Free New York Wd 3 Form in PDF

The New York WD-3 form, utilized within the Surrogate’s Court of the State of New the York, plays a pivotal role in the process of administering the estates of deceased individuals. It is specifically designed for cases where an administrat is applying for permission to settle a wrongful death claim and to have their account of the estate's management officially reviewed and settled by the court. This form encompasses a detailed account of the administrat's dealings, including the accumulation and distribution of the deceased's assets, settlement of claims against the estate, and management of the decedent's final affairs. Pertinent to this procedure are details such as the initial appointment of the administrat, the financial transactions undertaken on behalf of the estate, payment of the decedent's debts, and the proposed distribution of the estate's remaining assets to rightful heirs. Furthermore, the WD-3 form necessitates disclosure of any potential conflicts, such as claims by creditors or disputes over the rightful beneficiaries, ensuring that all parties' rights are adequately considered in the administrative process. By mandating a comprehensive and sworn statement of the administrat’s actions and decisions, the form serves as a safeguard for both the estate and its beneficiaries, ensuring accountability and transparency in the distribution of the assets of the deceased.

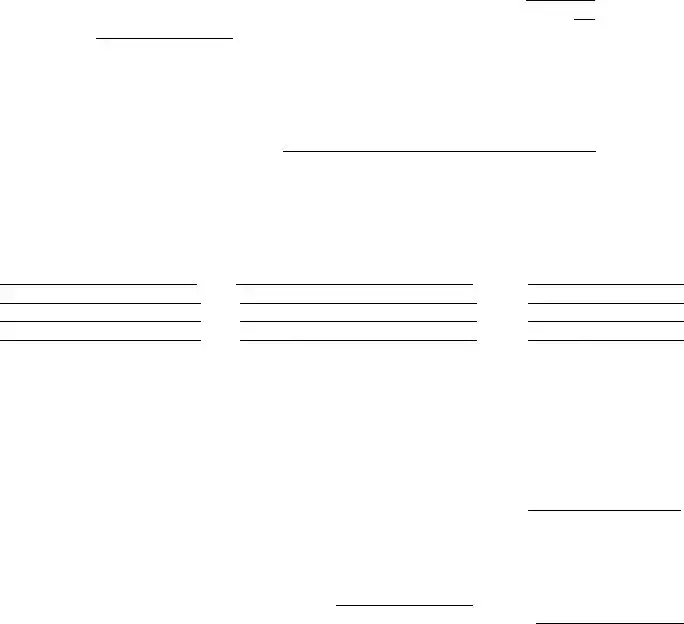

New York Wd 3 Sample

Form

SURROGATE’S COURT OF THE STATE OF NEW YORK

COUNTY OF

In the Matter of the Application of |

|

|

|

|

|

|

|

|

|

||||||||||

as Administrat |

|

|

of the Goods, Chattels and |

|

|

|

|

|

|

|

|

|

|||||||

Credits which were of |

|

|

|

|

|

|

ACCOUNT |

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Deceased. |

|

File # |

|

|

|

||||||

For leave to compromise a certain cause of action for |

|

|

|

|

|

|

|

|

|

||||||||||

wrongful death of the decedent and to render and have |

|

|

|

|

|

|

|

|

|

||||||||||

judicially settled an account of the proceedings as such |

|

|

|

|

|

|

|

|

|

||||||||||

Administrat |

|

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

TO THE SURROGATE’S COURT: |

|

|

|

|

|

|

|

|

|

||||||||||

1. I |

|

|

|

|

|

|

|

|

|

do render the following account of my |

|

|

|

||||||

proceedings as administrat |

|

|

of the goods, chattels and credits which were of |

|

|

, |

|

||||||||||||

deceased, consisting of a claim against |

|

|

|

|

|

, who is insured by |

|

|

|

||||||||||

|

|

|

|

|

|

|

Insurance Company, for wrongful death arising on or about |

|

|

, |

|||||||||

as the result of an automobile accident involving the decedent and |

|

. |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2.Letters of Administration of the goods, chattels and credits of the decedent were issued to me on

_______________________, said letters being limited to the prosecution only, and not for the collection of any proceeds of, any action or claim for wrongful death. Simultaneously herewith, leave is being asked to

compromise the claim for wrongful death of the decedent for the sum of $ |

|

. |

3.There is submitted with this account my petition as administrat________; and affidavit by

,Esq., attorney for the petitioner herein; a copy of the paid funeral bill; and waivers of the necessary parties.

4.In view of the facts and circumstances, it is my opinion that a satisfactory result has been achieved through the efforts of my attorneys, and they are requesting disbursements in the sum of

$ |

|

|

and that they receive thereafter a fee of |

|

% of the net proceeds. |

||

5. |

The funeral bill in the sum of $ |

|

has been paid through |

||||

6.There are no outstanding hospital bills or doctors’ bills.

7.The only property coming into my hands is by reason of the compromise of the claim against the

Insurance Company in the sum of $ |

|

. |

|

|

8. The decedent left surviving no other next of kin except |

|

, |

||

his/her widow/widower, and

,

his/her children. All of the above persons are entitled to share in the proceeds of the compromise.

(NOTE: WHERE THERE ARE NO DISTRIBUTEES UNDER A DISABILITY, THE RENDERING OF AN ACCOUNT IS USUALLY NOT REQUIRED.)

(NOTE: REIMBURSEMENT OF FUNDS PAID FOR FUNERAL AND OTHER ADMINISTRATIVE EXPENSES, UNDER MOST CIRCUMSTANCES, ARE ALLOWABLE, AS ARE STATUTORY COMMISSIONS TO THE ADMINISTRAT(OR)(RIX). IF REIMBURSEMENT OR COMMISSIONS ARE NOT SOUGHT, THE PETITION SHOULD CONTAIN A WAIVER THEREOF).

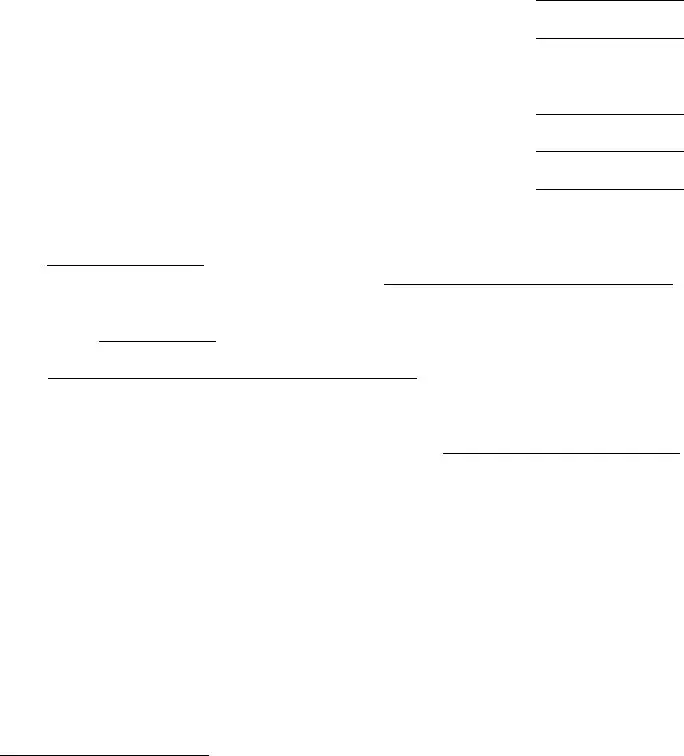

9.There are no other claims or creditors of the estate that have been presented to or have come into my hands or knowledge except for the following:

a)The Commissioner of Social Services has submitted a claim of $

for public assistance rendered to decedent and his/her family for the years

. This claim was rejected.

b) |

has submitted a claim for $ |

|

||||

|

|

based on |

|

|

|

|

This claim was rejected. |

|

|

|

|||

c) Decedent’s father/mother,

has sought a share of the recovery based on an alleged pecuniary loss. This claim was rejected.

10. The following are the only persons interested in this proceeding:

|

[L IST NAMES OF DISTRIBUTEES, ETC .] |

|

NAME |

RELATIONSHIP |

DATE OF BIRTH |

County Department |

|

||

of Social Services |

|

Possible Creditor |

|

New York State Tax Commission |

Possible Creditor |

||

|

|

|

Attorneys |

|

|

|

Defendant |

Insurance Company |

Defendant’s Insurance Company |

||

11.I charge myself as follows with the amount to be received on compromise of the claim for wrongful death against

Insurance Company: |

$ |

12. I credit myself as follows: |

|

|

|

|

||||||||

a) With the amount to be paid to |

|

|

, |

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Esqs., attorneys, including disbursements: |

|

$ |

||||||||||

b) With the amount to be paid to |

|

|

, |

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

widow/widower and distributee: ( |

%) |

$ |

||||||||||

|

|

|

|

|

|

|

|

|

|

|||

c) With the amount to be paid to the guardian of the person |

||||||||||||

and property of |

|

|

|

|

|

|

|

, |

|

|

||

infant, jointly with the Trust Officer of |

|

|

|

|

|

|||||||

Bank ( |

|

|

%): |

|

|

|

|

|

$ |

|||

d) with the amount to be paid to |

|

|

, |

|||||||||

|

|

|

|

|

|

|

|

|

|

|||

son/daughter ( |

%): |

|

|

|

|

$ |

||||||

|

|

|

|

Total: |

|

|

$ |

|||||

Leaving no balance. |

|

|

|

|

|

|

|

|

|

|

||

Dated:

STATE OF NEW YORK |

|

COUNTY OF |

SS.: |

being duly sworn, deposes and says:

That I am the administrat_______ /accountant in the above estate, having been duly appointed by a

decree of this Court.

The foregoing account of proceedings contains to the best of my knowledge and belief a true and complete statement of my receipts and disbursements in the estate of

of all monies and other property belonging to the estate or fund which have come into my hands or which have been received by any person or persons by my order or authority for use since my appointment, and a full and true statement of account of the manner in which I have disposed of same and all property remaining in my hands at the present time, and a full and true account of the nature of each and every transaction may by me since my appointment.

|

I do not know of any error or omission in said account to the prejudice of any person interested in |

|||||

said estate or fund. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

___________________________________ |

||||

Sworn to before me this |

|

|

|

|

|

|

day of |

|

|

. |

|

|

|

Notary Public

(Form |

File Overview

| Fact | Detail |

|---|---|

| Form Title | Form WD-3: Application for Leave to Compromise a Wrongful Death Claim and Settle Account |

| Purpose | To request permission from the Surrogate’s Court to settle a wrongful death claim and to present an accounting of the estate’s administration related to the decedent. |

| Governing Law | New York State Surrogate's Court Procedure Act (SCPA) |

| Key Components | Account of administration, petition for compromise of wrongful death claim, attorney fees and disbursements, distribution of the settlement, and waivers from necessary parties. |

| Filing Requirement | Filed by the administrator of the estate who has received limited letters of administration for the purpose of litigating a wrongful death claim. |

| Financial Details | Includes details of the wrongful death claim settlement, attorney’s fees and expenses, paid funeral bills, and distributions to beneficiaries. |

| Beneficiaries | Details the decedent's next of kin and their entitlements, and notes any claims against the estate. |

New York Wd 3: Usage Guidelines

Filling out the New York WD-3 form is a necessary step in the process of managing the affairs of a deceased individual, specifically when it involves a wrongful death claim. This form is used to account for the adminstration's actions concerning the estate, detailing the proceedings to compromise a claim for wrongful death and to settle the financial aspects related to that claim. It's important to provide accurate and complete information to ensure the smooth handling of the estate's affairs. Here's a step-by-step guide to help you complete the form accurately:

- Start by entering the county in New York State where the form is being filed at the top of the form.

- In the section labeled "In the Matter of the Application of," enter the name of the administrat (the person managing the deceased's goods, chattels, and credits) followed by the name of the deceased (referred to as "Deceased").

- Fill in the File # (file number) provided by the Surrogate’s Court.

- Under the item labeled "1," provide a detailed account of the proceedings as administrat. This includes the claim against the defendant (name and insurance company) for wrongful death resulting from an automobile accident, mentioning dates and parties involved.

- Fill in the date when the Letters of Administration were issued to you in the space provided.

- Indicate the amount agreed upon to compromise the wrongful death claim in the space provided.

- Attach the required documents: your petition as administrat, the attorney's affidavit, a copy of the paid funeral bill, and waivers from necessary parties.

- Discuss the reasoning and details behind the attorney fees and disbursements requested.

- Enter the amount paid for the funeral bill through no-fault insurance.

- Confirm there are no outstanding hospital or doctor bills.

- State the total property value received from the compromise with the Insurance Company.

- Identify the deceased's next of kin who are entitled to share in the proceeds, including their relationship to the deceased and their names.

- Discuss any claims or creditors of the estate that have been presented or are known, and declare if any have been rejected.

- List all interested persons in the proceeding, including their relationship to the deceased and their date of birth if relevant.

- Charge yourself with the total amount to be received from the compromise against the insurance company.

- Credit yourself with the amounts to be paid out to the attorneys, widow/widower and distributees, and any other specified parties, calculating the total and stating any remaining balance.

- Sign and date the form at the bottom. The statement must be sworn and notarized, so ensure a Notary Public is available to sign and date the form as well.

Once you carefully complete each step and ensure all the required documentation is attached, you are ready to submit the form to the Surrogate's Court. Proper completion and submission of this form is vital for a clear and lawful account of the adminstration's actions regarding the estate and the wrongful death claim. It's an essential part of fulfilling your responsibilities as an administrat and moving forward in settling the estate's affairs.

FAQ

What is the WD-3 form used for in the Surrogate’s Court of New York?

What information must be included in the WD-3 form?

Who needs to sign the WD-3 form?

Do I need an attorney to file a WD-3 form?

Can funeral expenses be reimbursed from the wrongful death settlement?

What happens if the decedent has no next of kin?

How is the attorney’s fee determined?

What if there are rejected claims against the estate?

Are distributions made directly to minors?

The WD-3 form is utilized when an administrat (administrator) wants to settle a wrongful death claim in New York's Surrogate’s Court. It's specifically for cases where the administrat is managing the estate of someone who has passed away and needs court approval to settle a wrongful death lawsuit and to have their account of the proceedings judicially settled.

The form requires detailed information about the deceased, the administrat, the wrongful death claim, including the parties involved, the proposed settlement amount, and an accounting of the administrat’s proceedings. It also mandates the inclusion of the decedent’s next of kin, any creditors or claims against the estate, and a statement concerning the distribution of the settlement.

It must be signed by the administrat or accountant of the estate, who attests under oath that the account of proceedings provided is complete and accurate to the best of their knowledge and belief. A Notary Public must also sign the form, verifying the identity of the administrat or accountant.

While not legally required, having an attorney’s assistance is highly recommended due to the complexity of wrongful death claims and estate administration. An attorney can help ensure that all legal requirements are met and can represent the estate in court proceedings.

Yes, reimbursement of funeral and other administrative expenses is typically allowable under the settlement. These expenses might be covered before the distribution of the remaining proceeds to the estate's distributees or next of kin.

If the decedent has no surviving next of kin, the rendering of an account might not be required. However, the court will decide on the distribution of the settlement funds, potentially allocating them to cover the decedent's debts or to the state if no creditors are present.

Attorney’s fees in wrongful death cases are often a percentage of the net proceeds from the settlement. The exact percentage can vary and should be agreed upon by the estate and the attorney in advance. It's important for the WD-3 form to specify both the disbursements and the percentage of the fee.

Any claims against the estate that have been presented and rejected should be listed on the WD-3 form, including the claimant's name and the reason for rejection. This ensures the court is aware of potential creditors and the estate’s stance on these claims.

No, distributions to minors are usually managed through a guardian of the property or a trust until the minor reaches a certain age. The WD-3 form will indicate the percentage of the settlement allocated to the minor, but it will be paid to their guardian or a trust account for their benefit.

Common mistakes

Filling out the New York WD-3 form, which is crucial for individuals serving as administrators of estates especially in cases involving wrongful death claims, can be challenging. Certain common mistakes can lead to delays or inaccuracies in estate management and distribution. Recognizing and avoiding these errors is essential for ensuring the process runs smoothly.

One of the first mistakes often made is the incorrect listing of the deceased's assets. The form requires a detailed account of the goods, chattels, and credits of the deceased, and inaccuracies or omissions can affect the estate's settlement. Similarly, failure to accurately document the dates letters of administration were issued can lead to bureaucratic delays.

Perhaps the most consequential error is inaccurate financial reporting, particularly regarding the claim against the insurance company for wrongful death. Specifying the sum agreed upon for the compromise incorrectly can have significant ramifications on the distribution of the estate. Equally important is the accurate representation of funeral expenses paid through no-fault insurance, as these details affect the net estate value.

- Inaccurate listing of the decedent’s assets, leading to potential discrepancies in estate valuation.

- Misidentifying the date when letters of administration were issued, causing delays.

- Incorrect financial reporting on the compromise reached for wrongful death claims.

- Inadequate documentation of paid funeral bills, affecting the accuracy of estate expenses.

- Omission of details about outstanding claims or creditors, potentially overlooking liabilities.

- Failure to properly allocate the shares to the distributees, which can result in unfair distribution.

- Incorrectly handling statutory commissions or administrative expenses, leading to financial mismanagement.

In addition to these common mistakes, overlooking the necessity to submit a waiver for reimbursement or commissions can result in financial inaccuracies. It is critical to understand the implications of each section on the overall estate and its distribution among the next of kin and other interested parties.

Moreover, failing to accurately describe the relational status and entitlements of the surviving next of kin can lead to challenges or disputes within the probate process. A detailed and careful approach to completing the New York WD-3 form can mitigate these risks and ensure a smoother estate management process.

In conclusion, administrators should proceed with caution and diligence when filling out the WD-3 form, paying special attention to:

- The precise documentation of assets and liabilities.

- The accurate calculation and reporting of financial transactions related to the estate.

- The clear identification and rightful allocation of the estate to the next of kin and other distributees.

By avoiding these common errors, administrators can fulfill their duties effectively, ensuring that the decedent’s estate is managed and distributed according to New York state laws and the wishes of the parties involved.

Documents used along the form

When handling the administration of an estate and the wrongful death claim in New York, as represented by the Form WD-3, a myriad of other forms and documents often must be compiled, submitted, and processed to ensure thorough and proper handling of the deceased's estate and the associated claims. These documents are designed to protect the interests of the estate, the administrator, and the beneficiaries or next of kin. Below is a list of forms and documents frequently used in conjunction with Form WD-3, each serving a critical role in the administration process.

- Letters of Administration: These are official documents issued by the surrogate's court authorizing an individual to act as the administrator of the deceased’s estate. This is crucial for legitimizing the administrator's capacity to make decisions on behalf of the estate.

- Petition for Administration: This document is filed to request the court to appoint an administrator for the deceased's estate, especially when no will is left behind. It outlines the necessity for administration and the proposed administrator's qualifications.

- Waivers and Consents: These are signed by heirs and other interested parties indicating that they consent to the appointment of the proposed administrator and agree to the terms of administration without necessitating a formal court hearing.

- Affidavit of Heirship: This document provides a detailed account of the deceased’s family history and the identities of heirs. It's used to legally establish who the rightful heirs or next of kin are.

- Funeral Bill: An itemized receipt of funeral expenses paid. This document is necessary for the estate administration as it may be reimbursed from the estate assets under certain circumstances.

- Death Certificate: This is the official document confirming the death. It is required for nearly all legal processes following a death, including the claims for wrongful death.

- Notice of Petition to Administer Estate: This notice is served on potential heirs and creditors, announcing the petition to administer the estate and providing them the opportunity to object.

- Inventory and Appraisement Forms: List and appraise the deceased's assets. This comprehensive inventory is crucial for properly managing and distributing the estate.

- Creditor's Claims Forms: Creditors of the deceased must file these forms to claim what is owed to them from the estate. This ensures all debts are considered and paid out from the estate assets before distribution.

- Settlement Agreement for Wrongful Death Claim: This document outlines the terms agreed upon for settling the wrongful death claim, including compensation amounts and the distribution among the heirs or beneficiaries.

Each document plays a unique role in the administration of an estate, particularly in cases involving wrongful death claims in New York. The administrator, guided by legal counsel, must carefully manage these documents to ensure the estate is correctly and diligently handled, honoring the deceased's memory and providing for the rightful heirs or beneficiaries. The Form WD-3 acts as a crucial component in this process, aimed at securing judicial approval for the compromise of wrongful death claims and the subsequent distribution of proceeds. Understanding and accurately handling these forms and documents can significantly impact the outcome and efficiency of estate administration and wrongful death claim settlements.

Similar forms

The New York WD-3 Form, designed for handling estates involved in wrongful death claims, shares similarities with various other legal documents, each geared towards managing different aspects of estate administration and litigation. These documents, while distinct, collectively provide a framework for legal proceedings surrounding estates, wrongful deaths, and other related matters.

One such document is the Petition for Probate, which initiates the process to authenticate a deceased person's will and appoint an executor. Similar to the WD-3, it involves presenting detailed information to the court, including the deceased's assets and the proposed plan for their distribution. However, while the Petition for Probate focuses on managing the decedent's assets according to their will, the WD-3 is specifically for seeking court approval to settle wrongful death claims and distribute the proceeds among the rightful beneficiaries.

The Letters of Administration, issued by a court to appoint someone to manage a deceased person's estate when there's no will, also bear resemblance. These letters grant authority similar to what's described in the WD-3, where the administrator is permitted to handle the decedent's assets, including litigating wrongful death claims. The key difference lies in the WD-3's specific purpose of resolving a wrongful death claim versus the broader estate management role defined by the Letters of Administration.

The Inventory of Estate Assets is another document related to the WD-3 form. It lists all assets owned by the deceased at the time of death, providing a comprehensive overview of the estate's components. While the WD-3 form details assets related specifically to the wrongful death claim settlement, both documents serve the purpose of accounting for the estate's assets to ensure proper management and distribution.

Accounting to the Court resembles the WD-3 form in its objective to provide a transparent report of an estate administrator's actions concerning the estate's assets. Both documents require detailed accounting of how assets have been managed, including expenses paid and distributions made. Unlike the WD-3, which is focused on accounting for the activities surrounding a wrongful death settlement, general estate accounting covers all aspects of estate administration.

The Release and Refunding Bond is another document with ties to the WD-3. It ensures that once heirs or beneficiaries receive their inheritance, they relieve the executor or administrator of further responsibility regarding that distribution. The WD-3 form's mention of distributing wrongful death claim proceeds includes an implicit agreement that beneficiaries will not seek further claims related to the wrongful death suit, drawing a parallel to the explicit relief provided by signing a Release and Refunding Bond.

The Sale of Real Estate by Executor/Administrator form, used when estate assets need to be liquidated to settle debts or distribute funds, shares the WD-3's premise of managing estate assets for the benefit of creditors and beneficiaries. Both documents are centered around optimizing the estate's value - in WD-3's case, by compromising on wrongful death claims, and in the real estate sale form's case, by liquidating property assets.

The Settlement Agreement in personal injury or wrongful death cases closely parallels the WD-3 form. Both are utilized to resolve disputes and facilitate compensation for damages. The WD-3 explicitly deals with the process of obtaining court approval for such settlements, underscoring the procedural similarities between these legal instruments in navigating compensation for loss or injury.

Lastly, the Guardian's Report, filed by a guardian managing the affairs of a minor or incapacitated person's estate, is akin to the reporting and accounting aspect of the WD-3 form. Both documents ensure that the court is informed about how assets are being managed and that the interests of those who cannot represent themselves are being protected, albeit in different contexts: the WD-3 within wrongful death settlements and the Guardian's Report in managing the wards' assets and well-being.

Dos and Don'ts

When filling out the New York WD-3 form, which pertains to the administration of estates and specifically the compromise of wrongful death claims, there are specific actions that should and should not be taken to ensure the process is handled correctly and efficiently. Below are the things to do and not to do.

- Do provide accurate and complete information about the decedent's goods, chattels, and credits, as well as details of the wrongful death claim, including the incident date, claim against whom, and the insurance company involved.

- Do include all required attachments, such as the petition as administrator, attorney affidavit, copy of the paid funeral bill, and waivers from necessary parties.

- Do ensure that the account of proceedings includes a thorough and truthful rendering of your administration of the estate, including receipts, disbursements, and any property coming into your hands as a result of the compromise.

- Don't leave out any next of kin or interested parties from the proceedings. Accurately list all distributees and any possible creditors or claimants against the estate.

- Don't forget to seek leave to compromise on the wrongful death claim at the sum specified, ensuring all legal requirements are met for such a settlement.

- Don't ignore statutory entitlements and obligations, such as reimbursement for funeral and administrative expenses or statutory commissions to the administrator, unless explicitly waived in your petition.

Properly managing these considerations is pivotal to the successful submission of the WD-3 form. Making sure each step is carefully considered and accurately represented will aid in the smooth processing of the estate and the wrongful death claim in question.

Misconceptions

When it comes to legal documents, misconceptions are not uncommon, and the New York WD-3 form, used in Surrogate's Court for administrating estates in wrongful death claims, is no exception. Here are nine common misunderstandings:

Only lawyers can fill out the WD-3 form. While it's beneficial to seek legal advice, an administrat (the person managing the deceased's estate) can fill it out. However, due to its complexity and the need for accuracy, many choose to work with an attorney.

The form is for claiming the estate's assets only. Actually, the WD-3 form’s primary purpose is for administrats to report their account of managing and distributing the assets of the deceased, specifically related to wrongful death claims, not just to claim assets.

Submitting a WD-3 form grants immediate access to funds. The truth is that funds will only be accessible after the court approves the form and the administrat's handling of the estate, which can take time.

The WD-3 form can be used for any death claim in New York. This form is specifically intended for wrongful death claims processed through the Surrogate's Court, not for all death-related claims.

Every field in the form must be filled. While thoroughness is important, some sections may not be applicable to every estate. In such cases, indicating that a section does not apply would be acceptable, rather than leaving it blank or providing inaccurate filler information.

No supporting documents are needed. Contrary to this belief, the form requires various supporting documents, including but not limited to the death certificate, petition for administration, and any relevant claims against the estate.

Once filed, no additional steps are necessary. Typically, filing the form is part of an ongoing process. The court may request additional information, or there may be hearings to attend as part of settling the estate.

The form allows the administrat to bypass outstanding debts. The form indeed includes a section on claims and debts, but it does not enable an administrat to simply ignore legitimate debts. Rather, it offers a transparent way to handle such financial matters within the estate.

The final distribution amounts are up to the administrat's discretion. Though the administrat proposes how the estate's assets should be distributed, the court must approve it. This ensures that distribution follows the law and the deceased's wishes when known.

Understanding these nuances is crucial for anyone involved in managing or settling an estate through a wrongful death claim in New York. Genuine comprehension of the form's purposes, requirements, and legal implications helps streamline the process, ensuring a smoother resolution for all parties involved.

Key takeaways

Filling out and using the New York Wd 3 form is an essential process for administrators managing the estate of a deceased individual, particularly in cases involving wrongful death claims. Here are four key takeaways to understand:

- The form requires a detailed accounting of the administrator's actions in managing the deceased's estate, including any claims against parties for wrongful death. This helps ensure transparency and proper handling of the estate's assets.

- Submission of this form to the Surrogate's Court is accompanied by necessary documentation such as the petition of the administrator, an attorney's affidavit, a copy of the paid funeral bill, and waivers from necessary parties, highlighting the importance of thorough documentation in the estate management process.

- Financial aspects such as the amount sought in a wrongful death claim, legal fees, and the distribution of proceeds among the decedent's next of kin are explicitly detailed, emphasizing the need for clear financial accounting and understanding of beneficiaries' entitlements.

- Rejection of claims against the estate by the administrator, as detailed in the form, illustrates the administrator's role in protecting the estate's assets and deciding on the legitimacy of claims made against it.

This form serves as a critical tool in the administration of estates, particularly in navigating the complexities of wrongful death claims and ensuring that the decedent's assets are managed and distributed responsibly and in accordance with New York law.

Common PDF Documents

Ct 400 - Provision for filing a completed tax report as an alternative to this form under specific timing conditions mentioned in the document.

Broker Dealer Registration Requirements - The NY M-11 form serves as a critical tool to protect investors by requiring issuers to disclose any legal or financial issues that might affect the offering.