Free New York Mv51 Form in PDF

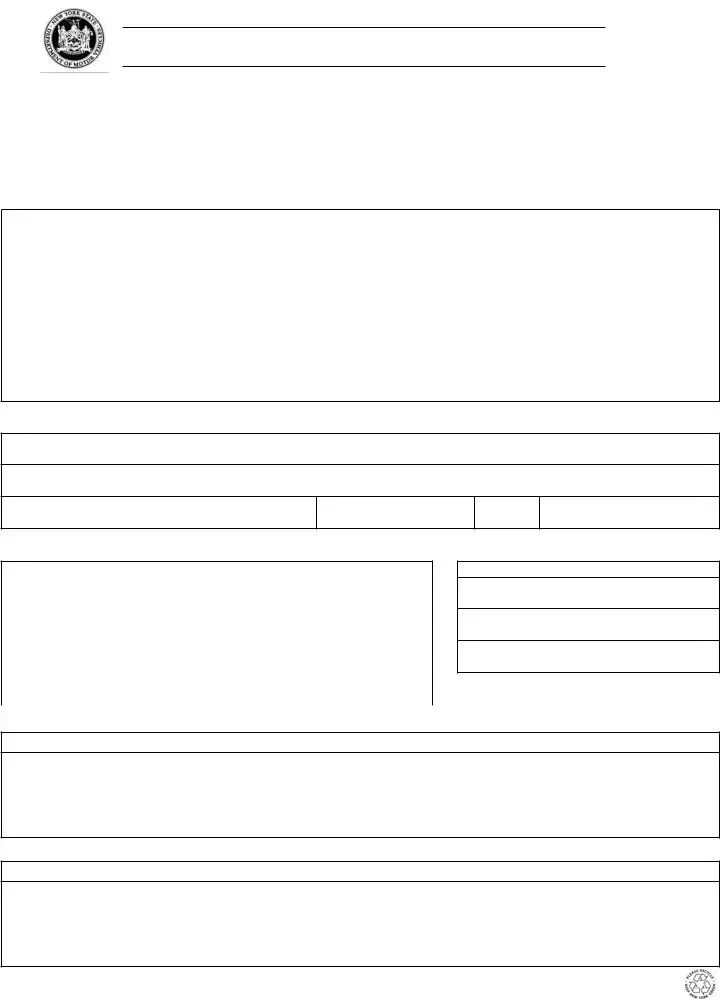

In the realm of vehicle transactions within New York, especially for those involving older or non-titled vehicles, the MV-51 form plays a crucial role. Issued by the New York State Department of Motor Vehicles, this Certification of Sale or Transfer is tailored for vehicles from the year 1972 or earlier, or any other vehicles that do not come with a title. The primary function of this form is to facilitate the smooth transfer of ownership from one party to another, ensuring all legal requirements are met without the need for a traditional title. The MV-51 form necessitates detailed entries, all to be filled in ink or typed, about the vehicle and the parties involved in the transaction. For the sale to be recognized legally, the form must be accompanied by bills of sale that track the vehicle's ownership history, thereby providing a continuous chain of ownership. Importantly, this form cannot be altered in any way, and any attempt to do so can void its validity. It also warns both seller and purchaser to be mindful of potential liens against the vehicle, advising them to check with the County Clerk's Office as a precautionary step. With sections dedicated to the vehicle's description, including its identification number and type of fuel, along with certifications from both the seller and purchaser, the MV-51 form is comprehensive in scope. It underscores the importance of truthfulness in the transaction process, with the reminder that false statements are punishable under Section 210.45 of the NYS Penal Law, reinforcing its legal significance and the serious nature of the document in the context of vehicle sales and transfers.

New York Mv51 Sample

NewYorkStateDepartmentofMotorVehicles

CERTIFICATION OF SALE OR TRANSFER FOR 1972 OR

OLDER VEHICLES ORANY OTHER

www.dmv.ny.gov

INSTRUCTIONS:

1.Printininkortypeallentries.

2.Thiscertificationistobeusedifthevehicleissoldbyapersonotherthanadealer.Adealercannotusethisformtosellavehicle.

3.Thiscertificationmustbeaccompaniedbybillsofsaleshowingcontinuityofownershipfromallpreviousowners.

Note:Thisformmustbeaccompaniedbysupportingdocumentswhichwillnotbeacceptedifthereareanychanges oralterationsonthem.

Name of Seller (Last, First, M.I.)

MailingAddress (Number and Street) |

|

|

|

|

|

Apt. # |

|

|

|

|

|

|

|

|

|

City or Post Office |

|

|

|

County |

State |

Zip Code |

|

|

|

|

|

|

|

|

|

Year of Last |

State of Last |

|

Plate No. |

|

|

|

|

Registration |

Registration |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of Last Registrant or Previous Owner(Last, First, M.I.) |

|

|

|

||||

|

|

|

|

|

|

|

|

Address of Last Registrant (Number, Street, Apt. #, |

City, State, and Zip Code) |

|

|

|

|||

PURCHASER: Before purchase, be sure you find out if there are any liens on it. One way to do this is to contact your County Clerk’s Office

Name of Purchaser (Last, First, M.I.)

MailingAddress (Number, Street,Apt. #)

City or Post Office

County

State

Zip Code |

Date of Purchase |

|

|

VEHICLE DESCRIPTION

Year |

Make |

Vehicle Identification Number |

|

|

|||

|

|

|

|

|

|

|

|

oGas |

oPropane |

oElectric |

oFlex |

oDiesel |

oCNG |

||

|

|

|

|

|

|

|

|

Body Type |

|

Color |

|

|

Maximum Performance |

|

|

|

|

|

|

|

Speed of Motorcycle |

|

|

|

|

|

|

|

|

|

|

Unladen Weight |

|

Cylinders |

|

|

|

||

|

Lbs. |

|

|

|

|

|

|

VEHICLE INSPECTION

Date of Last

Inspection

Inspection Sticker

Number

Station

Number

CERTIFICATION OF SELLER

I certify that I am the owner of the vehicle described on this form, and that I have sold this vehicle to the purchaser named on the form.

_______________________________________________________________________ |

____________________ |

(Sign Name in Full – If Not Individual Seller, Give Title) |

(Date) |

CERTIFICATION OF PURCHASER

I certify that I have purchased the vehicle described on this form from the seller named on the form.

_______________________________________________________________________ |

____________________ |

(Sign Name in Full – If Not Individual Purchaser, Give Title) |

(Date) |

File Overview

| Fact | Detail |

|---|---|

| Purpose | To certify the sale or transfer of vehicles from 1972 or earlier, or other non-titled vehicles in New York. |

| Usage | Used by private sellers, not dealers, to document the sale of a vehicle. |

| Accompanying Documents | Must be accompanied by bills of sale showing continuity of ownership from all previous owners. |

| Requirement for Supporting Documents | Supporting documents will not be accepted if there are changes or alterations. |

| Liens Check | Before purchase, purchasers are advised to check for any liens, potentially through the County Clerk’s Office. |

| Vehicle Information | Includes year, make, VIN, fuel type, body type, color, motorcycle speed, weight, and cylinders. |

| Inspection Information | Details of the vehicle's last inspection including date, sticker number, and station number. |

| Seller's Certification | A confirmation by the seller, certifying ownership and sale of the vehicle. |

| Purchaser's Certification | A confirmation by the purchaser, certifying the purchase of the vehicle from the seller. |

| Governing Law | False statements are punishable under Section 210.45 of the New York State Penal Law. |

New York Mv51: Usage Guidelines

When you have a vehicle from 1972 or earlier, or any other non-titled vehicle you want to sell or transfer in New York, the MV-51 form comes into play. This document helps formalize the transaction between the seller and the buyer, ensuring all the state's requirements are met. Before you start filling out this form, gather all necessary documentation, including any bills of sale from previous owners, to prove the vehicle's ownership chain. Below are the steps you'll need to follow to complete the MV-51 form correctly.

- Using blue or black ink, print clearly or type your information in each section of the form.

- Enter the Name of Seller with the last name, first name, and middle initial in the designated field.

- Provide the Mailing Address of the seller, including the apartment number if applicable, city or post office, county, state, and zip code.

- Fill in the details relating to the Year of Last Registration, State of Last Registration, and Plate Number.

- Under the section titled Name of Last Registrant or Previous Owner, include their full name and address details, following the same format as for the seller's information.

- For the Purchaser section, input the buyer's full name and mailing address, including the apartment number if applicable, city or post office, county, state, and zip code.

- Record the Date of Purchase.

- In the VEHICLE DESCRIPTION section, write down the year, make, and vehicle identification number. Also, select the type of fuel the vehicle uses and fill in the body type, color, maximum performance speed (for motorcycles), unladen weight, and engine cylinders.

- Provide the details of the VEHICLE INSPECTION, including the Date of Last Inspection, Inspection Sticker Number, and Station Number.

- Under the CERTIFICATION OF SELLER, the seller must sign and date, confirming ownership and the sale of the vehicle to the purchaser named on the form. If the seller is not an individual, include the title of the representative.

- Similarly, in the CERTIFICATION OF PURCHASER section, the buyer acknowledges the purchase of the vehicle as described, signing and dating the form. If the purchaser is not buying as an individual, their title should be included as well.

After the MV-51 form is fully completed, ensure that it's accompanied by all necessary supporting documents, including bills of sale for each change in ownership. These documents must be free from changes or alterations to be accepted. This careful attention to detail will facilitate a smooth transaction process, adhering to New York State's legal requirements for vehicles of this category.

FAQ

What is the purpose of the New York MV-51 form?

The purpose of the New York MV-51 form is to certify the sale or transfer of vehicles from 1972 or earlier, or any other non-titled vehicles, when the transaction occurs between individuals rather than through a dealer. This form verifies that the current owner has legally sold or transferred the vehicle to the new owner.

Who is required to use the MV-51 form?

The MV-51 form must be used by individuals selling or transferring ownership of a 1972 or older vehicle, or any vehicle that does not have a title, when the seller is not a dealer. Both the seller and the purchaser must complete their respective sections of the form to properly document the transaction.

What documents must accompany the MV-51 form?

Along with the MV-51 form, a series of bills of sale showing continuity of ownership from all previous owners must accompany the certification. It's important to note that any supporting documents will not be accepted if they contain changes or alterations. This requirement is in place to ensure the vehicle's ownership history is transparent and traceable.

How can a purchaser find out if there are any liens on the vehicle?

Before finalizing the purchase, the MV-51 form advises the purchaser to check for any existing liens on the vehicle. One effective way to do this is by contacting the County Clerk’s Office in their area. Ensuring there are no liens is crucial, as it affects the legal ownership and transferability of the vehicle.

What information is needed to complete the MV-51 form?

To complete the MV-51 form, detailed information regarding both the seller and the purchaser is needed, including names, mailing addresses, and signatures. Additionally, comprehensive details about the vehicle being sold or transferred, such as the year, make, vehicle identification number (VIN), body type, and color, must be provided. Information about the vehicle's inspection is also required.

What are the penalties for making false statements on the MV-51 form?

Making false statements on the MV-51 form is punishable under Section 210.45 of the New York State Penal Law. It is crucial for both the seller and the purchaser to provide accurate and truthful information to avoid legal consequences.

Can a dealer use the MV-51 form to sell a vehicle?

No, a dealer cannot use the MV-51 form to sell a vehicle. This form is specifically designed for transactions between private individuals, not for sales conducted by licensed dealers. Dealers are required to use different documentation when selling or transferring vehicles.

Common mistakes

Filling out the New York MV-51 form, which is required for the sale or transfer of vehicles from 1972 or earlier or any other non-titled vehicles, is a straightforward process that, if not done correctly, can lead to significant complications. A number of common mistakes can be avoided by paying close attention to the details.

Here are ten common errors people make:

- Not using ink or typewriter: All entries on the MV-51 form must be completed in ink or typed. Using pencil or any other erasable medium can cause the document to be rejected.

- Ignoring completeness: Every section of the form needs to be filled out. Leaving sections blank or partially filled can lead to processing delays or outright rejection.

- Incorrect seller information: It’s crucial to enter the complete and accurate name and address of the seller. Any discrepancies here can create problems during the ownership verification process.

- Leaving purchaser details incomplete: Similarly, the purchaser's full and correct information is necessary. This includes their name, mailing address, and any other requested details.

- Failing to check for liens: Before purchasing, it’s recommended to find out if any liens are on the vehicle. Neglecting this step can lead to issues with the transfer of ownership.

- Misidentifying the vehicle: Accurate vehicle information is a cornerstone of the form. This includes the year, make, vehicle identification number (VIN), and other descriptors.

- Skipping the vehicle inspection details: If applicable, the date of the last inspection, the inspection sticker number, and the station number must be provided. Incomplete details here can invalidate the form.

- Not providing a bill of sale: The MV-51 form must be accompanied by bill(s) of sale showing continuity of ownership from all previous owners. Skipping this requirement can halt the transaction.

- Altering the form: Any changes or alterations to the form or the supporting documents can result in them not being accepted. Always start with a new form if a mistake is made.

- Forgetting to sign and date: Both the seller and purchaser must sign and date the form. Unsigned or undated forms are considered incomplete.

To ensure a smooth transaction, individuals are advised to:

- Double-check all information for accuracy.

- Consult with the County Clerk’s Office if there’s any uncertainty about liens on the vehicle.

- Keep a copy of the completed form and all accompanying documents for personal records.

A careful review and adherence to the instructions can prevent delays, penalties, and frustration often associated with errors on the MV-51 form. Whether selling or purchasing a vintage or non-titled vehicle, attention to detail can make the process smoother for all parties involved.

Documents used along the form

When dealing with the registration and transfer of ownership for vehicles, particularly vintage or non-titled vehicles in New York State, the MV-51 form plays a crucial role. However, this form is often just a part of the documentary process. To ensure a smooth transition and legal compliance, several other documents may need to accompany the New York MV-51 form. Here’s a list of documents commonly used alongside the MV-51 form, each serving its purpose in the broader context of vehicle sale and registration.

- Bill of Sale: This document acts as a receipt for the transaction. It provides proof of the purchase price and the transfer of ownership from the seller to the buyer, detailing the vehicle’s make, model, year, and VIN.

- Odometer Disclosure Statement: Required for vehicles under 10 years old, this statement records the vehicle's odometer reading at the time of sale, ensuring the buyer is aware of the vehicle's mileage.

- Title Certificate: Essential for titled vehicles, the title certificate shows the legal ownership and must be transferred to the new owner upon sale.

- Vehicle Registration Application (Form MV-82): Necessary for registering the vehicle under the new owner’s name with the New York State Department of Motor Vehicles.

- Insurance Cards: Proof of insurance must be provided for the registration process. The vehicle must be insured under the purchaser’s name.

- Power of Attorney: If either party (seller or buyer) is not present to sign the necessary documents, a Power of Attorney may be required to grant authority to another individual to act on their behalf.

- Death Certificate: In events where the vehicle’s last owner is deceased, a death certificate is necessary to prove the transfer of ownership from the deceased to the new owner.

- Lien Release: If the vehicle was previously financed, a lien release must be provided to show that the vehicle is free from any financial encumbrances.

- Inspection Documents: Depending on the vehicle's age and type, inspection certificates may be required to verify that the vehicle adheres to New York State safety and emissions standards.

- Gift Letter: If the vehicle is being transferred as a gift, a gift letter may be required to clarify the nature of the transaction and to exempt it from sales tax.

While the MV-51 form is paramount for vehicles of 1972 or older in New York, understanding and procuring the correct accompanying documents is equally important. Each document serves to ensure the legality of the vehicle's sale, transfer, and registration, safeguarding the interests of both the seller and the purchaser. It is critical for individuals involved in such transactions to be aware of these requirements to ensure a successful and compliant transfer of ownership.

Similar forms

The New York MV-51 form, used for the certification of sale or transfer of non-titled vehicles or vehicles from 1972 or earlier, bears resemblance to the Certificate of Title. A Certificate of Title is a legal document issued by a state to certify the ownership of a vehicle. Like the MV-51, it includes critical information about the vehicle, such as its make, model, year, and Vehicle Identification Number (VIN). Both documents play a crucial role in the process of buying or selling a vehicle, providing a documented history of ownership.

Another related document is the Bill of Sale, which accompanies the MV-51 form. Bills of Sale serve as evidence of a transaction between a buyer and a seller. They list the details of the sale including the vehicle description, the sale date, and the purchase price, akin to certain information fields on the MV-51. This document is vital for proving the change of ownership and for taxation purposes, making it essential during the sale of non-titled vehicles.

The Odometer Disclosure Statement, mandated by federal law during the sale of a vehicle, also shares characteristics with the MV-51 form. It ensures the accuracy of the vehicle’s mileage at the time of sale. Although the MV-51 does not explicitly include a space for odometer readings (given its focus on older or non-titled vehicles), both documents serve to provide transparency and honesty in vehicle transactions by disclosing important vehicle conditions to the buyer.

A Vehicle History Report is not a form filled out during a sale, like the MV-51, but it is a crucial document that can be paralleled in terms of providing a vehicle’s historical context. It includes information on previous ownership, accidents, repairs, and inspections. Purchasers encouraged to research a vehicle's history, akin to the MV-51’s advisory on lien verification, underscore the importance of understanding a vehicle's past before proceeding with a purchase.

The Release of Liability form found in many states mirrors one aspect of the MV-51. When a vehicle is sold, this form notifies the state’s motor vehicle department of the change in ownership, potentially absolving the seller from liability if the vehicle is subsequently involved in violations or accidents. Both the MV-51 form and the Release of Liability document highlight the importance of officially documenting the transfer of a vehicle's ownership to avoid future legal complications for the seller.

Similarly, a Lien Release is pertinent when selling a vehicle that has been financed. Like the MV-51 form, which requires acknowledgment of any liens on the vehicle, a Lien Release proves that any loans on the vehicle have been paid off and that the lienholder no longer has a legal claim to it. This document is critical for a clean transfer of ownership.

The Manufacturer’s Certificate of Origin (MCO) is a document that shares a purpose with the MV-51 form for vehicles newly purchased and not yet titled. The MCO is provided by the manufacturer and is needed when the vehicle is first titled. It serves as the “birth certificate” for the vehicle, indicating its initial transfer from the manufacturer to the dealership or first owner, similar to how the MV-51 documents the sale or transfer of older or non-titled vehicles.

Last but not least, the Application for Registration is another document interconnected with the process signified by the MV-51. Once a vehicle is bought, especially if it's a non-titled or vintage vehicle indicated in the MV-51, the new owner must typically register it to legally operate it on public roads. This step demands detailed vehicle information, as provided in the MV-51, reinforcing the document's role in the larger vehicle transaction and ownership process.

Dos and Don'ts

When completing the New York State Department of Motor Vehicles MV-51 form, which is a certification of sale or transfer for vehicles from the year 1972 or older or any other non-titled vehicles, there are specific actions that one should take to ensure the process is handled accurately and legally. Equally, there are practices that should be avoided to prevent complications or legal issues. Below are lists detailing what individuals should and shouldn't do when filling out this form:

Do's:

- Ensure all entries are either printed in ink or typed to maintain clarity and legibility, which is crucial for official documents.

- Use this certification if you are not a dealer but a private seller, as it is designed for non-commercial transactions.

- Accompany the form with bills of sale that demonstrate the continuity of ownership, including details from all previous owners.

- Verify the absence of any liens on the vehicle before purchase by contacting the County Clerk’s Office, to protect against future legal or financial issues.

- Keep the documentation free from changes or alterations; supporting documents must be original and unaltered to be accepted.

Don'ts:

- Don't attempt to use this form if you are a dealer. This form is strictly for use by private sellers in transactions involving older or non-titled vehicles.

- Don't leave fields blank; incomplete forms may be rejected or may cause delays in the sale or transfer process.

- Avoid making any changes or alterations to the form or the supporting documents once they have been completed, as this may invalidate them.

- Do not forget to check for any liens against the vehicle being sold; failing to do so can result in legal complications for the buyer.

- Do not submit the MV-51 form without ensuring all information matches the details on the bills of sale and other supporting documents to ensure continuity and accuracy of the vehicle's recorded history.

Adhering to these guidelines can facilitate a smoother process for selling or transferring ownership of a vehicle that is 1972 or older or non-titled, in accordance with New York State requirements. It is crucial that both sellers and purchasers understand their responsibilities and ensure the accuracy and legality of the forms and documents they submit.

Misconceptions

When handling the New York MV-51 form, which is crucial for the certification of sale or transfer for vehicles from the year 1972 or older, or any other non-titled vehicles, it's important to have a clear understanding of its requirements and common misconceptions. Here are ten common misunderstandings concerning this form:

- The MV-51 form can be used by dealers. This form is specifically designed for use by private sellers. Dealers are not permitted to use this form for the sale of a vehicle.

- It's okay to fill out the form in pencil. All entries on the MV-51 form must be either typed or written in ink. Pencil writing is not acceptable and can result in the form being invalid.

- Bill of sale is not important. A common mistake is underestimating the importance of accompanying the MV-51 form with a bill of sale. The form alone is not enough; it must be accompanied by bills of sale that show continuity of ownership from all previous owners.

- Alterations or changes to supporting documents are acceptable. Any changes or alterations on the supporting documents invalidate them. They must be completely unchanged to be accepted.

- The form covers all types of vehicles. The MV-51 form is specific to vehicles from the year 1972 or older and other non-titled vehicles. It does not apply to all vehicle transactions.

- Liens on the vehicle do not need to be disclosed. It's crucial for the purchaser to investigate any liens on the vehicle before completing the purchase. The seller should also be transparent about such liens.

- Digital signatures are acceptable. The MV-51 form requires physical signatures. Digital signatures, while convenient, are not permissible for this particular form.

- The vehicle's last inspection details are optional. The date of the last inspection, inspection sticker number, and station number are all vital pieces of information that must be provided when applicable.

- Any type of vehicle identification number (VIN) formatting is acceptable. When filling out the MV-51 form, the vehicle identification number must be recorded accurately. Incorrectly formatting or entering the VIN can lead to issues with the transfer or sale.

- The form alone is enough for a legal transfer. Alongside the MV-51 form, proper documentation showing continuity of ownership and no alterations on supporting documents are required for a legal transfer to be recognized.

Understanding these misconceptions can help ensure a smooth and legally compliant process when selling or transferring an eligible vehicle in New York State. Always double-check your form and accompanying documents to avoid potential pitfalls.

Key takeaways

When dealing with the transfer or sale of a vehicle from 1972 or earlier, or any non-titled vehicle in New York State, the MV-51 form plays a crucial role. Understanding how to properly fill out and use this form ensures a legitimate and hassle-free transaction between the seller and the purchaser. Here are seven key takeaways to help guide you through this process:

- Use ink or a typewriter to complete all entries on the MV-51 form. This requirement ensures that the information remains permanent and legible, safeguarding against future disputes or misunderstandings.

- The form is designed exclusively for private sales. Dealerships or any commercial entity selling a vehicle cannot use this form for the sale or transfer process.

- Accompany the MV-51 form with bill(s) of sale that detail the vehicle's ownership history. These documents must show a clear chain of ownership from all previous owners to the current seller.

- Ensure no alterations or changes have been made to the MV-51 form or any accompanying documents. The DMV will not accept any paperwork with modifications, which could indicate potential fraud or misinformation.

- Prospective purchasers should check for any liens on the vehicle before committing to a purchase. This can prevent legal and financial issues down the line. The County Clerk’s Office is a suitable place to start when investigating potential liens.

- All sellers must certify their ownership and indicate the sale of the vehicle on the form. This declaration must include a full signature and, if applicable, the title of the signing individual.

- Similarly, all purchasers must acknowledge the purchase by signing the MV-51 form, thereby certifying they have acquired the vehicle from the named seller. If the purchaser is representing an entity rather than an individual, the buyer's title should also be included.

Understanding these key elements can significantly streamline the process of selling or transferring a vehicle in New York State, particularly for those rare or older models that don't have a title. Keeping these takeaways in mind ensures that both sellers and purchasers are well-informed and prepared for a smooth transaction.

Common PDF Documents

City Comptroller - Convey the extent of personal injuries and their impacts within New York City using the Comptroller's detailed claim form.

New York Attorney General Office - Despite the formal nature of the document, it seeks to be user-friendly by offering clear guidance on how to accurately provide the necessary information.

Who Pays Nyc Income Tax - By keeping your business information updated, you help ensure accurate tax billing and avoid possible penalties.