Free Ny It 203 Form in PDF

The NY IT-203 form is essential for people who have spent part of the year living or earning in New York State, New York City, or Yonkers but do not qualify as full-year residents. It’s the paperwork nonresidents and part-year residents use to report income earned during the time they lived in or derived income from these areas between January 1, 2021, and December 31, 2021. This comprehensive form walks you through detailing various types of income, from wages and dividends to rental real estate earnings, while also considering deductions, credits, and particular adjustments specific to New York taxes. It’s vital to accurately complete this form to ensure compliance with New York’s tax laws, benefiting from any applicable refunds or tax credits. Additionally, understanding the nuances of residency and how it affects tax liability, from identifying your permanent home address to calculating New York-adjusted gross income, is crucial for filers. Printed instructions, delineated sections for dependents, deductions, income adjustments, and taxpayers' detailed information, make it a navigational tool in fulfilling state tax obligations. Notably, the IT-203 form also incorporates sections for New York City and Yonkers taxes, ensuring that part-year residents and nonresidents can account for local tax liabilities in addition to state taxes.

Ny It 203 Sample

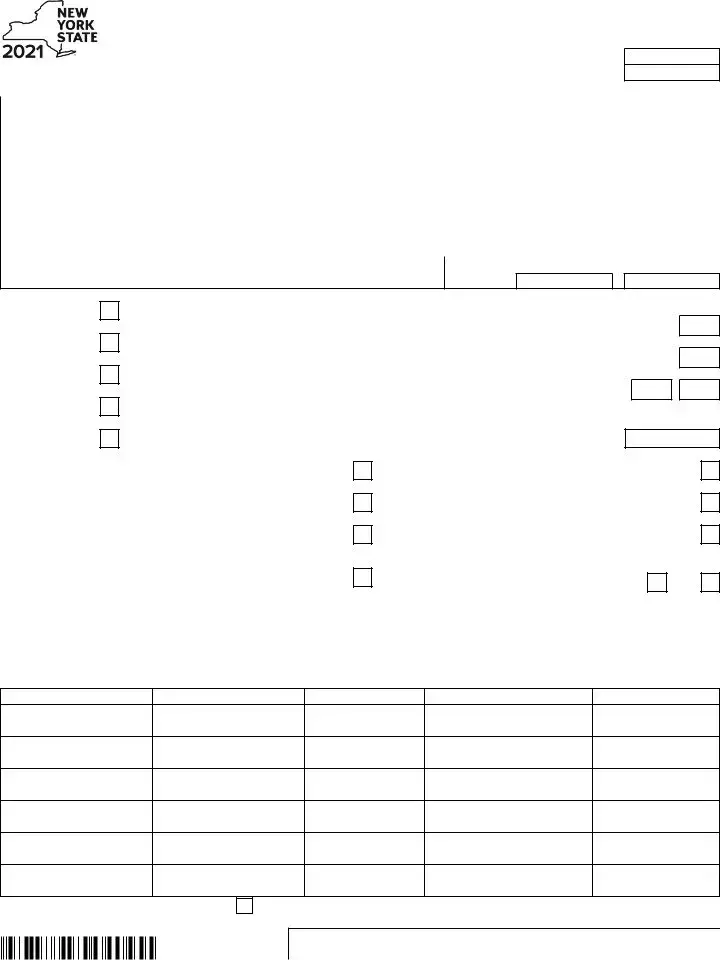

Department of Taxation and Finance

Nonresident and

Income Tax Return New York State • New York City • Yonkers • MCTMT

For the year January 1, 2021, through December 31, 2021, or fiscal year beginning ...........

and ending ...........

21

For help completing your return, see the instructions, Form

Your first name and middle initial |

Your last name (for a joint return, enter spouse’s name on line below) |

Your date of birth (mmddyyyy) |

Your Social Security number |

|||||||

|

|

|

|

|

|

|

|

|

||

Spouse’s first name and middle initial |

Spouse’s last name |

|

|

Spouse’s date of birth (mmddyyyy) |

Spouse’s Social Security number |

|||||

|

|

|

|

|

|

|

|

|

||

Mailing address (see instructions, page 12) (number and street or PO Box) |

|

|

|

Apartment number |

New York State county of residence |

|||||

|

|

|

|

|

|

|

|

|

||

City, village, or post office |

|

State |

ZIP code |

|

Country |

|

|

School district name |

||

|

|

|

|

|

|

|

|

|

|

|

Taxpayer’s permanent home address (see instr., pg. 12) (no. and street or rural route) |

Apartment no. |

|

City, village, or post office |

|

School district |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

code number |

|

State |

ZIP code |

Country |

Taxpayer’s date of death Spouse’s date of death

Decedent information

A Filing

status

(mark an X in one box):

Single

Married filing joint return

(enter both spouses’ Social Security numbers above)

Married filing separate return

(enter both spouses’ Social Security numbers above)

Head of household (with qualifying person)

Qualifying widow(er)

ENew York City

(1) Number of months you lived in NY City in 2021 .....

(2)Number of months your spouse lived

in NY City in 2021 ....................................................

FEnter your

G New York State |

Enter the date you moved into |

or out of NYS (mmddyyyy) |

B Did you itemize your deductions on your 2021 |

|

|

|

|

|

|

|

federal income tax return? |

Yes |

|

No |

|

|||

C Can you be claimed as a dependent on another |

|

|

|

|

|

|

|

taxpayer’s federal return? |

Yes |

|

No |

|

|||

D1 Did you have a financial account located in a |

|

|

|

|

|

|

|

foreign country? (see page 13) |

Yes |

|

No |

|

|||

D2 Were you required to report any nonqualified deferred |

|

|

|

compensation, as required by IRC § 457A, on your |

|

|

|

2021 federal return? (see page 13) |

Yes |

|

No |

On the last day of the tax year (mark an X in one box): |

|

1) |

Lived in NYS |

2) |

Lived outside NYS; received income from |

|

NYS sources during nonresident period |

3) |

Lived outside NYS; received no income from |

|

NYS sources during nonresident period |

HNew York State nonresidents (see page 14)

Did you or your spouse maintain |

|

|

living quarters in NYS in 2021? |

Yes |

No |

(if Yes, complete Form

IDependent information (see page 14)

First name and middle initial

Last name

Relationship

Social Security number

Date of birth (mmddyyyy)

If more than 6 dependents, mark an X in the box.

203001210094

For office use only

Page 2 of 4 |

Enter your Social Security number |

||

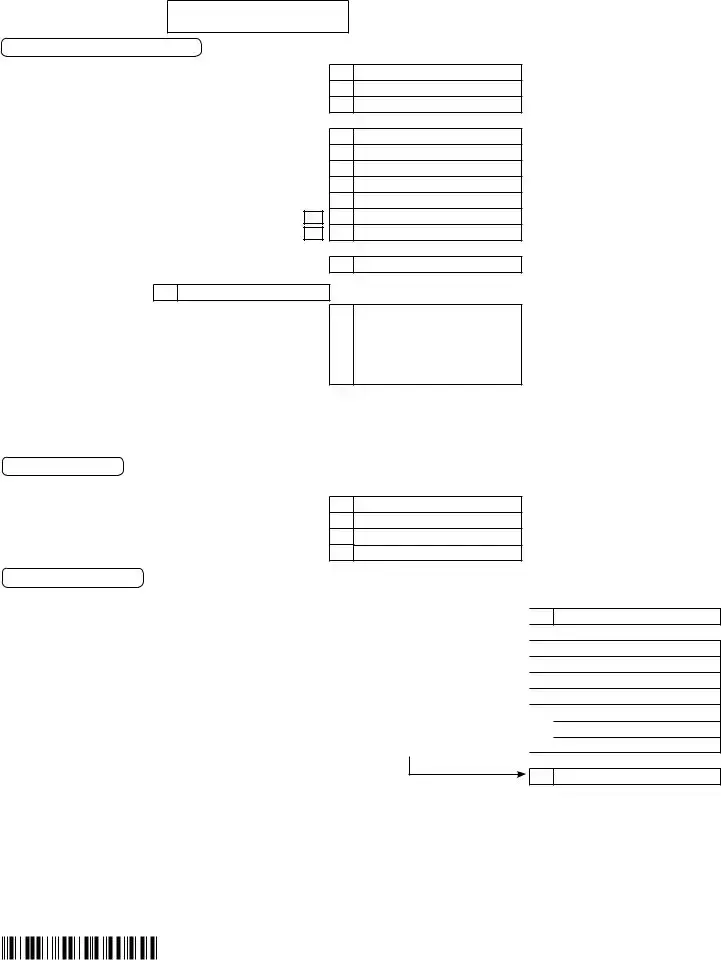

Federal income and adjustments |

(see page 16) |

||

1 |

Wages, salaries, tips, etc. |

.............................................. |

1 |

2 |

Taxable interest income |

2 |

|

3 |

Ordinary dividends |

.............................................. |

3 |

4Taxable refunds, credits, or offsets of state and local

|

income taxes (also enter on line 24) |

4 |

5 |

Alimony received |

5 |

6 |

Business income or loss (submit a copy of federal Sch. C, Form 1040) |

6 |

7 |

Capital gain or loss (if required, submit a copy of federal Sch. D, Form 1040) |

7 |

8 |

Other gains or losses (submit a copy of federal Form 4797) |

8 |

9 |

Taxable amount of IRA distributions. Beneficiaries: mark X in box |

9 |

10 |

Taxable amount of pensions/annuities. Beneficiaries: mark X in box |

10 |

11Rental real estate, royalties, partnerships, S corporations,

trusts, etc. (submit a copy of federal Schedule E, Form 1040) 11

12 Rental real estate included |

|

in line 11 (federal amount) 12. |

.00 |

Federal amount

Whole dollars only

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

|

New York State amount |

|

Whole dollars only |

|

|

1 |

.00 |

2 |

.00 |

3 |

.00 |

|

|

4 |

.00 |

5 |

.00 |

6 |

.00 |

7 |

.00 |

8 |

.00 |

9 |

.00 |

10 |

.00 |

|

|

11 |

.00 |

13 |

Farm income or loss (submit a copy of federal Sch. F, Form 1040) |

13 |

.00 |

|

14 |

Unemployment compensation |

14 |

.00 |

|

15 |

Taxable amount of Social Security benefits (also enter on line 26) |

15 |

.00 |

|

16 |

Other income (see page 22) |

Identify: |

16 |

.00 |

17 |

Add lines 1 through 11 and 13 through 16 |

17 |

.00 |

|

18Total federal adjustments to income (see page 22)

|

Identify: |

18 |

.00 |

19 |

Federal adjusted gross income (subtract line 18 from line 17) .. |

19 |

.00 |

19a |

Recomputed federal adjusted gross income (see page 23, Line 19a worksheets) |

19a |

.00 |

13 |

.00 |

14 |

.00 |

15 |

.00 |

16 |

.00 |

17 |

.00 |

|

|

18 |

.00 |

19 |

.00 |

19a |

.00 |

New York additions (see page 24)

20Interest income on state and local bonds and obligations

(but not those of New York State or its localities) ................

21Public employee 414(h) retirement contributions ...........

22Other (Form

23Add lines 19a through 22 ...............................................

20

21

22

23

.00

.00

.00

.00

20 |

.00 |

21 |

.00 |

22 |

.00 |

23 |

.00 |

New York subtractions (see page 25)

24Taxable refunds, credits, or offsets of state and

|

local income taxes (from line 4) |

24 |

.00 |

|

24 |

25 |

Pensions of NYS and local governments and the |

|

|

|

|

|

federal government (see page 25) |

25 |

.00 |

|

25 |

26 |

Taxable amount of Social Security benefits (from line 15) |

26 |

.00 |

|

26 |

27 |

Interest income on U.S. government bonds |

27 |

.00 |

|

27 |

28 |

Pension and annuity income exclusion |

28 |

.00 |

|

28 |

29 |

Other (Form |

29 |

.00 |

|

29 |

30 |

Add lines 24 through 29 |

30 |

.00 |

|

30 |

31 |

New York adjusted gross income (subtract line 30 from line 23) |

31 |

.00 |

|

31 |

.00

.00

.00

.00

.00

.00

.00

.00

32 Enter the amount from line 31, Federal amount column ..........................................................

32

.00

203002210094

Name(s) as shown on page 1 |

Enter your Social Security number |

|

|

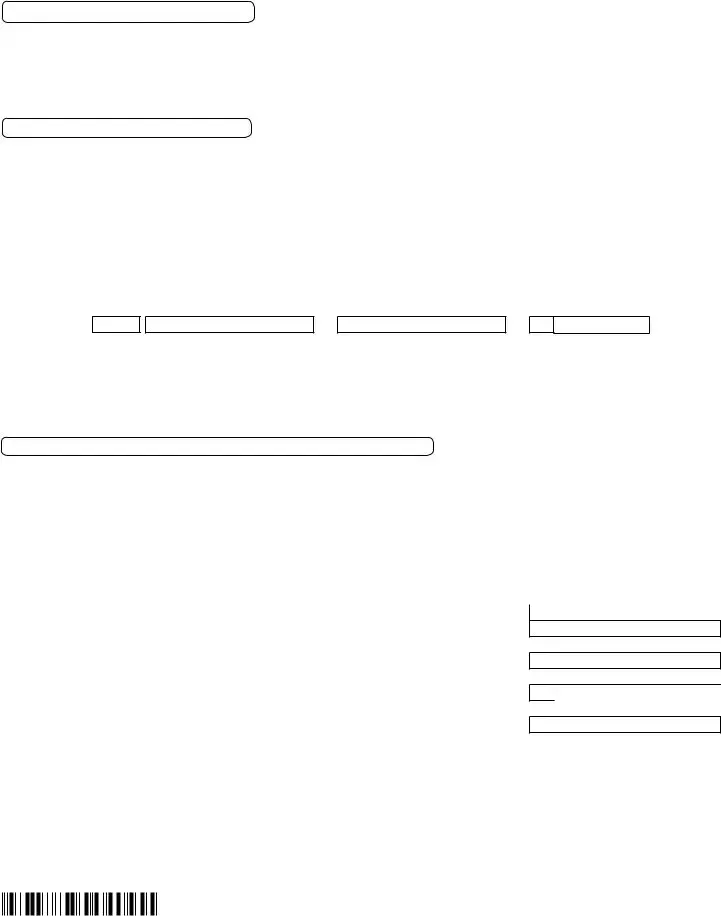

Standard deduction or itemized deduction (see page 27)

33 Enter your standard deduction (table on page 27) or your itemized deduction (from Form |

|

|

||||||

|

Mark an X in the appropriate box: ... |

|

Standard – or – |

|

Itemized |

33 |

.00 |

|

|

|

|

||||||

34 Subtract line 33 from line 32 (if line 33 is more than line 32, leave blank) |

|

|

34 |

.00 |

||||

35 Dependent exemptions (enter the number of dependents listed in Item I; see page 27) |

|

|

35 |

000.00 |

||||

36 New York taxable income (subtract line 35 from line 34) |

|

|

|

36 |

.00 |

|||

Tax computation, credits, and other taxes |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

37 |

New York taxable income (from line 36) |

|

|

|

37 |

.00 |

||

38 |

New York State tax on line 37 amount (see page 28) |

|

|

|

38 |

.00 |

||

39 |

New York State household credit (page 28, table 1, 2, or 3) |

|

|

|

39 |

.00 |

||

40 |

Subtract line 39 from line 38 (if line 39 is more than line 38, leave blank) |

|

|

40 |

.00 |

|||

41 |

New York State child and dependent care credit (see page 29) |

..................................................... |

|

|

|

41 |

.00 |

|

42 |

Subtract line 41 from line 40 (if line 41 is more than line 40, leave blank) |

|

|

42 |

.00 |

|||

43 |

New York State earned income credit (see page 29) |

|

|

|

43 |

.00 |

||

|

|

|

|

|

|

|

|

|

44 |

Base tax (subtract line 43 from line 42; if line 43 is more than line 42, leave blank) |

|

|

44 |

.00 |

|||

45Income percentage

(see page 29)

New York State amount from line 31

.00

÷

Federal amount from line 31

.00

=

Round result to 4 decimal places

45

46 |

Allocated New York State tax (multiply line 44 by the decimal on line 45) |

46 |

.00 |

47 |

New York State nonrefundable credits (Form |

47 |

.00 |

48 |

Subtract line 47 from line 46 (if line 47 is more than line 46, leave blank) |

48 |

.00 |

49 |

Net other New York State taxes (Form |

49 |

.00 |

50 |

Total New York State taxes (add lines 48 and 49) |

50 |

.00 |

New York City and Yonkers taxes, credits, and surcharges, and MCTMT

51 |

....... |

51 |

.00 |

|||

52 |

|

|

|

|||

|

child and dependent care credit |

52 |

.00 |

|||

52a |

Subtract line 52 from 51 |

52a |

.00 |

|||

52b |

MCTMT net |

|

|

|

|

|

|

earnings base.... |

52b |

|

.00 |

|

|

52c |

MCTMT |

|

|

|

52c |

.00 |

53 |

Yonkers nonresident earnings tax (Form |

53 |

.00 |

|||

54

(Form |

54 |

.00 |

55Total New York City and Yonkers taxes / surcharges and MCTMT (add lines 52a, and 52c through 54)

56Sales or use tax (See the instructions on page 31. Do not leave line 56 blank.) ..............................

57Voluntary contributions (Form

58Total New York State, New York City, Yonkers, and sales or use taxes, MCTMT,

and voluntary contributions (add lines 50, 55, 56, and 57) .....................................................

See instructions on pages 29 through 31 to compute New York City and Yonkers taxes, credits, and surcharges, and MCTMT.

55 |

|

.00 |

|

56 |

|

.00 |

|

|

|

||

57 |

|

.00 |

|

|

|

||

58 |

|

|

|

|

.00 |

|

|

203003210094

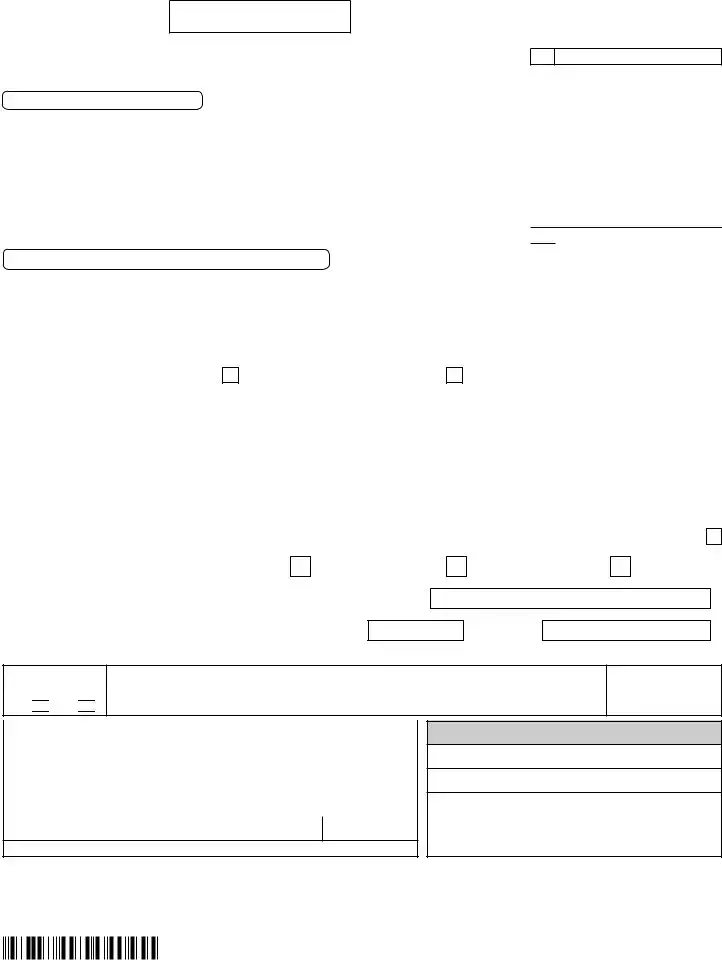

Page 4 of 4

Enter your Social Security number

59 Enter amount from line 58 |

59 |

Payments and refundable credits |

(see page 32) |

.00

60 |

60 |

|

.00 |

|

60a |

NYC school tax credit (rate reduction amount) |

60a |

|

.00 |

61 |

Other refundable credits (Form |

61 |

|

.00 |

62 |

Total New York State tax withheld |

62 |

|

.00 |

63 |

Total New York City tax withheld |

63 |

|

.00 |

64 |

Total Yonkers tax withheld |

64 |

|

.00 |

65 |

Total estimated tax payments/amount paid with Form |

65 |

|

.00 |

66 |

Total payments and refundable credits (add lines 60 through 65) |

............................................. |

||

If applicable, complete

Form(s)

Do not send federal

Form

66 |

.00 |

Your refund, amount you owe, and account information |

(see pages 34 through 36) |

|

|

||||||

|

|

|

|

|

|

|

|

||

67 |

Amount overpaid (if line 66 is more than line 59, subtract line 59 from line 66; see page 34) |

67 |

.00 |

||||||

68 |

Amount of line 67 available for refund (subtract line 69 from line 67) |

68 |

.00 |

||||||

|

TIP: Use this amount to check your refund status online. |

|

|

|

|

|

|||

68a |

Amount of line 68 that you want to deposit into a NYS 529 account (Form |

68a |

.00 |

||||||

68b Total refund after NYS 529 account deposit (subtract line 68a from line 68) |

68b |

.00 |

|||||||

|

|

direct deposit to checking or |

paper |

|

Refund? Direct deposit is the |

||||

|

Mark one refund choice: |

savings account (fill in line 73) - or - |

check |

|

|||||

|

|

easiest, fastest way to get your |

|||||||

69 |

Amount of line 67 that you want applied to your 2022 |

|

|

|

|

||||

|

|

|

|

refund. |

|||||

|

estimated tax (see instructions) |

|

|

69 |

|

.00 |

|

See page 35 for payment |

|

70 |

Amount you owe (if line 66 is less than line 59, subtract line 66 from line 59). To pay by electronic |

|

|||||||

|

options. |

||||||||

|

funds withdrawal, mark an X in the box |

|

and fill in lines 73 and 74. If you pay by check |

|

|||||

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

or money order you must complete Form |

70 |

.00 |

||||||

71Estimated tax penalty (include this amount on line 70,

or reduce the overpayment on line 67; see page 35) |

71 |

.00 |

See page 38 for the proper |

|

assembly of your return. |

||||

72 Other penalties and interest (see page 35) |

72 |

.00 |

||

|

73Account information for direct deposit or electronic funds withdrawal (see page 36).

If the funds for your payment (or refund) would come from (or go to) an account outside the U.S., mark an X in this box (see pg. 36)

73a |

Account type: |

|

|

Personal checking - or - |

73b |

Routing number |

|

|

|

|

|

|||

Personal savings - or -

73c Account number

Business checking - or -

Business savings

74 Electronic funds withdrawal (see page 36) |

Date |

Amount

.00

designee? (see instr.)

Yes

No

No

Print designee’s name |

Designee’s phone number |

|

|

( |

) |

|

|

|

Email:

Personal identification

number (PIN)

▼ Paid preparer must complete ▼ |

Preparer’s NYTPRIN |

NYTPRIN |

||||

(see instructions) |

|

|

|

excl. code |

|

|

Preparer’s signature |

|

Preparer’s printed name |

|

|

|

|

|

|

|

|

|

|

|

Firm’s name (or yours, if |

|

|

Preparer’s PTIN or SSN |

|||

|

|

|

|

|

|

|

Address |

|

|

Employer identification number |

|||

|

|

|

|

|

|

|

Date

Email:

▼ Taxpayer(s) must sign here ▼

Your signature

Your occupation

Spouse’s signature and occupation (if joint return)

Date |

Daytime phone number |

|

|

( |

) |

Email:

See instructions for where to mail your return.

203004210094

File Overview

| Fact | Detail |

|---|---|

| Form Type | IT-203, Nonresident and Part-Year Resident Income Tax Return |

| Applicability | For individuals who were nonresidents or part-year residents of New York State, New York City, or Yonkers |

| Tax Year | For the year starting January 1, 2021, and ending December 31, 2021, or applicable fiscal year |

| Residency Status | Informs tax liabilities based on residency in New York State, New York City, and Yonkers, including part-year residents and nonresidents |

| Governing Law | New York State Tax Law |

| Income Reporting | Requires detailed income reporting for periods of residency and nonresidency, including wages, interest, dividends, and other income |

| Special Credits and Deductions | Eligibility for specific credits and deductions, like New York State household credit and child and dependent care credit, depending on residency status |

Ny It 203: Usage Guidelines

Filling out the NY IT-203 form is a step-by-step process that involves providing personal information, income details, and tax liability. This guide will break down these steps to make completing the form easier. Remember, each section must be filled out accurately to ensure correct tax calculation and avoid any potential issues with your tax return.

- Start by entering your first name, middle initial, and last name, along with your date of birth (MMDDYYYY) and Social Security number in the designated spaces. If filing jointly, include your spouse’s information as well.

- Fill in your complete mailing address, including apartment number if applicable, New York State county of residence, city, village or post office, state, ZIP code, and country.

- Provide your taxpayer’s permanent home address following the same format as above. Include the school district name and code number.

- Mark your filing status by checking the appropriate box in section A. If applicable, fill out sections E and F with information on New York City and state part-year residency, including dates and special condition codes.

- Answer the questions regarding itemized deductions, dependency status, foreign accounts, and deferred compensation in sections B, C, D1, and D2.

- Enter dependent information in section I, including names, relationships, Social Security numbers, and dates of birth.

- On page 2, report your income and adjustments. Begin with wages, salaries, and tips, and continue down through other income types, including taxable interest, dividends, alimony, rental real estate, and so forth. Attach federal forms if required.

- Calculate your New York additions and subtractions, then enter the totals in the respective sections to determine your New York adjusted gross income.

- Choose between the standard deduction or itemized deduction on page 3 and subtract this from your adjusted gross income to find your New York taxable income.

- Compute your New York State tax, household credit, and apply any applicable credits to find your base tax and New York State income percentage.

- Calculate part-year New York City resident tax, Yonkers taxes, credits, and the Metropolitan Commuter Transportation Mobility Tax (MCTMT) if applicable.

- On page 4, tally up your payments and refundable credits, including New York State, New York City, and Yonkers tax withheld, as well as any estimated tax payments.

- Determine your refund or amount owed by comparing total payments and credits against your total tax liability. Decide if you would like a direct deposit for your refund or wish to apply any overpayment to next year’s estimated tax.

- Provide bank account information for direct deposit or electronic funds withdrawal if you owe additional taxes.

- Review your form, ensure all applicable sections are completed and attach any required documentation such as W-2 or 1099 forms.

- Sign and date the form. If a paid preparer completed the form, they must also sign and include their identification information.

Once all steps are completed, review your form for accuracy and completeness. Attach any required documentation, and mail it to the appropriate address listed in the form instructions. Filling out the NY IT-203 accurately and thoroughly is crucial for processing your nonresident and part-year resident income tax return without delays.

FAQ

-

What is the purpose of the NY IT-203 form?

The NY IT-203 form is used by nonresidents and part-year residents of New York State to file their income tax returns. This includes taxes for New York State, New York City, Yonkers, and the Metropolitan Commuter Transportation Mobility Tax (MCTMT).

-

Who needs to file the IT-203 form?

Individuals who lived outside New York State for part or all of the year but earned income from New York sources during the nonresident period, as well as those who moved into or out of New York State during the tax year, need to file the IT-203 form. If you or your spouse maintained living quarters in New York and had income connected to the state, you should also file this form.

-

What information do I need to complete the IT-203 form?

- Your and your spouse’s personal information, including Social Security numbers and dates of birth.

- Detailed income information, including wages, interest, dividends, and any income from New York sources.

- Information on any taxes already paid through withholding or estimated payments.

- Deductions or credits you’re claiming, such as itemized deductions or dependent exemptions.

-

Can I file the IT-203 form electronically?

Yes, you can file your IT-203 form electronically through approved software or a tax professional who is authorized to e-file New York State tax returns. Electronic filing is faster and more secure, and it enables quicker processing of your return and refund.

-

How do I calculate my taxable income on the IT-203 form?

To calculate your taxable income, start by reporting your federal adjusted gross income (AGI) and making any required additions or subtractions specific to New York State. Then, subtract either your standard deduction or itemized deductions, as well as any dependent exemptions you’re eligible for, to determine your New York taxable income.

-

What are the deadlines for filing the IT-203 form?

The IT-203 form is typically due on April 15th following the end of the tax year. However, if the 15th falls on a weekend or holiday, the deadline is the next business day. If you need more time to file, you can request a six-month extension, but you must still pay any estimated tax owed by the original deadline to avoid penalties and interest.

-

Where do I mail my completed IT-203 form?

The mailing address for your IT-203 form depends on whether you are expecting a refund, owe taxes, or are submitting the form without payment or refund due. Check the New York State Department of Taxation and Finance’s official website or the form’s instructions for the specific addresses for each scenario.

-

What if I discover an error on my filed IT-203 form?

If you find an error after submitting your IT-203 form, you should file an amended return using Form IT-203-X as soon as possible. Provide all corrected information and explain the changes on the form. Amending your return can help avoid potential interest and penalties.

-

Can I claim credits on the IT-203 form?

Yes, there are several credits available to qualifying nonresidents and part-year residents, including the New York State household credit, child and dependent care credits, and the New York State earned income credit. Check the form instructions and the New York State Department of Taxation and Finance’s website for eligibility requirements.

Common mistakes

Filling out the New York IT-203 form, intended for nonresident and part-year resident income tax returns, can be quite the task. Taxpayers often stumble over common pitfalls that could be easily avoided. Here’s a rundown of eight mistakes frequently made:

Incorrect Social Security Numbers (SSNs): A surprisingly common error is incorrect or omitted Social Security numbers for the filer or spouse. This mistake can lead to processing delays or wrongful assessments.

Filing Status Confusion: Selecting an incorrect filing status is another frequent error. Ensure to mark the correct box that represents your current status accurately, as this impacts your tax rate and applicable deductions.

Address Mishaps: Not providing a complete or accurate mailing address, including the apartment number if applicable, can lead to delays in receiving refunds or important correspondence from the tax department.

Dates of Birth Errors: Failing to include or incorrectly stating the date of birth for yourself and your spouse can also cause unnecessary delays with your filing.

Income Reporting Mistakes: One of the more complex sections involves reporting income. It’s crucial to accurately report income from all sources and match it to what's reported on federal returns.

Deduction and Credit Blunders: Missing out on deductions or credits you’re entitled to can increase your tax liability. Conversely, claiming deductions or credits without eligibility can result in adjustments and penalties.

Signature and Date Omission: It may seem basic, but forgetting to sign and date the form is a common oversight that renders the return incomplete, delaying processing.

Incorrect Tax Calculations: Manual errors in tax calculation can lead to underpayments or overpayments. Using incorrect tax tables or misunderstanding instructions for deductions and credits often causes these errors.

To avoid these and other mistakes, careful review of each section of the form is essential. Utilize the instructions provided for the IT-203 form to ensure accuracy, consult with a tax professional if uncertain, and always double-check your entries before submission.

Documents used along the form

Completing your New York State Nonresident and Part-Year Resident Income Tax Return, IT-203, is a process often enriched by referencing or including several other forms and documents to ensure a comprehensive and accurate filing. The following resources play pivotal roles in this endeavor, each contributing its specific detail or datum to the broader financial narrative of an individual’s fiscal year.

- Form IT-203-I: Offers detailed instructions for completing the IT-203 form. This resource is invaluable for understanding each line item and ensuring data is entered correctly.

- Form IT-203-B: Required if you or your spouse maintained living quarters in New York State and are filing as nonresidents. It collects information about the duration and location of any residence in the state.

- Form IT-2: Summarizes wage and withholding information for New York State residents. This form reports wages received and state taxes withheld, complementing the federal W-2 form.

- Form IT-196: Details New York State itemized deductions. Taxpayers who itemize must complete this form to calculate deductions specific to New York, which can differ from federal amounts.

- Form IT-225: Lists all New York State additions and subtractions, providing a detailed record of adjustments to federal adjusted gross income specific to New York State tax law.

- Form IT-227: Enables taxpayers to make voluntary contributions to various causes directly through their tax return, detailing each contribution option.

- Form IT-360.1: Used for part-year New York City residents to calculate tax owed during the period of residence within the city, reflecting the unique tax considerations for New York City dwellers.

- Form Y-203: For nonresidents earning income within Yonkers, detailing the city's income tax requirements and how they pertain to individuals not residing within Yonkers for the tax year.

- Form IT-370: Application for Automatic Six-Month Extension of Time to File for Individuals, crucial for those who cannot complete their tax return by the due date and need additional time to file.

The synergy between the IT-203 form and these additional documents facilitates a thorough and compliant tax filing process for nonresident and part-year residents of New York State. By understanding the role and requirements of each form, taxpayers ensure that their financial representation to the Department of Taxation and Finance is both accurate and complete, providing a solid foundation for their fiscal responsibilities within the state.

Similar forms

The Form 1040, known as the U.S. Individual Income Tax Return, shares several similarities with the New York IT-203 form. Both documents are used to file personal income tax returns, but while Form 1040 is for federal taxes, the IT-203 is specifically for those who must report New York State, New York City, and Yonkers taxes. Each form requires detailed income information, including wages, interest, dividends, and capital gains, as well as adjustments to income, deductions, and credits to calculate the tax owed or refund due.

The IT-201, New York State Resident Income Tax Return, is another document resembling the IT-203 form but is designed for full-year New York State residents. The IT-203 caters to nonresidents or part-year residents, capturing income derived from New York sources or earned during a portion of the year when the taxpayer lived in New York. Both forms ask for similar income details and tax computations to determine state tax liability, although the IT-201 focuses on income earned from all sources, not just those tied to New York.

The California Form 540, California Resident Income Tax Return, is akin to the IT-203 form in its function for state residents or part-year/nonresidents to report state income taxes. While the IT-203 form serves New Yorkers, Form 540 serves Californians, reflecting the state-specific tax laws and regulations. Both require detailed income data, deductions, credits, and other pertinent tax information to accurately compute the state income tax obligations.

Form IT-203-B, Nonresident and Part-Year Resident Income Allocation and College Tuition Itemized Deduction Worksheet, specifically complements the IT-203 form by providing a detailed method to allocate income for New York State nonresidents or part-year residents. It focuses on allocating various types of income, such as wages or business income, to New York State when filling out the IT-203. This ensures that taxpayers accurately report and tax the appropriate amount of income earned within the state.

The Schedule E (Form 1040), Supplemental Income and Loss, is similar to parts of the IT-203 form that deal with reporting income or loss from rental real estate, royalties, partnerships, S corporations, trusts, and similar entities. Taxpayers who have such income sources must fill out Schedule E for their federal taxes and include this information on their IT-203 form for state taxes, if relevant. Both documents play a pivotal role in ensuring income from these sources is accurately reported for tax purposes.

The Form W-2, Wage and Tax Statement, although not a tax return form like the IT-203, is fundamentally associated with it. Taxpayers use the information from Form W-2, which details wages earned and taxes withheld by employers, to complete the income and tax withholding sections of the IT-203 form. This form is critical for accurately reporting earnings and taxes withheld to calculate whether additional taxes are owed or a refund is due.

The Form IT-2, Summary of W-2 Statements, directly relates to the IT-203 in New York State tax filing, as it summarizes the information provided by an individual's Form W-2s. Taxpayers who file a New York State tax return use Form IT-2 to report wages and taxes withheld when they do not electronically file their return. Both the IT-2 and IT-203 forms integrate closely to ensure accurate reporting of income and tax withholdings to the state.

Dos and Don'ts

When it comes to filling out the NY IT-203 form, which is essential for nonresidents and part-year residents in New York State, there are specific practices to follow for a smooth submission process. Below are nine crucial dos and don'ts to guide you:

- Do read the instructions (Form IT-203-I) carefully before beginning to fill out your form to understand all guidelines and requirements.

- Do ensure all personal information, including your Social Security number, mailing address, and dates of birth, is accurate and clearly written.

- Do report all income, deductions, and credits accurately, ensuring they align with your federal income tax return, to avoid discrepancies.

- Do use whole dollars only when reporting financial figures on the form.

- Do attach all necessary documents, such as your federal return and any other schedules or forms that substantiate the information on your IT-203.

- Don't leave any mandatory field blank. If a section does not apply to you, make sure to indicate this as per the form’s instructions.

- Don't guess or estimate figures. Use exact amounts from your financial documents and federal tax return to ensure accuracy.

- Don't file your return without reviewing it for mistakes. Double-check your math and the completeness of your information before submission.

- Don't ignore the specific instructions for direct deposit or electronic funds withdrawal. Ensure your bank account information is correct to avoid delays with your refund or payments.

By following these dos and don'ts, you'll help ensure your New York State nonresident and part-year resident income tax return is completed correctly and processed efficiently.

Misconceptions

When it comes to filling out the New York State IT-203 form, there are several misconceptions that can lead to confusion. Understanding these can help ensure that the process is as smooth as possible.

- Misconception 1: Only New York State residents need to file an IT-203 form.

- Misconception 2: Income earned outside of New York State doesn't need to be reported.

- Misconception 3: Part-year residents use the same standard deduction as full-year residents.

- Misconception 4: The filing status used on a federal return must be used on the IT-203 form.

- Misconception 5: You can't be claimed as a dependent if you're filing an IT-203 form.

- Misconception 6: Nonresidents are not eligible for New York State credits.

- Misconception 7: You must physically live in New York State to be considered a resident for tax purposes.

- Misconception 8: All parts of the form must be filled out entirely.

- Misconception 9: Filing the IT-203 form is only necessary if you owe New York State taxes.

This is not true. The IT-203 form is designed for nonresidents and part-year residents who earned income from New York State sources. It ensures that individuals pay the appropriate amount of taxes for the time they lived in or earned income from the state.

While the IT-203 form is focused on New York State income, it requires a complete representation of your federal adjusted gross income. This means that all income, whether earned inside or outside of New York, must initially be reported before making specific adjustments for nonresident or part-year resident filings.

Part-year residents may need to prorate their standard deduction based on the proportion of the year they were New York residents. The misconception arises because the process to calculate this can be complex and is not the same as simply taking the full-year standard deduction.

Your filing status for New York State can differ from what you chose on your federal return. For instance, if you are married but file separately on your federal return due to various reasons (such as one spouse not needing to file), you might still choose to file a joint New York State return if it is more beneficial.

Whether or not you can be claimed as a dependent on another person's tax return does not preclude you from needing to file an IT-203 form. If you had New York State income, you might still need to file, regardless of your dependency status on another's return.

Nonresidents and part-year residents may be eligible for certain New York State tax credits. The availability of these credits depends on specific circumstances and criteria that must be met, so summarily assuming ineligibility could lead to missing out on beneficial tax credits.

Residency for tax purposes can extend beyond physical presence. For example, maintaining a permanent place of abode in New York State and spending more than 183 days of the taxable year in the state can make you a statutory resident, even if you also maintain a residence elsewhere.

Depending on your specific situation, certain sections of the IT-203 form may not apply to you. It's important to read the instructions carefully to understand which parts of the form are relevant to your situation.

Even if you believe you do not owe any New York State taxes, filing an IT-203 form can be necessary. It may turn out that you are due a refund, or there may be other requirements that necessitate filing a return beyond the simple payment of taxes.

Key takeaways

When filling out and using the New York State IT-203 form, which is designated for nonresidents and part-year residents, there are several key takeaways to ensure accuracy and compliance:

- Ensure you accurately determine your residency status as the form is specifically for nonresidents or part-year residents of New York State, New York City, or Yonkers.

- Report all income from New York sources during the period you were a nonresident, and all income from all sources if you were a part-year resident.

- The form requires detailed personal information, including Social Security numbers for you and your spouse, if filing jointly, which must match your federal return.

- If you lived in New York City or Yonkers for part of the year, you might be subject to taxes specific to those jurisdictions, which necessitates careful attention to the relevant sections of the form.

- Understanding your deductions and credits, including whether you itemized deductions on your federal return, is essential for accurate filing and optimizing your tax situation.

- Supporting documentation, such as W-2s, 1099s, and schedules for specific types of income or deductions, is not required to be submitted with the form but must be accurately reflected in the filing and available upon request.

Following the instructions for the IT-203 form meticulously is critical to ensure that your tax obligations are met and potential refunds are received without delay. Taking advantage of the guidance provided in the form's instructions can help navigate the specific requirements for nonresidents and part-year residents.

Common PDF Documents

New York Attorney General Office - Presence of a revision date on the form ensures that complainants are accessing the most current guidelines and addresses for filing their complaint.

Irc 125 on W2 - Assists corporations in deciding the most beneficial way to handle any overpaid taxes from the current fiscal period.

Notice of Appearance New York Supreme Court - Creditors must accurately specify any debt or property to give effect to the restraining notice, highlighting its targeted approach.