Free Ga 4 New York Form in PDF

In the landscape of municipal self-insurance in New York, the Quarterly Unified Employer Assessment Municipal Self-Insurers Remittance Form, recognized as GA-4, plays a pivotal role. This essential document is meticulously crafted to streamline the reporting and financial assessment of municipal self-insurers within the state. Its core function lies in its ability to gather crucial data regarding payroll, loss costs, and overall assessments due for each reporting period, which is broken down quarterly. Municipal employers that are self-insured are required to submit this form, along with its payment, within a stipulated thirty-day window following the end of each quarter. Adding a layer of complexity, additional municipal entities under the umbrella of a singular W number necessitate the use of the GA-4.1 addendum for accurate reporting. Such delineated measures ensure both comprehensive coverage and adroit management of self-insured municipal entities’ financial responsibilities towards workers' compensation. The form doubles as a means for the New York State Workers' Compensation Board to ascertain the accuracy of reported information, thereby safeguarding the integrity of self-insurance practices among municipalities. Furthermore, the instructions embedded within both GA-4 and its companion addendum, GA-4.1, are tailored to guide entities through the reporting process, marking a straightforward path towards compliance and fiscal transparency.

Ga 4 New York Sample

QUARTERLY UNIFIED EMPLOYER ASSESSMENT

Municipal

State of New York - Workers' Compensation Board

A. Municipal

1. |

WCB Identification |

|

2. Name of Municipal |

|

|

|

Number: |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

"W Number" |

|

|

|

|

|

|

|

Note: Additional employers covered under the W number shown must be reported on the |

|||

|

|

|

Quarterly Unified Employer Assessment Municipal |

|||

3. |

FEIN: |

|

|

FEIN Addendum |

|

|

4. |

Mailing Address: |

|

|

|

|

|

|

|

|

|

|

||

|

|

Number and Street |

City |

State |

Zip Code |

|

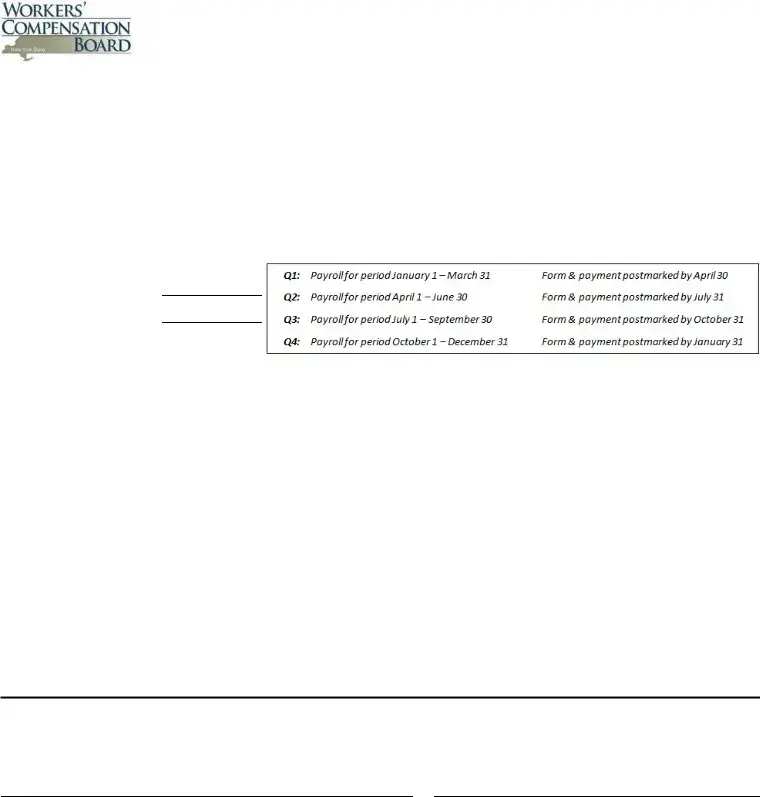

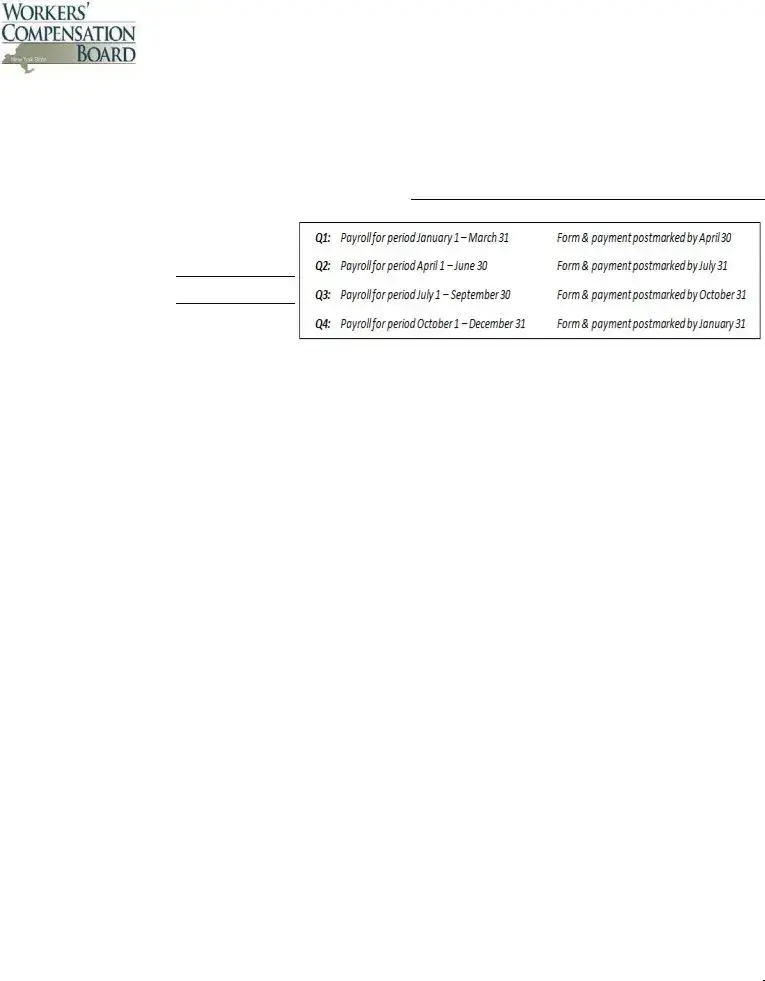

B.Reporting Period

1.Calendar Year:

2.Quarter Ending:

C.Basis for Assessment

|

|

|

|

(5) Total Loss |

|

|

|

(4) Loss Cost Per |

Cost |

|

|

(3) Quarterly |

|

|

(1) Payroll Class |

|

Hundred Dollars |

(3) x (4) divided |

|

Code |

(2) Description |

Payroll Dollars |

of Payroll |

by $100 |

Various |

School District - All Employees |

|

$0.50 |

|

Various |

All Other Municipal Employees |

|

$1.80 |

|

|

(6) Subtotal Payroll |

$0 |

|

|

(7) Excluded Payroll Not Subject to Assessment (if applicable) |

|

|

|

|

|

(8) Total Payroll = (6) + (7) |

$0 |

|

|

|

|

|

(9) Total Loss Cost |

|

|

|

(10) Assessment Rate |

13.8% |

|

|

|

(11) Total Assessment Due |

|

|

|

|

|

|

|

D. Certification

The undersigned certifies that the information presented herein, including all applicable addendums, has been examined

and is a true, correct and complete report made in good faith.

Signature |

|

Title |

|

|

|

Type or Print Name |

|

Date |

|

|

|

Phone Number |

|

(Instructions on Reverse Side) |

Instructions for Completing Quarterly Unified Employer Assessment

Municipal

General Instructions

1.The Quarterly Unified Employer Assessment Municipal

2.Additional municipal employers covered under the W number shown must be reported on the Quarterly Unified Employer Assessment Municipal Self- Insurers Remittance Form - Payroll by FEIN Addendum

3.Questions about the form or process should be directed to WCBFinanceOffice@wcb.ny.gov.

4.Checks are to be made payable to the Chair, NYS Workers' Compensation Board.

5.To ensure the proper application of payment please include W Number and applicable quarter on check.

6.This report and corresponding payment, along with applicable addendum, must be submitted quarterly by every municipal employer actively self- insured for workers' compensation. Employers that discontinued their

Submit completed form via

WCBFinanceOffice@wcb.ny.gov

and mail check to address below

Or mail completed form and check to:

New York State Workers’ Compensation Board

328 State Street

Finance Unit, Room 331

Schenectady, NY

Municipal

1.The WCB Identification Number or "W Number" as assigned to the municipal

2.The Name of the Municipal

3.The FEIN, or Federal Employer Identification Number, must be reported for the municipal

4.The full mailing address of the municipal

Basis for Assessment

1.A blended rate for municipal payroll will be used and there is no need to breakout by class.

2.Payroll must be broken out between employers which are school districts and all other municipal employers.

3.Total quarterly payroll associated with either the school district and/or all other types of municipal

4.The loss cost per hundred dollars of payroll for municipal employers and school districts is set annually by the Chair. The rates are shown on the Quarterly Unified Employer Assessment Municipal

5.The total loss cost is determined by multiplying the payroll by the loss cost shown and dividing by $100.

6.Subtotal of payroll reported on the Quarterly Unified Employer Assessment Municipal

7.Excluded payroll not subject to assessment.

8.With limited exception, total payroll should agree with that reported on the Quarterly Combined Withholding, Wage Reporting and Unemployment

|

Insurance Return |

|

please provide reconciliation. No payroll caps are to be applied. |

9. |

Equal to the sum of all of the loss cost by payroll class shown. |

10. |

The assessment rate for the rating period established by the Chair pursuant to WCL Section 151. This can be found on the WCB's website |

|

www.wcb.ny.gov. |

11. |

The total assessment due is equal to the total loss cost multipled by the assessment rate. |

Certification

In accordance with WCL Section 151 the Chair may conduct periodic audits of any

QUARTERLY UNIFIED EMPLOYER ASSESSMENT

Municipal

Payroll by FEIN Addendum

State of New York - Workers' Compensation Board

A. Municipal

|

|

2. Name of |

1. WCB Identification |

|

Municipal Self- |

Number: |

|

Insured Employer: |

|

|

|

|

"W Number" |

|

B.Reporting Period

1.Calendar Year:

2.Quarter Ending:

C.Municipal Employers Covered Under the W Number Shown Above

|

|

|

(4) Excluded |

|

|

(3) Quarterly |

Payroll (if |

(1) FEIN |

(2) Municipal |

Payroll |

applicable) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(5) Subtotal Payroll |

|

|

|

(6) Subtotal Excluded Payroll (if applicable) |

|

|

|

(7) Total Payroll = (5) + (6) |

|

$0 |

|

|

|

|

Instructions for Completing Quarterly Unified Employer Assessment

Municipal

Payroll by FEIN Addendum

General Instructions

1.The Quarterly Unified Employer Assessment Municipal

2.The Quarterly Unified Employer Assessment Municipal

3.The payroll by class code reported on the Quarterly Unified Employer Assessment Municipal

4.Questions about the form or process should be directed to WCBFinanceOffice@wcb.ny.gov.

5.This addendum, if applicable, must be sent quarterly with the Quarterly Unified Employer Assessment Municipal

Municipal

1.The WCB Identification Number or "W number" as assigned to the municipal

2.The Name of the Municipal

Municipal Employers Covered Under the W Number

1.The FEIN, or Federal Employer Identification Number, must be reported for the municipal

2.The municipal

3.Total quarterly payroll associated with the FEIN number.

4.Excluded payroll not subject to assessment.

5.Subtotal of payroll subject to assessment of the Quarterly Unified Employer Assessment Municipal

6.Subtotal of excluded payroll not subject to the assessment of the Quarterly Unified Employer Assessment Municipal

7.Total payroll and excluded payroll if applicable. With limited exception, total payroll should agree with that reported on the Quarterly Combined

Withholding, Wage Reporting and Unemployment Insurance Return

File Overview

| Fact Name | Detail |

|---|---|

| Form Purpose | The GA-4 form is used for quarterly unified employer assessment specifically for municipal self-insurers in New York State. |

| Governing Law | This form is governed by the New York State Workers' Compensation Law (WCL) Section 151. |

| Who Must File | Every active municipal self-insured employer must complete this form quarterly and submit it, along with payment, within thirty days of the end of the quarter. |

| Identification Requirements | Municipal self-insurers must report their WCB Identification Number ("W Number") and Federal Employer Identification Number (FEIN). |

| Address and Contact Information | The mailing address and email for correspondence related to the unified assessment must be provided. |

| Assessment Calculation Basis | Assessment is calculated based on total quarterly payroll and total loss cost, multiplied by an assessment rate established by the Chair of the NYS Workers' Compensation Board. |

| Payroll and Loss Reporting | Payroll must be broken out between school districts and all other municipal employers, with loss cost per hundred dollars of payroll determined annually. |

| Exclusions | Payroll not subject to assessment and any exclusions must be clearly reported. |

| Submission Process | Completed forms, along with the required payment, should be submitted via email to WCBFinanceOffice@wcb.ny.gov and physically mailed as specified in the instructions. |

Ga 4 New York: Usage Guidelines

After completing the GA-4 New York form, you are taking a critical step towards ensuring compliance with state regulations regarding workers' compensation for municipal self-insurers. This document, essential for quarterly reporting, helps maintain transparent and accurate records of payroll and associated costs, paving the way for a well-organized financial assessment. Next, you will submit this form, accompanied by the appropriate payment, to the New York State Workers’ Compensation Board, either via email or traditional mail. It is imperative to adhere to the submission deadlines to avoid any penalties or complications with your municipality's self-insured status.

- Identify the WCB Identification Number ("W Number") assigned to your municipality as approved for self-insurance and enter it into the designated space.

- Write the full legal name of the municipal self-insured employer as approved for self-insurance.

- Provide the Federal Employer Identification Number (FEIN) for the municipal self-insurer.

- Fill out the mailing address, including number and street, city, state, and zip code, to be used for all related correspondence.

- For the Reporting Period section, indicate the Calendar Year and Quarter Ending date for which you are reporting.

- Under Basis for Assessment, no need exists to separate municipal payroll by class. However, do specify payroll for school districts versus other municipal employers if applicable.

- Enter the Total Quarterly Payroll associated with either the school districts and/or other municipal employers, as outlined.

- List the Loss Cost Per Hundred Dollars of Payroll for each employer type, applying the rates supplied on the form.

- Calculate the Total Loss Cost by multiplying payroll by the loss cost shown and dividing by $100.

- Determine the Subtotal of Payroll, including any excluded payroll not subject to assessment, and sum these for the Total Payroll.

- Apply the specified Assessment Rate found on the WCB website to the total loss cost to find the Total Assessment Due.

- In the Certification section, ensure the signatory certifies the accuracy and completeness of the report inclusively of any addendums. Fill out the signature, title, typed or printed name, and the date.

- Before submitting, review the form for completeness and accuracy. Email the completed form to WCBFinanceOffice@wcb.ny.gov and send a check with the applicable W Number and quarter indicated to New York State Workers’ Compensation Board, Finance Unit, Room 331, 328 State Street, Schenectady, NY 12305-2318.

By following these detailed instructions for completing the GA-4 form, municipal self-insurers contribute to a well-structured, compliant environment under the State of New York's Workers' Compensation regulations. This procedural diligence ensures that municipal employees are adequately covered, all while adhering to the requisite financial and regulatory standards.

FAQ

What is the GA-4 New York form?

The GA-4 form, officially known as the Quarterly Unified Employer Assessment Municipal Self-Insurers Remittance Form, is a mandatory document for every active municipal self-insured employer in the State of New York. It is used for submitting quarterly assessments to the Workers' Compensation Board.

Who needs to file the GA-4 form?

Any municipal employer in New York State that is actively self-insured for workers' compensation needs to complete and submit this form every quarter. This includes municipalities covered under a county plan or part of a municipal group.

When is the GA-4 form due?

This form must be completed and submitted, with payment, within thirty days after the end of each quarter.

What information is required on the GA-4 form?

The form requires the municipal self-insurer's WCB Identification Number, Federal Employer Identification Number (FEIN), and mailing address. It also asks for detailed payroll information, including total loss cost, assessment rates, and the total assessment due.

How is the total assessment due calculated?

The total assessment is calculated by first determining the total loss cost, which involves multiplying the payroll by the loss cost per hundred dollars of payroll and dividing by 100. Then, this amount is multiplied by the assessment rate set by the Chair pursuant to WCL Section 151.

What if there are additional municipal employers covered under the same W number?

If there are additional municipal employers covered under the same W number, such as those in a county plan or municipal group, their payroll information must be reported separately on the GA-4.1, Payroll by FEIN Addendum.

What happens if the information reported is inaccurate?

If inaccurate reporting leads to an underpayment of the assessment, the self-insurer must pay the full amount due plus interest at an annual rate of 9%. Additionally, if it's found that the incorrect information was knowingly provided, an additional penalty of up to 20% of the underpaid amount may be imposed.

How can questions regarding the form or process be addressed?

Any questions related to the GA-4 form or the submission process should be directed to the Workers' Compensation Board Finance Office at WCBFinanceOffice@wcb.ny.gov.

Common mistakes

Filling out the GA-4 New York form, a Quarterly Unified Employer Assessment for Municipal Self-Insurers, requires attention to detail and a good understanding of the form's requirements. Common mistakes can lead to inaccuracies in reporting, potential fines, or issues with the Workers' Compensation Board. Here are five common errors:

- Omitting or incorrectly reporting the WCB Identification Number ("W Number"). This number is vital because it uniquely identifies the municipal self-insured employer. Without it, the form cannot be correlated with the correct entity.

- Failing to correctly list the Name of the Municipal Self-Insured Employer. This name must match the legal name of the employer approved to self-insure as any discrepancy could cause delays or misapplication of the filed report.

- Incorrectly filling out the FEIN (Federal Employer Identification Number). This mistake is particularly crucial because the FEIN is a federal identifier. Wrong information here can lead to issues not just with the Workers' Compensation Board but potentially with other federal reports.

- Inaccuracies in reporting Total Payroll and/or Excluded Payroll. Accurate payroll figures are essential for correct assessment calculation. Overestimating or underestimating these figures can directly affect the total assessment due.

- Not providing a proper reconciliation when the total quarterly payroll does not agree with NYS-45 figures. Without this reconciliation, it's challenging for the board to verify the accuracy of the reported payroll, potentially leading to audits or penalties.

Aside from these specific errors, individuals often overlook the certification section, leading to unsigned or improperly certified submissions. Each part of the form, including all applicable addendums, must be completed in good faith and certified as true and correct. Remember that aside from filling the form correctly, timely submission is also critical, with forms and payments due within thirty days of the quarter's end. Ensuring accuracy and attention to detail can save considerable time and prevent unnecessary complications with the Workers' Compensation Board.

Documents used along the form

When managing municipal self-insurers in New York, particularly for workers' compensation, the Quarterly Unified Employer Assessment Municipal Self-Insurers Remittance Form (GA-4) plays a crucial role. Besides the GA-4 form itself and its Payroll by FEIN Addendum (GA-4.1), various other documents and forms are also integral to the process, ensuring compliance and accurate assessment. These additional forms help provide a comprehensive view of an employer's responsibilities and financial obligations regarding workers' compensation insurance.

- NYS-45, Quarterly Combined Withholding, Wage Reporting, and Unemployment Insurance Return: This form is crucial for reporting an employer's quarterly wages paid, taxes withheld, and unemployment insurance contributions. It helps in verifying the payroll information provided on the GA-4 form.

- C-2F, Employer's Report of Work-Related Injury/Illness: Employers must use this form to report any work-related injuries or illnesses. It's vital for adjusting assessments based on claims and costs associated with workplace incidents.

- RB-89, Application for Board Review: This form is used to request a review of a decision by the Workers' Compensation Board. It's relevant for self-insurers managing claims and potentially contesting decisions impacting their assessment.

- Prima Facie Medical Report (Form C-4, C-4.2): Used by healthcare providers to document the initial medical evaluation of an injured worker. It impacts claims costs and, consequently, self-insurance assessments.

- EC-23, Annual Payroll Report: Although not directly related, this annual report of payroll to the New York State Insurance Fund might provide useful benchmarks for assessing payroll estimates and adjustments.

- Doctor's Initial Report (Form C-4): Used alongside the Prima Facie Medical Report, this document details the first medical examination for a work-related injury or illness, essential for the claims process.

- MG-2, Attending Doctor's Request for Approval of Variance: This form is used by physicians to request a variance from the Medical Treatment Guidelines. Variances can affect the cost of claims and self-insurance assessments.

Together, these forms and documents ensure that municipal self-insurers in New York maintain accurate records and comply with state workers' compensation laws. Completing and submitting these forms as required supports the integrity of the self-insurance program and aids in the accurate calculation of employer assessments. It's important for self-insured employers to familiarize themselves with these documents, stay compliant, and manage their workers' compensation responsibilities effectively.

Similar forms

The Quarterly Combined Withholding, Wage Reporting, and Unemployment Insurance Return (NYS-45) shares similarities with the GA-4 form in its core function—both require detailed payroll reporting from employers for a specific quarter. The NYS-45 specifically collects information on wages paid, taxes withheld, and unemployment insurance contributions for state purposes. Like the GA-4, it necessitates accurate payroll data to calculate financial liabilities accurately, emphasizing the importance of detailed and precise reporting in sustaining compliance with governmental regulations.

Another kindred document is the Federal Employer’s Quarterly Federal Tax Return (Form 941), which serves a parallel purpose at the federal level compared to the state-focused GA-4 form. Form 941 requires employers to report wages paid, federal income tax withheld, and both employer’s and employee’s shares of Social Security and Medicare taxes on a quarterly basis. This correlation underscores the meticulous financial disclosure required across both state and federal spheres to ensure accurate tax and insurance contributions.

The Workers' Compensation Annual Payroll Report is also aligned with the GA-4 form in its objective to collect payroll data, this time specifically for workers' compensation insurance premiums. Like the GA-4, it calculates liabilities based on payroll and classification codes but focuses on the insurance premium due for covered employees. This shared focus on payroll as a basis for financial assessment demonstrates the broader regulatory environment’s reliance on employment data for ensuring adequate insurance coverage.

The Unemployment Insurance Quarterly Tax Report is closely related to the GA-4, as it gathers information on wages paid to employees to determine unemployment insurance contributions. Both documents underline the necessity for employers to maintain accurate records of payroll data, with the specific aim of funding unemployment benefits out of these contributions. This represents the integrated role of payroll reporting in supporting social insurance programs.

Similarly, the Quarterly Report of Local Governmental Employers (often referred to by specific state designations) echoes the objectives of the GA-4 form by capturing payroll and employee data for locally employed personnel. This requirement for local governments to regularly report employment data helps in the administration and planning of local public sector compensation and benefits, illustrating another facet of public accountability and financial management paralleled in the GA-4’s design.

The Standard Industrial Classification (SIC) Report, while not a direct financial report, shares a conceptual linkage with the GA-4 through its classification of business activities possibly affecting payroll categorizations. By defining the nature of a business’s activity, the SIC codes potentially influence the assessment rates similar to those used in the GA-4’s basis for assessment. This connection highlights the broader context in which workplace activities are factored into financial and regulatory reporting.

Lastly, the Payroll-Based Journal (PBJ) reporting for healthcare facilities mandated by the Centers for Medicare and Medicaid Services (CMS) bears resemblance in its reliance on detailed payroll data for compliance and operational transparency. Required to be submitted quarterly, the PBJ reporting, like the GA-4, uses employment data as a measure for regulatory compliance, focusing on staffing and patient care ratios. This shared focus accentuates the critical role of accurate payroll reporting in various regulatory and compliance frameworks.

Dos and Don'ts

Filling out the GA-4 New York form accurately is essential for municipal self-insured employers. This form is used for reporting quarterly unified employer assessments to the Workers' Compensation Board. To help ensure that this process goes smoothly, here is a compiled list of dos and don'ts.

- Do ensure that the form is completed each quarter on a calendar year basis and submitted within thirty days of the quarter's end. Timeliness is crucial to avoid penalties.

- Do include the WCB Identification Number ("W Number") accurately. This is assigned when approved to self-insure and is essential for tracking and verification purposes.

- Do report the full legal name of the municipal self-insured employer. This helps in avoiding any confusion or misidentification.

- Do accurately report the Federal Employer Identification Number (FEIN) for the municipal self-insurer and any additional employers covered under the W number.

- Do ensure that the full mailing address of the municipal self-insurer is correct. This is necessary for all correspondences related to the unified assessment.

- Don't forget to check the assessment rate for the reporting period established by the Chair pursuant to WCL Section 151, which can be found on the WCB's website.

- Don't neglect to include all necessary information and addendums, such as the Payroll by FEIN Addendum (GA-4.1) if more than one employer is approved to self-insure under the W number shown.

- Don't miscalculate the total assessment due. Remember, it is equal to the total loss cost multiplied by the assessment rate. Any errors could result in underpayment and potential penalties.

- Don't submit inaccurate or incomplete forms. Inaccurate reporting can lead to underpaid assessments, interest charges, and additional penalties. In severe cases, it may even risk the revocation of self-insured status.

Filling out the GA-4 form accurately and on time helps ensure compliance with New York State laws and avoids any unnecessary penalties. Always double-check the details and refer to the instructions on the form to clarify any doubts.

Misconceptions

There are several misconceptions about the Quarterly Unified Employer Assessment Municipal Self-Insurers Remittance Form, also known as the GA-4 New York form. Below are five common misunderstandings and their clarifications.

- Misconception 1: The GA-4 form is required from all employers in New York State.

Clarification: The GA-4 form is specifically required from municipal employers in New York State that are actively self-insured for workers' compensation. This does not apply to private sector employers or those that are not self-insured.

- Misconception 2: One form covers all municipal entities.

Clarification: While the GA-4 form is used by self-insured municipal employers, additional municipal entities covered under the same W number must be reported on a separate form, the GA-4.1 (Payroll by FEIN Addendum). This is for cases such as those under a county plan or municipal group.

- Misconception 3: Payroll data does not need to be detailed.

Clarification: The form requires a detailed breakdown of the payroll, specifically differentiating between school districts and other municipal employees. Payroll must be accurately reported and reconciled, especially if discrepancies exist with the NY-45 form.

- Misconception 4: Payments can be made without specifying the quarter and W number.

Clarification: To ensure proper application of payment, the W Number and applicable quarter must be included on the check or in the payment instructions. This is crucial for accurate record-keeping and to avoid processing errors.

- Misconception 5: Only the GA-4 form needs to be submitted for comprehensive reporting.

Clarification: In addition to the GA-4 form, the GA-4.1 addendum may also need to be submitted if there are additional municipal employers covered under the W number. This addendum ensures that all payroll data relevant to the unified employer assessment is reported accurately.

Understanding these clarifications can help municipal self-insured employers comply with reporting requirements more efficiently and avoid common mistakes associated with the GA-4 New York form.

Key takeaways

Filling out the GA-4 New York form correctly is crucial for municipal self-insurers to ensure compliance with the Workers’ Compensation Board. Here are some essential takeaways.

- Timely submission is critical: The form must be completed and submitted every quarter within thirty days after the quarter ends, accompanied by the appropriate payment.

- The form requires detailed municipal self-insurer information, including the WCB Identification Number or "W Number", the full legal name of the municipal self-insured employer, and the Federal Employer Identification Number (FEIN).

- For municipalities covering additional employers under their W number, a GA-4.1 addendum is required, providing a consolidated reporting for all such employers.

- Communication with the Workers' Compensation Board should be directed to WCBFinanceOffice@wcb.ny.gov for any questions or clarifications needed regarding the form or submission process.

- Payments should be made to the Chair, NYS Workers' Compensation Board, and must clearly indicate the W Number and the applicable quarter for which the payment is being made to ensure proper application.

- Accurate payroll information is vital for the calculation of the assessment. Payrolls are categorized between school district employees and all other municipal employees without needing to breakout by class.

- The form includes sections on basis for assessment, detailing required information such as total payroll, loss costs per hundred dollars of payroll, and the total loss cost which determines the assessment due.

- The assessment rate for the rating period is established pursuant to WCL Section 151 and is essential for calculating the total assessment due.

- Penalties may apply for underpayment of assessments due to inaccurate reporting, incomplete information, or late submissions, including possible revocation of self-insured status for failure to comply.

- Employers found to have knowingly made a material misrepresentation of required information can be guilty of a class E felony, underscoring the importance of accuracy and honesty in completing this form.

Overall, the GA-4 and GA-4.1 forms are essential tools for municipal self-insurers in New York to report and contribute to workers' compensation and disability benefits accurately and on time. Understanding and following the outlined requirements helps ensure compliance and avoid potential penalties.

Common PDF Documents

Subpoena Ducus Tecum - Form utilized by attorneys or parties to obtain necessary documentation from court clerks for cases under appellate consideration.

Uft per Session Time Sheet - Supports strategic staffing decisions by facilitating exceptions in a regulated manner.