Free Nyc 1127 Form in PDF

Understanding the nuances of the NYC 1127 form can seem like a daunting task, but it plays a crucial role for nonresident employees of the City of New York hired on or after January 4, 1973. At its core, this form is designed to ensure these employees meet their tax obligations under Section 1127 of the New York City Charter. Essentially, it addresses the requirement for such employees to pay the difference—if any—between the city personal income tax they would pay as residents and any city tax liability reported on their state tax return. Key components include details about the employee and spouse (if applicable), employment information, filing status, and calculation of 1127 liability based on information found in the New York State Income Tax Return. In addition, it provides instructions for computing taxes owed or refunds due, taking into account various credits and deductions like the NYC School Tax Credit or the NYC Child and Dependent Care Credit. It's not merely a form but a declaration of one's fiscal relationship with the city, reflecting personal and financial changes such as marriage, retirement, or changes in residency. Importantly, the form also includes sections for amendments, certifying the truthfulness and completeness of the return, and offers guidance for electronic payments, highlighting the city's efforts to streamline and digitize the tax filing process. Understanding the 1127 form is crucial for those it affects, ensuring they remain compliant while potentially navigating changes in their personal or professional lives that might impact their tax status.

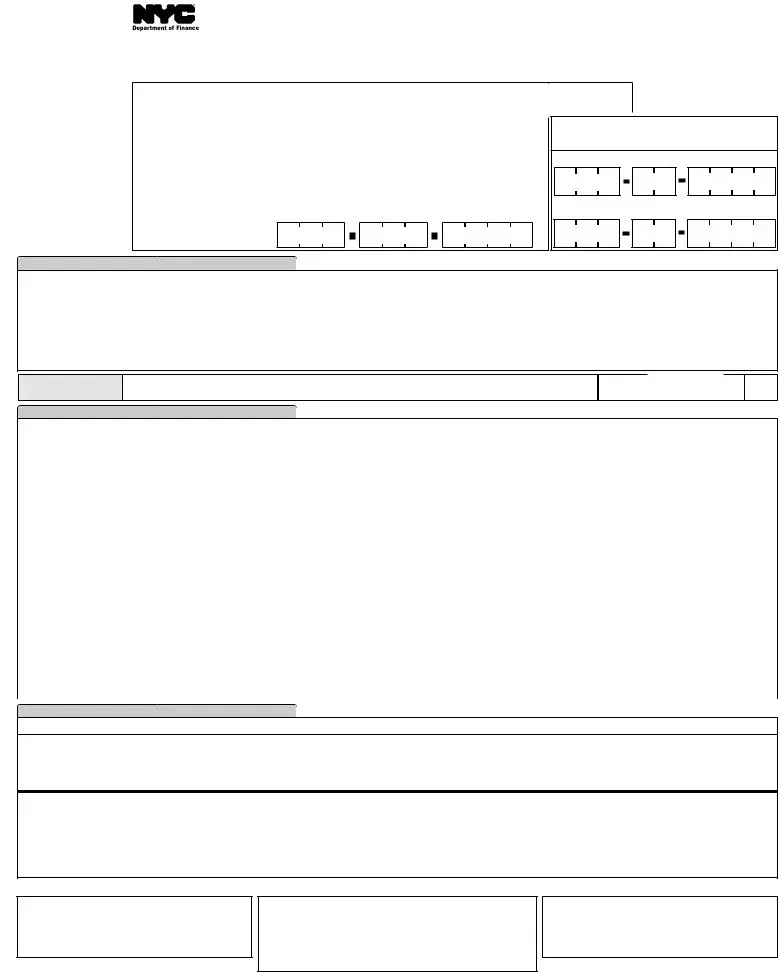

Nyc 1127 Sample

RURNRNNRDY |

HCYNYRK |

|

|

2020 |

|

HR NRAANUARY |

|

|

|

|

|

|

|

|

|

|

nn |

PRINT OR TYPE ▼ |

‑chcpecicondioncodeifppicbe( |

|

eincon |

||

|

|

|

|

|

|

*80012091*

First names and initials of employee and spouse: |

Last name: |

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

Home address (number and street): |

Apt. no.: |

|

Address |

n |

|

|||

|

|

|

|

|

|

Change |

|

|

|

|

|

|

|

|

|

|

|

City and State: |

|

|

Zip Code: |

|

Country (if not US) |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NYC Department or |

|

Employee ▼ |

|

Spouse |

▼ |

|

|

|

Agency where employed: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Daytime telephone number:

Name |

n AMENDED RETURN |

Change n |

TAXPAYER’S EMAILADDRESS

EMPLOYEE'S SOCIAL SECURITY NUMBER

SPOUSE’S SOCIAL SECURITY NUMBER

1 - FILING STATUS

A. n MARRIED FILING JOINTLY |

No If you file a joint Federal tax return but elect to |

B. n HEAD OF |

C. n SINGLE OR MARRIED |

OR SURVIVING SPOUSE |

exclude a spouse’s income, see the special computation |

HOUSEHOLD |

FILING SEPARATELY |

|

Schedule A on the back of this form and use Filing Status C. |

|

|

A. NUMBER OF MONTHS EMPLOYED IN 2020 |

EMPLOYEE: ___________________ |

SPOUSE: ___________________ |

B. DATE RETIRED FROM NYC SERVICE |

EMPLOYEE: ______ ______ ______ |

SPOUSE: ______ ______ ______ |

C. n CHECK BOX IF YOU AND YOUR SPOUSE ARE BOTH SUBJECT TO SECTION 1127. |

|

|

A.yen

......................................................................Amount being paid electronically with this return |

A. |

|

|

Payment Amount

2 - 1127 LIABILITY CALCULATION

All the information you will need to complete this 1127 form comes directly from your NYS Income Tax Return. For your convenience, we have listed where on your State tax return you can find this information depending on whether you filed a NYS Resident Income Tax Return (NYS

|

ine |

Wheedogeeon |

Aon |

||

|

|

|

|

|

|

1 |

NYS Taxable Income. |

◆ NYS |

No If you file a joint Federal tax return |

|

|

|

See instructions. |

◆ NYS |

but elect to exclude a spouse’s income, see |

|

|

|

the special computation Schedule A on the |

|

|

||

|

|

|

back of this form and use Filing Status C. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2 |

Section 1127 liability plus Other New York |

◆ Page 2 liability rate schedules |

|

||

|

City Taxes, if any. See instructions. |

◆ NYS |

|

|

|

|

|

|

|

|

|

3 |

New York City School tax and other credits |

◆ See Page 2, Schedule B and Instructions |

|

||

|

|

|

|

|

|

4 |

New York City 1127 amount withheld |

◆ Form 1127.2 |

|

|

|

|

|

|

|

|

|

5 |

Balance Due |

◆ If line 2 is greater than the sum of lines 3 and 4, |

|

||

|

|

enter balance due |

|

|

|

|

|

|

|

|

|

6 |

Refund |

◆ If line 2 is less than the sum of lines 3 and 4, enter refund |

|

||

|

|

amount (not to exceed the amount on line 4). (See instr.) |

|

||

|

|

|

|

|

|

3 - CERTIFICATION

I hereby certify that this return, including any accompanying rider, is, to the best of my knowledge and belief, true, correct and complete.

I authorize the Department of Finance to discuss this return with the preparer listed below. (see instructions) ...................................YES n

N |

_________________________________________________________ |

__________________________ |

H |

||

|

YOUR SIGNATURE |

DATE |

|

NY |

AR |

U |

_________________________________________ _____________________ |

________________ __________________________________ |

|||||

SIGNATURE OF PREPARER OTHER THAN TAXPAYER |

EIN OR SSN OR PTIN |

DATE |

PREPARER’S EMAIL ADDRESS |

|

||

_________________________________________________ |

_____________________________________________________________ |

|||||

PREPARER’S PRINTED NAME |

|

ADDRESS |

|

CITY |

STATE |

ZIP CODE |

AACHACCYURNYRKANCAXRURN |

NCUDNAHU |

●AYBDNUDARDRAWNNAUBANK |

|

|

|

ARURNRUNDRURN

NYC DEPARTMENT OF FINANCE

SECTION 1127

P.O. BOX 5564

BINGHAMTON, NY

RANC

AYNNWHRNYCVA NYCVVC

R

iyenndoNYCVNY

NYC DEPARTMENT OF FINANCE

P.O. BOX 3933

NEW YORK, NY

RURNCANRUND

NYC DEPARTMENT OF FINANCE

SECTION 1127

P.O. BOX 5563

BINGHAMTON, NY

|

|

|

|

|

|

|

|

Page 2 |

||

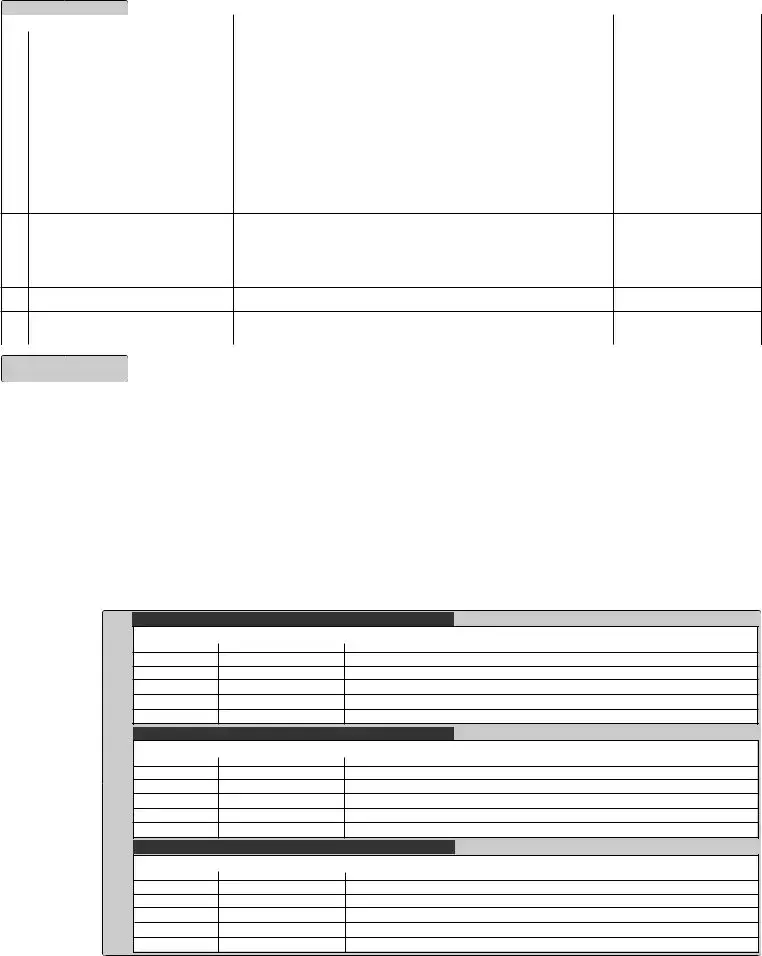

SCHEDULE A |

hedefoiediingoinyfopoend |

|

|

pyfopoe(oeinoNYCyog |

|

|

encyep oyee |

|||

|

|

ine |

|

|

|

|

|

|

|

Aon |

|

|

|

|

|

|

|

||||

1 |

NYS Adjusted Gross Income |

◆ NYS |

|

|

|

|||||

|

|

|

|

|

|

|||||

2 |

Non NYC Employee Income |

◆ Enter all income, additions and subtractions attributable to the non NYC employee |

||||||||

|

|

|

|

|

|

|

|

|

||

3 |

Net NYS Gross Income |

◆ Line 1 less Line 2 |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

4 |

Compute limitation percentage |

Line 3: |

$ |

|

|

eepoyeepo |

|

|

|

|

|

|

ndddedconnddependen |

|

|

|

|||||

|

|

|

______ |

|

|

|

|

|

||

|

|

|

Line 1: |

$ |

= _________ % |

exepononbedonn |

|

|

|

|

|

|

|

|

|

beofonepoyedbyNYC |

|

|

|

||

|

|

|

|

|

|

|

||||

5 |

Check only one box: |

n Standard Deduction: $8,000. |

|

|

|

|||||

|

|

|

R |

|

|

|

|

|

|

|

|

|

|

n Itemized deduction: $__________________ X _________ % |

= |

|

|

||||

|

|

|

(See instructions) |

|

amount from IT 201, line 34 % from line 4 |

|

|

|

||

|

|

|

|

|

|

amount from IT 203, line 33 |

|

|

|

|

6New York Dependent Exemption from

NYS return. No exemption is allowed ◆ NYS

filing separately for Section 1127 purposes, apply the limitation percentage from line 4).

7. Total Deductions and Exemptions |

◆ Line 5 + line 6 |

8.Allocated New York State

|

Taxable Income |

|

◆ Line 3 less line 7. |

Enter on Page 1, line 1. |

|

|

|

|

|

|

|

SCHEDULE B |

Nonefndbecedi |

|

|

|

|

|

|

|

|

|

|

|

ine |

|

|

Wheedogeeon |

Aon |

|

|

|

|

|

|

A1. |

NYC School Tax Credit (fixed amount) |

◆ See Instructions. |

*See below. |

|

|

|

|

|

|

|

|

A2. |

NYC School Tax Credit (rate reduction amount) |

◆ See Instructions |

|

|

|

|

|

|

|

|

|

B. |

UBT Paid Credit |

|

◆ See Instructions |

|

|

|

|

|

|

||

C. |

NYC household credit |

◆ from |

|

||

|

|

|

|

||

D. |

NYC Claim of Right Credit |

◆ from Form |

|

||

|

|

|

|

|

|

E. |

NYC Earned Income Credit |

◆ (attach |

|

|

|

|

|

|

|

|

|

F. |

Other NYC taxes |

|

◆ See Instructions |

|

|

|

|

|

|

||

G. |

NYC Child and Dependent Care Credit |

◆ See Instructions (attach |

|

||

|

|

|

|

||

H. |

Total of lines A1 - G |

◆ enter on page 1, line 3 |

|

||

|

|

|

|

|

|

*Enter income used to calculate eligibility for credit on Line A1: ____________________________

*80022091*

NEW YORK CITY 1127 LIABILITY RATES

beAiedfiingjoinyovivingpoe

If Form

VBUNV

$ |

0 |

$ |

21,600 |

$ |

21,600 |

$ |

45,000 |

$ |

45,000 |

$ |

90,000 |

$90,000

beBHedofhoehod

If Form

VBUNV

$ |

0 |

$ |

14,400 |

$ |

14,400 |

$ |

30,000 |

$ |

30,000 |

$ |

60,000 |

$60,000

beCngeoiedfiingepy

If Form

VBUNV

$ |

0 |

$ |

12,000 |

$ |

12,000 |

$ |

25,000 |

$ |

25,000 |

$ |

50,000 |

$50,000

HABY

|

|

|

3.078% |

of Form 1127, line 1 |

|

|

$ |

665 |

plus |

3.762% |

of the excess over |

$ |

21,600 |

$ |

1,545 |

plus |

3.819% |

of the excess over |

$ |

45,000 |

$ |

3,264 |

plus |

3.876% |

of the excess over |

$ |

90,000 |

|

|

|

HABY |

|

|

|

|

|

|

3.078% |

of Form 1127, line 1 |

|

|

$ |

443 |

plus |

3.762% |

of the excess over |

$ |

14,400 |

$ |

1,030 |

plus |

3.819% |

of the excess over |

$ |

30,000 |

$ |

2,176 |

plus |

3.876% |

of the excess over |

$ |

60,000 |

|

|

|

HABY |

|

|

|

|

|

|

3.078% |

of Form 1127, line 1 |

|

|

$ |

369 |

plus |

3.762% |

of the excess over |

$ |

12,000 |

$ |

858 |

plus |

3.819% |

of the excess over |

$ |

25,000 |

$ |

1,813 |

plus |

3.876% |

of the excess over |

$ |

50,000 |

NYRKCYDARNANC |

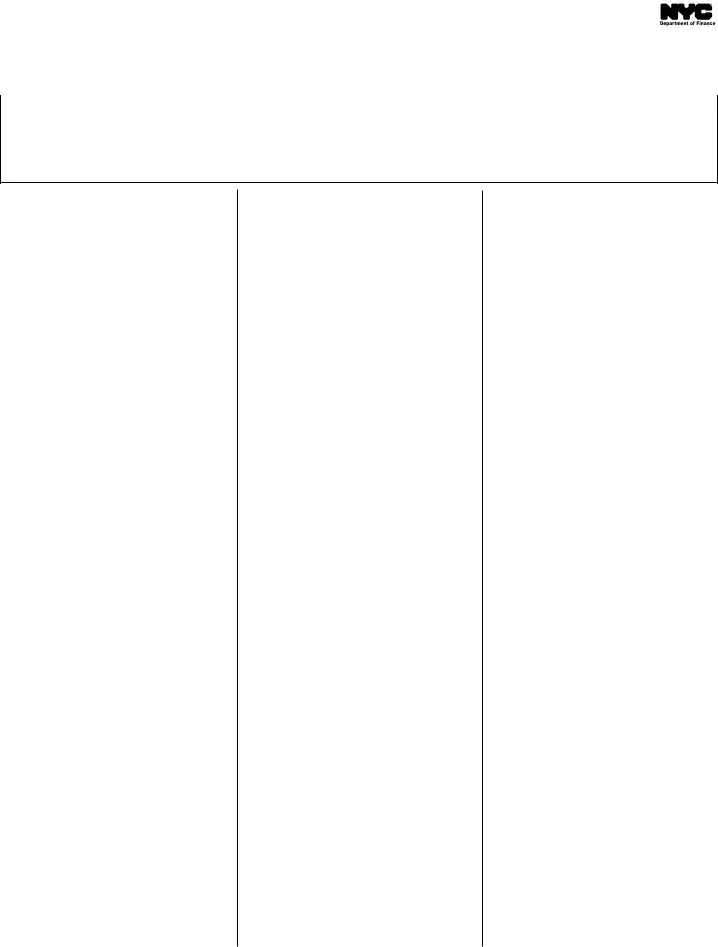

|

Instructions for Form |

|

ReturnforNonresidentEmployeesof theCityof NewYorkhiredonorafterJanuary 4,1973 |

2020 |

IMPORTANT INFORMATION CONCERNING FORM

Payments may be made on the NYC Department of Finance website at nycgoveevice , or via check or money order. If paying with check or money order, do not include these payments with your NewYork City return. Checks and money orders must be accompanied by payment voucher form

GENERALINFORMATION

LEGISLATIVE HIGHLIGHT

For tax years beginning before January 1, 2022, the

WHO MUST FILE

If you became an employee of the City of NewYork on or after January 4, 1973, and if, while so employed, you were a nonresident of the City during any part of 2020, you are subject to Section 1127 of the New York City Charter and must file Form

If you are subject to that law, you are required to pay to the City an amount by which a City personal income tax on resi- dents, computed and determined as if you were a resident of the City, exceeds the amount of any City tax liability computed andreportedbyyouontheCityportionof your 2020 NewYork State tax return.

NOTE:The payment required by Section 1127 of the NewYork City Charter is not a payment of any City tax, but is a pay- ment made to the City as a condition of employment. If you are subject to the fil- ing requirements of the City Resident Income Tax during any part of 2020, you must file tax returns with the New York

StateDepartmentofTaxationandFinance in the manner and at the time provided in the instructions for the State tax forms, regardless of any obligation you may have under Section 1127 of the Charter.

WHENAND WHERE TO FILE

Completed Forms

NYC Department of Finance

Section 1127

P.O. Box 5564

Binghamton, NY

Remittances - Pay online with Form

NYC Department of Finance

P.O. Box 3933

New York, NY

Forms claiming refunds:

NYC Department of Finance

Section 1127

P.O. Box 5563

Binghamton, NY

If you have been granted an extension of time to file either your federal income tax return or your New York State tax return, Form

If you file a State tax return or amended

return and the information reported on your original Form

CHANGE OFRESIDENCE

If you were a resident of the City of New York during part of 2020 and a nonresi- dent subject to the provisions of Section 1127 of the New York City Charter dur- ing all or part of the remainder of 2020, you must file a Form

If you were a New York City employee for only part of 2020, you must report that portion of your federal items of income and deduction which is attributa- ble to your period of employment by the City of New York.

MARRIED EMPLOYEES

Amarried employee whose spouse is not a New York City resident or an employ-

eeof the City should refer to instructions on page 1 of the return.

If you and your spouse are both employ- ees of the City of New York subject to Section 1127 of the New York City Charter

●and you and your spouse file sepa- rate New York State returns, you and your spouse must file separate Forms

Instructions for Form |

Page 2 |

● and you and your spouse file a joint |

there are no applicable special condition |

the year, enter on line 1 the amount from |

||

New York State return and were |

codes for tax year 2020. |

Check the |

line 47 of Form |

|

both subject to Section 1127 for the |

Finance website for updated special con- |

the period of employment is the period |

||

same period of time, you and your |

dition codes. If applicable, enter the two |

of NYC residence. |

||

spouse must file a joint Form NYC- |

charactercodeintheboxprovidedonthe |

|

||

1127. |

form. |

|

LINE 2 - LIABILITYAMOUNT |

|

|

|

|

Employees who are married and include |

|

PreparerAuthorization: Ifyouwantto |

In order to complete lines 1 through 6 of |

spouse’s income in Form |

||

allow the Department of Finance to dis- |

Form |

use Liability Table A on page 2 to com- |

||

cuss your return with the paid preparer |

you to refer to the instructions for filing |

pute the liability amount. |

||

who signed it, you must check the "yes" |

Form |

|

||

box in the signature area of the return. |

Form - State of New York) or Form IT- |

Married employees who choose not to |

||

This authorization applies only to the |

203 (Nonresident and |

include their spouse’s income on Form |

||

individual whose signature appears in |

Resident Income Tax Form - State of |

|||

the "Preparer's Use Only" section of |

NewYork). Booklets |

compute the liability amount. |

||

yourreturn. Itdoesnotapplytothefirm, |

I, issued by the New York State |

|

||

if any, shown in that section. By check- |

Department of Taxation and Finance, |

LIABILITYFOR OTHER NEW |

||

ing the "Yes" box, you are authorizing |

can be obtained from any District Tax |

YORK CITY TAXES |

||

the Department of Finance to call the |

Office of the New York State Income |

Include on line 2 the sum of your 1127 |

||

preparer to answer any questions that |

Tax Bureau. |

|

liability and the total of your liability for |

|

may arise during the processing of your |

|

|

other New York City taxes from New |

|

return. Also,youareauthorizingthepre- |

LINE 1 - NEWYORK STATE |

York State Form |

||

parer to: |

TAXABLE INCOME |

|

|

|

|

If you file NYS Form |

LINE 3 - NEWYORK CITY |

||

● Give the Department any informa- |

amount on line 37. If you |

file NYS |

SCHOOLTAX CREDITS |

|

tion missing from your return, |

Form |

Add lines a1 through g on page 2, |

||

|

36. If the amount withheld pursuant to |

Schedule B, to report credits and pay- |

||

● Call the Department for information |

Section 1127 was included in itemized |

ments that would have reduced your |

||

about the processing of your return |

deductions when calculating your New |

New York City resident income tax lia- |

||

or the status of your refund or pay- |

York State Personal IncomeTax liability, |

bility had you been a City resident. No |

||

ment(s), and |

you must add back that amount to the |

amount reported on line 3 is refundable. |

||

|

amount from line 37 of NYS |

Refunds of overpayments of tax and |

||

● Respond to certain notices that you |

line 36 of NYS |

refundable credits available to NewYork |

||

have shared with the preparer |

this line. |

|

State residents and |

|

aboutmatherrors,offsets,andreturn |

|

|

City residents must be claimed by filing |

|

preparation. The notices will not be |

NOTE: If you file a joint Federal tax |

forms |

||

sent to the preparer. |

return but elect to exclude a spouse’s |

|

||

|

income, see the special computation |

LINE 4 - PAYMENTS |

||

You are not authorizing the preparer to |

Schedule A on the back of this form and |

Enter on line 4 the amount withheld by |

||

receive any refund check, bind you to |

use Filing Status C. |

|

theCityfromyourwagesduring2020for |

|

anything(includinganyadditionalliabil- |

|

|

the amount due under Charter Section |

|

ity), or otherwise represent you before |

If you contributed to a New York State |

1127 as shown on your City Wage and |

||

the Department. The authorization can- |

Charitable Gifts Trust Fund, claim a |

Withholding Tax Statements for 2020. |

||

not be revoked, however, the authoriza- |

New York State itemized deduction for |

(Attach a copy of Form |

||

tion will automatically expire no later |

that contribution, and the period of your |

|

||

than the due date (without regard to any |

NYC employment encompassed the full |

LINE 5 - BALANCE DUE |

||

extensions) for filing next year's return. |

year, enter on line 1 the amount that you |

After completing this return, enter the |

||

Failure to check the box will be |

would have entered on line 47 of Form |

amount of your remittance on line A, |

||

deemed a denial of authority. |

page 1. Remittances must be made |

|||

|

payable to the order of: NYC DEPART- |

|||

SPECIFIC INSTRUCTIONS |

you contributed to a New York State |

MENTOFFINANCE |

||

|

Charitable Gifts Trust Fund, claim a |

|

||

Special Condition Codes |

New York State itemized deduction for |

LINE 6 - OVERPAYMENT |

||

that contribution and the period of your |

Ifline2islessthanthesumoflines3and |

|||

At the time this form is being published, |

||||

NYC employment encompassed part of |

4 you may be entitled to a refund. Note: |

|||

|

|

|

|

|

Instructions for Form |

Page 3 |

the refund may not exceed the amount |

|

A1 - NEWYORK CITYSCHOOL |

|

|||||

on line 4. To determine your refund |

|

TAX CREDIT (fixed amount) |

|

|||||

amount, compute the difference between |

|

ASchoolTaxCreditisallowedfor2020asfollows: |

|

|||||

the sum of lines 3 and 4, and line 2 (sub- |

|

|

|

|

|

|

|

|

|

iing |

fyoincoei |

|

|

|

Yocedii |

|

|

tractline2fromthesumoflines3and4). |

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

● Single |

|

|

$250,000 or less |

$63 |

|

||

Your refund amount is the lesser of this |

|

|

|

|

||||

|

|

|

|

|

||||

|

● Married filing |

|

|

|

|

|

||

difference and the amount on line 4. |

|

separate return |

|

Over $250,000 |

$0 |

|

||

|

|

|

|

|

|

|

||

|

|

● Head of household |

|

|

|

|

|

|

If the amount on line 2 is equal to the |

|

● Married filing |

|

$250,000 or less |

$125 |

|

||

|

joint return |

|

|

|||||

sum of lines 3 and 4, enter 0 on line 6. |

|

● Qualifying widow(er) |

|

Over $250,000 |

$0 |

|

||

|

|

with dependent child |

|

|

||||

Refunds cannot be processed unless a |

|

*Income, for purposes of determining your school |

|

|||||

|

tax credit means your federal adjusted gross |

|

||||||

complete copy of yourNewYork State |

|

income (FAGI) from Form |

|

|||||

return, including all schedules, and |

|

distributions from an individual retirement |

|

|||||

|

account and an individual retirement annuity from |

|

||||||

wageandtaxstatement (Form1127.2) |

|

|

||||||

are attached to your form. |

|

**The statutory credit amounts have been rounded. |

|

|||||

|

|

|

|

|

|

|

|

|

|

See also the instructions to Line 69 of New |

|

||||||

SPECIALINSTRUCTIONS FOR |

|

|

||||||

|

York State Form |

|

||||||

2020 FOR SCHEDULEA, PAGE 2. |

|

|

||||||

|

were employed by the City for only part of |

|

||||||

If you contributed to a New York State |

|

theyearshoulduseTable2inthoseinstruc- |

|

|||||

Charitable Gifts Trust Fund, filed a New |

|

tionstodeterminetheallowablecredit. See |

|

|||||

York State return claiming married filing |

|

also instructions to the other lines of New |

|

|||||

jointly status and claiming an itemized |

|

York State Form |

|

|||||

deduction for that contribution, you must |

|

|

|

|

|

|

|

|

recalculate NYS AGI by adding back the |

|

A2 - NEWYORK CITYSCHOOL |

|

|||||

amount of the contribution to the |

|

TAX CREDIT (rate reduction |

|

|||||

Charitable Gifts Trust Fund. Enter the |

|

amount) |

|

|

|

|

||

recalculated NYS AGI on line 1. Attach a |

|

The New York City tax credit rate reduc- |

|

|||||

worksheetshowingthecalculations.Ifyou |

|

tion amount is calculated as follows: |

|

|||||

contributedtoaNewYorkStateCharitable |

|

|

|

|

|

|

|

|

|

|

CconofNYCchooxcedi |

|

|

||||

Gifts Trust Fund, claim a New York State |

|

|

|

|

||||

|

(edcononfoiedfiingjoiny |

|

|

|||||

|

|

|

|

|||||

itemized deduction for that contribution |

|

|

ndqifyingido(e |

|

|

|||

|

|

|

|

|

|

|

|

|

and the period of your NYC employment |

|

fcixbeincoei |

|

hecedii |

|

|

||

encompassed part of the year, the amount |

|

ove |

bnoove |

|

|

|

|

|

online1ofScheduleAshouldbecalculat- |

|

$0 |

$21,600 |

|

|

.171% of taxable income* |

|

|

ed as if the period of employment is the |

|

$21,600 |

$500,000 |

|

|

$37 plus .228% of the |

|

|

period of NYC residence. |

|

|

|

|

|

excess over $21,600 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CconofNYCchooxcedi |

|

|

|||

SCHEDULEA, PAGE 2 - LINE 5 |

|

(edcononfoingendied |

|

|

||||

|

|

fiingepy |

|

|

||||

If the amount withheld pursuant to |

|

|

|

|

|

|

|

|

|

fcixbeincoei |

|

hecedii |

|

|

|||

Section 1127 was included in the item- |

|

ove |

bnoove |

|

|

|

|

|

ized deductions when calculating your |

|

$0 |

$12,000 |

|

|

.171% of taxable income* |

|

|

New York State Personal Income Tax |

|

|

|

|

|

|

|

|

|

$12,000 |

$500,000 |

|

|

$21 plus .228% of |

|

||

liability, you must reduce the amount of |

|

|

|

|

|

the excess over $12,000 |

|

|

your itemized deductions for purposes of |

|

|

|

|

|

|

|

|

|

|

CconofNYCchooxcedi |

|

|

||||

this line by that amount. |

|

|

(edconon |

|

|

|||

|

|

fohedofhoehod |

|

|

||||

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

SCHEDULE B, PAGE 2 |

|

fcixbeincoei |

|

hecedii |

|

|

||

|

ove |

bnoove |

|

|

|

|

||

|

|

|

|

|

|

|||

On Schedule B, report items for employ- |

|

|

|

|

|

|

|

|

|

$0 |

$14,400 |

|

|

.171% of taxable income* |

|

||

ee and spouse if filing a joint Form |

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

$14,400 |

$500,000 |

|

$25 plus .228% of |

|

|||

|

|

|

||||||

choose not to include their spouse’s |

|

|

|

|

|

the excess over $14,400 |

|

|

|

|

|

|

|

|

|

|

|

income in Form |

|

*If the period of your NYC employment encompassed the |

|

|||||

for employee only. |

|

full year, use the amount entered on page 1, line 1. If it |

|

|||||

|

encompassed part of the year, use the amount from line |

|

||||||

|

|

47 of Form |

|

|||||

|

|

ment is the period of NYC residence. |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

B - UBT PAID CREDIT

If you were a partner in a partnership doing business in the City, you may be entitled to a credit for a portion of the City Unincorporated Business Tax paid by that partnership. See Form

F- OTHER CITYTAXES

203)if any, as City tax (Form

G - NYC CHILDAND DEPENDENT CARE CREDIT

Refer to New York State Form

MAILING INSTRUCTIONS

In order for your form to be processed, you must attach the following to Form

◆Complete copy of New York State Income Tax Return, including all schedules

◆Wage and withholding statement (Form 1127.2)

◆Agency verification, if claiming line of duty injury deduction

SIGNATURE

You must sign and date your return at the bottom of page 1. If you file jointly on Form

and/orrefundcannotbeprocessedifit is not signed.

Instructions for Form |

Page 4 |

If you have a

ACCESSING NYC TAX FORMS

By Computer - Download forms from the Finance website at nyc.gov/finance

PRIVACYACT NOTIFICATION

The Federal Privacy Act of 1974, as amended, requires agencies requesting Social Security Numbers to inform individuals from whom they seek this information as to whether com- pliance with the request is voluntary or manda- tory,whytherequestisbeingmadeandhowthe information will be used. The disclosure of Social Security Numbers for taxpayers is mandatory and is required by section

File Overview

| Fact Name | Description |

|---|---|

| Purpose of NYC 1127 Form | Used for nonresident employees of the City of New York hired on or after January 4, 1973, to pay an amount akin to City personal income tax. |

| Eligibility | Employees who were nonresidents of the City during any part of the tax year and employed by the City of New York. |

| Governing Law | Section 1127 of the New York City Charter. |

| Filing Deadline | Forms must be filed on or before May 15, following the tax year. |

| Filing Status Options | Individuals can file as Married Filing Jointly, Head of Household, Single or Married Filing Separately. |

| Amended Return Provision | If changes are made to the original New York State tax return, an amended Form NYC 1127 must be filed with the New York City Department of Finance, Section 1127 Unit. |

Nyc 1127: Usage Guidelines

Completing the NYC 1127 form is a necessary step for certain nonresident employees of the City of New York to comply with tax requirements. This guide is meant to help simplify the process for you. Below, you will find straightforward, step-by-step instructions to ensure you correctly fill out and file your form. Remember, accurate completion is essential to avoid any potential issues with your filing.

- Begin with your personal information. Fill in your first names and initials, as well as the last name for both yourself and your spouse (if applicable).

- Next, provide your home address, including the apartment number if you have one. If your address has changed, make sure to check the "Address Change" box.

- Under the section marked "NYC Department or Employee", enter the agency where you are employed and your daytime telephone number.

- Indicate if you are amending your return by checking the box next to "AMENDED RETURN."

- Fill in your taxpayer’s email address and both your and your spouse’s social security numbers in the designated areas.

- For Filing Status, select the appropriate box: Married Filing Jointly, Head of Household, or Single/Married Filing Separately.

- Under employment information, enter the number of months employed in 2020 for both yourself and your spouse, if applicable.

- If applicable, fill in the date retired from NYC service for both you and your spouse.

- In the section marked "PAYMENT," if making an electronic payment with this return, enter the amount being paid electronically.

- Moving on to the 1127 Liability Calculation, fill in the sections based on information from your NYS Income Tax Return, referring to specific lines in the form as directed.

- Under Certification, check the box if you and your spouse are both subject to Section 1127 and sign the form, including the date. If the form is prepared by someone other than you, that individual must also sign and provide their information in the designated area.

Once you've completed all the necessary sections and attached any required documents, such as a complete copy of your New York State Income Tax Return and any schedules, your next step is to mail your form. If you’re submitting a payment with your form, use the address listed under the corresponding instructions. If claiming a refund or not including a payment, mail your form to the provided address for processing. Always ensure that your form is signed and dated to avoid any processing delays. Filing your NYC 1127 form accurately and on time is crucial to meeting your tax obligations as a nonresident employee of New York City.

FAQ

Who needs to file Form NYC-1127?

Employees of the City of New York hired on or after January 4, 1973, who were nonresidents of the city for any part of 2020, must file Form NYC-1127. This requirement is due to Section 1127 of the New York City Charter, mandating certain nonresident employees to compute and pay a city personal income tax equivalent as if they were city residents, which is intended as a condition of their employment.

What is the filing deadline for Form NYC-1127?

Forms, along with necessary attachments except those claiming refunds, are due by May 15, 2021. Should there be an approved extension for filing your federal or New York State tax returns, Form NYC-1127 must be filed within 15 days following this extended deadline. Documentation proving the granting of such extension must be submitted to the Section 1127 Unit no later than May 15, 2021.

Where should I file Form NYC-1127 and make payments or claim refunds?

- For general filings and payments, use the following address: NYC Department of Finance, Section 1127, P.O. Box 5564, Binghamton, NY 13902-5564. Pay online with Form NYC-200V at nyc.gov/eService, or mail payment and Form NYC-200V to NYC Department of Finance, P.O. Box 3933, New York, NY 10008-3933.

- For refund claims: NYC Department of Finance, Section 1127, P.O. Box 5563, Binghamton, NY 13902-5563.

What information is needed to complete Form NYC-1127?

Your NYS Income Tax Return details are required to fill out Form NYC-1127. Depending on whether you filed a NYS Resident Income Tax Return (NYS IT-201) or a NYS Non-Resident and Part-Year Resident Income Tax Return (NYS IT-203), the form directs you to specific lines on these returns for necessary information.

How do I calculate my liability on Form NYC-1127?

The form includes a liability calculation section guided by your New York State taxable income and applicable city taxes. Instructions on the form outline the calculation process, which also involves determining any New York City School tax and other credits. It’s imperative to follow these directives closely for accurate computation.

What if I need to file an amended Form NYC-1127?

If you submit a state tax return or amended return that alters the information previously reported on your original Form NYC-1127, it's necessary to file an amended Form NYC-1127. This amendment should reflect changed or corrected details and be filed with the New York City Department of Finance, Section 1127 Unit, to ensure compliance and accuracy in your tax obligations.

Common mistakes

Filling out the NYC 1127 form can be complex, leading to errors that could affect the accuracy of your tax liability. Identifying and understanding these mistakes is crucial to ensure compliance and accuracy.

Incorrectly reporting filing status: Taxpayers often select the wrong filing status, which could impact the calculation of their taxes. For example, choosing 'Married Filing Jointly' when you should select 'Married Filing Separately' for Section 1127 purposes, based on specific conditions related to spouse’s income.

Failing to accurately calculate New York State Taxable Income: On Line 1, taxpayers need to enter their taxable income correctly, which comes from specific lines on NYS IT-201 or NYS IT-203 forms. Inaccuracies in transferring these figures or misunderstanding which line from your state return is relevant can lead to errors in your taxable income reported.

Misunderstanding Section 1127 liability and New York City taxes: Line 2 requires summing your 1127 liability with other New York City taxes. Overlooking additional city taxes or incorrectly calculating your 1127 liability can distort your overall tax obligation.

Omitting information or calculating credits incorrectly on Schedule B: The NYC School Tax Credit, UBT Paid Credit, and other city taxes and credits have specific eligibility criteria and calculation methods. Errors in applying for these credits or failing to include necessary information can result in missed tax benefits or inaccuracies in the total credits claimed.

Correctly navigating these common mistakes involves careful reading of the instructions, double-checking figures from your state return, and ensuring all applicable incomes, taxes, and credits are accurately reported. Accurate completion of the NYC 1127 form is essential to avoid underpayment or overpayment of taxes, and in some cases, penalties.

Ensure accurate filing status selection: Carefully review the instructions regarding different filing statuses and their implications, especially for spouses with differing income scenarios.

Verify NYS income data: Double-check the lines from which you transfer income data from your NYS return to avoid reporting incorrect taxable income figures.

Comprehend Section 1127 liability: Understand how to calculate your liability, including the addition of other NYC taxes, to ensure accurate total tax liability reporting.

Accurately apply for credits: Review the eligibility requirements and calculation instructions for credits meticulously to ensure you don't miss out on any benefits or report incorrect amounts.

Taking the time to cross-reference information from your state tax return, understand the specific instructions for each section of the form, and accurately calculate taxes and credits can mitigate the risk of these common errors. Paying close attention to details, and possibly consulting a tax professional, can help ensure the correct and complete filing of the NYC 1127 form.

Documents used along the form

Completing the NYC 1127 form, necessary for nonresident employees of New York City, often requires the submission of additional forms and documents to ensure accurate filing and compliance with tax laws. Here's a look at some of those commonly associated forms and documents:

- NYS IT-201: This is the New York State Resident Income Tax Return form. It's required for filers who are residents of New York State for the entire year, providing comprehensive details on income, deductions, and credits.

- NYS IT-203: The Nonresident and Part-Year Resident Income Tax Return form is crucial for individuals who lived outside New York State for part of the year. It helps in calculating the tax based on the income earned during the residency period.

- Form 1127.2: This serves as a statement of New York City income tax withheld. It's essential for documenting the taxes already paid to the city, ultimately affecting the balance of tax due or refundable.

- Form IT-201-ATT: Attachments to IT-201 form, this document is used for claiming various credits and deductions not directly included in the main IT-201 form, allowing for a more tailored tax computation.

- Form IT-215: The Claim for Earned Income Credit form is necessary for filers looking to claim this specific tax credit, which can significantly reduce the amount of tax owed or provide a refund to lower-income individuals and families.

- Form IT-216: This form is used to claim the Child and Dependent Care Credit, offering tax relief to individuals who incurred expenses for the care of dependents while working or looking for work.

- Form IT-219: Relevant for filers seeking to claim credits for taxes paid to the Unincorporated Business Tax, enabling a partner in a partnership doing business in the city to reduce their taxable income.

- Form IT-257: Required when a taxpayer needs to claim a New York City Claim of Right Credit, this form addresses situations where income was reported in one year and repaid in another, affecting the taxpayer's liability.

Each of these forms plays a critical role in the completion of the NYC 1127 form, ensuring that all necessary information is accurately reported and that taxpayers can take advantage of applicable credits and deductions. Careful preparation and inclusion of these documents facilitate a smoother filing process, compliance with tax laws, and the proper determination of tax liabilities or refunds for nonresident employees of New York City.

Similar forms

The Internal Revenue Service (IRS) Form 1040, U.S. Individual Income Tax Return, is quite similar to the NYC 1127 form, as both are used for reporting individual income and calculating tax liability. Both forms require taxpayers to provide personal information, income details, and deductions to determine the amount of tax owed to the government or the refund due to the taxpayer. They serve the fundamental purpose of reconciling an individual's tax responsibilities for the year.

State Income Tax Return forms, like the New York State (NYS) IT-201 for residents, share similarities with the NYC 1127 form in that both require detailed income information, tax calculations, and deductions specific to their respective tax jurisdictions. While the NYC 1127 is focused on nonresident employees of NYC, the NYS IT-201 covers all residents of New York State, illustrating how both are tailored to capture the tax obligations of different groups within New York.

The W-2 Form, Wage and Tax Statement, is utilized by employers to report an employee's annual wages and the amount of taxes withheld from their paycheck. This document is akin to the NYC 1127 form to the extent that information from a W-2 is essential for accurately completing the 1127 form. Both are integral parts of the tax reporting process, with the W-2 providing the necessary wage and withholding details required on various lines of the NYC 1127 form.

Form IT-203, Nonresident and Part-Year Resident Income Tax Return, and the NYC 1127 form are designed for individuals who do not permanently reside in the tax area but have income subject to tax by the state or city. Both forms accommodate the unique situation of these taxpayers, calculating tax liabilities based on income earned within the jurisdiction, despite the taxpayer's nonresident status.

The 1099 form series, particularly the 1099-MISC, which reports miscellaneous income, is similar to the NYC 1127 form as they both deal with the reporting of income. While the 1099 forms are used to report income from various sources other than wages, salaries, and tips, information from these forms may be necessary to complete the NYC 1127 accurately, as it accounts for various income sources, including those not subject to withholding.

Schedule A (Form 1040), Itemized Deductions, shares similarities with the NYC 1127 form, especially in sections where taxpayers are allowed to detail deductions to reduce taxable income. Both forms recognize the role of deductions in determining the taxpayer's liability, albeit the specifics and eligibility criteria for deductions vary between the federal and NYC tax codes.

Form IT-201-ATT, Other Tax Credits and Taxes, is another document similar to the NYC 1127, in that both allow for the application of specific tax credits that reduce the tax liability for eligible individuals. Taxpayers must fill out these forms carefully to ensure they claim all applicable credits, such as those for school tax or dependents, that can directly impact the total tax due.

Form 1127.2, New York City Amount Withheld, directly complements the NYC 1127 form by providing the exact amount of NYC tax withheld from a nonresident employee’s paycheck. This document is essential for completing the NYC 1127, as it substantiates the claim for any tax already paid to the city through payroll deductions, highlighting the interconnected nature of these forms.

The Earned Income Tax Credit (EITC) forms, such as the IRS Form 8862 and its state equivalents, are designed to provide a tax break to low- to moderate-income working individuals and families, especially those with children. The EITC concept is mirrored in parts of the NYC 1127 form, where specific credits applicable to NYC taxpayers, including those for dependents, are calculated to reduce overall tax liability.

Form IT-215, Claim for Earned Income Credit, and the NYC 1127 form both provide mechanisms for individuals to claim tax credits designed to reduce poverty and incentivize work. Although the former specifically addresses state-level earned income credits, elements of the NYC 1127 form similarly allow nonresident employees of NYC to calculate and claim credits available to them, showcasing both forms’ roles in offering tax relief to eligible taxpayers.

Dos and Don'ts

When it comes to filling out the NYC 1127 form, navigating the guidelines correctly is key to a smooth process. With a focus on ensuring you provide accurate and complete information, here are eight dos and don'ts to guide you through completing this form accurately and efficiently.

- Do ensure you have all the necessary documents at hand, including your New York State Income Tax Return and any applicable wage and withholding statements. This preparation makes filling out the 1127 form smoother and helps avoid errors.

- Do not rush through the form without reading the specific instructions for each section. Each part of the form has detailed guidelines that can prevent common mistakes.

- Do print or type your information clearly. Legibility is crucial to preventing processing delays, which are common when information is hard to decipher.

- Do not forget to check if special condition codes apply to your situation, as failing to include relevant codes could lead to incorrect tax computations.

- Do accurately compute your liability using the information from your NYS Income Tax Return. The sections of this form correlate directly to lines on your state tax return, so precision in transferring amounts is critical.

- Do not exclude information regarding other New York City taxes you're liable for. If you're subject to additional city taxes, including these amounts ensures your 1127 liability calculation is complete and accurate.

- Do attach all necessary documentation, such as your complete New York State Income Tax Return and any wage and withholding statements. These documents are crucial for verifying the information you provide on the 1127 form.

- Do not fail to sign and date the form. An unsigned form is considered incomplete and can lead to processing delays or even rejection of your submission.

Approach the NYC 1127 form with care and diligence. By following these dos and don'ts, you're more likely to achieve a mistake-free submission, contributing to a hassle-free processing experience.

Misconceptions

- One common misconception about the NYC 1127 form is that it is only for employees who live in New York City. In reality, the NYC 1127 form is specifically designed for nonresident employees of the City of New York hired on or after January 4, 1973. These employees are subject to Section 1127 of the New York City Charter, which requires them to pay a tax equivalent to what they would owe if they were City residents, despite not living in the City.

- Another misunderstanding is that filing the NYC 1127 form is optional. This is not the case. If an individual meets the criteria as a nonresident employee of the City of New York, filing this form is mandatory. It is a condition of employment, ensuring that these individuals contribute to the City in a manner similar to residents, based on their earnings from City employment.

- Some people believe that if they did not owe any tax to New York State, they also do not need to file Form NYC 1127. This assumption is incorrect. The obligation to file Form NYC 1127 is not directly related to whether one owes New York State tax. Instead, it focuses on the employment relationship with the City of New York and one's residency status. Even if an employee does not owe state tax, they may still have to file Form NYC 1127 and potentially pay tax based on their City-derived income.

- Lastly, there is a misconception that the calculation of taxes due with the NYC 1127 form is complex and requires information not readily available to the taxpayer. However, all the necessary information to complete Form NYC 1127 can be found in the filer’s New York State income tax return. The form's instructions provide clear guidance on where to find the required data, whether the filer has submitted a NYS Resident Income Tax Return (NYS IT-201) or a NYS Non-Resident and Part-Year Resident Income Tax Return (NYS IT-203). This makes the process straightforward for those familiar with their state tax return details.

Key takeaways

Filing Form NYC-1127 is necessary for nonresident employees of the City of New York hired on or after January 4, 1973, to pay a tax equal to the difference between the city income tax for residents and the city tax liability reported on their New York State tax return.

All information required to complete Form NYC-1127 can be directly sourced from the filer's New York State Income Tax Return, simplifying the process.

The form accommodates various filing statuses, including Married Filing Jointly, Head of Household, Single, Married Filing Separately, and Surviving Spouse, with specific instructions for each scenario.

Payments due with Form NYC-1127 can be made electronically through the NYC Department of Finance website or via check/money order, but they must be accompanied by Form NYC-200V for processing.

Critical deadlines are in place, with the form and any payments typically due by May 15 of the following year, and extensions for filing align with extensions granted for federal or New York State tax returns.

The form requires detailed income calculations, including adjustments for non-NYC employee income and specific deductions and exemptions, to determine the taxable income allocated to NYC.

New York City offers specific credits such as the NYC School Tax Credit, which can affect the calculation of the balance due or refund owed on Form NYC-1127.

If a filer's situation involves amendments to their federal or state returns that influence the information reported on Form NYC-1127, an amended Form NYC-1127 must be filed to reflect these changes.

Special considerations and instructions are provided for married employees, highlighting the need to consider the employment status of both spouses and their residency when filing.

Documentation such as a complete copy of the New York State Income Tax Return and wage and tax statements must be attached to Form NYC-1127 for it to be processed effectively.

The finalization of Form NYC-1127 requires the certification that the information provided is true and correct, accompanied by the taxpayer's signature—and if filing jointly, both spouses must sign.

Common PDF Documents

Primary Beneficiary Designation - In cases where death is a result of an on-the-job accident, the form outlines who is eligible for an accidental death benefit, prioritizing spouses, children, and dependent parents.

Nys App - Applications without the necessary fee or incomplete information may lead to disapproval.