Free Ny It 2 Form in PDF

Filing taxes in New York requires careful attention to various forms, among which the Form IT-2, Summary of W-2 Statements, plays a crucial role for many taxpayers. This form acts as a bridge between the information reported on federal Form W-2s and the New York State (NYS) income tax return, summarizing wages, tips, and other compensation along with pertinent withholding information for NYS, New York City (NYC), and Yonkers. It is mandatory for taxpayers who have received Form W-2 and presents an organized method to report earnings and withholdings from NYS, NYC, or Yonkers, not to mention any foreign earned income that might not have come with a Form W-2. The form includes detailed sections for recording employers' information, employee earnings, and withholdings which facilitate accurate state tax reporting and ensures taxpayers' compliance with New York's tax regulations. Additionally, it outlines specific instructions for entering compensation, benefits, and corrected information if a federal Form W-2c is received, stressing the importance of accuracy and completeness in tax documentation. It's understood that this form, along with the summarized tax withheld information, must be filed with the taxpayer's New York State income tax return, reinforcing the interconnectedness of federal and state tax reporting systems. Taxpayers who have navigated the complexity of multiple income sources, including those taxable in other states, will find this form instrumental in consolidating their tax records for submission.

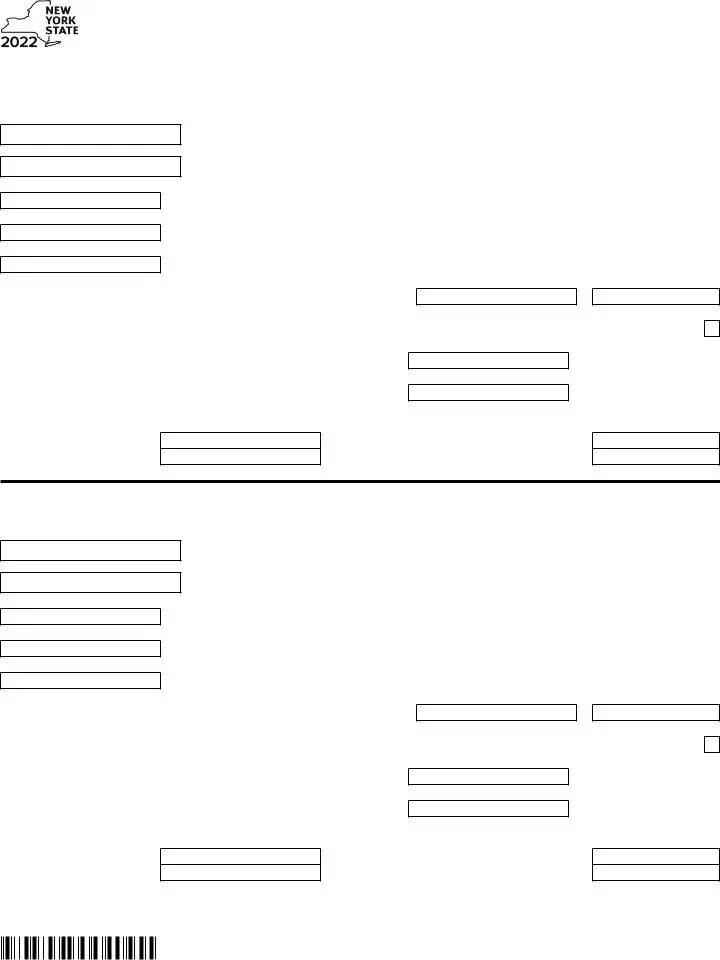

Ny It 2 Sample

Department of Taxation and Finance

Summary of

New York State • New York City • Yonkers

Do not detach or separate the

Box a Employee’s Social Security number for this

Box b Employer identification number (EIN)

Box 1 Wages, tips, other compensation

Box c Employer’s information

|

Employer’s name |

|

|

|

|

|

|

|

|

|

|

|

Employer’s address (number and street) |

|

|

|

|

|

|

|

|

|

|

|

City |

|

State |

ZIP code |

Country |

|

|

|

|

|

|

Box 12a Amount |

Code |

Box 14a Amount |

Description |

||

.00

Box 8 Allocated tips

.00

Box 10 Dependent care benefits

|

.00 |

|

|

|

|

|

|

|

|

Box 12b Amount |

|

|

Code |

|

|

.00 |

|

|

|

Box 12c Amount |

|

|

Code |

|

|

.00 |

|

|

Box 14b Amount |

|

|

Description |

|

.00 |

|

|

Box 14c Amount |

|

|

Description |

.00

Box 11 Nonqualified plans

|

.00 |

|

|

|

|

|

|

|

|

Box 12d Amount |

|

Code |

||

|

.00 |

|

|

Box 14d Amount |

|

|

Description |

|

.00 |

|

|

|

|

.00 |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

||||

Box 13 Statutory employee |

|

Retirement plan |

|

|

|

|

||||||

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

NY State information: |

Box 15a |

|

|

|

Box 16a NYS wages, tips, etc. |

|||||||

|

NY State |

N |

Y |

|

.00 |

|||||||

Other state information: |

Box 15b |

|

|

|

Box 16b Other state wages, tips, etc. |

|||||||

|

|

|

.00 |

|||||||||

|

other state |

|

|

|

||||||||

.00

Corrected

Box 17a NYS income tax withheld

.00

Box 17b Other state income tax withheld

.00

NYC and Yonkers information (see instr.):

Locality a

Locality b

Box 18 Local wages, tips, etc.

.00

.00

|

Box 19 Local income tax withheld |

|

|

Locality a |

.00 |

Locality b |

.00 |

Box 20 Locality name

Locality a

Locality b

Do not detach.

Box a Employee’s Social Security number for this

Box b Employer identification number (EIN)

Box 1 Wages, tips, other compensation

Box c Employer’s information

|

Employer’s name |

|

|

|

|

|

|

|

|

|

|

|

Employer’s address (number and street) |

|

|

|

|

|

|

|

|

|

|

|

City |

|

State |

ZIP code |

Country |

|

|

|

|

|

|

Box 12a Amount |

Code |

Box 14a Amount |

Description |

||

.00

Box 8 Allocated tips

|

.00 |

|

|

|

|

|

|

|

|

Box 12b Amount |

|

Code |

||

|

.00 |

|

|

Box 14b Amount |

|

Description |

|

.00

Box 10 Dependent care benefits

.00

Box 11 Nonqualified plans

|

.00 |

|

|

|

|

|

|

|

|

Box 12c Amount |

|

Code |

||

|

.00 |

|

|

|

|

|

|

|

|

Box 12d Amount |

|

Code |

||

|

.00 |

|

|

Box 14c Amount |

|

Description |

|

|

.00 |

|

|

Box 14d Amount |

|

Description |

|

|

.00 |

|

|

|

|

.00 |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

||||

Box 13 Statutory employee |

|

Retirement plan |

|

|

|

|

||||||

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

NY State information: |

Box 15a |

|

|

|

Box 16a NYS wages, tips, etc. |

|||||||

|

NY State |

N |

Y |

|

.00 |

|||||||

Other state information: |

Box 15b |

|

|

|

Box 16b Other state wages, tips, etc. |

|||||||

|

|

|

.00 |

|||||||||

|

other state |

|

|

|

||||||||

.00

Corrected

Box 17a NYS income tax withheld

.00

Box 17b Other state income tax withheld

.00

NYC and Yonkers information (see instr.):

Locality a

Locality b

Box 18 Local wages, tips, etc.

.00

.00

|

Box 19 Local income tax withheld |

|

|

Locality a |

.00 |

Locality b |

.00 |

Box 20 Locality name

Locality a

Locality b

102001220094

Instructions

General instructions

Who must file this form – You must complete Form

tax return and you received federal Form(s)

Form

If you received foreign earned income but did not receive a federal Form

Specific instructions

How to complete each

Complete additional Forms

Multiple

Form

Entering whole dollar amounts – When entering amounts, enter whole dollar amounts only (zeros have been preprinted). Use the following rounding rules when entering your amounts; drop amounts below 50 cents and increase amounts from 50 to 99 cents to the next dollar. For example, $1.39 becomes $1 and $2.50 becomes $3.

Enter in box a your entire

cthe EIN and employer’s name and address (including ZIP code) as they appear on the federal Form

Box 1 – Enter federal wages, tips, and other compensation shown in Box 1 of federal Form

Boxes 8, 10, and 11 – If applicable, enter the amounts from federal Form

Boxes 12a through 12d – Enter the amount(s) and code(s), if any, shown in the corresponding boxes on federal Form

as code J, nontaxable sick pay, or code AA, designated Roth

contributions under a section 401(k) plan, etc.). If there are more than four coded amounts, see Multiple

Box 13 – If your federal Form

Otherwise, leave blank.

Corrected

Enter the corrected information from the

Boxes 14a through 14d – Enter the amount(s) and description(s), if any, shown in box 14 of federal Form

Boxes 15a through 17a (NYS only) – Complete only for New York State wage and withholding information (the corresponding box 15a has been prefilled with NY). Enter in box 16a the New York

State wages exactly as reported on federal Form

Form

Boxes 15b through 17b (Other state information) – If the federal Form

Boxes 18 through 20 (NYC or Yonkers only) – Complete the locality boxes 18 through 20 only for NYC or Yonkers (or both) wages and withholding, if reported on federal Form

Transfer the tax withheld amounts to your income tax return. Include the total NYS tax withheld amounts, the total NYC tax withheld amounts, and the total Yonkers tax withheld amounts from all your Form(s)

•NYS tax withheld – Include on Form

•NYC tax withheld – Include on Form

•Yonkers tax withheld – Include on Form

Submit Form(s)

102002220094

File Overview

| Fact Name | Description |

|---|---|

| Purpose | The IT-2 form is used to summarize W-2 information for New York State (NYS), New York City (NYC), and Yonkers tax returns. |

| Filers Required to Submit IT-2 | Individuals filing a NYS income tax return who received federal Form W-2, and those with foreign earned income without a federal W-2, must complete Form IT-2. |

| Form Composition | IT-2 contains areas to report wages, tips, and other compensation, as well as tax withheld by NYS, NYC, Yonkers, or other states. |

| Alignment with Federal W-2 | Each box in the W-2 Record of IT-2 corresponds to similarly named or numbered boxes on the federal Form W-2. |

| Specific Instructions for Fields | Instructions detail how to enter information from the federal W-2, including wages, tips, tax withholdings, and codes for specific compensation types. |

| Governing Law | The requirements and usage of Form IT-2 are governed by New York State tax law. |

| Submission Guidelines | Form IT-2 must be submitted as a whole page with the NYS tax return. Filers are instructed not to detach or separate W-2 Records. |

Ny It 2: Usage Guidelines

Filling out the NY IT-2 form is a necessary step for individuals who file a New York State income tax return and have received federal W-2 forms. This form serves as a summary of the W-2 statements, including information on wages, tips, and taxes withheld. If you received foreign earned income without a W-2 form, this needs to be reported on the IT-2 as well. The instructions provided aim to simplify the process of completing each section of the IT-2 form accurately. Following these steps will ensure all required information is presented clearly, helping to avoid errors and possible delays with your tax return. It's important to prepare this form alongside your New York State income tax return, keeping federal W-2 forms for your records.

- Start by locating Box a on the form. Here, you should enter your 9-digit Social Security Number (SSN). If the W-2 form belongs to your spouse and you're filing jointly, enter your spouse's SSN instead.

- In Box b, fill in the Employer Identification Number (EIN) as shown on your federal W-2 form. If the EIN is too long, skip this step.

- Box c requires the employer’s information exactly as it appears on the federal W-2: include the employer's name, address, city, state, and ZIP code. If the employer is based outside the United States, include the country as well.

- Enter your wages, tips, and other compensation into Box 1, matching the amount reported on the federal W-2 form.

- For Boxes 8, 10, and 11, enter the allocated tips, dependent care benefits, and nonqualified plan amounts, respectively, if these were reported on your W-2.

- Boxes 12a through 12d are for specific amounts and codes found on your W-2. Copy the codes and amounts directly from the W-2 into the corresponding boxes. If you have more codes than spaces available, use an additional W-2 Record section.

- If there is a checkmark in Box 13 on your W-2 indicating you are a statutory employee, part of a retirement plan, or received third-party sick pay, mark an X in the corresponding box on the IT-2 form.

- Mark an X in the Corrected (W-2c) box if you are reporting information from a corrected W-2 form. Ensure all corrections are included on the IT-2.

- Fill in Boxes 14a through 14d with any amounts and descriptions shown in Box 14 on your W-2. Use additional forms if necessary.

- For individuals reporting New York State wages and withholdings, complete Boxes 15a through 17a. Leave blank if you have no New York State wages or withholding.

- If your W-2 includes wages and withholding for another state, fill in Boxes 15b, 16b, and 17b with the relevant state information.

- For New York City or Yonkers wages and taxes withheld, complete Boxes 18 through 20. Fill in the locality names as either "NYC" or "YONKERS" and include the respective wages and tax details.

After completing the form, make sure to double-check all information for accuracy. Attach the IT-2 form(s) to your New York State income tax return when you file. Do not detach or separate individual W-2 records from the IT-2 form. Remember, your federal W-2 forms should not be submitted with your tax return but kept for your records.

FAQ

FAQ: New York IT-2 Form

The New York IT-2 form, also known as the Summary of W-2 Statements, is an important document for many taxpayers in New York State, New York City, or Yonkers. Here are some frequently asked questions about the IT-2 form to help guide you through the process.

- What is the purpose of the New York IT-2 form?

- Who needs to file the IT-2 form?

- How do you fill out the W-2 Record sections?

- What should I do if I have corrections or multiple states' information?

- If you're reporting corrections to information previously submitted on a federal Form W-2c, mark an X in the Corrected (W-2c) box and provide the corrected details.

- For wages and withholding information for states other than New York, use boxes 15b, 16b, and 17b to enter the corresponding information.

- Do not use additional W-2 Records to report withholding by more than one other state for the same wages. If you have assessable local wages and taxes for NYC or Yonkers, complete the locality sections accordingly and make sure to include this information on your New York State income tax return.

The IT-2 form is designed for taxpayers to summarize the information found on their federal Form W-2s when filing their New York State income tax return. This includes reporting wages, tips, other compensation, and taxes withheld for New York State, New York City, or Yonkers.

If you're filing a New York State income tax return and you've received federal Form W-2, you'll need to complete Form IT-2. This includes taxpayers who have received foreign earned income without a federal Form W-2. You should fill out one W-2 Record section for each federal Form W-2 received, regardless of whether it indicates New York State, New York City, or Yonkers wages or tax withheld.

Each box in the W-2 Record corresponds to a similarly named or numbered box on your federal Form W-2. You should transfer the information directly, including amounts, codes, and descriptions. If your federal Form W-2 includes more than four items in box 12 or box 14, you'll need to complete additional W-2 Record sections. Remember, enter whole dollar amounts only, rounding according to the instructions.

Be sure to submit the IT-2 form(s) together with your New York State income tax return. Keep your federal Form(s) W-2 for your records but do not submit them. For further details on assembling your return, refer to the instructions for Form IT-201, IT-203, or IT-205. This process helps ensure that your tax responsibilities are accurately and fully reported to the State of New York.

Common mistakes

Filing New York's IT-2 form, known as the Summary of W-2 Statements, can be a daunting task, particularly for those not well-versed in tax preparation. This form is essential for individuals who are filing a New York State income tax return and have received W-2 forms for the year. Mistakes on this form can lead to processing delays or incorrect tax assessments. Let’s explore some common pitfalls that filers encounter with the IT-2 form and how to avoid them.

- Inaccurate Social Security and Employer Identification Numbers: One of the most common errors is not correctly transcribing the Social Security number (SSN) or the Employer Identification Number (EIN) from the federal W-2 to the IT-2 form. This mistake can lead to significant processing delays.

- Omitting Information for Multiple W-2s: If you received more than one W-2, each must be reported separately on the IT-2 form. Failing to provide a separate W-2 record for each W-2 received is another frequent oversight.

- Incorrect Wage Reporting: Box 1 requires you to enter wages, tips, and other compensation as shown on your federal W-2. Errors in transferring these figures can affect your state tax calculation.

- Forgetting to Declare Additional Income: Boxes 8, 10, and 11 pertain to allocated tips, dependent care benefits, and nonqualified plans, respectively. These are often overlooked, leading to incomplete income reporting.

- Misinterpreting Box 12 and Box 14 Codes and Descriptions: These boxes often cause confusion due to their code-based reporting requirements. Entering incorrect codes or descriptions can lead to inaccuracies in deducted amounts.

- Neglecting the Corrected W-2 (W-2c) Box: If any information changed after you received your W-2, you should mark the Corrected W-2 box. Failure to do so can result in the department having outdated information.

- Skipping NYC and Yonkers Information: For residents of New York City or Yonkers, specific wage and withholding information must be entered. Neglecting to include this information can affect local tax obligations.

- Round-off Errors: The IT-2 form requires entries to be in whole dollar amounts, using specific rounding rules. Incorrect rounding can introduce slight discrepancies in reported amounts.

To avoid these errors, take your time filling out the IT-2 form. Double-check each entry against your federal W-2 to ensure accuracy. Pay close attention to the specific instructions provided for each box, especially those related to code-based entries and rounding rules. Remember, accuracy on your tax forms not only prevents delays but also ensures that you are correctly meeting your tax responsibilities. Should you find the form challenging, seek guidance from a professional to avoid common pitfalls and ensure that your filing is flawless.

Documents used along the form

When filing taxes in New York, particularly with the use of Form IT-2, Summary of W-2 Statements, individuals often need to complement this form with additional documentation to ensure a comprehensive tax return. Here are several forms and documents typically filed alongside Form IT-2:

- Form IT-201: This is the Resident Income Tax Return form. It is used by individuals who live in New York State to file their annual income tax return. This form helps taxpayers calculate their total tax liability, report income, and outline the credits they are eligible to claim.

- Form IT-203: Nonresident and Part-Year Resident Income Tax Return. This form is specifically for individuals who did not reside in New York State for the entire year or those who live outside of New York State but generated income from within the state. It calculates income attributable to New York sources and determines the tax responsibilities related to that income.

- Form IT-205: Fiduciary Income Tax Return. Executors or trustees use this form to report income, deductions, and credits of estates or trusts. It is essential for handling taxation matters of deceased persons' estates or for trusts as specified under New York State law.

- Form W-2: Wage and Tax Statement. Although not submitted with the New York State tax return, the information from this federal document is vital for completing Form IT-2. It reports an employee's annual wages and the amount of taxes withheld from their paycheck.

- Form W-2c: Corrected Wage and Tax Statement. This form is used to correct errors on the original Form W-2 and is crucial for ensuring that the corrected information is accurately reported on Form IT-2 if applicable.

- Schedule IT-203-B: Nonresident and Part-Year Resident Allocation Schedule. Part-year residents and nonresidents who must allocate income to New York State use this schedule alongside Form IT-203 to precisely detail the portion of income attributable to New York State activities or sources.

Accurate and complete filings require careful preparation of these forms and documents. They work collectively to provide a full picture of an individual’s tax responsibilities and entitlements. Each plays a crucial role in ensuring that taxpayers comply with New York State tax laws while maximizing their eligible benefits.

Similar forms

The Form W-2, or Wage and Tax Statement, shares a direct similarity with the NY IT-2 form, as it essentially serves as the backbone for the NY IT-2 form. This document reports an employee's annual wages and the amount of taxes withheld from their paycheck. The IT-2 form requires taxpayers to summarize and transfer this information for their New York State income tax return, making the W-2 a foundational document for individuals filling out the IT-2.

Form 1040, the U.S. Individual Income Tax Return, while broader in scope, relates to the NY IT-2 form in its reliance on detailed income information. Specific lines on Form 1040 require input that is often derived from W-2 statements, and by extension, the summarized data on the IT-2 form. It underscores the interconnectedness of federal and state tax filings, with the IT-2 contributing vital information for accurately reporting income on federal returns.

The W-2c, Corrected Wage and Tax Statement, is used to correct errors on the original W-2 form and has a direct correlation with the NY IT-2 form because any corrections that impact New York State income must also be reflected in an updated IT-2 submission. This ensures that the state tax obligation is accurate and reflects true earnings and withhold was after corrections.

Form IT-201, Resident Income Tax Return, is a primary form for New York State residents reporting their annual income. The IT-2 form serves as a supplementary document that provides detailed wage and withhold tax information from multiple W-2 forms, simplifying the process of completing the IT-201 by summarizing this data in one place, specifically for New York State, New York City, and Yonkers tax calculations.

Form IT-203, Nonresident and Part-Year Resident Income Tax Return, similar to Form IT-201, necessitates the information from the IT-2 form for taxpayers who are not full-year residents but have earned income in New York State. It ensures that even those who live part of the year outside New York or move during the tax year can accurately report and pay taxes on their New York-sourced income.

Form IT-205, Fiduciary Income Tax Return, while mainly used for estates and trusts, similarly benefits from the detailed summaries provided by the IT-2 form when the entity has income sources that issue W-2 forms. This illustrates the broad applicability of the IT-2 form in providing essential wage and tax information across various tax scenarios and entities within New York State.

The Schedule C (Form 1040), Profit or Loss from Business, while primarily for self-employed individuals, intersects with the IT-2 when an individual has both self-employment income and W-2 wage income. In such cases, accurate reporting on the IT-2 ensures that New York State wage income is correctly accounted for, influencing the overall tax calculation when combined with business income.

Dos and Don'ts

Filling out the New York State Form IT-2, Summary of W-2 Statements, accurately is crucial for taxpayers who have received Form(s) W-2 and need to report their income tax returns to the New York State Department of Taxation and Finance. Below are key do's and don'ts to consider when completing this form.

Do's:

- Ensure you fill in each box on the W-2 Record section that correlates with the corresponding box on your federal Form W-2, using the exact amounts, codes, or descriptions provided.

- Round the amounts to whole dollar figures, adhering to the rounding rules: amounts below 50 cents should be dropped, and amounts from 50 to 99 cents should be increased to the next dollar.

- Include additional Forms IT-2 if your federal Form W-2 shows more than four items in box 12 or box 14, making sure the additional W-2 Records carry the same information as the first for the same federal Form W-2.

- Mark an X in the corrected (W-2c) box if you are submitting information from a federal Form W-2c, Corrected Wage and Tax Statement, ensuring to enter both the corrected and other requested information from your federal Form W-2.

- Include the total tax withheld amounts for New York State, New York City, and Yonkers, as applicable, from all of your Form(s) IT-2 on your income tax return.

Don'ts:

- Do not detach or separate the W-2 Records from Form IT-2 when filing your return. The form should be submitted as an entire page.

- Avoid entering incomplete or incorrect employer information. Boxes b and c should be filled out with the employer’s EIN, name, and address exactly as they appear on your federal Form W-2.

- Do not leave relevant sections blank. If you’re submitting information for multiple W-2 Records, ensure that all applicable boxes are filled out consistently across additional forms.

- Do not fill in additional W-2 Records to report withholding by more than one other state for the same wages. Stick to the rules for reporting multiple items in boxes 12 or 14.

- Do not submit your federal Form(s) W-2 with your income tax return. Keep these forms for your records, but ensure all pertinent information is transferred accurately to Form IT-2.

Misconceptions

One common misconception is that Form IT-2 must be filed separately from your New York State income tax return. However, you should include Form IT-2 as part of your entire tax return package, without separating any of the records.

Many believe federal Form W-2s must be submitted with the New York State tax return. This is incorrect; you should not submit your W-2 forms with your return. Instead, keep them for your records and only include the summarized information on Form IT-2.

There’s a misunderstanding that only New York State wages need to be reported. In reality, Form IT-2 requires details of all wages, including those from New York City or Yonkers, and foreign earned income if applicable.

Some people think that if their federal W-2 does not show New York wages or tax withheld, they do not need to complete a Form IT-2. However, if you are filing a New York State income tax return, you must complete Form IT-2 for each W-2 received, regardless of whether it shows NYS wages or tax withheld.

It is falsely assumed that if you have foreign earned income without a W-2, you don't need to report it on Form IT-2. Contrary to this belief, you must complete Form IT-2 for foreign earned income, even if you do not receive a federal Form W-2.

There is confusion about entering information for multiple items listed in Box 12 or Box 14 of the federal W-2. If more than four items exist, it is necessary to complete an additional W-2 Record section on Form IT-2, not try to fit all information in one section.

A common myth is that completing Form IT-2 is optional. In fact, anyone who files a New York State income tax return and has received federal Form(s) W-2 must complete Form IT-2.

Some taxpayers believe rounding rules do not apply when entering amounts on Form IT-2. Actually, you should round to whole dollar amounts, following specific rounding rules as mentioned in the form's instructions.

Another misconception is that corrections to wages or tax withheld should not be noted on Form IT-2. If you receive a corrected W-2 form (W-2c), you should mark the corrected box on Form IT-2 and include the corrected information.

Key takeaways

Filling out and using the New York IT-2 form correctly is essential for taxpayers who received W-2 forms and are filing a New York State income tax return. Here are key takeaways to ensure proper completion and submission:

- Who Must File: You must complete Form IT-2 if you are filing a New York State income tax return and received federal Form(s) W-2. This includes situations where you received foreign earned income not reported on a federal W-2 form.

- Filling Out the Form: Each box in the IT-2 form corresponds to similarly named or numbered boxes on your federal W-2 form. Only input the information requested in the IT-2 form for accurate reporting.

- Dealing with Multiple W-2 Records: If your W-2 form shows more than four items in box 12 or box 14, complete an additional W-2 record on the IT-2 form with the extra items.

- Entering Dollar Amounts: When entering amounts on the form, round to whole dollar amounts. Drop amounts below 50 cents and round amounts from 50 to 99 cents up to the next dollar.

- Corrected W-2 Forms: If submitting information from a corrected W-2 form (W-2c), make sure to mark the "Corrected (W-2c)" box and enter the corrected details on the IT-2 form.

- New York State, City, or Yonkers Information: Enter specific wage and tax withholding information for New York State, New York City, or Yonkers as applicable. Do not fill out these sections if they do not apply to your filing situation.

- Foreign Earned Income: For filers with foreign earned income without a W-2 form, leave the employer identification number (box b) blank if it exceeds the space provided.

- Tax Withholding Transfers: Transfer New York State, New York City, and Yonkers tax withheld amounts to your income tax return. Include these totals on the specified lines of your tax return form.

- Submission: Attach the IT-2 form(s) to your New York State income tax return submission. Do not separate the records or include the W-2 forms themselves—only the IT-2 is required for submission, and W-2s should be kept for your records.

Properly completing and submitting the IT-2 form with your New York State income tax return ensures accurate reporting of wage and tax information, facilitating the correct calculation of taxes owed or refunds due. Remember to keep a copy of your W-2 forms and the IT-2 form for your records.

Common PDF Documents

Nyc-1127 - Details filing deadlines and addresses for sending completed forms.

New York Estate Tax Exemption 2023 - It aids in the release of any tax liens placed on the real estate, allowing for sale or transfer to beneficiaries.