corporation. While the NYC 3L form compiles the overall tax information for the corporation within New York City, the Schedule K-1 is vital for individual shareholders to report their share of the corporation's income or loss on their personal tax returns. This delineation is crucial as it allows the IRS and state taxing authorities to ensure that the income reported by the S Corporation is accurately reflected in the income of the shareholders, maintaining the flow-through taxation principle that underpins S Corporations. Additionally, like the NYC 3L, the Schedule K-1 includes specifics on various types of income and tax deductions that are critical for accurately determining each shareholder's tax liability.

Another document that shares similarities with the NYC 3L form is the Form NYC-2, meant for C Corporations filing within New York City. While targeting a different classification of corporations, both forms serve as a means to report income, calculate tax liability, and outline payment information specific to their operational framework within the city. The primary difference lies in their applicability—NYC-2 addresses the tax responsibilities of C Corporations, subject to double taxation (on both corporate earnings and shareholder dividends), as opposed to the single-level taxation applicable to S Corporations via the NYC 3L form. Despite this distinction, both forms necessitate detailed financial disclosures and support the accurate imposition of taxes based on the corporation’s economic activities in New York City.

Furthermore, the NYC 3L form mirrors the function of the Form 1040 Schedule C used by sole proprietors and single-member LLCs on a federal level. While the latter is used by individuals to report profits and losses from a business they solely own, both documents share the underlying goal of assessing tax based on business income. They require detailed income statements, expense reports, and the calculation of net profit or loss to determine the taxable amount. Though serving different types of business entities, each form plays a critical role in the fiscal compliance and tax planning of the entity it’s designed for. This ensures that whether a business operates as a sole proprietorship or an S Corporation, there exists a structured process for tax reporting and payment in alignment with legal requirements.

Dos and Don'ts

When it comes to filling out the NYC-3L form, precision and accuracy are your best friends. Here are some key dos and don'ts you should always bear in mind to avoid common pitfalls and ensure a smooth process:

- Do double-check the tax year and fiscal year dates you're reporting for to avoid misfiling.

- Do thoroughly review the form instructions, as they provide critical guidance tailored to different sections of the form.

- Do ensure that all applicable sections and schedules are accurately filled out; missing information can lead to unnecessary delays or scrutiny.

- Don't leave any sections that apply to your corporation blank. If a section doesn't apply, clearly mark it as "N/A" or "0" if figures are requested.

- Don't overlook the requirement to attach all pages of your federal return, as well as any other required documentation, such as forms NYC-9.7 and NYC-9.8 if claiming credits.

- Don't forget to include the proper signatures and dates on the form. Unsigned or undated forms are considered incomplete and can lead to processing delays.

Accuracy, attention to detail, and a thorough understanding of your corporation's operations within the designated tax year or fiscal year can significantly streamline your NYC-3L form submission process. Armed with these tips, you're well on your way to successfully navigating your corporation's tax obligations in New York City.

Misconceptions

There are several misconceptions about the Form NYC-3L, which is the General Corporation Tax Return for the City of New York, specifically designed for use by S Corporations. Understanding these will help ensure accurate completion and submission. Here are five common misconceptions explained:

- Only applicable to businesses located within New York City: While Form NYC-3L is for businesses operating in New York City, it's a common misconception that it only applies to companies with a physical presence within the city limits. In reality, any S Corporation deriving income from New York City sources is required to file this form, regardless of whether they have a physical location in NYC.

- It's the same as the state return: Another misunderstanding is equating the NYC-3L with New York State corporate tax returns. Though both are tax documents, the NYC-3L specifically deals with city taxes, which operate independently from state taxes. This means an S Corporation must file separate returns for state and city tax obligations.

- Applicable to C Corporations: The language on the form clearly states that it is to be filed by S Corporations only. Despite this, some believe that C Corporations can also use this form if operating in NYC. However, C Corporations must file Form NYC-2, NYC-2S, or NYC-2A, depending on their specific situations, to meet their tax filing requirements.

- Filing is required only if the business owes tax: A common misconception is that filing Form NYC-3L is required only if the S Corporation owes tax to New York City. However, even if an S Corporation does not owe city tax or is expecting a refund, it must still file the form to report its income derived from NYC sources.