Free Ny M 11 Form in PDF

In today's regulatory landscape, understanding the specifications and requirements of the NY Form M-11 is essential for entities aiming to raise capital in New York State. Administered by the New York State Department of Law's Investment Protection Bureau, the form serves as a critical component in the compliance and disclosure framework for issuers outside of real estate or mortgage financing ventures. Issuers engaged in theatrical syndication or intrastate offerings have specific guidelines to follow, reflecting the form's adaptability to various segments of the capital markets. The document necessitates detailed disclosures ranging from the issuer's structure, business operations, and the securities being offered, to the allocation of proceeds from the offering. Additionally, it imposes rigorous transparency concerning the issuer's historical regulatory interactions, financial conditions, and the identities and backgrounds of key individuals within the organization. Completing this form accurately is not merely a regulatory formality but a foundational step in ensuring that potential investors are furnished with the essential information needed to make informed decisions. This comprehensive approach underscores New York's commitment to maintaining integrity and transparency in its financial markets while providing a structured avenue for businesses to access vital capital resources.

Ny M 11 Sample

NEW YORK STATE DEPARTMENT OF LAW INVESTMENT PROTECTION BUREAU 120 Broadway, 23rd Floor

New York, NY

www.ag.ny.GOV

ISSUER STATEMENT

(Section

NY FORM

File Number

(Found on fee receipt for original filing)

Issuer Name______________________________________________________________________________________________________

Principal Office Address ____________________________________________________________________________________________

____________________________________________________________________________________________

CityStateZip Code

Telephone Number ________________________________________________________________________________________________

Note: This form should not to be used by issuers engaged in any aspect of real estate or mortgage financing unless they also obtain a letter upon written application pursuant to General Business Law Section

1. Issuer is ___ an existing or ___a proposed

corporation; general partnership; limited partnership;

other (specify)_____________________ organized under the laws of ____________________ on _______________________.

other (specify)_____________________ organized under the laws of ____________________ on _______________________.

2.The business of the issuer is (describe briefly): __________________________________________________________________

_________________________________________________________________________________________________________

3.Issuer proposes to offer:

stock;

bonds;

notes;

partnership interests;

other (specify)

_________________________________________________________________________________________________________

4.The securities will be sold: by the partner(s), officer(s), director(s) or principal(s) of the issuer; issuer.

The securities will be sold on a best efforts basis? G

Yes G

Yes G

No. If no, please explain.

No. If no, please explain.

by salespeople employed by

5.Total amount of offering $ __________________; offering literature attached;

if not available, attach a letter of explanation.

Total anticipated offering expenses $ _________________ consisting of: Selling: $ ______________________;

Other: $ ______________________.

6.State use of the net proceeds to be obtained: _____________________________________________________________________

_________________________________________________________________________________________________________

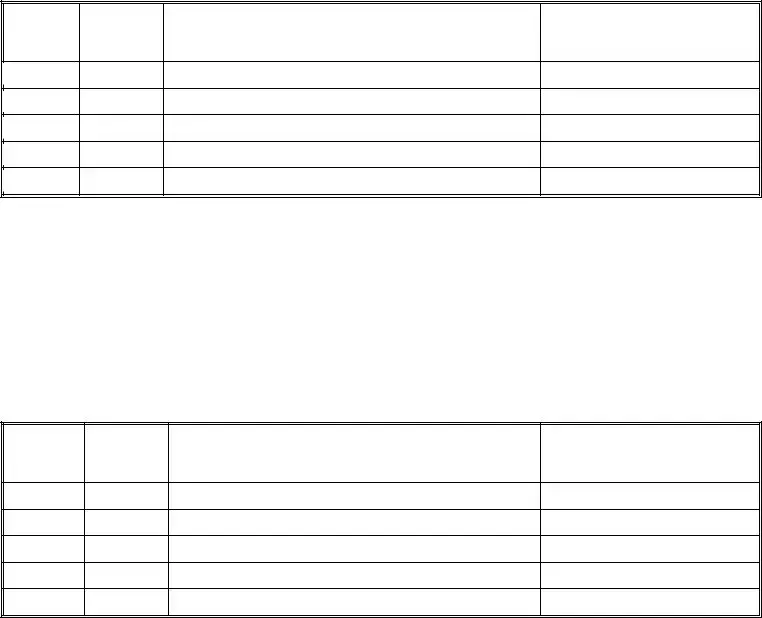

Please indicate where the fee receipt should be sent: [ ] Attorney [ ] Issuer

__________________________________________________

Attorney or Issuer Name

__________________________________________________

Street Address

__________________________________________________

City |

State |

Zip |

Filing Fee for Issuer Statement as follows: |

|

|

If total amount of offering is $500,000 or less |

Fee is $ |

300 |

If total amount of offering is more than $500,000... |

Fee is $ |

1,200 |

Make check payable to the NYS Department of Law.

Payment by Attorney's check, company check, certified check, bank check or money order. Personal checks not accepted.

Send remittance to: Investment Protection Bureau NYS Department of Law

120Broadway, 23rd Floor New York, New York 10271

IPS

7.Any secondary offering of securities by selling holders of the issuer, please check box G. Indicate the details of the secondary offering below for each seller.

Name of SellerAddressAnticipated Dollar Amount Offered

__________________________________________________________________________________________________________

__________________________________________________________________________________________________________

8. Has registrant, any officer, director or principal or partner ever...

A. been suspended or expelled from membership in any securities or commodities |

|

exchange, association of securities or commodities dealers or investment advisers? |

Yes [ ] No [ ] |

B.had a license or registration as a dealer, broker, investment adviser or sales person, futures commission merchant, associated person, commodity pool operator, or

commodity trading advisor denied, suspended or revoked? |

Yes [ ] No [ ] |

C.been enjoined or restrained by any court or government agency from:

|

1. |

the issuance, sale or offer for sale of securities or commodities? |

Yes [ |

] |

No [ |

] |

|

2. |

rendering securities or commodities advice? |

Yes [ |

] |

No [ |

] |

|

3. |

handling or managing trading accounts? |

Yes [ |

] |

No [ |

] |

|

4. |

continuing any practices in connection with securities or commodities? |

Yes [ |

] |

No [ |

] |

D. |

been convicted of any crime (other than minor traffic)? |

Yes [ |

] |

No [ |

] |

|

E. |

used or been known by any other name? |

Yes [ |

] |

No [ |

] |

|

F.been the subject of any professional disciplinary proceeding, hearing, settled

complaints or arbitrations in excess of $10,000? |

Yes [ ] No [ ] |

G.been adjudged a bankrupt or made a general assignment for the benefit of creditors; or been

an officer, director or principal of any entity which was reorganized in bankruptcy, |

|

adjudged a bankrupt or made a general assignment for the benefit of creditors? |

Yes [ ] No [ ] |

H.had an offering of securities within the last the three years or been an officer, director, partner of any entity which had an offering of securities within the

last three years |

Yes [ ] No [ ] |

I. If the answer to any of the above is "YES", attach a statement of full particulars.

9.Are there any outstanding judgments (not including judgments involving domestic

relations) against the issuer or any officer, director, principal or partner thereof? |

Yes [ ] No [ ] |

If yes, attach a statement of full particulars. |

|

10.List names or CRD Numbers of all employees (excluding officers and directors) of Issuer who are selling in New York State. A Form U4 must be submitted for each salesperson listed.

Name of EmployeeCRD Number

_________________________________________________________________________________________________________

_________________________________________________________________________________________________________

_________________________________________________________________________________________________________

11.Limited Partnerships are required to submit a list of all limited partners as soon as the offering is completed. This may be done in letter form.

12.If the Issuer is a limited partnership list all of the general partners.

_________________________________________________________________________________________________________

_________________________________________________________________________________________________________

IPS

13.For each officer, director, principal, partner or managing member, please provide the information requested. In the case of a corporate general partner information must be provided for all officers. Do not refer to a prospectus or offering literature. SEC biographies can be substituted for employment history only. If additional space is necessary, please attach additional pages. Social security numbers and residential information are strictly confidential.

a. |

Name: ________________________________________________ |

Title: ________________________________________ |

|

Address: _____________________________________________________________________________________________ |

|

|

Prior home addresses for the past 5 years:____________________________________________________________________ |

|

|

_____________________________________________________________________________________________________ |

|

|

_____________________________________________________________________________________________________ |

|

|

Telephone: ____________________________________________ |

Social Security #: ______________________________ |

|

Date of Birth: __________________________________________ |

Place of Birth:_________________________________ |

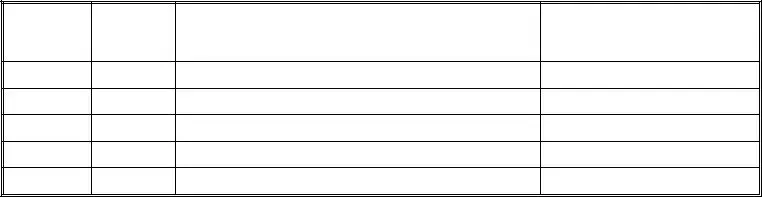

List employment and business affiliation record for the past five years. (Indicate periods of

From

Mo./ Yr.

To Mo./ Yr.

Employer or Business Affiliation

NameAddress

Position Held and Type of Business

b. |

Name: ________________________________________________ |

Title: _______________________________________ |

|

Address: _____________________________________________________________________________________________ |

|

|

Prior home addresses for the past 5 years:____________________________________________________________________ |

|

|

_____________________________________________________________________________________________________ |

|

|

_____________________________________________________________________________________________________ |

|

|

Telephone: ____________________________________________ |

Social Security #: ______________________________ |

|

Date of Birth: __________________________________________ |

Place of Birth:_________________________________ |

List complete employment and business affiliation record for the past five years. (Indicate periods of

From

Mo./ Yr.

To Mo./ Yr.

Employer or Business Affiliation

NameAddress

Position Held and Type of Business

IPS

13. Continued

c. Name: ________________________________________________ Title: ________________________________________

Address: _____________________________________________________________________________________________

Prior home addresses for the past 5 years:____________________________________________________________________

_____________________________________________________________________________________________________

_____________________________________________________________________________________________________

Telephone: ____________________________________________ |

Social Security #: ______________________________ |

Date of Birth: __________________________________________ |

Place of Birth:_________________________________ |

List complete employment and business affiliation record for the past five years. (Indicate periods of

From

Mo./ Yr.

To Mo./ Yr.

Employer or Business Affiliation

NameAddress

Position Held and Type of Business

The use of Power of Attorney is not acceptable. If all signatures are not available at time of filing, you must submit the proper total fee and all information required by item 13. One original signature is required at the time of filing. Note in your letter that counterpart forms with missing signatures will be submitted within 30 days of filing.

Limited Partnerships, Limited Liability Corporations and Limited Liability Partnerships must supply one signature for each general partner or managing member. One signature by an officer of a corporate general partner or managing member is sufficient, however, all selling officers must sign.

All officers, directors, partners, controlling principals, or managing members of the registrant listed in Item 13, provide an original signature below. All statements contained herein are true and correct and each individual understands that any false statement shall constitute a violation of Art.

Name and Title (please type or print) |

Signature |

Date |

________________________________________________ |

______________________________________ |

____________________ |

________________________________________________ |

______________________________________ |

____________________ |

________________________________________________ |

______________________________________ |

____________________ |

________________________________________________ |

______________________________________ |

____________________ |

________________________________________________ |

______________________________________ |

____________________ |

________________________________________________ |

______________________________________ |

____________________ |

________________________________________________ |

______________________________________ |

____________________ |

To complete this filing a State Notice and Further State Notice must be filed with the Department of State in Albany. In the case of a

IPS

File Overview

| Fact | Detail |

|---|---|

| Governing Law | General Business Law Section 359-e |

| Use Restrictions | Not for issuers engaged in real estate or mortgage financing without specific authorization. |

| Applicable To | Various organizational forms like corporations, partnerships, etc. |

| Securities That Can Be Offered | Includes stock, bonds, notes, partnership interests, among others. |

| Sale Mechanism | Directly by partners/officers or through employed salespeople. |

| Offering Expense Details | Includes total amount, with breakdowns for selling and other expenses. |

| Use of Proceeds | Issuers must state the intended use of net proceeds from the offering. |

| Changes or Amendments | Must be submitted within 30 days on NY Form M-3, accompanied by a $30 fee. |

Ny M 11: Usage Guidelines

Before commencing the process of filling out the NY Form M-11, it is essential to understand that accuracy and completeness are paramount. This document, mandated by the New York State Department of Law Investment Protection Bureau, serves a crucial role in the realm of securities issuance within the state. Individuals or entities intending to offer securities for investment purposes are required to furnish detailed information through this form, ensuring compliance with the state's regulatory framework. The steps outlined below are designed to guide issuers through a detailed and methodical completion of the form, ensuring that all necessary information is accurately reported to the state authorities.

- Begin by entering the File Number found on the fee receipt for the original filing at the top of the form.

- Fill in the Issuer Name and the Principal Office Address, including city, state, and zip code, followed by the telephone number.

- Specify whether the issuer is an existing or proposed entity by marking the appropriate box. Indicate the type of entity and state of organization, along with the date it was organized.

- Briefly describe the business of the issuer in the space provided.

- Detail the type of securities the issuer proposes to offer (e.g., stock, bonds, notes) and how they will be sold (e.g., by officers, directors, or employed salespeople).

- Enter the total amount of the offering and anticipated offering expenses, breaking down the expenses into selling and other categories.

- Clearly state the intended use of the net proceeds from the offering.

- Designate where the fee receipt should be sent (attorney or issuer) by providing the name and address accordingly.

- Calculate and enter the filing fee based on the total amount of the offering, ensuring to make the check payable to the NYS Department of Law and include it with your submission.

- For any secondary offering, check the appropriate box and provide details for each seller, including name, address, and anticipated dollar amount offered.

- Answer the questions regarding the registrant's and its principals' regulatory and legal history by checking the appropriate boxes (Yes or No). If any answer is "Yes," attach a detailed statement of full particulars.

- List names or CRD Numbers of all employees excluding officers and directors, who are selling in New York State, submitting a Form U4 for each salesperson listed.

- If the issuer is a limited partnership, a list of all the general partners and, upon completion of the offering, all limited partners must be provided in letter form.

- Complete the section for each officer, director, principal, partner, or managing member with their personal and employment details for the past five years.

- Ensure that all officers, directors, partners, controlling principals, or managing members of the registrant listed provide an original signature at the bottom of the form, attesting to the truth and correctness of all statements contained within.

- Review and double-check all entered information for accuracy before submission.

- Remember to file the requisite State Notice and Further State Notice with the Department of State in Albany, and for non-resident issuers, a Consent to Service of Process or U2 must also be filed.

After submitting the NY Form M-11 alongside the appropriate filing fee and additional required documents, it is essential to stay informed about any further communication from the New York State Department of Law Investment Protection Bureau. This may include requests for additional information or clarification. Maintaining duly noted amendments to the form, if necessary, within 30 days using NY Form M-3 with a corresponding fee, ensures continued compliance with state regulations related to securities offerings.

FAQ

What is the purpose of the NY Form M-11?

The NY Form M-11 is a document required by the New York State Department of Law, specifically by the Investment Protection Bureau. It serves as an Issuer Statement under Section 359-e of the General Business Law. This form is designed to provide details about issuers who propose to offer securities in New York State, outlining the nature of their business, the type of securities being offered, the total amount of the offering, and how the net proceeds from the offering will be used. It is a vital step for compliance with state regulations before securities can be offered to the public.

Who needs to file the NY Form M-11?

Any entity that intends to offer securities in New York State must file the NY Form M-11. This includes existing or proposed corporations, general partnerships, limited partnerships, and other types of organizations (as specified on the form) that are organized under the laws of any state and plan to issue securities such as stocks, bonds, notes, partnership interests, among others. However, issuers engaged in real estate or mortgage financing, and theatrical syndications must also meet additional requirements as prescribed by relevant sections of the General Business Law and the Arts and Cultural Affairs Law respectively.

Are there any specific sectors or types of offerings that are exempt from filing the NY Form M-11?

Yes, the form itself mentions that it should not be used by issuers engaged in any aspect of real estate or mortgage financing unless they also obtain a letter upon written application pursuant to General Business Law Section 352-e or 352-g. Furthermore, theatrical syndication must comply with Article 23 of the Arts and Cultural Affairs Law. This implies that entities operating within these sectors are subject to different filing requirements and may not be exempt but have to fulfill additional conditions.

What information is required to complete the NY Form M-11?

To complete the NY Form M-11, issuers need to provide comprehensive information including the issuer's name, principal office address, telephone number, the organizational structure of the issuer (e.g., corporation, partnership), a brief description of the issuer's business, details of the securities being offered, total amount of the offering and anticipated offering expenses, the intended use of net proceeds from the offering, and additional details if there is any secondary offering. Disclosure regarding any past legal or financial issues faced by the registrant, officers, directors, or principal partners is also required.

What is the filing fee for the NY Form M-11?

The filing fee for the NY Form M-11 depends on the total amount of the offering. If the total amount of the offering is $500,000 or less, the fee is $300. For offerings more than $500,000, the fee increases to $1,200. It is important to note that payment must be made via Attorney's check, company check, certified check, bank check, or money order, as personal checks are not accepted.

How does one submit the NY Form M-11?

The completed NY Form M-11, along with the proper filing fee, should be sent to the Investment Protection Bureau of the NYS Department of Law, located at 120 Broadway, 23rd Floor, New York, New York, 10271. It is crucial to ensure that all sections of the form are completed accurately and that all necessary documentation is included to avoid delays or rejections of the form.

What happens after filing the NY Form M-11?

After the NY Form M-11 is filed, the Investment Protection Bureau will review the submission to ensure compliance with the relevant sections of the General Business Law. If the form is approved, the issuer will be allowed to proceed with the offering of securities as described in the form. Issuers may also be required to file additional forms or notices with the Department of State, such as a State Notice or Consent to Service of Process, depending on the nature of the offering and the issuer's residency status.

Are amendments to the NY Form M-11 allowed after initial filing?

Yes, any changes or amendments to the information provided on the NY Form M-11 must be submitted within 30 days on the NY Form M-3, accompanied by a $30 fee. This requirement ensures that all information remains current and accurate, reflecting any significant changes to the offering or the issuer's situation.

What are the consequences of providing false information on the NY Form M-11?

Providing false information on the NY Form M-11 is taken very seriously and constitutes a violation of Article 23-A of the General Business Law. Such violations can lead to legal repercussions, including penalties and the possible revocation of the approval to offer securities in New York State. It is critical for all issuers to ensure the accuracy and truthfulness of all information provided on the form to avoid such outcomes.

Common mistakes

Filling out the NY Form M-11 correctly is crucial for compliance with the New York State Department of Law Investment Protection Bureau's requirements. However, several common mistakes can jeopardize the accuracy and completeness of the submission. Being aware of these pitfalls can help ensure that the process goes smoothly and avoids potential legal and administrative complications.

One major area of error involves the basic identification and structural information about the issuer. Mistakes here can include:

- Incorrectly identifying the type of entity (e.g., corporation, partnership) or failing to specify the entity's legal structure entirely.

- Providing an incomplete or inaccurate principal address, which is essential for establishing the entity's primary location for legal and communication purposes.

- Omitting or erroneously filling out the file number found on the fee receipt for the original filing, which is crucial for record-keeping and tracking purposes.

Another common set of mistakes pertains to the details of the securities being offered. These can include:

- Failing to properly describe the business of the issuer or the type of securities being offered, leading to uncertainties or misrepresentations about the investment opportunity.

- Overlooking the requirement to attach offering literature or, if it's not available, not providing a thorough letter of explanation as required by the form instructions.

- Incorrectly estimating or inadequately detailing the total amount of the offering and the anticipated offering expenses, which are critical for financial transparency and compliance.

The form also requires specific disclosures about the issuer's and its principals' past, which are often mishandled in the following ways:

- Failure to disclose previous legal or regulatory issues, such as suspensions or convictions, which is essential for evaluating the trustworthiness and track record of the issuance.

- Not listing all employees or principals involved in selling the securities in New York State, resulting in incomplete information about who is promoting the investment.

- Omitting or incorrectly completing information about past bankruptcies or financial reorganizations, which can significantly impact an investor's risk assessment.

- Not updating or amending the filing within 30 days as required when any changes to the supplied information occur, leading to potential discrepancies or compliance issues.

Attention to detail when filling out the NY Form M-11 and strict adherence to the form's instructions can help avoid these common mistakes. Doing so not only aids in maintaining transparency and compliance but also builds trust with potential investors by presenting a clear and responsible picture of the investment opportunity.

Documents used along the form

When navigating the intricacies of New York’s legal requirements for securities offerings, understanding the NY Form M-11 is just the beginning. Alongside this essential document, individuals and entities are likely to encounter other forms and documents that are just as crucial a part of the process. Each document serves its unique purpose, knitted closely into the fabric of compliance and regulatory adherence.

- NY Form M-3 (Amendments): This form is crucial for issuers who need to report any changes or amendments to information previously submitted on the NY Form M-11. It ensures the New York State Department of Law is kept up-to-date on any significant changes that might affect the securities offering or the issuer’s information. Just as the seasons change, so might the details of a securities offering; this form captures such evolutions accurately and officially.

- U2 Consent to Service of Process: Often required for out-of-state issuers, the U2 form acts as an agreement from the issuer to the jurisdiction of New York courts over any disputes arising out of the securities offering. It's akin to setting ground rules for how disputes will be managed, ensuring that if legal proceedings become necessary, they can proceed smoothly without jurisdictional hiccups.

- Form U4 (Uniform Application for Securities Industry Registration or Transfer): This form is used to register individuals who are selling securities in New York State. The Form U4 delves into the background of salespeople, ensuring transparency and integrity in the individuals who act as the face of the securities offering to potential investors.

- Offering Prospectus: Although not a form in the technical sense, the offering prospectus is a document that provides detailed information about the security being offered, the issuer, the terms of the offering, and associated risks. Think of it as the storybook of the investment offering, giving potential investors a comprehensive view of what they’re considering investing in. While it may not always be a formal requirement, it often accompanies the NY M-11 for clarity and full disclosure.

Together, these documents paint a fuller picture of the securities offering process in New York. Understanding how each plays into the overarching goal of compliance and transparency can guide issuers through the complexity of regulations, ultimately leading to a more seamless experience. That’s the allure of due diligence: it turns potential puzzles into straightforward pathways.

Similar forms

The Form D, often used in connection with offerings exempt from registration under Regulation D of the Securities Act of 1933, shares similarities with the NY Form M-11 in purpose and structure. Both forms play a crucial role in regulatory filings for securities offerings, offering a streamlined process for issuers to provide essential information about their securities offerings to regulatory bodies. Like the NY Form M-11, Form D requires issuers to disclose basic information about the company, the offered securities, the size of the offering, and how the proceeds will be used, ensuring that pertinent details are accessible for regulatory overview and investor protection.

Another document that resembles the NY Form M-11 is the SEC Form S-1, which is a registration statement for new securities to be sold to the public. Both forms require detailed information about the issuer, including business operations, financial condition, and management. However, while Form M-11 is tailored for specific types of offerings within New York State, Form S-1 is used universally across the United States for initial public offerings (IPOs) and is significantly more comprehensive, covering a broader range of disclosure requirements set by the SEC to protect investors.

The Uniform Application for Investment Adviser Registration (Form ADV) also has parallels with the NY Form M-11, especially in its purpose of enhancing transparency and facilitating regulatory oversight. Form ADV is required for investment advisers to register with both the Securities and Exchange Commission (SEC) and state securities authorities. Both the Form ADV and Form M-11 collect detailed information about the registrants' business practices, affiliations, and any disciplinary events, aiming to safeguard the interests of the investing public by providing accessible and relevant information about the entities managing or offering investment opportunities.

The Uniform Securities Act (USA) Form U-2, also known as the Consent to Service of Process, shares a fundamental similarity with the NY Form M-11 regarding interstate and intrastate securities regulation compliance. While the Form M-11 is specific to securities offerings in New York, requiring issuers to disclose key information, the Form U-2 is used by issuers to appoint a service agent in a state, consenting to the jurisdiction of the state’s courts. Both forms are integral components of the regulatory framework, ensuring that issuers operate within the legal parameters set by state laws.

The NASAA (North American Securities Administrators Association) Electronic Filing Depository's (EFD) system form, used for the submission of Form D filings for Regulation D offerings, bears resemblance to the NY Form M-11 in its objective to streamline the filing process for securities exemptions. While the EFD system allows for electronic filing of exemption notices across multiple states, the NY Form M-11 specifically targets entities offering securities in New York, optimizing transparency and efficiency in the regulatory filing process. Both platforms serve to enhance the accessibility and management of exemption filings, though they cater to different jurisdictions.

The NY Form M-3, intended for amendments to the initial M-11 filing, is closely related to the NY Form M-11 in its application and purpose. Just as the Form M-11 is used for the initial disclosure of an offering in New York, the Form M-3 allows issuers to update previously submitted information, ensuring that all disclosures remain accurate and current. This mechanism for amendments is crucial for maintaining the integrity of the information on which investors and regulators rely, facilitating ongoing compliance with the regulatory requirements.

Form S-3, a simplified securities registration form used by already public companies under the SEC regulations, shares a conceptual similarity with the NY Form M-11. Both forms aim to reduce the regulatory burden on issuers while ensuring that necessary information is provided to potential investors and regulatory bodies. Form S-3, however, is applicable for issuers meeting certain reporting requirements, offering a streamlined path for registering securities offerings, paralleling the aim of Form M-11 to simplify the filing process within the specific context of New York State offerings.

The California Department of Business Oversight’s Form DBO-260.211, used for securities offerings in California, is analogous to the NY Form M-11 in its state-specific focus on securities regulation. Similar to New York’s M-11 form, California’s filing requirements are designed to protect investors by mandating disclosures that include details about the offering, the company’s management, and financial condition. While each state has its own regulatory framework and forms, the underlying principle of both documents is to foster transparency and investor protection within the respective state’s jurisdiction.

Dos and Don'ts

When it comes to filling out the NY Form M-11, which is required for certain issuers by the New York State Department of Law, there are specific dos and don'ts that one should follow to ensure a smooth and compliant submission process. Here’s a guide to help you navigate the form correctly:

- Do ensure that all information provided is accurate and up-to-date. Falsifying information or omitting crucial data can lead to legal penalties or the rejection of your submission.

- Do provide a detailed description of the business of the issuer in the section allocated. This helps in understanding the purpose and the operational field of the issuer.

- Do attach any required offering literature or a letter of explanation if the literature is not available at the time of filing. This is crucial for the review process.

- Do clearly list the total anticipated offering expenses, breaking down the costs into selling expenses and other expenses to provide transparency.

- Do check all applicable boxes accurately in section 8 regarding the history of the issuer and its principals, to ensure full disclosure of any past regulatory issues or criminal activities.

- Don’t use personal checks for the filing fee. The form specifies acceptable forms of payment which include attorney's check, company check, certified check, bank check, or money order.

- Don’t forget to include the filing fee as per the amount of offering. Be aware of the tiered fee structure and ensure the correct amount is sent with your submission.

- Don’t omit any signatures required. If signatures cannot be provided at the time of filing, follow the procedure outlined in the instructions by submitting the proper total fee and all required information, with a note that additional signatures will follow.

This list is a concise guide to ensure your NY Form M-11 is filled out correctly and that your filing process is in compliance with the regulations set by the New York State Department of Law. Always read the form instructions carefully and consult with a legal advisor if you encounter any issues.

Misconceptions

There are several common misconceptions regarding the New York Form M-11, which is crucial for issuers of securities in New York State. Clarifying these misunderstandings can help ensure compliance with state laws and facilitate a smoother filing process.

Only corporations need to file Form M-11: This is not true. Form M-11 must be filed by various types of entities, including corporations, partnerships, and limited partnerships, that plan to offer securities within New York State. The requirement is based on the act of offering securities, not the type of entity making the offer.

Form M-11 is only for initial offerings: Actually, Form M-11 can be relevant for both initial and secondary offerings. Any offering of securities to the public in New York may require the completion and submission of this form to ensure regulatory compliance.

The form is straightforward and requires minimal information: In reality, Form M-11 requires detailed information about the issuer, including the business, the securities being offered, the use of proceeds, and background on the officers and directors. It is important to meticulously prepare and review the submission to avoid potential issues.

Real estate and mortgage financing issuers are exempt: This misconception could lead to noncompliance. While certain real estate and mortgage financing issuers may think they are exempt, they must also comply with specific sections of the General Business Law and potentially file Form M-11 along with obtaining a letter upon written application.

Electronic submissions are accepted: As of the last update, Form M-11 submissions require a physical mailing of the form along with the appropriate fee to the Investment Protection Bureau. Relying on an assumption that electronic submissions are acceptable can lead to a failure to properly file.

Personal checks are accepted for the filing fee: The instructions clearly state that payment can be made via attorney's check, company check, certified check, bank check, or money order. Personal checks are not accepted, and using one could delay the processing of the form.

Once filed, no further action is required: Issuers should be aware that changes or amendments to the information provided in Form M-11 must be submitted within 30 days on a separate form, M-3, with an additional fee. Keeping information current is a continual obligation rather than a one-time task.

Understanding and addressing these misconceptions about the NY Form M-11 can help entities navigate the complexities of securities law compliance in New York State more effectively.

Key takeaways

Filling out and using the NY Form M-11 requires careful attention to detail and adherence to guidelines set forth by the New York State Department of Law Investment Protection Bureau. Here are six key takeaways to help individuals and entities navigate the process effectively:

- The NY Form M-11 should not be used by issuers involved in real estate or mortgage financing unless they also obtain a letter upon written application pursuant to General Business Law Section 352-e or 352-g. This distinction is crucial for ensuring that the filing is appropriate for the issuer's specific type of business activity.

- Issuers must specify their business structure, such as a corporation, general partnership, limited partnership, or other, and provide detailed information about their business, the type of securities they propose to offer, and how these securities will be sold. This information helps the Department of Law understand the issuer's operations and the securities offering.

- Accurate financial details are essential, including the total amount of the offering and anticipated offering expenses. These figures are used to determine the filing fee, which varies depending on the total amount of the offering. Providing accurate financial information ensures that issuers comply with fee requirements and avoid delays.

- The form requires issuers to outline the intended use of net proceeds from the offering. This transparency ensures investors understand how their funds will be used and supports the Department of Law's oversight of securities offerings within the state.

- All officers, directors, principals, or partners need to disclose any past suspensions, expulsions, license or registration revocations, criminal convictions, and any involvement in bankruptcy or disciplinary proceedings. This disclosure is vital for maintaining integrity and trust in New York's securities market.

- The form necessitates one original signature at the time of filing, with the provision that counterpart forms with missing signatures be submitted within 30 days of filing. Ensuring that all necessary signatures are provided on time is crucial for the completeness and validity of the filing.

In summary, navigating the NY Form M-11 requires a detailed understanding of the form's requirements and adherence to New York State's legal guidelines for securities offerings. Accuracy, transparency, and timeliness in completing and submitting the form are critical for ensuring compliance and facilitating a successful securities offering process.

Common PDF Documents

Motor Vehicle Accident Claim - Its role is vital in ensuring that the compensation process is grounded in factual and verified data, minimizing any biases or inaccuracies.

Nyc Lease Renewal Form Pdf - Serving as an official document, it lends weight to the tenant's complaint, potentially facilitating quicker resolutions from landlords.