Free New York It 2 Form in PDF

At the crossroads of personal finance and tax obligations lies a critical document for New York taxpayers: the Form IT-2. Issued by the New York State Department of Taxation and Finance, this form plays a pivotal role in the tax filing process, acting as a summary of an individual’s W-2 statements for income earned within New York State, New York City, and Yonkers. Designed with the dual purpose of simplification and accuracy in mind, the IT-2 form mandates that individuals attach it in its entirety—without detaching or separating any part—when filing their state income tax returns. Pertinent details such as the taxpayer and, if applicable, their spouse's first names, middle initials, and last names alongside their social security numbers are prominently featured at the outset to ensure clarity and identity verification. Additionally, this form comprehensively covers an array of income-related information, including wages, tips, other compensation, and various deductions such as dependent care benefits and allocations for nonqualified plans. The specificity extends to employer identification details, income tax withheld by the state and local authorities, and any applicable local wages and tips, thereby encapsulating a wide spectrum of income factors relevant to tax preparation. By centralizing this information, Form IT-2 not only streamlines the tax submission process but also aids in the precise calculation of tax liabilities, ensuring that taxpayers meet their obligations with seamless accuracy.

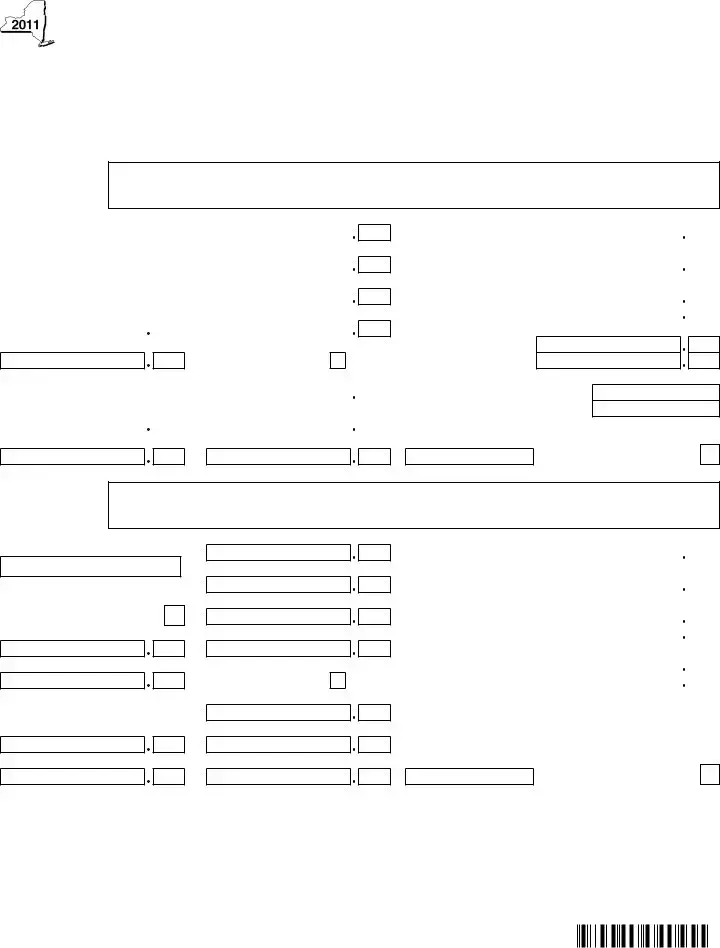

New York It 2 Sample

New York State Department of Taxation and Finance

Summary of

New York State • New York City • Yonkers

Do not detach or separate the

Taxpayer’s irst name and middle initial |

Taxpayer’s last name |

|

|

Your social security number |

|

|

|

|

|

Spouse’s irst name and middle initial |

Spouse’s last name |

|

|

Spouse’s social security number |

|

|

|

|

|

Box c Employer’s name and full address ( including ZIP code )

RECORD 1

|

|

|

|

|

|

|

|

|

Box 12a |

Amount |

Box b Employer identiication number ( EIN ) |

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Box 12b |

Amount |

This |

|

|

|

|

|

|

|

|

||

( MARK AN X IN ONE BOX ): |

|

|

|

|

|

|

Box 12c |

Amount |

||

Taxpayer |

|

|

Spouse |

|

|

|

||||

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

||||

Box 1 Wages, tips, other compensation |

Box 12d |

Amount |

||||||||

|

|

|

|

|

|

|

|

|

|

|

Code |

Box 15 State Box 16 State wages, tips, etc. ( for NYS ) |

|||||||

|

|

|

|

|

|

|

|

|

Code |

|

|

|

Box 17 New York State income tax withheld |

||||

|

|

|

|

|

|

|

|

|

Code |

|

|

|

Box 18 |

Local wages, tips, etc. ( SEE INSTR. ) |

|||

|

|

|

Locality a |

|

|

|

|

|

Code |

|

Locality b |

|

|

|

|

||

|

|

|

|

|

Box 19 |

Local income tax withheld |

|

|

Box 8 Allocated tips

Box 13 Statutory employee

Box 14 a Amount

|

Locality a |

|

Locality b |

Description |

Box 20 Locality name |

|

|

|

|

|

|

|

|

|

|

Locality a |

Box 10 |

Dependent care beneits |

|

|

|

Box 14 b Amount |

Description |

Locality b |

|||

|

|

|

|

|

|

|

|

|

|

|

Box 11 |

Nonqualiied plans |

|

|

|

Box 14 c Amount |

Description |

|

|||

Do not detach.

RECORD 2

Corrected (

Box c Employer’s name and full address ( including ZIP code )

Box b Employer identiication number ( EIN )

This

( MARK AN X IN ONE BOX ):

Taxpayer |

|

Spouse |

|

|

|

Box 1 Wages, tips, other compensation

Box 8 Allocated tips

Box 10 Dependent care beneits

Box 12a Amount

Box 12b Amount

Box 12c Amount

Box 12d Amount

Box 13 Statutory employee Box 14 a Amount

Box 14 b Amount

Code |

Box 15 State |

Box 16 |

State wages, tips, etc. ( for NYS ) |

|||||||

|

|

|

|

|

|

|

|

|

|

|

Code |

|

|

|

|

Box 17 New York State income tax withheld |

|||||

|

|

|

|

|

|

|

|

|

|

|

Code |

|

|

|

|

Box 18 |

Local wages, tips, etc. ( SEE INSTR. ) |

||||

|

|

|

Locality a |

|

|

|

|

|

||

Code |

|

Locality b |

|

|

|

|

|

|||

|

|

|

|

|

|

Box 19 |

Local income tax withheld |

|

|

|

|

|

|

Locality a |

|

|

|

|

|

||

|

|

|

Locality b |

|

|

|

|

|

||

Description |

|

|

Box 20 Locality name |

|||||||

|

|

|

|

|

|

Locality a |

|

|||

Description |

Locality b |

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

Box 11 Nonqualiied plans |

Box 14 c Amount |

Description |

Corrected (

1021110094

Please ile this original scannable form with the Tax Department.

File Overview

| Fact Number | Fact Details |

|---|---|

| 1 | The form IT-2 is issued by the New York State Department of Taxation and Finance. |

| 2 | It serves as a summary of W-2 Statements for New York State, New York City, and Yonkers. |

| 3 | Filers should not detach or separate the W-2 records provided below the form. |

| 4 | The form collects taxpayer and spouse's names, social security numbers, and employment income details. |

| 5 | Detailed information required includes the employer’s name, address, Employer Identification Number (EIN), wages, tips, other compensations, and taxes withheld. |

| 6 | Specific boxes are designated to report state and local wages, tips, and taxes withheld for both the taxpayer and the spouse. |

| 7 | Governing laws for the IT-2 form include New York State Tax Law and administrative regulations relating to income reporting and taxation. |

| 8 | The original, scannable form IT-2 must be filed with the New York State Tax Department. It should be submitted as a whole page. |

New York It 2: Usage Guidelines

Filing out the New York IT-2 form is a critical step for many taxpayers, serving as a way to summarize W-2 information for the New York State Department of Taxation and Finance. This is required for those who have received wages, tips, or other compensation that are reportable on their state income tax return. The form helps in organizing data from W-2 statements for New York State, New York City, and Yonkers taxes. Knowing how to correctly fill out this form is essential to ensure accuracy in tax reporting and to avoid potential issues with tax returns.

- Start by writing the taxpayer's first name, middle initial, and last name in the designated area at the top of the form.

- Enter the taxpayer's Social Security Number in the field labeled "Your social security number."

- If applicable, fill in the spouse’s first name, middle initial, and last land if they have received any wages, tips, or other compensation relevant to the form.

- Enter the spouse’s Social Security Number next to their name.

- For each W-2 record, identify the employer by writing the employer's name and full address, including the ZIP code, in Box c.

- Provide the Employer Identification Number (EIN) in Box b directly below the employer's address.

- Choose who the W-2 record is for—taxpayer or spouse—by marking an X in the appropriate box.

- Enter the amount from Box 1 (wages, tips, other compensation) from the W-2 statement.

- If there are amounts in Box 12a, 12b, 12c, and 12d on the W-2, record these amounts and the corresponding codes in the spaces provided.

- Fill in the state, represented by a code in Box 15, followed by state wages, tips, etc., for New York State (NYS) in Box 16.

- Enter the amount of New York State income tax withheld, which is found in Box 17 on the W-2.

- If local wages and tips are reported on the W-2, input these in Box 18, identifying the locality a and locality b if applicable, along with the corresponding local income tax withheld in Box 19.

- For any allocated tips, dependent care benefits, nonqualified plans, or other information that may appear in Boxes 8, 10, 11, 13, and 14 on the W-2, enter these amounts and descriptions in the designated spots on the IT-2 form.

- Specify the locality name(s) in Box 20 for where the local income taxes apply.

- If you have a second employer or W-2 record, repeat the steps for W-2 Record 2, ensuring all applicable information is correctly transferred onto the IT-2 form.

- Review the entire form for completeness and accuracy before filing. Ensure no sections have been missed and that all entries match the information provided on your W-2 forms.

After you have fully completed the IT-2 form with the necessary information from your W-2s, it is important to file this form as part of your New York State tax return. This summary of your W-2 statements plays a crucial role in the tax calculation process, helping ensure that you are credited with the correct amount of income and that the proper amount of tax is applied according to New York State, New York City, and Yonkers regulations.

FAQ

What is the purpose of the New York IT-2 form?

The New York IT-2 form serves as a summary of an individual's W-2 statements, specifically for income earned in New York State, New York City, and Yonkers. It is designed to consolidate information from an individual's or their spouse's W-2 forms, including wages, tips, other compensation, and tax withholdings. This form facilitates the accurate reporting of state and local income and withholdings to the New York State Department of Taxation and Finance, ensuring that taxpayers receive appropriate credits and deductions during the state tax return filing process.

Who needs to file Form IT-2?

Residents, part-year residents, and nonresidents of New York State who receive a W-2 form with New York State, New York City, or Yonkers tax withholdings are required to file Form IT-2. It is a mandatory form for individuals who are reporting wage and withholding information on their New York State income tax return and have received W-2 forms. This includes both employees and their spouses, if applicable, whose income details are necessary for accurately completing their state tax returns.

How is the Information on Form IT-2 organized?

Form IT-2 is structured to capture and summarize key financial details from an individual's or spouse's W-2 forms. Key sections include:

- Personal Information: Names and social security numbers of the taxpayer and spouse, if applicable.

- Employer Details: Employer's name, address, and Employer Identification Number (EIN).

- Income and Tax Withheld: Details of wages, tips, and other compensation, as well as federal, state, and local tax withholdings.

- Deductions and Benefits: Information regarding nonqualified plans, dependent care benefits, and other relevant financial data.

Can Form IT-2 be detached or separated?

No, Form IT-2 should not be detached or separated. The New York State Department of Taxation and Finance requires that the form be filed as an entire page to ensure that all information remains intact and is processed correctly. Taxpayers should submit this original, scannable form along with their New York State income tax return, keeping it in its full and original format.

What happens if a mistake is made on Form IT-2?

If an individual discovers a mistake on Form IT-2 after submission, they should file a corrected form, known as W-2c, to amend the inaccuracies. The corrected details should accurately reflect the individual's or spouse's income and withholding information as per the corrected W-2 forms provided by the employer. It is important to rectify any errors promptly to ensure that the New York State tax filing accurately reflects the correct amounts of income and taxes withheld.

Where can one find more instructions on filling out the IT-2 form?

Instructions for completing Form IT-2 are typically found on the back of the form and also available on the New New York State Department of Taxation and Finance's website. These instructions provide detailed guidance on how to accurately report W-2 information, including specific codes and descriptions for various boxes on the form. Additionally, taxpayers can contact the department directly for assistance or consult with a tax professional to ensure accurate completion and submission of the form.

Common mistakes

Filling out the New York State IT-2 form, which summarizes W-2 statements for state, New York City, and Yonkers taxes, can be tricky. A few common mistakes often occur during the process, leading to delays or errors in tax processing. Understanding these pitfalls can help ensure that the form is completed accurately and efficiently.

One frequently encountered mistake is not including social security numbers for both the taxpayer and the spouse, if applicable. The IT-2 form requires clear identification of filers, and missing or incorrect social security numbers can lead to processing delays or misfiled documents.

Another common error is incorrectly reporting wages, tips, and other compensation. Often, filers overlook the detailed breakdown required in Box 1 for state wages versus local wages, especially when they differ from federal wages due to specific tax treatments or deductions in New York State, New York City, or Yonkers.

- Not marking the correct status box for whom the W-2 record is intended, leading to confusion whether it's for the taxpayer or the spouse. This mistake can cause significant issues if earnings are attributed to the wrong person.

- Entering incorrect employer identification numbers (EINs) or omitting them altogether. Since the EIN is crucial for identifying the taxpayer's place of employment, this oversight can affect the accuracy of tax records.

- Misreporting amounts in Box 12 for various benefits and additional compensation types, such as nonqualified plans or dependent care benefits. Accurate reporting in these boxes is critical for proper tax calculation.

- Failing to report New York State and local income tax withheld accurately in Boxes 17 and 19. Accurate withholding amounts are essential to ensure that taxpayers receive the correct refund or bill.

- Omitting or misidentifying locality names and codes in Boxes 18 and 20, especially for filers who live or work in multiple localities. This information is vital for accurately allocating local taxes.

In addition to these specific mistakes, a general oversight is not reviewing the entire form for completeness and accuracy before submission. This includes ensuring that all necessary boxes and sections are filled out and that the information matches the official W-2 forms provided by employers.

- Double-check social security numbers and employer identification numbers for accuracy.

- Ensure that all income and tax withheld sections reflect the correct amounts as reported by employers.

- Review the form for any sections that may not apply and mark them accordingly to avoid confusion.

- Review the form thoroughly before submitting it to the New York State Department of Taxation and Finance, ensuring that all sections are complete and accurate.

Documents used along the form

When filing taxes in New York, the IT-2 form serves as a crucial document for summarizing W-2 information. However, to complete your tax return accurately, you might need several other forms or documents. These include forms that report different types of income, deductions, and credits, ensuring that the tax return is comprehensive and complies with New York State tax laws.

- Form IT-201: This is the Resident Income Tax Return form which is essential for most New York State taxpayers. It collects general income information, calculates the tax due, and allows for the inclusion of various credits and deductions. Form IT-201 is where you'd summarize and transfer information from the IT-2 form.

- Form IT-203: Non-residents and part-year residents of New York use this form to file their taxes. Similar to IT-201, but tailored for those who earned income in New York State without residing there for the entire year. It considers income sources both inside and outside New York State for the applicable period.

- Form IT-1099-R: If you received distributions from pensions, annuities, retirement or profit-sharing plans, IRAs, or insurance contracts, this form is necessary. It summarizes these distributions, which must be reported as part of your income.

- Form IT-215: This form is for claiming the Earned Income Credit, a beneficial tax credit for low to moderate-income working individuals and families, particularly those with children. The credit amount depends on the taxpayer's income and family size.

- Form IT-225: The New York State Modifications form is used to detail any additions and subtractions to your federal adjusted gross income, as not all federal income and deductions are treated the same by New York State. This form ensures that your state tax liability reflects these adjustments.

Together with the IT-2 form, these documents provide a thorough representation of an individual's tax situation. Understanding and accurately completing these forms is crucial for compliance with New York State tax obligations and for maximizing potential benefits through credits and deductions. For best practices, individuals may consult with a tax professional to ensure that all information is correctly reported and that they are taking advantage of all applicable tax benefits.

Similar forms

The Form IT-2, as used in New York, closely resembles the federal W-2 form, primarily serving as a summary of an individual’s W-2 statements. Similar to the W-2 form, the IT-2 captures essential information such as wages, tips, other compensation, and tax withholdings, including both federal and state levels. The W-2 form, issued by employers, is crucial for reporting an employee’s annual wages and the amount of taxes withheld from their paycheck. The IT-2 form, by summarizing this information, specifically for New York State, New York City, and Yonkers, mirrors the W-2's functionality by facilitating state and local tax filing processes, thus acting as a bridge between individual income records and state tax obligations.

Another document similar to the IT-2 form is the 1099 form, specifically the 1099-MISC, which reports miscellaneous income. Both forms are integral to tax reporting and filing, though they serve different types of income and recipients. While the IT-2 summarizes W-2 information for salaried or waged employees, the 1099-MISC is used to report payments made to independent contractors and others for services rendered outside of traditional employment. Despite these differences, both forms handle the reporting of income and tax withholdings to the IRS and state tax departments, ensuring that earners meet their tax liabilities accurately.

The IT-201 form, accounting for New York State residents’ income taxes, shares a functional similarity with the IT-2. Both forms are pivotal to the New York State tax filing process, with the IT-201 being the primary income tax return form for residents. The IT-2 complements the IT-201 by providing detailed W-2 information, including income and withholdings, which is necessary for accurately completing the IT-201. This relationship ensures that taxpayers present a comprehensive account of their yearly earnings and taxes withheld, allowing for accurate state income tax calculation and filing.

Lastly, the IT-203 form, used by non-residents or part-year residents of New York State to file income taxes, parallels the IT-2 in its role within the state's tax ecosystem. While the IT-203 caters to a different population, the requirement and utilization of W-2 information, as summarized by the IT-2, remains constant. Both forms play crucial roles in ensuring that individuals accurately report their income and pay the appropriate amount of taxes, whether they are full-year residents, non-residents, or part-year residents of New York State. Like the IT-2, the IT-203 relies on detailed employment income information, underscoring the importance of accurate W-2 records in the broader tax filing process.

Dos and Don'ts

When filling out the New York IT-2 form, there are specific guidelines that help ensure accuracy and compliance with the state's Department of Taxation and Finance requirements. Here are four important dos and don'ts to keep in mind:

Do:

- Review each section thoroughly before inputting information to ensure that all the data matches the information on your W-2 forms.

- Use black ink if filling out the form by hand, as it is required for the form to be read by scanning equipment.

- Make sure the social security numbers for both the taxpayer and spouse (if applicable) are correctly entered and clearly written to avoid processing delays.

- File Form IT-2 as an entire page without detaching or separating the W-2 Records below, as per the instructions on the form.

Don't:

- Do not omit any relevant details from boxes 1, 10, 11, 12 (a, b, c, d with codes), and 14 (a, b, c with descriptions) for each W-2 record, as these fields are crucial for accurate tax calculation.

- Avoid making corrections directly on the form with correction fluid or tape; instead, obtain a new form if mistakes are made.

- Do not guess information; if you are unsure about specific details, refer to your W-2 form or consult with a tax professional for guidance.

- Do not detach the W-2 Records from the main IT-2 form, as this may lead to processing errors or even the loss of important tax information.

Misconceptions

When it comes to the New York IT-2 form, misconceptions abound. These misunderstandings can lead to errors in filing, potentially causing delays in processing or issues with tax returns. Here's a guide to clarifying some of the most common misconceptions.

It's only for New York City residents: The IT-2 form is not exclusively for New York City residents. It summarizes W-2 information for state tax purposes and is relevant for anyone filing a New York State, New York City, or Yonkers tax return. Therefore, if you're a resident or have earned income in these areas, you might need to submit an IT-2 form.

You must attach your W-2 forms: Although the IT-2 form requires information from your W-2 forms, you shouldn't physically attach the W-2s to it. The IT-2 serves as a summary, and the instruction to not detach or separate W-2 records refers to the segments of the IT-2 form itself. Your original W-2 should go elsewhere as directed in your tax filing instructions.

The form is optional: Some may think that because the IT-2 form is a summary, it's optional. However, if you have received a W-2 form and you are filing a New York State tax return, the IT-2 form is mandatory. It plays a crucial role in documenting your taxable income and withholdings for the state.

Information for spouse is not required if filing separately: Even if you're filing separately, the IT-2 form has designated spots for both taxpayer and spouse information. This is because the state requires a comprehensive view of household income and tax withholdings. Thus, if applicable, you must provide your spouse's details as outlined on the form.

EINs and SSNs are interchangeable: On the IT-2 form, both employer identification numbers (EINs) and social security numbers (SSNs) are requested in specific boxes. It's a critical mistake to confuse the two. EINs are used for employers, while SSNs are for individual identification. Each serves a distinct purpose and cannot be substituted for the other on the form.

All boxes must be filled: While it's important to provide complete information, not all boxes on the IT-2 form will apply to every filer. For instance, allocated tips, dependent care benefits, and nonqualified plans are specific to certain employment situations. If these don't apply to you, leaving them blank is acceptable and won't affect the validity of your filing.

Understanding these nuances about the New York IT-2 form not only makes the tax filing process smoother but also helps ensure you're complying with state tax laws. Remember that accurate and complete filing is crucial to avoid unnecessary complications with your tax return.

Key takeaways

When dealing with the New York IT-2 form, it's important to understand its purpose and how to properly complete it. This form, issued by the New York State Department of Taxation and Finance, serves as a summary of W-2 statements for filing state, New York City, and Yonkers taxes. Here are six key takeaways to ensure accuracy and compliance:

- The IT-2 form must be filed as an entire page without detaching or separating any sections. This requirement helps in maintaining the integrity of the taxpayer's wage and tax information.

- It is necessary to fill out personal and employer information completely, including names, social security numbers, employer identification numbers (EIN), and addresses. Accuracy in these details is crucial for proper tax record maintenance and verification.

- For each W-2 record, selecting the correct beneficiary—whether for the taxpayer or spouse—is essential when recording wages, taxes withheld, and other compensation. This aids in accurate tax calculation and ensures that earnings and withholdings are attributed correctly.

- Details such as wages, tips, other compensation, state and local wages, allocated tips, dependent care benefits, and nonqualified plans must be meticulously recorded. This comprehensive breakdown helps in the detailed analysis of taxable income and applicable deductions.

- Tax withheld sections, including New York State income tax, local income tax, and any other specified withholdings, must be filled out based on the W-2 statements. Proper reporting of taxes withheld is vital for calculating the correct amount of tax due or refund owed.

- If any corrections to the W-2 information are needed after submission, a corrected W-2c form must be used. This process ensures that the revised information is accurately captured and processed by the Tax Department.

In summary, completing the IT-2 form with precision and attention to detail ensures compliance with New York State's tax requirements. It serves as a critical component of the state tax filing process, helping both taxpayers and tax professionals navigate the often complex landscape of tax documentation.

Common PDF Documents

Nys 100 - The NYS-100 is designed to identify if an employer has taken over a previous business, which is crucial for determining unemployment insurance liabilities.

Nyc Food Service Establishment Permit - This document serves as a critical checkpoint, ensuring that applicants meet the legal and ethical standards expected of New York State food service workers.

Unincorporated Business Tax - Business tax credit computation instructions are included for eligible entities.