Free Nyc 3360 Form in PDF

Amidst the maze of tax forms and regulations, the NYC 3360 form emerges as a crucial document for corporations within New York City, addressing adjustments to the general corporation tax base following audits or amendments by the Internal Revenue Service (IRS) and/or New York State Department of Taxation and Finance. This form is not merely a bureaucratic hurdle but a critical step to ensure tax compliance and accurate financial reporting for tax years beginning before January 1, 2015. Businesses are mandated to file this form within a specified period—90 days for individual entities and 120 days for combined groups—after the final decision by the IRS or state department to adjust the tax base. It isn't just a matter of reporting changes in filing status or the calculation of taxes owed; it involves a comprehensive recounting of financial shifts, tax rate applications, and the detailed arithmetic of tax liability adjustments. This includes, but is not limited to, recalculating net income allocated to New York City, reevaluating minimum taxes based on gross receipts, and substantiating any changes with documentary evidence from federal or state adjustments. Moreover, corporations are necessitated to articulate reasons for any discrepancy with the final determinations and adjust their filings accordingly. The document intricately details payment instructions, the importance of adhering to the reporting timeframes to avoid penalties, and the procedural nuances for those disputing adjustments or seeking refunds. Its meticulous instructions underscore the complexities of tax compliance, reaffirming the necessity for corporations to stay vigilant and proactive in their financial reporting and tax obligations.

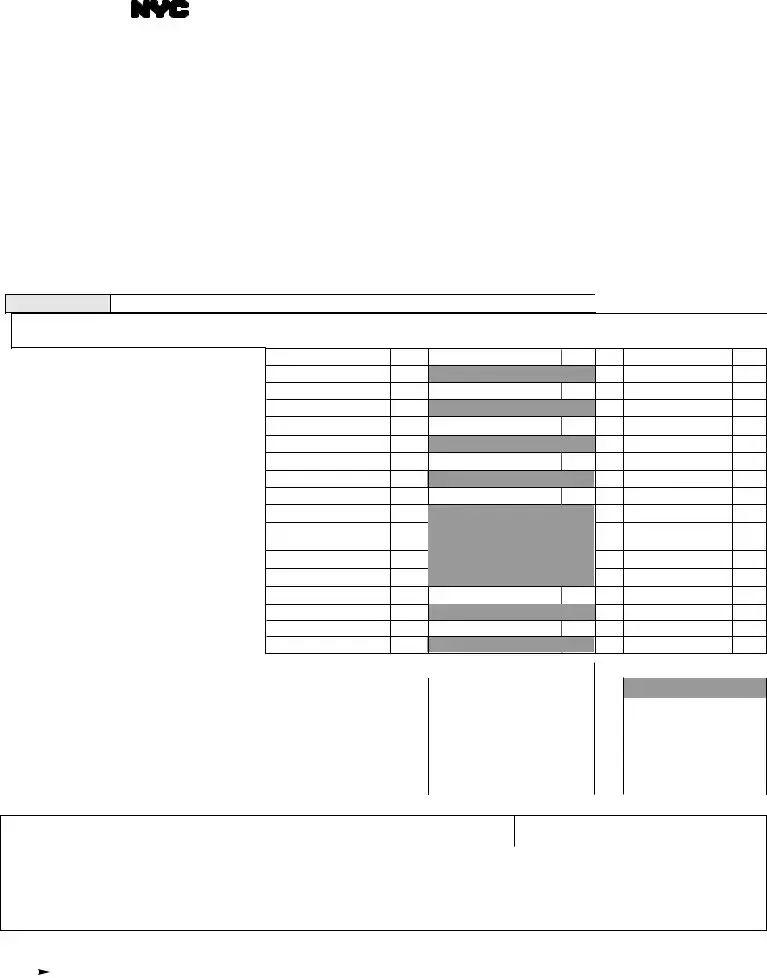

Nyc 3360 Sample

*30011591*

A.Payment

Department of Finance |

|

GENERAL CORPORATION TAX REPORT OF CHANGE IN |

|||||||||||||||||||||||||||||||||

|

TAXBASEMADEBYINTERNALREVENUESERVICEAND/OR |

||||||||||||||||||||||||||||||||||

|

|

|

|

|

NEWYORKSTATEDEPARTMENTOFTAXATIONANDFINANCE |

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|

TO BE FILED WITHIN 90 DAYS (120 DAYS FOR A COMBINED GROUP) AFTER A FINAL DETERMINATION |

||||||||||||||||||||||||||||||

|

|

|

|

|

FOR TAX YEARS BEGINNING PRIOR TO JANUARY 1, 2015 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

For CALENDAR YEAR __________ or FISCAL YEAR beginning ________________________ and ending _________________________ |

||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

ARE YOU REPORTING A CHANGE |

NEW FILING STATUS: |

|

|

|

|

|

ORIGINAL RETURN WAS FILED ON: |

|

|

|

|

|

|

|

||||||||||||||||||||

|

IN FILING STATUS? (SEE INSTR.) |

|

|

|

|

|

|

CHANGEIN |

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

SEPARATE |

|

|

COMBINED |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

nYES nNO |

n |

n |

nCOMBINEDGROUP |

|

n |

n |

n |

n |

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name |

|

Name |

|

Email Address |

|

|

|

|

|

|

|

EMPLOYER IDENTIFICATION NUMBER |

||||||||||||||||||||

|

t |

|

|

|

Change n |

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Typeor |

|

In Care of |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address (number and street) |

|

|

|

|

|

|

Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

Change n |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

Date of Final Determination: |

|

|

|

|

|

|

|

||||||||||||||||

|

t |

|

City and State |

|

|

|

Zip Code |

|

Country (if not US) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

n Federal |

|

|

|

||||||||||||||||

|

|

|

Business Telephone Number |

|

|

|

Person to contact |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

n New York State |

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Payment Amount |

|

|

|

|

|

|||||

Amountbeingpaidelectronicallywiththisreturn.............................................................................. A. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Calculation of General

Corporation Tax

COLUMN 1 |

COLUMN 2 |

COLUMN 3 |

Original Amount as last adjusted |

Net Change |

Correct Amount |

|

|

|

1. |

Net income allocated to New York City.... |

1. |

2. |

Tax at ______% (see instructions) |

2. |

3.Total capital allocated to New York City.. 3.

4. |

Tax at ______% (see instructions) |

4. |

5a. |

Alternative tax base (see instructions) |

5a. |

5b. |

Alternative tax (see instructions) |

5b. |

6. |

NYC Gross Receipts |

6. |

6a. |

Minimum tax (see instructions) |

6a. |

7. |

Subsidiary capital |

7. |

8. |

Tax at ______% (see instructions) |

8. |

9.Tax, (line 2, 4, 5b, or 6a, whichever

|

is largest, plus line 8) |

9. |

10. |

Minimum tax for subsidiaries |

10. |

11. |

Total tax (line 9 plus line 10) |

11. |

12. |

UBT Paid Credit (see instructions) |

12. |

13. |

TaxafterUBTPaidCredit(line11minusline12) |

13. |

14. |

Tax credits (see instructions) |

14. |

15. |

Net tax |

15. |

1.

2.

3.

4.

5a.

5b.

6.

6a.

7.

8.

9.

10.

11.

12.

13.

14.

15.

Additional Tax (or Refund) Due |

COLUMN A - Additional Tax Due |

COLUMN B - Refund Due |

16. |

If line 15 (col. 3) exceeds line 15 (col. 1), enter the difference in column A .......... 16. |

|

|||||

17. |

If line 15 (col. 3) is less than line 15 (col. 1), enter the difference in column B |

|

|

17. |

|

|

|

18. |

Interest (see instructions) |

18. |

|

|

|

|

|

19. |

Additional charges (see instructions) |

19. |

|

|

|

|

|

20. |

Total amount due (add lines 16 , 18, and 19) |

20. |

|

|

|

|

|

21. |

Refund due (enter amount from line 17 above) |

|

|

|

21. |

|

|

CERTIFICATION OF AN ELECTED OFFICER OF THE CORPORATION

Iherebycertifythatthisreturn,includinganyaccompanyingrider,is,tothebestofmyknowledgeandbelief,true,correctandcomplete. I authorize the Dept. of Finance to discuss this return with the preparer listed below. (see instructions) .....YES n

Firm's Email Address

_____________________________________________

SIGN |

|

|

|

|

|

|

|

Preparer's Social Security Number or PTIN |

||||||||||||||||||||||||

HERE ’ |

Signature of officer |

|

Title |

|

|

Date |

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Preparer's |

Preparer’s |

Check if self- |

n |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

PREPARER'S |

signature |

printed name |

employed 4 |

Date |

|

Firm's Employer Identification Number |

||||||||||||||||||||||||||

|

|

|

||||||||||||||||||||||||||||||

USE ’ |

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

ONLY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

s Firm's name (or yours, if

|

|

ALLRETURNSEXCEPTREFUNDRETURNS |

REMITTANCES |

RETURNSCLAIMINGREFUNDS |

Attach copies of federal and/or New York State |

To receive proper cred- |

|

|

MAILING |

|

changes and explanation of items. Make remittance |

it, you must enter your |

|||

INSTRUCTIONS NYC DEPARTMENT OF FINANCE |

ATNYC.GOV/ESERVICES |

NYC DEPARTMENT OF FINANCE |

|||||

payabletotheorderof: |

correct Employer |

||||||

|

|

GENERAL CORPORATION TAX |

GENERAL CORPORATION TAX |

||||

|

|

Identification Number |

|||||

|

|

P.O. BOX 5564 |

NYC DEPARTMENT OF FINANCE |

P.O. BOX 5563 |

|

||

|

|

|

on your form and remit- |

||||

|

|

BINGHAMTON, NY |

P.O. BOX 3646 |

BINGHAMTON, NY |

NYCDEPARTMENT OF FINANCE |

||

30011591 |

NEW YORK, NY |

|

PaymentmustbemadeinU.S.dollars,drawnonaU.S.bank. |

tance. |

|||

|

|

|

|||||

NYC - 3360 - 2015

Form |

Page 2 |

Payments may be made on the NYC Department of Finance website at nyc.gov/eservices, or via check or money order. If paying with check or money order, do not include these payments with your New York City return. Checks and money orders must be accompanied by payment voucher form

(Pursuant to Title 11, Chapter 6 of the Administrative Code of the City of New York)

For taxable years beginning prior to January 1, 2015, you must file Form

If you are filing this form to report a change in filing on a separate basis on a Form

For information regarding differences between Federal and City depreciation deductions, see Finance Memorandum

SPECIFIC INSTRUCTIONS

CALCULATION OF TAX

In Column 1, lines 1, 3, 5a, 6, 7, 12 and 14, enter amounts from the latest NewYorkCityreportreflectinganyclaimforcreditorrefundorNewYork City Department of Finance adjustment prior to the filing of this return. If youfiledanamendedreturnoriftheamountsshownonyouroriginalreturn were changed pursuant to a final Department of Finance adjustment, attach documentation reflecting the New York City changes and a schedule show- ing your calculations. In Column 2 enter net reportable changes resulting from changes made by the Internal Revenue Service or the New York State Department of Taxation and Finance and submit a schedule showing calcu- lations. In Column 3, lines 1, 3, 5a 6, 7, 12 and 14, enter the difference between,orsumof,columns1and2,asappropriate.

Submit schedule of allocation percentages (if any) utilized in mak- ing entries in column 2 of this report.

LINES 2, 4, 5b and 8

Use the tax rate schedule to determine the applicable rates for the taxable year covered by this report.

TAX RATE SCHEDULE

Taxable |

|

Allocated Net |

Allocated |

Allocated |

Years |

...and |

Income/ |

Businessand |

Subsidiary |

Beginning |

Before |

Alternative |

Investment |

Capital |

on or After... |

|

Tax |

Capital |

|

|

|

|

|

|

8.85% |

0.15% |

.075% |

||

|

|

|

|

|

NOTE: The rate of tax on capital for cooperative housing corpora- tions is 4/10 mill (.0004). For all other corporations subject to tax on capital (other than cooperative housing corporations) the rate of tax on capital is 1 1/2 mills (.0015).

LINE 5a, Column 3 - ALTERNATIVE TAX BASE

Submit schedule showing computation of alternative tax base. To compute the alternative tax base:

a)add to the amount of corrected allocated net income (loss), column 3 all salaries and compensation paid to every stock- holder owning more than five percent of the issued capital stock.

b)deduct from such total the statutory exemption amount, which is $40,000 for taxable years beginning on or after July 1, 1999 (a pro- portionate part is deducted in the case of a return for less than a year);

c)For tax years beginning on or after January 1, 2010, multiply the resulting total by 15%. See Ad Code §

The alternative tax base is computed based on revised entire net income (entire net income per original return plus or minus change in taxable income).

LINE 5b - ALTERNATIVE TAX

Todeterminethealternativetax,applytheappropriatetaxrateshownin thescheduleabovetothetaxbasedeterminedinline5a.

LINES 6, 6a and 10 – MINIMUM TAX

For tax years before 2009, the minimum tax is $300. If this form is being filed with respect to a corporation filing a combined report, enter $300 on line 6a for the reporting corporation, and enter on line 10 the total minimum tax of each corporation included in the combined report other than the reporting corporation, with the exception of any corpora- tionnototherwisesubjecttotax.

For tax years beginning in or after 2009, use the following table to deter- mine the minimum tax. Enter on line 6 NYC Gross Receipts. Enter on line 6a the minimum tax for the reporting corporation. Enter on line 10 the sum of the minimum tax for each corporation included in the com- bined group other than the reporting corporation. Attach a schedule showingeachsuchcorporationandtheamountofminimumtaxforeach. The amount of New York City receipts for the purpose of calculating the minimum tax for tax years beginning in or after 2009 is the total amount of all receipts the taxpayer has received in the regular course

Form |

Page 3 |

of business from such sources as sales of personal property, services |

of the General Corporation Tax Return (without regard to any |

||

performed, rentals of property and royalties. For taxpayers which have |

extension of time for payment) to the date of payment. (Section 11- |

||

filed an NYC 3L, this receipts amount would be the same as the |

675 of the Administrative Code). The applicable prescribed inter- |

||

amount that would have to be shown on Form |

est rate or rates are available from the interest rate table set forth on |

||

Column A, Line 2g. For taxpayers which are part of a combined |

the Finance website at nyc.gov/finance. |

||

group in tax years beginning in 2014 or 2013, this amount would be: |

Effective September 1, 1983, interest is compounded on a daily |

||

(i) for the reporting corporation, the amount on Form |

|||

ule H, Column A, Line 2g(A); and (ii) for corporations other than the |

basis at the applicable rate. |

||

reporting corporation (“subsidiaries”), the amount on Form NYC- |

For the rate of interest on overpayments, for a rate of interest not |

||

3A/B, Schedule H, Line 2g(A) in the column for that subsidiary, |

shown on the website and for interest calculations, call 311. If call- |

||

except if there is only one subsidiary, in which case the amount |

ing from outside of the five NYC boroughs, please call |

||

entered on form |

YORK |

||

|

|

||

TABLE - FIXED DOLLAR MINIMUM TAX |

|

LINE 19 - ADDITIONAL CHARGES |

|

For a corporation with New York City receipts of: |

|

||

|

a) A late filing penalty is assessed if you fail to file this form |

||

Not more than $100,000: |

$ 25 |

||

More than $100,000 but not over $250,000: |

$ 75 |

when due, unless the failure is due to reasonable cause. For |

|

every month or partial month that this form is late, add to the |

|||

More than $250,000 but not over $500,000: |

$ 175 |

||

tax (less any payments made on or before the due date) 5%, up |

|||

More than $500,000 but not over $1,000,000: |

$ 500 |

||

to a total of 25%. |

|||

More than $1,000,000 but not over $5,000,000: |

$1,500 |

||

|

|||

More than $5,000,000 but not over $25,000,000: |

$3,500 |

b) If this form is filed more than 60 days late, the above late filing |

|

Over $25,000,000: |

$5,000 |

penalty cannot be less than the lesser of (1) $100 or (2)100% of the |

|

|

|

||

Short periods - fixed dollar minimum tax. Compute the New York |

amount required to be shown on the form (less any payments made |

||

by the due date or credits claimed on the return). |

|||

City receipts for short periods (tax periods of less than 12 months) |

|||

|

|||

by dividing the amount of New York receipts by the number of |

c) A late payment penalty is assessed if you fail to pay the tax |

||

months in the short period and multiplying the result by 12. The |

shown on this form by the prescribed filing date, unless the fail- |

||

fixed dollar minimum tax may be reduced for short periods: |

ure is due to reasonable cause. For every month or partial |

||

|

|

month that your payment is late, add to the tax (less any pay- |

|

Period Reduction |

|

ments made) 1/2%, up to a total of 25%. |

|

|

|

||

l Not more than 6 months |

50% |

d) The total of the additional charges in a and c may not exceed |

|

l More than 6 months but not more than 9 months |

25% |

||

5% for any one month except as provided for in b. |

|||

l More than 9 months |

None |

||

|

|||

If this form is being filed with respect to a corporation filing a com- |

If you claim not to be liable for these additional charges, attach a state- |

||

ment to your return explaining the delay in filing, payment or both. |

|||

bined report, enter on line 10 the sum of the fixed dollar minimum |

|

||

tax amounts for each corporation (other than the reporting corpora- |

SIGNATURE |

||

tion) included in the combined report, except for any corporation |

This report must be signed by an officer authorized to certify that |

||

not otherwise subject to tax. To determine the fixed dollar mini- |

the statements contained herein are true. If the taxpayer is a pub- |

||

mum tax for each such corporation, use the above table. |

|

||

|

|

||

LINE 12 - UBT PAID CREDIT |

|

corporation, this return must be signed by a person duly authorized |

|

|

to act on behalf of the taxpayer. |

||

Enter on line 12, column 1 the total amounts from Form |

|||

|

|||

Preparer Authorization: If you want to allow the Department of |

|||

allchangestothisamountandenterthecorrectedamountincolumn3. |

Finance to discuss your return with the paid preparer who signed it, |

||

|

|

you must check the "yes" box in the signature area of the return. |

|

LINE 14 - |

|

This authorization applies only to the individual whose signature |

|

All applicable credits should be taken into account when computing |

appears in the "Preparer's Use Only" section of your return. It does |

||

the tax. Attach schedule of credits claimed. Attach Forms NYC- |

not apply to the firm, if any, shown in that section. By checking the |

||

9.5, |

"Yes" box, you are authorizing the Department of Finance to call |

||

Enter in column 2 all changes to these amounts and enter the cor- |

the preparer to answer any questions that may arise during the pro- |

||

rected amount in column 3. |

|

cessing of your return. Also, you are authorizing the preparer to: |

|

LINE 17 - CLAIM FOR REFUND |

|

l Give the Department any information missing from your return, |

|

|

l Call the Department for information about the processing of |

||

Where the federal or New York State change would result in a |

|||

refund, Form |

your return or the status of your refund or payment(s), and |

||

l Respond to certain notices that you have shared with the |

|||

it is accompanied by a complete copy of the federal and/or New |

preparer about math errors, offsets, and return preparation. |

||

York State Audit Report or Statement of Adjustment. |

|

||

|

The notices will not be sent to the preparer. |

||

|

|

||

Effective for taxable years beginning on or after January 1, 1989, if |

You are not authorizing the preparer to receive any refund check, |

||

this report is not filed within 90 days after the notice of the final |

bind you to anything (including any additional tax liability), or oth- |

||

federal (or New York State) determination, no interest on the |

erwise represent you before the Department. The authorization |

||

resulting refund will be paid. |

|

cannot be revoked, however, the authorization will automatically |

|

|

|

||

LINE 18 - INTEREST |

|

expire no later than the due date (without regard to any extensions) |

|

|

for filing next year's return. Failure to check the box will be |

||

Enter at Line 18, Column A, interest owed on the additional tax due |

|||

deemed a denial of authority. |

|||

at the applicable prescribed interest rate or rates from the due date |

|

||

File Overview

| Fact Number | Fact Name | Description |

|---|---|---|

| 1 | Governing Law | Title 11, Chapter 6 of the Administrative Code of the City of New York |

| 2 | Filing Deadline | Must be filed within 90 days (120 days for a combined report) after any final IRS or New York State determination |

| 3 | Reporting Final Adjustments | Form used to report final adjustments made by the Internal Revenue Service or New York State Department of Taxation and Finance |

| 4 | Tax Rates and Calculations | Various tax rates apply, dependent on the tax base and period. Includes columns for reporting original, adjusted, and correct amounts. |

| 5 | Minimum Tax Requirements | The minimum tax rates are based on New York City receipts, ranging from $25 to $5,000 for corporations with differing levels of New York City receipts. |

| 6 | Certification Required | A certified officer must sign the form, attesting to its accuracy. There is also an option to authorize the Department of Finance to discuss the return with the preparer. |

Nyc 3360: Usage Guidelines

After the Internal Revenue Service (IRS) or New York State Department of Taxation and Finance makes a final decision about your taxes, you might need to report these changes to the New York City Department of Finance using Form NYC-3360. This is especially true if these adjustments affect your general corporation tax. You have a set deadline to submit this form: 90 days after the final decision, or 120 days if you're reporting for a combined group. Don't attach this form to any other tax returns. If the changes include something you disagree with, make sure to complete the form with the originally reported amounts and attach a detailed explanation of your disagreement along with any additional tax or refund you believe is due.

Filling out NYC-3360- Write the calendar year or fiscal year start and end dates at the top of the form.

- If reporting a change in filing status, mark the "YES" box and choose the new filing status.

- Provide corporation name, employer identification number (EIN), contact information, and email address accurately.

- Record the date of the IRS or New York State's final determination of your tax changes.

- If there’s a change in address, ensure to check the appropriate box and update the address information.

- Enter the amount being paid electronically with this return, if applicable, in the designated section.

- Under "Calculation of General Corporation Tax," fill in the original amounts, net changes, and corrected amounts for each item listed. This includes net income allocated to NYC, taxes applied, the total capital allocated, and any alternative tax bases.

- Calculate any additional tax due or refund owed in the provided columns, following calculations based on instructions for lines 16 through 21.

- If you’re paying by check or money order, remember to also complete and send form NYC-200V to the specified address. Payment and mailing details are outlined within the form’s instructions.

- An elected officer of the corporation must sign the form certifying that the information provided is correct. The preparer's information, if not self-prepared, should also be entered.

- Attach copies of relevant IRS or New York State documentation supporting your reported changes along with explanations of items as needed.

- Mail the completed form and any payment (if paying by check or money order) to the Department of Finance at the appropriate address listed for either general returns or refund claims.

Ensure that every section of the form is completed accurately and that all necessary documentation is attached. Missing information or documentation can delay processing or influence the outcome of your tax adjustment report.

FAQ

What is the NYC 3360 form?

When do I need to file the NYC 3360 form?

What should be included with the NYC 3360 form when filing?

Can I file the NYC 3360 form online?

How is the additional tax or refund calculated on the NYC 3360 form?

What if there is a change in filing status?

How do I determine the correct tax rates for calculating the tax on the NYC 3360 form?

What are the penalties for filing the NYC 3360 form late?

Can this form be used to claim a refund?

Who is authorized to sign the NYC 3360 form?

The NYC 3360 form is a document used by the Department of Finance for General Corporation Tax. It's specifically for reporting any changes in tax base made by the Internal Revenue Service (IRS) and/or New York State Department of Taxation and Finance. This form must be filed within 90 days (120 days for a combined group) after receiving a final determination for tax years beginning prior to January 1, 2015.

You need to file the NYC 3360 form within 90 days for individual entities or 120 days for combined groups after any change in tax base that's been finalized by the IRS or New York State Department of Taxation and Finance.

When filing the NYC 3360 form, attach copies of federal and/or New York State changes and an explanation of items. If you're making a payment with this return, ensure to also include remittance and use a payment voucher form NYC-200V if paying by check or money order.

Yes, payments associated with the NYC 3360 can be made on the NYC Department of Finance website at nyc.gov/eservices. However, the form itself needs to be mailed with any applicable documentation to the Department of Finance as specified in the instructions.

The additional tax or refund is calculated based on changes in net income allocated to NYC, tax rates, capital allocated to NYC, and other tax bases as outlined in the form’s instructions. Calculations involve comparing original figures, net changes due to adjustments, and correcting these amounts to come up with the additional tax due or refund.

If there is a change in your filing status, mark “YES” on the provided section of the form and indicate the new filing status. This is crucial for entities switching from filing separately to a combined group status or vice versa.

Tax rates are determined based on the schedule provided in the form’s instructions. The rates vary depending on the taxable year and the type of tax base being taxed, such as net income, capital, or alternative tax base.

Late filing penalties include a charge of 5% of the unpaid tax for each month or part of a month the return is late, up to a total of 25%. If more than 60 days late, a minimum penalty applies.

Yes, the NYC 3360 form can be used to claim a refund if the changes resulted in an overpayment of taxes. Include a complete copy of the federal and/or New York State Audit Report or Statement of Adjustment if claiming a refund.

An elected officer of the corporation must sign the form to certify its accuracy. If the taxpayer is a publicly-traded partnership or an unincorporated entity taxed as a corporation, someone duly authorized to represent the taxpayer must sign.

Common mistakes

Filling out the NYC-3360 form can be a complex task for any business. This form is essential for reporting changes in tax base made by the Internal Revenue Service (IRS) and/or New York State Department of Taxation and Finance. These changes must be filed within a specified timeframe after a final determination for tax years beginning before January 1, 2015. During the completion of this form, several common errors can lead to incorrect submissions or processing delays. Being cognizant of these mistakes can save time and prevent unnecessary complications.

One of the initial areas where mistakes occur involves the reporting period. This section requires precise dates for the calendar or fiscal year beginning and ending. Confusion or inaccuracies in this section can lead to misinterpretation of the applicable tax year. Moreover, misunderstanding the question on changes in filing status can also lead to inaccuracies. A change in filing status might refer to altering from separate to combined reporting or the reverse. It's crucial to answer accurately to reflect the current status properly.

- Failing to check the correct box under the "NEW FILING STATUS" section to indicate whether there's been a change in filing status.

- Inaccurately reporting the Employer Identification Number (EIN), a critical identifier for any business entity.

- Omitting or incorrectly entering the “Date of Final Determination”, which is essential for the timely filing requirement.

- Incorrect calculation in the A. Calculation of General Corporation Tax section, where original amounts, net changes, and correct amounts must be precisely calculated and entered.

- Not attaching the required documentation, such as copies of federal and/or New York State changes and explanations of items, when there are adjustments to report.

- Misinterpreting the instructions for the payment amount section and incorrectly calculating the amount being paid electronically with the return.

- Forgetting to sign and date the certification at the end of the form, which verifies that the information provided is accurate and complete. This is a common yet crucial oversight.

- Improper submission or misunderstanding of payment procedures, especially when payment is made by check or money order, which must be accompanied by a payment voucher form (NYC-200V) and sent to a specific address.

In summary, while completing the NYC-3360 form, attention to detail is paramount. Missteps in filling out this form can range from errors in tax status reporting to miscalculations of tax liabilities or payments. Ensuring accuracy in the employer identification number, the date of final determination, tax calculations, and compliance with documentation and certification requirements can significantly impact the processing and outcome of the form submission. Additionally, understanding specific instructions about payment procedures is crucial for correct submission. Properly navigating these common mistakes can lead to a smoother process in fulfilling tax obligations.

Documents used along the form

When dealing with the NYC-3360 form, it's crucial to have a grasp of other related documents and forms that ensure full compliance and accurate reporting to the Department of Finance. Below, find a list of documents that often accompany the NYC-3360 form, each playing a unique role in the process.

- Form NYC-3L: General Corporation Tax Return for large corporations. It's used by corporations to report their income, deductions, and calculate their tax liability to New York City.

- Form NYC-3A: Combined General Corporation Tax Return. Required for corporations that are part of a combined group, reporting the combined income and deductions to calculate the total tax liability.

- Form NYC-4S: General Corporation Tax Return for S-Corporations. Specifically designed for S-corporations to report their income, deductions, and credits.

- Form NYC-4S-EZ: Simplified version of the NYC-4S for S-corporations with straightforward tax situations.

- Form NYC-200V: Payment Voucher for Electronic Payments. Utilized when making electronic payments for tax liabilities to ensure proper crediting of payments.

- IRS Adjustment Documents: Includes notices or documents from the IRS detailing adjustments to a corporation's federal tax return that may affect their NYC tax.

- New York State Department of Taxation and Finance Adjustment Documents: Similar to the IRS documents but pertaining to adjustments made by the New York State, impacting the tax calculation for the city.

- Schedule of Allocation Percentages: A detailed record showing how income, deductions, and credits are allocated between New York City and other jurisdictions, affecting the total tax liability.

Understanding each document's role and how it interacts with the NYC-3360 form can significantly streamline the tax reporting process. By ensuring that relevant documents are correctly filled out and accompanying the NYC-3360, corporations can accurately report changes to their tax base as affected by adjustments from both the IRS and the New York State Department of Taxation and Finance, thereby maintaining compliance and minimizing issues with tax liabilities.

Similar forms

The Form NYC-3360, a specialized document for reporting adjustments in general corporation tax base due to changes by the Internal Revenue Service (IRS) or the New York State Department of Taxation and Finance, shares similarities with many other tax-related forms and documents. Each of these documents is designed to ensure accurate tax reporting, compliance with tax laws, and proper tax collection processes.

One such document is the IRS Form 1120, U.S. Corporation Income Tax Return. This form is used by corporations to report their income, gains, losses, deductions, credits, and to figure out their federal income tax liability. Like the NYC-3360, IRS Form 1120 is essential for reporting a corporation's financial activities to a tax authority, albeit on a federal level. Both forms serve as a basis for determining the tax obligations of corporations, but under the jurisdiction of different tax authorities.

Another analogous document is the New York State CT-3, General Corporation Franchise Tax Return. This form is required by the New York State Department of Taxation and Finance for corporations to report their income, deductions, and credits to calculate their state franchise tax liability. Similar to the NYC-3360, the CT-3 facilitates tax compliance and ensures the accurate calculation of taxes owed to the state, reflecting the parallel structures of state and city tax obligations for corporations operating within New York.

The Form NYC-3L, General Corporation Tax Return, also bears resemblance to the NYC-3360. The NYC-3L is specifically for corporations paying tax to New York City and is used to calculate tax liability based on income, deductions, and credits. Both the NYC-3L and NYC-3360 are integral to corporate tax reporting within New York City, but while the NYC-3L is for initial tax filings, the NYC-3360 is for reporting subsequent adjustments to those filings.

Form 1040, U.S. Individual Income Tax Return, though primarily for individual taxpayers, shares the underlying purpose of reporting income to a tax authority (the IRS) for the correct determination of tax liability. Similarly, the NYC-3360 fulfills this role for corporations at the city level, demonstrating the universal need for detailed financial disclosure in tax processes, whether for individuals or corporations.

Lastly, the Form NYC-200V Payment Voucher is related to the NYC-3360 in its role in the payment process. While the NYC-3360 reports changes in tax base, the NYC-200V is used to accompany tax payments, ensuring they are correctly processed and attributed. Both forms are crucial for the correct assessment and collection of taxes, albeit at different stages of the tax reporting and payment cycle.

Dos and Don'ts

When completing the NYC 3360 Form, it's important to follow guidelines closely to ensure accurate and timely processing. Here are some essential dos and don'ts that can help.

- Do file the form within 90 days (120 days for a combined group) after receiving a final determination from the IRS or New York State Department of Taxation and Finance for tax years beginning prior to January 1, 2015.

- Do include complete and accurate calculations for the General Corporation Tax in the specified columns, ensuring that all changes made by the IRS or New York State Department of Taxation and Finance are clearly noted and accurately reflected.

- Do attach copies of the final determination, waiver, or notice of tentative carryback allowance from the IRS or New York State Department of Taxation and Finance, as these documents are critical for verifying the changes reported.

- Do not forget to sign the certification section by an authorized officer of the corporation. This signature is necessary to validate the form's accuracy and completeness.

- Do not include payment with the NYC 3360 form. If payment is due, it must be made electronically on the NYC Department of Finance website or via check or money order using the specified payment voucher form (NYC-200V).

- Do not leave out any required schedules or documentation that support your entries on the form. Incomplete information may delay processing and could potentially result in inaccuracies in tax determination.

By adhering to these guidelines, filers can avoid common mistakes and ensure their forms are processed smoothly and efficiently.

Misconceptions

Here are 10 common misconceptions about the NYC 3360 form, along with explanations to clarify the misunderstandings:

- The NYC 3360 form is only for businesses located in New York City. While it is specifically related to changes in tax base reported by the IRS or New York State Department of Taxation and Finance affecting New York City taxes, it pertains to any general corporation with taxable activities in NYC, regardless of where the business is headquartered.

- All businesses must file the NYC 3360 form annually. This form is not an annual requirement for all businesses but must be filed within 90 (or 120 for combined groups) days after a final determination by the IRS or New York State that affects the tax base for years beginning before January 1, 2015.

- Filing the NYC 3360 automatically amends your original tax returns. Filing this form reports changes to your tax base; it does not serve as an amendment to previous returns. A separate amended return might be required.

- If you don't owe additional tax, you don't need to file the NYC 3360. You must file this form to report any changes to your tax base, regardless of whether it results in additional tax due or a refund.

- Electronic payments are required when filing the NYC 3360. While electronic payments are encouraged and may be made through the NYC Department of Finance website, taxpayers can also pay via check or money order using form NYC-200V.

- The form is complicated and always requires professional preparation. While tax professionals can offer valuable assistance, the NYC 3360 form instructions are designed to guide taxpayers through the process. Some corporations may be able to complete it without professional help, depending on the complexity of their adjustments.

- There’s no penalty for late filing as long as you don't owe any additional tax. Late filing can result in penalties, regardless of whether additional tax is due. The form should be filed within the specified time frame to avoid penalties.

- Payments made with the NYC 3360 form should include the original tax amount. The payment accompanying this form should only cover any additional tax due as a result of the reported changes, along with any applicable interest and penalties.

- Reporting a change automatically triggers a tax audit. While it's important to ensure all information is accurate and complete, filing this form does not automatically initiate an audit. It is merely a compliance requirement following adjustments by the IRS or New York State.

- You cannot file this form if you disagree with the final IRS or State determination. If you disagree with the final determination, you should still file the form, reporting the amount from column 1 in column 3, and attach a statement explaining why you believe the determination was erroneous.

Understanding these key points about the NYC 3360 form helps ensure that corporations comply with New York City tax regulations while avoiding common pitfalls related to its filing requirements.

Key takeaways

Understanding the intricacies of the NYC 3360 form is vital for corporations in New York City. Here are seven key takeaways to ensure compliance and accuracy when dealing with changes in tax bases as a result of internal or external adjustments:

- Timely Filing: Corporations must file the NYC 3360 form within 90 days (or 120 days for combined groups) following a final tax determination by the IRS or New York State Department of Taxation and Finance for tax years beginning before January 1, 2015.

- Reporting Changes: This form is specifically designed to report adjustments to the corporation tax base made by the IRS or New York State, including any changes in filing status.

- Attachment Requirements: Copies of the final determination, waiver, or notice of tentative carryback allowance from the IRS or New York State must be attached to the form. Failure to include these documents can lead to incorrect processing of any adjustments.

- Amendment Obligations: If an amended federal or New York State return is filed, equivalently an amended New York City return must be filed within 90 days to reflect those changes.

- Detailed Tax Calculations: The form requires detailed information regarding original tax amounts, net changes, and correct amounts to effectively adjust the corporation's tax liability.

- Payment and Refund Instructions: Specific instructions are provided for calculating additional taxes due or refunds owed, including interest and additional charges in cases of late filing or payment.

- Authorizations and Preparer Information: The form allows the corporation to authorize the Department of Finance to discuss the return with the preparer, which facilitates more efficient resolution of issues that may arise during processing.

Understanding these key points ensures that corporations can effectively navigate the complexities of reporting tax base changes in New York City. Compliance with the filing requirements, along with accurate completion of the NYC 3360 form, safeguards corporations against potential penalties and optimizes tax outcomes.

Common PDF Documents

Construction Rules and Regulations - A comprehensive plan requiring the listing of construction devices and noise barriers to be used on-site.

Nycers Pension - Instructions for nominating an estate as a beneficiary highlight the exclusion of naming any other beneficiaries on the form.

Form It-203-b - Questions targeting managerial and consulting roles, particularly those intersecting with city agencies, in VENDEX forms, spotlight potential conflicts of interest that could affect contract integrity.