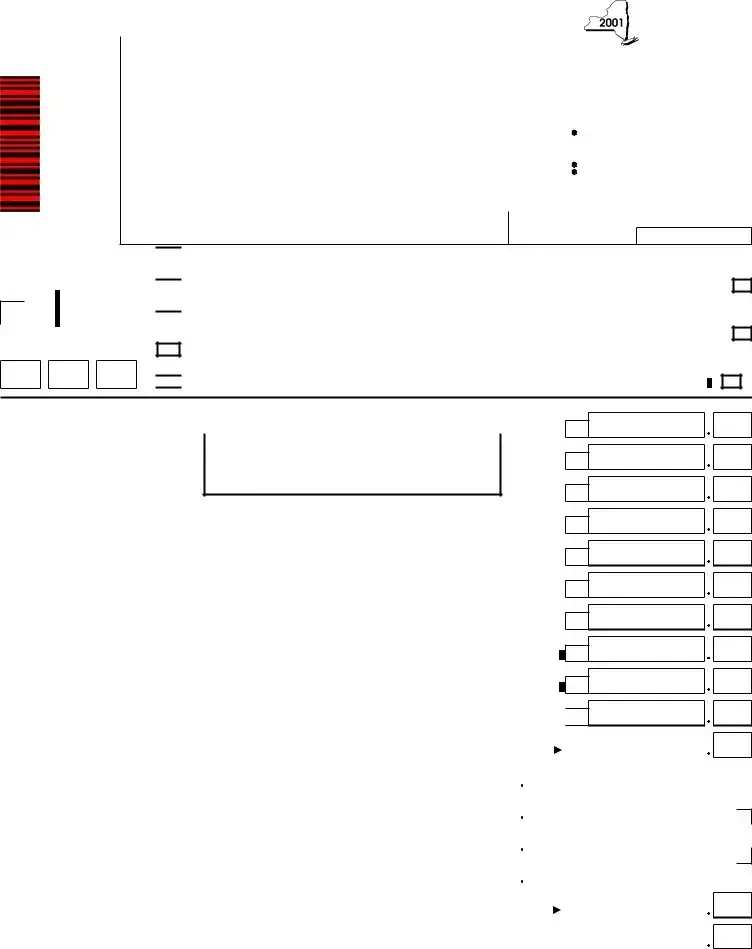

Free New York It 200 Form in PDF

The New York State Department of Taxation and Finance requires all full-year residents, not reporting specific types of income, to file the Resident Income Tax Return IT-200 form. This document is vital for many individuals residing within the state—including those in New York City and Yonkers—to accurately report wages, salaries, tips, and other forms of income such as taxable interest and dividends. Additionally, it addresses various deductions, tax credits like those for child and dependent care, and voluntary contributions to charitable causes. Notably, factors such as residency status, filing status, and eligibility to be claimed as a dependent on another's federal return significantly affect one’s tax obligations. Importantly, the form facilitates the process of calculating taxable income, determining the amount owed to the state or the potential refund due. It stands as an essential tool for ensuring compliance with state tax laws, offering a structured format for individuals to contribute their fair share towards the public services and amenities that enhance the quality of life in New York State.

New York It 200 Sample

For office use only

|

|

New York State Department of Taxation and Finance |

|

|

|

|

|||||

|

Resident Income Tax Return |

|

|||||||||

|

|

New York State • City of New York • City of Yonkers |

|

|

|||||||

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|||

typeor |

Important: You must enter your social security number(s) in the boxes to the right. |

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

Your first name and middle initial |

Your last name |

|

|

|

|

t Your social security number |

|||||

|

|

|

|

|

|||||||

printor |

|

|

|

|

|

|

|

|

|

|

|

Spouse’s first name and middle initial |

Spouse’s last name |

|

|

|

|

t Spouse’s social security number |

|||||

|

|

|

|

|

|||||||

label, |

|

|

|

|

|

|

|

|

|

|

|

Mailing address (number and street or rural route) |

|

|

Apartment number |

NY State county of residence |

|||||||

|

|

|

|||||||||

Attach |

|

|

|

|

|

|

|

|

|

|

|

City, village or post office |

|

State |

|

ZIP code |

|

School district name |

|||||

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

||

Permanent home address (see page 14 ) (number and street or rural route) |

Apartment number |

School district |

|

||||||||

|

|

|

|

|

|

|

|

|

|

code number |

|

|

|

|

|

|

|

|

|

|

|

|

|

City, village or post office |

State |

|

|

ZIP code |

If taxpayer is deceased, enter first name and date of death. |

||||||

NY

(A) Filing À

status — mark an Á

status — mark an Á  “X” in

“X” in

one box: Â

Ã

Ä

Single

Married filing joint return

(enter spouse’s social security number above)

Married filing separate return

(enter spouse’s social security number above)

Head of household (with qualifying person)

Qualifying widow(er) with dependent child

(B)Were you a city of New York resident for all of 2001?

must file Form |

|

Yes |

|

|

|

No |

|

|

|

|

(C)Can you be claimed as a dependent

on another taxpayer’s federal return? |

|

Yes |

|

|

|

No |

|

|

|

|

|||

|

|

|

(D)If you do not need forms mailed to you next

year, mark an “X” in the box (see instructions, page 8) .......

DollarsCents

1 |

Wages, salaries, tips, etc |

|

||

|

|

Reminder: Only |

|

|

2 |

Taxable interest income |

not reporting income such as IRA distributions, pensions/ |

.................. |

|

annuities, social security benefits, or capital gains may file |

||||

|

|

|

||

|

|

this form. All others, see page 5 of the instructions. |

|

|

3Ordinary dividends ....................................................................................................................................................

4Taxable refunds, credits, or offsets of state and local income taxes (also enter on line 12 below) ..............................

5Unemployment compensation ..................................................................................................................................

6Add lines 1 through 5 ................................................................................................................................................

7Individual retirement arrangement (IRA) deduction (see instructions, page 9) ............................................................

8Subtract line 7 from line 6. This is your federal adjusted gross income (see instructions, page 9) .........................

1

2

3

4

5

6

7

8

9 |

Public employee contributions (see instr., page 9) |

Identify: |

|

|

|

|

|

10 |

Flexible benefits program (IRC 125 amount) (see instr., page 9) |

Identify: |

|

9

10

10

|

Add lines 8, 9, and 10 |

|

|

|

|

|

|

|

|

|

|

|

11 |

|

|

|

|

|

|

11 |

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12 |

Taxable refunds, credits, or offsets of state and local income taxes from line 4 above |

|

12 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Interest income on U.S. government bonds (see instructions, page 9) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13 |

|

13 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

New York standard deduction (see instructions, page 9) |

|

|

|

|

0 |

0 |

|

|

|

|

|

14 |

|

14 |

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

15 |

Exemptions for dependents only (not the same as total federal exemptions; see instructions, page 10) |

|

15 |

0 0 0 |

|

0 |

0 |

|

2001 |

|||

|

|

|||||||||||

|

Add lines 12 through 15 (if line 16 is more than or equal to line 11, enter “0’’ on line 17 and skip to line 28) |

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|||||

16 |

|

|

|

16 |

|

|

||||||

|

Subtract line 16 from line 11. This is your taxable income (if $65,000 or more, stop; you must file Form |

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|||||

17 |

|

|

|

17 |

|

|

||||||

|

|

|

|

|

||||||||

011194 |

This is a scannable form; please file this original return with the Tax Department. |

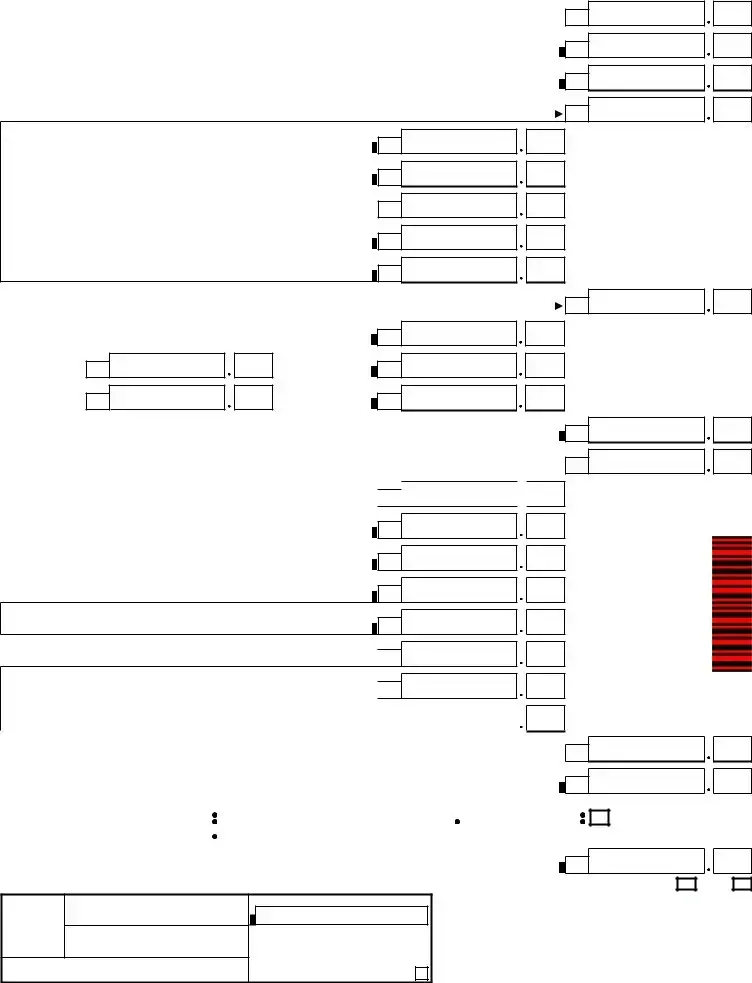

18Enter the amount from line 17 on the front page. This is your taxable income .....................................................

19New York State tax on line 18 amount (use the State Tax Table, violet pages 41 through 48 of the instructions) .................

20New York State household credit (from table I, II, or III; see instructions, page 10) .........................................................

18

19

20

21 Subtract line 20 from line 19 (if line 20 is more than line 19, leave blank). This is the total of your New York State taxes |

21 |

22 City of New York resident tax on line 18 amount. (use City Tax Table,

white pages 49 through 56 of the instructions) ...............................................

22

23 City of New York household credit (see instructions, page 11) .....................

24 Subtract line 23 from line 22 (if line 23 is more than line 22, leave blank) .......

25 City of Yonkers resident income tax surcharge (from Yonkers

Worksheet, page 11 of the instructions) ........................................................

23

24

25

•This is a scannable form; please file this original return with the Tax Department.

26 City of Yonkers nonresident earnings tax (attach Form

26

27 Add lines 24 through 26. This is the total of your city of New York and city of Yonkers taxes |

27 |

Voluntary gifts/contributions

(see instructions)

Return A Gift

to Wildlife  28

28

Olympic

Fund  29

29

00

00

Breast Cancer Research Fund

Missing/Exploited Children Fund

Alzheimer’s

Fund

30

31

32

00

00

00

33Add lines 28 through 32. This is your total voluntary gifts/contributions ..................................................................

34Add lines 21, 27, and 33 ..............................................................................................................................................

35New York State child and dependent care credit (from Form  35

35

36 |

New York State earned income credit (from Form |

36 |

37 |

Real property tax credit (from Form |

37 |

38 |

College tuition credit (from Form |

38 |

39 |

City of New York school tax credit (see instructions, page 12) |

39 |

40Total New York State tax withheld (staple wage and tax statements; see instr., page 12)  40

40

41Total city of New York tax withheld (staple wage and tax statements; see instr., page 13)  41

41

|

|

|

|

42 Total city of Yonkers tax withheld (staple wage and tax statements; see instr., page 13) |

|

42 |

|

|

|

33

34

•Staple your wage and tax statements to the bottom front of this return. See Step 7, page 15 of the instructions, for the proper assembly of your return and attachments.

0 0

43Add lines 35 through 42 ............................................................................................................................................

44If line 43 is more than line 34, subtract line 34 from line 43. This is the amount to be refunded to you ........

If you choose to have your refund sent directly to your bank account, complete a, b, and c below |

|

|||||

|

|

a Routing number |

|

b Type: |

|

Checking |

|

|

c Account number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

45 If line 43 is less than line 34, subtract line 43 from line 34. This is the amount you owe (do not send cash; make your check or money order payable to New York State Income Tax; write your social security number and 2001 income tax on it) ..

43

44

Savings

45

46 I authorize the Tax Department to discuss this return with the paid preparer listed below. (Mark the Yes or No box; see page 14.)  Yes

Yes

No

No

Preparer’s signature

Paid

preparer’s

use only Firm’s name (or yours, if

Address

tPreparer’s SSN or PTIN

•Employer identification number

|

|

|

|

|

|

Date |

Mark “X” if |

|

|

|

|

|

|

|

Sign |

Your signature |

|

|

|

|

|

|

your |

|

||

Spouse’s signature (if joint return) |

|||

return |

|

|

|

here |

|

|

|

Date |

Daytime phone number (optional) |

||

|

|

( |

) |

012194 |

Mail to: STATE PROCESSING CENTER, PO BOX 61000, ALBANY NY |

File Overview

| Fact | Detail |

|---|---|

| Form Title | New York State Resident Income Tax Return IT-200 |

| Applicable To | Full-year New York State residents not reporting specific types of income such as IRA distributions, pensions/annuities, social security benefits, or capital gains. |

| Key Sections | Income, Deductions, Taxable Income, Tax Computed, Household Credits, Contributions, Tax Credits, Total Taxes, and Refund or Amount Owed. |

| Filing Options | Single, Married filing jointly, Married filing separately, Head of household, and Qualifying widow(er) with dependent child. |

| Governing Laws | New York State Tax Law and Regulations |

New York It 200: Usage Guidelines

Starting the process of filing your tax return can be daunting, but by tackling it step-by-step, you can ensure that you correctly complete the New York State Resident Income Tax Return, also known as Form IT-200. This form is essential for residents who are filing their state taxes and do not need to report specific types of income like IRA distributions or social security benefits. By following the instructions provided below, you'll be well on your way to successfully filing your state tax return.

- Begin by attaching any payment (check or money order) you're making to the designated area at the top of the form.

- Enter your social security number, as well as your spouse's if filing jointly, in the boxes provided at the top right of the form.

- Fill in your first name, middle initial, and last name. Repeat this step for your spouse if applicable.

- Provide your mailing address, including apartment number if applicable, the NY State county of residence, and your school district name.

- If you have a different permanent home address, fill it in along with the corresponding school district code number.

- If the taxpayer is deceased, enter the first name and date of death.

- Select your filing status by marking an "X" in the appropriate box for single, married filing jointly, married filing separately, head of household, or qualifying widow(er) with dependent child.

- Answer whether you were a City of New York resident for all of the year.

- Indicate if you can be claimed as a dependent on another taxpayer’s federal return.

- If you do not need forms mailed to you next year, mark the "X" box.

- Report your income starting with wages, salaries, and tips, then taxable interest income, ordinary dividends, taxable refunds, credits, or offsets of state and local income taxes, and unemployment compensation.

- Add these amounts as instructed to calculate your federal adjusted gross income. Subtract individual retirement arrangement (IRA) deductions to find your adjusted income.

- Fill in contributions to public employee retirement plans and flexible benefits program amounts if applicable.

- Move to the back of the form to calculate your New York State tax, starting from the amount of taxable income carried from the front side. Use the appropriate state and city tax tables to calculate your taxes.

- Add in any New York State, City of New York, or City of Yonkers household credits you're eligible for.

- Calculate your total New York State, City of New York, and City of Yonkers taxes along with any voluntary contributions for specific funds like wildlife conservation, breast cancer research, etc.

- Fill in any applicable credits for child and dependent care, earned income credit, real property tax, college tuition, and New York or Yonkers school tax credits.

- Enter total New York State, City of New York, and City of Yonkers tax withheld from your wages.

- Total your payments and credits to find out if you owe additional tax or are due a refund. Fill in your bank account details if you opt for a direct deposit refund.

- Sign and date the form, including your spouse's signature if filing jointly. Fill in the preparer's information if someone else prepared your return.

- Staple any required wage and tax statements to the bottom front of the form as indicated.

- Finally, mail your completed IT-200 form along with any payment to the State Processing Center at the address given on the form.

By carefully following these steps and ensuring all information is accurate and complete, you will have successfully filled out the New York IT-200 form. Remember, accurate and thorough completion of all required sections is essential for the timely processing of your tax return. Should you have any questions or need clarification on specific parts of the form, consulting the instructions provided by the New York State Department of Taxation and Finance or seeking advice from a tax professional may be beneficial.

FAQ

What is the New York State IT-200 Form?

The New York State Resident Income Tax Return, IT-200, is a document required for full-year New York State residents to report their annual income for tax purposes. It encompasses various types of income, such as wages, salaries, and taxable interest, while also providing sections for deductions and credits specific to state residents. This form is utilized to calculate the amount of state tax owed or to determine the refund due to the taxpayer.

Who should file the IT-200 Form?

Full-year residents of New York State who do not report income sources like IRA distributions, pensions, social security benefits, or capital gains are eligible to file the IT-200 form. It is targeted at individuals or married couples who meet these criteria and wish to fulfill their state tax reporting obligations.

Are there residency requirements for filing the IT-200?

Yes, the IT-200 form is specifically designed for full-year residents of New York State. Those who reside in the state for the entirety of the tax year and do not possess income types that are excluded from this form’s filing requirements are deemed eligible. Part-year residents or those with more complex income situations are directed to other forms, such as the IT-201.

How does one’s filing status affect the IT-200 Form?

Your filing status determines the tax rates and standard deductions applicable to your return. You can file as Single, Married filing jointly, Married filing separately, Head of household, or Qualifying widow(er) with dependent child. Each status affects the calculation of your taxable income and the tax due, ensuring the tax responsibility reflects your personal circumstances.

What incomes are to be reported on the IT-200?

Income types such as wages, salaries, tips, taxable interest, ordinary dividends, taxable state and local income tax refunds, credits, or offsets, and unemployment compensation must be reported on the IT-200. These income streams represent the common categories of earnings for most full-year residents filing this form.

Can adjustments and deductions be made on the IT-200?

Yes, taxpayers can claim various adjustments and deductions on the IT-200, such as the Individual Retirement Arrangement (IRA) deduction and contributions to qualifying plans. Additionally, deductions for New York state taxes, the standard deduction, and exemptions for dependents are accounted for, potentially lowering the taxable income.

How does one report taxes and credits on the IT-200?

Taxes due are calculated by applying the appropriate tax rates to your taxable income, as detailed on the IT-200. State, NYC, and Yonkers residents may also be subject to city taxes. Various credits, including those for household, child and dependent care, earned income, and education, can reduce your overall tax liability. The form also enables reporting of voluntary contributions to funds such as wildlife conservation, breast cancer research, and others.

Common mistakes

Filling out the New York State Resident Income Tax Return IT-200 form can be a complex process, and it's common for individuals to make mistakes. Here are eight of the most common errors to avoid:

- Incorrect Social Security Numbers: A surprisingly frequent oversight involves entering wrong social security numbers for either the taxpayers or their spouse. This mistake can lead to processing delays.

- Filing Status Errors: Choosing the wrong filing status is another common misstep. This decision impacts tax liability and eligibility for certain credits, so choosing accurately between single, married filing jointly, married filing separately, head of household, or qualifying widow(er) with dependent child is crucial.

- Omitting Income: All sources of income, including wages, salaries, tips (line 1), taxable interest (line 2), and ordinary dividends (line 3), must be accurately reported. Forgetting or omitting income can lead to inaccurate tax calculations and potential penalties.

- Address and Residency Information: Errors in mailing addresses or in the NY State county of residence can affect where the return is processed and the applicability of certain local taxes.

- Inaccurate Deductions: Failing to correctly calculate deductions like the IRA deduction (line 7) or not understanding how to report specific credits and deductions, such as the New York State household credit (line 20), can lead to an incorrect tax liability.

- Calculation Mistakes: Simple mathematical errors in adding or subtracting the income and deduction lines are common but can significantly impact the final tax calculation.

- Incorrect Tax Calculation: Using the wrong figures from the State Tax Table to calculate New York State tax on line 19 or incorrectly determining the City of New York or City of Yonkers resident income tax can result in underpayment or overpayment of taxes.

- Signature Omission: Forgetting to sign the return at the bottom is a critical yet common mistake. A return isn’t considered filed until it's signed, which can delay processing and potentially result in late filing penalties.

When completing the IT-200 form, carefully reviewing instructions for each line can help avoid these errors. Taking time to double-check figures, reviewing the form for completeness, and ensuring accurate calculations can save taxpayers from unnecessary delays, audits, or penalties. Additionally, considering electronic filing options can reduce the likelihood of some of these errors, particularly those related to calculation mistakes and incorrect form submission..

Documents used along the form

When filing the New York State Department of Taxation and Finance Resident Income Tax Return IT-200, individuals often find that they need to include additional forms and documents to provide a complete financial picture for the tax year. These additional documents play crucial roles in determining the accuracy of the tax return and ensuring individuals receive any deductions, credits, or refunds for which they're eligible.

- Form IT-201: This form is used by part-year residents of New York. Individuals who moved to or from New York during the tax year need this form to correctly report their income for the portion of the year they were residents of the state.

- Form IT-215: Claim for Earned Income Credit. This form allows low- to moderate-income workers and families to claim the New York State Earned Income Tax Credit, potentially reducing their taxes owed or increasing their refund.

- Form IT-216: Claim for Child and Dependent Care Credit. This document is necessary for taxpayers who incurred expenses for the care of a child, dependent, or spouse to allow them to work or look for work.

- Form IT-214: Claim for Real Property Tax Credit. Homeowners and renters with low incomes can use this form to claim a credit for real property taxes or rent paid during the tax year.

- Form IT-272: Claim for College Tuition Credit or Itemized Deduction. This form is specific to individuals who paid college tuition expenses for themselves, their spouse, or their dependents and wish to claim a credit or deduction.

- Form Y-203: Yonkers Nonresident Earnings Tax Return. Required for individuals who worked in Yonkers but did not reside there, this form calculates the earnings tax owed to the city.

Each of these documents addresses different aspects of an individual's financial situation, from residency status to educational expenses, and helps ensure that they meet their tax obligations while maximizing eligible benefits. When preparing to file the IT-200 form, taxpayers should carefully review their financial records for the year to determine which, if any, of these additional forms are needed to complete their tax return accurately.

Similar forms

The Internal Revenue Service (IRS) Form 1040, "U.S. Individual Income Tax Return," is closely akin to the New York IT-200 form. Both documents are designed for individuals to report their annual income, apply deductions, and calculate the owed or refundable tax amounts. Each form requires detailed personal income information, including wages, salaries, dividends, and interest income, tailored to either federal (for Form 1040) or state (for IT-200) tax obligations. Additionally, both forms offer sections to claim various credits and deductions, reinforcing their role in guiding residents through their respective tax filing processes.

Form IT-201, "Resident Income Tax Return" for New York State part-year residents, shares several characteristics with the IT-200 form, primarily serving individuals to declare their income. Despite the IT-201 form catering to part-year or non-residents, both forms necessitate detailed income data, deductions, and tax credit information specific to New York State. This includes earnings from wages, taxable interest, and dividends, showcasing their utility in navigating state tax liabilities for differing resident statuses.

The California Resident Income Tax Return, Form 540, is another document with similarities to the IT-200 form. Tailored for California residents, Form 540 allows individuals to disclose their income, calculate taxes due to the state, and claim permissible deductions and credits, akin to the IT-200 form's function for New York State residents. Both forms are essential tools for state residents to fulfill their tax reporting duties, highlighting their income and applicable deductions to accurately determine state tax responsibilities.

New York City's Form 1127, "Nonresident Employees of the City of New York Hired on or after January 4, 1973," parallels the IT-200 form in catering to tax obligations related to a specific jurisdiction. Although Form 1127 is specifically for nonresident employees of New York City, like the IT-200, it requires detailed income information and tax calculations based on earnings. This demonstrates the tailored approach both forms take to accommodate the taxation requirements of individuals based on their working or residential status within New York.

The Yonkers Nonresident Earnings Tax Return, Form Y-203, shares a purpose with the IT-200 form by focusing on individuals' income earned within a specific geographic entity, in this case, the city of Yonkers. Like the IT-200 form, which includes sections relevant to both the City of New York and Yonkers, Form Y-203 is designed for nonresidents to report earnings generated in Yonkers. Both forms are integral parts of the regional tax landscape, reflecting the nuanced tax obligations individuals face depending on where they live or work within New York State.

Dos and Don'ts

When filling out the New York IT-200 form, it is essential to pay attention to detail and follow specific guidelines to ensure that the information provided is accurate and complete. Adhering to these dos and don'ts can help streamline the process and avoid common pitfalls:

- Do:

- Ensure all personal information is current and correct, including your social security number, address, and filing status.

- Double-check the social security numbers for both you and your spouse, if filing jointly, to prevent any processing delays.

- Itemize deductions accurately and ensure they are allowable for the state of New York.

- Attach all required documentation, such as W-2s or other income statements, securely to the form.

- Utilize the correct tax tables for calculating New York State, City of New York, or City of Yonkers taxes.

- Consider using direct deposit for refunds to expedite the process.

- Sign and date the form. If filing jointly, both spouses must sign.

- Review the entire form for errors or omissions before filing.

- Make a copy of the completed form and all attachments for your records.

- Mail the form to the correct address provided by the New York State Department of Taxation and Finance.

- Don't:

- Forget to enter your filing status or mark the incorrect box.

- Omit any income received during the tax year, as this could result in underreporting and penalties.

- Claim deductions or credits for which you are not eligible.

- Staple or attach your check or money order so securely that it damages the form.

- Ignore the specific instructions for city residents, particularly if you lived in New York City or Yonkers.

- Miss the deadline for filing, as this could lead to late filing fees and interest charges.

- Send cash through the mail with your return.

- Use the form to report income types that are not supported, such as IRA distributions, without reviewing the relevant instructions or using the correct form.

- Forget to include any voluntary contributions you wish to make to state funds.

- Neglect to review the options for direct bank account refunds, if you expect to receive one.

Misconceptions

One common misconception is that the IT-200 form is only for full-time New York State residents. While it's true that the form is designed for full-year residents, the critical distinction lies in the income types being reported. Specifically, full-year residents not reporting certain income types such as IRA distributions, pensions, or annuities can use this form. Hence, the suitability of the form depends more on the nature of your income than simply your residency status.

Another misunderstanding involves the belief that if your filing status changes during the year, you cannot use the IT-200 form. The form actually allows you to select from various filing statuses, accommodating different personal circumstances that might have occurred throughout the tax year, including changes in marital status or becoming a head of household.

There's also a misconception that you cannot file the IT-200 form if you owe taxes. The form provides clear instructions for calculating the amount you owe, if any, and includes a section for determining your New York State taxes, along with instructions for making a payment if necessary.

Many believe they cannot file the IT-200 form electronically and are required to mail in a physical copy. However, the form is scannable, and New York State encourages electronic filing, which is faster and often more secure than traditional paper filing.

A significant misunderstanding is that the IT-200 doesn’t allow for deductions or credits. In reality, the form has specific lines dedicated to deductions such as IRA deductions and a multitude of credits, including those for child and dependent care, earned income, and education.

Some residents mistakenly think they can’t file the IT-200 form if they didn’t earn income in New York State. While the form is primarily intended for reporting New York State income, it’s crucial to file it to account for your residency status and any possible credits or deductions for which you may be eligible, regardless of the state in which you earned your income.

Another false belief is that the form doesn’t accommodate voluntary contributions. Contrary to this belief, the IT-200 form includes a section for voluntary gifts and contributions to various funds, such as those supporting wildlife conservation or breast cancer research, enabling taxpayers to contribute to causes they care about directly through their tax return.

Lastly, there is a misconception that taxpayers over a certain age are exempt from filing the IT-200 form. Age does not exempt New York State residents from filing a tax return. All full-year residents, regardless of age, need to file a tax return if they meet the state’s income requirements, ensuring compliance and potentially benefiting from age-related tax credits.

Key takeaways

Filing the New York IT-200 form, the Resident Income Tax Return, is essential for residents to comply with state tax obligations. Here are seven key takeaways to ensure the process is smooth and accurate:

- Accurate Information: Always double-check social security numbers and personal details for you and your spouse, if applicable. Errors can delay processing.

- Filing Status: Choose the correct filing status, as it affects your tax rates and deductions. This includes options like Single, Married Filing Jointly, Married Filing Separately, Head of Household, and Qualifying Widow(er) with Dependent Child.

- Income Reporting: Include all wages, salaries, taxable interest, dividends, and other incomes. Ensure that any unemployment compensation is reported accurately.

- Deductions and Adjustments: Take note of available deductions such as the IRA deduction or contributions to flexible benefits programs, which can lower taxable income.

- New York Specific Credits: Residents may be eligible for New York State credits like the household credit, which can reduce tax liability. Ensure to check if you qualify for any specific city credits too, such as those for New York City or Yonkers.

- Attachments: Staple wage and tax statements to your return if you're claiming tax withheld. Incorrect or missing attachments can cause processing delays.

- E-filing Option: Consider e-filing for a faster and more secure submission. It reduces the risk of errors and speeds up the processing of refunds.

Before submitting, review your form carefully. Double-check the math and ensure that all required sections are complete. If you owe money, prepare a check or money order payable to New York State Income Tax and include your social security number and the tax year on it. If expecting a refund, you have the option to receive it directly in your bank account, which can expedite access to your funds.

Finally, remember that tax laws and forms can change. Always use the most current version of the IT-200 form and consult the New York State Department of Taxation and Finance's guidelines or a tax professional if you have questions or need clarification on specific points.

Common PDF Documents

Motion for Entry of Default Judgment - The form requires the claimant to specify the basis for the judgment, such as default by the defendant, a judge’s order, or trial among others.

Nyc Lease Renewal Form Pdf - The comprehensive design of the form allows for the detailed collection of data necessary for the DHCR to assess and address the complaint efficiently.

Nyc Summons Ticket - The form's stipulation for black ink ensures that entries are legible and permanent, minimizing discrepancies or misunderstandings.