Free Nyc 204Ez Form in PDF

Filing taxes can often be a complex and daunting process, especially for partnerships and limited liability companies (LLCs) in New York City. Enter the NYC 204EZ form, a document designed to streamline the unincorporated business tax return for certain partnerships. The NYC Department of Finance introduced this form specifically for partnerships, including LLCs treated as partnerships for federal income tax purposes, which are required to file an Unincorporated Business Tax Return but have no tax liability. It's applicable for those whose unincorporated business gross income exceeds $95,000 for the tax year and serves as an essential tool for businesses aiming to disclaim any liability for tax by engaging solely in activities exempt from this tax. However, it's not a one-size-fits-all solution. The 204EZ form sets clear exclusions, such as businesses with NYC modifications, those allocating income within and outside NYC differently, or claiming certain exemptions and credits, pointing them toward the more detailed NYC-204 form. Requirements for completing the form are quite specific, demanding details from business inception to any cessation of operations, alongside deductions for active partners’ services, and even touching on unique situations like claiming 9/11/01-related federal tax benefits. This particular form exemplifies the city's efforts to balance between tax accountability and the administrative burden on businesses, providing a simplified reporting tool while ensuring compliance with local tax laws.

Nyc 204Ez Sample

*60911291*

TM |

|

UNINCORPORATED BUSINESS TAX RETURN 2012 |

|||

NEWYORK CITYDEPARTMENT OF FINANCE |

|

|

|

|

|

|

FOR PARTNERSHIPS (INCLUDING LIMITED LIABILITY COMPANIES) |

|

|

||

|

|||||

FINANCE |

|

|

|

|

|

|

For CALENDAR YEAR 2012 or FISCAL YEAR beginning _________________2012, and ending _________________ , ______ |

||||

Entity Type: ● ■general partnership |

● ■registered limited liability partnership |

● ■ limited partnership |

● ■limited liability company |

|

● ■ Amended return |

● ■ Final return - Check this box if you have ceased operations. |

|

||

●■ Check box if you are engaged in an exempt unincorporated business activity ● ■ Check box if you claim any

Date business |

- |

- |

Date business ended |

- |

- |

|

began in NYC: |

in NYC(if applicable): |

|||||

|

|

|

|

|||

|

|

|||||

IF BUSINESS TERMINATED DURING THE YEAR, ATTACH A STATEMENT SHOWING THE DISPOSITION OF BUSINESS PROPERTY

Name

In Care Of

Address (number and street)

City and State |

|

Zip Code |

|

|

|

Business Telephone Number |

Nature of Business |

|

|

|

|

TAXPAYER’S EMAIL ADDRESS

EMPLOYER IDENTIFICATION NUMBER

BUSINESS CODE NUMBER AS PER FEDERAL RETURN

This form is for certain partnerships, including limited liability companies treated as partnerships for federal income tax purposes, who are required to file an Unincorporated Business Tax Return but have no tax liability. For taxable years beginning on or after January 1, 2009, a partnership engaged in an unincorpo- rated business is required to file an Unincorporated Business Tax return if its unincorporated business gross income is more than $95,000. This form may also be used by a partnership that is not required to file but wishes to disclaim any liability for tax because it is engaged solely in activities exempt from the tax.

You may not use this form if:

◆You have NYC modifications other than the addback of income and Unincorporated Business Taxes on Schedule B, line 13 of Form

◆You allocate total business income within and without NYC. (If you allocate 100% of your business income to NYC, you may use this form.)

◆

◆You claim a partial exemption for investment activities. (See instructions to Form

◆You have any investment income or loss (See instructions for

◆You claim any deduction for a net operating loss. (See Form

◆Your unincorporated business gross income less the allowance for active partners' services is more than $90,000. (See Form

1. AmountfromAnalysisofNetIncome(Loss)fromfederalForm1065,ScheduleK,line1 |

● 1. |

2.Otherincomeandexpensesnotincludedonline1thatarerequiredtobereported

separatelytopartners(attachscheduleandseeinstructions) |

● 2. |

3.IncometaxesandUnincorporatedBusinessTaxdeductedonfederalForm1065

(attachlistandseeinstructions) |

● 3. |

4. Total Income (add lines 1 through 3) |

● 4. |

5.Amountincludedinline4representingnetincomeorlossfromactivitiesexemptfromthetax(seeinstr.) ● 5.

6. |

Subtractanynetincomeonline5from,oraddanynetlossonline5to,line4amount |

● 6. |

|

7. |

Allowanceforactivepartners'services(seeinstructions)Numberofactivepartners: ● # |

● 7. |

|

8. |

Line6minusline7 |

● 8. |

|

9. |

EnterthenumberofmonthsinbusinessinNYCduringthetaxyear |

● 9. |

|

10. |

Enterthemaximumtotalallowedincomefromtableonpage2basedonthenumberofmonths |

|

|

|

online9. If the amount on line 8 exceeds the amount on line 10 by more than $100 you |

|

|

|

|

|

00 |

|

cannot use this form; - you must file on Form |

● 10. |

|

11.EnterpaymentofestimatedUnincorporatedBusinessTaxincludingcarryovercreditfrom

|

|

|

|

● 11. |

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||

12. |

.Amountofline11toberefunded - ■ Direct deposit - fill out line 12a OR ■ Paper check |

............... |

● 12. |

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||

12a. |

Routing |

|

|

|

|

|

|

|

|

|

Account |

|

|

|

|

ACCOUNT TYPE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Checking ■ |

Savings ■ ● |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

Number |

|

|

|

|

|

|

|

|

|

Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

13. Amount of line 11 to be credited to 2013 estimated tax on form |

|

● 13. |

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||

14. |

NYC rent deducted on Federal return |

|

● 14. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CERTIFICATION |

|

Iherebycertifythatthisreturn,includinganyaccompanyingrider,is,tothebestofmyknowledgeandbelief,true,correctandcomplete. |

|

|

Firm'sEmailAddress: |

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||

|

I authorize the Dept. of Finance to discuss this return with the preparer listed below. (see instructions) |

YES ■ |

|

●_____________________________________________ |

|

||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

SIGN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||

|

|

HERE: |

|

|

|

Signature of partner: |

|

|

|

|

|

|

|

Title |

Date |

|

|

|

|

|

|

● Preparer'sSocialSecurityNumberorPTIN |

|

||||||||||||||||||||||||||||||||

|

|

PREPARER'S |

|

Preparer's |

|

|

|

|

|

|

Preparer's |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

USE ONLY: |

|

|

signature: |

|

|

|

|

|

|

printed name: |

Date |

|

|

|

|

|

|

|

● Firm'sEmployerIdentificationNumber |

|

|||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Check the box |

|

■ |

|

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

if |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

▲ Firm's name |

|

|

|

|

▲ Address |

|

▲ Zip Code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

60911291 |

|

|

|

YOU MUST ATTACH A COPY OF FEDERAL FORM 1065, INCLUDING THE INDIVIDUAL |

|

||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

COMPLETE THE ADDITIONAL INFORMATION SECTION ON PAGE 2. SEE OVER FOR MAILING INSTRUCTIONS. |

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||

Form |

|

|

|

|

|

|

Page 2 |

|||

|

|

|

|

|

|

|

|

|

|

|

INSTRUCTIONS |

|

|

|

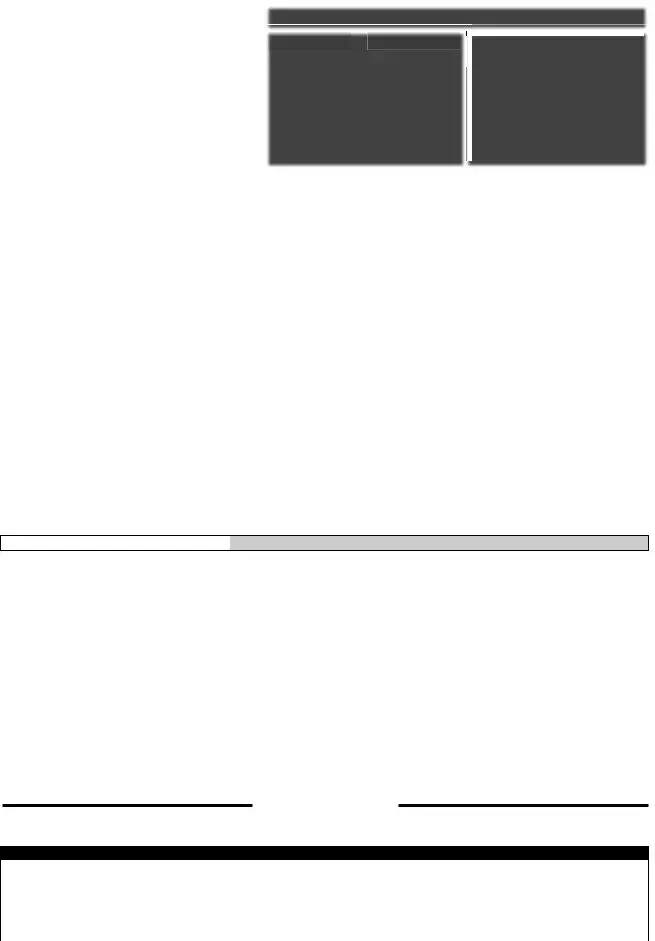

TABLE OF MAXIMUM ALLOWED INCOME FROM BUSINESS |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

NUMBER OF MONTHS |

|

MAXIMUM TOTAL |

|

|

Iftotalincomefrombusiness |

||||

|

IN BUSINESS |

|

INCOME FROM BUSINESS |

|

|

|||||

ofthefollowingbenefitsonyourfederalreturn:(i)bonusdepreciationoradeduc- |

|

1 |

$85,416 |

|

|

|||||

|

|

|

after deduction for active |

|||||||

tion under IRC §179 for property in the NY Liberty Zone or Resurgence Zone, |

|

2 |

$85,833 |

|

|

|||||

|

3 |

$86,250 |

|

|

partnersʼ services is more |

|||||

whether or not you file form |

|

|

|

|||||||

|

4 |

$86,667 |

|

|

||||||

converted due to the attacks on the World Trade Center. Attach Federal forms |

|

|

|

than$90,000,youmustuse |

||||||

|

5 |

$87,083 |

|

|

||||||

4562, 4684 and 4797 to this return. See instructions for Form NYC 204, Sch. |

|

6 |

$87,500 |

|

|

Form |

||||

B, lines 14d, 19 and 20. |

|

7 |

$87,917 |

|

|

|||||

|

|

|

|

|

||||||

|

|

|

|

8 |

$88,333 |

|

|

|

|

|

Line 2. Enter the net amount of the partners' distributive shares of income |

|

9 |

$88,750 |

|

|

FIFTEEN OR MORE CALENDAR |

||||

and deduction items not included in line 1 but required to be reported |

|

10 |

$89,167 |

|

|

|||||

|

11 |

$89,583 |

|

|

|

|

||||

separately on federal Form 1065. Attach a schedule. |

|

|

|

DAYSCONSTITUTESONEMONTH |

||||||

|

12 |

$90,000 |

|

|

||||||

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Line 3. Enter the amount of income and unincorporated business taxes

imposed by New York City, New York State or any other taxing jurisdiction that was deducted in computing the amounts on lines 1 or 2. Attach a schedule.

Line 5. Enter on this line the amount included in line 4 that represents the net income or net loss from an activity that is not an unincorporated business carried on by the taxpayer wholly or partly in the City. See Instructions for Form

(i)exclude the income or loss of an entity, other than a dealer as defined in Ad. Code

(ii)for taxable years beginning on or after July 1, 1994, exclude the income, gain or loss from real property held to produce rental income or from the disposition of such property by an entity, other than a dealer. Also exclude income or loss from a business conducted at the property solely for the benefit of tenants at the property that is not open to the public, and eligible income from parking services rendered to tenants. SeeAd. Code

(iii)exclude the income or loss from any separate and distinct activity carried on wholly outside of New York City.

(iv)for tax years beginning on or after August 1, 2002, exclude all of the federal taxable income of partnerships that receive 80% or more of their gross receipts from charges for the provision of mobile telecommunications services to customers and exclude a partner's distributive share of income, gains, losses and deductions from any partnership subject to tax underAd. Code Title II, Ch. II as a “utility” as defined inAd. Code section

Line 7. Adeduction may be claimed for reasonable compensation for personal services rendered by the partners. The allowable deduction is the lower of (i) 20% of line 6 (if greater than zero) or (ii) $10,000 for each active partner.

PreparerAuthorization: If you want to allow the Department of Finance to discuss your return with the paid preparer who signed it, you must check the "yes" box in the signature area of the return. This authorization applies only to the individual whose signature appears in the "Preparer's Use Only" section of your return. It does not apply to the firm, if any, shown in that section. By checking the "Yes" box, you are authorizing the Department of Finance to call the preparer to answer any questions that may arise during the processing of your return. Also, you are authorizing the preparer to:

◆Give the Department any information missing from your return,

◆Call the Department for information about the processing of your return or the status of your refund or payment(s), and

◆Respond to certain notices that you have shared with the preparer about math errors, offsets, and return preparation. The notices will not be sent to the preparer.

You are not authorizing the preparer to receive any refund check, bind you to anything (including any additional tax liability), or otherwise represent you before the Department. The authorization cannot be revoked, however, the authorization will automatically expire no later than the due date (without regard to any extensions) for filing next year's return. Failure to check the box will be deemed a denial of authority.

ADDITIONAL REQUIRED INFORMATION

The following information must be entered for this return to be complete.

The following information must be entered for this return to be complete.

*60921291*

60921291

1. |

Did you file a NYC Partnership Return in 2010? |

■ YES |

■ NO |

2. |

Did you file a NYC Partnership Return in 2011? |

■ YES |

■ NO |

3.HastheInternalRevenueServiceortheNewYorkStateDepartmentofTaxationandFinanceincreased

ordecreasedanytaxableincome(loss)reportedinanytaxperiod,orareyoucurrentlybeingaudited? |

■ YES |

■ NO |

||

If"yes,"bywhom? |

InternalRevenueService ■ |

NewYorkStateDepartmentofTaxationandFinance ■ |

|

|

State periods: _________________________________________________________ and answer (4). |

|

|

||

4. |

■ YES |

■ NO |

||

5.At any time during the taxable year, did the partnership have an interest in real property

|

located in NYC or in an entity owning such real property? |

■ YES |

■ NO |

6. |

If "YES"to 5: |

|

|

|

a) Was there a partial or complete liquidation of the partnership? |

■ YES |

■ NO |

|

b) Was 50% or more of the partnership interests transferred in the last 3 years or according to a plan? |

■ YES |

■ NO |

7. |

If "YES" to 6a or 6b, was a Real Property Transfer Tax Return filed? |

■ YES |

■ NO |

8.If "NO" to 7, explain: (attach additional sheet if necessary) ___________________________________________________

9. |

Is this taxpayer subject to the Commercial Rent Tax? |

● |

■ YES |

■ NO |

10. |

If "YES", were all required Commercial Rent Tax Returns filed? |

● ■ YES |

■ NO |

|

PRIVACY ACT NOTIFICATION

The Federal PrivacyAct of 1974, as amended, requires agencies requesting Social Security Numbers to inform individuals from whom they seek this information as to whether compliance with the request is voluntary or mandatory, why the request is being made and how the information will be used. The disclosure of Social Security Numbers for taxpayers is mandatory and is required by section

MAILING INSTRUCTIONS

|

The due date for calendar year 2012 is on or beforeApril 15, 2013. |

|

|

RETURNSCLAIMINGREFUNDS |

|

|

ALL OTHER RETURNS |

|

|

Forfiscalyearsbeginningin2012filebythe15thdayofthefourth |

|

|

NYC DEPT. OF FINANCE |

|

|

NYC DEPT. OF FINANCE |

|

|

month following the close of the fiscal year. |

|

|

UNINCORPORATEDBUSINESSTAX |

|

|

UNINCORPORATEDBUSINESSTAX |

|

|

To receive proper credit, you must enter your correct Employer |

|

|

P.O. BOX 5050 |

|

|

P.O. BOX 5060 |

|

|

Identification Number on your tax return. |

|

|

KINGSTON, NY |

|

|

KINGSTON, NY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Download forms and instructions online at nyc.gov/finance or call 311.

If calling from outside of the five NYC boroughs, please call

File Overview

| Fact Name | Detail |

|---|---|

| Form Purpose | Unincorporated Business Tax Return for Partnerships, including LLCs treated as partnerships, with no tax liability. |

| Gross Income Requirement | Required filing for partnerships engaged in business with gross income over $95,000. |

| Eligibility for Use | Cannot be used by entities with specific NYC modifications, investment activities exemptions, or claiming certain credits. |

| Adjustments and Exemptions | Includes adjustments for net income from exempt activities and allowances for active partners' services. |

| Additional Documentation | A copy of Federal Form 1065, including individual K-1s, must be attached. |

| Preparer Authorization | Option to authorize the Department of Finance to discuss the return with the preparer. |

| Governing Laws | Governed by New York City Administrative Code (Ad. Code) for tax administration and related provisions. |

| Mailing Instructions | Specific instructions provided for mailing based on whether a refund is claimed or not. |

Nyc 204Ez: Usage Guidelines

The NYC 204EZ form is vital for certain partnerships and limited liability companies operating in New York City. Designed for entities with specific criteria that relieve them from tax liability, it's a simpler version tailored for businesses that fall under the threshold requiring more comprehensive filing. Ensuring its correct completion is crucial for compliance and for making any claims pertinent to business operations for the tax year.

- Identify the entity type by checking the appropriate box (general partnership, limited liability company, etc.).

- If applicable, check the "Amended return" or "Final return" box, especially if the business has ceased operations.

- Fill in the date the business began and ended in NYC, using the MM-DD-YYYY format.

- Complete the contact information section with the business name, address, telephone number, taxpayer’s email address, employer identification number, and the business code number as per the federal return.

- Enter the amount from Analysis of Net Income (Loss) from federal Form 1065, Schedule K, line 1 in the corresponding field.

- Report other income and expenses not included on line 1 that are required to be reported separately to partners (attach schedule and see instructions) on line 2.

- On line 3, input the income taxes and Unincorporated Business Tax deducted on the federal Form 1065 (attach list as instructed).

- Add lines 1 through 3 to find the Total Income, and enter this on line 4.

- Line 5 requires the amount included in line 4 representing net income or loss from activities exempt from the tax. Consult the instructions for details.

- To calculate line 6, subtract any net income or add any net loss from line 5 to the line 4 amount.

- Enter the allowance for active partners' services on line 7, including the number of active partners.

- Determine the income after subtracting the allowance for active partners' services (line 6 minus line 7) and record on line 8.

- State the number of months in business in NYC during the tax year on line 9.

- Refer to the table on page 2 to enter the maximum total allowed income based on the number of months in business (line 9), and enter this on line 10.

- Indicate the payment of estimated Unincorporated Business Tax, including carryover credit from the previous year and payment with extension, NYC-EXT, on line 11. This is your overpayment.

- Choose between direct deposit or paper check for the refund method and fill out line 12 accordingly. If direct deposit is chosen, provide the routing and account numbers and specify the account type.

- Specify the amount of line 11 to be credited to 2013 estimated tax on form NYC-5UB on line 13.

- Input the NYC rent deducted on the federal return on line 14.

- Sign and date the certification to affirm the return is true, correct, and complete. The preparer, if applicable, must also sign and provide their contact information.

Ensure all required schedules and attachments, including a copy of the federal Form 1065 and individual K-1s, are included with the return. Additionally, complete the additional information section on page 2 to fully comply with filing requirements. Upon completion, review the entire form for accuracy before submitting it to the appropriate address as detailed in the mailing instructions, ensuring it is sent by the due date for the filing period to avoid penalties.

FAQ

-

What is the purpose of Form NYC-204EZ?

Form NYC-204EZ is designed for certain partnerships, including limited liability companies (LLCs) treated as partnerships for federal income tax purposes, that operate in New York City. It is used to file an Unincorporated Business Tax Return for those entities that have no tax liability. This form is applicable to partnerships with an unincorporated business gross income over $95,000 or those wishing to disclaim any liability for tax due to engagement solely in activities exempt from the tax.

-

Who should not use Form NYC-204EZ?

This form is not suitable for all entities. You should not use Form NYC-204EZ if:

- You have NYC modifications other than the addback of income and Unincorporated Business Taxes.

- Your business allocates total income both within and outside of NYC.

- You claim a credit for Unincorporated Business Tax paid or other tax credits.

- You claim a partial exemption for investment activities or have any investment income/loss.

- Your business gross income less the allowance for active partners' services exceeds $90,000.

-

Can Form NYC-204EZ be used to claim refunds?

Yes, partnerships can use Form NYC-204EZ to claim refunds. Specifically, line 11 of the form allows the entity to report payments of estimated Unincorporated Business Tax, carryover credits from the previous year, and payments with extensions. The amount reported is considered an overpayment and can be refunded or credited towards the next year’s estimated tax.

-

What documentation is required alongside Form NYC-204EZ?

When filing Form NYC-204EZ, partnerships must attach a copy of their Federal Form 1065, including the individual K-1s, to this return. Moreover, if the business terminated during the year, a statement showing the disposition of business property is also required. The form also requests additional information related to past filings and any changes in taxable income.

-

How should Form NYC-204EZ be submitted?

The completed Form NYC-204EZ, along with any required attachments, should be mailed to the NYC Department of Finance. The mailing address differs depending on whether the return is claiming a refund or not. For refunds, the address is P.O. Box 5050, Kingston, NY 12402-5050. All other returns should be sent to P.O. Box 5060, Kingston, NY 12402-5060. Ensure the Employer Identification Number is correctly entered on the return to avoid processing delays.

Common mistakes

Filling out the NYC 204EZ form, a document required for certain partnerships, including limited liability companies treated as partnerships for federal income tax purposes, can be tricky. There are several common mistakes that filers should be vigilant to avoid to ensure that their Unincorporated Business Tax Return is processed smoothly by the New York City Department of Finance.

The first mistake involves the misrepresentation of business income or improperly claiming exemptions. Many filers do not realize the importance of accurately reporting their unincorporated business gross income, which must be more than $95,000 for the tax year to necessitate filing this form. Additionally, incorrectly claiming engagement in activities exempt from tax can lead to complications. It's crucial to thoroughly review the eligibility criteria for exemptions and ensure that all income is accurately presented.

Another common error is related to the allocation of business income. The form strictly requires that filers allocate 100% of their business income to NYC to use this streamlined form. Misallocation or the failure to allocate business income entirely to New York City can result in the need to file a more complex form (NYC-204) and potentially delays in processing.

- Incorrectly using the form for entities with modifications or investment activities not allowed: The NYC 204EZ form cannot be used by entities that have NYC modifications (other than the addback of income and Unincorporated Business Taxes on Schedule B, line 13 of Form NYC-204), allocate business income within and without NYC, claim specific credits or partial exemptions, have investment income or losses, or claim deductions for a net operating loss. Failure to comply with these restrictions often leads to the selection of an incorrect form for filing, which can delay processing times and impact legal compliance.

- Failing to attach necessary documentation: A critical and often overlooked requirement is the attachment of a copy of federal Form 1065, including the individual K-1s. Neglecting to attach these documents can result in processing delays or even the rejection of the return since these attachments provide essential information that complements the data entered in the NYC 204EZ form.

Moreover, filers sometimes inaccurately calculate the "Total Income" or incorrectly report adjustments. It's essential to add lines 1 through 3 correctly to determine the "Total Income" and understand what constitutes other income and expenses that need to be reported separately. Additionally, inaccurately processed deductions for income taxes, Unincorporated Business Tax, or the allowance for active partners' services can lead to significant discrepancies in the reported figures, affecting the overall tax liability.

- Inaccurate data entry, especially regarding dates and financial amounts, can delay the processing of the return.

- Choosing the wrong entity type or incorrectly marking the form as an "Amended return" or "Final return" without understanding the qualifications for each choice can lead to processing issues.

- Not understanding the specifics around what constitutes investment activities or exemptions under the NYC tax code can erroneously influence the decision to use this form.

- Overlooking the additional required information section, which asks about previous NYC Partnership Returns and potential audits or changes in taxable income by the IRS or the New York State Department of Taxation and Finance, is a frequent oversight that can have implications for the return's accuracy and completeness.

Avoiding these common mistakes requires careful attention to the detailed instructions provided with the form and, when necessary, consulting with a tax professional familiar with New York City's Unincorporated Business Tax requirements. Ensuring accuracy and completeness when filling out the NYC 204EZ form not only facilitates smoother processing but also aligns with compliance obligations, potentially avoiding penalties and interest due to errors or omissions.

Documents used along the form

When preparing to file the NYC 204EZ form for Unincorporated Business Tax Return for partnerships, including limited liability companies treated as partnerships for federal income tax purposes, it's crucial to gather all necessary documentation. This form is designed for entities that have no tax liability for the year but still meet the requirements for filing. Understanding the accompanying forms and documents that might be needed alongside the NYC 204EZ can streamline the filing process, ensuring accuracy and compliance. Here is a breakdown of other essential forms and documents that are often used with the NYC 204EZ form:

- Federal Form 1065: This is the U.S. Return of Partnership Income form. It is required to provide a detailed report of the partnership's financial activities for the year. Attached schedules and the individual K-1s for each partner must be included with the NYC 204EZ.

- Schedule K-1 (Form 1065): This schedule provides details on each partner's share of the partnership's income, deductions, credits, etc. It's necessary for each partner to report their portion of the partnership's income on their individual tax returns.

- NYC-115: Tax Report of Change in Taxable Income Made by the IRS or New York State. This form is used if there have been adjustments to your taxable income by the IRS or the New York State Department of Taxation and Finance.

- NYC-EXT: Application for Automatic Extension of Time to File Business Income Tax Returns. If you need more time to file the NYC 204EZ form, this document helps secure an extension.

- NYC-5UB: Declaration of Estimated Unincorporated Business Tax. This is for businesses required to make estimated tax payments for the next tax year.

- Commercial Rent Tax Returns: If your partnership is subject to the Commercial Rent Tax in NYC, these returns must be filed accordingly and may accompany your NYC 204EZ if relevant.

- Real Property Transfer Tax Return: Required if the partnership has had an interest in real property located in NYC or an entity owning such real property which has undergone substantial changes such as a partial or complete liquidation, or significant transfer of partnership interests.

Each document plays a vital role in accurately reporting the financial activities of a partnership and ensuring compliance with tax obligations in New York City. It's essential to review each form's requirements and instructions to ensure that all necessary information is reported correctly. Where applicable, additional documents may be required based on the specific circumstances of the business or its partners. Timely and accurate filing of the NYC 204EZ and associated documents can help avoid penalties and ensure the partnership's good standing.

Similar forms

The NYC 204EZ form is similar to the Federal Form 1065 - U.S. Return of Partnership Income. Both forms are designed for partnerships and limited liability companies treated as partnerships to report their income, gains, losses, deductions, and credits to the IRS and the NYC Department of Finance respectively. They require detailed financial information about the business's operations over the fiscal year, including income and deductions, and they mandate attachments such as Schedules K-1 for each partner, showing their share of the partnership's income and losses.

Another document resembling the NYC 204EZ form is the Schedule K-1 (Form 1065) - Partner's Share of Income, Deductions, Credits, etc. This form complements the Federal Form 1065 by providing detailed information about each partner's share of the partnership's financial results. Similar to the requirement in the NYC 204EZ form for including the individual K-1s, Schedule K-1 ensures each partner reports their share of the income or losses on their own personal tax returns, aligning with the pass-through taxation principle of partnerships.

The NYC 1127 - Return for Nonresident Employees of the City of New York is akin to the NYC 204EZ form in its purpose of collecting taxes specific to New York City. While the NYC 204EZ form collects unincorporated business tax from partnerships, the NYC 1127 form is geared towards nonresident employees of the city, ensuring they pay their fair share of taxes on income earned from NYC sources. Both forms underscore the city's unique tax requirements, distinct from federal or state tax obligations.

The Form NYC-202 - Unincorporated Business Tax Return for Individuals is similar to the NYC 204EZ form as both are integral to reporting and paying the Unincorporated Business Tax (UBT) to New York City. The major difference lies in their target filers; the NYC-202 is intended for individual business owners, while the NYC-204EZ is for partnerships. Nonetheless, they share the common purpose of calculating the tax due on income generated from unincorporated businesses within NYC.

Form NYC-3L - General Corporation Tax Return, although aimed at corporations, shares similarities with the NYC 204EZ in its structure and intent of taxing business income within New York City. Both forms aim to ensure businesses contribute to the city's revenue based on their operating income, with specific adjustments and tax calculations suited to the entity's structure, whether corporate or partnership.

The Form IT-204-LL - Partnership, Limited Liability Company, and Limited Liability Partnership Filing Fee Payment Form for New York State also parallels the NYC 204EZ form. Despite the IT-204-LL form being a state filing requirement and focusing on the payment of a filing fee rather than an income-based tax, it targets the same types of entities—partnerships and LLCs. Both forms are necessary for partnerships and LLCs operating in New York, highlighting the multifaceted tax obligations of these businesses at both the city and state levels.

Similar to the NYC 204EZ form is the Form NYC-EXT - Application for Automatic Extension of Time to File Business Income Tax Returns. While the NYC-204EZ is for reporting annual tax information, the NYC-EXT is used when a partnership needs more time to prepare and submit its tax documentation. Both documents are vital for compliance with the city's tax filing requirements, ensuring businesses have the option to extend their filing deadline if necessary.

The Commercial Rent Tax Return (CRT) shares a common focus with the NYC 204EZ form on businesses operating in New York City. While the CRT specifically taxes commercial tenants based on their rent payments in certain districts of Manhattan, the NYC 204EZ levies a tax on the overall income of unincorporated businesses. Both forms play roles in the broader landscape of NYC-specific business taxation, emphasizing the city's unique tax structures for different aspects of business operations.

The Form NYC-114.7 - Claim for Credit for Unincorporated Business Tax Paid parallels the NYC 204EZ by involving the Unincorporated Business Tax, but from the angle of tax credits. The NYC-114.7 allows for a credit against the General Corporation Tax for UBT paid, indicating the interconnectedness of different tax obligations and relief options within NYC's tax system. This form highlights the possibility for businesses to mitigate their tax liabilities through credits, a complexity also inherent in navigating the eligibility and calculations related to the NYC 204EZ form.

Lastly, the Form NYC-RPT - Real Property Transfer Tax Return, although focusing on the transfer of real property in New York City, shares the concept of city-specific taxation with the NYC 204EZ form. Both documents underscore the many layers of tax responsibilities businesses and individuals face within NYC, each targeting different transactions or income types but collectively contributing to the city’s revenue from its diverse economic activities.

Dos and Don'ts

Filling out the NYC 204EZ form, intended for certain partnerships and limited liability companies (LLCs) reporting Unincorporated Business Tax in New York City, calls for meticulous attention to detail to ensure accuracy and compliance. Here are key dos and don'ts to consider:

- Do verify if your entity is eligible to use the NYC 204EZ form. This form is not suitable for all types of partnerships or LLCs, especially those with specific deductions, credits, or income allocations.

- Don't use this form if your business has NYC modifications other than the addback of income and Unincorporated Business Taxes indicated on Schedule B, line 13 of Form NYC-204, or if you allocate business income within and without NYC.

- Do check the appropriate boxes at the top of the form to indicate the entity type, any claims for 9/11/01-related federal tax benefits, and whether this is an amended or final return.

- Don't guess or estimate dates when filling out the sections on when the business began or ended in NYC. Accurate dates are crucial for proper assessment.

- Do attach a copy of the Federal Form 1065, including the individual K-1s, as required by the form's instructions. This is essential for cross-reference and verification purposes.

- Don't skip the preparer’s authorization section if you would like the Department of Finance to discuss your return with the preparer. Check the appropriate box to grant authorization.

- Do ensure that all income and deductions are correctly reported and that any exempt income or expenses are properly identified as such.

- Don't forget to complete the additional information section on page 2 of the form. This information is crucial for a complete and thorough return.

- Do review the mailing instructions carefully to ensure your return is sent to the correct address, depending on whether you are claiming a refund or not.

By adhering to these guidelines, partnerships and LLCs can more confidently navigate the process of completing and filing the NYC 204EZ form, thereby minimizing errors and ensuring compliance with New York City's Department of Finance requirements.

Misconceptions

There are some misunderstandings about who can use the NYC 204EZ form, what it is for, and under what circumstances it needs to be filed. Here, we're going to clear up five common misconceptions.

Only partnerships can use the NYC 204EZ form. While it's true that the form is designed for partnerships, including limited liability companies treated as partnerships for federal income tax purposes, it's not exclusive to them. Registered limited liability partnerships, limited partnerships, and general partnerships can also use this form, provided they meet the criteria set out in the instructions.

If your business made no income, you don't need to file the NYC 204EZ form. This is not entirely accurate. Even if your partnership had no taxable income or was engaged solely in activities exempt from the tax, you might still need to file the form to disclaim any tax liability. The requirement to file depends on your gross income being more than $95,000 or if you wish to report that you are engaged in exempt activities.

Any partnership with business activities in NYC can use form NYC 204EZ. This generalization misses important restrictions. Partnerships that allocate business income within and without NYC, have NYC modifications other than the addback of certain taxes, claim certain credits or exemptions, or have investment income or losses are not eligible to use this form. It’s limited to relatively straightforward partnership tax situations.

Filing the NYC 204EZ form is complicated and requires detailed financial reporting. Actually, this form is designed for simplicity compared to the longer NYC-204 form. It requires less detailed information because it is intended for partnerships with straightforward financial situations and no tax liability. If you meet the criteria for using form NYC 204EZ, it's a simpler way to fulfill your filing requirements.

The use of the NYC 204EZ form is optional if you meet the requirements. While technically true, choosing not to use the NYC 204EZ form when you qualify could mean unnecessarily completing the more complicated NYC-204 form. If your partnership’s unincorporated business gross income is more than $95,000 and you don’t meet any of the disqualifications, using the 204EZ form simplifies your filing process.

Understanding when and how to use the NYC 204EZ form can make your tax filing process more straightforward. If your partnership qualifies, it saves you time and effort by simplifying your tax return process. Always ensure you meet the eligibility requirements before opting to use this form.

Key takeaways

When filling out and using the NYC 204EZ form for partnerships, including limited liability companies (LLCs) treated as partnerships for federal income purposes, several key takeaways should be noted:

- The form is designated for partnerships that need to file an Unincorporated Business Tax Return but whose unincorporated business gross income exceeds $95,000, yet have no tax liability.

- If your partnership engages solely in activities exempt from tax, you can use this form to disclaim any liability for tax.

- Partnerships cannot use this form if they have NYC modifications other than the addback of income and Unincorporated Business Taxes, allocate business income both within and outside NYC, claim any tax credits, or partake in investment activities that lead to partial tax exemptions.

- The maximum allowed income from business activities in NYC is delineated in a table on the second page of the instructions, contingent upon the number of months the business operated in NYC during the tax year.

- Any refunds or credits toward estimated taxes for the next year are processed through this form, with options for direct deposit or paper check for refunds.

- Every business must attach a copy of the Federal Form 1065, including the individual K-1s, to ensure the return is adequately supported by federal tax information.

- It's mandatory to report any increases or decreases in taxable income as adjusted by the IRS or the New York State Department of Taxation and Finance, as well as the filing status of your NYC Partnership Returns for the two years preceding the current filing year.

- Every return necessitates disclosure of any interests in real property located in NYC or in an entity owning such real property during the taxable year, including relevant details on partnership liquidations or transfers, which could impact the filing.

Important Note: Privacy Act Notification explains the mandatory disclosure of Social Security Numbers and how they are used strictly for tax administration purposes, complying with section 11-102.1 of the Administrative Code of the City of New York.

Mailing instructions specify different addresses depending on whether the return is claiming refunds or filing for other purposes, stressing the importance of submitting returns to the correct department to ensure proper processing. Additionally, ensuring the correct Employer Identification Number is entered on the return is crucial for receiving proper credit.

Common PDF Documents

Nyc Lease Renewal Form Pdf - The affirmation section underscores the legal seriousness of the application, deterring frivolous or dishonest claims.

Sales Tax in New York - A final return and dissolution process are necessary for closing a business; the DTF-95 cannot be used for this purpose.