Free New York It 2659 Form in PDF

Businesses operating in New York face several obligations, among which is managing and filing taxes appropriately. A notable aspect of this includes dealing with the New York State Department of Taxation and Finance IT-2659 form, designed specifically for Partnerships and New York S Corporations that have either underpaid or failed to pay the estimated tax required for their nonresident individuals and corporate partners or shareholders. This requirement, relevant for the 2012 calendar year or fiscal years beginning and ending within that timeframe, necessitates careful attention to detail. The form serves as a vehicle to compute penalties associated with underpayments, thereby necessitating a meticulous completion of Schedules A through D. Additionally, this form underscores the state’s stringent approach towards tax compliance, enforcing entities to pre-emptively manage their tax responsibilities to avoid financial penalties. The IT-2659 form must be filed by a specific deadline, reflecting the later of April 15, 2013, or the partnership or S corporation tax return due date for the year, considering any extensions. Moreover, the filing process must adhere to strict instructions that ensure payments are made promptly and accurately to the Commissioner of Taxation and Finance, emphasizing the importance of diligence in tax practices for partnerships and S corporations within New York.

New York It 2659 Sample

New York State Department of Taxation and Finance |

|

||||

Estimated Tax Penalties for |

|

||||

|

|

|

|||

Partnerships and New York S Corporations |

|||||

(For underpayment or nonpayment of estimated tax required to be paid on behalf of |

|||||

partners and shareholders who are corporations or nonresident individuals) |

|

|

|

||

|

|

|

|

|

|

For calendar year 2012 or iscal year beginning |

|

|

and ending |

|

|

(See instructions, Form IT‑2659‑I, for assistance) |

|

|

|

|

|

|

|

|

|

||

Print or type

Legal name

Trade name of business if different from legal name above

Address (number and street or rural route)

City, village, or post ofice |

State |

ZIP code |

Employer identiication number

Type of entity (mark an X in the applicable box):

Partnership

S corporation

Complete Schedules A through D on pages 2, 3, and 4, as applicable, to compute your penalty.

Staple check or money order here.

Pay amount shown on page 4, line 52. Include only the line 52

amount in your check or money order, and make payable to: COMMISSIONER OF TAXATION AND FINANCE

Payment enclosed

.00

File Form IT‑2659 by the later of April 15, 2013, or the due date of the partnership

or S corporation tax return for the year determined with regard to any extension of time to ile).

Do not attach or ile Form IT‑2659 with any other form.

Paid preparer must complete (see instructions) |

Date: |

||

Preparer’s signature |

Preparer’s NYTPRIN |

||

|

|

|

|

|

|

|

|

Firm’s name (or yours, if |

Preparer’s PTIN or SSN |

|

|

|

|

|

|

Address |

Employer identiication number |

||

|

|

|

|

|

|

Mark an X if |

|

|

|

self‑employed |

|

E‑mail: |

|

|

|

Mail this form and payment to: NYS TAX DEPARTMENT -

ALBANY NY

Sign your return here

Signature of general partner or member, elected oficer, or authorized person

Date |

Daytime phone number |

( )

E‑mail:

069001120094

Page 2 of 4

Schedule A – Computation of estimated tax underpayment (if any). All ilers must complete this part. Only include partners and shareholders who are subject to estimated tax paid on their behalf by the partnership or New York S corporation (see instructions).

Current year

1Total of all nonresident individual partners’ or shareholders’ distributive

|

or pro rata shares of 2012 income earned from New York sources.... |

1 |

|

.00 |

|

|

2 |

Total of all nonresident individual partners’ or shareholders’ shares of |

|

|

|

|

|

|

2012 partnership deductions allocated to New York (see instructions) |

2 |

|

.00 |

|

|

3 |

Subtract line 2 from line 1 |

3 |

|

.00 |

|

|

4 |

Individual tax rate (8.82%) |

4 |

|

.0882 |

|

|

5 |

Multiply line 3 by line 4 |

5 |

|

.00 |

|

|

6 |

Total of all nonresident individual partners’ or shareholders’ distributive |

|

|

|

|

|

|

or pro rata shares of 2012 partnership or S corporation credits |

6 |

|

.00 |

|

|

7 |

2012 estimated tax required to be paid on behalf of nonresident individuals (subtract line 6 from line 5) |

............. 7 |

||||

8 |

Total of all corporate partners’ distributive shares of 2012 income earned from NY sources |

8 |

|

.00 |

|

|

9 |

Corporation tax rate (7.1%) |

9 |

|

.071 |

|

|

10 |

Multiply line 8 by line 9 |

10 |

|

.00 |

|

|

11 |

Total of all corporate partners’ distributive shares of 2012 partnership credits |

11 |

|

.00 |

|

|

12 |

2012 estimated tax required to be paid on behalf of corporations (subtract line 11 from line 10) |

|

12 |

|||

13 |

Total estimated tax required to be paid for 2012 (add lines 7 and 12) |

|

|

13 |

||

14 |

90% of the estimated tax required to be paid for 2012 (multiply line 13 by 90% (.90)) |

14 |

||||

.00

.00

.00

.00

Prior year

15Total of all nonresident individual partners’ or shareholders’ distributive

|

or pro rata shares of 2011 income earned from New York sources .... |

|

15 |

|

.00 |

|

|

16 |

Total of all nonresident individual partners’ or shareholders’ shares of |

|

|

|

|

|

|

|

2011 partnership deductions allocated to New York (see instructions).. |

|

16 |

|

.00 |

|

|

17 |

Subtract line 16 from line 15 |

|

17 |

|

.00 |

|

|

18 |

Individual tax rate (8.97%) |

|

18 |

|

.0897 |

|

|

19 |

Multiply line 17 by line 18 |

|

19 |

|

.00 |

|

|

20 |

Total of all nonresident individual partners’ or shareholders’ distributive |

|

|

|

|

|

|

|

or pro rata shares of 2011 partnership or S corporation credits |

20 |

|

.00 |

|

|

|

21 |

2011 estimated tax computed for individuals (subtract line 20 from line 19) |

.......................................................... |

|

21 |

|||

22 |

Total of all corporate partners’ distributive shares of 2011 income earned from NY sources |

|

22 |

|

.00 |

|

|

23 |

Corporation tax rate (7.1%) |

|

23 |

|

.071 |

|

|

24 |

Multiply line 22 by line 23 |

|

24 |

|

.00 |

|

|

25 |

Total of all corporate partners’ distributive shares of 2011 partnership credits |

|

25 |

|

.00 |

|

|

26 |

2011 estimated tax computed for corporations (subtract line 25 from line 24) |

|

26 |

||||

27 |

Total estimated tax computed for 2011 (add lines 21 and 26) |

|

27 |

||||

|

If the sum of lines 17 and 22 is more than $150,000, and the entity is not primarily |

|

|

|

|||

|

engaged in farming or ishing, complete line 28 and continue with Schedule B. If the |

|

|

|

|||

|

sum of lines 17 and 22 is $150,000 or less, skip line 28 and continue with Schedule B. |

|

|

|

|||

28 |

Multiply line 27 by 110% (1.10) |

|

28 |

||||

.00

.00

.00

.00

Schedule B – Short method for computing the penalty. Complete lines 29 through 34 if you paid four equal estimated tax installments (on the due dates), or if you made no payments of estimated tax. Otherwise, you must complete Schedule C.

29If you were not required to make an entry on line 28, enter the lesser of lines 14 or 27.

|

If you were required to make an entry on line 28, enter the lesser of lines 14 or 28 |

29 |

.00 |

30 |

Enter the total amount of estimated tax payments made for 2012 |

30 |

.00 |

31 |

Total underpayment for the year (subtract line 30 from line 29; if zero or less you do not owe the penalty) |

31 |

.00 |

32 |

Multiply line 31 by .04976 and enter the result |

32 |

.00 |

33 |

If the amount on line 31 was paid on or after April 15, 2013, enter 0. If the amount on line 31 was paid |

|

|

|

before April 15, 2013, make the following computation to ind the amount to enter on this line: |

|

|

|

Amount on line 31 × number of days before April 15, 2013 × .00020 = |

33 |

.00 |

34 |

Penalty (subtract line 33 from line 32; enter here and on line 51) |

34 |

.00 |

(continued)

069002120094

|

|

|

|

|

|

|

|

Page 3 of 4 |

|||

|

|

|

|

|

|

|

|

|

|

|

|

Schedule C – Regular method |

|

|

|

|

|

|

|

|

|

|

|

Part 1 – Computing the underpayment |

|

|

|

|

|

|

|

|

|

|

|

|

Payment due dates |

|

A |

4/15/12 |

B |

6/15/12 |

C |

9/15/12 |

|

D |

1/15/13 |

35 |

Required installments (see instructions) |

35 |

|

.00 |

|

.00 |

|

|

.00 |

|

.00 |

36 |

Estimated tax paid |

36 |

|

.00 |

|

.00 |

|

|

.00 |

|

.00 |

Complete lines 37 through 39, one column |

|

|

|

|

|

|

|

|

|

|

|

at a time, starting in column A. |

|

|

|

|

|

|

|

|

|

|

|

37 |

Overpayment or underpayment from prior period .... |

37 |

|

|

|

.00 |

|

|

.00 |

|

.00 |

38 |

If line 37 is an overpayment, add lines 36 |

|

|

|

|

|

|

|

|

|

|

|

and 37; if line 37 is an underpayment, |

|

|

|

|

|

|

|

|

|

|

|

subtract line 37 from line 36 (see instructions) |

38 |

|

.00 |

|

.00 |

|

|

.00 |

|

.00 |

39 |

Underpayment (subtract line 38 from line 35) |

|

|

|

|

|

|

|

|

|

|

|

or overpayment (subtract line 35 from |

|

|

|

|

|

|

|

|

|

|

|

line 38; see instructions) |

39 |

|

.00 |

|

.00 |

|

|

.00 |

|

.00 |

Part 2 – Computing the penalty |

|

|

|

|

|

|

|

|

|

|

|

|

Payment due dates |

|

A |

4/15/12 |

B |

6/15/12 |

C |

9/15/12 |

|

D |

1/15/13 |

|

40 Amount of underpayment (from line 39) |

40 |

|

.00 |

|

.00 |

|

|

.00 |

|

.00 |

First installment (April 15 - June 15, 2012) |

|

|

|

|

|

|

|

|

|

|

|

41April 15 ‑ June 15 =

(61 ÷ 366) × 7.5% = .01249

|

|

|

- or - |

|

||||

April 15 ‑ |

|

|

= |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

|

|

÷ 366) × 7.5% = |

. |

|

|

|

|

|

|

41 |

|

|||||

42 Multiply line 40, column A, by line 41 ............ 42 |

.00 |

|||||||

Second installment (June 15 - September 15, 2012)

43June 15 ‑ September 15 = (92 ÷ 366) × 7.5% = .01884

-or -

June 15 ‑ |

|

= ( |

|

÷ 366) × 7.5% = |

. |

|

43 |

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

44 Multiply line 40, column B, by line 43 |

44 |

.00 |

||||||

Third installment (September 15, 2012 - January 15, 2013)

45September 15 ‑ December 31 = (107 ÷ 366) × 7.5% = .02192

January 1 ‑ January 15 |

= (15 ÷ 365) × 7.5% = .00307 |

|

|

|

|||||

|

|

|

|

|

.02499 |

Total |

|

|

|

|

|

- or - |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

||

September 15 ‑ |

|

|

= ( |

|

÷ 366) × 7.5% = |

. |

|

|

|

|

|

|

|

|

|

|

|

||

January 1 ‑ |

= ( |

|

÷ 365) × 7.5% = |

. |

|

|

|

||

|

|

|

|

|

|

|

Total |

45 |

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

||

46 Multiply line 40, column C, by line 45 |

|

|

|

|

|

||||

|

|

46 |

.00 |

||||||

Fourth installment (January 15 - April 15, 2013)

47January 15 ‑ April 15 = (90 ÷ 365) × 7.5% = .01848

-or -

|

January 15 ‑ |

|

= ( |

|

÷ 365) × 7.5% = |

. |

|

|

|

|

|

|

|

|

47 |

|

|||

48 |

Multiply line 40, column D, by line 47 |

............................................................................................................................ 48 |

.00 |

||||||

49 |

Penalty (add lines 42, 44, 46, and 48) |

49 |

.00 |

||||||

(continued)

069003120094

Page 4 of 4

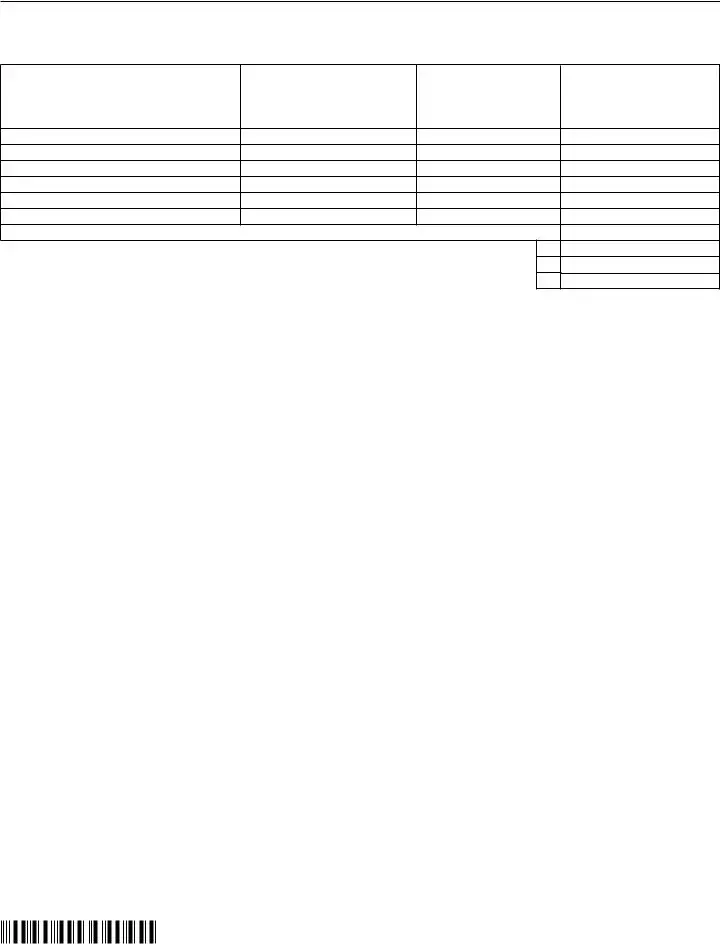

Schedule D – Failure to pay estimated tax on behalf of partners or shareholders who are corporations or nonresident individuals. Only include partners and shareholders who are subject to estimated tax paid on their behalf by the partnership or New York S corporation (see instructions). If you are listing more than six partners or shareholders, attach additional sheet(s) using the same four‑column format as in the chart below. Include all column D totals from additional sheets on the line provided.

A

Name of

partner/shareholder

B

Identifying number

(EIN/SSN)

C

Number of quarters (1‑4)

during the year estimated tax

was not paid

D

Column C × $50

Column D total from attached sheet(s) (if any) |

||

50 |

Penalty (total of column D) |

50 |

51 |

Penalty (from line 34) |

51 |

52 |

Total penalty (add lines 49, 50, and 51, as applicable; enter here and in Payment enclosed box on the front page) |

52 |

.00

.00

.00

069004120094

File Overview

| Fact | Detail |

|---|---|

| 1. Purpose | To compute and pay estimated tax penalties for partnerships and S corporations in New York. |

| 2. Form Number | IT-2659 |

| 3. Applicable Year | Calendar year 2012 or fiscal year beginning in 2012 and ending in 2013. |

| 4. Entity Types Concerned | Partnerships and S corporations with nonresident individual partners or shareholders and corporate partners or shareholders. |

| 5. Payment Requirement | Estimated tax required to be paid on behalf of nonresident individuals and corporations. |

| 6. Deadline | April 15, 2013, or the due date of the entity's tax return with any extension. |

| 7. Penalty Computation Methods | Short method on Schedule B or regular method on Schedule C, based on estimated tax payments made. |

| 8. Governing Law(s) | New York State Tax Law. |

| 9. Submission Address | NYS TAX DEPARTMENT - IT-2659, PO BOX 397, ALBANY NY 12201-0397. |

New York It 2659: Usage Guidelines

Filling out the New York State Department of Taxation and Finance IT-2659 form is important for partnerships and S Corporations that need to calculate estimated tax penalties for underpayment or nonpayment of estimated taxes on behalf of partners and shareholders. This form ensures that entities comply with New York taxation laws by accurately reporting and paying due amounts. Here are the steps to fill out the form:

- Identify the tax period: At the top of the form, specify whether you are reporting for a calendar year (2012) or a fiscal year by filling out the beginning and ending dates.

- Provide business information: Enter the legal name, trade name (if different), address, city, state, ZIP code, and the employer identification number of the business.

- Select the type of entity: Mark an X in the box to indicate whether the entity is a Partnership or an S corporation.

- Complete Schedules A through D:

- Schedule A requires you to compute the estimated tax underpayment, if any. Include the total New York source income, deductions, individual tax rate computation, and credits for both nonresident individuals and corporate partners or shareholders.

- If applicable, transfer the required information from Schedule A to proceed with Schedule B or C, depending on your estimated tax payment method. Schedule B applies for entities that paid four equal estimated tax installments (or made no payments), and Schedule C is for the regular computation method.

- Schedule D is for calculating the failure to pay estimate tax on behalf of partners or shareholders who are corporations or nonresident individuals. List each affected individual, their identifying number, and calculate the penalties based on the number of quarters the estimated tax was not paid.

- Payment information: Staple the payment to the form if applicable. Ensure the check or money order is payable to the "COMMISSIONER OF TAXATION AND FINANCE" with the amount shown on page 4, line 52.

- Preparer information (if prepared by someone other than the taxpayer): Fill in the date, preparer's signature, identification numbers, firm's name (or individual name if self-employed), and contact details.

- Sign the form: The form must be signed by a general partner, member, elected officer, or an authorized person. Include the date and daytime phone number.

- Mail the form and payment (if applicable) to:

NYS TAX DEPARTMENT - IT-2659

PO BOX 397

ALBANY NY 12201-0397

After completing and mailing the form, it is advisable to keep a copy of the form and any correspondence for your records. This form is a critical tool for ensuring compliance with New York's tax laws and avoiding potential penalties for your partnership or S corporation.

FAQ

-

What is the IT-2659 form used for in New York State?

The IT-2659 form is used by partnerships and New York S corporations to report and pay estimated tax penalties related to the underpayment or nonpayment of estimated taxes on behalf of their partners and shareholders who are corporations or nonresident individuals. This procedure ensures that any income earned from New York sources by these entities is appropriately taxed.

-

Who needs to file Form IT-2659?

Partnerships and New York S corporations are required to file Form IT-2659 if they have partners or shareholders who are corporations or nonresident individuals, and they underpaid or did not pay estimated taxes due on income earned from New York sources.

-

When is the deadline to file Form IT-2659?

The form must be filed by the later of April 15, 2013, or the due date of the partnership or S corporation tax return for the year, determined with consideration of any extensions to file.

-

How is the penalty for underpayment or nonpayment calculated on Form IT-2659?

Penalties are calculated based on schedules A through D included within the form. These calculations take into account the total income of nonresident individual partners or shareholders from New York sources, the applicable tax rate, and any credits. Penalties are determined by the shortfall between the estimated taxes that were required to be paid and the actual amounts paid, with specific rates applied according to how late the payment was made.

-

Can Form IT-2659 be attached to other tax forms when filed?

No, Form IT-2659 should not be attached to or filed with any other tax form. It must be filed separately to ensure proper processing.

-

What are the payment instructions for the IT-2659 form?

Payment of the calculated penalty should be made by check or money order, payable to the "COMMISSIONER OF TAXATION AND FINANCE." The exact amount from line 52 of the form should be included, and the payment should be stapled to the form. Payment along with the form should then be mailed to the specified address provided on the form.

-

What if I need to report more than six partners or shareholders?

If there are more than six partners or shareholders for whom estimated tax was not paid, additional sheets following the same format as Schedule D should be attached. Ensure that you include the total of column D from these additional sheets on the line provided in Schedule D.

-

Who completes the preparer section of Form IT-2659?

The preparer section of the form should be completed by the paid preparer, if applicable. This section includes the preparer's signature, identification numbers, and contact information. If the form is self-prepared, this section may be left blank.

Common mistakes

Filling out the New York IT-2659 form accurately is crucial for partnerships and New York S Corporations aiming to avoid penalties associated with underpayment or nonpayment of estimated taxes for nonresident individuals and corporate partners or shareholders. However, several common mistakes can lead to errors in the filing process.

First, a frequent error is not accurately calculating the total income earned from New York sources by nonresident individual partners or shareholders. This figure is critical for determining the estimated tax required to be paid on their behalf. An incorrect income calculation can lead to either an underestimation or an overestimation of taxes due, resulting in penalties or overpayment.

- Omitting or inaccurately reporting the total of all nonresident individual partners’ or shareholders’ shares of partnership deductions allocated to New York. This mistake impacts the accuracy of the tax calculation by failing to properly subtract these amounts from the total income.

- Incorrect application of individual and corporation tax rates to calculate the estimated tax required. Using outdated tax rates or misapplying them can significantly affect the final tax liability.

- Failure to accurately compute the penalty using the correct method, whether it's the short method for those who paid four equal estimated tax installments or the regular method for others. This oversight can either inflate or deflate the penalty amount due.

- Not including or incorrectly calculating the estimated tax payments made for the year. This can result in an overestimation of the underpayment and, consequently, a higher penalty.

Moreover, overlooking the need to attach additional sheets for listing more than six partners or shareholders subject to estimated tax paid on their behalf is another common mistake. This not only affects the accuracy of the form but also could result in incomplete compliance with the filing requirements.

- Ensure all calculations are based on accurate income figures and deductions.

- Apply the appropriate tax rates for the relevant year to determine the estimated tax properly.

- Opt for the correct penalty computation method depending on your payment schedule throughout the tax year.

- Accurately report any estimated tax payments made to avoid overestimating the underpayment penalty.

- Lastly, remember to attach additional sheets if you have more than six partners or shareholders who are nonresidents or corporations, ensuring you meet the documentation requirements fully.

By sidestepping these common mistakes, filers can ensure a smoother, more accurate process in complying with New York State's estimated tax payment regulations for nonresident individuals and corporate partners or shareholders.

Documents used along the form

When handling taxes for partnerships and New York S corporations, particularly for underpayment or nonpayment of estimated taxes, the New York State Department of Taxation and Finance IT-2659 form is central. However, to ensure compliance and accuracy in reporting, several other forms and documents often accompany the IT-2659 form. Understanding these additional forms not only helps in navigating the complexities of tax filings but also aids in preempting possible discrepancies that could lead to penalties.

- Form IT-204: This is the Partnership Return form. It details the income, deductions, gains, losses, etc., of partnerships operating in New York. It is crucial because the information on the IT-204 form directly affects the estimated tax payments reported on the IT-2659 form.

- Form CT-3-S: For New York S corporations, the CT-3-S form serves a similar purpose as the IT-204 does for partnerships. It is the New York S Corporation Franchise Tax Return form, summarizing the corporation's income, deductions, and credits. The estimations made here are foundational to the IT-2659 computations for any S corporation.

- Form IT-2105: Known as the Estimated Tax Payment Voucher for Individuals, this form is not just for individual filers. Partners and shareholders of S corporations who need to make estimated tax payments directly may need to use this form, depending on their specific arrangements and New York State tax law requirements.

- Form IT-204-CP: This is the Partnership, LLC, and LLP Filing Fee Payment Form for New York State. While not directly related to estimated tax payments, it is often filed in conjunction with other tax documents by entities that fall under these classifications. Ensuring that all fees and taxes are paid is essential for compliance and accurate tax filing.

Together, these forms create a comprehensive framework for reporting and paying taxes for partnerships and S corporations in New York. They address different facets of the taxation process, from income to franchise tax, ensuring entities meet their obligations effectively. Keeping abreast of the requirements for each document and how they interlink can streamline the compliance process, reducing the risk of errors and penalties.

Similar forms

The New York State IT-2659 form is closely related to the Federal Form 1040-ES, "Estimated Tax for Individuals." Like the IT-2650, Form 1040-ES is used for the calculation and payment of estimated taxes, albeit at the federal level and for individuals rather than partnerships and S corporations. Both forms are designed to facilitate payment of taxes on income not subject to regular withholding. Taxpayers, whether they are nonresident individuals or entities, use these forms to compute their estimated income tax liability and ensure they meet their tax payment obligations throughout the year to avoid penalties.

Another similar document is the Form 1065, "U.S. Return of Partnership Income." This form is used by partnerships to report their income, gains, losses, deductions, credits, etc., to the IRS. While IT-2659 deals specifically with estimated tax penalties for partnerships in New York State, Form 1065 addresses the broader task of reporting all taxable activities of the partnership at the federal level. Both documents are crucial for partnerships, ensuring compliance with tax reporting and payment requirements.

The Form 1120-W, "Estimated Tax for Corporations," parallels the IT-2659 in its purpose for corporations. This form is utilized by corporations to calculate and pay their estimated federal tax liability on a quarterly basis. Similar to the focus of IT-2659 on partnerships and S corporations in New York, Form 1120-W addresses the payment of estimated taxes to avoid underpayment penalties, but from a federal standpoint and for all corporations. These documents are instrumental in guiding entities through their respective tax obligations to prevent accruing interest and penalties associated with underpayments.

Form IT-204-LL, "Partnership, Limited Liability Company, and Limited Liability Partnership Filing Fee Payment Form" for New York State, serves a comparable function to IT-2659, though it specifically relates to the filing fee rather than estimated tax payments. Both forms target partnerships and their equivalents, requiring financial disclosures intended to comply with state tax obligations. IT-204-LL focuses on the payment of the filing fee by partnerships and LLCs, underscoring the financial responsibilities of these entities beyond just the payment of taxes.

On a similar note, the form IT-203-GR, "Group Return for Nonresident Partners," is another New York State tax document related to IT-2659 but focuses on nonresident partners in a partnership. It allows for the filing of a collective income tax return on behalf of nonresident individuals, calculating their share of income derived from New York sources. While IT-2659 deals with the estimation and penalty for underpayment of taxes on behalf of these individuals, IT-203-GR consolidates the reporting and tax payment process for nonresidents, highlighting the complex tax obligations faced by entities with nonresident members.

Lastly, the Form IT-204, "Partnership Return," closely resembles IT-2659 in its requirement for New York State partnerships but focuses on reporting annual income, deductions, and gains or losses. This form encapsulates the yearly financial activities of partnerships, similar to how IT-2659 addresses the estimated tax and penalties for not making adequate payments throughout the year. IT-204 ensures that partnerships disclose their full economic activities, complementing IT-2659's role in managing estimated tax payments and penalties.

In summary, while the IT-2659 form is unique in its focus on estimated tax penalties for partnerships and S corporations in New York, other forms at both the state and federal levels share similarities in their function and purpose. These documents collectively ensure that businesses and individuals comply with tax payment and reporting requirements, thereby avoiding penalties and maintaining good standing with tax authorities.

Dos and Don'ts

When filling out the New York IT-2659 form, individuals and entities must navigate the process with care to avoid common errors that can lead to penalties or delays. The following guidelines aim to simplify this task:

Do:

- Ensure all information is accurate and up to date, including the legal name, trade name of the business (if different), and addresses.

- Correctly identify the type of entity by marking the applicable box for either a Partnership or an S corporation, as this influences the form's subsequent sections.

- Complete Schedules A through D meticulously to calculate the estimated tax underpayment accurately, if any. This step is pivotal in determining whether there is a penalty.

- Attach a check or money order for the amount shown on page 4, line 52, ensuring that it is payable to the COMMISSIONER OF TAXATION AND FINANCE and correctly includes only the line 52 amount.

- File Form IT-2659 by the specified due date, which is the later of April 15, 2013, or the due date of the partnership or S corporation tax return for the year, considering any extensions.

- Sign the form in the designated area to validate its submission. This applies to the general partner, elected officer, or an authorized person of the entity.

Don't:

- Forget to attach payment to the form. It is essential to staple the check or money order to the form where indicated to ensure correct processing.

- Omit any required schedules. Failing to complete sections A through D, as applicable, can result in incomplete filing and potential penalties.

- Include incorrect or outdated information regarding the business name, address, or employer identification number, as this could lead to processing errors.

- Fail to accurately calculate the estimated tax penalties on Schedules A through D, as any mistake could lead to underpayment or overpayment.

- Mix Form IT-2659 with other tax filings when submitting by mail. This form must be mailed separately to the specified address to ensure proper handling and processing.

- Overlook the signature section at the end of the form. An unsigned form is considered invalid and will not be processed until properly signed.

Misconceptions

Many people hold misconceptions about the New York State Department of Taxation and Finance IT-2659 form, which can lead to confusion or errors in filing. Here are nine common misunderstandings and the truths behind them:

- Misconception 1: The IT-2659 form is only for individual taxpayers.

Truth: This form is specifically designed for partnerships and New York S corporations to report and pay estimated tax penalties on behalf of their partners and shareholders who are either corporations or nonresident individuals. - Misconception 2: The IT-2659 can be filed at any time during the year.

Truth: It must be filed by the later of April 15 following the tax year or the due date of the partnership or S corporation tax return, taking into account any extensions. - Misconception 3: IT-2659 should be attached to the partnership's or S corporation's tax return.

Truth: Form IT-2659 should not be attached to any other tax form and must be filed separately. - Misconception 4: All partners and shareholders of the entity must be included in the IT-2659 calculations.

Truth: Only those who are nonresident individuals or corporations should be included in the IT-2659 calculations. - Misconception 5: Estimated tax payments are optional.

Truth: If the entity's distributive share of income to nonresident individuals or corporations exceeds certain thresholds, estimated tax payments are required, or penalties may apply. - Misconception 6: The computation of penalties is straightforward and does not require detailed information.

Truth: Penalties require careful computation according to specific rules, including the entity’s income, deductions, and the dates on which estimated payments were made or should have been made. - Misconception 7: Any overpayment of estimated taxes cannot be adjusted in the IT-2659 form.

Truth: Overpayments and underpayments must both be calculated on the form to determine the correct penalty or adjustment. - Misconception 8: The tax rates applied are the same for all partners and shareholders.

Truth: Tax rates differ based on whether the partner or shareholder is an individual or a corporation, and the applicable tax rates must be used in the calculations. - Misconception 9: Penalties for underpayment can be waived simply upon request.

Truth: Penalties may only be waived if specific criteria are met, such as reasonable cause or the correction of a mistake, and detailed explanation and documentation are usually required.

Understanding the specifics and requirements of Form IT-2659 is crucial for partnerships and S corporations to comply with New York State tax laws and avoid unnecessary penalties.

Key takeaways

Understanding the requirements and procedures for filling out the New York State Department of Taxation and Finance IT-2659 form is crucial for partnerships and New York S corporations. This form is designed to calculate and report estimated tax penalties for underpayment or nonpayment of estimated taxes required to be paid on behalf of partners and shareholders who are corporations or nonresident individuals. Below are six key takeaways to guide you through the process:

- The IT-2659 form is applicable for tax periods beginning in the calendar year 2012 or the fiscal year specified on the form. It is essential for entities to accurately report income and deductions to compute potential underpayments and the associated penalties correctly.

- Entities must identify the type of entity they are by marking the appropriate box as either a Partnership or an S corporation. This classification affects the calculation of estimated taxes and penalties.

- Calculations within Schedules A through D are required to determine the total estimated tax underpayment and the associated penalties. This comprehensive approach ensures that entities account for all nonresident individual partners' or shareholders' shares of income and deductions, as well as corporate partners' shares.

- A payment for any calculated penalty on page 4, line 52, must be included with the form submission. It is critical to accurately calculate and provide the correct payment amount to avoid further penalties or the need for additional corrections and submissions.

- The form must be filed by the later of April 15, 2013, or the due date of the partnership or S corporation tax return for the year, considering any extensions. Timely filing is essential to comply with state tax regulations and to avoid late filing penalties.

- Entities are discouraged from attaching or filing Form IT-2659 with any other forms. This separate submission ensures that the estimated tax penalty calculation is processed efficiently and accurately by the New York State Department of Taxation and Finance.

By closely following these guidelines and diligently completing the IT-2659 form, partnerships and New York S corporations can ensure compliance with New York State's tax laws regarding the payment of estimated taxes for nonresident individuals and corporate partners or shareholders.

Common PDF Documents

How to Apply for New York Nursing License by Endorsement - A section dedicated to professional title, state or jurisdiction, and licensure limitations requires completion for all held licenses.

Ny Board of Accountancy - Criteria for acceptable professional experience for CPA licensure in New York outlined in Form 4B.

It 204 Ll - Businesses benefit from the structured format of the NYC 204, making it easier to compile and report their financial information.