Free Ny Et 141 Form in PDF

The New York State Department of Taxation and Finance's ET-141 form, officially named the New York State Estate Tax Domicile Affidavit, plays a critical role for estates of individuals who passed away after May 25, 1990, specifically when claiming that the decedent was not domiciled in New York State at the time of death. This form requires detailed information about the decedent, including their last address, date of death, citizenship status if born outside the United States, ties to New York State such as property ownership, and voting history, among others. It is designed for completion by the fiduciary, whether an executor or administrator, the surviving spouse, or a direct family member who can furnish the required information. The comprehensive nature of the form reflects an attempt to thoroughly assess the decedent's domicile status, with implications for estate tax liabilities in New York. Its submission is integral to the estate settlement process, accompanying specific other documents depending on the date of death. The affidavit also underscores the importance of accuracy and honesty in its completion, as it directly impacts the determination of domicile and, consequently, estate taxation in New York State.

Ny Et 141 Sample

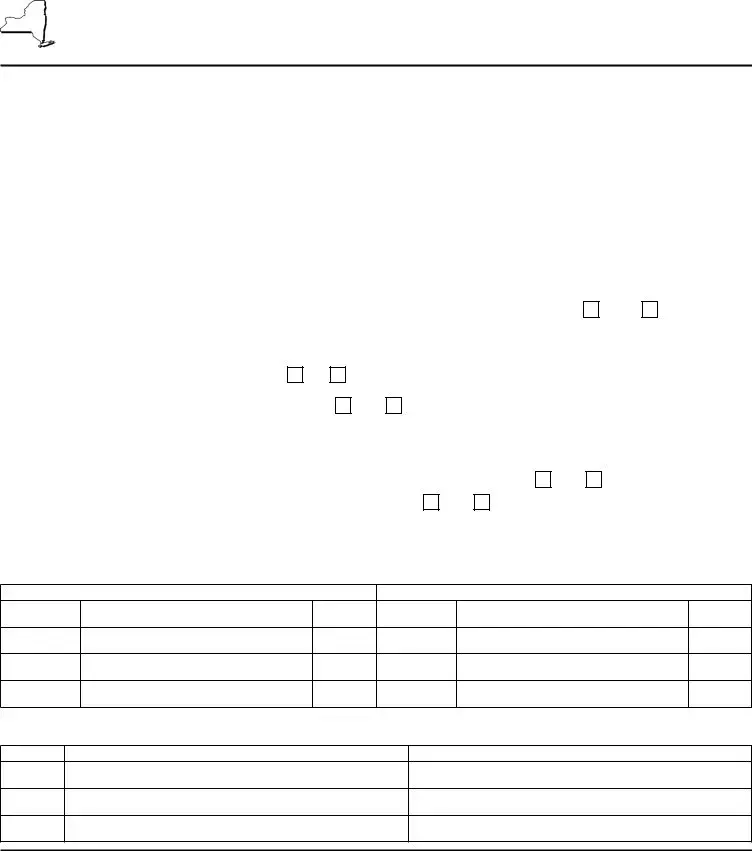

New York State Department of Taxation and Finance |

||

New York State Estate Tax Domicile Afidavit |

||

(1/15) |

For estates of decedents dying after May 25, 1990

Complete Form

The iduciary (executor or administrator), the surviving spouse, or a member of the decedent’s immediate family who can provide all the information requested below should complete this afidavit.

Answer all questions completely. Submit this form with Form

Decedent’s last name |

First |

|

|

|

|

Middle initial |

|

Social security number |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address of decedent at time of death (number and street) |

|

|

|

|

|

|

|

Date of death |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City, village or post ofice |

County |

|

|

|

State |

ZIP code |

|

Country of residence |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Age of death |

Date of birth |

Place of birth |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

1 |

If born outside the United States, was the decedent a naturalized citizen of the United States? |

|

|

|

|

||||||||

|

If Yes, enter (below) the name and address of the court where the decedent was naturalized. |

Yes |

No |

||||||||||

Name and address of court where naturalized |

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Did decedent ever live in New York State? Yes |

|

|

|

|

|

|

|

|

||||

2 |

No |

If Yes, list periods. |

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

Did decedent ever own, individually or jointly, any |

|

|

|

If Yes, list addresses and periods below (submit additional sheets if necessary). |

||||||||

|

interest in real estate located in New York State? |

Yes |

No |

|

|||||||||

Periods of time - from/to |

Addresses of property |

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

||||

4 |

Did decedent lease a safe deposit box located in New York State at the time of death? |

Yes |

No |

|

|

|

|||||||

|

If Yes, complete box below. Also, if Yes, has it been inventoried? |

Yes |

No |

If Yes, submit a copy of inventory. |

|||||||||

Name and address of bank where box is located |

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5Provide the following information regarding the residences of the decedent during the last ive years preceding death (submit additional sheets if necessary).

Period of time

from - to

Address

Residence

owned - rented other - explain

Period of time

from - to

Address

Residence

owned - rented other - explain

6For the ive years prior to death, list (1) the Internal Revenue Service Centers and (2) the states or other municipalities where the decedent iled income tax returns (if no income tax returns were iled, enter NONE).

Year

Internal Revenue Service Center

State, county, or municipality

Privacy notiication

New York State Law requires all government agencies that maintain a system of records to provide notiication of the legal authority for any

request, the principal purpose(s) for which the information is to be collected, and where it will be maintained. To view this information, visit our Web site, or, if you do not have Internet access, call and request Publication 54, Privacy Notiication. See Need help? for the Web address

and telephone number.

7List the states where the decedent was registered to vote during the last ive years preceding death (list latest year irst).

Years |

|

State |

|

|

|

|

|

From |

|

To |

|

|

|

|

|

|

|

Date of Death |

|

|

|

|

|

|

|

|

|

|

|

|

|

If decedent did not vote in those ive years, when did he or she last vote? |

|

Where? |

|

|

|

8List employment or business activities (if any) engaged in by the decedent during the ive years preceding the date of death.

|

|

|

In New York State |

|

|

|

|

|

Outside New York State |

|

|||

Period of time |

|

Nature of employment or business activities |

Period of time |

|

Nature of employment or business activities |

||||||||

|

from - to |

|

from - to |

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

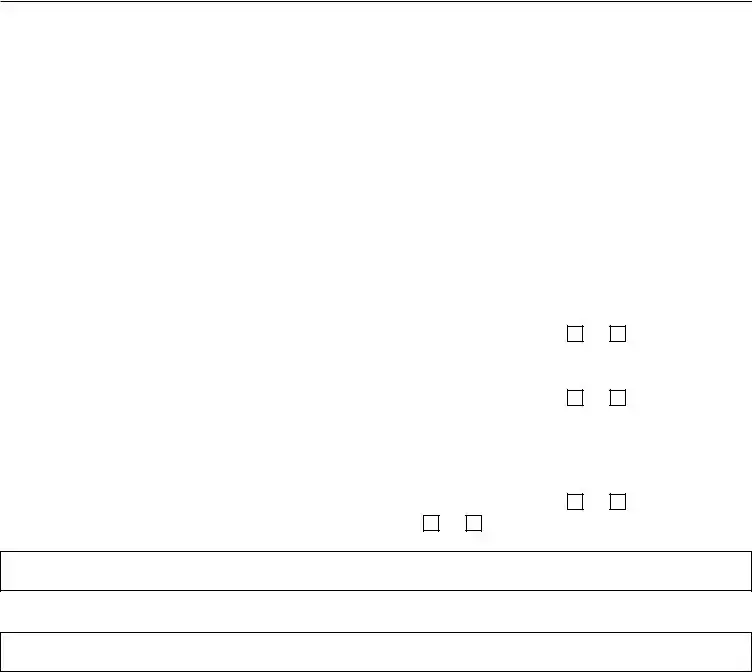

9 |

Was decedent a party to any legal proceedings in New York State during the last ive years? |

Yes |

No |

If Yes, list courts, dates, |

|||||||||

and types of action. |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10 |

Did decedent have a license to operate a business, profession, motor vehicle, airplane, or boat? |

Yes |

No |

If Yes, list below. |

|||||||||

|

License number |

|

Type of license |

Date of issuance |

|

|

|

Name and location of issuing ofice |

|||||

|

|

|

|

|

|

|

|

|

|||||

11 |

Did decedent execute any trust indentures, deeds, mortgages, or any other documents |

|

|

|

|

||||||||

|

describing his or her residence during the last ive years preceding death? |

|

|

|

Yes |

No |

If Yes, submit a copy. |

||||||

12 |

Was the decedent a member of any church, club, or organization? |

Yes |

No |

|

|

|

|

||||||

If Yes, give name, address, and other details. (Submit additional sheets if necessary.)

13What other information do you wish to submit in support of the contention that the decedent was not domiciled in New York State at the time of death? (Submit additional sheets if necessary.)

Applicant’s last name |

First name |

Middle initial |

Relationship to decedent |

|

|

|

|

Address (number and street) |

|

|

Connection with estate |

|

|

|

|

City, village, or post ofice |

State |

ZIP code |

Country of residence |

|

|

|

|

The undersigned states that this afidavit is made to induce the Commissioner of the Department of Taxation and Finance of the State of New York to determine

domicile, and that the answers herein contained to the foregoing questions are each and every one of them true in every particular.

|

|

|

|

|

|

|

Signature of Notary Public, Commissioner of Deeds or Authorized New York State |

|

Signature of applicant |

|

|

|

|

|

Department of Taxation and Finance employee (no seal required) |

||

Sworn before me this |

|

|

day of |

|

20 |

|

|

|

|

|

|

|

|

|

|

Signature |

|

File Overview

| # | Fact | Detail |

|---|---|---|

| 1 | Form ET-141 Name | New York State Estate Tax Domicile Affidavit |

| 2 | Purpose | To claim the decedent was not domiciled in New York State at the time of death. |

| 3 | Applicable for Decedents | Estates of decedents dying after May 25, 1990. |

| 4 | Who Should Complete | Fiduciary (executor or administrator), surviving spouse, or a member of the decedent's immediate family. |

| 5 | Submission With | Must be submitted with Form ET-30, ET-85, ET-90 (before February 1, 2000), ET-130, ET-133, or ET-706 (on or after February 1, 2000), as applicable. |

| 6 | Information Required | Decedent's information including last address, social security number, date of death, and domicile-related questions. |

| 7 | Privacy Notification | New York State Law requires a privacy notification for the collection of information, detailed in Publication 54. |

| 8 | Evidence of Non-Domicile | Includes history of residences, voting status, employment, and memberships related to non-New York domicile claim. |

| 9 | Legal Proceedings Involvement | Disclosure of decedent's involvement in any New York State legal proceedings in the last five years. |

| 10 | Governing Law | New York State Department of Taxation and Finance oversees and governs the form submission and process. |

Ny Et 141: Usage Guidelines

When a loved one passes away, besides the emotional turmoil, there's the daunting task of handling their estate. If the deceased wasn't living in New York at the time of their passing but had significant ties or assets within the state, you might need to fill out the ET-141 form. This New York State Estate Tax Domicile Affidavit helps determine if estate tax is due. This step-by-step guide will simplify the process, making sure you complete the form accurately.

- Gather necessary information: Have the decedent's social security number, address at the time of death, date and place of birth, and other personal details on hand.

- Section for naturalization details: If the decedent was born outside the U.S. and became a naturalized citizen, be ready to provide the court's name and address where the naturalization happened.

- Residency and Real Estate Interests: Fill out sections that ask if the decedent ever lived in New York State or owned real estate there. Include addresses and the periods of residency or ownership.

- Safe deposit box information: If applicable, enter details about any New York-based safe deposit box, including the bank's name and address, and whether it's been inventoried.

- List of residences: Provide information, such as the addresses and whether these residences were owned or rented, for where the decedent lived in the five years before their death. If necessary, attach additional sheets.

- Tax filing history: Detail the IRS Centers and states or municipalities where the decedent filed income tax returns in the last five years.

- Voter registration: List the states where the decedent was registered to vote during the five years before their death, including the last time they voted and where.

- Employment and business activities: Mention any employment or business activities, both in and outside of New York State, during the five years preceding the decedent's death.

- Legal proceedings: If the decedent was involved in legal proceedings in New York State within the last five years, specify the courts, dates, and types of action.

- Licenses held: List any license the decedent held, such as for operating a business, motor vehicle, airplane, or boat, including the license number and issuing office.

- Documentation of residence: If the decedent executed any trust indentures, deeds, mortgages, or other documents indicating their residence, submit copies.

- Church, club, or organization membership: Provide details of any such memberships the decedent had, attaching additional sheets if necessary.

- Additional supporting information: Submit any other information or documents that support the claim the decedent was not domiciled in New York State at their time of death.

- Applicant's information: Fill out the section with your details, including name, address, relationship to the decedent, and your connection to the estate.

- Sign and date: The form must be signed by a Notary Public, Commissioner of Deeds, or an authorized New York State Department of Taxation and Finance employee. The applicant must also sign and date the form.

Once completed, this form, along with any required accompanying documentation, should be submitted with the appropriate estate tax form. Properly filling out and providing accurate information can significantly streamline the process of settling the decedent's estate in accordance with New York State laws.

FAQ

Frequently Asked Questions about New York State Estate Tax Domicile Affidavit (ET-141)

- What is the purpose of Form ET-141?

Form ET-141, also known as the New York State Estate Tax Domicile Affidavit, is designed to establish whether a decedent was not domiciled in New York State at the time of death. This determination is crucial since it affects the applicability of New York State estate taxes to the decedent's estate. The form serves as a declaratory document, providing essential details to support the claim that the deceased did not consider New York their permanent home.

- Who should complete Form ET-141?

The fiduciary of the estate, which can be either the executor or administrator, the surviving spouse, or a member of the decedent's immediate family, is responsible for completing this affidavit. The individual completing the form should have comprehensive knowledge of the decedent's residence and domicile status and be able to provide detailed information to substantiate the claim that the decedent was not domiciled in New York State.

- What accompanying documents must be submitted with Form ET-141?

Form ET-141 should be submitted alongside one of several possible estate tax forms, depending on the date of the decedent’s death and other factors. These forms include ET-30, ET-85, ET-90 (for dates of death before February 1, 2000), ET-130, ET-133, or ET-706 (for dates of death on or after February 1, 2000), as applicable. The selection of the correct accompanying form is dictated by the specific requirements of the decedent's estate and the timing of the death.

- How does ownership of property in New York State affect the domicile status?

Ownership, whether individual or joint, of real estate located in New York State can significantly impact the determination of a decedent's domicile. Such ownership does not automatically establish New York as the decedent's domicile but is a critical factor considered in the overall evaluation. The form requires detailed information on any New York State property, including addresses and periods of ownership, to assess domicile in conjunction with other residency and personal connections to the state.

- What if the decedent rented a safe deposit box in New York State?

The leasing of a safe deposit box in New York State at the time of death is another factor that may influence the domicile determination. Applicants must indicate whether a safe deposit box was rented and, if so, provide the name and address of the bank where it is located. If the box has been inventoried, a copy of the inventory should also be submitted. This information helps to establish the extent of the decedent's ties to New York.

- How important is the decedent’s voting history in determining domicile?

The states where the decedent was registered to vote during the last five years preceding death play a significant role in affirming the decedent's intended domicile. Voting registration is a strong indicator of a person’s permanent residence, or domicile, reflecting their civic engagement and personal identification with a particular location. If the decedent did not vote in those five years, information on the last voting activity can still provide valuable insights into their domicile status.

- Can employment and business activities outside New York State support the non-domicile claim?

Yes, employment or business activities conducted by the decedent outside of New York State can substantiate the claim that they were not domiciled in New York. The nature, duration, and location of such activities, especially if sustained over a significant period, may indicate a closer connection to another state or country, thereby supporting the argument against New York domicile. Detailed information about these activities must be provided, including specific periods and locations.

Common mistakes

Filling out the New York State ET-141 form, a crucial document for estate representatives to claim a decedent’s non-domicile status in New York State, requires meticulous attention to detail. Here are six common mistakes people make when completing this form:

- Not answering all questions completely. Each section demands precise information. Leaving parts blank or providing incomplete answers can delay processing or lead to the rejection of the form.

- Failing to attach additional sheets when necessary. For questions that demand detailed responses, such as listing all residences in the last five years, attaching extra pages is essential if space provided on the form is insufficient.

- Omitting documentation. If the decedent had any interest in real estate, leased a safe deposit box in New York, or executed significant legal documents like trusts or deeds, failing to submit copies of these documents can undermine the credibility of the domicile claim.

- Incorrectly listing voting registration or activity. The form requires listing states where the decedent was registered to vote in the last five years before death. Including incorrect dates or failing to mention the last voting activity can affect the domicile assessment.

- Overlooking details about the decedent’s personal connections. Whether the decedent was a member of clubs, churches, or other organizations, accurate reporting of such affiliations is important. Neglecting to provide this information may miss an opportunity to strengthen the argument of non-domicile.

- Not ensuring the correct notarization. The form must be signed in the presence of a notary public, Commissioner of Deeds, or authorized New York State Department of Taxation and Finance employee. An oversight in this step can lead to delays or the necessity to resubmit the form.

By avoiding these pitfalls, filers can enhance the clarity and persuasiveness of their domicile affidavit, supporting a smoother process in estate tax matters. A careful review and adherence to the form's requirements can significantly impact the outcome of the domicile determination.

Documents used along the form

When it comes to handling the estate of a decedent, specifically in situations where it is claimed that the deceased was not domiciled in New York State at the time of their passing, several key documents and forms often accompany the New York State Department of Taxation and Finance ET-141, New York State Estate Tax Domicile Affidavit. The ET-141 form is crucial for estates of decedents dying after May 25, 1990, and serves to provide evidence regarding the decedent's domicile. Along with the ET-141 form, there are other important documents that help paint a complete picture of the decedent's residency and financial affairs. Each document plays a specific role in the estate planning and execution process.

- Form ET-30 (Estate Tax Return Waiver): This form is often required when transferring assets that were owned by the deceased. It acknowledges that the estate tax return or specific assets are not subject to New York State estate tax and allows for the release of the state's lien on these assets.

- Form ET-85 (Release of Lien Estate Tax Waiver): Similar to form ET-30, this document is used to obtain a release of lien for New York State estate tax purposes. It's specifically used to remove a lien on real estate or other tangible assets within New York State.

- Form ET-90 (Resident Decedent Affidavit for Recipients of Gifts): For dates of death before February 1, 2000, this affidavit is used by recipients of gifts from the decedent to declare the residence status of the decedent at the time of making the gift, which may affect the tax treatment of such gifts.

- Form ET-130 (Estate Tax Domicile Affidavit): This is another document designed to establish the domicile of the decedent. It is particularly used in complex cases where domicile status is disputed or unclear.

- Form ET-133 (Estate Tax Certification): This certification form is necessary for estates that are required to file an estate tax return in New York. It serves as a confirmation of tax filing and payment, which is needed for various legal and financial transactions involving the estate.

- Form ET-706 (New York State Estate Tax Return): For dates of death on or after February 1, 2000, form ET-706 is a comprehensive tax return document for New York State estates. It details the assets, deductions, tax calculations, and payments associated with the deceased's estate, providing a critical part of determining the estate's tax obligations.

Beyond these forms, executors and administrators may also need to gather additional documents such as death certificates, wills, trusts, property deeds, and financial statements to fully comply with New York State's tax and legal requirements. Understanding the purpose and necessity of each document can streamline the administrative process, ensuring that the estate is managed and settled effectively, honoring the decedent's wishes and adhering to state laws.

Similar forms

The Form ET-706, similar to ET-141, is integral for individuals managing the complexities of estate planning and taxation in New York State. Specifically, ET-706 is used for filing estate tax for decedents who passed away on or after February 1, 2000. Both forms require detailed information about the decedent, including their domicile, assets, and activities, to accurately assess the applicable estate taxes. They work in conjunction to provide a comprehensive understanding of the decedent's financial and residential status at the time of death, ensuring the correct tax liabilities are determined.

Form ET-30, akin to the ET-141, plays a vital role in processing the estates of individuals. This form is necessary for executors or administrators to obtain release of lien for New York State estate tax purposes. The ET-30 and ET-141 forms together ensure that estate matters are thoroughly reviewed, specifically regarding the decedent’s domicile and its impact on tax obligations. This coordinated review helps legal professionals and family members manage and settle estates in compliance with New York's tax laws.

Form ET-85, much like ET-141, is integral for estates that are not required to file a New York State estate tax return because the estate does not meet the filing threshold. When paired with the ET-141, these forms serve to establish the domicile of the decedent and whether the estate is liable for New York State estate taxes based on domicile and the value of the estate. It's a critical differentiation that significantly affects the financial handling of the decedent's estate.

Form ET-90, used for filing estate taxes for dates of death before February 1, 2000, shares a connection with the ET-141. Both forms require detailed information on the decedent's domicile and assets to accurately assess estate taxes applicable before the year 2000. Together, they ensure that estates of decedents who died before this date navigate the tax implications of domicile and asset distribution according to New York State law.

Form ET-130 is utilized alongside the ET-141 when handling the estate of a non-resident decedent who owned real property in New York State. This form aids in determining the specific estate tax due on such real property, relevant when the ET-141 asserts the decedent was not domiciled in New York State. The combination of these forms helps clarify tax responsibilities related to real estate owned by non-residents, ensuring proper taxation based on domicile and property location.

Just as the ET-141 form, Form ET-133 serves a crucial role for estates seeking a clearance for estate tax purposes specifically for cooperative apartments owned by the decedent. When the ET-141 form establishes a non-New York domicile, and the ET-133 is applied to a cooperative apartment's estate matters, they together address the unique estate tax implications for such properties, ensuring compliance with state tax laws for non-resident decedents.

The IRS Form 706 shares a similar objective with the ET-141 in determining the estate tax liabilities, but on a federal level. While ET-141 focuses on establishing the decedent's domicile for New York State estate taxes, the IRS Form 706 calculates the overall estate tax due to the federal government. These forms together ensure that estates are assessed correctly for both state and federal estate taxes, addressing different jurisdictions' requirements.

The Affidavit of Domicile is yet another document resembling the ET-141 in its purpose. This legal document is often required by financial institutions to determine the decedent's state of domicile at the time of death, directly impacting the transfer of securities and other assets. When used alongside the ET-141, it further substantiates claims regarding the decedent's domicile, aiding in the accurate processing of estate transfers and the settlement of tax obligations.

Form IT-2663, used for nonresident real property transfers in New York, parallels the ET-141 in the context of tax implications for nonresidents. While ET-141 determines domicile for estate tax purposes, IT-2663 is applied when a nonresident sells real property in New York, necessitating state income tax withholding. Both documents are critical in ensuring nonresidents meet their New York State tax obligations on real estate transactions and estates.

The Real Property Transfer Tax Return (NYC-RPT) also complements the ET-141, especially in real estate transactions within New York City. This form is essential for documenting transfer taxes on real estate sold or transferred within the city. When a decedent's estate involves property in New York City, the ET-141's determination of domicile can significantly affect how the NYC-RPT is prepared and processed, ensuring appropriate tax handling based on residency status at the time of death.

Dos and Don'ts

When filling out the New York ET-141 Estate Tax Domicile Affidavit, certain practices should be followed to ensure the form is completed accurately and effectively. Below are four essential dos and don'ts to consider:

- Do: Provide complete and accurate information for every question. If the question does not apply, indicate with “N/A” (not applicable) rather than leaving it blank.

- Do: Attach additional sheets if necessary, especially when listing periods of residence, property ownership, or any legal proceedings. Ensure these sheets are clearly marked and referenced to the question they relate to.

- Do: Double-check the decedent’s details, such as the social security number, dates of residence, and property ownership to avoid discrepancies, which could delay the processing of the affidavit.

- Do: Include a copy of the decedent’s naturalization documents if they were born outside the United States and became a naturalized citizen.

- Don’t: Overlook the need to submit this form along with the appropriate companion form (ET-30, ET-85, ET-90, ET-130, ET-133, or ET-706), depending on the date of death. These forms are required for a complete estate tax filing.

- Don’t: Forget to sign and date the affidavit. The signature of a Notary Public, Commissioner of Deeds, or an authorized New York State Department of Taxation and Finance employee must also be included.

- Don’t: Ignore the privacy notification. Understanding the legal authority for the request and the purpose of the information collection is crucial for compliance and privacy reasons.

- Don’t: Leave out details of the decedent’s involvement in any clubs, organizations, or legal proceedings within the last five years as these can be pivotal in determining domicile.

Misconceptions

Many individuals find the process of dealing with estate matters daunting, particularly when it involves understanding specific documents like the NY ET-141 form. This form plays a crucial role in the administration of an estate, specifically for individuals who were not domiciled in New York State at the time of their death. There are several misconceptions surrounding the NY ET-141 form that can complicate its use. Let's address some of these misunderstandings to clarify its purpose and requirements.

- Misconception #1: The NY ET-141 form is required for all estates. This form is specifically for estates where the deceased was claimed not to have been domiciled in New York State at the time of death.

- Misconception #2: Any friend of the deceased can complete the form. The form should be completed by the fiduciary (executor or administrator), the surviving spouse, or a close family member who is knowledgeable about the decedent’s domicile status.

- Misconception #3: The form is only for U.S. citizens. While there is a section concerning naturalization, non-citizens can also be involved, particularly if domicile outside New York is being claimed.

- Misconception #4: Completion of the ET-141 form exempts the estate from New York State taxes. The form is used to determine domicile for tax purposes, but it does not itself grant any tax exemptions.

- Misconception #5: The ET-141 only focuses on the decedent’s place of residence. While residence is a significant factor, the form also inquires about real estate ownership, voting records, and other ties to New York State which may affect domicile determination.

- Misconception #6: The form is straightforward and does not require detailed information. In reality, the ET-141 form requires comprehensive details about the decedent’s connections to New York and elsewhere to accurately assess domicile.

- Misconception #7: Only the ET-141 form needs to be submitted for domicile-related matters. This form is part of a larger estate documentation process and must be accompanied by other forms depending on the date of death and other factors.

- Misconception #8: The form negates the need for a will or other estate planning documents. The ET-141 form is a tax document and does not substitute for a will or dictate the distribution of the estate.

- Misconception #9: Filling out the ET-141 form is optional. If it is claimed that the decedent was not domiciled in New York State, completing this form is a necessary step in the estate administration process.

- Misconception #10: Information about the decedent's church, club, or organization memberships is irrelevant. Such details can provide additional evidence regarding the decedent’s domicile and must be included if applicable.

Understanding the actual requirements and purpose of the NY ET-141 form can significantly simplify the process of settling an estate. It's important for fiduciaries and family members to accurately complete this form to ensure compliance with New York State tax laws and to accurately reflect the decedent's domicile status. Misinterpreting these aspects can lead to unnecessary complications during an already challenging time.

Key takeaways

The ET-141 form, also named the New York State Estate Tax Domicile Affidavit, plays a crucial role in the estate settlement process for a deceased individual not considered domiciled in New York State at the time of death. The following key takeaways shed light on the importance, requirements, and procedural steps associated with this document:

- The ET-141 form is specifically designed for estates of decedents passing away after May 25, 1990, indicating its relevance to contemporary estate settlements.

- Completion of this affidavit is necessary when it is asserted that the decedent was not domiciled in New York State at their time of death, impacting the estate's tax obligations.

- A fiduciary, such as an executor or administrator, the surviving spouse, or an immediate family member who possess all requested information, is eligible to complete the affidavit.

- It is imperative to answer all questions on the form fully and accurately to avoid processing delays or issues in determining the estate's domicile status.

- The affidavit must be submitted alongside the appropriate estate tax return form depending on the decedent's date of death, such as Form ET-30, ET-85, ET-90 for dates of death before February 1, 2000, ET-130, ET-133, or ET-706 for dates of death on or after February 1, 2000.

- Information required includes details about the decedent's residence(s), property ownership in New York State, voting history, and tax filings, among other personal and financial details.

- Documenting the decedent's history of employment, business activities, and legal proceedings within and outside New York State further supports the domicile determination.

- The form requires disclosure of any safe deposit boxes the decedent leased in New York at the time of death, including a request for an inventory if applicable.

- Documentation associated with trusts, deeds, or licenses executed by the decedent, alongside memberships in various organizations, could be imperative in establishing domicile.

- The affidavit concludes with a section for any additional information or documentation deemed relevant to substantiating the claim of non-domicile in New York State.

- Accuracy and honesty in completing the affidavit are critical, as the information provided is utilized by the New York State Department of Taxation and Finance to make a domicile determination affecting estate tax liabilities.

Understanding and correctly filling out the ET-141 form is of paramount importance for representatives of estates where the decedent is believed not to have been domiciled in New York State. This process ensures compliance with state tax laws and assists in the correct determination of the estate's tax obligations.

Common PDF Documents

It-2 Form - Details of allocated tips and their taxation are crucial entries for individuals in the service industry filing the IT-2.

New York W2 Reporting Requirements - Each page has space for detailed employee wage information, including Social Security numbers and total taxes withheld.