Free Nyc 3A Form in PDF

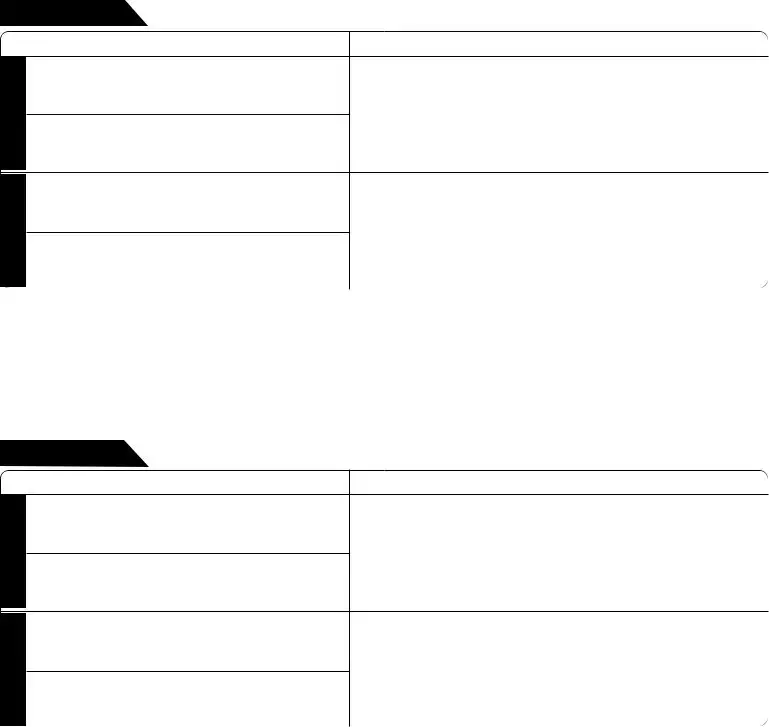

In navigating the complexities of corporate taxation within the vibrant economic landscape of New York City, the NYC 3A form stands out as a critical tool for corporations looking to comply with local tax obligations. This document serves as the Combined General Corporation Tax Return, essential for reporting to the Department of Finance. Its structure is designed to accommodate both regular fiscal years and specific circumstances requiring a special short period return, emphasizing its flexibility to cater to diverse corporate needs. With options for amended and final returns, it underscores the city's attentiveness to the evolving nature of business operations, including those affected by significant events such as the 9/11 attacks, as indicated by the provision to claim related federal tax benefits. Corporations engaged in activities regulated by the NYC Taxi and Limousine Commission are instructed to employ a distinctive business code, reflecting the form's consideration for industry-specific tax situations. Schedules integrated into the document pave the way for a detailed computation of taxable income, allocated combined net income, and various credits, illustrating the comprehensive approach required for accurate tax liability assessment. Moreover, the inclusion of precise instructions for calculating alternative tax, minimum tax obligations, and payments ensures clarity in fulfilling the city's tax requirements. Corporations are also guided through the process of scheduling payments for estimated taxes and detailing assets, receipts, and compensation contributing to their tax base. The form mandates certification by an elected corporation officer, underlining the seriousness with which the information must be treated. Additionally, mailing instructions and schedules for detailing affiliations, principal business activities, and intercorporate transactions further exemplify the thoroughness expected in completing the NYC 3A form.

Nyc 3A Sample

F I N A N C E NEW ● YORK

w w w .nyc.gov/ finance

N Y C CO MBIN ED GEN ERAL |

|

|

|

|

||

3 A |

CORPORATION TAX RETU RN |

|

|

|

|

|

● ■ Special short period return. See Instr . |

|

▲ DO NOT WRITE IN THIS SPACE - FOR OFFICIAL USE ONLY ▲ |

|

|||

|

|

|

||||

|

|

|

|

|

||

Check "yes" if you claim any |

|

|

|

|||

|

|

|

||||

benefits (see inst.) ● ■ YES |

|

|

||||

● ■ Am ended return |

● ■ Final return. Check box if corporation has ceased operations. |

2 0 0 3 |

|

|||

|

|

|

|

|

|

|

For CALENDAR YEAR 2003 or FISCAL YEAR beginning ________________ 2003, and ending __________________

*30110391*

N Y C - 3 L R E T U R N S F O R A L L C O R P O R A T I O N S I N C L U D E D I N T H E C O M B I N E D R E T U R N M U S T B E A T T A C H E D T O T H I S R E T U R N

|

Nam e of reporting corporation |

|

|

EM PLOYER IDENTIFICATION NUM BER OF REPORTING CORPORATION |

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

▼ |

Address (num ber and street) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Type |

|

|

|

BUSINESS CODE NUM BER |

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

IMPORTANT: All corporations licensed |

|

|||||||||||||||||

City and State |

Zip Code |

|

|

||||||||||||||||||||

|

AS PER FEDERAL RETURN |

|

|

and/or regulated by the NYC Taxi and |

|

||||||||||||||||||

or |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Limousine Commission use business |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

Business Telephone Num ber |

Date business began in NYC |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

code 999900 in lieu of federal code. |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

▼ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nam e of parent of controlled group |

Em ployer Identification Num ber |

|

|

|

|

|

|

NYC PRINCIPAL BUSINESS ACTIVITY |

|

||||||||||||||

|

|

|

|

|

|

|

|

||||||||||||||||

●

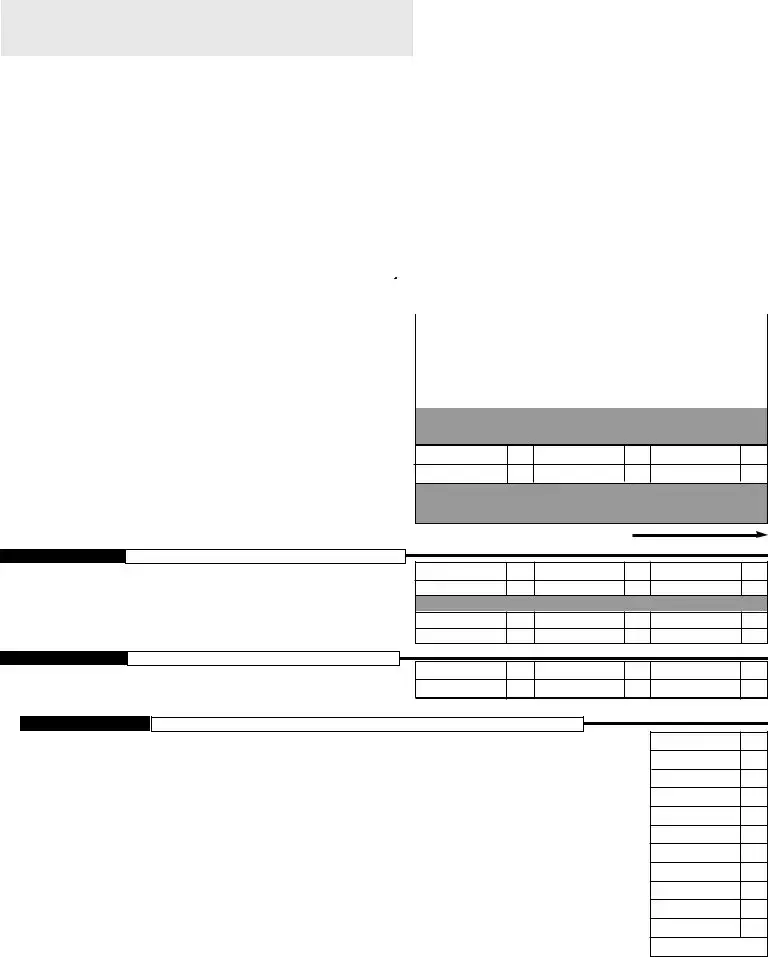

S C H E D U LE A

Computation of Tax - BEGIN WITH SCHEDULE I ON PAGE 2 - COM PLETE ALL OTHER SCHEDULES. TRANSFER APPLICABLE AM OUNTS TO SCHEDULE A

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Payment Enclosed |

|

|

|

A. |

Payment |

Pay amount shown on line 23 - Make check payable to: NYC Department of Finance ● |

|

|

|

|

|

|

|||||||||||||||

1. |

|

Allocated combined net income (from Schedule M, line 7) .. |

● 1. |

|

|

|

|

|

|

|

|

|

X .0885 |

● 1. |

|

|

|

|

|

||||

2. |

|

Allocated combined capital (from Schedule M, line 10) (see instr.).. |

● 2. |

|

|

|

|

|

|

|

|

|

X .0015 |

● 2. |

|

|

|

|

|

||||

3. Alternative tax (applies to all corporations including professional corporations) |

|

● 3. |

|

|

|

|

|

||||||||||||||||

4. Minimum tax for reporting corporation only |

|

|

|

|

|

|

|

|

|

|

|

4. |

|

300 |

00 |

||||||||

5. |

|

Allocated subsidiary capital (from Schedule M, line 11) |

● 5. |

|

|

|

|

|

|

|

|

|

|

X .00075 |

● 5. |

|

|

|

|

|

|||

6. Combined tax (line 1, 2, 3, or 4, whichever is largest, PLUS line 5) |

|

|

|

|

|

|

|

|

● 6. |

|

|

|

|

|

|||||||||

7. |

|

Minimum tax for taxable corporations (see instr.) - number of corporations |

● |

|

|

|

|

X $300 |

● 7. |

|

|

|

|

|

|||||||||

8. Total combined tax - add line 6 and line 7 |

|

|

|

|

|

|

|

|

|

|

|

● 8. |

|

|

|

|

|

||||||

9. UBT Paid Credit (attach Form |

|

|

|

|

|

|

|

|

|

|

|

● 9. |

|

|

|

|

|

||||||

10 |

. Credits from Form |

|

|

|

|

|

|

|

|

|

|

|

● 10. |

|

|

|

|

|

|||||

11 |

. |

Credits from Form |

|

|

|

|

|

|

|

|

|

|

|

● 11. |

|

|

|

|

|

||||

12 |

. Tax after credits (line 8, less total of lines 9, 10 and 11) |

|

|

|

|

|

|

|

|

|

|

|

● 12. |

|

|

|

|

|

|||||

13 |

. First installment of estimated tax for period following that covered by this return: |

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

a) If application for extension has been filed, enter amount from line 4 of Form |

● 13a. |

|

|

|

|

|

|

||||||||||||||

|

|

b) If application for extension has not been filed and line 12 exceeds $1,000, enter 25% of line 12 |

● 13b. |

|

|

|

|

|

|

||||||||||||||

14 |

. Sales tax addback per Admin. Code |

|

● 14. |

|

|

|

|

|

|||||||||||||||

15 |

. Net tax (total of lines 12, 13a or 13b and 14) |

|

|

|

|

|

|

|

|

|

|

|

● 15. |

|

|

|

|

|

|||||

16 |

. Total prepayments listed on each attached return (see instructions) |

|

|

|

|

|

|

|

|

● 16. |

|

|

|

|

|

|

|||||||

17 |

. Balance due (line 15 less line 16) |

|

|

|

|

|

|

|

|

|

|

|

● 17. |

|

|

|

|

|

|

||||

18 |

. Overpayment (line 16 less line 15) |

|

|

|

|

|

|

|

|

|

|

|

● 18. |

|

|

|

|

|

|||||

19a. Interest (see Form |

|

|

|

19a. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

....................................19b. Additional charges (see Form |

|

|

|

19b. |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

19c. Penalty for underpayment of estimated tax (attach Form |

● 19c. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

20 |

. Total of lines 19a, 19b and 19c |

|

|

|

|

|

|

|

|

|

|

|

● 20. |

|

|

|

|

|

|||||

21 |

. Net overpayment (line 18 less line 20) |

|

|

|

|

|

|

|

|

|

|

|

● 21. |

|

|

|

|

|

|

||||

22 |

. Amount of line 21 to be: (a) Refunded |

|

|

|

|

|

|

|

|

|

|

|

● 22a. |

|

|

|

|

|

|||||

|

|

|

(b) Credited to 2004 estimated tax |

|

|

|

|

|

|

|

|

● 22b. |

|

|

|

|

|

||||||

23 |

. |

TOTAL REMITTANCE DUE (see instructions). Enter payment amount on line A above |

|

● 23. |

|

|

|

|

|

||||||||||||||

24 |

. |

Combined group's issuer’s allocation percentage (from Schedule M, line 12) |

|

● 24. |

% |

|

|

|

|||||||||||||||

25 |

. |

Gross receipts or sales from page 3, column C, line A |

|

|

|

|

|

|

|

|

|

|

|

● 25. |

|

|

|

|

|

||||

26 |

. |

Total assets from page 3, column C, line B |

|

|

|

|

|

|

|

|

|

|

|

● 26. |

|

|

|

|

|

|

|||

27 |

. |

Compensation of more than 5% stockholders as used in computation of line 3 |

|

● 27. |

|

|

|

|

|

||||||||||||||

28 |

. |

NYC rent or NYC rent deducted on federal return - THIS LINE MUST BE COMPLETED |

|

● 28. |

|

|

|

|

|

||||||||||||||

29 |

. |

Combined Group Business Allocation Percentage (from Schedule J, line 12) |

|

● 29. |

% |

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C E R T I F I C A T I O N O F A N E L E C T E D O F F I C E R O F T H E C O R P O R A T I O N

I hereby certify that this return, including any accompanying rider, is, to the best of my knowledge and belief, true, correct and complete.

I authorize the Dept. of Finance to discuss this return with the preparer listed below. (see instructions) |

YES ■ |

SIGN

HERE → Signature of officer

PREPARER'S Preparer's signature

USE

ONLY →

Title |

|

Date |

Check if |

■ |

Date |

|

|

|

Preparer's Social Security Number or PTIN

●

Firm's Employer Identification Number

●

|

|

|

|

|

|

● Firm's name (or yours, if |

▲ Address |

▲ Zip Code |

|

||

|

|

|

|

||

30110391 ATTACH REMITTANCE TO THIS PAGE ONLY - MAKE REMITTANCE PAYABLE TO: NYC DEPARTMENT OF FINANCE (SEE PAGE 3 FOR MAILING INSTRUCTIONS) |

Rev.11/17/03 |

||||

Form |

|

|

|

|

|

|

|

|

|

|

Page 2 |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CORPORATION NAME |

CORPORATION NAME |

CORPORATION NAME |

|||||||||

|

|

|

|

|

COLUMN 1 |

|

COLUMN 2 |

|

COLUMN 3 |

||||||

|

|

|

|

|

● Employer |

|

|

● Employer |

|

|

● Employer |

|

|||

|

|

|

|

|

Identification Number |

|

|

Identification Number |

|

|

Identification Number |

|

|||

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

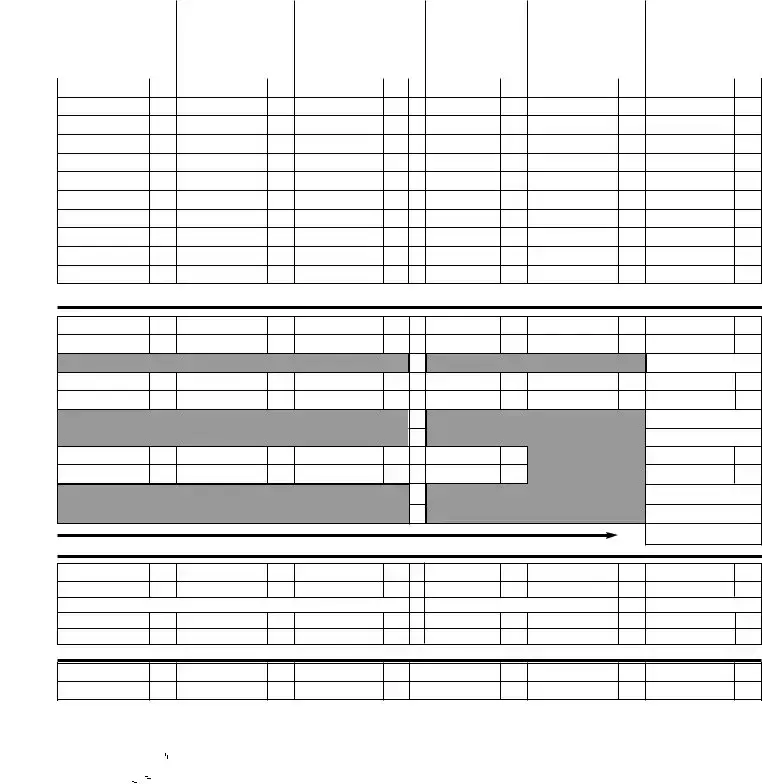

SCHEDULE I |

Analysis of income & capital from Form |

|

|

|

|

|

|

|

|

|

|

|

|

||

1. |

Entire net income (Schedule B, line 19 or 20) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

● 1. |

|

|

|

|

|

|

|

|

|

|

|

|

|||

2. |

....................................................Investment income (Schedule B, line 23) |

● 2. |

|

|

|

|

|

|

|

|

|

|

|

|

|

3. |

.......................................................Business income (Schedule B, line 24) |

● 3. |

|

|

|

|

|

|

|

|

|

|

|

|

|

4. |

.............................NYC gain (loss) on qualified property (See instructions) |

● 4. |

|

|

|

|

|

|

|

|

|

|

|

|

|

5. |

.....................................................Optional depreciation (See instructions) |

● 5. |

|

|

|

|

|

|

|

|

|

|

|

|

|

6. |

.................................................................Total capital (Schedule E, line 7) |

● 6. |

|

|

|

|

|

|

|

|

|

|

|

|

|

7. |

........................................................Subsidiary capital (Schedule E, line 8) |

● 7. |

|

|

|

|

|

|

|

|

|

|

|

|

|

8. |

.....................................................Investment capital (Schedule E, line 10) |

● 8. |

|

|

|

|

|

|

|

|

|

|

|

|

|

9. |

........................................................Business capital (Schedule E, line 11) |

● 9. |

|

|

|

|

|

|

|

|

|

|

|

|

|

..................................A. Gross receipts or sales (federal Form 1120, line 1c) |

● A. |

|

|

|

|

|

|

|

|

|

|

|

|

||

..................B. Total assets from federal return (Schedule E, line 1, column C) |

● B. |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SCHEDULE J |

Business allocation from Form |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

1. |

Property - New York City (Schedule H, line 1f, column A) |

● 1. |

|

|

|

|

|

|

|

|

|

|

|||

2. |

Property - total (Schedule H, line 1f, column B) |

● 2. |

|

|

|

|

|

|

|

|

|

|

|||

3. |

................................................................New York City percent, line 1 ÷ line 2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4. |

Receipts - New York City (Schedule H, line 2g, column A) |

● 4. |

|

|

|

|

|

|

|

|

|

|

|

||

5 Receipts - total (Schedule H, line 2g, column B) |

● 5. |

|

|

|

|

|

|

|

|

|

|

||||

6.New York City percent, line 4 ÷ line 5 ................................................................

7.Additional Receipts Factor (enter percent from line 6) (See instructions) ..........

8. |

Payroll - New York City (Schedule H, line 3a, column A) |

● 8. |

9. |

Payroll - total (Schedule H, line 3a, column B) |

● 9. |

10.New York City percent, line 8 ÷ line 9 ................................................................

11.Total New York City percents, sum of lines 3, 6, 7 and 10.................................

12. Business allocation percentage, line 11 ÷ three or by the number of percentages used if other than three (see instructions)

SCHEDULE K

Investment allocation from Form

1.New York City (Schedule D, line 1, column G)............................................

2.Total (Schedule D, line 1, column E) ...........................................................

3.Investment allocation percentage, line 1 ÷ line 2 (see instructions) ............

4.Cash (Schedule D, line 3, column E)...........................................................

5.Total Investment Capital (Schedule D, line 4, column E) ............................

●1.

●2.

●4.

●5.

SCHEDULE L

Subsidiary allocation from Form

1. |

New York City (Schedule C, line 2, column G) |

1. |

2. |

Total (Schedule C, line 1, column E) |

2. |

SCHEDULE M

Summary (References in this Schedule M are to schedules in this return)

*30120391*

1. |

New York City investment income (Schedule I, line 2, column C x Schedule K, line 3) |

1. |

2. |

New York City business income (Schedule I, line 3, column C x Schedule J, line 12) |

2. |

3. |

Total New York City income, line 1 plus line 2 |

3. |

4. |

NYC gain (loss) on qualified property (Schedule I, line 4, column C) |

4. |

5. |

Total, line 3 plus line 4 |

5. |

6. |

Optional depreciation (Schedule I, line 5, column C) |

6. |

7. |

Allocated combined net income, line 5 minus line 6 (enter here and on Schedule A, line 1) |

7. |

8. |

New York City investment capital (Schedule I, line 8, column C x Schedule K, line 3) |

8. |

9. |

New York City business capital (Schedule I, line 9, column C x Schedule J, line 12) |

9. |

10. |

NYC investment & business capital, line 8 plus line 9 (enter here and on Schedule A, line 2) |

10. |

11. |

New York City subsidiary capital (Schedule L, line 1, column C) (enter here and on Schedule A, line 5) |

11. |

12. |

Issuer's allocation percentage (Schedule M, line 10 plus line 11 ÷ Schedule I, line 6, col. C) (enter here and on Sch. A, line 24) (see instr.) ... |

12. |

%

30120391

Form |

Page 3 |

SCHEDULE I

● 1.

● 2.

● 3.

● 4.

● 5.

● 6.

● 7.

● 8.

● 9.

● A.

● B.

|

CORPORATION NAME |

CORPORATION NAME |

|

CORPORATION NAME |

|

COLUMN A |

|

COLUMN B |

|

COLUMN C |

|||||||

|

|

COLUMN 4 |

|

COLUMN 5 |

|

|

COLUMN 6 |

|

|

|

INTERCORPORATE |

|

TOTAL |

||||

|

|

● Employer |

|

|

|

● Employer |

|

|

|

● Employer |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

TOTAL |

|

ELIMINATIONS |

|

LESS INTERCORPORATE |

||||

|

|

Identification Number |

|

|

|

Identification Number |

|

|

|

Identification Number |

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

(EXPLAIN ON RIDER) |

|

ELIMINATIONS |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1.

2.

3.

4.

5.

6.

7.

8.

9.

A.

B.

SCHEDULE J

● 1. |

1. |

|

● 2. |

2. |

|

● 3. |

3. |

% |

● 4. |

4. |

|

● 5. |

5. |

|

● 6. |

6. |

% |

|

||

● 7. |

7. |

% |

● 8. |

8. |

|

● 9. |

9. |

|

● 10. |

10. |

% |

● 11. |

11. |

% |

● 12. |

|

% |

|

|

SCHEDULE K

● 1. |

1. |

● 2. |

2. |

●3.

3.

3.

● 4. |

4. |

● 5. |

5. |

SCHEDULE L

1.

2.

%

*30130391*

|

|

|

|

|

|

|

|

|

▼ M A I L I N G |

I N S T R U C T I O N S ▼ |

||

|

|

|

|

|

|

|

Attach |

Make remittance payable to the order of |

To receive proper credit, you must |

|||

|

|

|

|

federal |

|

|

||||||

|

|

|

tax |

|

|

copy of all pages |

NYC DEPARTMENT OF FINANCE |

enter your correct Employer |

||||

|

|

|

return |

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

of your federal tax return |

Payment must be made in U.S. dollars, |

Identification Number on your tax |

|||

or pro forma federal tax return. |

drawn on a U.S. bank. |

return and remittance. |

||||||||||

RETURNS WITH REMITTANCES |

RETURNS CLAIMING REFUNDS |

ALL OTHER RETURNS |

||||||||||

NYC DEPARTMENT OF FINANCE |

NYC DEPARTMENT OF FINANCE |

NYC DEPARTMENT OF FINANCE |

||||||||||

P.O. BOX 5040 |

P.O. BOX 5050 |

P.O. BOX 5060 |

||||||||||

KINGSTON, NY |

KINGSTON, NY |

KINGSTON, NY |

||||||||||

The due date for the calendar year 2003 return is on or before March 15, 2004.

For fiscal years beginning in 2003, file on or before the 15th day of the 3rd month following the close of the fiscal year.

30130391

Form |

Page 4 |

*30140391*

A F F I L I A T I O N S S C H E D U L E

COMPLETE THIS SCHEDULE OR ATTACH FEDERAL FORM 851

Tax year beginning ______________, ______ and ending ______________, ______

Name of reporting corporation on |

|

|

Employer Identification Number: |

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of common parent corporation on consolidated federal income tax return:

P a r t I

Ge n e r a l I n f o r m a t i o n

Corp. |

Name and address of corporation |

|

|

|

Employer Identification Number |

|

|||||||||

No. |

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Com m on parent corporation |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

● 1. |

on federal return: |

1. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Reporting corporation |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

● 2. |

on NYC- 3A: |

2. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

● 3. |

Affiliated |

3. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

corporations: |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

● 4. |

|

4. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

● 5. |

|

5. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

● 6. |

|

6. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

● 7. |

|

7. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

● 8. |

|

8. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

● 9. |

|

9. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

● 10. |

|

10. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

P a r t I I

P r i n c i p a l Bu s i n e s s Ac t i v i t y , V o t i n g S t o c k I n f o r m a t i o n , Et c .

STOCKHOLDINGS AT BEGINNING OF YEAR

Corp. |

|

|

|

number |

|

percent of |

|

percent |

|

Owned by |

|

|

|

|

|

|

|||||

No. |

Principal business activity (PBA) |

NAICS |

|

of |

|

voting |

|

of |

|

corporation |

|

|

|

|

shares |

|

power |

|

value |

|

number |

● 1. |

Com m on parent corporation on federal return: |

|

1. |

|

|

% |

|

|

% |

|

|

|

|

|

|

|

|

|

|

|

|

● 2. |

Reporting corporation on NYC- 3A: |

|

2. |

|

|

% |

|

|

% |

|

|

|

|

|

|

|

|

|

|

|

|

● 3. |

Affiliated corporations: |

|

3. |

|

|

% |

|

|

% |

|

|

|

|

|

|

|

|

|

|

|

|

● 4. |

|

|

4. |

|

|

% |

|

|

% |

|

|

|

|

|

|

|

|

|

|

|

|

● 5. |

|

|

5. |

|

|

% |

|

|

% |

|

|

|

|

|

|

|

|

|

|

|

|

● 6. |

|

|

6. |

|

|

% |

|

|

% |

|

|

|

|

|

|

|

|

|

|

|

|

● 7. |

|

|

7. |

|

|

% |

|

|

% |

|

|

|

|

|

|

|

|

|

|

|

|

● 8. |

|

|

8. |

|

|

% |

|

|

% |

|

|

|

|

|

|

|

|

|

|

|

|

● 9. |

|

|

9. |

|

|

% |

|

|

% |

|

|

|

|

|

|

|

|

|

|

|

|

● 10. |

|

|

10. |

|

|

% |

|

|

% |

|

|

|

|

|

|

|

|

|

|

|

|

30140391

Form |

Page 5 |

*30150391*

- CO M BINED GRO UP INFO RM ATIO N SCHEDULE -

NAM E OF REPORTING CORPORATION: |

EM PLOYER IDENTIFICATION |

|

|

|

NUM BER OF REPORTING |

|

CORPORATION: |

|

|

THE FOLLOWING INFORMATION MUST BE PROVIDED

FOR THIS RETURN TO BE CONSIDERED COMPLETE

Refer to instructions before completing this section.

PART 1 |

General Information |

|

|

|

|

1.Have there been ANY CHANGES in the COMPOSITION of the group of corporations INCLUDED in this Combined General Corporation Tax Return from the PRIOR TAX PERIOD OR ANY MATERIAL CHANGES in the ACTIVITY of any member of the group OR ANY corporation NOT INCLUDED in the group that meets the stock ownership requirements for filing on a

combined basis? |

(See instructions, page 1) |

■ YES |

■ NO |

|

2. Check this box |

■ |

and attach an explanation if you meet ANY of the following conditions: |

||

a.NO MEMBERS of this group FILED or REQUESTED AN EXTENSION to file a combined return under Article

REPORT, OR

b.TWO (2) OR MORE MEMBERS of this group FILED or REQUESTED AN EXTENSION to file a New York State combined return for the TAX PERIOD COVERED BY THIS REPORT but there are differences in the membership of this group and the group that filed or will file a New York State combined return, OR

c.A combined filing by any member(s) of this group has been REVISED or DISALLOWED by New York State for THIS or ANY PRIOR TAX PERIOD.

3.You MUST complete Part 2 of this schedule if you meet ANY of the following conditions:

a.This is the FIRST Combined General Corporation Tax Return being FILED FOR THIS GROUP of corporations, OR

b.There have been CHANGES in the COMPOSITION of the group of corporations SINCE the PRIOR

TAX PERIOD, OR

c.There have been ANY MATERIAL CHANGES in the STOCK OWNERSHIP or ACTIVITY of any corporation INCLUDED in the group or in ANY corporation NOT INCLUDED in the group that meets the stock ownership requirements for filing on a combined basis. (See instructions, page 1)

30150391

*30160391* |

|

Form |

|

|

Page 6 |

|

|

|

|

|

|

|

|

|

PART 2 |

|

Distortion Requirement |

|

||

|

|

|

|

|||

|

|

|

|

|

||

|

|

A Complete this Subpart A for each corporation included in the Combined General Corporation Tax Return that (i) was not |

||||

|

|

included in the Combined General Corporation Tax Return for the prior tax period; or (ii) for which there has been any |

||||

|

|

material change in the stock ownership or activity during the tax period covered by this report. |

||||

|

|

Explain how the filing of a return on a separate basis distorts the corporation’s activities, business, income or capital in New |

||||

|

|

York City, including the nature of the business conducted by the corporation, the source and amount of its gross receipts and |

||||

|

|

expenses and the portion of each derived from transactions with other corporations listed on the Affiliations Schedule. |

||||

Subpart A |

|

|

|

|

|

|

NAME OF CORPORATION / EIN |

REASON(S) INCLUDED IN COMBINED RETURN |

|||||

Name:

1.

EIN:

Name:

2.

EIN:

IF ADDITIONAL SPACE IS REQUIRED, PLEASE USE THIS FORMAT ON A SEPARATE SHEET AND ATTACH IT TO THIS PAGE.

BComplete this Subpart B for each corporation excluded from the Combined General Corporation Tax Return that (i) was included in the Combined General Corporation Tax Return for the prior tax period; or (ii) for which there has been any material change in the stock ownership or activity during the tax period covered by this report.

Explain the reason(s) for the exclusion of each corporation for the combined return, including a description of the nature of the business conducted by the corporation, the source and amount of its gross receipts and expenses and the portion of each derived from transactions with other corporations listed on the Affiliations Schedule.

Subpart B

NAME OF CORPORATION / EIN |

REASON(S) EXCLUDED FROM COMBINED RETURN |

Name:

1.

EIN:

Name:

2.

EIN:

30160391 |

IF ADDITIONAL SPACE IS REQUIRED, PLEASE USE THIS FORMAT ON A SEPARATE SHEET AND ATTACH IT TO THIS PAGE. |

|

File Overview

| Fact Number | Fact Name | Description |

|---|---|---|

| 1 | Form Designation | NYC Combined General 3A Corporation Tax Return |

| 2 | Purpose | Used for filing general corporation tax returns in NYC |

| 3 | Special Features | Includes options for amended, final, and special short period returns |

| 4 | 9/11/01-Related Federal Tax Benefits | Provides a checkbox for claiming any 9/11-related federal tax benefits |

| 5 | Eligibility | All corporations included in the combined return must attach their individual returns |

| 6 | NYC Taxi and Limousine Commission | Corporations regulated by the NYC Taxi and Limousine Commission use business code 999900 |

| 7 | Computation of Tax | Includes various schedules and calculations, such as allocated combined net income |

| 8 | Credits and Payments | Details various tax credits and payment instructions |

| 9 | Governing Law | Governed by the New York City Department of Finance regulations |

| 10 | Dual Reporting | May require information from federal tax returns or pro forma federal returns |

Nyc 3A: Usage Guidelines

Filling out the NYC 3A form can feel daunting, especially when considering its impact on your business taxes. However, with clear instructions, the process becomes manageable. This form is vital for reporting the combined general corporation tax return for businesses within New York City. Below are step-by-step instructions to guide you through completing the form accurately, ensuring compliance with city tax regulations.

- Start by selecting the appropriate tax year for your return at the top of the form, marking it as either a calendar year or fiscal year beginning and ending in 2003.

- Check the boxes on the first page to indicate if the return is special, amended, or final, depending on your specific circumstances.

- Complete the name and address of the reporting corporation section, ensuring accuracy with the employer identification number, address, and business telephone number.

- For entities regulated by the NYC Taxi and Limousine Commission, utilize business code 999900 in place of the federal code in the "Type Business Code Number" field.

- Under the "Name of parent of controlled group" section, provide the employer identification number and principal business activity information.

- Begin with the computation of tax on Schedule A by transferring applicable amounts from other schedules as instructed, starting with Schedule I on page 2.

- Accurately calculate and fill in the allocated combined net income, allocated combined capital, alternative tax, and minimum tax amounts in the relevant sections of Schedule A.

- Determine the payment amount on line A, making sure the check is payable to the NYC Department of Finance.

- Fill out Schedules I through M with detailed financial information as per the form's structure and instructions, including analysis of income, capital, business allocation, investment allocation, and subsidiary allocation.

- Provide certification with the signature of an elected officer of the corporation and the date in the designated area at the bottom of the page.

- If applicable, fill out the affiliations schedule or attach the federal Form 851.

- For the combined group information schedule, complete all required sections, especially if there have been changes in the composition of the combined group or any material changes in the stock ownership or activity of any included or excluded corporation.

- Attach a copy of all pages of your federal tax return or pro forma federal tax return, then review and ensure that your Employer Identification Number is correctly entered on your tax return and remittance.

- Refer to the mailing instructions provided on the form to send your completed NYC 3A form and remittance to the correct address, based on whether you are making a payment, claiming a refund, or sending a non-remittance return.

Upon successful submission, the NYC Department of Finance will process your return. It is critical to adhere to deadlines to avoid penalties. If there are any doubts or complications, consulting with an accountant or tax advisor specializing in New York City tax matters can provide clarity and assistance, ensuring your business stays on the right track.

FAQ

What is the NYC 3A Form?

The NYC 3A Form is a document filed by corporations to report combined general corporation tax in New York City. It's used to calculate taxes owed based on net income, allocated capital, and alternative minimum tax requirements, among other factors. This form is often required for corporations operating within a controlled group or those that are affiliated and conducting business in New York City.

Who needs to file the NYC 3A Form?

Corporations licensed and/or regulated by the NYC Taxi and Limousine Commission, as well as those part of a controlled group or affiliated group conducting business in New York City, need to file the NYC 3A Form. This includes both domestic and foreign corporations operating in the city.

What are the key schedules attached to the NYC 3A Form?

The NYC 3A Form includes several key schedules such as Schedule A (Computation of Tax), Schedule I (Analysis of Income & Capital), Schedule J (Business Allocation), Schedule K (Investment Allocation), Schedule L (Subsidiary Allocation), and Schedule M (Summary of New York City Income and Capital). These schedules are essential for accurately calculating the tax obligations of a corporation.

What information is required to complete the NYC 3A Form?

Completing the NYC 3A Form requires detailed financial information, including allocated combined net income, allocated combined capital, minimum tax for the reporting corporation, subsidiary capital, and various tax credits. Additionally, the corporation’s employer identification number, business code number, principal business activity, and detailed allocation percentages for business activities within New York City are necessary.

How is the tax calculated on the NYC 3A Form?

Tax is calculated by considering allocated combined net income, allocated combined capital, alternative tax for all corporations, and minimum tax obligations. The larger sum of these amounts, plus allocated subsidiary capital, determines the total combined tax. Tax credits and prepayments are then applied to calculate the net tax owed or overpayment due.

Can I claim credits on the NYC 3A Form?

Yes, the NYC 3A Form allows for various tax credits, including UBT Paid Credit and credits transferred from Forms NYC-9.5 and NYC-9.6. These credits can reduce the total amount of tax owed by the corporation.

What if my corporation ceased operations during the tax year?

If your corporation ceased operations during the tax year, you need to check the “Final return” box on the NYC 3A Form. This indicates that the corporation will no longer be filing returns in the future due to cessation of all business activities in New York City.

Where do I file the NYC 3A Form, and what is the deadline?

The NYC 3A Form should be filed with the NYC Department of Finance. For the calendar year 2003, the due date was on or before March 15, 2004. Generally, for fiscal years, the form is due on or before the 15th day of the third month following the close of the fiscal year. Specific filing addresses and instructions are provided on the form itself, including separate addresses for returns with payments, claiming refunds, and all other returns.

Common mistakes

Filling out the New York City (NYC) 3A Combined General Corporation Tax Return form can be a complex task. It is easy to make mistakes if individuals are not familiar with the specific requirements and details expected by the NYC Department of Finance. Here are nine common mistakes made when completing the NYC 3A form:

- Incorrect Employer Identification Number (EIN): It is crucial to enter the EIN accurately. An incorrect number can lead to processing delays or misattribution of your tax liabilities and payments.

- Failing to Check the Correct Tax Year: The applicable tax year or period for which the return is filed must be clearly specified, including the exact start and end dates for fiscal year filers.

- Not Listing All Included Corporations: For a combined return, details of all corporations included in the combined return must be attached. Missing information leads to incomplete submission, potentially resulting in fines.

- Using the Wrong Business Code Number: The form specifically instructs certain businesses, like those regulated by the NYC Taxi and Limousine Commission, to use a specific business code. Using an incorrect code can affect tax calculations.

- Incorrect Allocation Percentages: Allocation involves dividing income, capital, and other items among New York City and other jurisdictions. Inaccurate calculations can significantly affect tax liability.

- Omitting Required Schedules or Attachments: Each section of the NYC 3A form that references schedules or requires additional documentation must be completed and included. Omission can result in an incomplete return.

- Miscalculating Payment Amounts: Line 23 requires entering the payment amount accurately. Calculation errors here can result in underpayment or overpayment of taxes.

- Forgetting to Sign and Date the Return: An unsigned or undated return is considered invalid and will not be processed until corrected, possibly incurring penalties for late filing.

- Incorrectly Reporting Federal Tax Benefits Related to 9/11: The form asks for reporting of any federal tax benefits related to 9/11 events. Overlooking or inaccurately reporting these benefits can lead to discrepancies and potential audits.

Avoiding these mistakes requires careful review and understanding of the form's instructions and the specific tax situation of the reporting corporation. When in doubt, consulting with a tax professional familiar with corporate tax obligations in New York City is advisable. This proactive approach can save time and prevent unnecessary penalties.

Documents used along the form

The NYC 3A Combined General Corporation Tax Return is a significant document required for certain corporations operating within New York City, ensuring compliance with local tax regulations. However, to fully complete this process, various other forms and documents may often accompany the NYC 3A form, each serving a unique purpose in the broader context of corporate tax filing. Understanding these additional forms can provide clarity and streamline the process for businesses.

- Form NYC-3L: Used by corporations to compute their business and investment income allocated within New York City, this form feeds directly into the computation of tax liability on the NYC 3A.

- Form NYC-9.7: This form allows corporations to claim credits for Unincorporated Business Tax (UBT) they've already paid, preventing double taxation on the same income.

- Form NYC-9.5: Specifically designed for utilities tax credits, corporations can use it to reduce their overall tax payable, applicable to those entities involved in public service activities.

- Form NYC-9.6: This document facilitates claiming of credits for real estate taxes, particularly relevant for corporations that own significant property within the city limits.

- Form NYC-222: Corporations anticipating penalties for underpayment of estimated taxes use this form to calculate and report those penalties, ensuring full transparency and compliance.

- Federal Tax Return: Although technically a separate requirement, a copy of the corporation's Federal Tax Return must be attached or a pro forma federal return provided, offering a comprehensive view of the entity's financial activities beyond NYC.

Together, these documents work in concert with the NYC 3A form to provide a full picture of a corporation's financial and tax status to the New York City Department of Finance. Ensuring each form is accurately completed and submitted timely prevents penalties and facilitates a smoother interaction with tax authorities, supporting the city's economic infrastructure and the businesses that thrive within it.

Similar forms

The NYC 3A form, a comprehensive document used for reporting combined general corporation tax return in New York City, shares similarities with other key tax and financial reporting forms utilized by corporations within the United States. Each document, while serving unique purposes, overlaps in function and information requirements with the NYC 3A form, reflecting the intricate weave of tax compliance and financial disclosure inherent to corporate operations.

One similar document is the IRS Form 1120, the U.S. Corporation Income Tax Return. Like the NYC 3A, Form 1120 is used by corporations to report their income, gains, losses, deductions, and credits to the Internal Revenue Service. Both forms require detailed financial information to calculate the tax liability of the corporation, including gross receipts, dividends, and total income. The significant overlap lies in the necessity for corporations to provide a comprehensive overview of their financial activities for tax assessment purposes.

The IRS Form 1065, U.S. Return of Partnership Income, although primarily for partnerships, bears resemblance to the NYC 3A in its function to report income, financial deductions, and calculate taxable income. Partnerships, like corporations, must allocate income and losses among partners, a process akin to the allocation of income and deductions among affiliated corporations in a combined return like the NYC 3A. The emphasis on clear financial disclosure aligns both forms in their objective to ensure tax compliance.

IRS Form 851, Affiliations Schedule, is directly akin to parts of the NYC 3A form, especially when dealing with combined or consolidated tax returns. This document identifies the members of an affiliated group filing a consolidated return. The NYC 3A's requirement for detailed reporting on the composition of the combined group and its members' financial activities reflects a similar necessity to understand the corporate structure influencing tax responsibilities and benefits.

New York State Form CT-3, the Corporation Franchise Tax Return, is another closely related document. It mandates detailed financial reporting and tax computation for corporations operating within the state, akin to the city-level requirements of the NYC 3A form. Both forms are integral to their respective jurisdictions' efforts to assess and collect corporate taxes based on income, capital, and other financial measures.

The IRS Form 5471, Information Return of U.S. Persons With Respect To Certain Foreign Corporations, shares the theme of reporting financial information and calculating tax liability, albeit in the context of international operations. Corporations filing the NYC 3A that have foreign subsidiaries or affiliates might find parallels in reporting requirements, especially in disclosing income from all sources and calculating taxes owed.

Lastly, the Schedule K-1 (Form 1065), Partner's Share of Income, Deductions, Credits, etc., is used in partnership taxation to report each partner's share of the partnership's earnings, which mirrors the reporting of income and deductions across affiliated corporations in a combined return like the NYC 3A. The focus is on equitable distribution of income or losses and the tax implications thereof, ensuring that each entity pays its fair share based on accurate financial representation.

While each document caters to specific entities or tax situations, the core objective of thorough financial reporting and tax compliance unites them with the NYC 3A form, highlighting the complexity and interconnectedness of corporate taxation requirements.

Dos and Don'ts

When filling out the NYC-3A form, there are several do's and don'ts that individuals should keep in mind to ensure the form is completed correctly and efficiently. Here is a list of important factors to consider:

- Do verify the tax year and fiscal period dates at the beginning of the form to ensure accuracy.

- Don't skip the section checking for 9/11/01-related federal tax benefits if applicable.

- Do accurately report the Name of the reporting corporation and Employer Identification Number as they are critical for identification.

- Don't use business code 999900 unless your corporation is licensed and/or regulated by the NYC Taxi and Limousine Commission.

- Do carefully calculate and enter your allocated combined net income and capital, following instructions provided for each line.

- Don't forget to sign and date the form as an elected officer of the corporation to certify the return's accuracy.

- Do attach the payment to this page only, ensuring the remittance is payable to the NYC Department of Finance.

- Don't neglect to attach a copy of your federal tax return or pro forma federal tax return as required.

Adhering to these guidelines when completing the NYC-3A form will help ensure that the submission process is smooth and error-free, reducing the likelihood of delays or problems with your corporation's tax return.

Misconceptions

When it comes to understanding the complexities of tax forms such as the NYC 3A, misconceptions are common. Here are five of the most frequent misunderstandings about the NYC 3A form and the truths behind them:

Only for large corporations: One common misconception is that the NYC 3A form is exclusively for large corporations. In reality, this form is not just for large corporations but for all corporations, including those combined for tax purposes, that operate in New York City. This includes small and medium-sized enterprises that meet certain criteria.

It's only about reporting income: While reporting income is a significant part of the NYC 3A form, it encompasses much more. The form also involves calculations related to allocated combined capital, alternative tax, and minimum taxes for reporting corporations and their subsidiaries. Thus, it provides a comprehensive picture of a corporation's tax liabilities.

Claiming 9/11-related benefits is irrelevant: Some may think that the section on claiming 9/11/01-related federal tax benefits is no longer applicable or irrelevant. However, for corporations that were directly affected and qualify for specific benefits, this section remains an important part of their tax return process.

Business code numbers are fixed and unchangeable: The misconception here is that the business code number provided in the NYC 3A form must match federal codes in all cases. However, corporations licensed or regulated by the NYC Taxi and Limousine Commission are instructed to use a specific business code (999900) instead of their federal code, indicating that there is flexibility dependent on certain conditions.

Attachments are optional: Some may mistakenly believe that attaching additional documents, such as schedules or the previous year's return, is optional. However, for a complete and accurate filing, attaching all relevant schedules and documents as instructed is mandatory. This can include anything from detailed financial statements to schedules outlining the business's activities.

Understanding these key aspects of the NYC 3A form can help ensure accurate and compliant tax reporting for corporations operating within New York City.

Key takeaways

- Identify the type of form: NYC 3A is described as a Combined General Corporation Tax Return, indicating it's designed for use by corporations operating within New York City, consolidating tax reporting for all included corporations.

- Filing period: The form specifies options for calendar year filers and fiscal year filers, requiring the start and end dates of the fiscal year to be stated explicitly.

- Marking special conditions: Special options include checkboxes for claiming 9/11/01-related federal tax benefits, filing an amended return, and indicating if it's a final return because the corporation has ceased operations.

- Information required: Reporting corporation's name, Employer Identification Number (EIN), address, business code number, and telephone number. For businesses regulated by the NYC Taxi and Limousine Commission, a specific business code number (999900) is to be used instead of the federal code.

- Calculation of tax: The form involves detailed computation of taxes due, including allocated combined net income, allocated combined capital, alternative tax, and minimum taxes, highlighted in sections such as Schedule A and Schedule M.

- Credits and payments: It mentions different credits like UBT Paid Credit and provides lines for computing tax after credits, total prepayments, balance due or overpayment, and additional charges like interest and penalties.

- Attachments needed: The necessity to attach a copy of all pages of the federal tax return or pro forma federal tax return, as well as the importance of attaching remittance to the specified page and making it payable to NYC Department of Finance, is highlighted.

- Mailing instructions are clarified, separating addresses for returns with remittances, returns claiming refunds, and all other returns, ensuring correct delivery based on the nature of the return being filed.

- Certificate of an elected officer of the corporation is required at the end, underscoring the need for the form to be certified as true, correct, and complete.

Common PDF Documents

Dob Forms - Filing this form is a prerequisite for securing a Place of Assembly Certificate of Operation, a must-have for venues hosting large gatherings.

Unemployment Claim Pending Status Ny - Explains the consequences of failing to timely and accurately report all employment and wages for UI claims.

Note of Issue New York - By signing and dating the form, employees solidify their understanding and agreement with the provided employment terms, including overtime rates.