Free Char500 Nys Form in PDF

The process of filing annual reports for charitable organizations in New York State requires careful attention to detail and adherence to specific guidelines provided by the New York State Office of the Attorney General. The CHAR500 form serves as a comprehensive document that charitable organizations must submit to remain transparent and compliant with state regulations. This form is not only a display of fiscal responsibility but also a reflection of an organization's commitment to lawful operations within New York. It asks for general information about the organization, including but not limited to, fiscal year dates, any changes in address or name, and the organization's identification numbers. Significantly, it mandates the certification by two signatories under the penalty of perjury, ensuring the accuracy and completeness of the submission. Moreover, the form distinguishes between organizations based on their gross receipts, assets, and whether they have engaged in professional fundraising, adjusting the filing requirements accordingly. Exemptions from certain parts of the filing are made possible for smaller organizations, pointing to a tiered compliance mechanism that aims to ease the procedural burden on less resourced bodies. Additionally, the fee structure outlined requires organizations to pay according to their category of registration and financial threshold, further tailoring the process to the size and scale of the charity. It's clear that the CHAR500 form, with its detailed instructions and attachments, plays an integral role in fostering a transparent, accountable, and well-regulated charitable sector in New York State.

Char500 Nys Sample

CHAR500 |

NYS Office of the Attorney General |

2019 |

|

|

Send with fee and attachments to: |

|

|

NYS Annual Filing for Charitable Organizations |

Charities Bureau Registration Section |

Open to Public |

|

28 Liberty Street |

|||

Inspection |

|||

www.CharitiesNYS.com |

New York, NY 10005 |

||

|

|

|

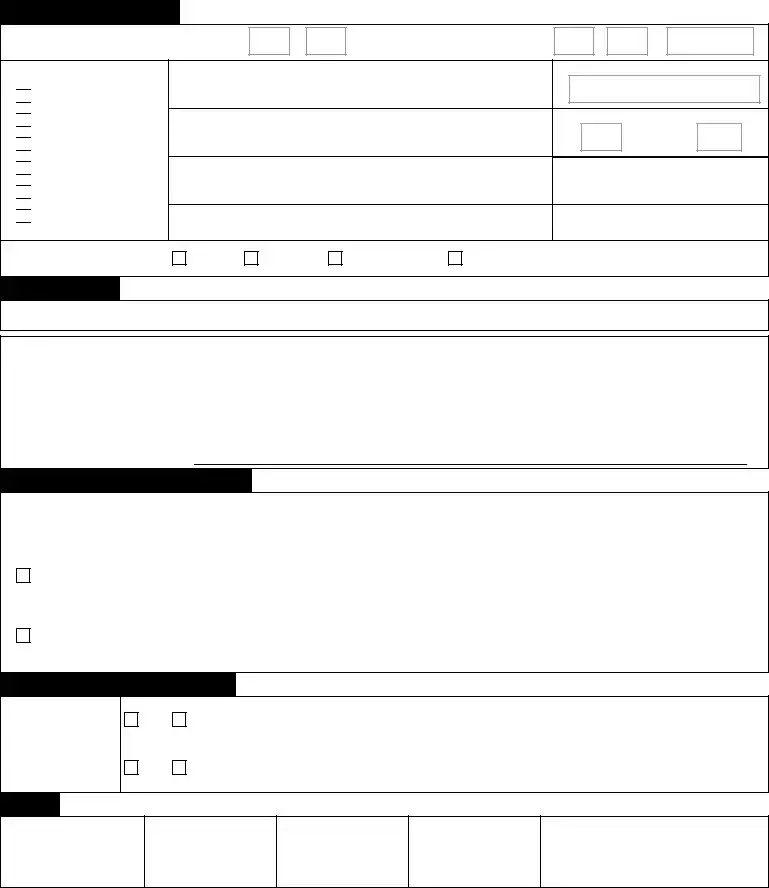

1. General Information

For Fiscal Year Beginning (mm/dd/yyyy) _______/_______/ 2019 and Ending (mm/dd/yyyy) _______/_______/_____________

Check if Applicable:

Address Change

Address Change

Name Change

Name Change

Initial Filing

Initial Filing

Final Filing

Final Filing

Amended Filing

Amended Filing

Reg ID Pending

Reg ID Pending

Name of Organization:

Mailing Address:

City / State / Zip:

Website:

Employer Identification Number (EIN):

NY Registration Number:

- |

|

- |

|

|

|

Telephone:

Email:

Check your organization's |

|

7A only |

|

EPTL only |

|

DUAL (7A & EPTL) |

|

|

|

|

|

||||

registration category: |

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EXEMPT*

Confirm your Registration Category in the

Charities Registry at www.CharitiesNYS.com.

2. Certification

See instructions for certification requirements. Improper certification is a violation of law that may be subject to penalties. The certification requires two signatories.

We certify under penalties of perjury that we reviewed this report, including all attachments, and to the best of our knowledge and belief,

they are true, correct and complete in accordance with the laws of the State of New York applicable to this report.

President or Authorized Officer: |

Signature |

Print Name and Title |

Date |

Chief Financial Officer or Treasurer: |

Signature |

Print Name and Title |

Date |

3. Annual Reporting Exemption

Check the exemption(s) that apply to your filing. If your organization is claiming an exemption under one category (7A or EPTL only filers) or both categories (DUAL filers) that apply to your registration, complete only parts 1, 2, and 3, and submit the certified Char500. No fee, schedules, or additional attachments are required. If you cannot claim an exemption or are a DUAL filer that claims only one exemption, you must file applicable schedules and attachments and pay applicable fees.

3a. 7A filing exemption: Total contributions from NY State including residents, foundations, government agencies, etc. did not exceed $25,000 and the organization did not engage a professional fund raiser (PFR) or fund raising counsel (FRC) to solicit contributions during the fiscal year.

3b. EPTL filing exemption: Gross receipts did not exceed $25,000 and the market value of assets did not exceed $25,000 at any time during the fiscal year.

4. Schedules and Attachments

See the following page for a checklist of schedules and attachments to complete your filing.

|

Yes |

|

No |

4a. Did your organization use a professional fund raiser, fund raising counsel or commercial |

|

|

|||

|

|

fund raising activity in NY State? If yes, complete Schedule 4a. |

||

|

Yes |

|

No |

|

|

|

4b. Did the organization receive government grants? If yes, complete Schedule 4b. |

||

|

|

5. Fee

See the checklist on the next page to calculate your fee(s). Indicate fee(s) you are submitting here:

7A filing fee:

$______

EPTL filing fee:

$______

Total fee:

$______

Make a single check or money order

payable to:

"Department of Law"

CHAR500 Annual Filing for Charitable Organizations (Updated January 2020) |

Page 1 |

|

*The “Exempt” category refers to an organization's NYS registration status. It does not refer to its IRS tax designation. |

||

|

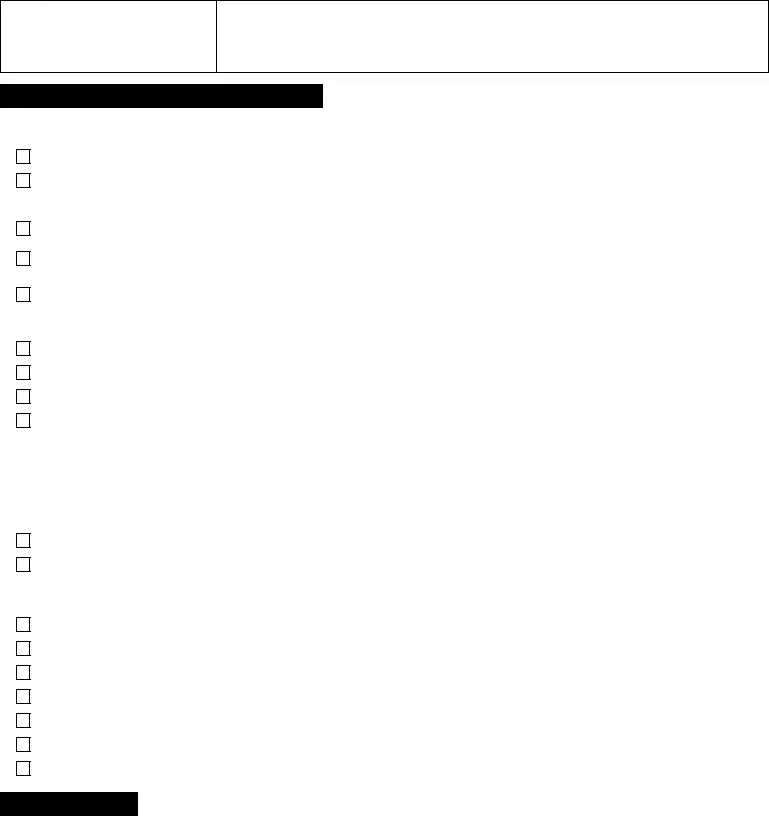

CHAR500

Annual Filing Checklist

Simply submit the certified CHAR500 with no fee, schedule, or additional attachments IF:

-Your organization is registered as 7A only and you marked the 7A filing exemption in Part 3.

-Your organization is registered as EPTL only and you marked the EPTL filing exemption in Part 3.

-Your organization is registered as DUAL and you marked both the 7A and EPTL filing exemption in Part 3.

Checklist of Schedules and Attachments

Check the schedules you must submit with your CHAR500 as described in Part 4:

If you answered "yes" in Part 4a, submit Schedule 4a: Professional Fund Raisers (PFR), Fund Raising Counsel (FRC), Commercial

If you answered "yes" in Part 4b, submit Schedule 4b: Government Grants

Check the financial attachments you must submit with your CHAR500:

IRS Form 990,

All additional IRS Form 990 Schedules, including Schedule B (Schedule of Contributors). Schedule B of public charities is exempt from disclosure and will not be available for public review.

Our organization was eligible for and filed an IRS

If you are a 7A only or DUAL filer, submit the applicable independent Certified Public Accountant's Review or Audit Report:

Review Report if you received total revenue and support greater than $250,000 and up to $750,000.

Audit Report if you received total revenue and support greater than $750,000

No Review Report or Audit Report is required because total revenue and support is less than $250,000

We are a DUAL filer and checked box 3a, no Review Report or Audit Report is required

Calculate Your Fee

For 7A and DUAL filers, calculate the 7A fee:

$0, if you checked the 7A exemption in Part 3a

$25, if you did not check the 7A exemption in Part 3a

For EPTL and DUAL filers, calculate the EPTL fee:

$0, if you checked the EPTL exemption in Part 3b

$25, if the NET WORTH is less than $50,000

$50, if the NET WORTH is $50,000 or more but less than $250,000

$100, if the NET WORTH is $250,000 or more but less than $1,000,000

$250, if the NET WORTH is $1,000,000 or more but less than $10,000,000

$750, if the NET WORTH is $10,000,000 or more but less than $50,000,000

$1500, if the NET WORTH is $50,000,000 or more

Is my Registration Category 7A, EPTL, DUAL or EXEMPT? Organizations are assigned a Registration Category upon registration with the NY Charities Bureau:

7A filers are registered to solicit contributions in New York under Article

EPTL filers are registered under the Estates, Powers & Trusts Law ("EPTL") because they hold assets and/or conduct activites for charitable purposes in NY.

DUAL filers are registered under both 7A and EPTL.

EXEMPT filers have registered with the NY Charities Bureau and meet conditions in Schedule E - Registration Exemption for Charitable Organizations. These organizations are not required to file annual financial reports but may do so voluntarily.

Confirm your Registration Category and learn more about NY law at www.CharitiesNYS.com.

Send Your Filing

Send your CHAR500, all schedules and attachments, and total fee to:

NYS Office of the Attorney General

Charities Bureau Registration Section

28 Liberty Street

New York, NY 10005

Need Assistance?

Visit: www.CharitiesNYS.com

Call: (212)

Email: Charities.Bureau@ag.ny.gov

Where do I find my organization's NET WORTH? NET WORTH for fee purposes is calculated on:

-IRS From 990 Part I, line 22

-IRS Form 990 EZ Part I line 21

-IRS Form 990 PF, calculate the difference between Total Assets at Fair Market Value (Part II, line 16(c)) and Total Liabilities (Part II, line 23(b)).

CHAR500 Annual Filing for Charitable Organizations (Updated January 2020) |

Page 2 |

CHAR500 |

Visit: |

www.CharitiesNYS.com |

2019 |

|

|

Need Assistance? |

|

||

Instructions for Completing Your NY Annual Filing |

Call: |

(212) |

Open to Public |

|

Email: Charities.Bureau@ag.ny.gov |

Inspection |

|||

www.CharitiesNYS.com |

||||

|

|

|||

|

|

|

|

|

Before You Begin

Visit www.CharitiesNYS.com and search the Charities Registry to find your organization's NY State Registration Number

1. General Information

Enter the accounting period covered by the report. Provide the best contact information for your organization. This information will be publicly available in the Charities Registry and will be used for communication to your organization. If your organization is registered and this is your regular annual filing, check Initial Filing. If your contact information needs to be updated, check Address Change and/or Name Change. Check Amended Filing if you are making a change to a previous filing. If you have submitted a CHAR410 - Registration Statement for Charitable Organizations - but do not yet have a NY State Registration Number, check NY Reg Pending. If this is a final filing and the organization is seeking dissolution or ceasing operations, check Final Filing and submit all applicable IRS schedules and attachments. If your organization is a NY corporation, visit www.CharitiesNYS.com for information on how to dissolve. Check the Charities Bureau Registration Category of your organization (7A, EPTL, DUAL, or EXEMPT). EXEMPT organizations are those that have registered with the NY Charities Bureau and meet conditions in Schedule E - Registration Exemption for Charitable Organizations - but have registered and file voluntarily.

2. Certification

When you have completed the form, sign and print the name, title and date. For 7A and DUAL filers, the CHAR500 must be signed by both the president or another authorized officer and the chief financial officer or treasurer. These must be different individuals. EPTL filers have the option of a single signature if the certification is by a banking institution or a trustee of a trust. Clearly state the title of the representative (e.g. "President," "CEO", Treasurer," "CFO," "Bank Vice President" or "Trustee").

3. Annual Reporting Exemption

You may claim an exemption from the reporting and fee requirements if you meet the filing exemptions applicable to your organization. If claiming an exemption under one statute (7A and EPTL only filers) or both statutes (DUAL filers) that apply to your registration, complete only parts 1, 2, and 3, and submit the certified Char500. No fee, schedule, or additional attachments are required. Otherwise, file all required schedules and attachments and pay applicable fees.

Note: A 7A or DUAL filer with contributions over $25,000 that did not contract with a professional fund raiser may check the 7A filing exemption in Part 3 if it (i) received all or substantially all of its contributions from a single government agency to which it submitted an annual report similar to that required by Executive Law Article 7A, or (ii) it received an allocation from a federated fund, United Way or incorporated community appeal and contributions from all other sources did not exceed $25,000.

4. Schedules and Attachments

If you do not qualify for the reporting exemptions as described in Part 3, review the checklist of schedules and attachments required to complete your filing. If your organization qualified for and submitted an IRS

5. Fee

Your total fee is based on your registration category (7A, EPTL or DUAL). 7A or EPTL filers only pay the fee that applies to the statute under which they have registered unless they have claimed an exemption in Part 3. DUAL filers must pay both fees, unless they have claimed an exemption in Part 3. Consult the CHAR500 to calculate your fee or contact the NY Charities Bureau if you have additional questions.

When to Submit Your Filing

7A and DUAL filers: postmarked within 4 1/2 months after the organization's accounting period ends. For example, fiscal year end December 31 reports

are due by May 15th of the following year. EPTL filers: postmarked within 6 months after the organization's accounting period ends. An additional 180 day extension is automatically granted. Information regarding extensions is available at www.CharitiesNYS.com.

Where to Submit Your Filing

Payment must be made to the "Department of Law". Send the complete filing with payment to:

NYS Office of the Attorney General, Charities Bureau Registration Section, 28 Liberty Street, New York, NY 10005.

Penalties

The Attorney General may cancel the registration of or seek civil penalties from an organization that fails to comply with the filing requirements.

CHAR500 Instructions for Completing Your NY Annual Filing (Updated January 2020) |

Page 1 |

CHAR500

Schedule 4a: Professional Fund Raisers, Fund Raising Counsels, Commercial

2019

Open to Public

Inspection

If you checked the box in question 4a in Part 4 on the CHAR500 Annual Filing for Charitable Organizations, complete this schedule for EACH Professional Fund Raiser (PFR), Fund Raising Counsel (FRC) or Commercial

Definitions

A Professional Fund Raiser (PFR), in addition to other activities, conducts solicitation of contributions and/or handles the donations (Article 7A,

A Fund Raising Counsel (FRC) does not solicit or handle contributions but limits activities to advising or assisting a charitable organization to perform such functions for itself (Article 7A,

A Commercial

charitable organization (Article 7A,

Professional fund raising does not include activities by an organization's development staff, volunteers, or a grantwriter who has been hired solely to draft applications for funding from a government agency or tax exempt organization.

1. Organization Information

Name of Organization:

NY Registration Number:

- |

|

- |

|

|

|

2. Professional Fund Raiser, Fund Raising Counsel, Commercial

Fund Raising Professional type:

Professional Fund Raiser

Fund Raising Counsel

Commercial

Name of FRP:

Mailing Address:

City / State / Zip:

NY Registration Number:

- |

|

- |

|

|

|

Telephone:

3. Contract Information

Contract Start Date:

Contract End Date:

4. Description of Services

Services provided by FRP:

5. Description of Compensation

Compensation arrangement with FRP:

Amount Paid to FRP:

6. Commercial

Yes |

|

No |

If services were provided by a CCV, did the CCV provide the charitable organization with the interim or closing report(s) required by |

|

|||

|

Section 173(a) part 3 of the Executive Law Article 7A? |

||

|

|

|

CHAR500 Schedule 4a: Professional Fund Raisers, Fund Raising Counsels, Commercial |

Page 1 |

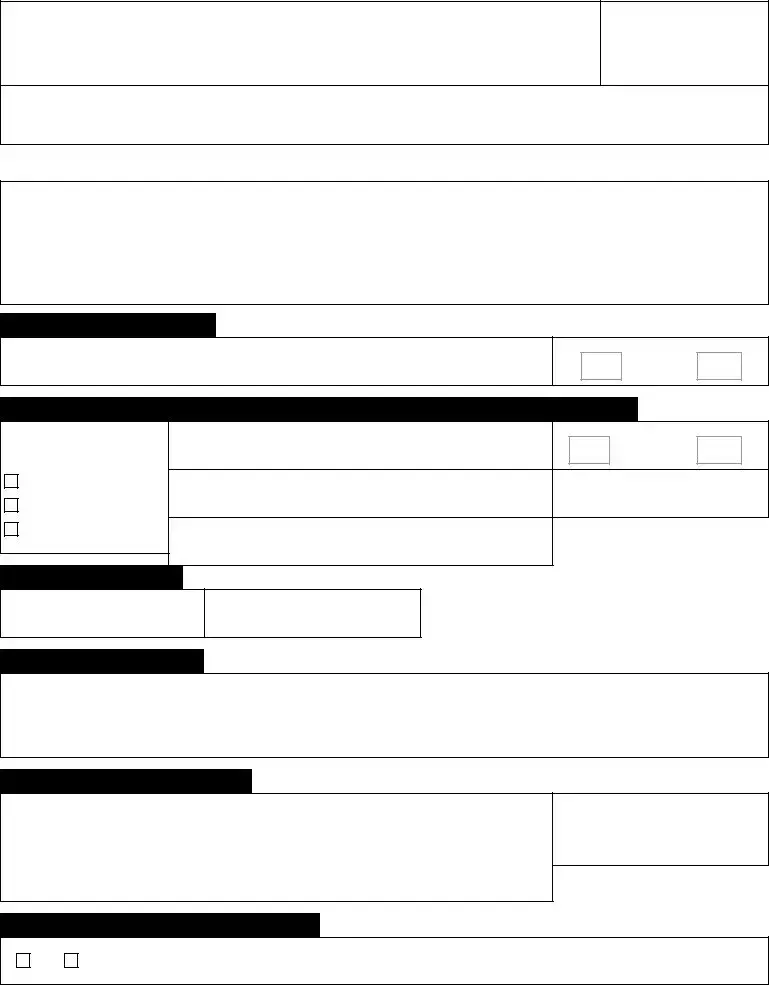

CHAR500

Schedule 4b: Government Grants www.CharitiesNYS.com

2019

Open to Public

Inspection

If you checked the box in question 4b in Part 4 , complete this schedule and list EACH government grant award by a domestic (federal, state or local) agency; interstate or intergovernmental agency (for example Port Authority of New York and New Jersey); and state or local authorities.

Use additional pages if necessary. Include this schedule with your certified CHAR500 NYS Annual Filing for Charitable Organizations.

1. Organization Information

Name of Organization:

NY Registration Number:

-

-

2. Government Grants

Name of Government Agency |

Amount of Grant |

|

|

1. |

1. |

|

|

2. |

2. |

|

|

3. |

3. |

|

|

4. |

4. |

|

|

5. |

5. |

|

|

6. |

6. |

|

|

7. |

7. |

|

|

8. |

8. |

|

|

9. |

9. |

|

|

10. |

10. |

|

|

11. |

11. |

|

|

12. |

12. |

|

|

13. |

13. |

|

|

14. |

14. |

|

|

15. |

15. |

|

|

Total Government Grants: |

Total: |

|

|

CHAR500 Schedule 4b: Government Grants (Updated January 2020) |

Page 1 |

File Overview

| Fact Name | Detail |

|---|---|

| Submission Address | CHAR500 NYS filings must be sent to the Office of the Attorney General, Charities Bureau Registration Section, 28 Liberty Street, New York, NY 10005. |

| Annual Reporting Requirement | Organizations must annually file the CHAR500 to remain in compliance with New York State law. |

| Governing Law | Forms must adhere to regulations under the New York State Executive Law Article 7-A and/or the Estates, Powers & Trusts Law (EPTL), dependent on the organization's registration type. |

| Registration Categories | Organizations can be categorized as 7A, EPTL, DUAL, or EXEMPT filers, affecting their reporting requirements and fees. |

| Exemption Criteria | Organizations may qualify for an Annual Reporting Exemption under specific conditions related to their financial contributions and activities, thus simplifying their filing process. |

| Fee Structure | Fees for filing vary based on the organization’s registration category and net worth, with distinct fees for 7A, EPTL, and DUAL filers. |

| Attachment Requirements | Depending on the organization’s activities and financial situation, additional schedules such as for professional fundraisers or government grants, as well as financial attachments like IRS Form 990 versions, may be necessary. |

Char500 Nys: Usage Guidelines

Once the CHAR500 NYS form is ready to be filled out, attention to detail and accuracy is crucial to ensure compliance with state requirements. This process can seem daunting at first; however, following a step-by-step guide can greatly simplify the task. Below is a detailed breakdown of how to correctly complete this form for charitable organizations in New York State.

- Start by visiting www.CharitiesNYS.com to confirm your organization's NY State Registration Number and Registration Category (7A, EPTL, DUAL, or EXEMPT).

- In section 1. General Information, fill in the fiscal year start and end dates in the format mm/dd/yyyy.

- If applicable, check the boxes next to Address Change, Name Change, Initial Filing, Final Filing, and/or Amended Filing.

- Enter the full Name of the Organization, Mailing Address, City, State, Zip, Website, Employer Identification Number (EIN), NY Registration Number, Telephone, and Email.

- In the registration category, tick the box that applies to your organization (7A only, EPTL only, DUAL, or EXEMPT) after verifying your status on the Charities Registry.

- Move to section 2. Certification. This part requires signatures from the President or Authorized Officer and the Chief Financial Officer or Treasurer, indicating that the information provided is accurate. Insert names, titles, and dates accordingly.

- For section 3. Annual Reporting Exemption, check any exemptions your organization qualifies for. Use the guidance provided to determine if you are exempt from filing fees and schedules.

- In section 4. Schedules and Attachments, indicate whether the organization used a professional fundraiser or received government grants by checking "Yes" or "No". If "Yes" is checked, you must complete the corresponding Schedule 4a or 4b.

- Calculate the applicable fee for your organization in section 5. Fee, based on the instructions provided and enter the amount(s). Make a single check or money order payable to "Department of Law".

- Review the attached schedules and ensure all necessary documentation, including the IRS Form 990 and any other required schedules, are attached. For DUAL filers, ensure both the independent Certified Public Accountant's Review or Audit Report is included, if applicable.

- Double-check all sections for completeness and accuracy. Ensure that the form and all attachments are signed and dated.

- Mail the completed CHAR500 form, along with all schedules, attachments, and payment to the provided address: NYS Office of the Attorney General, Charities Bureau Registration Section, 28 Liberty Street, New York, NY 10005.

Ensuring that the CHAR500 NYS form is completed meticulously and submitted before the deadline is essential for maintaining compliance with state requirements for charitable organizations. This step-by-step guide is designed to assist in navigating the process efficiently and accurately. If assistance is required during this process, the Charities Bureau provides resources and support to guide organizations.

FAQ

What is the CHAR500 form used for?

The CHAR500 form is an annual filing requirement for charitable organizations registered with the New York State Office of the Attorney General's Charities Bureau. It is designed to provide the state with updated information on the charity's financial health, activities, and changes in organizational details, ensuring transparency and regulatory compliance for organizations operating or soliciting donations within New York State.

Who needs to file the CHAR500 form?

Charitable organizations registered under either the Article 7-A of the Executive Law (7A), the Estates, Powers and Trusts Law (EPTL), or both (DUAL), as well as EXEMPT organizations choosing to file, must submit the CHAR500 form annually. The requirement applies whether the charity is based in New York or is an out-of-state entity conducting charitable activities or fundraising within the state.

What are the deadlines for filing the CHAR500 form?

The deadlines vary depending on the organization’s filing status. For 7A and DUAL filers, the form must be postmarked within 4 1/2 months after the end of the organization's fiscal year. EPTL filers have a deadline of 6 months post fiscal year-end, with an additional 180 day extension automatically granted. Complying with these deadlines avoids penalties and ensures continuous registration.

Are there any exemptions to filing the CHAR500 form?

Yes, exemptions are available if your organization's financial activity falls below certain thresholds. If total contributions from New York State do not exceed $25,000 and the organization did not engage a professional fundraiser, a 7A filing exemption may be claimed. Similarly, for EPTL filers, if both gross receipts and the market value of assets were under $25,000 during the fiscal year, an exemption applies. Dual filers can claim exemptions under both categories if applicable.

How is the filing fee for the CHAR500 determined?

The filing fee is calculated based on the organization's registration category (7A, EPTL, or DUAL) and its financial threshold. Fees vary, starting at $0 for those who qualify for exemptions under part 3 of the form, up to $1,500 for organizations with a net worth of $50,000,000 or more. The appropriate fee must accompany the form submission to ensure processing.

What schedules and attachments are required with CHAR500?

- If your organization used a professional fundraiser, fundraising counsel, or commercial co-venturer, complete Schedule 4a.

- Complete Schedule 4b if the organization received government grants.

- Include IRS Form 990, 990-EZ, or 990-PF, and 990-T if applicable, along with all additional IRS Form 990 Schedules, except Schedule B for public charities, which is exempt from public disclosure.

- For 7A only or DUAL filers, an independent certified public accountant's review or audit report is required if total revenue and support exceeds certain thresholds, unless an exemption applies.

Providing accurate and complete schedules and attachments is crucial for the comprehensive review and approval of the filing.

Common mistakes

Filling out the CHAR500 NYS form, a crucial document for charitable organizations in New York State, can be a complex process. Making errors on this form can lead to various consequences, ranging from processing delays to legal issues. Here are nine common mistakes people often make when completing this form:

- Ignoring the required signatures. The CHAR500 needs to be signed by both the President or an Authorized Officer and the Chief Financial Officer or Treasurer. Overlooking this requirement can invalidate the submission.

- Failure to accurately check the registration category. Whether your organization is 7A only, EPTL only, DUAL (7A & EPTL), or EXEMPT is crucial for determining which sections of the form you must complete.

- Misunderstanding the annual reporting exemption. Organizations sometimes claim exemptions incorrectly because they do not fully understand the criteria under 7A or EPTL exemptions.

- Incorrectly calculating the filing fee or submitting the wrong fee amount. This mistake can occur if the organization's net worth or received contributions are miscalculated.

- Omitting necessary schedules and attachments. Depending on answers to questions in parts 4a and 4b, additional documents like Schedule 4a for professional fundraisers or Schedule 4b for government grants may be required.

- Not utilizing the CHAR500 checklist for required attachments. This could lead to missing documents such as the IRS Form 990 and the Certified Public Accountant's Review or Audit Report, where applicable.

- Providing incorrect or outdated contact information. The form asks for the best contact information to be publicly available in the Charities Registry, crucial for future communications.

- Entering the wrong fiscal year dates. Organizations must provide the specific beginning and ending dates of the fiscal year being reported.

- Overlooking the address and name change boxes when applicable. If your organization's address or name has changed since the last filing, marking these boxes is essential for updating the public record.

It’s crucial for organizations to approach the CHAR500 with attention to detail and an understanding of their specific obligations under the law. Utilizing resources like the CharitiesNYS website and seeking assistance when needed can also help avoid these common pitfalls.

Overall, filling out the CHAR500 NYS form accurately is important for remaining compliant with the New York State Attorney General’s office requirements. Avoiding these mistakes not only aids in processing your filing more efficiently but also helps in maintaining the integrity and accountability of your charitable organization.

Documents used along the form

When filing the CHAR500 with the New York State Office of the Attorney General, charitable organizations are often required to include various forms and documents to ensure a complete and compliant submission. Understanding these documents is crucial for a smooth filing process.

- IRS Form 990, 990-EZ, or 990-PF: These forms are the Internal Revenue Service (IRS) forms used by tax-exempt organizations to provide the IRS with annual financial information. The specific form used depends on the organization's financial activities and size.

- Schedule B (Schedule of Contributors): This is a schedule that accompanies the IRS Form 990, detailing information on contributors who have donated significant sums. Though required for IRS submission, it is not public information in New York State filings.

- IRS Form 990-T: If a tax-exempt organization generates income from business activities unrelated to its exempt purpose, this form is used to report and pay taxes on that income.

- Audited Financial Statements: Organizations with total revenue and support exceeding certain thresholds may be required to submit financial statements that have been audited by an independent certified public accountant.

- Independent Certified Public Accountant's Review Report: For organizations with total revenue and support within a certain range, a review report prepared by an independent CPA might be necessary. This is less comprehensive than an audit but still provides a level of assurance about the financial statements.

- Schedule 4a: Used by organizations that engage professional fund-raisers, fund-raising counsels, or commercial co-venturers. It details the information regarding these arrangements, including compensation and services provided.

- Schedule 4b: This schedule lists each government grant awarded to the organization. It requires details such as the name of the government agency and the amount of the grant.

- IRS 990-N e-Postcard: For smaller organizations that typically gross less than $50,000 annually, the 990-N e-Postcard fulfills federal reporting requirements, but for New York State purposes, an IRS Form 990-EZ must still be filed.

- Conflict of Interest Policy: While not always directly submitted with the CHAR500, having a written conflict of interest policy is required for certain filers and might need to be attested to within the CHAR500 or accompanying documents.

- Charitable Organization Annual Report: Some organizations, particularly those that do not need to file the full set of IRS 990 forms or those with specific exemptions, might complete a state-specific annual report form that summarizes their activities, finances, and governance.

Navigating these documents can be complex, requiring a thorough understanding of both state and federal guidelines for charitable organizations. Proper preparation and knowledge of these forms can help ensure that your organization remains in good standing and continues to operate transparently and effectively.

Similar forms

The CHAR500 form shares similarities with the IRS Form 990, known as the "Return of Organization Exempt from Income Tax." Both documents are used by tax-exempt organizations to provide the public with financial information. While the CHAR500 is specific to the New York State Charities Bureau, Form 990 serves a broader purpose, fulfilling federal requirements and offering insight into an organization's operations, including revenues, expenses, and compensation.

Similarly, the Form 990-EZ, "Short Form Return of Organization Exempt from Income Tax," aligns with the CHAR500 in its goal to report financial and operational details. It's a simplified version for smaller entities, mirroring the CHAR500's role for New York State's smaller charities, offering a less complex method for fulfilling reporting obligations and ensuring transparency to the public and government agencies.

The Form 990-PF, "Return of Private Foundation," is another comparative document, focusing on private foundations' financial activities. Like the CHAR500, it ensures compliance and transparency in financial dealings but caters to a specific segment of charitable organizations. This form is detailed, showcasing charitable distributions, investments, and more, akin to the in-depth financial disclosures on the CHAR500.

The CHAR500's exemption sections bear resemblance to the IRS 990-N "e-Postcard," designed for small tax-exempt organizations with annual receipts of $50,000 or less. Both allow simpler reporting mechanisms for eligible entities, reducing administrative burdens while keeping these organizations accountable for minimal financial information disclosure.

The Schedule of Contributors, known as Schedule B in IRS filings, is closely related to the CHAR500's need for similar disclosures. Organizations are required to list donors of significant gifts, ensuring transparency about sources of funding. This synchronization between state and federal requirements underscores the importance of accountability in charitable financing.

The CHAR410, "Registration Statement for Charitable Organizations," is essential for new charities, akin to the IRS's initial exemption application. It establishes a charity's eligibility to operate and solicit funds in New York, paralleling the IRS process that confirms an organization's tax-exempt status, setting the foundation for future reporting including through forms like the CHAR500.

The Schedule 4a attached to the CHAR500, focusing on "Professional Fund Raisers, Fund Raising Counsels, Commercial Co-Venturers," is mirrored by federal requirements to disclose the involvement of professional fundraisers. This ensures that donors understand who is asking for donations, and how much of their contribution goes to the charitable cause versus fundraising expenses.

The Schedule 4b, related to "Government Grants," is comparative to federal disclosures about grants received from governmental entities. Both state-specific and federal forms require detailed listings of grant sources and amounts, reflecting the necessity for transparent operations and the influence of public funding on charitable activities.

The "Annual Reporting Exemption" section of the CHAR500, which allows organizations to claim exemption from detailed reporting under certain conditions, can be compared to the federal counterpart where small organizations may be exempt from filing the full Form 990 or 990-EZ. This similarity underscores a broader regulatory attempt to reduce paperwork for smaller entities while maintaining essential oversight.

Last, the Annual Filing Checklist within the CHAR500 echoes aspects of the IRS form instructions and the necessity for certain schedules like the Audit Report. Both federal and state guidelines necessitate this kind of documentation for larger entities, emphasizing the demand for comprehensive financial scrutiny to ensure fiscal responsibility and the proper use of charitable funds.

Dos and Don'ts

When completing the CHAR500 NYS form for your charitable organization, there are certain practices to follow and others to avoid to ensure a smooth submission process. Here are 10 do's and don'ts to keep in mind:

- Do review the entire form and instructions before beginning to ensure you understand all requirements.

- Do double-check that your organization's contact information is current and accurate, including address, phone number, and email.

- Do confirm your organization's registration category (7A, EPTL, DUAL, or EXEMPT) via the Charities NYS website to accurately complete the form.

- Do make sure that the fiscal year beginning and ending dates are correctly entered in the General Information section.

- Do provide both required signatures for the certification section; one from the President or Authorized Officer and one from the Chief Financial Officer or Treasurer.

- Do check the box that corresponds to your situation, such as Address Change, Name Change, Initial Filing, Final Filing, or Amended Filing, if applicable.

- Do carefully review the schedules and attachments checklist to ensure all necessary documentation is included with your filing.

- Do not leave any required fields blank. Enter “N/A” or “None” where applicable if there's no information to provide.

- Do not submit the form without reviewing it for accuracy and completeness to prevent delays in processing.

- Do not forget to calculate and include the correct filing fee based on your organization's registration category and financial thresholds.

By diligently following these guidelines, organizations can ensure their CHAR500 NYS form is submitted accurately and efficiently, helping to maintain compliance with New York State requirements for charitable organizations.

Misconceptions

One common misconception is that the CHAR500 is only necessary for large charities. In reality, most charitable organizations operating in New York State must file this form, regardless of their size, unless they meet specific exemption criteria.

Many believe that if they file the IRS Form 990, they do not need to submit the CHAR500. However, organizations are required to file the CHAR500 with the New York State Attorney General’s Office in addition to fulfilling federal reporting obligations to the IRS.

Some think that the CHAR500 form is only about financial reporting. While financial information is a significant component, the form also collects details about changes in address or leadership, registration categories, and specific exemptions applicable to the organization.

There's a misconception that once an organization files as "EXEMPT" on the CHAR500, it no longer needs to file in subsequent years. Actually, exempt organizations may be required to file annually to maintain their status and ensure compliance with state regulations.

People often assume that filing the CHAR500 automatically updates an organization's information in the Charities Bureau Registry. Organizations need to actively check and update their profile information on the Charities Bureau’s website separately if there are changes.

Some organizations believe that there is a flat filing fee for the CHAR500. The truth is, fees vary based on the organization's registration category and financial thresholds, such as net worth and total revenue.

There's a belief that new organizations don't need to file the CHAR500 in their first year. New organizations must indeed file, potentially as “Initial Filing” if within the applicable reporting period for their fiscal year.

Many assume that if they didn’t conduct any fundraising activities, they don't need to file the CHAR500. Even without fundraising activities, organizations may still need to file to report their financial status and maintain compliance.

A misconception exists that all attachments and schedules are mandatory for every filer. The specific schedules and attachments required depend on the organization's activities, like fundraising in New York State or receiving government grants, and its registration category.

Key takeaways

Filling out and using the CHAR500 form is a crucial annual task for charitable organizations in New York State, ensuring they remain in compliance with legal obligations. To simplify this process, here are four key takeaways:

- Check your organization's registration category: Before you begin, it's essential to know whether your organization is categorized as 7A, EPTL, DUAL, or EXEMPT. This determines the specific sections of the CHAR500 you must complete, the attachments required, and the fees you'll need to pay. The CharitiesNYS.com website provides a tool to confirm your Registration Category.

- Annual reporting exemptions can reduce your workload: If your organization's financial activity falls below certain thresholds, you might be eligible for reporting exemptions. For example, if total contributions from NY State did not exceed $25,000, you might not need to file the full slate of schedules and attachments or pay any fees, significantly simplifying your filing process.

- Correct certification is non-negotiable: The CHAR500 requires certification by two signatories to attest that the information provided is accurate and in compliance with New York State laws. This step is critical and serves as a legal affirmation of the report's completeness and accuracy. Improper certification could lead to legal ramifications, including penalties.

- Sending your filing correctly is crucial for compliance: Once completed, the CHAR500 form, along with all required schedules, attachments, and fees, should be sent to the specific address provided on the form. This ensures that your filing is processed in a timely manner and helps avoid any delays or penalties associated with late or incomplete filings.

Understanding these key aspects of the CHAR500 form can help charitable organizations in New York State navigate the filing process more effectively, ensuring compliance with state requirements and helping them continue their valuable work without interruption.

Common PDF Documents

It 214 - It is not just a formality but a legal obligation that ensures integrity and transparency in residential property transactions in New York.

How Long Does Voter Registration Take to Process - Registering to vote in New York empowers you to influence local and state decisions.