Free Nyc 115 Form in PDF

The NYC-115 Form, officially named the Unincorporated Business Tax Report of Change in Taxable Income Made by Internal Revenue Service and/or New York State Department of Taxation and Finance, plays a crucial role for unincorporated businesses operating within New York City. Designed for adjustments in taxable income stemming from audits conducted by the IRS or the New York State Department of Taxation and Finance for tax years beginning prior to January 1, 2015, this form mandates filing within 90 days following a final determination. Businesses are required to detail any changes that affect their tax obligations, including recalculations of income, taxable income, tax credits, and additional taxes or refunds due. The form further elucidates on schedules for explaining federal and state adjustments, recalculating business tax credits, and detailing specific instructions for calculation. Furthermore, it addresses the importance of timely filing and payment, outlining penalties for late submissions and inadequate payments while also providing guidance on claims for refunds. Crucial to maintaining compliance, the NYC-115 underscores the nuances of the tax system and the necessity for transparent reporting following audit adjustments.

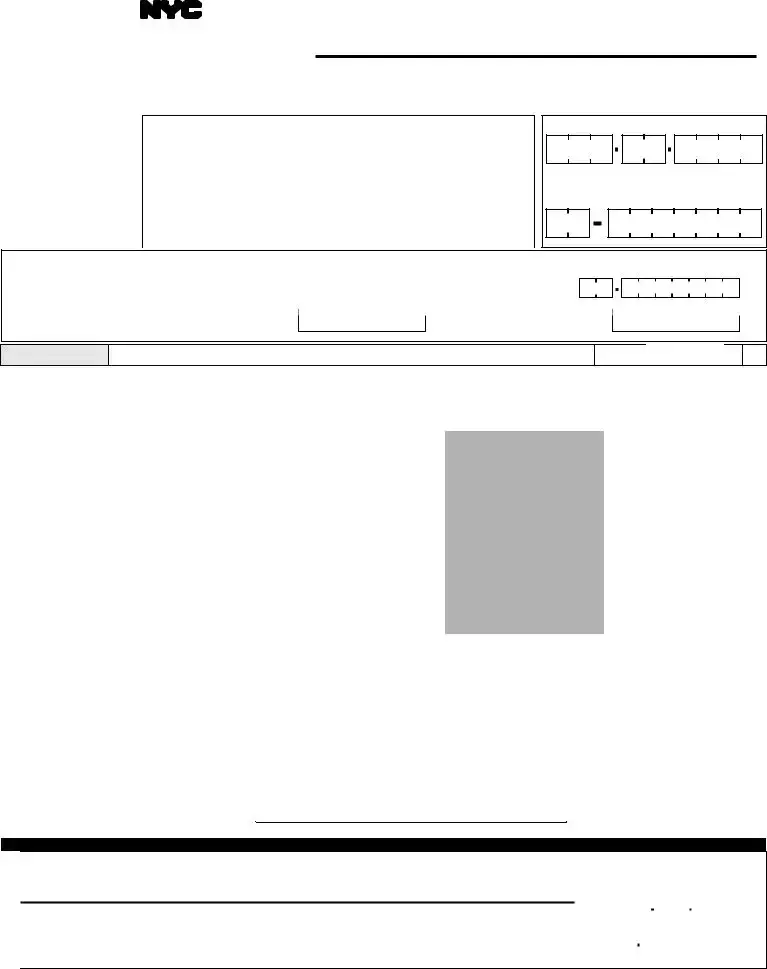

Nyc 115 Sample

*60111591*

TM |

UNINCORPORATED BUSINESS TAX REPORT OF |

Department of Finance |

CHANGE IN TAXABLE INCOME MADE BY INTERNAL |

REVENUE SERVICE AND/OR NEW YORK STATE

DEPARTMENT OF TAXATION AND FINANCE

FOR TAXABLE YEARS BEGINNING PRIOR TO JANUARY 1, 2015

TO BE FILED WITHIN 90 DAYSAFTERAFINAL DETERMINATION

For CALENDAR YEAR _________or FISCAL YEAR beginning ______________________ and ending _______________________

|

Name |

|

Name |

n |

|

|

|

||

|

|

|

Change |

|

|

|

|

|

|

|

In Care of |

|

|

|

Type |

|

|

|

|

Address (number and street) |

|

Address |

|

|

or |

|

|

||

|

|

Change n |

||

|

|

|||

City and State |

Zip Code |

Country (if not US) |

|

|

|

|

|||

|

|

|

|

|

|

Telephone Number |

Taxpayer’s Email Address |

|

|

|

|

|

|

|

SOCIAL SECURITY NUMBER

PARTNERSHIPS, ESTATESAND TRUSTS ONLY, ENTER EMPLOYER IDENTIFICATION NUMBER

A.If this form is filed by a member of a partnership to report a federal or New York State change affecting his/her share, give name and Employer Identification Number of partnership.

Name of member: _____________________________________________________________________________ |

EIN: |

B. Enter date of Final Determination: (3) |

nFederal |

- -

nNew York State

- -

A.Payment

...............................................................................Amountbeingpaidelectronicallywiththisreturn |

A. |

|

|

Payment Amount

|

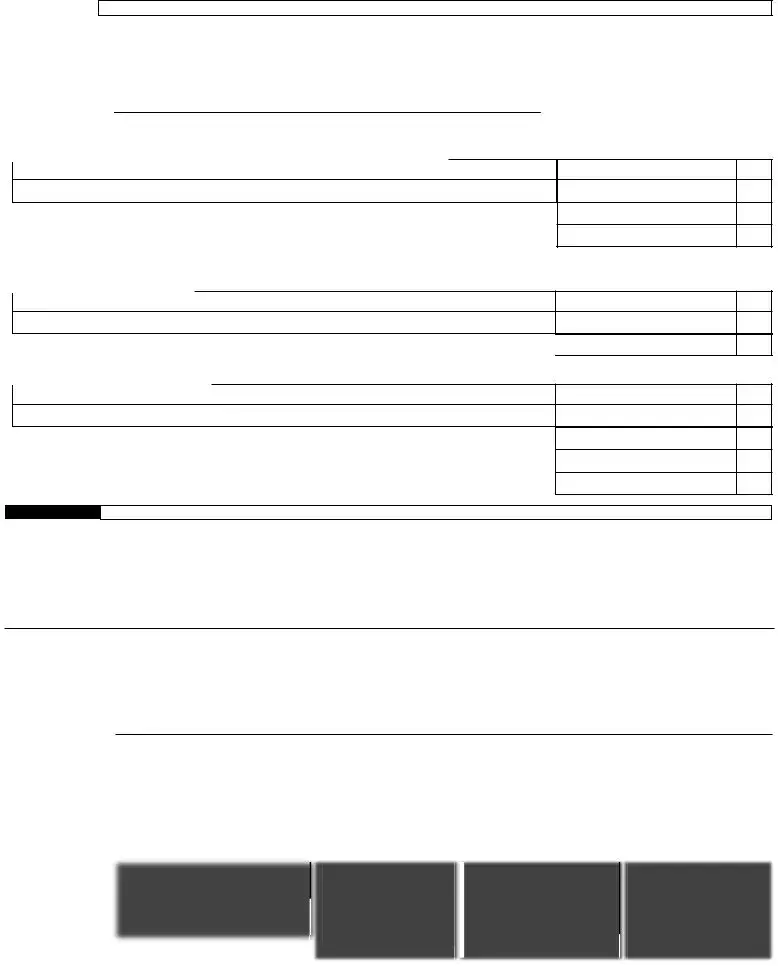

Calculation Of Unincorporated |

|

COLUMN A |

|

COLUMN B |

|

|

|

COLUMN C |

||

|

Business Tax - See Instructions. |

|

Original Amount |

|

Net Change |

|

|

|

Correct |

||

|

|

as last adjusted |

|

From Page 2, ScheduleA |

|

|

|

Amount |

|||

|

|

|

|

|

|

|

|

|

|

|

|

1. |

Total income |

|

|

|

|

|

|

1. |

|

|

|

2. |

Taxable income |

2. |

|

|

|

|

|

|

2. |

|

|

3. |

Tax |

3. |

|

|

|

|

|

|

3. |

|

|

4. |

Business tax credit |

4. |

|

|

|

|

|

|

4. |

|

|

5. |

Line 3 less line 4 |

5. |

|

|

|

|

|

|

5. |

|

|

6. |

UBT paid credit |

6. |

|

|

|

|

|

|

6. |

|

|

7. |

Line 5 less line 6 |

7. |

|

|

|

|

|

|

7. |

|

|

8. |

Other credits |

8. |

|

|

|

|

|

|

8. |

|

|

9. |

Net tax (line 7 less line 8) |

9. |

|

|

|

|

|

|

9. |

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

SUMMARY |

|

COLUMN D |

|

|

|

COLUMN E |

||||

|

|

Additional Tax Due |

|

|

|

Refund Due |

|||||

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|||

10. If amount in column C, line 9 is greater than amount in column A, enter |

|

|

|

|

|

|

|

|

|||

|

difference in column D (see instructions for treatment of prior NYC adjustments) |

10. |

|

|

|

|

|

|

|

||

11. |

If amount in column C, line 9 is less than amount in column A, enter |

|

|

|

|

11. |

|

|

|

||

|

difference in column E (see instructions for treatment of prior NYC adjustments) |

11. |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

||||

12. |

Interest (see instructions) |

|

12. |

|

|

|

|

|

|

|

|

13. |

Additional charges (see instructions) |

|

13. |

|

|

|

|

|

|

|

|

14. |

Total amount due(add lines 10, 12 and 13) |

|

14. |

|

|

|

|

|

|

|

|

15. |

Refund due(enter amount from line 11 above) |

|

|

|

|

|

15. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CERTIFICATION

t |

|

SIGN |

HERE |

|

|

|

t |

PREPARER'S |

USE ONLY |

|

|

Iherebycertifythatthisreturn,includinganyaccompanyingrider,is,tothebestofmyknowledgeandbelief,true,correctandcomplete. |

Firm's EmailAddress: |

||||||||||||||||||

IauthorizetheDept.ofFinancetodiscussthisreturnwiththepreparerlistedbelow.(seeinstructions)....YES n |

_________________________________________ |

||||||||||||||||||

Signature of taxpayer: |

|

Title: |

|

Date: |

|

|

Preparer'sSocialSecurityNumberorPTIN |

||||||||||||

|

|

|

|

||||||||||||||||

Preparer's |

|

Preparer’s |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

signature: |

|

printed name: |

|

Date: |

|

|

Firm's Employer Identification Number |

||||||||||||

|

|

|

|

Check if self- n |

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

employed |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Firm's name |

s Address |

s Zip Code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

60111591

Form |

Page 2 |

SCHEDULEA

Explanation of Federal and/or New York StateAdjustments (if additional space is needed, attach schedule)

1. |

Items increasing profit (or decreasing loss) from business or profession (federal Schedule C) or |

COLUMN F |

|

|

partnership income (federal Form 1065 or Form |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2. |

Total increases |

|

|

3.Items decreasing profit (or increasing loss) from business or profession (federal Schedule C) or partnership income (federal Form 1065 or Form

4.Total decreases

5.Net (federal/New York State) adjustments (combine lines 2 and 4)

NEW YORK CITY CHANGESAFFECTING (Federal/New York State)ADJUSTMENTS LISTEDABOVE

6.Additions (see instructions) t

7. Total additions

8.Subtractions (see instructions) t

9.Total subtractions

10.Net New York City changes (combine lines 7 and 9)

11.Net reportable changes (transfer amount to page 1, column B, line 1)

SCHEDULE B

Computation of Business Tax Credit - page 1, line 4, column C (check one)

nBusiness Tax Credit for 1996

1.If the tax on page 1, line 3, Column C is $800 or less, your credit on line 4 is the entire amount of tax on page 1, line 3, Column C.

2.If the tax on page 1, line 3, Column C is $1,000 or over, no credit is allowed. Enter “0” on page 1, line 4, Column C.

3.If the tax on page 1, line 3, Column C is over $800 but less than $1,000, your credit is computed by the following formula:

tax on page 1, line 3, Column C X ( |

$1,000 minus tax on page 1, line 3, Column C ) |

= |

___________ |

|

$200 |

|

(your credit) |

nBusiness Tax Credit for 1997 through 2008

1.Ifthetaxonpage1,line3,ColumnCis$1,800orless,yourcreditonline4istheentireamountoftaxonpage1,line3,ColumnC.

2.If the tax on page 1, line 3, Column C is $3,200 or over, no credit is allowed. Enter “0” on page 1, line 4, Column C.

3.If the tax on page 1, line 3, Column C is over $1,800 but less than $3,200, your credit is computed by the following formula:

tax on page 1, line 3, Column C X ( $3,200 minus tax on page 1, line 3, Column C ) |

= |

___________ |

$1,400 |

|

(your credit) |

*60121591*

nBusiness Tax Credit for 2009 and Later

1.Iftheamountonpage1,line3,ColumnCis$3,400orless,yourcreditonline4istheentireamountoftaxonpage1,line3,ColumnC.

2.If the amount on page 1, line 3, Column C is $5,400 or over, no credit is allowed. Enter “0” on page 1, line 4, Column C.

3.If the amount on page 1, line 3, Column C is over $3,400 but less than $5,400, your credit is computed by the following formula:

|

tax on page 1, line 3, Column C X ( $5,400 minus tax on page 1, line 3, Column C ) = ___________ |

||||||||

|

|

|

$2,000 |

|

|

(your credit) |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MAILING INSTRUCTIONS |

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Attachcopiesoffederaland/orNewYorkStatechangesandexplanationofitems. |

|

ALLRETURNSEXCEPTREFUNDRETURNS |

|

|

REMITTANCES |

|

RETURNSCLAIMINGREFUNDS |

|

|

Makeremittancepayabletotheorderof NYCDEPARTMENTOFFINANCE |

|

NYC DEPARTMENT OF FINANCE |

|

|

|

NYC DEPARTMENT OF FINANCE |

||

|

PaymentmustbemadeinU.S.dollars,drawnonaU.S.bank. |

|

P.O. BOX 5564 |

|

|

AT NYC.GOV/ESERVICES |

|

P.O. BOX 5563 |

|

|

Toreceivepropercredit,youmustenteryourcorrectEmployerIdentification |

|

BINGHAMTON, NY |

|

|

OR |

|

BINGHAMTON, NY |

|

|

|

|

|

Mail Payment and Form |

|

||||

|

Numberand/orSocialSecurityNumberonyourtaxreturnandremittance. |

|

|

|

|

NYC DEPARTMENT OF FINANCE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

P.O. BOX 3646 |

|

|

|

|

|

|

|

|

|

|

|

|

|

60121591 |

|

|

|

|

|

NEW YORK, NY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Form |

Page 3 |

|

|

IMPORTANT INFORMATION CONCERNING FORM

Payments may be made on the NYC Department of Finance website at nyc.gov/eservices, or via check or money order. If payingwithcheckormoneyorder,donotincludethesepaymentswithyourNewYorkCityreturn.Checksandmoneyorders

GENERAL INFORMATION

(Pursuant to Title 11, Chapter 5 of theAdministrative Code of the City of NewYork)

FortaxableyearsbeginningpriortoJanuary1,2015.

This form is to be used by unincorporated businesses for reporting adjust- mentsintaxableincomeresultingfromanInternalRevenueServiceauditof yourfederalincometaxreturn,and/orNewYorkStateDepartmentofTaxa- tion and Finance audit of your NewYork State income tax return and must be filed within 90 days after a final determinationor as required by the De- partmentofFinance. Itmustbeaccompaniedbytheamountofadditionaltax due. ExplainfederalorNewYorkStateadjustmentsindetailonScheduleA of this form and attach an exact copy of the entire report of federal and/or NewYorkStatefindings. Ifyoudisagreewiththeresultsofafinaldetermi- nationinafederalorStateaudit,completetheformshowingtheamountfrom column 1incolumn3,and attach a schedule showingthe additional tax(or refund)duereportingthechangesinaccordancewiththefinaldetermination andattachastatementexplainingwhyyoubelievetheadjustmentsareerro- neous. Ifnosuchstatementisattached,theamountoftheNewYorkCitytax resultingfromthefederalorStatedeterminationreportedonthisformasdue willbedeemedassessedonthedatethisformisfiled. Thisformistobefiled separately.Donotattachittoanytaxreturn.

Thisformisrequiredifthetaxpayerexecutesawaiverofrestrictions on assessments as provided in IRC section 6213(d) or NYS Tax Law section681(f).

AnamendedNewYorkCityreturnmustbefiledwithin90daysafter filinganamendedfederalorNewYorkStatereturn.

NOTE:

FortaxyearsbeginningonorafterJanuary1,2012,alltaxpayersmust allocateunincorporatedbusinesstaxableincomeusingformulaalloca- tion.Tax year2011 is the last taxable yearin which eligible taxpayers

ChangestotheUnincorporatedBusinessTaxineffectfortaxyearsbe- ginning on or after January 1, 2009, include: single factor allocation

For information regarding depreciation deductions for “qualified property,” “qualified New York Liberty Zone property,” “qualified New York Liberty Zone leasehold improvements” and "qualified ResurgenceZoneproperty"placedinserviceafterSeptember10,2001,

Forinformationregardingdepreciationdeductionsforpropertyplaced in service outside New York after 1984 and before 1994, see Finance

PreparerAuthorization: IfyouwanttoallowtheDepartmentofFinance todiscussyourreturnwiththepaidpreparerwhosignedit,youmustcheck the"yes"boxinthesignatureareaofthereturn.Thisauthorizationapplies onlytotheindividualwhosesignatureappearsinthe"Preparer'sUseOnly" section of your return. It does not apply to the firm, if any, shown in that section. Bycheckingthe"Yes"box,youareauthorizingtheDepartmentof Finance to call the preparer to answer any questions that may arise during theprocessingofyourreturn. Also,youareauthorizingthepreparer to:

lGive the Department any information missing from your return,

lCalltheDepartmentforinformationabouttheprocessingofyourre- turn or the status of your refund or payment(s), and

lRespondtocertainnoticesthatyouhavesharedwiththepreparer about math errors, offsets, and return preparation. The notices will notbe sent to the preparer.

You are not authorizing the preparer to receive any refund check, bind you to anything (including any additional tax liability), or otherwise rep- resent you before the Department. The authorization cannot be revoked, however, the authorization will automatically expireno laterthan the due date(withoutregardtoanyextensions)forfilingnextyear'sreturn. Fail- uretochecktheboxwillbedeemedadenialofauthority.

SPECIFIC INSTRUCTIONS

CALCULATION OFTAX

In ColumnAenter amounts from the latest NewYork City report or final New York City Department of Finance adjustment prior to the filing of this return. If you filed an amended return or if the amounts shown on your original return were changed pursuant to a final Department of Fi- nance adjustment, attach documentation reflecting the New York City changes and a schedule showing your calculations.

If you originally filed Form

LINE1

IncolumnAenterthesumoftheamountofthetotalbusinessincomeyou reported on line 1, ScheduleA, Form

In column B enter the net reportable changes from line 11 of ScheduleA on page 2 of this form.

In column C add or subtract the amount in column B from columnA.

LINE2

IncolumnAentertheamountoftaxableincomeyoureportedonline16of

LINES3through8

In column A enter the amount reported on the corresponding lines of Schedule A, Form

Form |

Page 4 |

|

|

nallyfiledorpreviouslyadjusted. IncolumnCrecalculatethoseamounts |

||

and enter appropriate amounts. For line 4, compute the revised business |

Theamountenteredonline5(columnF)shouldbethenetadjustmentsmade |

|

tax credit by completing Schedule B on page 2 of this form. |

by a federal or New York State audit before taking into consideration any |

|

NewYorkCitychangesapplicablethereto.Notethatarecomputationorre- |

||

visionofyourfederalorNewYorkStatereturnincreasingnetprofit(orloss) |

||

Interest on the additional tax due, entered in column D, line 10, is com- |

||

fromabusinessorprofessionorpartnershipincomereportedthereon,which |

||

puted from the due date of the original tax return to the date paid. Leave |

resultsinareductionofanoverpaymentorrefundclaimed,mustbereported |

|

columnD,line12blankiftheamountofinterestcomputedislessthan$1. |

on this form even though you receive a refund or overpayment credit fol- |

|

Theapplicableprescribedinterestrateorratesareavailablefromtheinter- |

||

estratetablesetforthontheDepartmentofFinance’sinternetwebsiteat: |

|

Fortherateofinterestonoverpayments,forarateofinterestnotshownontheweb- |

IfanyfederalorNewYork StateitemreportedincolumnFissubjecttoa |

||

modificationincreasingordecreasingthatitemforNewYorkCitytaxpur- |

|||

site and for interest calculations, call 311. If calling from outside of the five NYC |

poses pursuant to Section |

||

boroughs, please call |

|||

of NewYork, show the details and enter the NewYork City net change at |

|||

|

|

||

line 10. If a NewYork City business allocation percentage or investment |

|||

a) |

Alate filing penalty is assessed if you fail to file this form when |

allocation percentage is utilized, submit allocation schedule. |

|

|

due,unlessthefailureisduetoreasonablecause. Foreverymonth |

||

|

or partial month that this form is late, add to the tax (less any pay- |

||

|

ments made on or before the due date) 5%, up to a total of 25%. |

||

b) |

If this form is filed more than 60 days late, the above late filing |

ACCESSING NYC TAX FORMS |

|

|

penaltycannotbelessthanthelesserof(1)$100or(2)100%ofthe |

By Computer - Download forms from the Finance website at: |

|

|

amountrequiredtobeshownontheform(lessanypaymentsmade |

nyc.gov/finance |

|

|

by the due date or credits claimed on the return). |

||

|

|

||

c) |

Alatepaymentpenaltyisassessedifyoufailtopaythetaxshownon |

By Phone - call 311. If calling from outside of the five NYC boroughs, |

|

|

thisformbytheprescribedfilingdate,unlessthefailureisduetorea- |

please call |

|

|

sonablecause. Foreverymonthorpartialmonththatyourpaymentis |

Mail all returns, except refund returns: |

|

|

late,addtothetax(lessanypaymentsmade)1/2%,uptoatotalof25%. |

||

d) |

ThetotaloftheadditionalchargesinAandCmaynotexceed5%for |

NYCDepartmentofFinance |

|

|

any one month, except as provided for in B. |

P.O.Box5564 |

|

Ifyouclaimnottobeliablefortheseadditionalcharges,attachastatement |

|||

to your return explaining the delay in filing, payment or both. |

|||

|

|

||

or Mail payment and Form |

|||

|

|||

Where the federal or New York State change in business income would |

NYCDepartmentofFinance |

||

P.O.Box3646 |

|||

vided it is accompanied by a complete copy of the federal and/or New |

NewYork,NY |

||

York StateAudit Report or Statement ofAdjustment. |

|

||

EffectivefortaxableyearsbeginningonorafterJanuary1,1989,ifthisre- |

Returns claiming refunds: |

||

portisnotfiledwithin90daysafterthenoticeofthefinalfederal(orNew |

NYCDepartmentofFinance |

||

YorkState)determination,nointerestshallbepaidontheresultingrefund. |

|||

|

|

P.O.Box5563 |

|

SCHEDULEA |

|||

LINES1THROUGH4 |

|

||

PRIVACYACTNOTIFICATION |

|||

TheFederalPrivacyActof1974,asamended,requiresagenciesrequestingSocialSecurityNumbers |

|||

|

This is the amount of federal gross income from federal Schedule C, |

toinformindividualsfromwhomtheyseekthisinformationwhethercompliancewiththerequestis |

|

|

Form1040,lessdeductions. Therefore,anyfederalorNewYorkState |

voluntaryormandatory,whytherequestisbeingmade,andhowtheinformationwillbeused. Thedis- |

|

|

adjustmentaffectingnetprofit(orloss)fromabusinessorprofession |

||

|

mustbereportedonthisform,eventhoughthebusinessisnotsubject |

theAdministrativeCodeoftheCityofNewYork. Suchnumbersdisclosedonanyreportorreturnare |

|

|

requestedfortaxadministrationpurposesandwillbeusedtofacilitatetheprocessingoftaxreturnsand |

||

|

to federal or state tax. For example, the disallowance of a deduction |

toestablishandmaintainauniformsystemforidentifyingtaxpayerswhoareormaybesubjecttotaxes |

|

|

increasesnetprofitfromabusinessorprofessionandtheallowanceof |

administeredandcollectedbytheDepartmentofFinance,and,asmayberequiredbylaw,orwhenthe |

|

|

an additional deduction not claimed on the original return decreases |

taxpayer gives written authorization to the Department of Finance for another department, person, |

|

|

agencyorentitytohaveaccess(limitedorotherwise)totheinformationcontainedinhisorherreturn. |

||

|

net profit from a business or profession. |

|

|

AnyfederalorNewYorkStateadjustmentsmadetoitemsofincome, gain,lossordeductionaffectingpartnershipincomefromfederalForm 1065 or

Any Federal or NewYork State adjustments made to items of invest- mentincomeorlossoftheunincorporatedbusinessalsoshouldbere- ported here.

File Overview

| Fact | Detail |

|---|---|

| Official Name | NYC-115 Unincorporated Business Tax Report of Change in Taxable Income |

| Purpose | To report adjustments in taxable income due to audits by the IRS and/or New York State Department of Taxation and Finance |

| Applicability | For taxable years beginning prior to January 1, 2015 |

| Filing Deadline | Within 90 days after a final determination |

| Governing Law | Title 11, Chapter 5 of the Administrative Code of the City of New York |

| Eligible Entities | Unincorporated businesses, including partnerships, estates, and trusts |

| Amended Return Requirement | An amended NYC return must be filed within 90 days after filing an amended federal or New York State return. |

| Payment Options | Payments can be made online on the NYC Department of Finance website, or via check or money order accompanied by payment voucher form NYC-200V. |

| Attachment Requirements | Attach copies of federal and/or New York State changes and explanation of items." |

| Business Tax Credit Calculation | Schedule B of the form provides instructions for calculating the business tax credit based on the tax amount. |

Nyc 115: Usage Guidelines

When it comes to amending your Unincorporated Business Tax due to revisions made by the Internal Revenue Service and/or New York State Department of Taxation and Finance, completing Form NYC-115 is a necessary step. This form is specifically designed for taxable years beginning before January 1, 2015, and it requires prompt attention once a final determination on income adjustments has been made. Missteps or delays in submitting this form could introduce complications or potential penalties, underlining the importance of meticulous compliance. The form itself might seem daunting at first glance, but by breaking down the process into manageable steps, filers can navigate through it more effectively. Ensuring accuracy and completeness in filling out Form NYC-115 not only facilitates smoother interactions with tax authorities but also aligns with one’s legal obligations.

- Complete the "FOR CALENDAR YEAR" or "FISCAL YEAR beginning and ending" section at the top of the form with the appropriate dates.

- Fill in the taxpayer's name, address (including city, state, zip code, and country if outside the US), telephone number, and email address under the Name and Address sections.

- If applicable, provide the Social Security Number or, for PARTNERSHIPS, ESTATES AND TRUSTS, enter the Employer Identification Number.

- For those reporting a change as a member of a partnership, complete section "A" with the member's name and the partnership's Employer Identification Number (EIN).

- Enter the date of Final Determination for both Federal and New York State changes, if applicable.

- Under "Payment Amount Calculation Of Unincorporated Business Tax", record the Original Amount, Net Change, and Correct as Last Adjusted amounts for Total income, Taxable income, Tax, Business tax credit, UBT paid credit, and Other credits as instructed.

- In the SUMMARY section, calculate any Additional Tax Due or Refund Due and record the amounts in the respective columns.

- Fill out the Interest and Additional charges sections as per the instruction guidelines provided within the form.

- On Schedule A, provide a detailed explanation of the Federal and/or New York State Adjustments. This section requires you to outline items that have increased or decreased profit or loss from business, as well as the total increases and decreases.

- For Schedule B, calculate the Business Tax Credit, adhering to the specific guidelines for the year your tax credit applies to.

- Ensure correct computation of the total amount due or refund due, taking into account any additional charges or interests.

- Before signing the form, review all entries for accuracy. The taxpayer must sign and date the form, and if prepared by someone other than the taxpayer, the preparer's details must also be filled out.

Remember, each section of the form comes with instructions specific to the information required. It is crucial to read these instructions carefully to ensure that the form is completed accurately. If you encounter complex adjustments or are unsure about certain sections, seeking advice from a tax professional can be invaluable. With careful attention to detail and a systematic approach, completing Form NYC-115 can be a straightforward process that ultimately ensures compliance with tax adjustment reporting requirements.

FAQ

What is the purpose of Form NYC-115?

Form NYC-115 is used by unincorporated businesses to report adjustments in taxable income resulting from audits by the Internal Revenue Service (IRS) or the New York State Department of Taxation and Finance. These adjustments may pertain to taxable years beginning prior to January 1, 2015. The form must be filed within 90 days following a final determination of the audit.

Who needs to file Form NYC-115?

Any unincorporated business, which includes sole proprietors, partnerships, estates, and trusts, that has had changes to its taxable income as a result of federal or New York State audits must file Form NYC-115. This is necessary to report and reconcile these changes with New York City's Department of Finance.

What information is required on Form NYC-115?

To complete Form NYC-115, you'll need to provide detailed business identification information, including the name, address, telephone number, taxpayer’s email address, social security number or employer identification number, and the specific period covered by the tax year. Additionally, details about the changes made by the IRS or New York State Department of Taxation and Finance, including the date of final determination and the specifics of the adjustments, are required. A clear explanation of federal and/or New York State adjustments on Schedule A and the calculation of the corrected unincorporated business tax must be provided as well.

What happens if I don't file Form NYC-115 within the 90-day period?

If Form NYC-115 is not filed within the specified 90-day period after receiving the final determination from an audit, the taxpayer may face penalties, interest, and additional charges. The failure to timely report these adjustments can also result in inaccurate tax liabilities being assessed against the business.

How can I submit Form NYC-115 and the payment for any additional tax due?

Form NYC-115 can be mailed to the appropriate address as indicated in the form's instructions. If there is additional tax due as a result of the adjustments, payment can be made online through the NYC Department of Finance website or by including a check or money order with the mailed form. It's crucial to use Form NYC-200V when making a payment to ensure it is correctly processed. Ensure all payments are made in U.S. dollars and drawn on a U.S. bank.

Common mistakes

When individuals and businesses complete the NYC-115 form, errors can occur that may lead to potential delays, misunderstandings with tax authorities, or even penalties. The NYC-115 form is essential for reporting changes in taxable income as determined by the Internal Revenue Service (IRS) and/or New York State Department of Taxation and Finance for unincorporated businesses for tax years beginning prior to January 1, 2015. Avoiding common pitfalls can streamline the process and ensure accurate reporting.

Among the most prevalent mistakes are:

- Not filing within the required 90-day window after receiving a final determination from the IRS or New York State Department of Taxation and Finance. This timeframe is crucial for compliance and to avoid potential penalties.

- Incorrectly filling out personal and business information, such as the taxpayer’s name, address, social security number, and Employer Identification Number (EIN). Accurate identification is vital for proper processing and record-keeping.

- Failing to report the final determination date correctly, whether it pertains to federal or New York State adjustments. This date is critical for establishing the timeline for compliance.

- Errors in the Calculation of Unincorporated Business Tax section, which can lead to an incorrect assessment of taxes owed or refund due. It's essential to thoroughly understand the calculation instructions provided in the form.

- Omitting payment information or inaccurately calculating the amount due. This could result in underpayment penalties or delays in processing.

- Not attaching required documents, such as copies of federal and/or New York State changes and the explanation of items. These documents are necessary for verifying the adjustments being reported.

- Incorrectly or incompletely filling out Schedules A and B, which detail federal and New York State adjustments and the computation of business tax credit, respectively. Each schedule must be accurately completed to reflect the changes in taxable income and applicable credits.

- Failure to sign the certification section or to authorize the Department of Finance to discuss the return with the preparer, if applicable. This authorization is important for resolving any issues that may arise during processing.

Avoiding these errors requires careful attention to detail and a thorough understanding of tax obligations. Taxpayers should consider consulting with a professional if they have questions or concerns about filling out the NYC-115 form correctly. Doing so can help ensure compliance with tax laws and minimize the risk of errors that could lead to penalties or additional charges.

Documents used along the form

When filing the NYC-115 Form, an Unincorporated Business Tax Report of Change in Taxable Income, individuals and businesses often need to accompany it with other pertinent documents and forms. Understanding these documents is crucial for compliance and ensuring accurate reporting of any changes in taxable income as identified by the Internal Revenue Service and/or New York State Department of Taxation and Finance. Below is an overview of forms and documents typically associated with the NYC-115 Form.

- Federal or New York State Audit Report or Statement of Adjustment: This document outlines the findings from audits conducted by the IRS or the New York State Department of Taxation and Finance, detailing adjustments made to previously filed tax returns.

- Form NYC-202 (Unincorporated Business Tax Return): Required for unincorporated businesses filing an annual tax return in New York City, providing details on income, deductions, and taxes due.

- Form NYC-200V (Payment Voucher): Used for making payments towards outstanding tax liabilities, accompanying the NYC-115 form if there's an additional tax due.

- Schedule A (Adjustment Detail): A supplementary schedule for the NYC-115, detailing the specifics of federal and/or New York State adjustments affecting profit or loss from business or profession.

- Form 1065 or Form 1065-B: For partnerships, these forms report the income, deductions, gains, losses, etc., of the business. They are necessary when the NYC-115 form is filed by a member of a partnership to adjust their share of partnership income based on audited changes.

- Form 1040 Schedule C: Sole proprietors must include this with their NYC-115 Form if adjustments are made to their profit or loss from business as a result of an IRS or New York State audit.

Each of these documents plays a specific role in ensuring that the NYC-115 Form is filled out thoroughly and accurately. They help provide a comprehensive picture of the financial adjustments needed and ensure that businesses and individuals report their taxes correctly. Working with these documents can be complex, so seeking professional advice or assistance may be beneficial to navigate the intricacies of tax reporting and compliance.

Similar forms

The NYC 115 form, designed for reporting changes in taxable income due to audits by the IRS or the New York State Department of Taxation and Finance, has similarities with other tax documents that cater to reporting adjustments or amendments in previously filed tax returns. One such document is the IRS Form 1040X, the Amended U.S. Individual Income Tax Return. This form is used by individuals to correct previously filed Form 1040, 1040-A, or 1040-EZ. Similar to the NYC 115 form, Form 1040X requires a detailed explanation of the adjustments being made and the impact on taxable income, demonstrating the process of revising previously reported tax information.

Another comparable document is the IRS Form 1120X, the Amended U.S. Corporation Income Tax Return. This form serves corporations needing to amend their previously filed Form 1120 series. Like the NYC 115 form, it requires corporations to provide specific details about the nature of the adjustments, the reason for each amendment, and the resulting tax implications. The resemblance lies in the structured approach to amending reported taxable income and tax liabilities.

Additionally, the Form 1065X, Amended Return or Administrative Adjustment Request (AAR) for Adjusted Partnership Returns, mirrors the NYC 115's functionality for partnerships. It is used when changes need to be made to a previously filed Form 1065, U.S. Return of Partnership Income. Form 1065X, like the NYC 115 form, allows partnerships to communicate adjustments to their income, deductions, and credits, ensuring accurate tax responsibilities are met. This demonstrates the process of rectifying previously reported financial data to reflect accurate taxable earnings and deductions.

State-level forms similar to the NYC 115 include the California Form 540X, Amended Individual Income Tax Return. This form is designed for individuals to amend their state income tax returns. The parallel between Form 540X and the NYC 115 lies in the process of detailing adjustments to income or deductions, precisely the necessity to outline the basis for the amendments and the consequent tax implications, focusing on ensuring state tax compliance through the provision of corrected information.

Another example is the New Jersey Form A-1, the Resident Decedent Estate or Trust Declaration of Estimated Tax. While not an amendment form per se, it shares a relation with the NYC 115 form in the sense that it deals with the reporting and adjusting of taxable income for estates or trusts within a specific tax jurisdiction. The linking factor is the adjustment to previously estimated or reported income, underlining the importance of accurate tax reporting in varying contexts.

Lastly, the Texas Amended Franchise Tax Report parallels the NYC 115 form in purpose for businesses within the state. Similar to the NYC 115, it provides entities the opportunity to correct or update previously submitted tax reports. This form, akin to the NYC 115, underscores the necessity for detailed explanations of amendments, showcasing the role of corrective filings in maintaining tax accuracy.

Each of these documents, while catering to different taxpayers – individuals, corporations, partnerships, estates, and trusts – share a common purpose with the NYC 115 form. They facilitate the rectification process of previously reported tax information, ensuring the accuracy and integrity of tax filings through detailed amendments and adjustments. This reinforces the fundamental concept of compliance and the continuous obligation taxpayers have to report accurate financial data to tax authorities.

Dos and Don'ts

When preparing the NYC 115 Form, an Unincorporated Business Tax Report of Change in Taxable Income Made by Internal Revenue Service and/or New York State Department of Taxation and Finance, it's crucial to approach the task with attention to detail and an understanding of the requirements. Here are nine essential dos and don'ts to guide you through the process:

- Do ensure that the form is filed within 90 days after receiving a final determination from either the IRS or New York State Department of Taxation and Finance.

- Don't wait to gather all necessary documents, including a copy of the final determination and any related adjustments.

- Do carefully read all instructions provided with the Form NYC-115 to avoid common mistakes.

- Don't omit any portion of your address or contact information; complete details are crucial for proper processing.

- Do double-check your Social Security Number (SSN) or Employer Identification Number (EIN), as applicable. Incorrect numbers can lead to processing delays or misfiled information.

- Don't guess on dates or amounts. If you're uncertain, refer back to your original tax documents or consult a tax professional.

- Do attach detailed explanations for any federal or New York State adjustments as required in Schedule A of the form.

- Don't forget to sign and date the form. An unsigned form is considered incomplete and will not be processed.

- Do keep a copy for your records. Having a copy can be incredibly helpful in case there are any questions or discrepancies in the future.

Following these guidelines will help ensure that the process of filling out the NYC 115 form goes as smoothly as possible, mitigating the risks of errors or delays. Remember, accuracy and thoroughness are paramount when dealing with tax-related documents.

Misconceptions

When it comes to understanding the NYC-115 form, it's easy to encounter misconceptions. This document is crucial for reporting changes in taxable income following audits by the Internal Revenue Service (IRS) or the New York State Department of Taxation and Finance for unincorporated businesses. Here, we clarify seven common misunderstandings:

- Misconception 1: The NYC-115 form is only for big businesses. In reality, any unincorporated business, regardless of its size, must file the NYC-115 form if there are adjustments to its taxable income as a result of federal or state audits.

- Misconception 2: Filing the NYC-115 form is optional after an audit. It is mandatory to file the NYC-115 within 90 days after a final determination by the IRS or the New York State Department of Taxation and Finance to ensure compliance and correct tax assessment.

- Misconception 3: Only negative adjustments need to be reported. Both increases and decreases in taxable income resulting from audits need to be reported. This is critical for ensuring that your business pays the correct amount of taxes or receives the appropriate refund.

- Misconception 4: The form is too complicated for non-accountants to complete. While the NYC-115 form can appear complex, its instructions are designed to guide taxpayers through the process. Additionally, professional tax preparers or accountants can assist in its completion.

- Misconception 5: Adjustments reported on the NYC-115 form don't impact future tax filings. Adjustments made and reported on this form may affect future tax liabilities or refunds, making accurate reporting crucial for long-term tax planning and compliance.

- Misconception 6: There's no need to attach documentation of the audit findings. It's essential to attach a complete copy of the audit report or statement of adjustments from the IRS or New York State. This documentation supports the changes reported and ensures proper adjustment.

- Misconception 7: The form does not accept electronic submissions. While many taxpayers may assume paper filing is the only option, the NYC Department of Finance provides avenues for electronic submissions, offering a more convenient and faster processing option.

Understanding these common misconceptions about the NYC-115 form can help ensure that unincorporated businesses remain compliant with their tax obligations, accurately report adjustments to their taxable income, and utilize the form's provisions efficiently.

Key takeaways

Understanding the nuances of filling out the NYC 115 form can be pivotal for unincorporated businesses navigating post-audit adjustments. Here are key takeaways to ensure accuracy and compliance:

- Timeliness is crucial: The form must be filed within 90 days following a final determination from an Internal Revenue Service or New York State Department of Taxation and Finance audit.

- Accuracy in details: It's essential to provide detailed information regarding any changes in taxable income as a result of the audits. This includes reporting adjustments to income, deductions, and credits.

- Payment accompanying the form: If additional tax is due as a result of the audit adjustments, the correct amount must be submitted with the NYC 115 form.

- Documentation is key: Attach a complete and accurate copy of the audit report or statement of adjustment from the IRS or New York State to the NYC 115 form.

- Amended returns: If you have already filed an amended return for the federal or New York State adjustments, the NYC 115 form must be filed within 90 days of that amended return filing.

- Understanding business tax credits: Any recalculations of business tax credits as a result of audit adjustments must be accurately reflected in the form, which may also impact the amount of additional tax due or refund claimed.

Completing the NYC 115 form accurately and promptly, following an audit, ensures that unincorporated businesses meet their tax obligations without incurring unnecessary penalties. Attention to detail and thorough documentation are the cornerstones of a smooth submission process.

Common PDF Documents

Ny 45 - Provides a mechanism for reconciling previous quarters' contributions and withholding amounts.

Ny Biennial Statement File Online - Instructions for foreign professional service LLCs on changing company names and filing under Section 1306.

Nys Sales Tax Registration - It includes sections for the corporation’s name, purpose, location within New York State, stock details, and the designation of the Secretary of State as the agent for service of process.