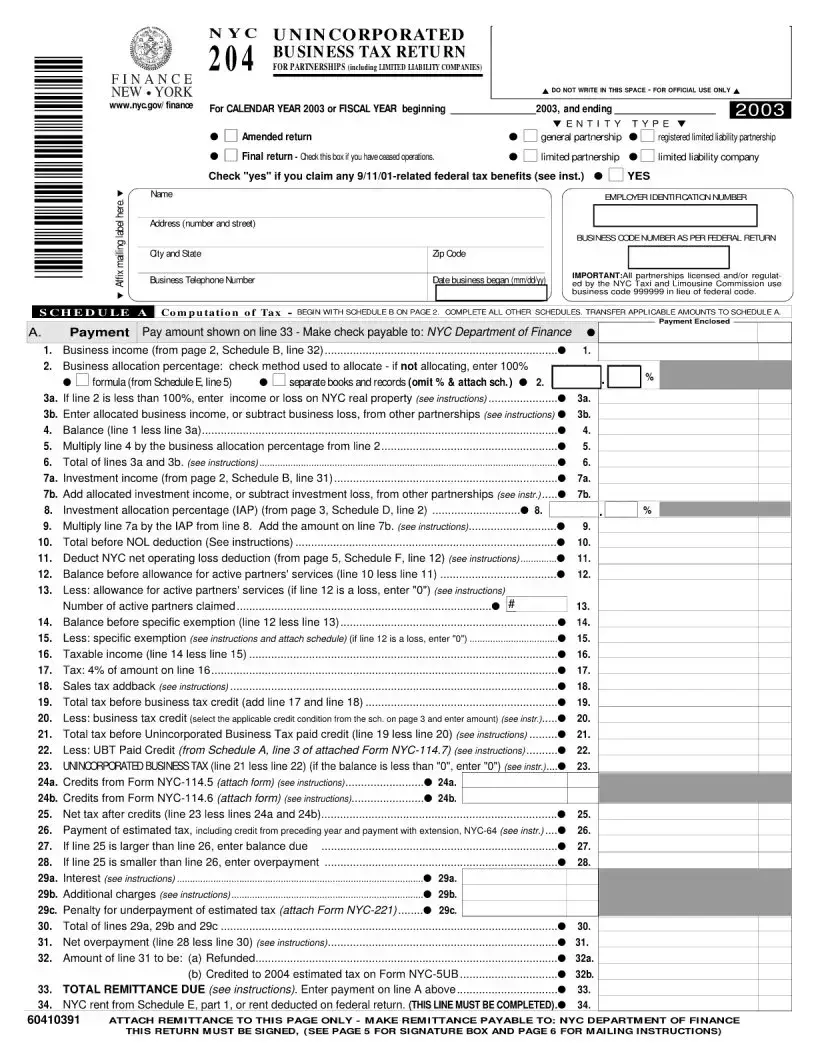

Free Nyc 204 Form in PDF

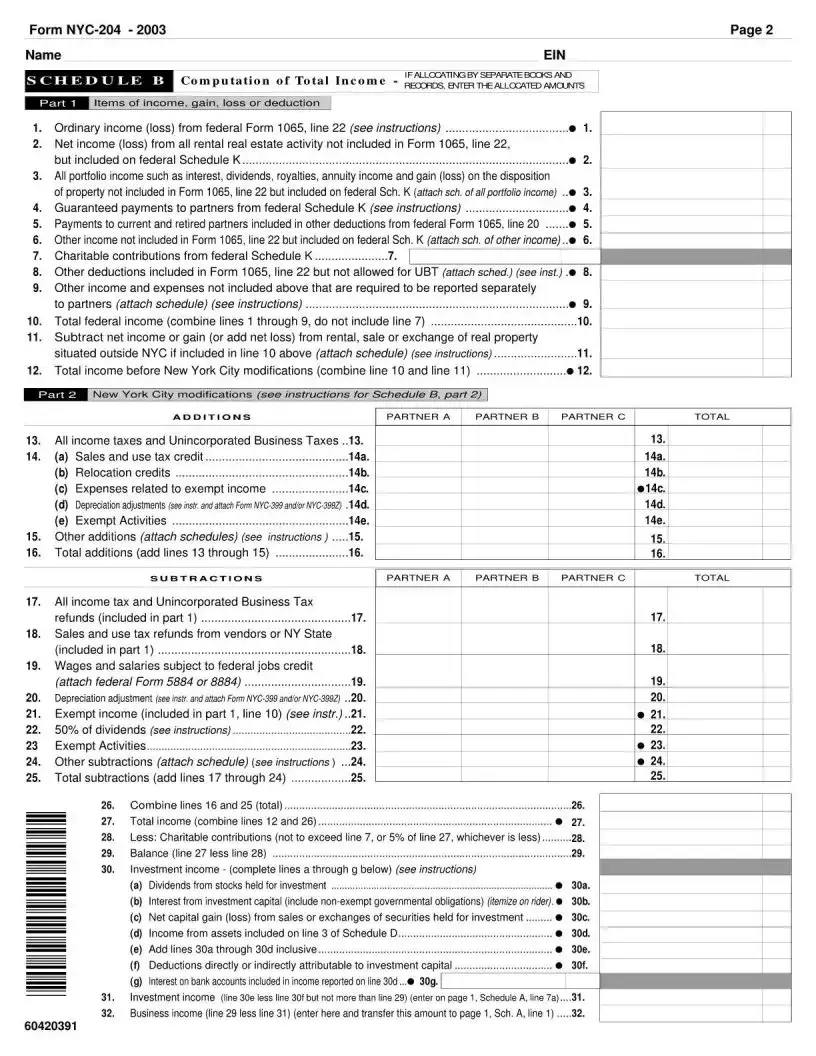

Understanding the intricacies of financial reporting and compliance requirements is crucial for businesses operating within New York City, where the NYC 204 form plays a pivotal role. Primarily, this document serves as an essential tool for unincorporated businesses, including but not limited to partnerships and joint ventures, ensuring that their earnings are accurately reported for tax purposes. It acts as an assertion of income allocation among the partners or members residing within the city, highlighting the city's concern for maintaining a fair tax structure. Additionally, the form underscores the city's broader goal of fiscal transparency and integrity, requiring detailed disclosure of income, deductions, and the apportionment of business income. By meticulously guiding entities through the process of reporting their distributed shares of income, the NYC 204 form not only aids in the smooth functioning of the local tax system but also significantly affects the financial management strategies of businesses. Its role in facilitating the accurate calculation of taxable income emphasizes the intricate balance between ensuring compliance and supporting the economic ecosystem of New York City.

Nyc 204 Sample

File Overview

| Fact Name | Description |

|---|---|

| Purpose | The NYC 204 form is designed for businesses to report their annual income and calculate related taxes in New York City. |

| Required Filers | All businesses operating within New York City limits are required to file this form if they meet certain criteria based on their taxable income and business structure. |

| Governing Law | This form is governed by the New York City Administrative Code, particularly related to business income taxes. |

| Submission Deadline | The form must be filed annually, typically on or before April 15th, following the end of the taxable year. |

Nyc 204: Usage Guidelines

After the NYC 204 form is filled out, it will provide essential information necessary for processing. This form is a critical document that requires attention to detail and accuracy. The steps listed below are designed to guide individuals through the process of completing the form correctly, ensuring all required information is clearly provided. Carefully following these instructions will facilitate a smoother processing experience.

- Start by entering the calendar year at the top of the form, which identifies the tax year the form is being filed for.

- In the section labeled "Name of Partnership," input the legal name of the partnership.

- Fill in the Partnership’s Employer Identification Number (EIN) in the designated space.

- Provide the principal business activity of the partnership in the space provided.

- Enter the business code number that corresponds with the principal business activity.

- Input the date the partnership was formed and the city, state, and country where it was established.

- Detail the partnership's business address, including the street name, number, city, state, and ZIP code.

- If the partnership has a different mailing address, enter this information in the designated area.

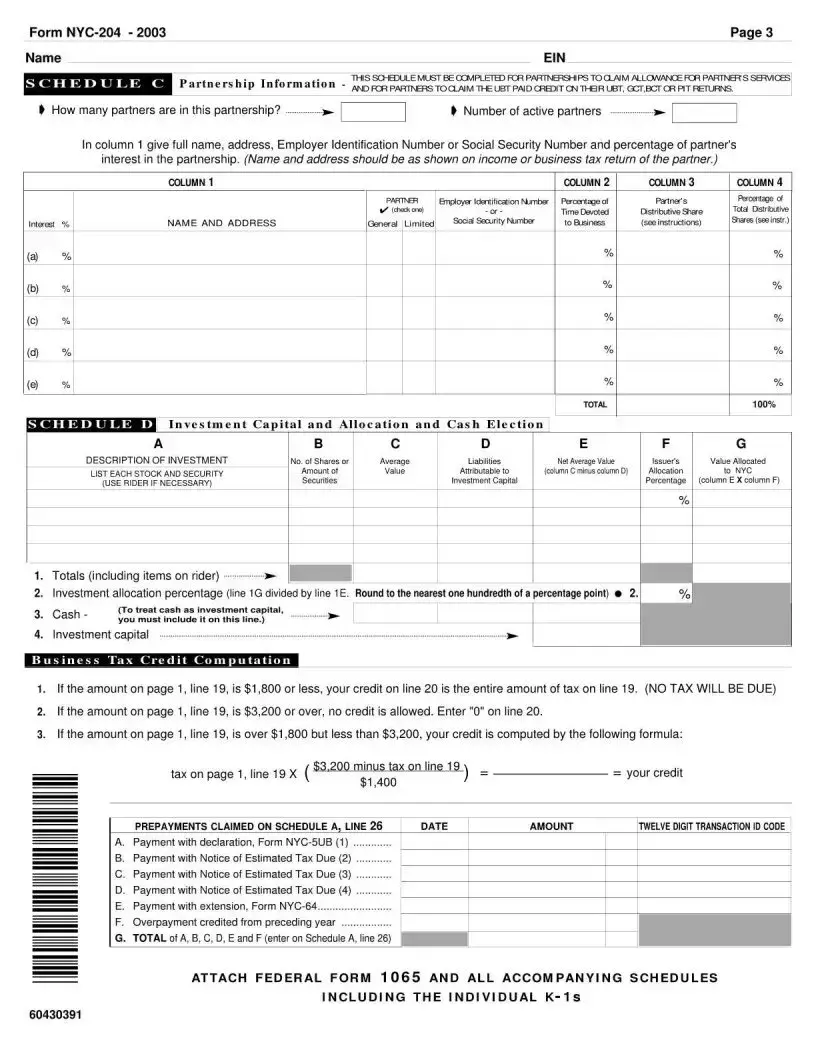

- List the names and Social Security Numbers or Individual Taxpayer Identification Numbers of all the partners in the partnership.

- Specify each partner's contribution to the partnership, whether in the form of cash, property, or services.

- Detail the profit and loss sharing percentages agreed upon by the partners.

- For each partner, indicate the percentage of ownership in the partnership.

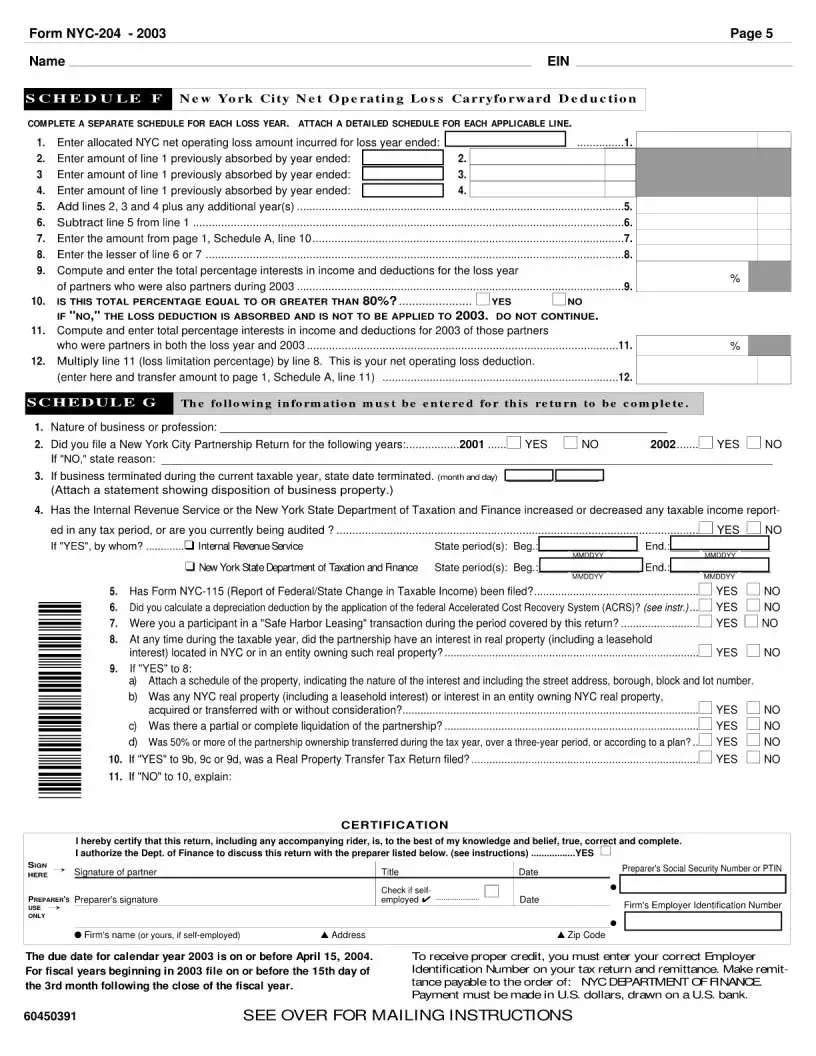

- Sign and date the form at the bottom, ensuring that a designated partner or authorized representative completes this section.

Once the NYC 204 form is filled out and reviewed for accuracy, it should be submitted following the instructions provided by the agency. It is essential to keep a copy of the completed form for your records. Timely submission of accurately filled forms facilitates compliance with regulations and contributes to the seamless continuity of the partnership’s operations.

FAQ

-

What is the NYC 204 form used for?

The NYC 204 form is primarily used by individuals, partnerships, or entities that own rental real estate properties in New York City. Its main purpose is to report income and expenses related to these properties. This form helps in calculating the net income that will be subject to taxation under local New York City laws.

-

Who is required to file the NYC 204 form?

Partnerships and individuals who own rental property in New York City and do not conduct their business as a corporation are required to file the NYC 204 form. This includes Limited Liability Companies (LLCs) that are treated as partnerships or disregarded entities for tax purposes.

-

When is the NYC 204 form due?

The due date for filing the NYC 204 form is on or before April 15th following the end of the tax year. If the due date falls on a weekend or holiday, the deadline is moved to the next business day. Extensions for filing may be granted, but specific conditions apply.

-

How can one file the NYC 204 form?

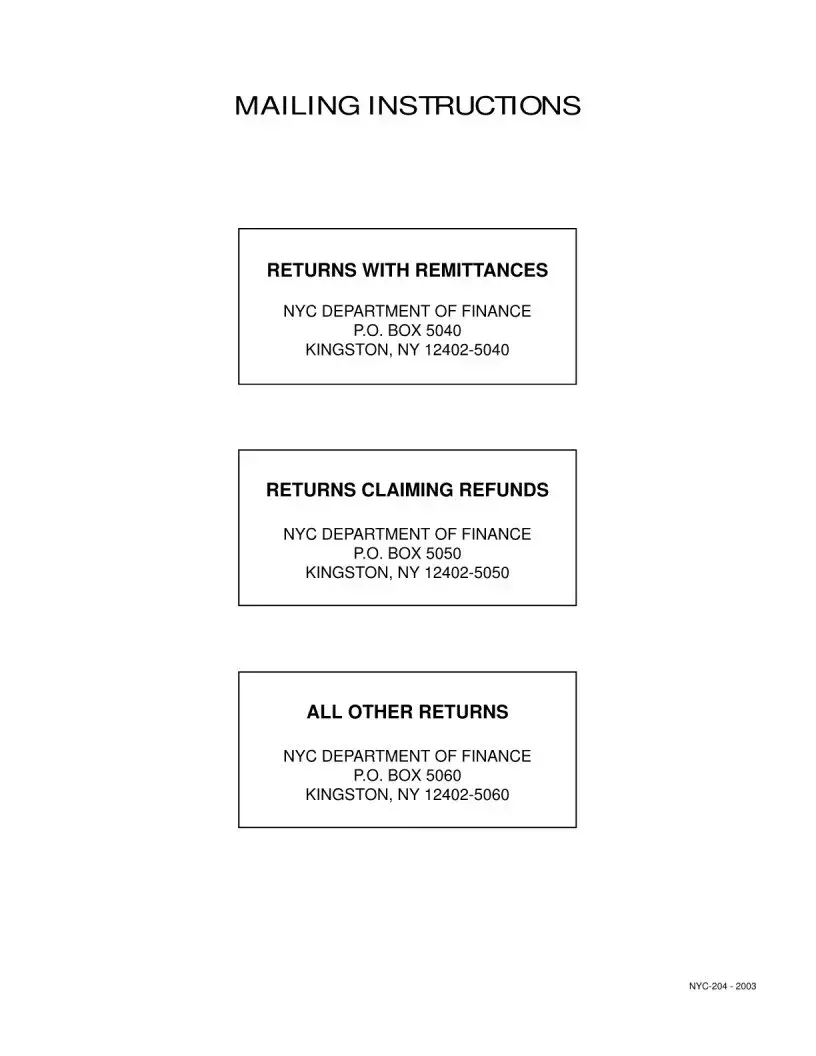

The NYC 204 form can be filed electronically through the New York City Department of Finance's website, or it can be submitted in paper form by mail. Electronic filing is encouraged for faster processing and convenience. Detailed instructions on how to file are available on the NYC Department of Finance website.

-

What information is required on the NYC 204 form?

Information needed for the NYC 204 form includes the taxpayer's name, address, and Social Security Number (or Employer Identification Number for entities). It also requires details about the rental property, including location, rental income received, and allowable deductible expenses incurred during the tax year.

-

Are there any penalties for late filing or non-filing of the NYC 204 form?

Yes, there are penalties for late filing or non-filing of the NYC 204 form. These can include monetary fines and interest charges on the unpaid tax. The specifics of the penalties depend on how late the form is filed and the amount of unpaid tax. It's important to file on time to avoid these penalties.

-

Can amendments be made to a filed NYC 204 form?

If a mistake is discovered on a filed NYC 204 form, amendments can be made. This involves filing an amended return with the corrected information. Instructions for amending a filed return are provided by the New York City Department of Finance. Timely correction may reduce potential penalties.

-

Is electronic filing available for all types of properties?

Electronic filing is available for most types of properties, but there might be exceptions depending on the specific circumstances or property types. It's best to consult the New York City Department of Finance's website or contact them directly to ensure electronic filing is an option for your property type.

-

Where can someone get help with filling out the NYC 204 form?

Assistance with filling out the NYC 204 form can be obtained through several channels. The New York City Department of Finance offers resources and guidelines on their website. Additionally, professional tax advisors, accountants, or attorneys who specialize in New York City property taxes can provide guidance and help ensure that the form is filled out correctly.

Common mistakes

Filling out the NYC 204 form can be a crucial step for individuals and businesses alike. This document, often used for tax or regulatory purposes, requires careful attention to detail. Unfortunately, common errors can complicate or delay its processing. By highlighting these mistakes, individuals can ensure a smoother experience when handling this important form.

One of the most frequent mistakes is the failure to provide complete information. Every section of the NYC 204 form is designed to collect specific data. When individuals omit details, it can lead to requests for additional information or, in some cases, the rejection of the submission. Ensuring that every required field is filled out is fundamental to a successful submission.

Another area where errors often occur is in the accuracy of the information provided. Details such as names, addresses, and tax identification numbers must match official documents. Inconsistencies in this information can raise red flags, leading to further scrutiny and, potentially, delays in processing.

Here are other common mistakes made when filling out the NYC 204 form:

- Not double-checking the form for mathematical errors. The NYC 204 form may require calculations, and inaccuracies can significantly impact the outcome or validity of the form.

- Forgetting to sign and date the form. An unsigned or undated form is often considered incomplete and can halt the entire process.

- Using outdated forms. The city may update the form periodically, and using an older version can result in the submission being rejected.

- Failure to include necessary supporting documents. Often, the NYC 204 form requires attachments such as proof of identity or financial records. Not including these can lead to delays.

Moreover, people often overlook the importance of retaining a copy of the form for their records. This oversight can become problematic if there are questions or issues with the submission later on. Keeping a copy ensures that individuals have the details of their submission readily available for reference or to rectify any issues.

Finally, a significant mistake is waiting until the last minute to fill out and submit the form. Not only does this increase the likelihood of errors, but it also reduces the time available to correct them before any deadlines. Early preparation and submission can mitigate many of the errors associated with rushing to complete the NYC 204 form.

By avoiding these common mistakes, individuals can navigate the complexities of the NYC 204 form more effectively. Paying close attention to detail, verifying information against official documents, and allowing sufficient time for completion and review are steps that can lead to a successful submission, ultimately serving the individual's or business's objectives more efficiently.

Documents used along the form

Completing tax-related forms is a crucial aspect of managing a business or fulfilling individual tax responsibilities. In New York City, one such form that often comes into play is the NYC 204 form, which is essentially used by unincorporated entities to report their income and claim deductions. Given the complexities of tax reporting, this form does not stand alone. It's usually accompanied by various other documents, each serving its own purpose in the broader landscape of tax preparation and filing.

- Schedule C (Form 1040 or 1040-SR): This is a federal tax form used by sole proprietors to report their income or loss from a business. It details the income earned, costs of goods sold, and expenses related to conducting business.

- Form IT-204-LL: Used by New York State, this form is relevant for limited liability companies (LLCs), requiring the disclosure of income, deductions, and tax preference items for the year. It's important for entities doing business in multiple states.

- Form 1065: This IRS form is for reporting the income, gains, losses, deductions, credits, etc., of a partnership. It is a necessary form for partnerships and multi-member LLCs to comply with federal tax obligations.

- W-9 Form: Request for Taxpayer Identification Number and Certification, this form is used to provide the correct taxpayer identification number (TIN) to entities that are required to file an information return with the IRS, often needed in business transactions.

- Form W-2: Wage and Tax Statement, this document is issued by employers to report employee wages, tips, and taxes withheld. It is crucial for employees' individual tax returns.

- Form 1099-MISC: This form reports miscellaneous income, such as payments made to independent contractors, rental property income, and other forms of income not covered by a W-2.

- Form 8829: Expenses for Business Use of Your Home, this form is used by freelancers and home-based businesses to calculate deductions for the business use of their home, allowing for part of housing expenses to be deducted.

Each of these documents plays a role in the comprehensive process of managing and reporting taxes. Understanding when and how to appropriately utilize these forms—in conjunction with the NYC 204 form, when applicable—can significantly impact the accuracy and efficiency of tax preparation. For businesses and individuals alike, staying informed and seeking the necessary guidance on these matters is paramount.

Similar forms

The NYC 204 form, often utilized in transactions involving the City of New York, shares similarities with several other key documents in the realm of contract and procurement management. One such document is the Standard Form 33 (SF-33), Solicitation, Offer and Award. The SF-33 is used by federal agencies to solicit offers from potential contractors and to award contracts. Similar to the NYC 204, it plays a crucial role in formalizing the terms between a government body and a contractor, specifying the services or goods to be provided, the cost, and other critical details that ensure both parties are aligned on the expectations and deliverables.

Another document analogous to the NYC 204 is the Request for Proposal (RFP). RFPs are comprehensive documents that outline the scope of a project, requirements for potential vendors, and criteria for evaluation. They are widely used in both public and private sectors to solicit bids for services or products that require a detailed proposal. Like the NYC 204, RFPs ensure that all parties have a clear understanding of the project requirements, timelines, and anticipated outcomes. This process facilitates fair competition and allows the issuing body to assess the capabilities of each proposer in meeting their needs.

The Purchase Order (PO) document also shares common ground with the NYC 204 form. A PO is a formal document sent from a buyer to a seller, commissioning the purchase of services or goods. POs detail the type, quantity, and price of the items or services ordered, similar to how the NYC 204 specifies the scope and cost of a contract. The issuance of a PO is a key step in the procurement process, initiating the contractual relationship between buyer and seller, and setting the stage for fulfilling the contract terms.

The Contract Award letter is another document closely related to the NYC 204. This letter serves as official notice to a bidder that they have been selected to fulfill a contract, detailing the essential terms such as scope, timing, and price. It marks the transition from the proposal/bidding phase to the execution phase of a contract. The Contract Award letter performs a role similar to the NYC 204 in that it formalizes the agreement between the contracting authority and the successful vendor, laying the groundwork for the work to begin.

The Statement of Work (SOW) document significantly overlaps with the content and purpose of the NYC 204 form. An SOW outlines the specific tasks, timelines, and deliverables for a project or contract. It provides a detailed description of the work to be done, the resources required, and the expectations for performance. By defining the scope of work explicitly, like the NYC 204, an SOW helps to ensure that both parties understand their obligations and the standards for successful completion of the project.

Lastly, the Performance Bond is a document that, while differing in function, shares a fundamental connection with the NYC 204. A Performance Bond is a type of surety bond issued by a bank or insurance company to guarantee satisfactory completion of a project by a contractor. It provides financial protection to the project owner should the contractor fail to fulfill their obligations. In relation to the NYC 204, both serve to safeguard the interests of the contracting authority by ensuring that the obligations of the contract will be met, although the Performance Bond does so by providing a financial guarantee rather than detailing the terms of the agreement.

Dos and Don'ts

When it comes to completing the NYC 204 form, it's crucial to proceed with care and attention to detail. This form is a key document for businesses in New York City, serving various purposes, including tax filings. Here are some essential tips to help you navigate the process more smoothly, ensuring accuracy and compliance.

Do's

- Double-check for accuracy: Before submitting the form, go over each entry meticulously. Ensure that all the information provided matches your records and is free from errors. Accurate data is crucial for the processing of your form.

- Use black ink: If you're filling out a physical copy of the form, use black ink. This makes your entries clear and legible, reducing the chance of any misunderstandings due to poor readability.

- Refer to official instructions: The NYC 204 form comes with its set of instructions. Always refer to these guidelines when filling out the form to ensure that you are complying with the specific requirements and are filling out the form correctly.

- Seek professional advice if necessary: If you encounter any difficulties or have questions regarding the form, don't hesitate to consult with a tax professional or accountant. Their expertise can guide you through the process and help avoid potential errors.

Don'ts

- Don’t rush through the process: Taking your time to fill out the form carefully is crucial. Rushing through the form can lead to mistakes that may complicate your tax filings or result in the need to submit corrections.

- Don't leave fields blank: If a section of the form does not apply to your situation, it's better to write "N/A" (not applicable) instead of leaving it blank. This indicates to the reviewers that you did not overlook the section.

- Don’t use correction fluid or tape: If you make a mistake, it’s advisable to start over with a new form rather than using correction fluid or tape. These can make the form look unprofessional and may even lead to processing delays.

- Don’t forget to sign and date the form: An unsigned or undated form is considered incomplete and may be rejected. Ensure that all required signatures are present before submission.

Following these do's and don'ts will help you fill out the NYC 204 form accurately and efficiently. Remember, the key to a smooth submission process is attentiveness and compliance with the official guidelines. Should you need help, seeking professional advice is a step in the right direction.

Misconceptions

Understanding the complexities of legal documents is crucial for accurately navigating through them. The NYC 204 form, a key document for residents and businesses in New York City dealing with specific financial transactions, is surrounded by several misconceptions. Clarifying these misconceptions is essential for a proper understanding and handling of the form. Here are five common misunderstandings:

- Misconception 1: The form is only relevant for large businesses. Contrary to this belief, the NYC 204 form applies to a broader spectrum of entities, including small businesses and sometimes individuals, especially in scenarios involving certain kinds of taxable transactions or activities within New York City. The form's relevance is determined not by the size of the entity but by the nature of its financial transactions.

- Misconception 2: Submission is complicated and always requires professional assistance. While it's true that legal or financial advice can be beneficial, especially for complex cases, many can complete and submit the form without professional help. The city provides guidelines and assistance for those who need it, making the process more accessible to everyone.

- Misconception 3: Electronic submission is not an option. In the digital age, this statement is increasingly inaccurate. Electronic submissions are not only possible but encouraged, offering a convenient, faster, and more environmentally friendly option for fulfilling this obligation. It simplifies the process, reduces errors, and ensures faster processing times.

- Misconception 4: There are no penalties for late submissions. This is a dangerous assumption. Late submissions can lead to penalties, including fines and interest on owed amounts. Prompt submission is crucial to avoid unnecessary financial consequences. Being aware of the deadlines and planning accordingly can save a lot of trouble.

- Misconption 5: Once submitted, the form cannot be amended. This is not the case. If mistakes are made or if there is a need to update the information provided, amendments are allowed. The process for amending a submission is outlined by the city, ensuring that individuals and businesses can rectify errors without significant complications.

Cleaning up these misconceptions allows for a smoother, more informed interaction with the NYC 204 form. Whether you're a small business owner or an individual engaged in specific financial activities in New York City, understanding these key aspects ensures compliance and avoids potential legal and financial pitfalls.

Key takeaways

Understanding the correct way to fill out and utilize the NYC 204 form is vital for individuals and businesses that are required to do so. Here are five key takeaways that can help ensure the process is handled accurately and effectively:

The NYC 204 form is designed specifically for unincorporated business organizations to report their taxable income to the New York City Department of Finance. It's essential for businesses operating within this structure to familiarize themselves with the form's requirements.

Accuracy is paramount when completing the NYC 204 form. All income and deductions must be reported correctly to avoid potential audits or penalties. This means gathering all relevant financial information before starting the process.

Deadlines are crucial in the filing process. The specific due date for submitting the NYC 204 form typically falls on or before April 15th following the tax year being reported. Noting and adhering to this deadline can help avoid late fees and interest charges.

Digital submissions have become increasingly favored by many, offering a convenient and efficient way to file. However, it's important to ensure that the digital platform used is secure and recognized by the New York City Department of Finance.

Seeking assistance from a tax professional or legal advisor is often a wise choice, especially for those who are new to the process or have complex financial records. Expert guidance can help navigate the intricacies of tax law and ensure the form is filled out correctly.

Common PDF Documents

Do I Need a Real Estate License to Rent Out Property - Find out what to do if a tenant claims you locked them out illegally, and learn about the legal repercussions and remedies.

Do You Have to Pay Taxes on Estate Inheritance - Requires information about any legal proceedings the decedent was involved in within New York State.

City Of Ny Affirmation - The document is a testament to the city's commitment to maintaining a trustworthy and financially secure contracting environment.