Free New York Dof 1 Form in PDF

In the bustling landscape of New York City's business community, the Department of Finance (DOF) plays a crucial role, ensuring that business tax records are accurate and current. They have provided an essential tool, the DOF-1 form, designed for businesses to report any changes in vital information such as business name, identification numbers, and contact or location details. This form serves as a conduit for updating the city’s records across various tax types including General Corporation, Unincorporated Business, and Hotel Tax, among others. It's structured to be straightforward and comprehensive, asking businesses to indicate the specific taxes affected by the changes, and to provide both old and new information for a seamless transition. The DOF-1 form not only mandates businesses to clarify the nature of their changes—be it a change in business activity or a shift in the entity type—but also requires attaching pertinent documents for certain changes like dissolution or cessation of business within New York City. This procedure is underscored by a commitment to privacy, with a clear notification on the use of Social Security Numbers in compliance with the Federal Privacy Act of 1974. Furthermore, it's emphasized that timely submission of this form is crucial for maintaining accurate tax records, ultimately facilitating efficient tax administration and ensuring compliance with city regulations.

New York Dof 1 Sample

FINANCE

NEW ● YORK

THE CITY OF NEW YORK DEPARTMENT OF FINANCE

n y c . g o v / f i n a n c e

D O F

1

NEW YORK CITY DEPARTMENT OF FINANCE

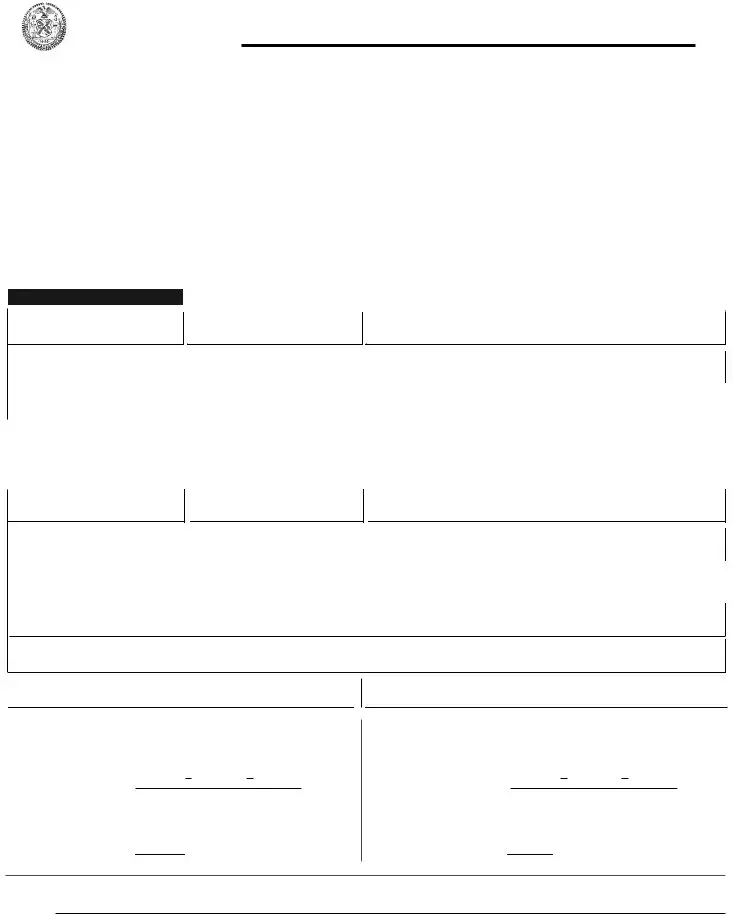

CHANGE OF BUSINESS INFORMATION

USE THIS FORM TO REPORT ANY CHANGES IN YOUR BUSINESS'S NAME, ID NUMBERS, BILLING OR BUSINESS

ADDRESS, OR TELEPHONE NUMBER. (SEE INSTRUCTIONS ON BACK BEFORE COMPLETING.)

SECTION I: TAX RECORD AFFECTED -

Check (✓) the box(es) below to indicate which business and excise tax records should be changed.

■ General Corporation Tax |

■ Unincorporated Business Tax |

|

■ Commercial Rent Tax |

■ Commercial Motor Vehicle Tax |

|

■ Banking Corporation Tax |

■ Retail Beer, Wine and Liquor License Tax |

|

■ Utility Tax |

■ Hotel Tax |

■ Other (Tax Type)____________________ |

SECTION II: BUSINESS INFORMATION - Enter in the spaces below the old, new (revised or changed) or

OLD I NFORM ATI ON

Entity ID (EIN or SSN)

Account ID (see instructions)

Trade Nam e (DBA, etc.)

Legal Nam eBusiness Telephone Num ber

|

|

|

|

|

|

|

( |

) |

||

|

|

|

|

|

|

|

|

|

|

|

|

Business Address |

|

|

|

|

City |

|

|

State |

Zip Code |

|

|

|

|

|

|

|

|

|

|

|

|

|

EFFECTIVE DATE |

|

|

|

|

|

|

|

|

|

NEW I NFORM ATI ON |

|

|

|

|

|

|

|

|

|

|

|

MON TH |

|

DAY |

|

YEAR |

|

|||

|

|

|

|

|

|

|||||

|

........................................................ |

■ Individual |

■ Partnership |

|

■ Corporation |

|

||||

|

Entity Type (check one) |

|

|

|||||||

Entity ID (EIN or SSN)

Account ID (see instructions)

Trade Nam e (DBA, etc.)

Legal Nam eBusiness Telephone Num ber

|

|

( |

) |

|

|

|

|

Business Address |

City |

State |

Zip Code |

|

|

|

|

Billing Address c/o (no. and street)

City |

State |

Zip Code |

Reason(s) for change ▼

Change of business activity ▼

Check (✓) if appropriate

■

EFFECTIVE DATE

MON TH |

DAY |

YEAR |

ATTACH: Certificate of Dissolution (if corporation); Notarized Affidavit (if unincorporated business or partnership)

Did you file a final return? |

■ YES |

■ NO |

■INACTIVE IN NEW YORK CITY

EFFECTIVE DATE

MON TH |

DAY |

YEAR |

ATTACH: Form

Did you file a final return? |

■ YES |

■ NO |

SIGN →

HERE

Signature |

Title |

Date |

|

|

|

Once you complete this form, mail it immediately to: New York City Department of Finance, Account Examinations, 59 Maiden Lane, 19th Floor, New York, NY 10038. (If there are no changes to the above information, keep this form in your files. In the event a change occurs, complete the form and send it to us as soon as possible.)

Page 2 |

|

|

|

The purpose of Form

If there are currently no changes to your business's information, keep this form in your files. In the event a change occurs, complete the form and send it to us as soon as possible. If you need addition- al forms, call Customer Assistance at ( 212)

SECTION I - TAX RECORD AFFECTED

Indicate which business tax record should be changed by marking

a✔ in the appropriate box( es) in this section. If your change affects a tax not listed, check the box labeled "Other" and enter in the space directly to the right of it the tax type.

SECTION II - BUSINESS INFORMATION

Enter in the spaces available all old and new information regarding your business's operation.

In the OLD INFORMATION area, enter your:

ENTITY ID NUMBER This is the number that is currently used to identify your business tax account. It is the number that either appears on all Department mailing labels you are presently receiv- ing, or it is the number that you entered when you last filed a tax return. This identifying number must be entered in order for us to make any account changes.

Leave this area blank unless you are changing the tax records listed below. If you have more than one account ID number, list the account ID number in the appropriate line in the chart below.

IF THE BUSINESS |

THE ACCOUNT ID NUMBER |

TAX IS.... |

TO ENTER IS... |

|

|

➧ Commercial Rent Tax |

➧ Commercial Rent Tax Registration |

|

● |

____________________________________________________________ |

|

➧ Commercial Motor Vehicle |

➧ Commercial License Plate |

|

● |

____________________________________________________________ |

|

➧ Retail Beer, Wine and |

➧ License Number |

Liquor License Tax |

● |

____________________________________________________________ |

|

➧ Utility Tax |

➧ Utility Tax Registration |

|

● |

____________________________________________________________ |

|

➧ Hotel Tax |

➧ New York City Certificate |

●

____________________________________________________________

TRADE NAME This is the name that you use in conducting your normal

Your legal name is the name under which your business owns assets or incurs debts. For sole proprietorships, it is the name of the sole proprietor; for corporations, it is the name filed with the New York Secretary of State; and for partnerships, it is the legal name used in the partnership agreement.

The address where your major business activity is physically located.

The number where you can

usually be reached during normal business hours.

In the NEW INFORMATION area, enter the date the new information became effective. Enter your new or revised:

ENTITY TYPE This is the legal form of the taxpayer. Check either individual ( e.g., sole proprietor or

ENTITY ID NUMBER If yo u have rec ently rec eived an EIN ( Employer Identification Number) or have otherwise changed your identification number, enter the new number here. ( If there is no change, leave this space blank.)

ACCOUNT ID NUMBER ( SEE ABOVE)

TRADE NAME ( SEE ABOVE)

LEGAL NAME ( SEE ABOVE)

BUSINESS ADDRESS AND TELEPHONE NUMBER ( SEE ABOVE)

The address where you now want us to send all of your tax returns and notices. Be sure to include your street name and number, city and post office box number, if any. ( If there is no change, leave this space blank.)

Enter the specific reaso n( s) fo r sending us this form ( i.e., change of name, change of ID number, change of entity, change of address, etc.) .

Enter any other pertinent information that will help us to properly change information about your tax records. ( If you need more space, attach a sheet to this form.)

SIGNATURE Sign your name and enter your title and the date in the spaces provided. Send your completed form to:

NYC DEPARTMENT OF FINANCE ACCOUNT EXAMINATIONS

5 9 MAIDEN LANE, 1 9 TH FLOOR NEW YORK, NY 1 0 0 3 8

PRIVACY ACT NOTIFICATION

The Federal Privacy Act of 1974, as amended, requires agencies requesting Social Security Numbers to inform individuals from whom they seek this information as to whether compliance with the request is voluntary or mandatory, why the request is being made and how the information will be used. The disclosure of Social Security Numbers for taxpayers is mandatory and is required by sec- tion

File Overview

| 1 | Purpose | The DOF-1 form is used for reporting changes in business information such as name, ID numbers, addresses, and telephone number. |

| 2 | Sections | Two main sections: Tax Record Affected and Business Information. |

| 3 | Required Attachments | Attachments required vary by business type, including Certificate of Dissolution for corporations and notarized affidavit for unincorporated businesses or partnerships. |

| 4 | Final Return | Businesses must indicate whether they have filed a final tax return. |

| 5 | Entity Types | Includes individual, partnership, and corporation as entity type options. |

| 6 | Submitting Address | Completed forms should be mailed to the NYC Department of Finance, Account Examinations, at 59 Maiden Lane, 19th Floor, New York, NY 10038. |

| 7 | Governing Law | Governed by the Administrative Code of the City of New York; specifically relates to tax administration. |

| 8 | Privacy Act Notification | Complies with the Federal Privacy Act of 1974, explaining the need for Social Security Numbers for tax administration purposes. |

| 9 | Finance Memorandum | References Finance Memorandum 99-1 for additional information regarding disregarded entities for federal income tax purposes. |

New York Dof 1: Usage Guidelines

Fulfilling the New York Department of Finance Form DOF-1 is a key step in keeping your business's tax records up to date, especially if there have been changes in your business's name, ID numbers, billing or business address, or telephone number. It's a straightforward process but requires attention to detail to ensure all your business information is accurately captured and updated. Once completed, this form should be mailed immediately to ensure your business records are corrected without delay. Below are the steps you'll need to follow to accurately complete the DOF-1 form.

- Identify the tax records affected by the change(s) in SECTION I: TAX RECORD AFFECTED. Check the appropriate box(es) for the business and excise tax records that need to be updated.

- In the OLD INFORMATION section, provide your current or previous business details as they are recorded in tax records. This includes your entity ID number, account ID, trade name (DBA), legal name, business telephone number, and address.

- Indicate the effective date (month, day, year) when the old information ceased being accurate.

- Under the NEW INFORMATION section, fill in the new or revised business information. Include your entity type, entity ID number (if changed), account ID number, trade name (DBA), legal name, business telephone number, business address, and billing address. Remember to check the box if your business is out-of-business or inactive in New content York City and attach the required documentation.

- Specify the reason(s) for the change(s) by selecting the appropriate reason(s) from the provided list.

- Sign the form at the bottom. Include your signature, title, and the date to authenticate the form. If you're updating information for a corporation, the signature should be that of an authorized individual.

- Mail the completed form to the specified address: New York City Department of Finance, Account Examinations, 59 Maiden Lane, 19th Floor, New York, NY 10038.

Ensure that all information provided is accurate and complete before mailing the form. Inaccuracies may lead to confusion or delays in updating your business's tax records. Keeping this form on file, even with no current changes, is advisable so you can quickly address any future updates. Remember to call Customer Assistance at (212) 504-4036 if you require additional forms or have questions about completing the DOF-1 form.

FAQ

What is the purpose of the New York DOF-1 form?

The New York DOW-1 form is intended for businesses to report any changes in their business's name, identification numbers, billing or business address, or telephone number to the New York City Department of Finance. It ensures that the city's tax records are up-to-date, which is crucial for accurate assessment and collection of taxes and for maintaining official business documentation. The form provides a structured means for businesses to convey changes effortlessly and helps in preventing discrepancies in tax-related matters.

When should I submit the DOF-1 form?

You should submit the DOF-1 form immediately after any change occurs in your business information, including changes in name, ID numbers, addresses, or telephone number. If, however, there are currently no changes to your business's information, it is advised to keep this form in your files for future use. Prompt submission after changes ensures that your business remains in compliance with New York City's tax laws and regulations.

Which sections of the DOF-1 form must be filled out?

To accurately report the necessary changes, you must complete two main sections in the DOF-1 form: Section I, where you check the box(es) to indicate which tax records should be changed; and Section II, where you provide both the old and the new information related to your business operation. This includes details about your business’s entity type, entity and account ID numbers, trade and legal names, business and billing addresses, reasons for change, and the effective date of such changes. Additionally, if applicable, attach any required documents as outlined in the instructions.

What needs to be attached to the form if my business is going out of business or becoming inactive in New York City?

If your business is going out of business, you are required to attach a Certificate of Dissolution if it is a corporation, or a Notarized Affidavit if it is an unincorporated business or a partnership. For businesses becoming inactive in New York City, you must attach Form NYC-245 if it is a corporation, federal Schedule C if it is an unincorporated business, or federal Form 1065 if it is a partnership. Also, indicate whether you have filed a final return by checking the appropriate box.

Where should I send the completed DOF-1 form?

The completed DOF-1 form should be mailed to: New York City Department of Finance, Account Examinations, 59 Maiden Lane, 19th Floor, New York, NY 10038. Ensure that the form is filled out completely and accurately before sending, and include any necessary attachments to avoid processing delays.

What is the significance of the Entity ID Number and Account ID Number on the DOF-1 form?

The Entity ID Number and Account ID Number are crucial identifiers used by the New York City Department of Finance to accurately match the information being reported on the DOF-1 form with your business's tax account. The Entity ID Number may be your business’s Employer Identification Number (EIN) or Social Security Number (SSN), while the Account ID Number is specific to the tax records held by the Department of Finance. Accurately providing these numbers ensures that changes are appropriately recorded against the right tax records, maintaining the integrity of your business’s tax account.

Common mistakes

Filling out the New York Department of Finance Form 1 (DOF-1) is a critical step for businesses that need to report changes such as a new name, ID numbers, or address updates. However, several common errors can lead to processing delays or incorrect record updates. Understanding these mistakes is key to ensuring that the form serves its intended purpose without unnecessary complication.

One frequent mistake is the incorrect entry of the Entity ID Number. This number, either an EIN or SSN, uniquely identifies the business for tax purposes. It's crucial to enter the current number accurately, as it's the primary identifier the Department of Finance uses to track business tax accounts. If this number is incorrect, it can lead to misfiled changes or updates that do not get applied to the right business account.

Another area where errors occur is the Account ID Number section. Depending on the tax type, businesses might have multiple account ID numbers. The proper number corresponding to the specific tax record that the change affects must be entered. Mixing up these numbers or entering a number for a different tax type can lead to ineffective record changes.

The Effective Date of new information is also a crucial detail that is often overlooked or incorrectly filled. This date signifies when the reported changes take effect and must be accurately provided to ensure that records reflect the current status of the business from the correct date. Inaccuracies in this section can lead to discrepancies in the timing of when changes are recognized, affecting tax responsibilities and filings.

- Incorrectly completing the Business Information section. This includes not accurately reporting the old and new (revised or changed) information or omitting information about the business's address, telephone number, or legal name, which can result in miscommunication or delays in processing.

- Failure to include necessary attachments such as the Certificate of Dissolution or Notarized Affidavit for changes in business status. These documents are essential for verifying the reported changes, especially when a business goes out of operation or changes its entity type.

Additionally, ensuring that the form is signed and dated is a step that, surprisingly, gets overlooked. Without the authorized signature and title of the individual completing the form, the Department of Finance may consider the form incomplete and not process the requested changes. Attention to detail in each section of the DOF-1 form not only facilitates smoother interactions with the Department of Finance but also helps maintain accurate and up-to-date business records essential for compliance and operational purposes.

Documents used along the form

When navigating the complexities of updating business information with the New York City Department of Finance, several documents alongside the DOF-1 form may also be required or useful. This necessity arises from different regulatory, legal, and operational needs that a business may encounter during its lifecycle. Understanding these documents and their purposes ensures compliance with all pertinent laws and regulations and facilitates smoother transactions with government agencies.

- Form NYC-245: Required for corporations detailing changes in corporate structure or status, this form is often necessary alongside the DOF-1 when a corporation declares itself inactive in New York City.

- Certificate of Dissolution: For corporations ending their business operations, this official document proves that the company has been formally dissolved according to state law and is typically attached to the DOF-1 form.

- Notarized Affidavit: Used by unincorporated businesses or partnerships, this legal document, once notarized, confirms specific facts or changes related to the business. It might be required to substantiate the claims made on the DOF-1 form.

- Federal Schedule C: This tax document details the profits or losses of a sole proprietorship or single-member LLC and must be attached to the DOF-1 when an unincorporated business reports cessation of business activities.

- Federal Form 1065: Partnerships use this form to report their financial results to the IRS. When a partnership declares inactivity or changes affecting its tax obligations, it may need to provide this form along with the DOF-1.

- Articles of Amendment: These documents are filed with the state to officially record any changes to a corporation's charter documents. They may be brought into play when the changes being reported on the DOF-1 also affect the corporation's legal standing or operational guidelines.

- Business License Renewal Forms: Depending on the change reported via the DOF-1, businesses might need to update or renew their licenses, requiring a variety of specific forms dictated by the nature of the business and its regulatory body.

- Power of Attorney (POA): This legal document potentially accompanies the DOF-1 when a business authorizes another entity or individual to act on its behalf in financial, legal, or business matters.

- Lease Agreement or Amendment: For businesses reporting a change of address through the DOF-1, the lease agreement for the new location, or an amendment to an existing lease reflecting the new circumstances, might be necessary.

- Change of Address Form for the IRS: Similar to the DOF-1's purpose, this form officially updates a business's address on record with the federal government and might be required if the change on the DOF-1 also affects federal tax obligations or filings.

In essence, the DOF-1 form serves as a critical tool for businesses in New York City to ensure that tax and legal records are up-to-date. Accompanied by relevant supporting documents, it facilitates accurate and efficient communication with the Department of Finance. Properly compiling and submitting these forms protects businesses from potential legal or financial implications of outdated information and secures compliance with local and federal regulations.

Similar forms

The IRS Form 8822, Change of Address, is quite similar to the New York DOF-1 form in its purpose. Both forms are used by entities to report changes in essential information, specifically their mailing address. However, the IRS Form 8822 is utilized on a federal level for notifying the Internal Revenue Service of a change in address to ensure tax documents and correspondence are sent to the correct location. This parallels the DOF-1’s role in updating the New York City Department of Finance with new business details.

Another comparable document is the IRS Form SS-4, Application for Employer Identification Number (EIN). This form is used by businesses to apply for an EIN, a fundamental piece of information that the DOF-1 form also deals with if there's a change. Even though the SS-4's main function is to obtain a new EIN rather than update business information, both forms play crucial roles in maintaining accurate tax records and entity identification within their respective tax systems.

The Statement of Information (SOI) filed with many Secretary of State offices is also analogous to the DOF-1 form. This document is typically filed on an annual or biennial basis and includes updates on a business's address, officers, and sometimes the business type—information that is also updated through the DOF-1 form. The key difference lies in the SOI's broader requirement for corporate governance updates versus the DOF-1's focus on tax-related information changes.

The Business License Application forms found in various jurisdictions serve a similar function to the DOF-1 in that they may be used to update information regarding a business’s location, ownership, and contact details. While these forms are often part of initiating or renewing a business license, they share the DOF-1’s role in ensuring that public records accurately reflect current business information, especially concerning the business’s location and identity.

Lastly, the UCC-1 Financing Statement Amendment is another document that, while serving a different primary purpose, shares some similarities with the DOF-1. It is used to amend a previously filed UCC-1 form, which alerts the public to a secured interest in a debtor’s collateral. Amendments might include changes in the debtor’s name or address—details that are also a focus of the DOF-1 when a business’s basic information changes. However, the UCC-1 Amendment is primarily related to secured transactions, contrasting with the tax focus of the DOF-1.

Dos and Don'ts

When filling out the New York DOF-1 form, there are essential dos and don'ts to adhere to, ensuring your form is properly processed without delay. Here's a guide to help you through the process:

Things you should do:

Review the instructions on the back of the form carefully before filling it out to avoid mistakes.

Ensure all changes in your business's name, ID numbers, billing or business address, or telephone number are accurately reported.

Check the correct box in Section I to indicate which business and excise tax records should be changed.

Fill in both the old and new information if there's a change, so the Department of Finance has a clear record of updates.

Include the effective date of the new information to keep your records current and accurate.

Choose the correct entity type that reflects the legal form of your business to prevent misclassification.

Sign the form and include your title and the date to verify the authenticity of the information provided.

Mail the completed form immediately to the provided address to ensure timely processing.

Keep a copy of the form in your files for future reference or in case verification is needed.

If applicable, attach the required documents such as a Certificate of Dissolution or Notarized Affidavit.

Things you shouldn't do:

Don't leave any required fields blank, as incomplete forms may delay processing.

Avoid making changes directly on the form without properly highlighting which information is old and which is new.

Do not forget to check the appropriate boxes that apply to your business tax records in Section I.

Don't use outdated information or fail to update all relevant sections of the form.

Avoid guessing your Entity ID or Account ID number; ensure these numbers are correct to avoid processing errors.

Do not neglect to sign the form, as an unsigned form is considered incomplete.

Don't delay mailing the form; timely submission is crucial for accurate record-keeping.

Avoid omitting the reason(s) for the change since specific reasons help in updating records effectively.

Do not disregard the Privacy Act Notification and understand why certain information is requested.

Avoid sending the form without the necessary attachments if your situation requires it.

Misconceptions

When dealing with the New York Department of Finance (DOF) Form 1 (DOF-1), various misconceptions can arise due to its nuanced requirements and instructions. Correcting these misunderstandings is crucial for business owners looking to ensure their information is accurately reflected in city records. Here are seven common misconceptions:

- It’s only for reporting name changes. This is a misunderstanding. While the DOF-1 form is indeed used for reporting changes in a business’s legal or trade name, its scope extends far beyond name changes. It covers a variety of information updates including, but not limited to, changes in business address, entity type, entity ID number (EIN or SSN), and telephone number.

- Submission is optional. Some may think submitting the DOF-1 form is optional. However, reporting any changes to the business information as described in the form is a requirement, not a suggestion. Keeping information current ensures compliance with city regulations and aids in accurate tax collection and record maintenance.

- All sections must be completed. Not all sections of the DOF-1 form need to be filled out for every submission. The form is designed to capture a variety of potential changes. Businesses should only complete sections relevant to the changes they are reporting. For example, if a business is only changing its telephone number, only that section needs to be filled out.

- It’s a one-size-fits-all solution. While the DOF-1 form is comprehensive, it is not universally applicable to every conceivable business change. For significant changes, such as dissolution of a corporation or a major shift in business activity, additional forms or documentation may be required beyond what is outlined in the DOF-1 instructions.

- Electronic submission is available. As of the last available information, the DOF-1 form must be mailed to the specified address. Despite many processes moving to digital formats, the city requires a hard copy submission for this particular form. This ensures proper handling and processing of sensitive information.

- It covers all New York City taxes. Business owners might think the DOF-1 covers changes for all types of New York City taxes. However, the form only applies to specific business and excise taxes listed in Section I. Other taxes might require different forms or methods of notification for changes in business information.

- It doubles as a final tax return. Another misconception is the belief that filing a DOF-1 form with an "out-of-business" status serves as a final tax return. While indicating a business’s closure is important, it does not replace the need to file a final tax return for the periods the business was operational. Additional forms, like a final return, may still be required.

Critically evaluating these misconceptions and understanding the purpose and requirements of the DOF-1 form can significantly smooth the process of updating business information with New York City’s Department of Finance. Properly and promptly managing these updates is essential for maintaining compliance and ensuring accurate records.

Key takeaways

Understanding the New York Department of Finance (DOF) Form 1 is critical for all business owners in the city who need to report changes in their business details. The following key takeaways will guide you through filling out and using the form efficiently:

- Form DOF-1 is specifically designed for reporting changes in your business's name, ID numbers, billing or business address, or telephone number.

- It is important to retain a copy of this form in your business records even if no changes are currently needed; it will serve as a valuable resource when any changes occur.

- Ensure to complete the section indicating which tax records are affected by the changes to keep your tax records updated and accurate.

- When filling out the form, include both the old and new information as required, making it easier for the Department of Finance to process the changes.

- The Entity ID Number, whether an EIN or SSN, is a crucial detail that identifies your business tax account and must be accurately reported for successful processing of changes.

- Understanding the difference between your trade name and legal name is essential; the former refers to your business's operating name, while the latter refers to the legal name registered with the state or used in partnership agreements.

- The effective date of the new information is required to accurately reflect when the changes took place or became official.

- Specifying the reason for the changes helps the Department of Finance understand the nature of the update, ensuring appropriate adjustments are made to your records.

- The form requires a signature from a person with the authority to make legal declarations on behalf of the business, signifying the accuracy and legitimacy of the information provided.

- Lastly, it's crucial to submit the completed form promptly to the New York City Department of Finance at the provided address to ensure timely updates to your business records.

Compliance with these requirements and timely reporting of any changes in your business details using the DOF-1 Form can help maintain the accuracy of your business's tax records, avoid potential issues, and ensure smooth operations with the New York City Department of Finance.

Common PDF Documents

Notice of Appearance New York Supreme Court - It provides a means for creditors to legally prevent the transfer or sale of a debtor's property pending the satisfaction of a debt.

Nys State Aid Voucher - A document designed to initiate the release of state funds, detailing agency origin, payee information, and specific financial amounts and dates.

Ny Biennial Statement File Online - Insights into the DOS 1710 form’s section for prior names of the foreign professional service limited liability company.