Free New York Prs 2 Form in PDF

Understanding the intricacies of the New York PRS-2 form is essential for teachers aiming to claim credit for prior service in the New York State Teachers’ Retirement System. Located at the heart of teacher retirement benefits, this document serves as a gateway for educators to ensure their previous years of service are recognized and accounted for, influencing both eligibility for and calculation of retirement benefits. Crucially, the PRS-2 form, updated in April 2012, outlines the requirement for educators to list their entire eligible prior service before their current membership began. It emphasizes the need for verification of such service if not previously credited by NYSTRS or the New York State & Local Retirement System. Moreover, the form delineates the varied costs associated with purchasing prior service credits across different membership tiers, highlighting the financial implications for the claimant. With specific rules governing allowable service—including stipulations for out-of-state teaching and limitations on certain types of service—navigating through the PRS-2 form's requirements is a critical step for educators in safeguarding their retirement benefits. Additionally, it underscores the necessity to file this form well in advance of retirement to avoid any potential pitfalls in the crediting process. As such, understanding every aspect of the PRACTICE TIME

New York Prs 2 Sample

NY |

NEW YORK STATE TEACHERS’ RETIREMENT SYSTEM |

|

|

STRS |

10 Corporate Woods Drive, Albany, NY |

|

|

|

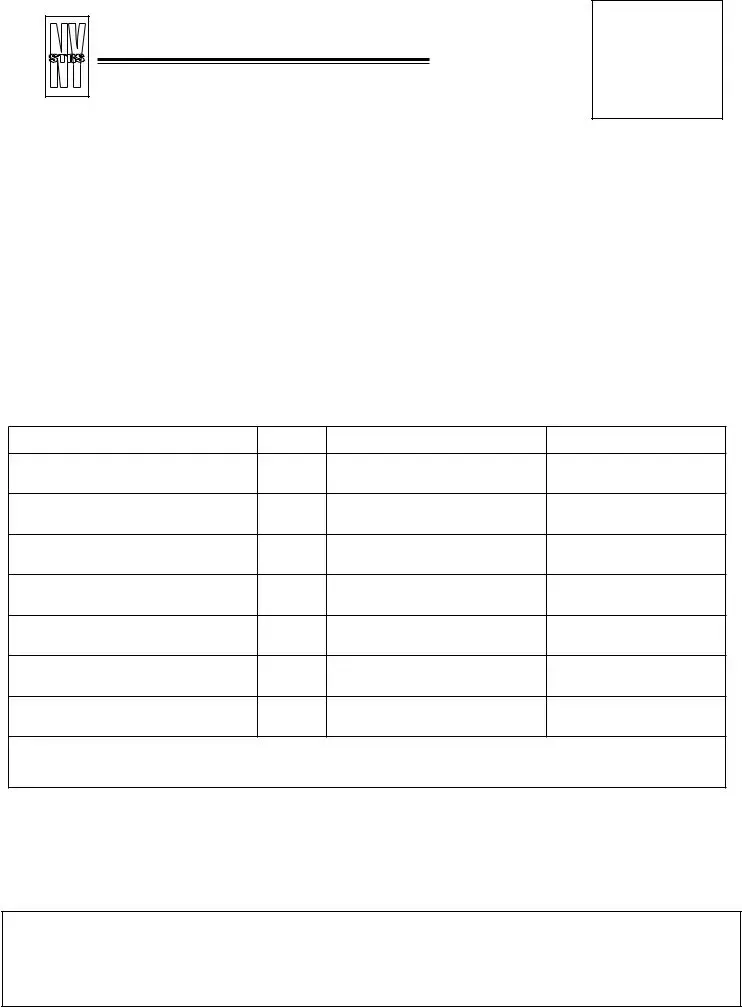

PRIOR SERVICE CLAIM |

Please review the instructions on the reverse before completing this form.

OFFICE SERVICES ONLY

|

EmplID # |

|

|

|

|

|

Social Security # |

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

NAME |

(First) |

|

|

|

(Middle) |

(Last) |

|

|

|

|

|

|

|

FORMER NAME(S) |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

ADDRESS |

(Street) |

|

|

|

|

(City) |

|

|

|

|

|

|

|

(State) |

(Zip Code) |

|||||||

|

|

|

|

|

|

|||||||||||||||||

Is this address your PERMANENT address to be used by the System? |

Yes |

|

No |

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

PHONE NUMBER: ( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

I wish to claim credit in the New York State Teachers’ Retirement System for the service listed below and any other service which I am eligible to claim. I have rendered such service prior to my current membership date and desire to have it credited when I have fulfilled the statutory requirements.

NAME OF EMPLOYER

STATE

JOB TITLE

DATES OF SERVICE

PLEASE NOTE: It is necessary to submit a completed Veriication form unless the service indicated above was previously credited to a former membership at NYSTRS or New York State & Local Retirement System. The appropriate veriication

form(s)

1. |

Were you credited with the above service in another public retirement system? YES |

NO |

2. |

Are you presently a member of another public retirement system? YES NO |

|

3. |

If a member, or former member, please state name of system and registration/ID number: |

|

|

____________________________________________________________________ |

|

I hereby certify that I am not now receiving a benefit and will not be entitled to receive a benefit at any future time from another public retirement system, in this State, in any other state or from the Federal Government on account of any of the above service.

_________________________________________________ _________________________________

Signature of Claimant |

Date |

INSTRUCTIONS FOR CLAIMING CREDIT FOR SERVICE RENDERED

BEFORE YOUR CURRENT DATE OF MEMBERSHIP (PRIOR SERVICE)

1.PRIOR SERVICE CLAIM

List by location name and year on the front of this form all prior service you wish to claim.

THIS FORM MUST BE SIGNED AND RETURNED TO THE SYSTEM BEFORE YOUR DATE OF RETIREMENT OR BEFORE THE DATE YOUR MEMBERSHIP CEASES. Additionally, you must be credited with

a minimum of two years of membership credit before you may purchase (if applicable) and be credited with any prior service for which you are eligible.

2.MEMBERSHIP TIERS

Tier |

Dates Last Joined |

Tier |

Dates Last Joined |

1 |

Before 7/1/1973 |

4 |

9/1/1983 - 12/31/2009 |

2 |

7/1/1973 - 7/26/1976 |

5 |

1/1/2010 - 3/31/12 |

3 |

7/27/1976 - 8/31/1983 |

6 |

On or after 4/1/12 |

3.ALLOWABLE PRIOR SERVICE

NYS and NYC Public and Teaching Service: Members of ALL tiers may receive credit for NYS public and teaching service

service was rendered.

Tier 1 |

Members may receive credit for up to ten years of teaching in |

|

public schools or |

Tier 2 |

Members may receive credit for |

|

if this service was credited to a former Tier 1 membership in TRS. |

Tiers 3 – 6 |

Members cannot receive credit for |

4. COST |

|

Tiers 1 and 2 |

There is no cost to have prior service credited. |

Tier 3 |

The cost is 3% of the salary received during the period of the service. |

|

Interest of 5% per year is charged only on service rendered under a |

|

former Tier 3 membership. |

Tier 4 |

The cost is 3% of the salary received during the period of service plus 5% |

|

interest per year on all service. |

Tier 5 |

The cost is 3.5% of the salary received during the period of service plus 5% |

|

interest per year on all service. |

Tier 6 |

The cost is 6% of the salary received during the period of service plus 5% |

|

interest per year on all service. |

FService for private or parochial schools, for the federal government or in armed forces dependent schools is not creditable in our System under any tier.

FService credit can affect your eligibility for, and the calculation of, your benefits. It may also affect the point at which Tier 4 members are eligible to cease making mandatory member contributions. If you are unsure about your prior service eligibility, you should file a claim for service not already credited to your membership.

FIn addition to filing this form with NYSTRS, you must send the applicable verification form to your former employer to complete and return to NYSTRS. The various verification forms (e.g., for NYS teaching; or other NYS public employment) are available on our Web site at

File Overview

| Fact | Detail |

|---|---|

| Form Number and Revision Date | PRS-2 (4/12) |

| Institution | New York State Teachers’ Retirement System (NYSTRS) |

| Address | 10 Corporate Woods Drive, Albany, NY 12211-2395 |

| Purpose | To claim credit for prior service before the current date of membership in the NYSTRS. |

| Membership Tiers | Identifies six different membership tiers with specific date ranges for each. |

| Allowable Service Types | Credits for NYS public and teaching service, including NYC and out-of-state teaching service under certain conditions based on the tier. |

| Excluded Services | Services in private or parochial schools, federal government, or in armed forces dependent schools are not creditable. |

| Cost to Credit Prior Service | Varies by membership tier, with specific percentages of the salary received during the service period plus interest rates applying. |

| Verification Requirement | A completed verification form is necessary unless the service was previously credited to a former membership at NYSTRW or New York State & Local Retirement System. |

| Governing Law | New York State law, as applicable to public retirement systems and presumably specific statutes governing public education and retirement benefits. |

| Additional Requirements | Claimants must not be receiving, nor be entitled to receive, benefits from another public retirement system for the same service. |

New York Prs 2: Usage Guidelines

Filling out the New York PRS-2 form is an important step for claiming credit for service rendered before your current date of membership with the New York State Teachers’ Retirement System (NYSTRS). This process allows you to potentially enhance your retirement benefits by acknowledging your previous educational or public service. It is essential to complete this form accurately and submit it alongside any necessary documentation well before you plan to retire or end your NYSTRS membership. Follow these steps to ensure your form is filled out correctly.

- Start with your personal information. Enter your full name (first, middle, last) as well as any former names you might have used in the past.

- Provide your current address. Make sure to indicate whether this address is your permanent one. If you select 'No,' ensure that NYSTRS has your permanent address on file for future communication.

- Enter your phone number, including the area code.

- In the section designated for claiming credit, list the name of your employer during the service period you wish to claim. Include the state where you were employed, your job title during this time, and the dates of your service.

- Check the box indicating whether you were credited for the above service in another public retirement system and if you are currently a member of another public retirement system. If yes, provide the name of the system and your registration or ID number.

- Sign and date the form at the bottom to certify that you are not receiving and will not be entitled to receive benefits from another public retirement system for the service periods you've listed.

- Remember, if your claimed service was not previously credited by NYSTRS or New York State & Local Retirement System, you must submit a completed Verification Form (PRS-3 through PRS-3.5), which can be found on the NYSTRS website.

After filling out the form, make sure to review all the provided information to ensure accuracy and completeness. Once satisfied, submit the form and any additional documentation to NYSTRS by mail. Keep a copy of all submitted items for your records. Timely and accurate submission will help facilitate the review of your prior service claim, bringing you one step closer to securing the retirement benefits aligned with your total service contribution.

FAQ

What is the New York PRS-2 Form?

The New York PRS-2 form is a document used by current members of the New York State Teachers’ Retirement System (NYSTRS) to claim credit for service rendered before their current membership date. This includes full-time, part-time, or substitute teaching service in New York State public and teaching positions, including New York City, and certain out-of-state teaching positions, depending on membership tier. Before retirement or the cessation of membership, this form must be signed and returned to the NYSTRS.

How can I claim credit for prior service?

To claim credit for prior service, members must list by location name and year all prior services they wish to claim on the front of the PRS-2 form. It is also necessary to submit a completed Verification form unless the service was previously credited to a former membership at NYSTRS or New York State & Local Retirement System. Verification forms (PRS-3 through PRS-3.5) are available on the NYSTRS website or can be ordered through their Hotline.

Is there a cost associated with crediting prior service?

Yes, depending on the membership tier, there may be a cost for having prior service credited. For members in Tiers 1 and 2, there is no cost. For those in Tier 3, the cost is 3% of the salary received during the period of service, with 5% interest per year charged on service rendered under a former Tier 3 membership. Tier 4 members pay 3% of the salary received plus 5% interest per year. For Tier 5, the cost is 3.5% of the salary received plus 5% interest per year, and for Tier 6, it is 6% of the salary received plus 5% interest per year. These costs help to ensure that credited service accurately reflects contributions towards the retirement system.

Am I eligible to receive credit for out-of-state teaching?

Eligibility for receiving credit for out-of-state teaching service depends on your membership tier. Tier 1 members may receive credit for up to ten years of teaching in out-of-state public schools or state-supported colleges. Tier 2 members can receive credit for out-of-state public teaching service if this service was credited to a former Tier 1 membership in TRS. However, members in Tiers 3 to 6 cannot receive credit for out-of-state teaching service. These restrictions are in place to maintain the integrity and financial stability of the NYSTRS by ensuring that credited service is closely related to New York State teaching positions.

Common mistakes

Filling out the New York PRS 2 form, individuals often make several mistakes that can impact their retirement credit for prior service. Understanding these common errors can help ensure that the process is completed accurately and efficiently.

Not clearly listing prior service by location name and year: The form requires specific details about prior work history, including the name of the employer and the dates of service. An incomplete or vague listing can lead to delays or denial of credit for prior service.

Overlooking the need to submit verification forms: For the service to be credited, it's necessary to submit completed verification forms (PRS-3 through PRS-3.5) unless the service was previously credited to a former membership. Failing to provide these forms can result in the inability to credit the service properly.

Failing to confirm membership in other public retirement systems: The form asks whether you are currently a member of another public retirement system or have been credited with the above service in another system. Incorrectly answering these questions can affect eligibility for service credit.

Omitting former names: If any service was rendered under a different name, failing to include that name on the form can lead to difficulties in verifying past employment and crediting the service.

When filling out the form, it's also crucial to consider the various membership tiers and their respective requirements and costs for prior service credit, as outlined in the instructions. Each tier has specific rules regarding eligibility and calculation of cost for crediting prior service, particularly for out-of-state teaching service and service rendered under different membership tiers. Additionally, certain types of service (e.g., private or parochial school service, federal government service) are not creditable in the system under any tier.

Ultimately, thoroughly reviewing the instructions on the form and ensuring all necessary documentation is correctly completed and submitted can significantly ease the process of claiming credit for prior service in the New York State Teachers’ Retirement System.

Documents used along the form

When completing the New York State Teachers' Retirement System's PRS-2 form for prior service credit, individuals often need to submit additional documents to support their application. These documents play a crucial role in ensuring that the process is smooth and the applicant's claim for prior service credit is accurately assessed. Below is a list of common forms and documents that are typically used in conjunction with the PRS-2 form.

- PRS-3 through PRS-3.5 Verification Forms: These forms are essential for verifying the prior service that is being claimed. Each is designed for different types of public service or teaching periods, and the correct form must be submitted for each specific claim.

- W-2 Forms or Paystubs: Used as proof of employment for the period being claimed. These documents help verify the dates of service and the salary received, which are critical for calculating credit and any associated costs.

- Birth Certificate: May be required to verify age, which can be relevant for tier determination and retirement benefits calculations.

- Marriage Certificate: In cases where a name change has occurred, a marriage certificate may be necessary to link prior service records under a former name to the current application.

- Proof of Name Change: If there has been a legal name change not related to marriage, official documentation of the change is required.

- TRS Membership Application: For individuals who are not yet members of the NYSTRS, the membership application is a prerequisite for submitting a PRS-2 form.

- Beneficiary Designation Forms: These forms are not directly related to the PRS-2 application but are often submitted concurrently to ensure that all retirement account details are up to date.

- Divorce Decree: If applicable, a divorce decree might be needed, especially if it affects beneficiary designations or if there are claims related to service credit during the marriage.

- Death Certificate: In the event that the application involves claiming service credit on behalf of a deceased member, a death certificate will be required.

- Letter of Explanation: For any unusual circumstances or gaps in documentation, a detailed letter of explanation from the applicant may help clarify the situation and support the application.

Submitting the correct supplementary documents alongside the PRS-2 form is crucial for a successful claim for prior service credit. Each document helps build a comprehensive picture of the applicant's employment history, ensuring that all eligible service is appropriately credited. Applicants are encouraged to review the requirements carefully and prepare all necessary documents in advance to facilitate a smooth and efficient processing of their claim.

Similar forms

The Application for Membership in New York State Public Retirement Systems closely mirrors the New York PRS-2 form in that both are gateway documents for individuals entering or claiming service in a public retirement system. Each requires basic personal information and details about public service that could influence retirement benefits. These forms mark the initial steps in recognizing an individual's service and ensuring it is considered for retirement benefits, setting the stage for how their retirement will be mapped out.

The Verification of Prior Service (PRS-3 through PRS-3.5) documents are also akin to the PRS-2 form, specifically in their function to verify previous employment relevant to retirement benefits. While the PRS-2 form is used to claim such service, the PRS-3 series is utilized to provide proof of this service, making them complementary components in the process of securing retirement benefits for public employees. Both serve pivotal roles in the validation and crediting of service time towards retirement.

Similarly, the Beneficiary Designation Form used in many retirement systems, including NYSTRS, shares the essence of preparation and future planning found in the PRS-2 form. While the PRS-2 focuses on claiming past service, a beneficiary designation form secures an employee's future by delineating who will receive benefits in the event of their death. Both documents are integral in the broader context of retirement planning, emphasizing the forward-looking nature of such arrangements.

The Request for Estimate Forms, often utilized by members approaching retirement, have a semblance to the PRS-2 form as both are pivotal in planning retirement. The PRS-2 facilitates claiming past service for future credit, while the estimate requests provide a financial preview of retirement benefits based on accumulated service, including any prior service claimed. Each document aids in orchestrating the financial landscape of an individual’s retirement phase.

The Tier Reinstatement Form, similar to the PRS-2, involves the recognition and adjustment of an individual's status within a retirement system. Where the PRS-2 is concerned with acknowledging past service, tier reinstatement allows members who've left the system and returned, to potentially recover their original tier status, directly influencing their retirement benefits and contributions based on past decisions and actions.

Loan Application Forms within retirement systems echo the proactive engagement with one's retirement benefits observed in the PRS-2 form. While the PRS-2 pertains to claiming service credit, taking a loan engages a member’s accumulated contributions for immediate financial needs, reflecting different facets of how individuals can interact with their accrued benefits before retirement.

The Service Purchase Application, much like the PRS-2, is involved in the expansion of credited service in a retirement system. Whereas the PRS-2 claims service potentially missed or not credited, the purchase application allows for the addition of various types of service (e.g., military service) that weren't initially covered, further enhancing an individual's retirement benefits through deliberate action.

The Disability Retirement Application shares a focus on retirement benefits through a different lens than the PRS-2. While the PRS-2 is about enhancing one’s retirement through prior service, applying for disability retirement involves a shift towards claiming retirement benefits due to health reasons, underscoring the diverse paths through which retirement can be influenced and claimed.

Finally, the Change of Address Form, while administratively simpler than the PRS-2, shares the fundamental necessity of keeping personal information up to date to ensure smooth communication and the processing of benefits. Both forms are critical in the ongoing relationship between the individual and the retirement system, ensuring that benefits are managed and delivered effectively according to current needs and status.

Dos and Don'ts

When it comes to filling out the New York PRS-2 form, a document crucial for claiming credit for prior teaching service with the New York State Teachers' Retirement System, accuracy and thoroughness are key. To ensure that the process is as smooth and error-free as possible, here are some essential dos and don'ts:

Do:- Review the instructions on the reverse side of the form before you start filling it out. This will give you a clear overview of what information is required and how to submit your claim correctly.

- Complete all sections with accurate information about your previous employment, including the name of the employer, state job title, and dates of service. Missing or incorrect details can delay the processing of your claim.

- Use the verification forms (PRS-3 through PRS-3.5) if your service has not been previously credited to a former membership at NYSTRS or New York State & Local Retirement System. These forms can be found on the NYSTRS website and are vital for verifying your claimed service.

- Sign and date the form before returning it to the system. The signature certifies that you are not receiving, nor will you be entitled to receive a benefit from another public retirement system for the same service.

- Forget to list all prior service you wish to claim, by location name and year, on the front of the form. Omitting any prior service can result in not receiving credit for that service once you meet the statutory requirements.

- Delay submitting your form until you're close to retirement or your membership ceases. It must be returned to the system before these dates to ensure your service is credited in time.

- Assume all prior service costs the same. The cost to have prior service credited varies by membership tier, and it's essential to understand these costs as they apply to your service and tier.

- Overlook the requirement to send the applicable verification form to your former employer. Without the completed and returned verification form, your prior service claim may not be processed.

By following these guidelines, you'll be better prepared to successfully claim credit for your prior service, setting a solid foundation for your retirement planning with the New York State Teachers’ Retirement System.

Misconceptions

The New York PRS-2 form is an essential document for teachers in the state of New York seeking to claim credit for prior service in the New York State Teachers’ Retirement System (NYSTRS). Despite its importance, there are several misconceptions about the form and its requirements. Understanding these can help educators navigate their retirement planning more effectively.

Only teaching service within New York State can be claimed: This is not entirely true. While the form primarily focuses on service within New State, certain out-of-state teaching service, particularly for Tier 1 members, and under specific conditions for Tier 2 members, may also be credited.

There is a fee for all tiers to credit prior service: Incorrect. Tier 1 and Tier 2 members are not required to pay any cost to have their prior service credited. Fees apply starting from Tier 3 and onwards, with the percentage increasing progressively.

The form is only for public school teachers: This is a misconception. The form applies to any member of the NYSTRS, which includes individuals in various educational sectors, not strictly public school teachers.

All past service is creditable, no matter the role: Service in private or parochial schools, for the federal government, or in armed forces dependent schools, is not creditable under any tier, dispelling the notion that any and all past educational service qualifies.

Submitting the form guarantees credit for the claimed service: Merely submitting the PRS-2 form does not ensure credit. Verification is required, and the claimed service must meet specific eligibility criteria detailed by NYSTRS.

You can claim prior service credit at any time: To claim prior service, the form must be signed and returned to NYSTRS before your date of retirement or before your membership ceases. This timing aspect is crucial and often misunderstood.

A completed PRS-2 form is all you need to submit: Additional documentation, specifically the appropriate verification form(s) (PRS-3 through PRS-3.5), depending on the type of service, is also required for the process.

Out-of-state service is never creditable for Tiers 3-6 members: While generally true, there are nuanced exceptions, particularly pertaining to services credited to a former Tier 1 membership in NYSTRS for Tier 2 members, challenging the belief of absolute ineligibility for later Tiers.

The process is the same regardless of when the service occurred: The eligibility and verification process can vary significantly depending on the type of service, the timeframe when it was rendered, and the specific tier of the member.

Filing a claim guarantees cessation of mandatory member contributions: Affecting eligibility for, and the calculation of, benefits is a potential outcome of filing a claim. However, the cessation of mandatory contributions for Tier 4 members, for example, involves specific conditions not solely reliant on filing the PRS-2 form.

Understanding the details of the New York PRS-2 form and addressing these misconceptions is crucial for educators planning their retirement. Accurate information ensures that they are fully informed about their benefits and requirements, leading to better planning and fewer surprises down the line.

Key takeaways

When filing the New York PRS-2 form for claiming prior service credit in the New York State Teachers’ Retirement System (NYSTRS), here are key takeaways to guide you through the process effectively:

- Ensure that the PRS-2 form is completed and submitted to NYSTRS before your date of retirement or before your membership ceases, to claim credit for service rendered before your current date of membership.

- You must accumulate a minimum of two years of membership credit in the NYSTRS before you are eligible to purchase and be credited for any prior service.

- Credit for prior service is available for various membership tiers, with eligibility for out-of-state teaching service varying significantly between tiers. For instance, Tier 1 Members may receive credit for up to ten years of out-of-state public school teaching, while Tiers 3 through 6 have restrictions.

- There is no cost for Tiers 1 and 2 members to have prior service credited; however, for Tiers 3, 4, 5, and 6 members, the cost is based on a percentage of the salary received during the period of service, with additional interest charges applicable for some tiers.

- Services rendered in private or parochial schools, for the federal government, or in armed forces dependent schools are not creditable under any tier within the NYSTRS.

- Having your service credited can influence your eligibility for, and the calculation of, your retirement benefits. It can also affect when Tier 4 members are eligible to stop making mandatory member contributions.

- It is essential to file a PRS-2 form even if you are uncertain about your prior service eligibility. This ensures that you claim all service credit not already applied to your membership.

- Submitting the appropriate verification form, found on the NYSTRS website, to your former employer is required for the completion and processing of your prior service claim. Your ex-employer needs to complete and return this form to NYSTRS.

- If your service was previously credited to a former membership at NYSTRS or the New York State & Local Retirement System, you are required to submit a completed Verification form unless the service indicated on the PRS-2 was previously credited.

By adhering to these guidelines, you can ensure that the process of claiming prior service credit is handled accurately and efficiently, maximizing your benefits under the NYSTRS.

Common PDF Documents

What Is a Judgement Filed - Addresses the practicalities of managing legal expenses, from initial filing fees to the costs associated with the concluding stages of a case.

Corprate Tax Rate - It distinguishes between different corporation types by requiring all C Corporations to file alternative forms such as the NYC-2, NYC-2S, or NYC-2A instead.