Free Nyc 202 Form in PDF

At the heart of navigating New York City's complex tax landscape, Form NYC-202 emerges as a crucial document for estates and trusts operating with an Employer Identification Number (EIN). Designed specifically for the tax year 2021, it caters to individuals and single-member LLCs engaged in unincorporated business activities within the bustling metropolis. This form meticulously outlines the process for reporting income, calculating taxes due, and claiming credits or deductions available under the city's tax code. By requiring detailed information about the business, including its name, address, and the nature of its operations, Form NYC-202 serves as a comprehensive tool for ensuring compliance with local tax obligations. It addresses various scenarios, from changes in business information to the cessation of operations, and provides spaces for articulating federal and state tax adjustments. Additionally, it delves into the computation of taxes, with schedules dedicated to calculating total income, business tax credits, and prepayments of estimated tax. This detailed approach not only facilitates accurate tax reporting but also underscores the city's effort to streamline tax administration for unincorporated businesses. Moreover, the inclusion of Schedules E and F for reporting net operating losses and essential business details exemplifies the form's role in encompassing various tax situations, thereby supporting businesses in their endeavor to maintain fiscal responsibility in New York City.

Nyc 202 Sample

Estates and Trusts using an EIN as their primary identifier must use Form |

|

|

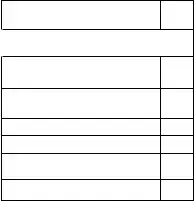

UNINCORPORATED BUSINESS TAX RETURN 2022

FOR INDIVIDUALS AND

For CALENDAR YEAR 2022 beginning ___________________________ and ending ____________________________

*60212291*

First name and initial |

|

Last name |

|

Name |

n |

|

|

|

|

|

|

Change |

|

|

|

|

|

|

|

|

In Care Of |

|

|

|

|

|

|

|

|

|

|

|

|

|

Business name |

|

|

|

|

|

|

|

|

|

|

|

|

|

Business address (number and street) |

|

Address |

n |

|||

|

|

|

|

|

Change |

|

|

|

|

|

|

|

|

City and State |

|

|

Zip Code |

|

Country (if not US) |

|

|

|

|

|

|

|

|

Business Telephone Number |

Date business began in NYC |

Date business ended in NYC |

||||

|

|

|

|

|

|

|

TAXPAYER’S EMAIL ADDRESS

SOCIAL SECURITY NUMBER

BUSINESS CODE NUMBER

FROM FEDERAL SCHEDULE C:

APPLY |

n ndedreturn |

If the purpose of the amended return is to report a |

n |

IRS change |

Date of Final |

|

||

|

|

|

Determination |

|

||||

|

federal or state change, check the appropriate box: |

nNYS change |

|

|||||

THAT |

n inalreturn |

Check this box if you have ceased operations in NYC. Attach copy of your entire federal Form 1040 and statement showing disposition of business property. |

||||||

ALL |

||||||||

n Engaged in a fully exempt unincorporated business activity |

|

n Engaged in a partially exempt unincorporated business activity |

|

|||||

CHECK |

|

|

||||||

n laianlatedfederaltaxbenefitseinstructin |

s |

nn ter‑characterspecialcnditincdeifapplicableeinstru |

ctins |

|||||

|

|

|

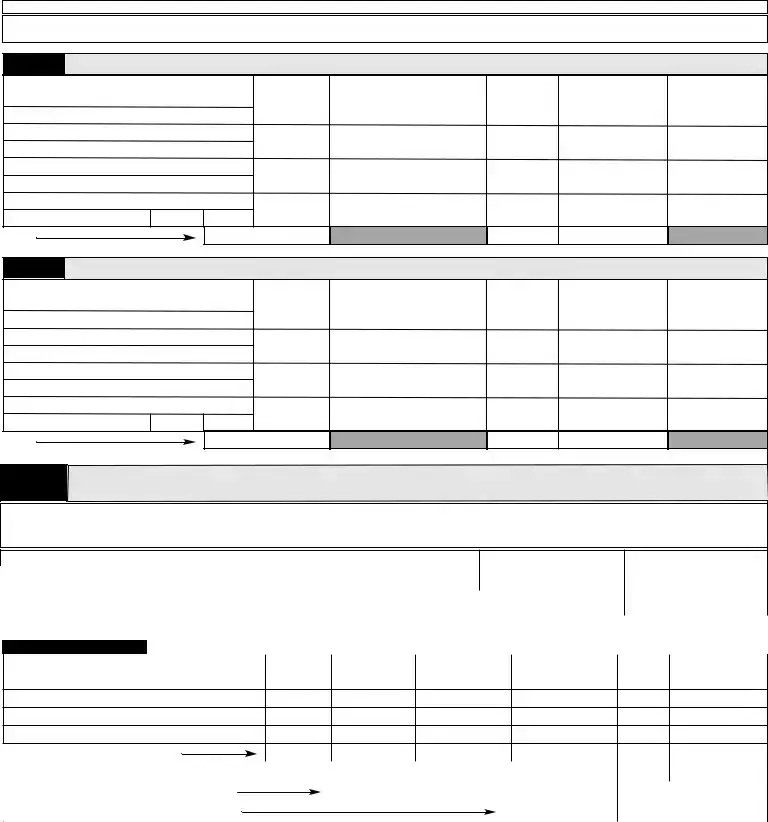

SCHEDULE A |

Computation of Tax |

BEGIN WITH SCHEDULE B ON PAGE 3. COMPLETE ALL OTHER SCHEDULES. TRANSFER APPLICABLE AMOUNTS TO SCHEDULE A. |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Payment Amount |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Payment |

Amount being paid electronically with this return |

...................................................................... |

|

A. |

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

1. |

sinessincrpageScheduleline |

|

|

|

|

|

1. |

________________________________ |

|

|

||||||

|

2. |

ntentinalltted |

|

|

|

|

|

|

2. |

________________________________ |

|

||||||

|

3. |

fbusinessallcatinpercentagefrSchedulePartine |

|

islessthan |

|

|

|

|

|

|

|

||||||

|

|

|

enterincrlssnNYrealprpert |

|

(see instructions) |

|

|

|

3. |

________________________________ |

|

|

|||||

|

4. |

lanceinelessline |

|

|

|

|

|

|

4. |

________________________________ |

|

|

|||||

|

5. |

MultiplinebthebusinessallcatinpercentagefrSched |

|

ulePartine |

|

5. |

________________________________ |

|

|

||||||||

|

6. |

untfrlineYrealprpertincandgainntsubject |

|

|

tallcatin |

(see instructions) |

6. |

________________________________ |

|

|

|||||||

|

7. |

nvestntincrpageScheduleline |

|

|

|

|

|

7. |

________________________________ |

|

|

||||||

|

8. |

ntentinalltted |

|

|

|

|

|

|

8. |

________________________________ |

|

||||||

|

9. |

MultiplinebtheinvestntallcatinpercentagefrSch |

|

eduleine |

(see instructions) |

9. |

________________________________ |

|

|

||||||||

|

10. |

talbefreNdeductinflinesand |

|

(see instructions) |

10. |

________________________________ |

|

|

|||||||||

|

11. |

eductNYnetperatinglssdeductinrrNY |

|

|

|

line |

(see instructions) |

11. |

________________________________ |

|

|

||||||

|

12. |

lancebefreallwancefrtaxpar’sservicesinelessline |

|

|

|

12. |

________________________________ |

|

|

||||||||

|

13. |

essallwancefrtaxpar’sservicesdntenterrethan |

|

fliner$ |

|

|

|

|

|

|

|

||||||

|

|

|

whicheverisless |

(see instructions) |

|

|

|

|

|

13. |

________________________________ |

|

|

||||

|

14. |

lancebefreexetininelessline |

|

|

|

|

|

14. |

________________________________ |

|

|

||||||

|

15. |

essexetin$axparperatingrethannebusin |

|

|

essrshrtperid |

|

|

|

|

|

|

|

|||||

|

|

|

taxpar |

see instructions) |

|

|

|

|

|

15. |

________________________________ |

|

|

||||

|

16. |

axableincinelessline |

(see instructions) |

|

|

|

16. |

________________________________ |

|

|

|||||||

|

17. |

axbefrebusinesstaxcreditfauntnline |

|

|

|

|

|

17. |

________________________________ |

|

|

||||||

|

18. |

essbusinesstaxcreditlecttheapplicablecreditcnditin |

|

frthesinessaxredit |

|

|

|

|

|

|

|||||||

|

|

|

utatinschedulenthebttfpageandentera |

|

|

unt |

(see instructions) |

|

18. |

________________________________ |

|

|

|||||

|

19. |

NNRPRSNinelessline |

|

|

(see instructions) |

|

19. |

________________________________ |

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

60212291 |

|

THIS RETURN MUST BE SIGNED. (SEE PAGE 5 FOR SIGNATURE BOX AND MAILING INSTRUCTIONS.) |

|

NY |

||||||||||||

Form

Name ___________________________________________________________________________ SSN _________________________________________

20a.RreditttachNY |

|

|

20a. |

|

|

|

|

|

|

|

||||||||||

20b.RealateaxlatinlntpprtunitRelcatin |

|

|

|

|

|

|

|

|

|

|

||||||||||

|

stsandreditsttachNY |

|

|

20b. |

|

|

|

|

|

|

|

|||||||||

20c.MRreditttachNY |

|

|

20c. |

|

|

|

|

|

|

|

||||||||||

20d.ntentinallleftblan |

|

|

20d. |

|

|

|

|

|

|

|

||||||||||

20e.erPrductinreditttachNY |

|

|

20e. |

|

|

|

|

|

|

|

||||||||||

21. |

Nettaxaftercreditsinelesssuflinesathrugh |

e |

21. |

|

|

|

||||||||||||||

22. |

Pantfestitednincrpratedsinessax |

|

|

includingcarrvercreditfr |

|

|

|

|

|

|||||||||||

|

precedingarandpantwithextensinNY |

(see instructions) |

22. |

|

|

|

||||||||||||||

23. |

flineislargerthanlineenterbalancedue |

|

|

|

23. |

|

|

|

||||||||||||

24. |

flineissllerthanlineenterverpant |

|

|

|

|

|

24. |

|

|

|

||||||||||

25a.nteresteinstructins |

|

|

25a. |

|

|

|

|

|

|

|

||||||||||

25b.ditinalchargeseinstructins |

|

|

25b. |

|

|

|

|

|

|

|

||||||||||

25c.Penaltfrunderpantfestitedtax |

|

ttachfrNY |

25c. |

|

|

|

|

|

|

|

||||||||||

26. |

talflinesabandc |

|

|

|

|

|

26. |

|

|

|

||||||||||

27. |

Netverpantinelessline |

(see instructions) |

|

|

|

27. |

|

|

|

|||||||||||

28. |

untflinetbeRefunded |

n irectdepsit |

fill out line 28c OR |

n Paperchec 28a. |

|

|

||||||||||||||

|

|

|

|

|

|

|

reditedtitedaxnrNY |

|

|

|

|

28b. |

|

|

|

|||||

28c. |

Routing |

|

|

|

|

|

|

|

|

|

Account |

|

|

|

|

ACCOUNT TYPE |

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

Number |

|

|

|

|

|

|

|

|

|

Number |

|

|

|

Checking n Savings n |

|

|

|||

29. |

Total remittance due (see instructions) |

|

|

|

29. |

|

|

|

||||||||||||

30. |

NYrentdeductednfederaltaxreturnrNYrentfrSchedule |

Part |

30. |

|

|

|

||||||||||||||

31. |

rssreceiptsrsalesfrfederalreturn |

|

|

|

|

|

31. |

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Business Tax Credit Computation

*60222291*

1. |

ftheauntnpagelineis$rlessur |

|

3. ftheauntnpagelineisver$butle |

|

ssthan |

||||

|

|

||||||||

|

creditnlineistheentireauntftaxnline |

|

$urcreditiscutedbthefllwingfrla |

|

|

|

|||

|

W |

|

|

auntnpgline |

X |

$nustaxnline |

|

_______ |

|

|

|

|

|

|

|

||||

2. |

ftheauntnpagelineis$rvern |

|

|

|

$ |

urcredit |

|

||

|

creditisallwedter“”nline |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Prepayments of Estimated Tax Computation |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

PREPAYMENTS CLAIMED ON SCHEDULE A, LINE 22 |

|

|

|

DATE |

AMOUNT |

|||

PantwithdeclaratinrNY

PantwithNticefitedaxue

PantwithNticefitedaxue

PantwithNticefitedaxue

PantwithextensinrNY

verpantcreditedfrprecedingar

G.TOTAL fnternScheduleline

60222291

|

Form |

|

Page 3 |

||

|

Name ___________________________________________________________________________ |

SSN _________________________________________ |

|||

|

|

|

|

|

|

|

SCHEDULE B |

Computation of Total Income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Part |

tefbusinessincgainlssrdeductin |

|

|

|

1. |

Netprfitrlssfrbusinessfarngrprfessinsasreprtedf |

rfederaltaxpurpsesfr |

|

||||

|

federalSchedulerr |

|

(see instructions) |

|

|

1. |

|

2. |

fenteringincfrrethannefederalSchedule |

|

rrchecthisbx |

|

2. |

||

|

terthenuerfSchedulesrattached |

|

➧ |

|

|

|

|

|

|

|

|

|

|||

3. |

ainrlssfrsalefbusinesspersnalprpertrbusinessreal |

prpert |

(attach federal |

|

|||

|

Schedule D or Form 4797) (see instructions) |

|

|

3. |

|||

4. |

Netauntfrentalrrltincfrbusinesspersnalprpe |

|

rtrbusinessrealprpert |

|

|||

|

(attach federal Schedule E) (see instructions) |

|

|

4. |

|||

5. |

therbusinessincrlss |

(attach schedule) (see instructions) |

|

5. |

|||

6. |

talfederalincrlssinelinesthrugh |

|

|

|

|

6. |

|

7. |

Subtractnetincrgainraddnetlssfrrentalsaler |

|

exchangefrealprpert |

|

|||

|

situatedutsideNewYritifincludedinliner |

abve |

(attach schedule) (see instructions) |

7. |

|||

8. |

talincbefreNewYritdificatinsinelines |

|

and |

|

8. |

||

|

|

|

|

|

|

||

Part |

|

NewYritdificatinseinstructinsfrSchedulepart |

|

|

|

||

n

ADDITIONS |

|

|

|

|

|

|

|

|

|

|

|

|||

9. |

linctaxesandnincrpratedsinessaxes |

|

|

|

|

|

9. |

|

|

|||||

10a.Relcatincredits |

|

|

|

|

|

|

|

|

10a. |

|

|

|||

10b.ensesrelatedtexetinc |

|

|

|

|

|

|

|

10b. |

|

|

||||

10c.epreciatinadjustnts |

|

(attach Form |

10c. |

|

|

|||||||||

10d.Realestateadditins |

(see instructions) |

|

|

|

|

10d. |

|

|

||||||

11. |

theradditins |

(attach schedule) (see instructions) |

|

|

|

11. |

|

|

||||||

12. |

taladditinsddlinesthrugh |

|

|

|

|

|

|

12. |

|

|

||||

SUBTRACTIONS |

|

|

|

|

|

|

|

|

|

|

||||

13. |

linctaxandnincrpratedsinessaxrefundsncludedin |

|

|

part |

13. |

|

|

|||||||

14. |

Wagesandsalariessubjecttfederaljbscredit |

(see instructions |

|

|

14. |

|

|

|||||||

15. |

epreciatinadjustnt |

|

(attach Form |

|

|

15. |

|

|

||||||

16. |

tincincludedinpart |

|

(attach schedule) |

|

|

|

16. |

|

|

|||||

17. |

fdividends |

(see instructions) |

....................................................................................................... |

|

|

|

17. |

|

|

|||||

|

|

|

|

|

|

|

||||||||

18. |

Realestatesubtractins |

|

(see instructions) |

|

|

|

18. |

|

|

|||||

19. |

thersubtractins |

(attach schedule) (see instructions) |

|

|

|

19. |

|

|

||||||

20. |

talsubtractinsddlinesthrugh |

|

|

|

|

|

20. |

|

|

|||||

21. |

NYdificatinsinelinesand |

|

|

|

|

|

|

21. |

|

|

||||

22. |

talincinelinesand |

|

|

|

|

|

|

|

22. |

|

|

|||

23. |

essharitablecntributinsttexceedfline |

|

|

(see instructions) |

23. |

|

|

|||||||

24. |

lance |

inelessline |

|

|

|

|

|

|

|

24. |

|

|

||

25. |

nvestntincletelinesathrughgbelw |

|

|

(see instructions) |

|

|

|

|||||||

|

(a) |

ividendsfrstcheldfrinvestnt |

|

|

|

|

|

25a. |

|

|

||||

|

(b) |

nterestfrinvestntcapitalncludennxetgvernntal |

|

|

bligatins |

|

|

|

||||||

|

|

(itemize on rider) |

|

|

|

|

|

25b. |

|

|

||||

|

(c) |

Netcapitalgainssfrsalesrexchangesfsecuritiesheldf |

|

rinvestnt |

25c. |

|

|

|||||||

|

(d) |

ncfrassetsincludednlinefSchedule |

|

|

|

|

25d. |

|

|

|||||

|

(e) |

dlinesathrughdinclusive |

|

|

|

|

|

25e. |

|

|

||||

|

(f) |

eductinsdirectlrindirectlattributabletinvestntinc |

|

|

|

25f. |

|

|

||||||

|

(g) |

nterestnbanaccuntsincludedinincreprtednline |

|

d |

25g. |

|

|

|

|

|||||

26. |

nvestntinc |

ineelesslinef |

nternpageSchline |

|

|

|

26. |

|

|

|||||

27. |

BUSINESS INCOME inelessline |

nterhereandtransferaunttpgSchline |

|

..................................... |

27. |

|

|

|||||||

|

|

|

|

|||||||||||

*60232291* 60232291

Form |

Page 4 |

Name ___________________________________________________________________________ |

SSN _________________________________________ |

SCHEDULE C

Locations of Places of Business Inside and Outside New York City

Locations of Places of Business Inside and Outside New York City

All taxpayers must complete Schedule C, Parts 1 and 2.

Part

catinfreachplacefbusinessNSNewYriteinstructinsattachriderifnecessar

|

letedress |

|

Rent |

Naturefivities |

Nfles |

WagesSalariesc |

uties |

|

|

|

|

|

|

|

|

|

|

NM |

SR |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Y |

|

S |

ZP |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NM |

SR |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Y |

|

S |

ZP |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NM |

SR |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Y |

|

S |

ZP |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NM |

SR |

|

|

|

|

|

|

|

Y |

|

S |

ZP |

|

|

|

|

|

tal |

Part

catinfreachplacefbusinessSNewYriteinstructinsattachriderifnecessar

|

letedress |

|

Rent |

Naturefivities |

Nfles |

WagesSalariesc |

uties |

|

|

|

|

|

|

|

|

|

|

NM |

SR |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Y |

|

S |

ZP |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NM |

SR |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Y |

|

S |

ZP |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NM |

SR |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Y |

|

S |

ZP |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NM |

SR |

|

|

|

|

|

|

|

Y |

|

S |

ZP |

|

|

|

|

|

tal |

Part

SingleReceiptsactrsinesslcatinPercentage Taxpayers must report their Business Allocation Percentage in this schedule for this return to be accepted.

Taxpayers who do not allocate business income outside New York City must enter 100% on Schedule C, Part 3, line 2. Taxpayers who allocate business income both inside and outside New York City must complete Schedule C, Part 3.

DESCRIPTION OF ITEM USED AS FACTOR

COLUMN A - NEW YORK CITY

COLUMN B - EVERYWHERE

|

1. Gross sales of merchandise or charges for services during the year |

|

|

1. |

|

|

|

|

|

|

|

|

|

|

|

|||||

|

2. BusinessAllocationPercentage(line 1a divided by line 1b rounded to the nearest hundredth of a percent). |

............................................................................. |

|

|

2. |

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SCHEDULE D |

Investment Capital and Allocation and Cash Election |

|

|

|

|

|

|

|

|

|||||||||

|

|

A |

|

|

|

B |

C |

D |

|

E |

|

|

|

F |

|

G |

||||

|

|

RPNNVM |

|

|

|

NfSharesr |

verage |

|

iabilitiestributable |

|

NetverageValue |

|

|

ssuerlcatin |

ValuelcatedtNY |

|

||||

|

|

|

|

|

|

untfSecurities |

Value |

|

tnvestntapital |

|

lunusclu |

|

|

Percentage |

lu |

xclu |

|

|||

|

|

SHSKSRYSRNY |

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

talsncludingitenrider |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2. |

nvestntallcatinpercentage |

inedividedbline |

round to the nearest hundredth of a percent |

|

|||||

3. |

ash |

(To treat cash as investment capital, |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

you must include it on this line.) |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

||

4. |

nvestntcapitaltalflinesand |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

*60242291*

60242291

ATTACH FEDERAL SCHEDULE C, SCHEDULE

Form |

|

Page 5 |

|

Name ___________________________________________________________________________ |

SSN _________________________________________ |

||

|

|

|

|

|

SCHEDULE E |

If you are taking a Net Operating Loss Deduction this year, please attach |

|

|

Form |

|

|

|

|

|

|

|

|

|

|

SCHEDULE F

The following information must be entered for this return to be complete. (See Instructions)

The following information must be entered for this return to be complete. (See Instructions)

1.Naturefbusinessrprfessin _________________________________________________ ____________________________________

2. |

NewYrStateSalesaxNuer |

_________________________________________ |

|

|

|

|

|||

3. |

idufileaNewYritnincrpratedsinessaxReturn |

frthefllwingars |

|

|

|

|

|||

|

2020: n Y |

n N |

2021: n Y |

n N |

|

|

|

|

|

|

f“N”statereasn |

__________________________________________________ ____________________________________________ |

|||||||

4. |

terhaddress |

__________________________________________________ ________________________ |

Zipde___________ |

||||||

5. |

fbusinessternatedduringthecurrenttaxablearstated |

ateternatedd |

|

||||||

|

tachastatentshwingdispsitinfbusinessprpert |

|

|

|

|

|

|

||

6. |

HasthenternalRevenueServicertheNewYrStateepartn |

tfaxatinandinanceincreasedrdecreasedantaxablei |

ncss |

|

|||||

|

reprtedinantaxperidrareucurrentlbeingaudited |

|

n Y |

n N |

|

|

|

||

|

fbwh |

|

n Internal Revenue Service |

|

Stateperidg________________ |

|

d________________ |

||

|

|

|

|

|

|

MM |

YY |

MM |

YY |

|

|

|

n New York State Department of Taxation and Finance |

Stateperidg________________ |

|

d________________ |

|||

|

|

|

|

|

|

MM |

YY |

MM |

YY |

7.f“Ytquestin

7a. rarsprirthasrNYeprtfederalSt |

|

|

|

atehangeinaxablencbeenfiled |

|

|

|

|

|

|

|

|

|

|

|

|

n Y |

n N |

|||||||||||||||||||||||

7b. rarsbeginningnrafterhasanandedreturn |

|

beenfiled |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

n Y |

n N |

|||||||||||||||||||||||

8. |

iducalculateadepreciatindeductinbtheapplicati |

|

nfthefederalleratedstRecverSeRS |

|

|

(see instr.) |

n Y |

n N |

|||||||||||||||||||||||||||||||||

9. |

Wereuaparticipantina“SafeHarbreasing”transactindu |

ringtheperidcveredbthisreturn |

|

|

|

|

|

|

|

|

|

|

|

|

n Y |

n N |

|||||||||||||||||||||||||

10.esthistaxparparentgreaterthan$franprese |

|

|

|

sinNYinthebrughfManhattansuthf |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

thStreetfrthepurpsefcarrngnantradebusinessp |

rfessinvcatinrcrcialactivit |

|

|

|

|

|

|

|

|

|

|

|

|

|

n Y |

n N |

|||||||||||||||||||||||

11. fwereallrequiredrcialRentaxReturnsfiled |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

n Y |

n N |

||||||||||||||||||||

|

|

PleaseenterlrdentificatinNuerrScialSecuritNuer |

|

whichwasusednthercialRentaxReturn |

__________________________ |

||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CERTIFICATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

I hereby certify that this return, including any accompanying rider, is, to the best of my knowledge and belief, true, correct and complete. |

irsildress |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

I authorize the Dept. of Finance to discuss this return with the preparer listed below. (See instructions) ......YES n |

_______________________________________ |

|||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SIGN |

|

|

Signatureftaxpar |

|

|

|

itle |

|

ate |

|

PreparersScialSecuritNuerrPN |

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

|

HERE: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

PREPARER'S |

|

PreparersPreparer’s |

|

|

|

|

|

hecifself |

|

n |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

USE |

’ |

|

|

signatureprinted |

|

na |

ate |

|

✔ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

ONLY |

|

|

|

|

eld |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

irlrdentificatinNuer |

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

s irsna |

rursifselfld |

s dress |

|

|

|

|

|

s Zipde |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MAILING INSTRUCTIONS

Attach copy of federal Form 1040, Schedule C, Schedule

To receive proper credit, you must enter your correct Social Security Number on your tax return and remittance.

The due date for the calendar year 2022 return is on or before April 18, 2023.

For fiscal years beginning in 2022, file on or before the 15th day of the fourth month following the close of the fiscal year.

ALLRETURNSEXCEPTREFUNDRETURNS

NYMN

NNRPRSN

PX

NHNNY

REMITTANCES

PAY ONLINE WITH FORM

AT NYC.GOV/ESERVICES

OR

Mail Payment and Form

NYMN

PX

NYRKNY

RETURNSCLAIMINGREFUNDS

NYMN

NNRPRSN

PX

NHNNY

*60252291* 60252291

File Overview

| Fact | Detail |

|---|---|

| Form Type | NYC-202EIN Unincorporated Business Tax Return 2021 |

| Purpose | For Estates and Trusts using an EIN as their primary identifier, individuals, and single-member LLCs operating in NYC |

| Required Attachments | Copy of entire federal Form 1040 and, if applicable, statement showing disposition of business property |

| Key Sections | Computation of Tax, Business Tax Credit Computation, Prepayments of Estimated Tax Computation |

| Governing Law | New York City Administrative Code |

Nyc 202: Usage Guidelines

Filing the NYC 202 form is a rigorous yet necessary step for Estates and Trusts using an EIN (Employer Identification Number) and for individuals or single-member LLCs operating unincorporated businesses in New York City. This document captures essential information about the business, including general, financial, and operational details. It serves as an unincorporated business tax return for the 2021 calendar year. Before starting, ensure all required information and supplementary documentation, such as federal tax returns and schedules, are on hand to facilitate accurate reporting.

- Begin by entering the start and end dates for the 2021 calendar year.

- Fill in the taxpayer’s first name, initial, and last name. If there has been a name change, mark the provided box.

- Enter the In Care Of address, business name, and business address, including any changes to these addresses.

- List the city, state, zip code, and country if outside the US.

- Provide the business telephone number.

- Fill in the date the business began and ended in NYC, if applicable, using the mm-dd-yy format.

- Enter the taxpayer's email address and social security number.

- Provide the business code number from the federal Schedule C.

- If applicable, indicate if the return is an amended return due to IRS, NYS changes, or if it's the final return because operations in NYC have ceased. Attach the required documentation as noted.

- Check the appropriate box if the business was engaged in a fully or partially exempt unincorporated business activity.

- Complete Schedule A with details on income and allocations as instructed, transferring applicable amounts from Schedules B through F as needed.

- Fill in sections regarding payments, including electronic payments, and details about any taxes or credits on the second page.

- Provide information on Business Tax Credit Computation and Prepayments of Estimated Tax.

- Complete Schedule C with information about the locations of the business inside and outside New York City, including rent paid, nature of activities, and wages.

- Fill out details on Investment Capital and Allocation in Schedule D.

- Attach federal Schedule C, C-EZ, or Schedule F as applicable.

- Provide detailed information regarding the business, such as the nature of the business or profession, New York State Sales Tax Number, and compliance with New York City unincorporated business tax returns in previous years.

- Review all information for accuracy, then sign and date the form along with the preparer’s information, if prepared by someone other than the taxpayer.

- Attach a copy of the federal Form 1040, including Schedules C, C-EZ, or F. If applicable, attach the entire copy of federal Form 1040 for final returns.

- Make a payment payable to NYC DEPARTMENT OF FINANCE and mail to the appropriate address provided in the instructions, taking into account whether you are claiming a refund or not.

After completing and submitting this form along with any required payment and attachments, the NYC Department of Finance will process your unincorporated business tax return. It’s essential to ensure that all information provided is accurate and complete to avoid any potential issues or delays.

FAQ

Below are some frequently asked questions regarding the NYC-202 form, designed to help individuals and single-member LLCs navigate the complexities of their unincorporated business tax return for 2021.

- What is Form NYC-202 EIN?

Form NYC-202 EIN, known as the Unincorporated Business Tax Return for Individuals and Single-Member LLCs, is a document required by the New York City Department of Finance. It's used by estates and trusts employing an Employer Identification Number (EIN) as their primary identifier to report and pay taxes on income generated within NYC for the calendar year 2021.

- Who needs to file Form NYC-202 EIN?

This form must be filed by individuals or single-member LLCs that conduct unincorporated business activities in New York City. Whether the business is fully or partially exempt from taxes, activities reported must use an EIN to comply with local tax obligations.

- How do I begin filling out Form NYC-202 EIN?

To fill out this form, start by providing detailed information about the taxpayer, including the first name, last name, business name, business address, telephone number, and the primary business activity's start and end dates in NYC. It's critical to also note any changes in care of business name or address if applicable.

- What schedules and additional information are required with Form NYC-202 EIN?

Alongside the main form, several schedules and additional documents are necessary. These include Schedule A for computation of tax, Schedule B for total income, and Schedules C, D, and E for detailing business locations, investment capital, and net operating loss deductions respectively. Importantly, ensure to attach a copy of the federal Form 1040 and related schedules as meticulously instructed throughout the form.

- What are the key deadlines for submitting Form NYC-202 EIN?

The deadline for submitting Form NYC-202 EIN for the calendar year 2021 is April 18, 2022. For those operating on a fiscal year basis, the form must be filed by the 15th day of the fourth month after the fiscal year ends. Adherence to these deadlines is crucial to avoid penalties.

- How can I submit Form NYC-202 EIN and make payments?

Form NYC-202 EIN can be submitted along with the payment for taxes owed via mail or electronically. If choosing the mail option, ensure to use the correct mailing address as provided on the form based on whether you are expecting a refund or making a payment. For electronic submissions, payments can be made online through the NYC Department of Finance's eServices portal.

For any further details or clarification, consider reaching out directly to the NYC Department of Finance or consulting with a tax professional to ensure compliance and accurate filing.

Common mistakes

Filling out tax forms can be a meticulous process, where accuracy is paramount. The NYC-202 form, used by Estates and Trusts sporting an EIN and applicable to Individuals and Single-Member LLCs conducting business in New York City, is no exception. People often make mistakes when completing this form, which can lead to delays or inaccuracies in processing. Identifying and avoiding these common errors can help ensure smoother interactions with tax authorities.

Firstly, a common mistake is the incorrect use of identifiers, notably when individuals incorrectly fill in the Social Security Number (SSN) or Employer Identification Number (EIN). This foundational information must be accurately reported to properly associate the tax return with the correct entity or individual.

Another frequent oversight is failing to accurately report the date business operations commenced or concluded in NYC. This information is crucial for the Department of Finance to assess the tax period accurately.

- Incorrectly reporting business address or failing to note a change in business address can lead to miscommunication or delayed tax form processing.

- Miscalculating or mistakenly leaving blank the business income and deduction sections can significantly affect the computed tax owed. Accurate calculations are vital for a correct tax return.

- Overlooking the declaration of the cessation of business operations in NYC and failing to attach the required documentation, such as a copy of the final federal Form 1040 and a statement showing the disposition of business property, might lead to incorrect assessments of business activity and tax obligations.

- Improper calculation or failure to claim eligible business tax credits can lead to missed opportunities for reducing tax liability.

Moreover, errors in the Schedules attached to the NYC-202 form are also common. Schedules A through F require careful completion as they detail specific financial activities and tax computation bases:

- Schedule A mistakes might occur if there is an incorrect transfer of amounts from other Schedules or miscalculation within the Schedule itself.

- Failure to properly allocate income between New York City and other jurisdictions in Schedule C can lead to inaccurate tax assessments, especially for businesses operating both inside and outside NYC.

- Incorrectly listing investment incomes or deductions in Schedule D might result in an inaccurate portrayal of the taxpayer’s financial standing and tax liabilities.

Lastly, ensuring all necessary documents and Schedules are attached is crucial. Omitting documents, such as the federal Schedule C or the NYC-NOLD-UBTI, can lead to requests for additional information or amendments to the submitted return, further delaying processing times. Being detail-oriented and methodically verifying each section of the form can prevent these common mistakes, ensuring a smoother tax filing process.

Documents used along the form

When it comes to navigating the ins and outs of tax returns, especially for estates, trusts, and unincorporated businesses in New York City, submitting Form NYC-202 is just the beginning. This document is crucial for these entities using an Employer Identification Number (EIN) to report their unincorporated business tax for the year. However, to ensure a comprehensive and compliant tax return, various other forms and documents often accompany Form NYC-202. These additional documents play integral roles, from detailing business income and losses to claiming specific tax credits.

- Form NYC-202EIN - This form is specifically designed for estates and trusts, including single-member LLCs, to report unincorporated business taxes. It gathers details about the business's income, losses, and operational specifics over the calendar year.

- Schedule C (Form 1040) - Often attached to Form NYC-202, this federal document reports profit or loss from a business operated as a sole proprietorship. It details the income and expenses of the business, helping to determine the net profit or loss for the year.

- Form NYC-399 - This form, used for depreciation adjustment for certain property, is essential for businesses that have significant capital assets. It helps calculate the correct amount of depreciation that can be claimed as a deduction, impacting the overall taxable income reported on NYC-202.

- Form NYC-200V - This payment voucher is crucial for any payments due with the NYC-202 form. It ensures that payments are correctly processed and matched to the taxpayer's account, providing a system for electronic or check payments.

- Form NYC-NOLD-UBTI - For businesses operating in NYC that encounter a net operating loss, this form allows them to calculate the deductible amount. By detailing the loss, businesses can carry it forward to offset future taxable income, lowering tax liabilities in subsequent years.

Understanding and assembling the correct combination of forms and documents for tax purposes is fundamental not only for legal compliance but also for optimizing tax outcomes. Whether it's capitalizing on depreciation, accurately reporting income and expenses, or navigating loss carryovers, each document holds a key piece in the puzzle of tax preparation and submission. By familiarizing themselves with these forms, taxpayers in NYC can streamline their tax reporting process, ensuring they meet their obligations while taking advantage of available deductions and credits.

Similar forms

The IRS Form 1040, including its attached Schedule C, is a document that shares similarities with the NYC-202 form, particularly concerning individuals and single-member LLCs that operate as unincorporated businesses. Both forms require the reporting of income and expenses related to the business, including sales, costs, and net profit or loss. While the Form 1040 Schedule C focuses on federal tax reporting for sole proprietors and single-member LLCs, the NYC-202 form fulfills a similar purpose at the municipal level for New York City, indicating a nested relationship in tax obligations from federal to local.

Form 1065 is another document that bears resemblance to the NYC-202 form, albeit for partnerships rather than individual entrepreneurs or single-member LLCs. Like the NYC-202, Form 1065 requires detailed reporting of income, gains, losses, deductions, and credits to determine the entity’s taxable income. The parallel lies in the structure of both forms aiming to capture the operational financial snapshot of the business for a specific tax period, however, NYC-202 caters specifically to unincorporated business entities within New York City, emphasizing localized tax responsibilities.

Form NYC-3L, targeted at corporations doing business in New York City, parallels the NYC-202 in its local focus but diverges in its applicability to incorporated entities. Both forms aim to determine the tax liability based on business activities conducted within New York City, with tailored calculations to reflect either the corporate (NYC-3L) or unincorporated (NYC-202) frameworks. The emphasis on accurately capturing business income and allocating it based on city-specific guidelines underlines the role of both forms in sustaining municipal fiscal health.

The Schedule E (Form 1040) is akin to the NYC-202 form as both involve the declaration of income from specific types of activities – with Schedule E focusing on rental real estate, royalties, partnerships, S corporations, trusts, and more, contrasting with NYC-202's scope of unincorporated business income. Despite this difference, each form is integral to disclosing passive or active income streams to tax authorities, underscoring the tax payer's broader financial landscape and obligations.

Lastly, the UBTI (Unrelated Business Taxable Income) form parallels the NYC-202 in its intent to tax income from business activities that do not relate directly to the tax-exempt purpose of the organization. While the UBTI is more specific to tax-exempt entities like charities or educational institutions earning from commercial activities, the NYC-202 encompasses all unincorporated businesses in NYC. Both documentations serve as tools to ensure that income generating activities, regardless of the entity’s primary purpose, contribute to the tax base.

Dos and Don'ts

Filling out the NYC-202 form, an important document for estates and trusts using an EIN as their primary identifier, requires attention to detail and a thorough understanding of your business activities in New York City. To ensure accuracy and prevent common pitfalls, here are 10 dos and don'ts to consider:

- Do make sure you have all the necessary information about your business, including the EIN, before you begin filling out the form.

- Do carefully read the instructions for each section to ensure that you understand what is required.

- Do check the box that corresponds to your specific situation, whether it's a change in address, an amended return due to IRS or state changes, or if you have ceased operations in NYC.

- Do attach a copy of your entire federal Form 1040 and statement showing disposition of business property if you've ceased operations in NYC.

- Do accurately calculate and enter your payment amount, beginning with Schedule A and transferring applicable amounts as instructed.

- Do ensure that all entries regarding business income, investment income, and deductions are accurate and align with your federal return.

- Do not leave any sections that apply to you incomplete. For instance, if you're claiming a business tax credit, make sure to fill out and attach the necessary schedules or documentation.

- Do not forget to sign the form. Unsigned forms are considered invalid and will not be processed.

- Do not make calculations or entries based on outdated tax laws or rates. Verify the current year's guidelines to ensure compliance.

- Do not ignore the mailing instructions. Make sure your return is sent to the correct address, and remember to attach a copy of your federal return along with any other required documents.

By following these guidelines and consulting with a tax professional when necessary, you can navigate the complexities of the NYC-202 form more smoothly and ensure that your tax obligations are fulfilled accurately and timely.

Misconceptions

Understanding the intricacies of tax forms is essential, especially in a bustling city like New York. The NYC-202 form, a crucial document for individuals and entities dealing with unincorporated business tax, is often shrouded in confusion. Let's debunk some common misconceptions surrounding this form to ensure accurate and stress-free filing.

Misconception 1: The NYC-202 form is only for large businesses.

This form is not exclusive to large businesses. Individuals and single-member LLCs operating within NYC must file this form if they are engaged in any unincorporated business activities. It's about the activity, not the size.

Misconception 2: Estates and Trusts cannot use the NYC-202 form.

Estates and Trusts using an Employer Identification Number (EIN) as their primary identifier must use Form NYC-202EIN. It's a common error to think these entities are excluded from this requirement.

Misconception 3: You only need to file if you made a profit.

Whether profitable or not, businesses must file the NYC-202 form to report their activities in New York City. Reporting is based on activities within the tax year, regardless of profitability.

Misconception 4: Amending your return is not possible.

The form explicitly provides an option for amending returns to report changes from IRS or state adjustments. Amending a return is a necessary step if there are any alterations to your reported data after the initial submission.

Misconception 5: The NYC-202 form is only for reporting income.

Beyond income, this form requires details on business allocation percentage, computation of tax, and other credits. It's a comprehensive document that covers various aspects of business taxation.

Misconception 6: Electronic payments aren't allowed.

Contrary to this belief, the form mentions that payment can be made electronically. This option facilitates easier and faster processing of tax returns.

Misconception 7: There's no need to attach federal tax documents.

One key requirement is attaching a copy of the entire federal Form 1040 and other specific schedules, depending on your business's nature. This supports the information provided on your NYC-202 form.

Clarifying these misconceptions ensures that individuals and businesses can file their NYC-202 forms correctly and avoid common pitfalls. Accurate and timely filing is crucial to comply with New York City's tax regulations and avoid potential penalties.

Key takeaways

Filling out and using the NYC-202 form, Unincorporated Business Tax Return for Individuals and Single-Member LLCs, involves several key takeaways to ensure accuracy and compliance with New York City's Department of Finance requirements:

- Estate and Trust entities utilizing an Employer Identification Number (EIN) as their primary identifier are required to fill out Form NYC-202EIN specifically designed for the 2021 calendar year. This highlights the importance of selecting the appropriate form based on the entity's tax identification mechanism.

- The form mandates comprehensive information about the business, including but not limited to the business name, address, the period of operation within the fiscal year, taxpayer’s email address, and social security number or EIN. Accurate and complete information is crucial for the processing of this tax document.

- Form NYC-202 provides sections to detail the computation of tax, business tax credit computation, and prepayments of estimated tax, among others. Taxpayers must carefully compute and report their financial data, as these figures play a critical role in determining the tax liability or refund due.

- Submissions of the form require attachments, such as a copy of the federal Form 1040 and, if applicable, a statement showing the disposition of business property. This underscores the necessity of maintaining thorough records and documentation that support the tax return.

Additionally, the form needs to be signed and dated by the taxpayer, with an option to authorize the Department of Finance to discuss the return with the preparer listed on the document. It's essential for taxpayers to adhere to the submission deadlines to avoid penalties, which for the calendar year 2021 return was on or before April 18, 2022.

Common PDF Documents

Minimum Insurance - A warning about penalties for fraudulent insurance acts is included to discourage dishonesty in the claims process.

Nysid 41C W - Part of a broader system aiming to maintain fair and competitive insurance practices.

Visual Acuity Test - The NYC LIC 60 form serves as a certification of visual fitness for welders, integral to professional standards and safety regulations.