Free Ny 4B Certification Of Employer Form in PDF

The New York 4B Certification of Employer form plays a pivotal role for aspiring Certified Public Accountants (CPAs) in demonstrating their work experience, a crucial step towards licensure in the state. This form is meticulously designed to ensure that the experience gained by the applicant is under the guidance of a duly licensed and registered CPA, verifying the authenticity and relevance of the work performed. It encompasses a range of positions and responsibilities, from audits and financial reporting to tax preparation and management advisory services, reflecting a broad spectrum of accounting skills. For those aiming for an initial license, the form outlines specific requirements based on educational background and, notably, offers a pathway for applicants with extensive experience in lieu of traditional education benchmarks. Furthermore, it facilitates the endorsement of CPAs licensed in other jurisdictions, looking to practice in New York, with provisions for self-verification of experience under certain conditions. Completing this form accurately is essential for applicants to navigate the licensure process successfully, highlighting its importance in the broader framework of professional accounting standards and ensuring compliance with New York State's rigorous qualification criteria.

Ny 4B Certification Of Employer Sample

The University of the State of New York

The State Education Department

Office of the Professions

Division of Professional Licensing Services

www.op.nysed.gov

Instructions for Completing Verification of Experience by Supervisor Form 4B

NOTE: Send these instructions with the Form 4B to each supervisor.

Who can complete this form? A certified public accountant licensed in one of the U.S. jurisdictions who is properly licensed and registered or authorized to practice in the jurisdiction of their principal place of business. If a CPA supervisor was not properly licensed or registered or authorized to practice in the state where they practiced, the experience cannot be accepted. The CPA must have acted in a supervisory capacity to the applicant in the same employing organization.

What is acceptable experience? An applicant must present evidence, satisfactory to the State Board for Public Accountancy, of

Full and part time experience.

How much experience must be certified on Form(s) 4B?

●Initial license: 150 semester hour education requirements - must document at least 1 year of acceptable

●Initial license: 120 semester hour education requirements - must document at least 2 years of acceptable

●Endorsement of a CPA license issued in another state - must document 4 years of full time experience (or the

●Foreign Endorsement - must document 4 years of full time experience (or

●Applicants for an initial license based on 15 years of experience in lieu of meeting the education requirements - must document at least 15 years of acceptable full time experience (or the

Instructions for Completing Item 7,

Indicate the applicant's service(s) performed during the attested experience.

A.Independent Audit: Includes experience where the applicant was involved:

1.in examining financial statements of clients where the application of generally accepted auditing standards has been employed for the purpose of expressing an opinion that the financial statements are presented in accordance with generally accepted accounting principles; or

2.in examining financial statements of clients when certain auditing procedures have been applied but a disclaimer is expressed, including Statements on Auditing Standards (SASs), Statements on Standards for Attestation Engagements (SSAEs), and Statements on Quality Control Standards (SQCSs).

The preparation of a client’s related income tax returns and management letters by the applicant who participated in the examination of the financial statements may also be included in this category. Involvement in the examination of the financial statement is mandatory for including these tax preparation and management letter activities in the audit category.

B.Compilations and Reviews: The independent preparation of financial statements from the books of account without audit, including compilations as defined by Statements on Standards for Accounting and Review Services (SSARS), and performing related services in which the applicant has demonstrated a knowledge of generally accepted accounting principles.

Certified Public Accountant Form 4BInst, Page 1 of 2, Rev. 9/20

C.Internal, Management, or Government Audit: Includes all audit activities that are not conducted independently or to determine that financial statements are presented in accordance with generally accepted accounting principles, such as:

1.objective analysis of internal controls and evaluation of risk related to an organization's governance, operations and information systems;

2.structured review of the efficiency/effectiveness of an organization's systems and procedures;

3.review of corporate or individual tax returns on behalf of a governmental entity;

4.any audit activities conducted by an employee of a governmental entity.

D.Forensic Accounting: The application of accounting skills at a level to determine issues such as: fraud; criminal investigations; estimates of losses, damages and assets related to potential legal cases.

E.Bookkeeping Services and Internal Financial Statement Preparation: Preparing books of original entry, preparing payrolls, checks, and posting to subsidiary ledgers. Posting to the client's general ledger in connection with preparing financial statements should be classified as bookkeeping services. Providing general accounting services to an employer or client is considered bookkeeping.

F.Tax Preparation or Tax Advice:

1.Preparing corporation, fiduciary, partnership and individual tax returns from information compiled by others, or from unaudited data furnished by clients.

2.Preparing payroll tax reports, sales and similar tax returns.

3.Researching tax law; tax planning for clients; preparing protests, Tax Court petitions, and briefs; and representing clients before taxing authorities.

4.Examining tax returns.

5.Providing information and advice on tax issues to clients or an employer.

6.Estate planning for clients.

G.Management Advisory Services:

1.Designing and installing accounting, cost or other systems for a client or employer, when not related to an extension of auditing assignments.

2.Any other management advisory services provided for a client or employer.

H.Financial Advisory Services: Includes a range of financial analysis and advice for either a client or employer including:

1.Financial management activities;

2.Pension management;

3.Securities analysis;

4.Personal Financial Planning.

I.Consulting (Includes a range of consulting services surrounding technological and industry experience.):

1.Business valuation.

2.Mergers and acquisitions.

3.Client training on accounting systems.

J.Teaching College Accounting: Preparation and delivery of accounting courses for academic credit at a regionally accredited 4 year degree granting college or university. Teaching by a

K.Other Professional Services: Any other professional services for a client or employer that do not fit in the categories above. Do not list paid time off (PTO), Continuing Professional Education (CPE), Training or other

Instructions for

Only for Applicants Who Hold a CPA License Issued by Another State (Endorsement Applicants ONLY)

An applicant for licensure in New York, who is licensed in another state, may certify his/her own experience on Form 4B if:

1.he/she is working in private industry, government, or a not for profit and he/she does not have a US licensed CPA supervisor; or

2.he/she is working as a sole proprietor of a CPA firm in a state other than New York.

To

●Provide his/her personal information in Section I: Applicant Information;

●Provide his/her professional credentialing information in Section II, Item 1;

●Detail his/her experience in Section 2, Items 2 - 10; and

●Sign the affidavit at the end of the form.

Certified Public Accountant Form 4BInst, Page 2 of 2, Rev. 9/20

The University of the State of New York |

|

|

The State Education Department |

Certified Public Accountant Form 4B |

|

Office of the Professions |

||

Verification of Experience by Supervisor |

||

Division of Professional Licensing Services |

||

www.op.nysed.gov |

|

|

|

|

Applicant Instructions: Complete Section I before sending the form along with a copy of Instructions for Completing Verification of Experience by Supervisor (Form 4BInst) to your supervisor. Use a separate Form 4B for each supervisor you listed on Form 1. Ask your supervisor to complete Section II. The supervisor must submit the form directly to the address at the end of this form. This form will not be accepted if submitted by the applicant.

Section I: Application Information

1. |

Last 4 Digits of Social Security Number |

|

|

|

|

2. |

Birth Date |

Month |

|

Day |

|

Year |

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

(Leave this blank if you do not have a U.S. Social Security Number) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

3. |

Print Name as it Appears on Your Application for Licensure (Form 1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Last |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

First |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Middle |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4. |

Telephone/Email Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

Daytime Phone |

|

|

|

Email Address (please print clearly) |

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Area Code |

Phone |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

5. |

Name as it appears on degree or other credentials (if different from above) |

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

6. |

Endorsement Applicants Only: Date of Licensure |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

Month |

|

Day |

|

Year |

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Section II: Verification of Experience

Instructions to Supervisor: Read the accompanying instructions before completing this section. The information you provide in this section will be used by the New York State Board for Public Accountancy to determine whether the applicant has satisfied the experience requirement of Section 70.3 of the Commissioner's Regulations. Sign and date the affirmation and submit the entire form along with any required documentation to the Office of the Professions at the address at the end of the form. Do not return this form to the applicant. This form will not be accepted if submitted by the applicant.

1. |

|

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

License Number |

State in which licensed |

Date Licensed |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

2. |

|

Firm or organization were you supervised the applicant. |

|

|

|||||||||||||

|

|

Firm or Organization Name |

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

City |

|

|

|

|

|

State |

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||

3. |

|

List your title or position while supervising the applicant |

|

|

|||||||||||||

|

|

|

|

|

|

|

|

||||||||||

4. |

|

Indicate your principal place of business (the state) during the time period attested |

|

|

|||||||||||||

|

|

|

|

|

|

||||||||||||

5. |

|

If the state of your principal place of business and the state of licensure are different, were you lawfully practicing* in the state of your |

|||||||||||||||

|

|

principal place of business during the time attested? |

|

|

|||||||||||||

|

|

|

Yes |

|

No |

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

*For questions on lawful practice in the state of your principal place of business with an out of state license, please refer to the state board |

||||||||||||||||

|

of accountancy in that state. |

|

|

|

|

|

|

|

|

||||||||

6. Employer Category (check one): |

|

|

|

|

|||

|

|

Public Accounting Firm |

|

Government |

|

Private Industry |

|

|

|

|

|

||||

|

|

|

Law Firm |

|

Education |

||

|

|

|

|

||||

|

|

Other (please describe) |

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

Certified Public Accountant Form 4B, Page 1 of 2, Rev. 9/20

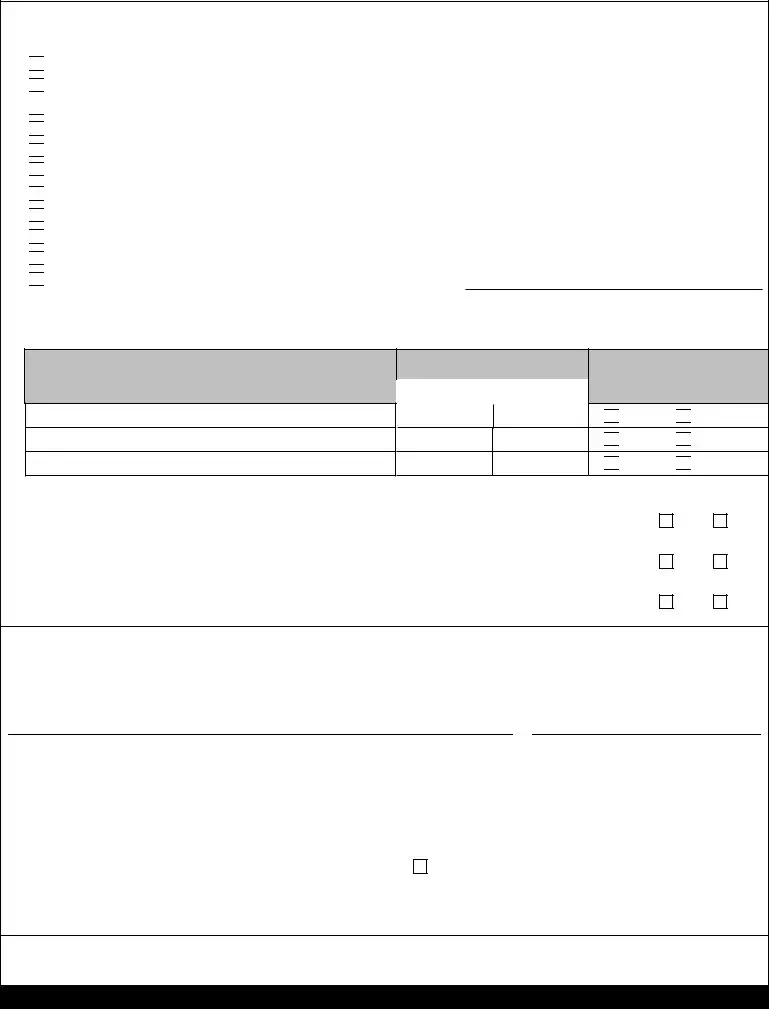

Items 7 - 11: Applicant's work experience record to which I am attesting and acted in a supervisory capacity:

7.Type of services performed by the applicant:

A.* Independent Audit

A.* Independent Audit

B.* Compilations and Reviews

B.* Compilations and Reviews

C. Internal, Management, or Government Audit

C. Internal, Management, or Government Audit

D. Forensic Accounting

D. Forensic Accounting

E. Bookkeeping and Internal Financial Statement Preparation

E. Bookkeeping and Internal Financial Statement Preparation

F. Tax Preparation or Tax Advice

F. Tax Preparation or Tax Advice

G. Management Advisory Services

G. Management Advisory Services

H. Financial Advisory Services

H. Financial Advisory Services

I. Consulting

I. Consulting

J. Teaching College Accounting

J. Teaching College Accounting

K Other Professional Services (describe in detail or attach additional sheets)

K Other Professional Services (describe in detail or attach additional sheets)

*A and B - restricted to registered public accounting firms only.

8.Applicant's Job Classification:

Job Title

Date Supervised (MM/DD/YYYY)

From |

To |

|

|

Full Time/Part Time*

Full Time

Full Time

Part Time*

Part Time*

Full Time

Full Time

Part Time*

Part Time*

Full Time

Full Time

Part Time*

Part Time*

*Part time experience will not be accepted without supporting documentation. See instructions for acceptable supporting documentation.

9.Were you employed in the same employing organization as the applicant?

If No, Stop. You are not authorized to submit the experience for this applicant.

10.Did you act in a supervisory capacity to the applicant in the employing organization for the dates you are attesting to? If No, Stop. You are not authorized to submit the experience for this applicant.

11.Does the applicant, in your opinion, possess good moral character and have other attributes required of a CPA? If No, please attach an explanation.

Yes

Yes

Yes

No

No

No

Affirmation

Ideclare and affirm under penalty of perjury that the statements made in the foregoing application, including any attached statements, are true, complete and correct and that the experience and competency I am attesting to meets the definition and practice as a certified public accountant.

Supervisor Signature |

|

|

|

|

Date |

||

Print Name |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

Title |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

Telephone |

|

|

|

|

|

||

|

|

|

|

|

Check here if you are attaching additional information |

||

Fax |

|

|

|||||

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

Return Directly to by mail: New York State Education Department, Office of the Professions, Division of Professional Licensing Services, CPA Unit, 89 Washington Avenue, Albany, NY

DPLSExperience@nysed.gov.

Certified Public Accountant Form 4B, Page 2 of 2, Rev. 9/20

File Overview

| Fact | Detail |

|---|---|

| Form Purpose | Verification of Experience by Supervisor for CPA licensure in New York. |

| Eligible Supervisors | Must be a certified public accountant licensed and registered/authorized to practice in their jurisdiction. |

| Experience Requirement for License | Varies based on education and licensure status; ranges from 1 to 4 years of full-time experience or its part-time equivalent. |

| Acceptable Experience Types | Includes accounting services or advice using skills in areas such as audit, tax, consulting, under the supervision of a licensed CPA. |

| Definition of Full-time Employment | Considered to be a 5-day work week with 35-40 hours per week, excluding overtime. |

| Part-time Experience | Accepted based on one week of experience for every two weeks worked, requiring supportive documentation of hours worked. |

| Self-Verification Option | Available for applicants licensed in another state, under specific conditions such as working in private industry or as a sole proprietor in a CPA firm. |

| Service Categories | Includes Independent Audit, Compilations and Reviews, Tax Preparation/Advice, Consulting, and more. |

| Governing Law | Administered under the New York State Education Department, Office of the Professions, guided by Section 70.3 of the Commissioner's Regulations. |

Ny 4B Certification Of Employer: Usage Guidelines

Filling out the NY 4B Certification of Employer form accurately is vital for individuals pursuing licensure or certification in certain professions within New York State. This process involves presenting verified experience under the supervision of a qualified individual. The document must be completed by both the applicant and their supervisor to ensure all necessary information is accurately reported. By adhering to the instructions provided, applicants can facilitate a smooth verification process, which is an essential step toward achieving professional certification or licensure in New York.

Steps to Fill Out the NY 4B Certification of Employer Form- Begin by completing Section I of the form, providing personal information such as the last four digits of your Social Security Number, birth date, full name (as it appears on your application for licensure, Form 1), daytime phone number, email address, and, if applicable, the name as it appears on your degree or other credentials.

- If you are applying for endorsement, indicate the date of licensure in the appropriate space provided in Section I.

- Before sending the form to your supervisor, ensure Section I is fully completed. Include a copy of the instructions for completing Verification of Experience by Supervisor (Form 4BInst) when sending the form to your supervisor.

- Request your supervisor to complete Section II, which includes information on the supervisor's name, license number, date licensed, the firm or organization where the applicant was supervised, the supervisor's title or position, the principal place of business, and verification of lawful practice in the state of principal place of business if different from the state of licensure.

- The supervisor must check the appropriate employer category (e.g., Public Accounting Firm, Government, Private Industry) in Section II.

- In Section II, items 7 through 11 require the supervisor to detail the type of services performed by the applicant, the applicant's job classification, dates supervised, and whether the employment was full-time or part-time. Supporting documentation for part-time experience must be included, as stated in the instructions.

- The supervisor should verify if they have acted in a supervisory capacity to the applicant within the same employing organization for the attested period.

- It is essential for the supervisor to affirm whether the applicant possesses good moral character and the attributes required of a CPA.

- Upon completion, the supervisor must sign and date the form, affirming that the statements made are true, complete, and correct under penalty of perjury.

- The form, along with any attached additional information or required supporting documentation, must be returned directly by the supervisor to the address provided at the end of the form or submitted via email as specified.

It is important to note that the form will not be accepted if submitted by the applicant themselves; it must be sent by the supervisor. Following these steps carefully will ensure the form is completed accurately and submitted properly, thereby supporting the applicant's pursuit of professional licensure or certification in the state of New York.

FAQ

Who is eligible to complete the NY 4B Certification of Employer form?

The NY 4B form must be completed by a Certified Public Accountant (CPA) who is properly licensed and registered, or authorized to practice in the jurisdiction of their principal place of business. This individual must have directly supervised the applicant in the same employing organization. If the CPA was not properly licensed, registered, or authorized to practice in the state where they worked, the experience reported will not be accepted.

What types of experience are considered acceptable on the NY 4B form?

Experience that is acceptable for the purpose of this certification includes full-time provision of accounting services or advice that involves the use of accounting, attest, compilation, management advisory, financial advisory, tax, or consulting skills. Such experience can be gained in various settings, including a public accounting firm, government, not-for-profit entities, private industry, or an educational institution. However, internships are not accepted toward fulfilling the experience requirement if they are used to meet degree requirements or listed for academic credit on the transcript. Both full-time and part-time experiences are considered, with the requirement that part-time work must be no fewer than 20 hours per week.

How much experience is required to be certified on the NY 4B forms?

The amount of experience required to be certified varies based on the type of license application:

- For an initial license with 150 semester hour education requirements, applicants must document at least 1 year of full-time experience or its part-time equivalent.

- For an initial license with 120 semester hour education requirements, applicants must document at least 2 years of full-time experience or its part-time equivalent, unless they submit acceptable transcripts and are approved as meeting the 150 semester hour education requirements.

- For endorsement of a CPA license issued in another state, applicants must document 4 years of full-time experience (or its part-time equivalent) since the out-of-state license was issued and within the last 10 years.

- For foreign endorsement or applicants for an initial license based on 15 years of experience in lieu of meeting the education requirements, specific conditions apply as detailed in the form instructions.

Can an applicant self-verify their experience on Form 4B?

Yes, but only under certain conditions. An applicant who holds a CPA license issued by another state and is applying for licensure in New York may self-verify their experience on Form 4B if they are working in private industry, government, or a not-for-profit organization without a U.S. licensed CPA supervisor, or if they are working as a sole proprietor of a CPA firm in a state other than New York. To self-verify, the applicant must provide their personal and professional credentialing information, detail their experience, and sign the affidavit at the end of the form.

Common mistakes

Filling out the NY 4B Certification of Employer Form accurately is crucial for applicants seeking licensure or endorsement in accounting. However, several common pitfalls can compromise the process. By recognizing these mistakes, individuals can ensure their submissions are complete and comply with the requirements of the New York State Education Department.

Mismatch in Licensing Information: A fundamental error occurs when the supervisor completing the form is not properly licensed, registered, or authorized to practice in their jurisdiction at the time they supervised the applicant. This oversight can invalidate the submitted experience.

Omission of Required Details: Sometimes, supervisors may overlook providing detailed descriptions of the services performed by the applicant. Specificity in outlining the applicant's tasks and roles is crucial for each category of service, whether it’s audit, tax, advisory, or any other professional service listed in the form.

Failure to Document Part-time Work Properly: Part-time employment, under the terms of the form, must include explicit documentation of the hours worked each week. General averages or estimates are not acceptable. Failure to provide the required supporting documentation often leads to the rejection of part-time experience.

Incorrect Calculation of Experience Duration: Applicants and their supervisors must accurately document the length of experience, adhering to the specific criteria for full-time and part-time work as defined in the instructions. Overlooking these details can result in mistakenly reporting the duration of experience.

Overlooking the Supervisory Relationship: The form specifically requires that the certifying CPA acted in a supervisory capacity to the applicant in the same organization. Ignoring this requirement or inaccurately portraying the relationship between the supervisor and the applicant could negate the attested experience.

Insufficient Evidence of Competency and Character: The form asks whether the supervisor believes the applicant possesses good moral character and other attributes required of a CPA. Failing to provide a sufficient explanation when the answer is “No” leaves a critical gap in the applicant's profile.

Self-Verification Confusion: Applicants licensed in another state and eligible to self-verify experience must adhere to strict guidelines. Misunderstandings or incorrect information in this section can complicate or delay the application process.

Avoiding these mistakes requires careful attention to detail and a thorough understanding of the instructions provided by the New York State Education Department. By ensuring that all parts of the form are completed accurately and completely, applicants and their supervisors can facilitate a smoother licensure or endorsement process.

Documents used along the form

When working with the NY 4B Certification Of Employer form, professionals often find that additional forms and documents are required to complete a comprehensive application or submission for licensure. The following are commonly used documents alongside the NY 4B form to ensure a smooth and detailed application process for licensure in accounting or related fields.

- Form 1 - Application for Licensure: This is the initial application form required for any type of licensure in New York State. It collects basic information about the applicant, including personal details, education, and the specific license being applied for.

- Official Transcripts: Unsealed, official transcripts are required from every educational institution attended by the applicant. These documents verify the applicant’s educational qualifications and are crucial for meeting specific education requirements for licensure.

- Experience Verification Form: Similar to the Form 4B, this form is used by other professionals who supervised the applicant to verify additional work experience outside the direct supervision of a certified public accountant, if applicable.

- CPA Examination Scores: Applicants must submit official score reports for the Uniform CPA Examination. These scores provide evidence of the applicant's knowledge and readiness for licensure.

- Character Reference Forms: These forms are completed by individuals who can attest to the applicant’s professional character and suitability for licensure. They are essential for evaluating the non-academic capabilities of the applicant.

- Foreign Credential Evaluation (if applicable): Applicants with educational credits from non-U.S. institutions must provide an evaluation of these credentials to verify their equivalency to U.S. educational standards.

- Self-Employment Documentation (if applicable): For applicants self-verifying their experience due to lack of a US licensed CPA supervisor, detailed records of self-employment, including a list of services provided, clients served, and durations of engagements, are required.

These documents, used together with the NY 4B Certification Of Employer form, create a clear picture of an applicant's qualifications, experience, and readiness for licensure. It's important for applicants to carefully prepare and review each document for accuracy and completeness, as this can significantly influence the processing and outcome of their licensure application.

Similar forms

The "Verification of Experience by Supervisor" is comparable to the "Professional Experience Verification" form used in various professions to document the specific experience required for licensure or certification. This form serves as a record of an individual’s work under the direction and supervision of a more seasoned professional. In the same way, it validates the authenticity and relevance of work experience, ensuring it meets the specific standards or competencies set forth by a licensing body or professional organization.

Similarly, the "Internship Completion Certificate" is another document that echoes the essence of the Form 4B. This certificate is often required upon the successful completion of an internship program, particularly if it's a prerequisite for obtaining a degree or professional qualification. It serves as proof that the intern has acquired practical experience and skills in their field of study or work under the guidance of a seasoned professional, akin to the supervision requirement outlined in the NY Form 4B.

The "Annual Performance Review" document used in many organizations for evaluating an employee's work performance over a specified period also shares similarities with the NY Form 4B. While its primary goal is to assess and provide feedback on employee performance, it can include sections that detail the supervisee's experience and the competencies developed during the review period. Hence, like Form 4B, it can act as a record of professional growth and skill acquisition under supervision.

The "Continuing Professional Education (CPE) Reporting Form" used by certified professionals to document their ongoing learning activities is similar in nature to Form 4B. Both forms are tools for verification, with the CPE form focusing on verifying that a professional has met the required educational activities to maintain their licensure. This form ensures that the individual remains competent and up-to-date in their field, paralleling how Form 4B certifies relevant experience under a licensed CPA's supervision.

A "Project Completion Certificate" resembles the NY Form 4B in that it officially recognizes the accomplishment and participation of an individual in completing a specific project. This certificate can detail the nature of the project, the role of the participant, and the professional skills utilized or gained— mirroring the detailed experience verification sought by Form 4B. It's a formal attestation of an individual's contribution and capability, significant for career development and recognition.

Additionally, the "License Endorsement Application" for professionals moving across states or seeking to validate their license in a new jurisdiction shares the purpose of establishing qualifications through previously gained experience. Like the NY Form 4B, an endorsement application often requires detailed documentation of professional experience and may require verification from supervisors or licensed professionals, ensuring that the applicant meets the new state’s licensure standards.

Lastly, the "Skill Certification Form" provided by technical and vocational education programs or institutions follows a similar validation process as Form 4B. This form certifies that an individual has achieved a certain level of skill mastery and practical experience in a specific trade or technology, often under supervised conditions. It is crucial for demonstrating competency to potential employers or for advancing in one’s career, paralleling the role of experience verification in professional licensing.

Dos and Don'ts

Filling out the NY 4B Certification Of Employer form is a crucial step in the process for accounting professionals in New York to certify their professional experience. Here are some guidelines of what you should and shouldn't do when completing this form:

- Do ensure that the supervisor completing the form is a certified public accountant licensed in the U.S. and has directly supervised your work.

- Do not proceed with a supervisor who was not properly licensed, registered, or authorized to practice during the time of your employment as this will lead to your experience being deemed unacceptable.

- Do include full and part-time work experience that is relevant, ensuring that part-time work is no less than 20 hours per week and is properly documented with the number of hours worked each week.

- Do not list any internships used to meet degree requirements or any work experience prior to your licensure when applying for endorsement or initial license based on experience.

- Do make sure that all sections of the form are filled out thoroughly, providing detailed descriptions of your work experience and the specific type of services performed.

- Do not allow for any ambiguity in the form regarding your full-time or part-time status, and explicitly provide supporting documents for part-time work when necessary.

- Do verify that the supervisor has indicated their ability to lawfully practice in the state of their principal place of business if different from where they are licensed.

- Do not submit the form yourself. It must be submitted directly by the supervisor to maintain the integrity and confidentiality of their assessment.

- Do double-check that the form includes the supervisor’s affirmation and signature, confirming the accuracy and truthfulness of the information provided.

By meticulously following these guidelines, you can ensure that your NY 4B Certification Of Employer form is completed accurately and efficiently, thereby facilitating the verification of your professional experience by the New York State Education Department.

Misconceptions

When navigating the complexities of the NY 4B Certification of Employer form, individuals often encounter misconceptions that can lead to confusion and errors in the submission process. Understanding the truth behind these misconceptions is vital for ensuring accurate and timely compliance with the requirements of the New York State Education Department - Office of the Professions. Below are four common misconceptions about the NY 4B form and explanations to clarify each point.

- Only full-time experience counts toward the experience requirement. This is a misunderstanding. The form acknowledges both full-time and part-time work experience. Full-time employment is defined as a 5-day work week, working 35-40 hours per week. For part-time positions, those worked no fewer than 20 hours per week are also considered, with one week of experience accounted for every two weeks worked. Importantly, part-time work must include documentation detailing the number of hours worked each week.

- Internships always qualify towards the experience requirement. In reality, internships may not be recognized as qualifying experience especially if they are used to meet degree requirements or are listed for academic credit on a transcript. This specification ensures that only professional work experience that truly develops relevant skills is considered towards licensure.

- Any CPA can sign off on the experience verification. Another common misunderstanding. Only CPAs who are properly licensed and registered or authorized to practice in the jurisdiction of their principal place of business may complete this form. Moreover, the CPA must have acted in a supervisory capacity to the applicant within the same employing organization. This ensures that the person verifying the experience is qualified and has firsthand knowledge of the applicant's work.

- Self-verification is not allowed under any circumstances. This statement is not entirely accurate. Certain applicants, specifically endorsement applicants or those licensed in another state working in private industry, government, or not-for-profit and do not have a US licensed CPA supervisor, or are sole proprietors of a CPA firm outside of New York, may self-verify their experience. This exception accommodates professionals who may not have access to a qualifying supervisor but can still demonstrate their qualifications and competency.

Correcting these misconceptions is crucial for professionals navigating the licensure process, reinforcing the need for careful review of the form's instructions and requirements. By ensuring accurate and comprehensive completion of the NY 4B Certification of Employer form, applicants and supervisors can contribute to the maintenance of high standards within the profession.

Key takeaways

Understanding the process and requirements of filling out the New York 4B Certification of Employer form is essential for both supervisors and applicants aiming to verify accounting experience for licensure. Here are key takeaways from the instructions and content of the form:

- Only a certified public accountant (CPA) who is licensed and registered or authorized to practice in their principal place of business within the U.S. jurisdictions can complete this form. This ensures that the supervisor has the proper authority and knowledge to attest to an applicant's experience.

- The form is designed to document a variety of acceptable experiences ranging from public accounting to non-profit work. It includes specific categories like independent audit, tax preparation, management advisory services, and teaching college accounting, among others.

- Experience requirements vary based on the pathway to licensure. For example, initial licensure requires documentation of at least 1 or 2 years of experience, depending on the applicant’s educational background, while endorsement from another state requires 4 years of post-license experience.

- Both full-time and part-time experiences are acceptable, but part-time work must consist of no fewer than 20 hours per week and needs proper documentation to verify the number of hours worked.

- Internships cannot be counted towards the experience requirement if they were used to meet degree requirements or were listed for academic credit on the transcript, emphasizing the necessity for professional, post-educational experience.

- The form distinguishes between different types of accounting work, and supervisors must specifically indicate the type of services the applicant performed. This differentiation ensures that applicants gain comprehensive experience across the field’s various specialties.

- Applicants who hold a CPA license issued by another state may self-verify their experience only if certain conditions are met, such as working in private industry or as a sole proprietor, and if they do not have a U.S. licensed CPA supervisor.

- The form must be submitted directly by the supervisor to the New York State Education Department, Office of the Professions. This submission protocol underscores the form's integrity and the seriousness of the attestation made by the supervisor.

Adhering to these guidelines when completing and submitting the NY 4B Certification of Employer form is crucial for ensuring the accuracy and acceptability of the attested accounting experience required for CPA licensure in New York.