Free 99 Ny Form in PDF

For countless individuals and businesses, navigating the complexities of tax documentation is a daunting undertaking, made all the more challenging when encountering specific and less common forms. Among these, the 99 NY form stands as a pivotal document, integral to certain financial reporting requirements within New York. Its role primarily encompasses the detailed disclosure of income, expenses, and other pertinent financial data, tailored to specific entities or scenarios within the state. This document not only serves as a testament to transparency and compliance with local regulations but also as a critical tool for financial planning and analysis. Understanding its purpose, the intricacies involved in its completion, and the potential implications of inaccuracies is crucial. This comprehensive exploration aims to demystify the 99 NY form, offering clarity and insight into its importance, thereby empowering individuals and businesses to navigate their fiscal responsibilities with confidence and precision.

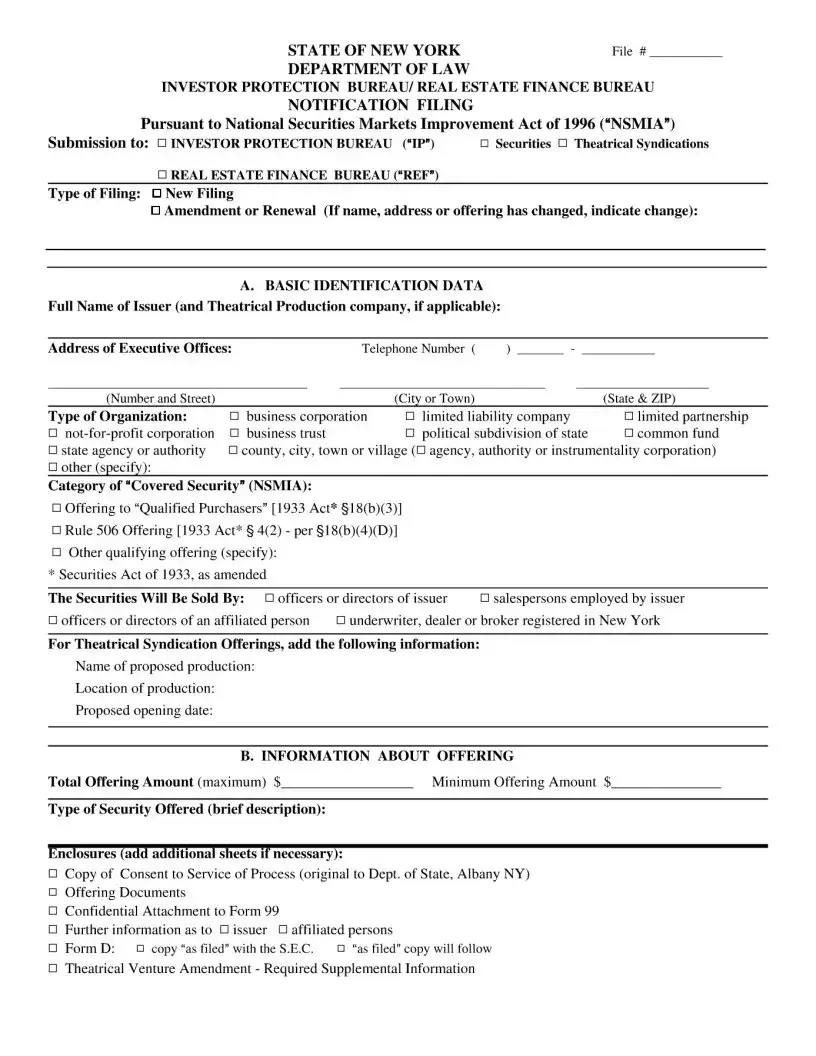

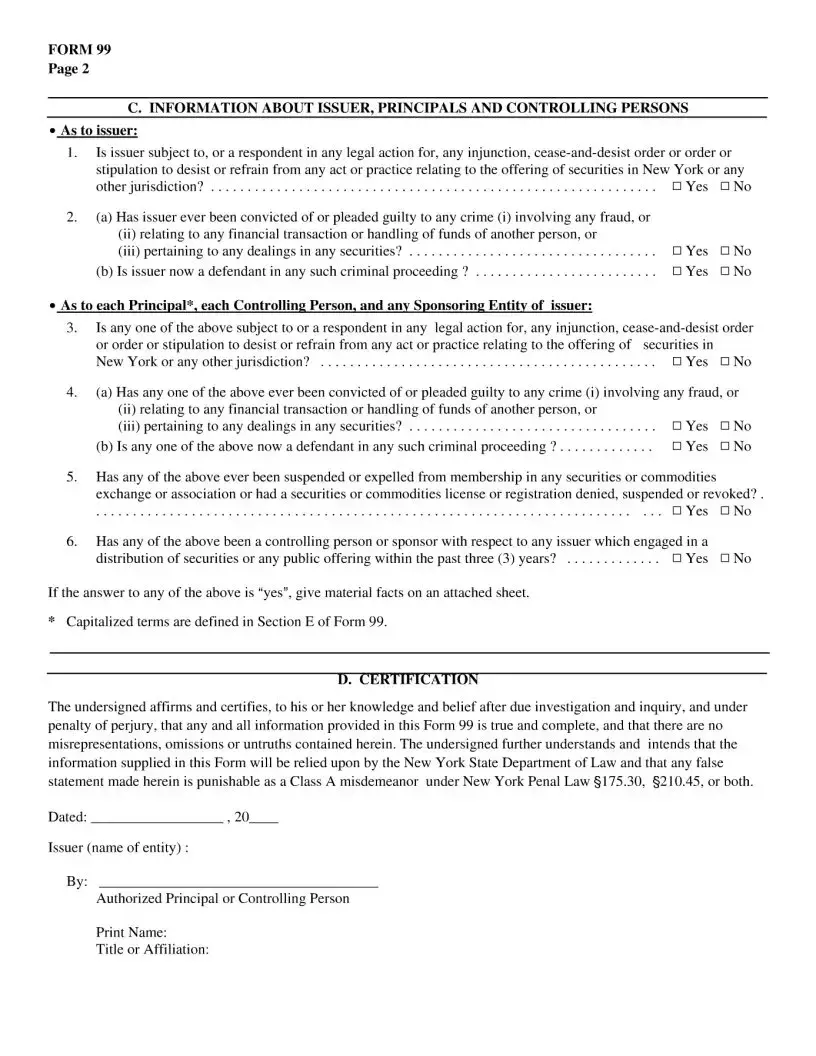

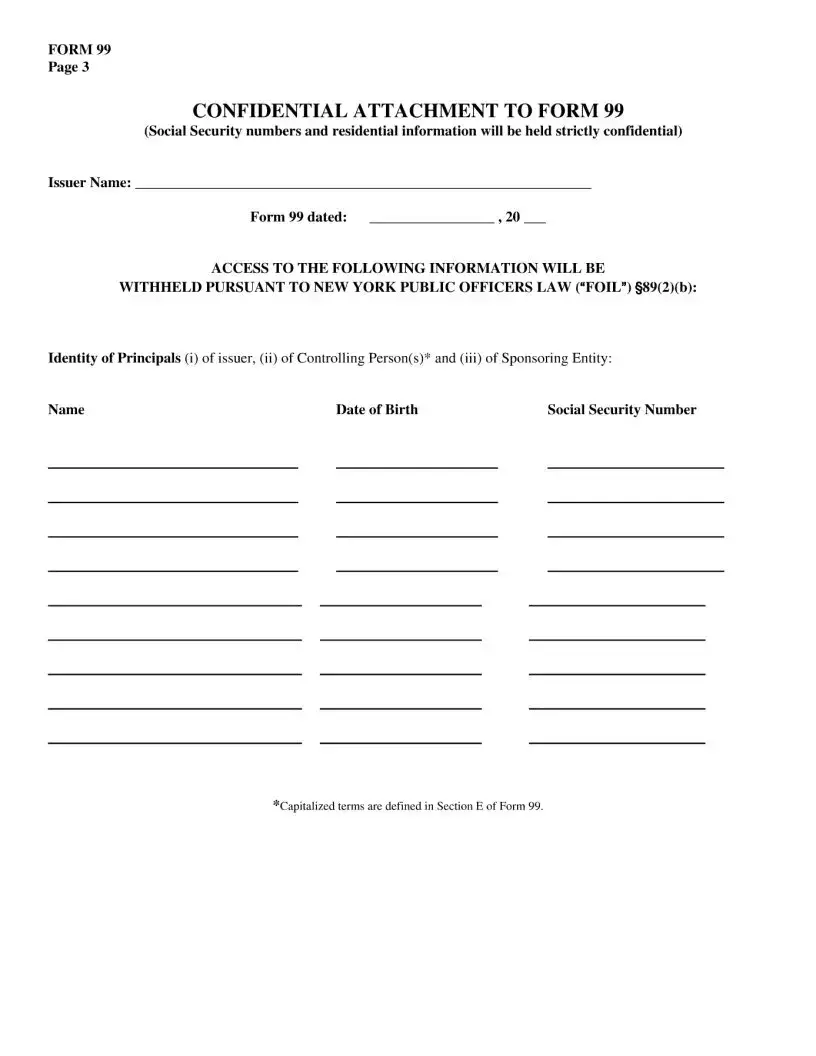

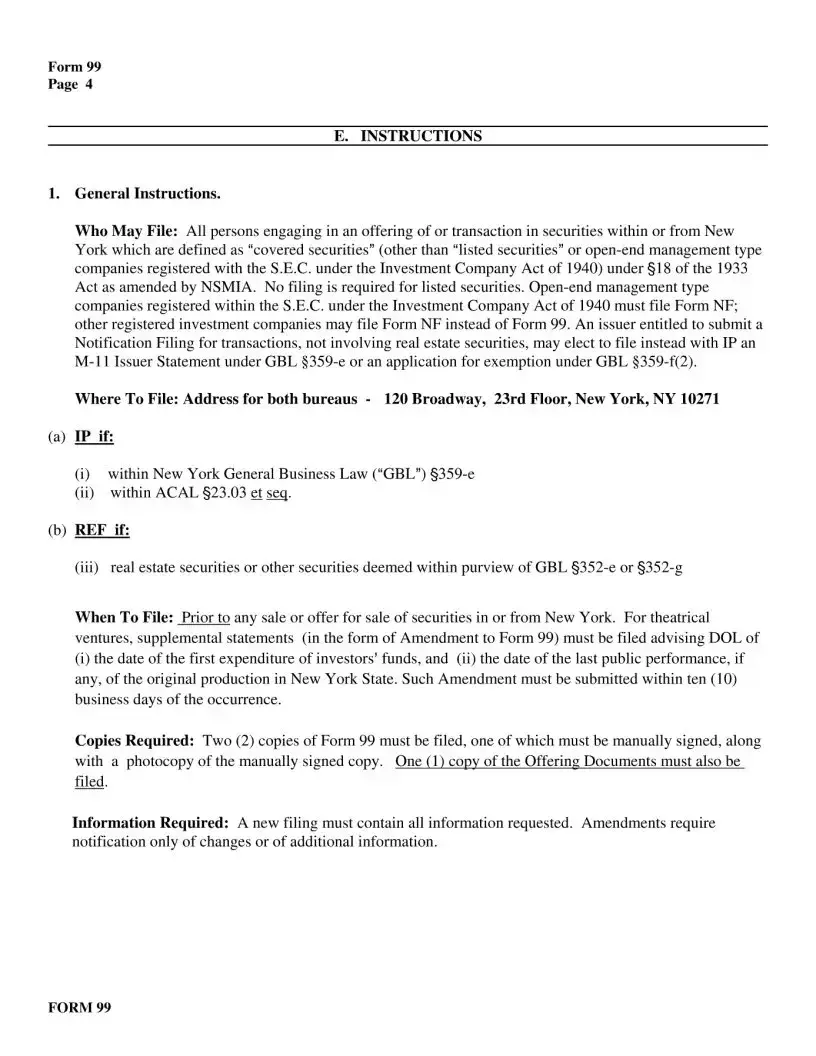

99 Ny Sample

File Overview

| Fact Name | Description |

|---|---|

| Form Identification | The form is known as the 99 Ny form. |

| Purpose | It is used for specific reporting requirements, details of which depend on the context in which the form is being used. |

| Usage | Entities or individuals in New York State use this form to comply with certain state regulations. |

| Governing Law | The form is governed by New York State laws, which dictate how and when it should be used and submitted. |

| Submission Process | Users must complete the form with accurate information and submit it to the designated New York State authority or department. |

| Filing Requirements | The specific filing requirements, including deadlines and the necessity for accompanying documents, vary based on the form's purpose. |

| Accessibility | The form is accessible through New York State's official websites or offices where it is required. |

| Electronic Filing | In some cases, this form may be filed electronically, facilitating a more efficient submission process. |

99 Ny: Usage Guidelines

Filling out tax forms can often feel overwhelming, but taking it one step at a time can help manage the stress. The 99 NY form is crucial for certain financial reporting requirements. After completing this form, you will have completed a necessary step in ensuring your financial affairs are in order. To get started, ensure you have all the relevant information at hand, such as your financial documents for the past year. Now, let's break down the steps needed to fill out this form correctly.

- Start by reading the form thoroughly to understand what is required. This will help you gather all the necessary documents and information before you begin filling it out.

- Enter your personal information, including your full name, address, and Social Security Number (SSN). Accuracy is crucial, so double-check these details.

- Proceed to the financial section. Here, you’ll need to report your income, dividends, or any other financial benefits you've received over the past year. Use your financial documents as a guide to ensure every detail is accurately reported.

- If there are any deductions or credits you are eligible for, make sure to fill out those sections thoroughly. These might include charitable donations, educational expenses, or healthcare costs.

- Calculate the total amount due attentives or the refund owed to you, according to the instructions on the form. This step often requires close attention to detail to ensure the math adds up correctly.

- Review every section of the form to ensure all the information provided is complete and accurate. Mistakes can delay processing or result in fines, so take your time during this step.

- Sign and date the form. Your signature is essential as it validates the form. If you’re filing jointly with a spouse, ensure both parties sign.

- Finally, submit the form to the appropriate agency. Check the form instructions for specific mailing addresses or online submission options. Keep a copy of the form and any supporting documents for your records.

After submitting the form, the next steps typically involve waiting for any response or assessment from the agency. They may contact you for further information or to clarify the details you’ve provided. Regularly check your mail or other contact information you provided for any correspondence regarding your form. Staying organized and keeping your documents accessible will help make any future steps smoother.

FAQ

What is the 99 Ny form used for?

The 99 Ny form is primarily utilized for reporting and summarizing a variety of financial data and other key information by entities or individuals in New York. Its specific purpose can vary, but it often relates to tax filings, financial disclosures, or compliance reports required by state regulations or governing bodies.

Who is required to file the 99 Ny form?

Entities or individuals which are mandated to file the 99 Ny form typically include businesses, nonprofits, and sometimes independent contractors who meet certain criteria set by New York state law. The exact requirements can depend on the financial activity, the presence of operations within the state, or other regulatory thresholds.

When is the 99 Ny form due?

The deadline for submitting the 99 Ny form can vary based on the specific reporting requirements it pertains to. Usually, the due date is aligned with fiscal year-end reporting obligations or other state-established timelines, which can differ for businesses versus individuals. It's critical to consult the latest guidelines or a professional to understand the specific due date relevant to your situation.

Where can I obtain the 99 Ny form?

The 99 Ny form is typically accessible through the official website of the New York State Department of Taxation and Finance or the specific state agency requiring the form. In some cases, it may also be distributed by professional organizations, tax preparers, or legal advisers who assist with state compliance matters.

Can the 99 Ny form be filed electronically?

Yes, in many instances, the 99 Ny form can be filed electronically through the appropriate state department's online portal. This method is encouraged as it can streamline the submission process, improve accuracy, and often results in quicker confirmation of receipt. However, eligibility for electronic filing and the availability of online services can vary, so it's advised to check with the specific department or agency.

What information do I need to complete the 99 Ny form?

Filling out the 99 Ny form requires a variety of information, which can include entity or individual identifier details (like social security or taxpayer identification numbers), financial data relevant to the reporting period, disclosures of certain transactions or operations, and compliance with specific New York state regulations. It's important to carefully review the form instructions and consult with a professional if needed to ensure all necessary details are accurately reported.

Are there penalties for late or incorrect filings?

Yes, failing to file the 99 Ny form on time or submitting incorrect information can result in penalties, which may include fines, interest on owed amounts, or other sanctions determined by the state of New York. The severity of the penalty often depends on the extent of the delay or the nature of the inaccuracies. Proactive steps should be taken to avoid such outcomes, including seeking extensions if delays are anticipated.

How can I get help with filling out the 99 Ny form?

Assistance with completing the 99 Ny form can be sought from tax professionals, legal advisers, or accountants who are familiar with New York state regulations and reporting requirements. Additionally, guidance often can be found through resources provided by the state department responsible for the form, including websites, helplines, and instructional materials.

What happens after I submit the 99 Ny form?

Upon submission, the 99 Ny form will be processed by the relevant state department, which may involve review, auditing, or further inquiries for additional information. You should receive a confirmation of receipt once the form is submitted, especially if filed electronically. Following processing, you may be notified of any further actions required, approval of compliance, or assessments of taxes or penalties due.

Can I amend a previously submitted 99 Ny form?

It is generally possible to amend a previously submitted 99 Ny form if errors are discovered or adjustments are needed after the original filing. The process for making amendments can depend on the specific requirements of the state agency or department, but usually involves submitting an amended form with the corrected information and a notation of the changes from the original submission. Seeking advice from a professional can be helpful in ensuring the amendment process is handled correctly.

Common mistakes

Filling out official forms can be daunting, and when it comes to the 99 NY form, there are common mistakes that many people make. These errors can delay the processing of your form or potentially cause issues with your records. By being aware of these mistakes, individuals can ensure their forms are completed accurately and efficiently.

One frequent mistake is not double-checking the information for accuracy. It's easy to overlook details such as dates, names, and identification numbers. Misinformation or typos can lead to significant delays or even the rejection of the form. Taking the time to review your form before submission can save a lot of time and hassle.

Many individuals forget to sign the form. Although this might seem like a small oversight, an unsigned form is considered incomplete and cannot be processed. Always ensure that you sign in the designated areas to validate the form.

Another common error is not providing all the necessary supporting documents. The 99 NY form often requires additional documentation for verification purposes. Failing to attach all required documents can result in a processing delay or a request for further information.

People sometimes use the wrong version of the form. Forms can be updated, and using an outdated version could mean your submission does not meet current requirements. Always check that you have the most recent form version before starting to fill it out.

Lastly, incorrectly filled sections or leaving sections blank is a mistake that can be easily avoided. If a section does not apply to you, instead of leaving it blank, you should write "N/A" (not applicable). This shows that you did not accidentally skip the section.

In conclusion, completing the 99 NY form carefully and attentively can prevent these mistakes. Taking the extra time to ensure all information is correct, the form is signed, all necessary documents are included, the latest form version is used, and no sections are left blank can streamline the process. This attention to detail can lead to a smoother experience and quicker processing of your form.

Documents used along the form

When preparing or dealing with the 99 Ny form, individuals often find that additional documentation is necessary to fully address their legal needs. The 99 Ny form serves a specific purpose, and to complement its function, several other forms and documents may be utilized. Understanding the purpose and details of these documents can greatly enhance the effectiveness of one’s legal preparations. The following is a list of documents commonly used in conjunction with the 99 Ny form.

- Power of Attorney: This crucial document allows an individual to appoint someone else to make decisions on their behalf. It often complements forms like the 99 Ny by assigning authority to an agent, facilitating decisions when the principal cannot act personally.

- Will and Testament: A legal declaration by which an individual names one or more persons to manage their estate and provides for the transfer of their property at death. While it serves a broader estate planning purpose, it often intersects with the uses of the 99 Ny form in ensuring personal wishes are honored.

- Advance Directive: Also known as a living will, this document specifies what actions should be taken for an individual’s health if they are no longer able to make decisions due to illness or incapacity, working alongside forms like the 99 Ny to cover a comprehensive range of personal decisions.

- Healthcare Proxy: Similar to a power of attorney, this document allows an individual to appoint someone else to make healthcare decisions on their behalf if they become unable to do so. It’s particularly relevant when health issues intersect with legal and personal choice matters detailed in the 99 Ny form.

Utilizing these documents in conjunction with the 99 Ny form can provide a comprehensive legal strategy that addresses a wide range of personal and estate planning needs. Ensuring that all necessary paperwork is in order is an essential step towards achieving peace of mind and ensuring that personal wishes are respected and executed as intended. Each document serves a unique role but together, they create a strong foundation for personal legal affairs.

Similar forms

The Form 990 is a document required by the IRS from tax-exempt organizations, offering a comprehensive overview of an organization's activities, governance, and detailed financial information. A similar document is the Form 1023, which is used by organizations to apply for recognition of exemption from federal income tax under section 501(c)(3) of the Internal Revenue Code. Both forms are designed to ensure transparency and compliance with IRS regulations, but while Form 990 focuses on reporting for an existing tax-exempt entity, Form 1023 is for entities seeking to establish their tax-exempt status.

Another document similar to the Form 990 is the Form 1120, which is the U.S. Corporation Income Tax Return. Though primarily for taxable entities, it serves a parallel purpose to Form 990 by requiring detailed financial information, allowing the IRS to assess tax liabilities. Where Form 990 demonstrates a nonprofit's adherence to the regulations governing tax-exempt status, Form 1120 ensures that for-profit corporations accurately report their income and correctly pay their due taxes.

The Schedule K-1 (Form 1065) bears resemblance to Form 990 in that it details an entity's financial activities, but it applies to partnerships rather than nonprofit organizations. This form reports a partner's share of a partnership's earnings, deductions, credits, etc., thus providing the IRS with information necessary to determine the tax liability of both the partnership and the individual partners. Like Form 990, it emphasizes financial transparency and accountability, though within a different context.

Form 5500, Annual Return/Report of Employee Benefit Plan, shares objectives with Form 990 in terms of reporting requirements, but it applies to employee benefit plans. This document provides the government with information necessary to ensure that these plans comply with the Employee Retirement Income Security Act (ERISA) and the Internal Revenue Code. Both forms aim to protect stakeholders (employees in the case of Form 5500 and the general public and donors for Form 990) by ensuring adherence to relevant laws and regulations.

The Form 1041, U.S. Income Tax Return for Estates and Trusts, also aligns with the Form 990 in its requirement for detailed financial reporting. This form ensures that estates and trusts report income, deductions, and credits to the IRS. While Form 990 assures the government and the public of a nonprofit's proper financial conduct, Form 1041 ensures that estates and trusts meet their tax obligations and that beneficiaries receive their due share of income.

State-specific charitable solicitation registration forms are akin to the Form 990 in that they require nonprofits to disclose financial and operational information to state regulators. These forms are crucial for maintaining public trust in charitable organizations by providing transparency about where and how funds are used. Although they vary by state, their intention mirrors that of Form 990, striving for accountability and compliance within the realm of charitable activities.

Lastly, the Form 941, Employer's Quarterly Federal Tax Return, resembles Form 990 by demanding detailed reporting, but for payroll taxes withheld from employees' wages, rather than nonprofit financial and operational data. The form is a critical tool for the IRS to monitor payroll tax obligations. While serving different sectors, both forms underscore the importance of thorough financial reporting as a means of ensuring entities meet their respective regulatory requirements.

Dos and Don'ts

Filling out the 99 NY Form, a critical task for many, requires attention to detail and an understanding of what is expected. To help guide you through this process smoothly and efficiently, here's a comprehensive list of do's and don'ts:

- Do read the instructions carefully before you start. Each section has its own set of instructions, and overlooking these could lead to mistakes that may delay your process.

- Do use black ink or type your responses if the form allows. This ensures clarity and makes it easier for the processing team to read your information.

- Do double-check your information for accuracy. Ensure names are spelled correctly, numbers are accurate, and no section is left unanswered unless specified.

- Do keep a copy of the completed form for your records. Having a copy can be incredibly helpful if there are any questions or issues down the line.

- Don't use correction fluid or tape. Mistakes should be cleanly crossed out with a single line, and the correct information should be clearly written nearby.

- Don't leave any fields blank unless the form specifically instructs you to do so. If a section does not apply, it's safer to write "N/A" to indicate this clearly.

- Don't sign the form until you are entirely sure that all information is accurate and complete. Your signature often certifies that you have provided truthful information to the best of your knowledge.

Remember, the key to successfully completing the 99 NY Form, or any form for that matter, lies in taking it step by step and reviewing everything before making it final. Keep these pointers in mind to streamline the process and avoid common pitfalls.

Misconceptions

Understanding the complexities of 99 Ny form is crucial for individuals and businesses alike. There are several common misconceptions about this form that need to be addressed to ensure compliance and proper use.

It's Only for Non-Profit Organizations: A widespread misconception is that the 99 Ny form is exclusively for non-profit organizations. While it's primarily used by non-profits to report their annual financial information, certain other types of organizations may also be required to file it under specific circumstances.

It's the Same as a Tax Return: People often confuse the 99 Ny form with tax returns. Although it serves a similar purpose by reporting annual information, it's specifically designed for the unique reporting requirements of non-profits and other entities, not for individual or corporate tax returns.

There's Only One Version of the Form: It's a common mistake to think there's only one version of the form. In reality, there are several, including 99-EZ, tailored to different sizes and types of organizations based on their gross receipts and assets.

Filing it Once is Enough: Some believe that once they've filed the 99 Ny form, they don't need to do it again. However, it's an annual requirement, and organizations must file it every year to maintain their compliance and tax-exempt status.

Digital Submission Isn't Allowed: Another myth is that the 99 Ny form has to be mailed in paper form. Today, digital submissions are not only allowed but encouraged, simplifying the process and ensuring faster processing times.

Small Organizations Don't Need to File It: There's a misconception that small organizations with minimal income or activities can skip filing the form. In reality, while there are thresholds for different forms, almost all organizations are required to file some version of the 99 Ny form annually.

Any Mistake Leads to Immediate Penalties: Many believe that any error on the 99 Ny form will immediately result in penalties. While accuracy is crucial, organizations usually have the opportunity to correct mistakes without facing immediate penalties, especially if the errors are not intentional.

Personal Information is at Risk: With privacy concerns on the rise, some worry that filing the 99 Ny form puts personal information at risk. However, the form requires organizational rather than personal financial information, and the IRS has strict safeguards to protect this data.

By dispelling these misconceptions, organizations can better understand their obligations regarding the 99 Ny form, ensuring they remain compliant and make the most of their tax-exempt status.

Key takeaways

The 99 Ny form is an important document for individuals and entities in certain situations. Below are key takeaways to consider when filling out and using this form:

- Accuracy is Crucial: Ensure all information provided on the form is accurate. Inaccurate or incomplete forms might lead to processing delays or outright rejection.

- Understand the Purpose: Be clear on why you're filling out the 99 Ny form. Its purpose will guide the type of information required and how it should be presented.

- Follow Instructions Carefully: Each section of the form comes with specific instructions. Read these instructions thoroughly to avoid common mistakes.

- Sign and Date: The 99 Ny form typically requires a signature and date to verify the information provided. Ensure this step is not overlooked as an unsigned or undated form is considered incomplete.

- Keep Personal Information Secure: Since the form may contain sensitive personal or business information, make sure it's handled and submitted securely.

- Know the Deadline: If the form is being submitted to meet a specific deadline, be aware of the date and plan accordingly to avoid late submissions.

- Retain a Copy: After the form has been completed and submitted, keep a copy for your records. This is important for future reference or in case any issues arise.

Common PDF Documents

Tr-570 Instructions - Preparers of the return have a designated section to fill out, including their identification and contact information.

Ny Dmv Forms - Through this form, the DMV reinforces its dedication to maintaining a secure and verified database of drivers and non-drivers alike in New York.

How Much Did I Pay in Property Taxes in 2022 - The document is essential for condominium and cooperative buildings seeking eligibility for tax relief benefits within NYC.