Free New York Et 133 Form in PDF

In the midst of the challenging terrain of estate settlement and inheritance proceedings, numerous forms and legal documents come into play, each with its own crucial role in ensuring the process unfolds smoothly and lawfully. Among these critical documents is the New York Et 133 form, an essential piece of paperwork specifically designed to facilitate the timely release and transfer of funds held in bank accounts of deceased individuals to their rightful heirs or estate executors. Acting as a conduit between the financial institutions holding the deceased's assets and the beneficiaries awaiting their inheritance, this form serves a pivotal role in the intricate web of estate administration. Not only does it streamline the process by providing a standardized template for requests, but it also ensures compliance with state regulations, safeguarding all parties involved from potential legal pitfalls. As estates vary in complexity and size, the importance of correctly understanding and filling out the New York Et 133 form cannot be overstated, making it a focal point for executors and heirs navigating the complexities of estate resolution.

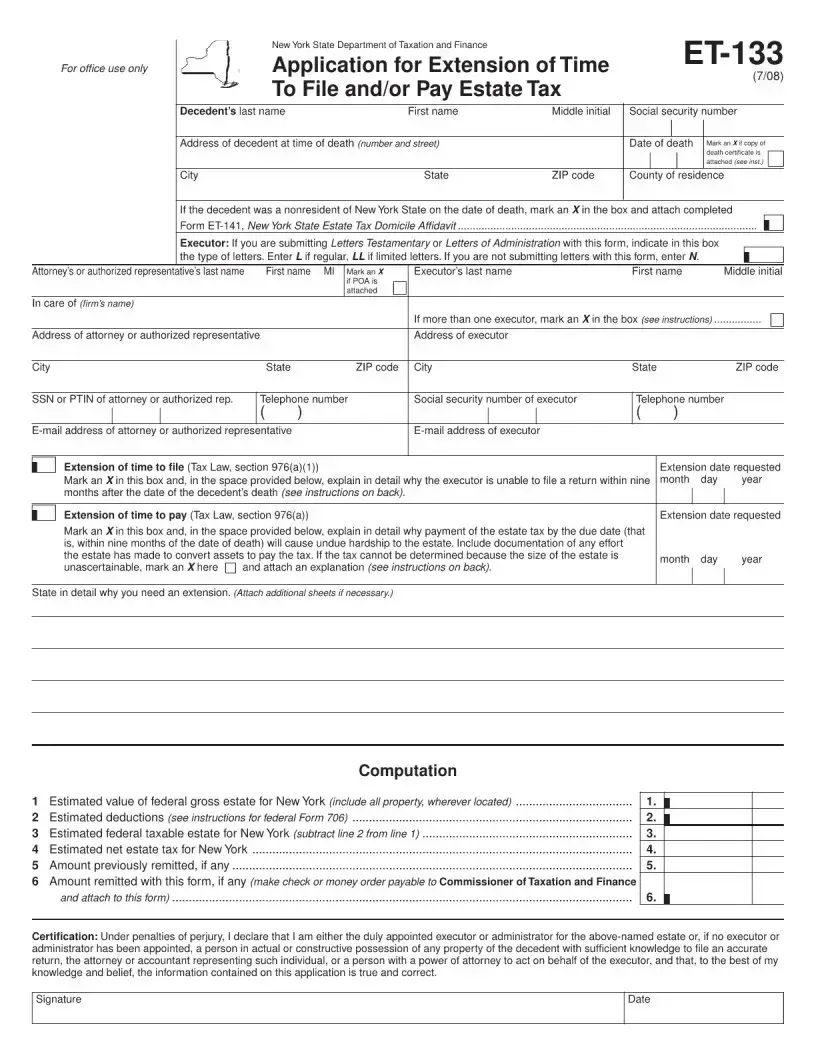

New York Et 133 Sample

File Overview

| Fact | Details |

|---|---|

| Name of Form | New York ET-133 |

| Purpose | Request for an extension of time to file an estate tax return |

| Applicable Law | New York State Estate Tax Law |

| Who Must File | Executors or administrators of estates in New York requiring more time to file an estate tax return |

| Time Extension Granted | Up to six months from the original due date |

| How to File | It must be completed and mailed to the New York State Department of Taxation and Finance |

New York Et 133: Usage Guidelines

After a loved one passes away, handling the estate can be a complex process. This involves not only understanding the wishes of the departed but also complying with legal requirements. One such step in New York is filling out the ET-133 form, which is necessary for moving forward in the estate settlement process. It's important to fill out this form accurately to avoid any potential complications. The following steps will guide you through the process of completing the ET-133 form correctly.

- Start by gathering the necessary information about the deceased, including their full legal name, date of death, and Social Security number.

- Obtain the exact legal name of the estate or trust that is involved, as it should be listed on all documentation.

- Identify the name and address of the estate’s representative. This person will be the main point of contact for any matters related to the estate.

- Prepare to list all the assets held by the estate. This includes bank accounts, real estate, stocks, and any other investments. The value of these assets as of the date of death will need to be accurately reported.

- Find the section of the form dedicated to liabilities and expenses. Here, you'll report any debts and expenses the estate is responsible for, such as funeral costs, outstanding loans, and legal fees.

- Calculate the gross estate value by adding together all the assets. Then, subtract the liabilities and expenses to determine the net estate value.

- Fill in the date the form is being completed and the city or town in New York where it is being filed.

- Ensure the estate’s representative signs the form, as their signature is a certification that the information provided is accurate and complete to the best of their knowledge.

- After the form is fully completed and signed, review it one last time for accuracy. Missing or incorrect information can cause delays.

- Submit the form to the appropriate New York State office, along with any required filing fees or additional documentation as specified in the form's instructions.

Once you've carefully completed and submitted the ET-133 form, you'll have taken another step towards resolving the estate's affairs. It’s important to keep a copy of the submitted form and any correspondence from the state office for your records. Should any issues arise or additional information be needed, being organized can greatly simplify the process. Remember, handling an estate is a significant responsibility, and attention to detail can help ensure everything proceeds as smoothly as possible.

FAQ

-

What is the New York ET-133 form?

The New York ET-133 form, also known as the "Application for Extension of Time to File an Estate Tax Return," is used by estate representatives in New York State to request additional time to file the required estate tax return. This extension allows those responsible for administering an estate to gather necessary information and documents to accurately complete the tax return.

-

Who needs to file the ET-133 form?

This form is specifically designed for the executors or administrators of estates in New York State. If these individuals find that they cannot file the estate tax return by the original due date, they must submit the ET-133 form to request an extension of time for filing.

-

When is the ET-133 form due?

The ET-133 form must be filed before the original due date of the estate tax return. Generally, estate tax returns are due nine months after the decedent’s date of death. Therefore, to avoid penalties, it is crucial to submit the ET-133 before this nine-month period ends.

-

How long is the extension granted with the ET-133 form?

When approved, the ET-133 form typically grants a six-month extension beyond the original nine-month filing deadline. However, it is important to verify the specific terms of the extension upon approval, as circumstances may affect the length of the extension.

-

What information is required to complete the ET-133 form?

- Filer's name and address

- The decedent's name and date of death

- The estate's file number, if available

- A detailed reason for requesting the extension

- Signature of the executor or administrator

-

Can the ET-133 form be filed electronically?

Yes, in most cases, the ET-133 form can be submitted electronically through the New York State Department of Taxation and Finance website. Electronic filing is encouraged as it expedites processing time and confirmation of the extension request.

-

Is there a fee to file the ET-133 form?

No, there is no fee associated with filing the ET-133 form for an extension of time to file an estate tax return in New York State.

-

What happens if the extension is not granted?

If the extension request is not approved, the executor or administrator will be expected to file the estate tax return by the original due date to avoid late filing penalties. It is crucial to provide a valid reason for needing an extension to increase the likelihood of approval.

-

Where can additional information about the ET-133 form be found?

For more details or specific questions about the ET-133 form and the estate tax return filing process, individuals should visit the New York State Department of Taxation and Finance website or contact them directly. This can provide the most current information and guidance regarding estate tax filings in New York State.

Common mistakes

Filling out governmental forms can be a daunting process. The New York ET-133 form, used for estate tax waivers, is no exception. Many individuals, in their quest to navigate these waters, may find themselves making common errors. Recognizing and avoiding these mistakes can help ensure a smoother process for all involved.

- Incorrect personal information: One of the most straightforward but often overlooked mistakes is entering incorrect personal information. Names, addresses, and social security numbers must match official documents exactly. Any discrepancy can lead to delays or the rejection of the form.

- Not double-checking the tax identification number: The tax identification number is crucial for the process, yet it's common for people to transpose digits or enter them incorrectly. This error can significantly slow down the processing of the form.

- Omitting necessary attachments: The ET-133 form requires specific attachments for processing. Failing to include these documents can stall the process. It's essential to review the requirements carefully and ensure all necessary paperwork is attached.

- Ignoring the estate’s size: The applicability of the ET-133 form depends, in part, on the size of the estate. Misunderstanding these criteria can result in the unnecessary submission of the form or the omission of a required filing.

- Using outdated forms: Government forms are updated periodically. Using an outdated version of the ET-133 form can invalidate the submission. Always check the New York State Department of Taxation and Finance website for the most current version.

- Illegible handwriting: While filling out the form by hand, it's crucial to write clearly and legibly. Illegible handwriting can lead to misinterpretation of the information, causing delays or errors in processing.

- Failing to sign and date: An unsigned or undated form is considered incomplete and can't be processed. This oversight is a common reason forms are returned to applicants.

- Incorrectly calculating tax liabilities: Errors in calculating tax liabilities can lead to incorrect filings. It's essential to double-check these calculations or seek professional advice to ensure accuracy.

- Sending the form to the wrong office: Finally, sending the ET-133 form to the incorrect office or mailing address can lead to significant delays. Always verify the correct submission address before mailing the form.

by avoiding these common pitfalls, individuals can navigate the complexities of the ET-133 form with greater confidence and efficiency. Each detail, no matter how small it may seem, plays a critical role in the successful processing of estate tax waivers. Double-checking information, staying updated on form versions, and attention to clarity can make a significant difference in achieving a timely and favorable outcome.

Documents used along the form

The New York ET-133 form is one integral piece in the process of managing estate affairs in the state of New York, particularly related to estate tax clearance. In conjunction with this key document, several other forms and documents are often required to ensure thorough and compliant management of an estate's tax responsibilities. These additional documents help provide a comprehensive overview of the estate's financial status, designate beneficiaries, and detail the assets and liabilities of the deceased.

- ET-30 (Application for Release(s) of Estate Tax Lien): This form is necessary for estates that need to release a New York State estate tax lien on real property or certain other assets.

- ET-85 (Affidavit for Transfer of Personal Property Without Administration): Used when transferring personal property of the decedent without a formal administration process. This affidavit can simplify the process of asset distribution to beneficiaries.

- ET-117 (Release of Lien of Estate Tax): After the estate tax has been paid, this form serves as proof that the estate tax lien has been officially released by the state.

- ET-706 (New York State Estate Tax Return): This return is filed by the executor or administrator of an estate to report the value of the estate and calculate the estate tax owed to New York State.

- Surrogate’s Court Citation: This is a legal document issued by the court that requires individuals or entities to appear in court in relation to the estate’s administration. It helps ensure all interested parties are notified of the proceedings.

- Inventory of Assets: A detailed list of all assets owned by the decedent at the time of death, including real estate, personal property, and financial accounts, which is critical for proper estate valuation and taxation.

- Letters Testamentary: These legal documents are issued by the court authorizing an executor or personal representative to manage and distribute the decedent’s estate according to the will.

- Letters of Administration: Issued by the court when there is no will, these letters grant an administrator the authority to settle the estate according to state laws.

- Last Will and Testament: This is the legal document through which a person expresses their wishes as to how their property is to be distributed at death, and names one or more persons, the executor, to manage the estate until its final distribution.

Together, the New§ York ET-133 form and these accompanying documents and forms provide a framework for effectively managing and settling an estate's tax and legal responsibilities. By utilizing these documents, executors and administrators can ensure compliance with New York State laws and regulations, efficiently manage estate administration, and facilitate the accurate and timely distribution of the deceased’s assets.

Similar forms

The New York ET-133 form, used for releasing a lien on an estate, shares similarities with the New York ET-117 form. The ET-117 form is essential for releasing the estate tax lien, specifically when an estate has satisfied its tax obligations or when no tax is due. Both forms play a critical role in the administration of estates, effectively signaling to relevant authorities and parties that specific legal and tax-related conditions have been met or that certain exemptions apply.

Another document that bears resemblance to the New York ET-133 form is the Federal Form 706, United States Estate (and Generation-Skipping Transfer) Tax Return. Although the Federal Form 706 is a tax return rather than a lien release form, it shares the purpose of addressing estate taxes. The completion and filing of Form 706 can lead to a determination of no tax due, which might subsequently require the use of ET-133 form in New York to release the state's lien on the estate, reflecting their interconnected roles in the estate tax process.

The New York TP-584 form, used for recording real estate transactions, also shares characteristics with the ET-133 form. While the TP-584 is primarily for reporting and paying taxes related to the transfer of real property, it often coincides with the estate administration process, during which the ET-133 form might be required if the real property is part of an estate. Both documents facilitate the proper legal and tax treatment of estates and real property, ensuring compliance with New York State laws.

Similarly, the New York IT-2663 form, required for nonresident real property transfers, aligns with the ET-133 form in its role within the context of estate administration and property transfer. Though the IT-2663 form is specifically designed for nonresident sellers of New York State real property, the need for an ET-133 may arise when such properties are part of an estate undergoing tax-related proceedings. The two forms contribute to the overarching legal framework governing estates and property transactions in New York.

Lastly, the Affidavit of Heirship presents parallels to the ET-133 form, despite its different function. This affidavit is used to establish the rightful heirs and beneficiaries of an estate, which is a necessary step in many estate settlements. Like the ET-133 form, which facilitates the release of an estate tax lien indicating that tax liabilities have been addressed, the Affidavit of Heirship helps clarify the parties entitled to the estate assets, including cleared real property. Both documents are integral to the process of settling an estate and ensuring the lawful distribution of the decedent’s assets.

Dos and Don'ts

Filling out the New York ET-133 form, which is essential for estate tax closure documents, requires careful attention to ensure all information is accurately and comprehensively provided. Below are some guidelines to help navigate the completion of this form effectively.

Do:

Read the instructions provided by the New York State Department of Taxation and Finance thoroughly before you start filling out the form. These instructions are designed to guide you through each section, ensuring clarity and compliance with state requirements.

Double-check the decedent’s personal information for accuracy, including full name, social security number, and date of death. This step is critical as it pertains to the identity of the person whose estate is under consideration.

Use black ink or type the information if the form is available in a fillable PDF format. This ensures legibility and avoids any processing delays that might occur due to hard-to-read responses.

Gather and cross-reference all necessary documentation related to the estate before inputting numbers related to assets, deductions, and tax calculations. Accurate figures are necessary to determine the correct tax obligations.

Sign and date the form where required. An unsigned form is often considered incomplete and can be returned or delayed until properly completed.

Keep a copy of the completed ET-133 form for your records. Having a copy can be invaluable for reference, especially if questions arise from the tax department or if there are disputes within the estate.

Seek professional advice if you encounter difficulties. Estate tax laws can be complex, and professional guidance can ensure that the form is completed correctly and in compliance with current tax laws.

Don't:

Rush through the process without understanding the form’s requirements. Missing or incorrect information can lead to delays or incorrect tax assessments.

Overlook the importance of accurate calculations. Estimating values rather than using exact amounts can result in penalties or further scrutiny from the tax department.

Forget to document and attach required proofs for deductions and exemptions claimed on the form. The absence of supporting documentation can invalidate these claims, leading to a higher estate tax liability.

Assume that handwritten corrections are acceptable. If you make a mistake, it’s advisable to start with a fresh form to ensure the document’s clarity and integrity.

Use white-out or similar correction fluids on the form. Such alterations can raise questions about the authenticity of the information provided.

Neglect to check the most current form version and instructions on the New York State Department of Taxation and Finance website. Tax forms and regulations can change, and using outdated versions may result in processing delays or inaccuracies.

Submit the form without ensuring all sections are completed. An incomplete form can lead to unnecessary back-and-forth correspondence with the state tax authority, delaying the settlement of the estate.

Misconceptions

When addressing the New York ET-133 form, individuals often come across a variety of misunderstandings. These misconceptions can lead to confusion, delay in process, and sometimes even incorrect filing. Here, we clarify some of the most common inaccuracies to ensure individuals are well-informed and can approach the ET-133 form with confidence.

- Only for Estates of Deceased New Yorkers: It's a common belief that the New York ET-133 form is only applicable to estates of individuals who were residents of New York State at the time of their death. However, this form is also required for non-resident decedents who owned real property or had tangible personal property located in New York.

- Requires an Attorney to File: Many presume that an attorney must file the ET-133 form. While legal guidance is beneficial, especially in complex estate situations, an executor or administrator of the estate can file the form without a lawyer’s assistance.

- Available Only in Hard Copy: With the digital age, the notion prevails that certain legal documents, such as the ET-133, are only available in hard copy. This is inaccurate as the form can be downloaded, completed, and even submitted online through New York State's official website.

- Its Purpose is for Estate Tax Calculation Only: While primarily involved in the estate tax realm, the ET-133 form's use extends beyond mere tax calculation. It serves to request a release of lien for New York State estate taxes, which is crucial for the clear transfer of property titles.

- Fixed Filing Deadline: A misunderstanding exists about a fixed deadline by which the ET-133 must be filed. The reality is that the filing deadline can vary, depending on the estate’s circumstances, and extensions can be requested under certain conditions.

- One-size-fits-all Approach to Filing: There's a misconception that filling out the ET-133 form is straightforward and fits all estates similarly. In reality, each estate may have unique aspects that affect how the form should be completed, highlighting the importance of careful review of the specific estates’ details.

- No Revision is Allowed After Submission: Finally, many believe once the ET-133 form is submitted, it cannot be revised or corrected. This is not true. Corrections or amendments can be made after submission, provided that proper procedures are followed and justification for the amendment is provided.

Understanding the nuances associated with the New York ET-133 form is essential for accurate and efficient handling of estate matters. By dispelling these misconceptions, individuals can better navigate their estate planning and execution responsibilities with greater clarity and confidence.

Key takeaways

Filling out the New York ET-133 form, which is essential for estate tax purposes, can seem daunting at first. However, understanding its key aspects can simplify the process and ensure compliance with the state's legal requirements. Here are the crucial takeaways to keep in mind:

- The purpose of the ET-133 form is to request an extension of time to file a New York State estate tax return. This is critical for individuals managing the deceased's estate when more time is needed to gather all necessary information.

- It's important to file the ET-133 form before the due date of the estate tax return to avoid penalties. Timeliness is a crucial factor in maintaining compliance with tax obligations.

- The form requires detailed information about the decedent (the person who has passed away), including their full legal name, social security number, and date of death. Accuracy in providing this information is crucial.

- There is a distinction between receiving an extension to file the return and an extension to pay the estate taxes due. The ET-133 form primarily deals with an extension to file the return, not necessarily to pay the taxes.

- Filing this form does not relieve the estate from any applicable interest charges on taxes owed. It's essential to be aware that any taxes due are still expected to be paid by the original due date.

- The person filing the form must also include their relationship to the decedent and their contact information. This ensures the state can follow up with the right individual about the estate's tax obligations.

- Accuracy in filling out the form is critical to avoid further inquiries or complications. Ensuring that all information is correct and up-to-date can help expedite the process.

- Should there be any questions or uncertainties when filling out the ET-133 form, consulting with a professional experienced in New York estate law or a tax advisor is advisable. They can provide guidance tailored to the specific situation of the estate.

- Finally, keeping a copy of the ET-133 form for the estate's records is advisable. It's essential for tracking the estate's compliance with New York State's tax obligations and for future reference.

By keeping these key points in mind, individuals handling the estate of someone who has passed away can navigate the process of requesting an extension for the estate tax return with greater ease and accuracy.

Common PDF Documents

Resale Permit - A legal document used in New York Family Court to assess a relative's suitability as a foster parent for a child under 18, considering allegations of abuse or neglect.

Form It-558 Pdf - Part of the form is dedicated to enabling electronic funds transfers from taxpayers' bank accounts to pay state taxes.