Free New York It 245 Form in PDF

Community service in the form of volunteer firefighting and ambulance work is a cornerstone of public safety across New York State. Individuals who dedicate their time and skills to these critical roles are eligible for a gesture of gratitude through the New York State Department of Taxation and Finance's IT-245 form. This document serves as a Claim for Volunteer Firefighters’ and Ambulance Workers’ Credit, providing a tax credit to those who have committed themselves to these volunteer services throughout the tax year. To qualify, individuals must be full-year New York State residents who have not received a real property tax exemption for their services. The form outlines a straightforward process for determining eligibility, documenting volunteer service, and calculating the credit amount, which can be a significant financial acknowledgment of the valuable contributions these volunteers make to their communities. By attaching the completed IT-245 form to Form IT-201, Resident Income Tax Return, volunteers can claim this credit, underscoring the state's recognition of their service and sacrifice. In cases where the volunteer's service was not the basis for a real property tax exemption, even if the property is co-owned, the credit can still be claimed, ensuring that each eligible volunteer receives the benefit they deserve. The process not only underscores the volunteer's role in safeguarding the community but also reaffirms New York State's support for these indispensable community servants.

New York It 245 Sample

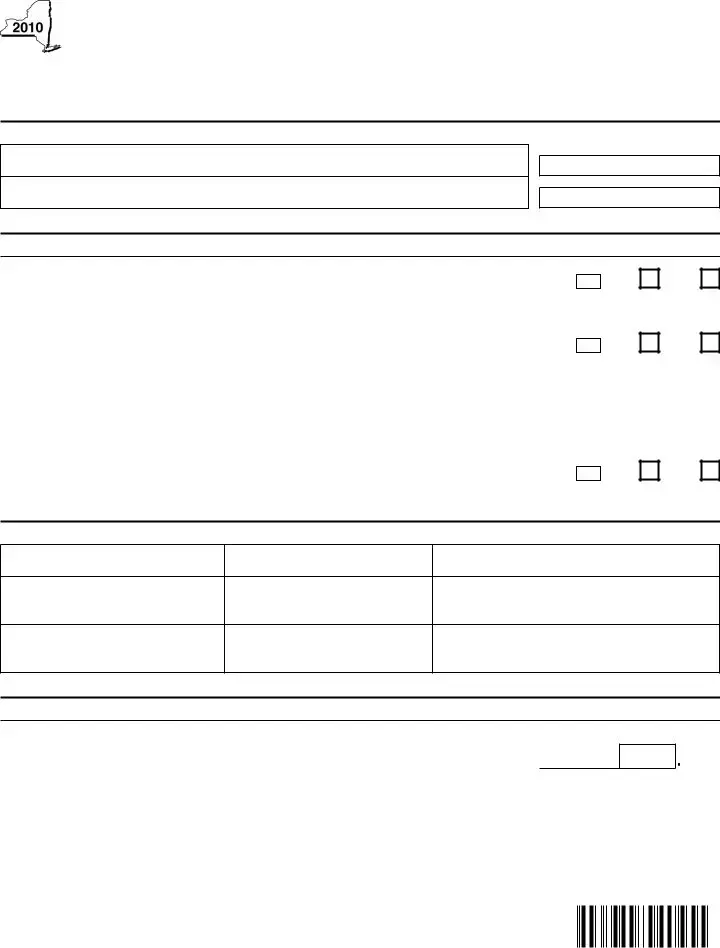

New York State Department of Taxation and Finance

Claim for Volunteer Firefighters’ and Ambulance Workers’ Credit

Tax

Attach your completed Form

Step 1 — Enter identifying information

Your name as shown on return

Your social security number

Spouse’s name

Spouse’s social security number

Step 2 — Determine eligibility ( for lines 1 through 3, mark an X in the appropriate box )

1 Were you (and your spouse if iling a joint return) a New York State resident for all of this tax year? ......

If you marked an X in the No box, stop; you do not qualify for this credit.

2 Were you an active volunteer ireighter or ambulance worker for all of this tax year

who did not receive a real property tax exemption for these services ( see instructions )? ......................

If your iling status is , Married filing joint return, continue with line 3. For any other iling status:

If you marked an X in the No box, stop; you do not qualify for this credit. If you marked an X in the Yes box, continue with Step 3.

3If your iling status is , Married filing joint return, was your spouse an active volunteer ireighter or ambulance worker for all of this tax year who did not receive a real property tax exemption for

these services ( see instructions )? ............................................................................................................

If you marked an X in the No box at both lines 2 and 3, stop: you do not qualify for this credit.

1.

2.

3.

Yes

Yes

Yes

No

No

No

Step 3 — Enter qualifying information (see instructions)

Name of qualifying volunteer

Volunteer ire company/department

or ambulance company

Address of volunteer ire company/department or

ambulance company

Step 4 — Determine credit amount

4If you marked the Yes box at either line 2 or line 3, but not both enter 200.

If you marked the Yes box at both lines 2 and 3, enter 400 |

4. |

Enter the line 4 amount and code 354 on Form |

|

0 |

0 |

3541100094

Please file this original scannable form with the Tax Department.

Instructions

General information

What is the volunteer firefighters’ and ambulance workers’ credit?

The volunteer ireighters’ and ambulance workers’ credit is available to

You cannot claim the volunteer ireighters’ and ambulance workers’ credit if you receive a real property tax exemption that relates to your volunteer service under Real Property Tax Law (RPTL), Article 4, Title 2. However, if the property has multiple owners, the owner(s) whose volunteer service was not the basis of the exemption may be eligible to claim the credit.

If the credit exceeds your tax for the year, any excess will be refunded without interest.

Definitions

Active volunteer firefighter means a person who has been approved by the authorities in control of a duly organized New York State volunteer ire company or New York State volunteer ire department as an active volunteer ireighter of the ire company or department and who is faithfully and actually performing service in the protection of life and property from ire or other emergency, accident or calamity in connection with which the services of the ire company or ire department are required.

Volunteer ambulance worker means an active volunteer member of a New York State ambulance company as speciied on a

list regularly maintained by the company for purposes of the volunteer ambulance workers’ beneit law.

How do I claim the credit?

File Form

Do not attach this form to your return unless you are claiming the credit.

Specific instructions

See the instructions for your tax return for the Privacy notification or if you need help contacting the Tax Department.

Step 2 — Determine eligibility

If your iling status is Single, Married filing separate return,

Head of household, or Qualifying widower, complete lines

1 and 2. If your iling status is Married filing joint return, complete lines 1, 2, and 3.

Line 2 — If you received a real property tax exemption under the RPTL that relates to your volunteer service, mark an X in the No box.

Line 3 — If your iling status is , Married filing joint return, and your spouse received a real property tax exemption under the RPTL that relates to his/her volunteer service, mark an X in the No box.

Step 3 — Enter qualifying information

If you are an active volunteer for both a ire company/department and an ambulance company, enter the qualifying information for either the ire company/department or the ambulance company. Do not enter the information for both.

3542100094

Please file this original scannable form with the Tax Department.

File Overview

| Fact | Detail |

|---|---|

| Governing Law | Tax Law—Section 606(e-1) |

| Eligibility | Full-year New York State residents who are active volunteer firefighters or volunteer ambulance workers for the entire tax year. |

| Exclusion | Credit not available if the volunteer receives a real property tax exemption for volunteer service under Real Property Tax Law (RPTL), Article 4, Title 2. |

| Credit Amount | $200 for individual service or $400 for combined service of a married couple filing jointly, if both qualify. |

| Filing Requirement | Must file Form IT-245 with Form IT-201, Resident Income Tax Return. |

| Refund Policy | If the credit exceeds the taxpayer's liability for the year, any excess will be refunded without interest. |

New York It 245: Usage Guidelines

Filling out the IT-245 form is a straightforward process that allows eligible New York State residents to claim a credit for their service as volunteer firefighters and ambulance workers. This guide offers a step-by-step approach to completing the form accurately. Before starting, ensure that you qualify for the credit by reviewing the eligibility criteria. If you're unsure about any part of the form, it's a good idea to consult with a tax professional.

- Begin with Step 1: Enter your full legal name and social security number at the top of the form. If you're filing jointly, also include your spouse's name and social security number in the provided spaces.

- Proceed to Step 2: This part requires you to determine your eligibility for the credit.

- For line 1: Check "Yes" if you and your spouse, if filing jointly, were New York State residents for the entire tax year.

- For line 2: Check "Yes" if you were an active volunteer firefighter or ambulance worker for the full tax year and did not receive a real property tax exemption for these services. If you're married and filing a joint return, move to line 3; otherwise, skip to Step 3.

- For line 3: This applies only to those filing a joint return. Check "Yes" if your spouse was also an active volunteer firefighter or ambulance worker for the entire tax year without receiving a real property tax exemption for these services.

- In Step 3: Provide the qualifying information for either the volunteer fire department/company or ambulance service. Include the name of the qualifying volunteer (this could be you or your spouse), along with the address of the volunteer fire company/department or ambulance company. If you served in both capacities, you only need to enter the information for one.

- Finally, Step 4 determines the credit amount:

- If "Yes" was checked for either line 2 or line 3 (but not both), enter $200.

- If "Yes" was checked for both lines 2 and 3, enter $400.

After completing these steps, ensure that you attach the completed IT-245 form to your Form IT-201. Review all entered information for accuracy before submitting to the New York State Department of Taxation and Finance. This careful preparation assists in the smooth processing of your tax return and the successful claiming of your deserved credit.

FAQ

Many people have questions about the New York It 245 form, the Claim for Volunteer Firefighters’ and Ambulance Workers’ Credit. Below are some of the most common inquiries and their answers to help navigate this important form.

What is the purpose of the IT-245 form?

The IT-245 form is used by New York State residents to claim a tax credit for active volunteer firefighters and ambulance workers. This credit acknowledges the valuable service these individuals provide to their communities without receiving compensation.

Who is eligible to claim the credit?

To be eligible, you must be a full-year New York State resident and an active volunteer firefighter or ambulance worker for the entire tax year. Additionally, you cannot claim this credit if you receive a real property tax exemption for your volunteer services.

Can both spouses claim the credit on a joint return?

Yes, if filing jointly and both spouses qualify as active volunteer firefighters or ambulance workers (and neither received a real property tax exemption for these services), they can claim a combined credit. Each situation is detailed on the form under steps 2 and 3 to help taxpayers determine the correct credit amount.

What amount can be claimed through this tax credit?

Eligible individuals can claim $200 for themselves or $400 on a joint return if both spouses qualify. This amount is entered on Form IT-201-ATT, line 12, with code 354.

How do I claim the credit?

You must file Form IT-245 with your Form IT-201, which is the Resident Income Tax Return. If you and your spouse are filing separately, and both qualify, each must file a separate Form IT-245 with your Form IT-201.

What information is required to complete the form?

Required information includes your identifying information, eligibility details, the name of the volunteer fire company/department or ambulance company, and the address of the volunteer organization. Following these steps ensures that you properly claim the credit.

What happens if the credit exceeds my tax for the year?

If the amount of the credit exceeds your tax for the year, you will receive the excess as a refund without interest. This makes the credit even more beneficial for eligible volunteers.

Where can I find more information or assistance?

More detailed instructions are available on the back of the IT-245 form. Additionally, the instructions for your tax return may offer further guidance, along with contact information for the New York State Department of Taxation and Finance if you need direct assistance.

This FAQ aims to cover the basic questions regarding the IT-245 form but always consult the form's instructions or a tax professional for your specific situation.

Common mistakes

Filling out the New York IT-245 form, which is the Claim for Volunteer Firefighters’ and Ambulance Workers’ Credit, requires careful attention to detail. However, mistakes can occur, leading to processing delays or even denial of the credit. Here are 10 common errors to avoid:

- Not verifying residency status – Only full-year New York State residents are eligible for the credit. Overlooking the residency requirement on line 1 can result in an unqualified claim.

- Misunderstanding the eligibility criteria – Claimants sometimes miss that they must not have received a real property tax exemption for their volunteer services. This misunderstanding can lead to incorrectly marking the Yes/No boxes on lines 2 and 3.

- Filing status errors – Joint filers sometimes fail to complete line 3, which specifically asks if the spouse was an active volunteer and did not receive a real property tax exemption. Both lines 2 and 3 must be correctly marked to qualify for the joint credit amount.

- Omitting volunteer organization details – Step 3 requires information about the volunteer fire company/department or ambulance company. Leaving this section blank or incomplete can disqualify the application.

- Incorrect credit calculation – Some applicants mistakenly enter the wrong amount in Step 4. The form clearly states to enter $200 if either line 2 or 3 is marked Yes, but not both, and $400 if Yes is marked on both lines 2 and 3.

- Forgetting to attach the form to IT-201 – The IT-245 form must be filed alongside Form IT-201. Failure to attach it can result in the credit not being processed.

- Claiming the credit without eligibility – Applicants sometimes assume they are eligible without thoroughly reading the criteria. If you received a real property tax exemption for your volunteer service, you cannot claim this credit.

- Dual role confusion – If you are an active volunteer for both a fire company/department and an ambulance company, you must choose one for qualifying information. Attempting to enter details for both can cause confusion and potential processing issues.

- Not using the original scannable form – The instructions specify that the original scannable form must be filed with the Tax Department. Photocopies or non-scannable forms may not be accepted.

- Overlooking the specific instructions for married filing separately – If both spouses qualify and choose to file separately, each must file an IT-245 form with their own IT-201 return. Couples sometimes overlook this, leading to only one spouse claiming the credit.

To ensure the smooth processing of the IT-245 form, participants should carefully read and follow the form’s instructions. It’s crucial to provide accurate and complete information about your volunteer service and to correctly calculate the credit amount. Double-checking eligibility criteria and filing status can prevent common mistakes. Lastly, always use the original scannable form and attach it to the correct tax return form to avoid delays or denial of the credit.

Documents used along the form

When filing the New York IT-245 form, which is a claim for Volunteer Firefighters’ and Ambulance Workers’ Credit, taxpayers may need to prepare and submit additional forms and documents to successfully claim their credit or to fulfill other related tax obligations. These additional documents ensure that all the required information is accurately captured and eligibility is correctly determined.

- Form IT-201: This is the Resident Income Tax Return form. It serves as the primary document for New York State residents when filing their yearly income taxes. The IT-245 form must be attached to it when claiming the Volunteer Firefighters’ and Ambulance Workers’ Credit.

- Form IT-201-ATT: This attachment to Form IT-201 includes a section for other tax credits, including the specific line 12 mentioned in the IT-245 form instructions. It helps in aggregating various tax credits that a filer may be eligible for.

- Form IT-2: This form summarizes W-2 information for filers. Since eligibility for the IT-245 credit might depend on specific income thresholds or tax obligations, having wage and withholding information readily available is necessary.

- Proof of Volunteer Service: Although not a standardized form, documentation proving active volunteer service as a firefighter or ambulance worker for the entire tax year is essential. This may include letters of acknowledgment or official volunteer logs.

- Real Property Tax Bills: As eligibility for the IT-245 credit is affected by whether the filer receives a real property tax exemption related to volunteer services, having current and past year property tax bills can provide necessary proof.

- Form IT-203: For filers who are not full-year residents but were residents for a part of the year and volunteered as a firefighter or ambulance worker, Form IT-203, the Nonresident and Part-Year Resident Income Tax Return form, may also be relevant, along with a pro-rated claim on a separate IT-245 form, if applicable.

- Form RP-466-c: This is the application form for the real property tax exemption for volunteer firefighters and ambulance workers. If a filer has applied for or received this exemption, it could impact their eligibility for the credit claimed on IT-245, necessitating a review of the application or the exemption decision.

The seamless integration of forms like IT-201 and IT-201-ATT with the specific IT-245 showcases the importance of understanding the interconnection between different tax documents. As taxpayers navigate through their tax obligations, having knowledge of and access to these additional forms ensures that they can rightly claim any credits due while also adhering to regulatory requirements.

Similar forms

The New York State Form IT-201, which is the Resident Income Tax Return, shares similarities with the IT-245 form primarily in its function as a key component for individuals filing their state tax returns. Just as the IT-245 form allows volunteers to claim specific credits, the IT-201 serves as the primary document for residents to report their annual income, calculate taxes owed, and identify eligibility for various deductions and credits. Both forms are necessary for accurately figuring and fulfilling state tax obligations, and the IT-245 form specifically requires attachment to the IT-201, highlighting their interconnected usage in the tax filing process.

Form IT-214, Claim for Real Property Tax Credit for Homeowners and Renters, is akin to the IT-245 in its purpose of providing tax relief to eligible New York State residents. While IT-245 offers a credit to volunteer firefighters and ambulance workers, IT-214 targets those who pay property taxes or rent on their primary residence. Both forms enable taxpayers to reduce their taxable income based on specific criteria met within the tax year, emphasizing New York State’s effort to provide financial incentives for various societal contributions and personal expenditures.

The New York State Form IT-216, Claim for Child and Dependent Care Credit, parallels the IT-245 form in that it caters to a specific group of taxpayers seeking to claim a tax credit for particular personal expenses. The IT-216 allows individuals to claim a credit for expenses related to child and dependent care, necessary for employment. Like the IT-245 form, which acknowledges the community service of volunteers, the IT-216 recognizes the economic contribution of working residents with dependents, offering them tax relief to mitigate some of the expenses incurred.

Similar to the IT-245, the New York State Form IT-215, Claim for Earned Income Credit, provides a tax benefit aimed at low-to-moderate-income working individuals and families. The primary goal of both forms is to offer financial relief: IT-245 by acknowledging volunteer services that benefit the community and IT-215 by supporting the economic stability of working residents. Each form identifies a specific segment of the population eligible for tax credits based on their contributions to society, whether through employment or volunteer service, underlining New York State’s comprehensive approach to tax incentives.

Form IT-272, Claim for College Tuition Credit or Itemized Deduction, shares a commonality with the IT-245 form in its targeted approach to tax credits. IT-272 allows taxpayers to claim a credit or deduction for qualified college tuition expenses paid for themselves, their spouse, or their dependents. This tax benefit, much like the one provided by IT-245 for volunteers, acknowledges the personal investment in education or community service by offering a financial incentive through the tax code. Both forms demonstrate New York State’s recognition of the value of personal contributions, whether to one's own education or to community safety and well-being.

Dos and Don'ts

Filling out the New York IT-245 form, which allows for the claim of a credit for volunteer firefighters and ambulance workers, requires careful attention to detail. To help ensure accuracy and compliance, here are several do's and don'ts to consider:

- Do ensure that you were a New York State resident for the entire tax year if you wish to claim this credit. Residency is a key criterion for eligibility.

- Do confirm your status as an active volunteer firefighter or ambulance worker for the whole tax year, without having received a real property tax exemption for these services. This credit is specifically designed for active volunteers.

- Do accurately enter all qualifying information, including the name of the volunteer fire company/department or ambulance company, as well as the address. This information is crucial for the processing of your claim.

- Don't proceed with the claim if you marked "No" to being a New York State resident for the tax year, being an active volunteer firefighter or ambulance worker for the whole year, or if you received a real property tax exemption for such services. These criteria disqualify you from claiming the credit.

- Don't guess or estimate details regarding your eligibility or the qualifying information. Ensure that all data entered on the form is accurate and verifiable.

- Don't forget to attach the completed IT-245 form to your IT-201 form when filing your state income tax return. This attachment is essential for your claim to be processed.

Adhering to these do's and don'ts will help streamline the process and avoid common pitfalls that could delay or impact the acceptance of your claim for the volunteer firefighters’ and ambulance workers’ credit.

Misconceptions

Understanding the New York IT-245 form—Claim for Volunteer Firefighters’ and Ambulance Workers’ Credit, can sometimes be challenging due to prevalent misconceptions. Here's a clear breakdown of some common misunderstandings:

- Residency Requirements: It's commonly misconceived that only those residing in New York City are eligible for this credit. However, the form specifies that full-year New York State residents qualify, expanding eligibility beyond the city to include the entire state.

- Active Volunteer Status: Another misunderstanding involves the definition of an "active volunteer." To be eligible, one must be engaged actively in duties for the entire tax year. It’s not limited to those responding to emergency calls but also includes participating in other required services and duties as defined by the volunteer organization.

- Filing Status Impact: There's confusion around how filing status affects eligibility. For married couples filing jointly, both spouses can qualify for the credit if both meet the criteria as active volunteers. This clarity eliminates the myth that only one spouse can benefit from the credit on a joint return.

- Real Property Tax Exemption Misunderstanding: Individuals often believe if they, or their spouse, have any real property tax exemption, they cannot claim this credit. The specific exclusion is for exemptions related to volunteer service under Real Property Tax Law. Other unrelated tax exemptions do not disqualify one from claiming the credit.

- Documentation Necessity: A common falsehood is the assumption that no verification from the volunteer organization is needed when filing Form IT-245. While the form itself does not request attached proof of service, maintaining documentation is crucial as the New York State Department of Taxation and Finance may request verification of eligibility at a later date.

Correcting these misunderstandings encourages eligible volunteers to take advantage of the tax benefits rightfully available to them, recognizing their essential service to the community.

Key takeaways

When completing the New York IT-245 form, it's crucial to know important details to ensure you correctly apply for the Volunteer Firefighters’ and Ambulance Workers’ Credit. Here are four key takeaways:

- Residency Requirement: To be eligible for this tax credit, you must have been a full-year resident of New York State for the tax year. If not, you do not qualify for this credit.

- Active Service Necessity: You must have been an active volunteer firefighter or ambulance worker throughout the entire tax year. Additionally, you should not have received a real property tax exemption for these services. This is crucial for eligibility.

- Credit Amount: The credit amount is determined by your status and filings. If either you or your spouse (if filing jointly) meet the eligibility criteria, you can claim $200. If both you and your spouse qualify, the credit amount doubles to $400.

- Proper Filing: Remember to attach Form IT-245 to your Form IT-201, Resident Income Tax Return. This step is necessary to claim the credit. If you are married but file separately, and both you and your spouse qualify for the credit, each must file a separate Form IT-245 with their tax return.

Ensuring these conditions are met and properly filling out and submitting the IT-245 form will help qualified New York State volunteers receive the financial credit they are eligible for. Always refer to the specific instructions on the form and consult with a tax professional if you have questions.

Common PDF Documents

Nys S Corp Minimum Tax - Designed to capture a corporation's full spectrum of activities, the CT-245 enables foreign businesses to comprehensively report their New York operations.

Nyc Retirement System - It serves as a declaration form for NYCERS employees, locking in their pension distribution preference and ensuring beneficiary protection.